Beruflich Dokumente

Kultur Dokumente

Financial Terms

Hochgeladen von

financedataOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Terms

Hochgeladen von

financedataCopyright:

Verfügbare Formate

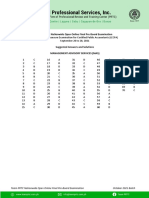

FINANCIAL TERMS

Account Receivable

A balance due from a customer. Accounting Beta Method A method of estimating a project's beta by running a regression of the company's return on assets against the average return on assets for a large sample of firms.

Accounting Profit Accruals

A firm's net income as reported on its income statement.

Continually recurring short-term liabilities, especially accrued wages and accrued taxes.

Acquiring Company

A company that seeks to acquire another firm.

Actual Realized Rate of Return,-ks

The rate of return on a common stock actually received by stockholders.-ks may be greater or less that ^ks and/or ks.

Add-On Interest

Interest that is calculated and added to funds received to determine the face amount of an installment loan.

Additional Funds Needed (AFN)w

Funds that a firm must raise externally through borrowing or by selling new common or preferred stock.

Adjustable Rate Preferred Stocks (ARPs) After-tax Cost of Debt, kd(1-T)

Preferred stocks whose dividends are tied to the rate on Treasury securities.

The relevant cost of new debt, taking into account the tax deductibility of interest; used to calculate the WACC.

Agency Problem

A potential conflict of interest between the agent (manager) and (1) the outside stockholders or (2) the creditors (debtholders).

Aging Schedule

A report showing how long accounts receivable have been outstanding.

Amortization Schedule

A table showing precisely how a loan will be repaid. It gives the required payment on each payment date and a breakdown of the payment, showing how much is interest and how much is repayment of principal.

Amortized Loan

A loan that is repaid in equal payments over its life.

Annual Compounding

The arithmetic process of determining the final value of a cash flow or series of cash flows when interest is added once a year Annual Percentage Rate (APR) The periodic rate X the number of periods per year.

Annual Percentage Rate (APR)

A rate reported by banks and other lenders on loans when the effective rate exceeds the nominal rate of interest.

Annual Report

A report issued annually by a corporation to its stockholders. It contains basic financial statements, as well as management's opinion of the past year's operations and the firm's future prospects.

Annuity

A series of payments of an equal amount at fixed intervals for a specified number of periods.

Annuity Due Arbitrage

An annuity whose payments occur at the beginning of each period.

The simultaneous buying and selling of the same commodity or security in two different markets at different prices, and pocketing a risk-free return.

Arrearages

Unpaid preferred dividends . Asset Management Ratios A set of ratios which measure how effectively a firm is managing its assets.

Asymmetric Information

The situation in which managers have different (better) information about firms' prospects than do investors.

Average Tax Rate Balance Sheet Base Case

Taxes paid divided by taxable income

A statement of the firm's financial position at a specific point in time.

An analysis in which all of the input variables are set at their most likely values.

Base-Case NPV

The NPV when sales and other input variables are set equal to their most likely (or base-case) values.

Basic Earning Power (BEP) Ratio

This ratio indicates the ability of the firm's assets to generate operating income; calculated by dividing EBIT by total assets.

Benchmarking

The process of comparing a particular company with a group of "benchmark" companies.

Best-Case Scenario

An analysis in which all of the input variables are set at their best reasonably forecasted values.

Beta coefficient, b

A measure of the extent to which the returns on a given stock move with the stock market.

Bird-in-the-Hand Theory

MM's name for the theory that a firm's value will be maximized by setting a high dividend payout ratio.

Bond

A long-term debt instrument.

Bracket Creep

A situation that occurs when progressive tax rates combine with inflation to cause a greater portion of each taxpayer's real income to be paid as taxes.

Break Point (BP)

The dollar value of new capital that can be raised before an increase in the firm's weighted average cost of capital occurs.

Breakeven Point

The volume of sales at which total costs equal total revenues, causing operating profits (or EBIT) to equal zero.

Breakup Value

A firm's value if its assets are sold off in pieces.

Business Ethics

A company's attitude and conduct toward its employees, customers, community, and stockholders

Business Risk Call Option

The risk associated with projections of a firm's future returns on assets.

An option to buy, or "call," a share of stock at a certain price within a specified period.

Call Provision

A provision in a bond contract that gives the issuer the right to redeem the bonds under specified terms prior to the normal maturity date.

Cannibalization

Occurs when the introduction of a new product causes sales of existing products to decline.

Capital Asset Pricing Model (CAPM)

3

A model based on the proposition that any stock's required rate of return is equal to the risk-free rate of return plus a risk premium which reflects only the risk remaining after diversification.

Capital Budgeting

The process of planning expenditures on assets whose cash flows are expected to extend beyond one year.

Capital Component

One of the types of capital used by firms to raise money.

Capital Gain or Loss

The profit (loss) from the sale of a capital asset for more (less) than its purchase price.

Capital Gains Yield

The capital gain during a given year divided by the beginning price.

Capital Intensity Ratio Capital Markets

The amount of assets required per dollar of sales (A*/So)

The financial markets for stocks and for long-term debt (one year or longer)

Capital Rationing

A situation in which a constraint is placed on the total size of the firm's capital budget.

Cash Budget

A table showing cash flows (receipts, disbursements, and cash balances) for a firm over a specified period.

Cash Discount

A reduction in the price of goods given to encourage early payment.

Cash Flow (CF)

This term designates uneven cash flows.

Change in Net Working Capital

The increased current assets resulting from a new project minus the spontaneous increase in accounts payable and accruals.

Check Clearing

The process of converting a check that has been written and mailed into cash in the payee's account.

Classified Stock

Common stock that is given a special designation, such as Class A, Class B, and so forth, to meet special needs of the company.

Clientele Effect

The tendency of a firm to attract a set of investors who like its dividend policy.

Closely Held Corporation

4

A corporation that is owned by a few individuals who are typically associated with the firm's management.

Coefficient of Variation (CV)

Standardized measure of the risk per unit of return; calculated as the standard deviation divided by the expected return.

Collection Policy

The procedures that a firm follows to collect accounts receivable.

Collections Float

The amount of checks that we have received but which have not yet been credited to our account.

Commercial Paper

Unsecured, short-term promissory notes of large firms, usually issued in denominations of $100,000 or more and having an interest rate somewhat below the prime rate.

Commodity Futures

A contract that is used to hedge against price changed for input materials.

Common Stockholders' Equity (Net Worth)

The capital supplied by common stockholder-capital stock, paid-in capital, retained earnings and, occasionally, certain reserves. Total equity is common equity plus preferred stock.

Compensating Balance

A bank balance that a firm must maintain to compensate the bank for services rendered or for granting a loan.

Compensating Balance

A minimum checking account balance that a firm must maintain with a commercial bank, generally equal to 10 to 20 percent of the amount of loan outstanding.

Compounding

The arithmetic process of determining the final value of a cash flow or series of cash flows when compound interest is applied.

Computerized Inventory Control System

A system of inventory control in which a computer is used to determine reorder points and to adjust inventory balances.

Congeneric Merger

A merger of firms in the same general industry, but for which no customer or supplier relationship exists.

Conglomerate Merger Consol

A merger of companies in totally different industries.

A perpetual bond issued by the British government to consolidate past debts; in general, any perpetual bond.

Constant Growth Model

Also called the Gordon Model, it is used to find the value of a constant growth stock.

Constant Ratio Method

A method of forecasting future financial statements, and future financial requirements, that assumes certain financial ratios will remain constant.

Continuous Compounding

A situation in which interest is added continuously rather than at discrete points in time.

Conversion Price, Pc

The effective price paid for common stock obtained by converting a convertible security.

Conversion Ratio, CR

The number of shares of common stock that are obtained by converting a convertible bond or share of convertible preferred stock.

Conversion Value, Ct Convertible Bond

The value of common stock obtained by converting a convertible security.

A bond that is exchangeable, at the option of the holder, for common stock of the issuing firm.

Convertible Currency Convertible Security

A currency that may be readily exchanged for other currencies.

A security, usually a bond or preferred stock, that is exchangeable at the option of the holder for the common stock of the issuing firm.

Corporate Bonds

Bonds issued by corporations.

Corporate, or Strategic, Alliance Corporate, or Within-Firm, Risk

A cooperative deal that stops short of a merger.

Risk not considering the effects of stockholders' diversification; it is measured by a project's effect on uncertainty about the firm's future earnings.

Corporation

A legal entity created by a state, separate and distinct from its owners and managers, having unlimited life, easy transferability of ownership, and limited liability.

Correlation

The tendency of two variables to move together.

Correlation Coefficient

A measure of the degree of relationship between two variables. The cost of external equity; based on the cost of retained earnings, but increased for flotation costs.

Cost of New Common Equity, ke

Cost of Preferred Stock, kps

The rate of return investors require on the firm's preferred stock. kps is calculated as the preferred dividend, Dps, divided by the net issuing price, Pn.

Cost of Retained Earnings, ks Costly Trade Credit

The rate of return required by stockholders on a firm's common stock.

Credit taken in excess of free trade credit, whose cost is equal to the discount lost.

Country Risk

The risk that arises from investing or doing business in a particular country.

Coupon Interest Rate Coupon Payment

The stated annual rate of interest on a bond.

The specified number of dollars of interest paid each period, generally each six months . Credit Period The length of time for which credit is granted.

Credit Policy

A set of decisions that include a firm's credit period, credit standards, collection procedures, and discounts offered.

Credit Standards

Standards that stipulate the required financial strength that an applicant must demonstrate to granted credit.

Credit Terms

A statement of the credit period and any discounts offered--for example, 2/10, net 30.

Crossover Rate

The discount rate at which the NPV profiles of two projects cross and, thus, at which the projects' NPV's are equal .

Cumulative

A protective features on preferred dividends previously not paid to be paid before any common dividends can be paid.

Current Ratio

This ratio is calculated by dividing current assets by current liabilities. It indicates the extent to which current liabilities are covered by those assets expected to be converted to cash in the near future.

Current Yield

The annual interest payment on a bond divided by the bond's current price.

Days Dales Outstanding (DSO) Days Sales Outstanding (DS0)

The average length of time required to collect credit sales.

The ratio calculated by dividing accounts receivable by average sales per day; indicates the average length of time the firm must wait after making a sale before receiving cash.

Debenture

A long-term bond that is not secured by a mortgage on specific property.

Declaration Date

The date on which a firm's directors issue a statement declaring a dividend.

Default Risk Premium (DRP)

The difference between the interest rate on a U. S. Treasury bond and a corporate bond of equal maturity and marketability.

Defensive Merger Depreciation Derivatives

A merger designed to make a company less vulnerable to takeover.

The charge for assets used in production Depreciation is not a cash outlay.

Securities whose values are determined by the market price or interest rate of some other asset.

Detachable Warrant Devaluation

A warrant that can be detached from a bond and traded independently of it.

The process of officially reducing the value of a country's currency relative to other currencies.

Disbursement Float

The value of the checks which we have written but which are still being processed and thus have not been deducted from our account balance by the bank.

Discount Bond

A bond that sells below its par value; occurs whenever the going rate of interest rises above the coupon rate.

Discount Interest

Interest that is calculated on the face amount of a loan but is paid in advance.

Discount on Forward Rate

The situation when the spot rate is less than the forward rate.

Discounted Payback Period

The length of time required for an investment's cash flows, discounted at the investment's cost of capital, to cover its cost.

Discounting

The process of finding the present value of a cash flow or a series of cash flows; discounting is the reverse of compounding.

Diversifiable Risk

That part of a security's risk associated with random events; it can be eliminated by proper diversification.

Divestiture

The sale of some of a company's operating assets.

Dividend Irrelevance Theory

The theory that a firm's dividend policy has no effect on either its value or its cost of capital.

Dividend Policy Decision

The decision as to how much of current earnings to pay out as dividends rather than to retain for reinvestment in the firm.

Dividend Reinvest Plan (DRP)

A plan that enables a stockholder to automatically reinvest dividends received back into the stock of the paying firm.

Dividend Yield Du Pont Chart

The expected dividend divided by the current price of a share of stock.

A chart designed to show the relationships among return on investment, asset turnover, the profit margin, and leverage.

Du Pont Equation

A formula which shows that the rate of return on assets can be found as the product of the profit margin times the total assets turnover

Earnings Per Share (EPS) Economic Value Added

Net income divided by the number of share of common Stock outstanding.

Value added to shareholders by management during a given year.

Effective (Equivalent) Annual Rate (EAR/EFF%)

The annual rate of interest actually being earned, as opposed to the quoted rate. Also called the "equivalent annual rate."

Efficient Markets Hypothesis (EMH)

9

The hypothesis that securities are typically in equilibrium-that they are fairly priced in the sense that the price reflects all publicly available information on each security.

Equilibrium

The condition under which the expected return on a security is just equal to its required return ^k =k. Also, ^Po = Po, and the price is stable.

Equivalent Annual Annuity (EAA) Method

A method which calculates the annual payments a project would provide if it were an annuity. When comparing projects of unequal lives, the one with the higher equivalent annual annuity should be chosen.

Eurobond

A bond sold in a country other than the one in whose currency the bond is denominated.

Eurodollar

A U.S. dollar deposited in a bank outside the United States.

Ex-Dividend Date

The date on which the right to the current dividend no longer accompanies a stock; it is usually four working day prior to the holder-of-record date . Exchange Rate The number of units of a given currency that can be purchased for one unit of another currency.

Exchange Rate Risk

The risk that relates to what the basic cash flows will be worth in the parent company's home currency.

Executive Stock Option

An option to buy stock at a stated price within a specified time period that is granted to an executive as part of his or her compensation package

Expansion Project

A project that is intended to increase sales.

Expectations Theory

A theory which states that the shape of the yield curve depends on investors' expectations about future interest rates.

Expected Rate of Return, ^k

The rate of return expected to be realized from an investment; the weighted average of the probability distribution of possible results.

Expected Rate of Return,^ ks

The rate of return on a common stock that a stockholder expects to receive.

Expected Return on a Portfolio, ^kp

The weighted average of the expected returns on the assets held in the portfolio.

10

Expected Total Return Externalities FASB #13

The sum of the expected dividend yield and the expected capital gains yield.

Effects of a project on cash flows in other parts of the firm. The statement of the Financial Accounting Standards Board that details the conditions and procedures for capitalizing leases.

FVAn

The future value of an annuity over n periods.

Fair (Equilibrium) Value Financial Futures

The price at which investors are indifferent between buying or selling a security.

A contract that is used to hedge against fluctuating interest rates, stock prices, and exchange rates.

Financial Intermediaries

Specialized financial firms that facilitate the transfer of funds from savers to demanders of capital.

Financial Lease

A lease that does not provide for maintenance services, is not cancelable, and is fully amortized over its life; also called a capital lease.

Financial Leverage Financial Leverage

The use of debt financing.

The extent to which fixed-income securities (debt and preferred stock) are used in a firm's capital structure.

Financial Merger

A merger in which the firms involved will not be operated as a single unit and from which no operating economies are expected.

Financial Risk

An increase in stockholders' risk, over and above the firm's basic business risk, resulting from the use of financial leverage.

Financial Service Corporation

A firm which offers a wide range of financial services, including investment banking, brokerage operations, insurance, and commercial banking.

Fixed Assets Turnover Ratio

The ratio of sales to net fixed assets.

Fixed Charge Coverage Ratio

This ratio extends the TIE ratio to include the firm's annual long-term lease and sinking fund obligations.

Fixed Exchange Rate System

11

The world monetary system in existence after World War II until 1971, under which the value of the U.S. dollar was tied to gold, and the values of the other currencies were pegged to the U.S. dollar.

Floating Exchange Rates

A system under which exchange rates are not fixed by government policy but are allowed to float up or down in accordance with supply and demand.

Floating Rate Bond

A bond whose interest rate fluctuates with shifts in the general level of interest rates.

Flotation Cost, F

The percentage cost of issuing new common stock.

Foreign Bond A bond sold by a foreign borrower but denominated in the currency of the country

in which it is sold.

Foreign Bonds

Bonds issued by either foreign governments or foreign corporations.

Formula Value

The value of an option calculated at the current stock price minus the strike, or exercise, price.

Forward Contract

A contract under which one party agrees to buy a commodity at a specific price on a specific future date and the other party agrees to make the sale. Physical delivery occurs.

Forward Exchange Rate

An agreed-upon price at which two currencies will be exchanged at some future date.

Founders' Shares

Stock owned by the firms' founders that has sole voting rights but restricted dividends for a specified number of years.

Free Cash Flows

The firm's operating cash flows less mandatory equity investments.

Free Trade Credit Friendly Merger

Credit received during the discount period.

A merger whose terms are approved by the managements of both companies.

Future Value (FV)

The amount to which a cash flow or series of cash flows will grow over a given period of time when compounded at a given interest rate.

Future Value Interest Factor for an Annuity (FVIFAi,n)

12

The future value interest factor for an annuity of n periods compounded at i percent.

Future Value Interest Factor for i and n (FVIFi,n)

The future value of $1 left on deposit for n periods at a rate of i percent per period.

Futures Contract

Standardized contracts that are traded on exchanges and are "marked to market" daily, but where physical delivery of the underlying asset is virtually never taken.

Going Public

The act of selling stock to the public at large by a closely held corporation or its principal stockholderrs.

Golden Parachutes Growth Rate, g Hedging

Large payments made to the managers of a firm if it is acquired.

The expected rate of growth in dividends per share

Using transactions to lower risk.

Holder-of-Record Date

If the company lists the stockholder as owner on this date, then the stockholder receives the dividend . Holding Company A corporation that own sufficient common stock of another firm to achieve working control over it.

Horizontal Merger Hostile Merger

A combination of two firms that produce the same type of good or service.

A merger in which the target firm's management resists acquisition.

Hostile Takeover

The acquisition of a company over opposition of its management . Hurdle Rate The discount rate (cost of capital ) which the IRR must exceed if a project is to be accepted.

IRR

The discount rate which forces the PV of a project's inflows to equal the PV of its costs.

Improper Accumulation

Retention of earnings by a business for the purpose of enabling stockholders to avoid personal income taxes.

13

Income Bond

A bond that pays interest only if the interest is earned.

Income Statement

A statement summarizing the firm's revenues and expenses over an accounting period, generally a quarter or a year.

Incremental Cash Flow Indenture

The net cash flow attributable to an investment project.

A formal agreement between the issuer of a bond and the bondholders.

Independent Projects

Projects whose cash flows are not affected by the acceptance or nonacceptance of there projects.

Indexed (Purchasing Power) Bond

A bond that has interest payments based on an inflation index so as to protect the holder from inflation.

Inflation

The tendency of prices to increase over time.

Inflation Premium (IP)

A premium equal to expected inflation that investors added to the real risk-free rate of return.

Inflow

A cash receipt.

Information Content (Signaling) Hypothesis

The theory that investors regard dividend changes as signals of management's earnings forecasts.

Initial Public Offering (IPO) Market

The market consisting of stocks of companies that are in the process of going public.

Interest Rate Parity

Specifies that investors should expect to earn the same return in all countries after adjusting for risk.

Interest Rate Risk

The risk of capital losses to which investors are exposed because of changing interest rates.

Interest Rate Risk

The risk of a decline in a bond's price due to an increase in interest rates.

Internal Rate of Return (IRR) Method

14

A method of ranking investment proposal using the rate of return on an investment, calculated by finding the discount rate that equates the present value of future cash inflow s to the project's cost.

Intrinsic Value,^Po

The value of an asset that, in the mind of a particular investor, is justified by the facts;^Po may be different from the asset's current market price, its book value, or both.

Inventory Turnover Ratio Inverse Floater

The ratio calculated by dividing sales by inventories

A note in which the interest paid moves counter to market rates.

Inverted ("Abnormal") Yield Curve

A downward-sloping yield curve.

Investment Banking House

An organization that underwrites and distributes new investment securities and helps businesses obtain financing.

Investment Grade Bonds

Bonds rated triple-B or higher; many banks and other institutional investors are permitted by law to hold only investment grade bond.

Investment Opportunity Schedule (IOS)

A graph of the firm's investment opportunities ranked in order of the projects' rates of return.

Investment Opportunity Schedule (IOS)

A graph of the firm's investment opportunities ranked in order of the projects' rates of return.

Joint Venture

A corporate alliance in which two or more independent companies combine their resources to achieve a specific, limited objective.

Junk Bond

A high-risk, high-yield bond.

Just-in-Time (JIT) System

A system of inventory control in which a manufacturer coordinates production with suppliers so that raw materials or components arrive just as they are needed in the production process.

Lessee Lessor

The party that uses, rather than the one who owns, the leased property.

The owner of the leased property.

15

Leveraged Buyout (LBO)

A situation in which a small group of investors (which usually includes the firm's managers borrows heavily to buy all the shares of a company.

Limited Liability Partnership (Limited Liability Company)

A hybrid form of organization in which all partners enjoy limited liability for the business's debts. It combines the limited liability advantage of a corporation with the tax advantages of a partnership.

Limited Partnership

A Hybrid form of organization consisting of general partners who have unlimited liability for the partnership's debts, and limited partners, whose liability is limited to the amount of their investment

Line of Credit

An informal arrangement in which a bank agrees to lend up to a specified maximum amount of funds during a designated period.

Liquid Asset

An asset that can be converted to cash quickly without having to reduce the asset's price very much.

Liquidation

A liquidation occurs when the assets of a division are sold off piecemeal, rather than as an operating entity.

Liquidity Preference Theory

The theory that lenders, other things held constant, would prefer to make shortterm loans rather than long-term loans; hence, they will lend short-term funds at lower rates than long-term funds.

Liquidity Premium (LP)

A premium added to the equilibrium interest rate on a security if that security cannot be converted to cash on short notice and at close to "fair market value."

Liquidity Ratios

Ratios that show the relationship of a firm's cash and other current assets to its current liabilities.

Lockbox Plan

A procedure used to speed up collections and reduce float through the use of post office boxes in payers' local areas.

Long Hedges

Futures contracts are bought in anticipation of (or to guard against) price increases.

Long-Term Equity Anticipation Security (LEAPS)

Long-term options that are listed on the exchanges and tied to both individual stocks and to stock indexes.

Low-Regular-Dividend-Plus-Extras

16

The policy of announcing a low regular dividend that can be maintained no matter what, and then when times are good paying a designated "extra" dividend.

Lumpy Assets

Assests that cannot be acquired in small increments but must be obtained in large, discrete units Marginal Cost of Capital (MCC) The cost of obtaining another dollar of new capital; the weighted average cost of the last dollar of new capital raised.

Marginal Investor

A representative investor whose actions reflect the beliefs of those people who are currently trading a stock. It is the marginal investor who determines a stock's price . Marginal Tax Rate The tax rate applicable to the last unit of a person's income.

Market Portfolio

A portfolio consisting of all stocks . Market Price Po The price at which a stock sells in the market.

Market Risk

That part of a security's risk that cannot be eliminated by diversification.

Market Risk Premium, RPM

The additional return over the risk-free rate needed to compensate investors for assuming an average amount of risk.

Market Value Added (MVA)

The difference between the market value of equity and the amount of equity capital that investors supplied.

Market Value Ratios

A set of ratios that relate the firm's stock price to its earnings and book value per share.

Market, or Beta, Risk

That part of a project's risk that cannot be eliminated by diversification; it is measured by the project's beta coefficient.

Market/Book (M/B) Ratio Marketable Securities Maturity Date

The ratio of a stock's market price to its book value.

Securities that can be sold on short notice.

A specified date on which the par value of a bond must be repaid.

Maturity Matching, or "Self-Liquidating," Approach

A financing policy that matches asset and liability maturites. This is a moderate policy.

17

Maturity Risk Premium (MRP)

A premium which reflects interest rate risk.

Merger

The combination of two firms to form a single firm.

Moderate Current Asset Investment Policy Modified IRR (MIRR)

A policy that is between the relaxed and restricted policies.

The discount rate at which the present value of a project's cost is equal to the present value of its terminal value, where the terminal value is found as the sum of the future values of the cash inflows, compounded at the firm's cost of capital.

Money Market Fund

A mutual fund that invests in short-term, low-risk securities and allows investors to write checks against their accounts.

Money Markets

Then financial markets in which funds are borrowed or loaned for short periods (less than one year).

Monte Carlo Simulation

A risk analysis technique in which probable future events are simulated on a computer generating estimated rates of return and risk indexes.

Mortgage Bond

A bond backed by fixed assets. First mortgage bonds are senior in priority to claims of second mortgage bonds.

Multinational, or Global Corporation Multiple IRRs

A firm that operates in an integrated fashion in a number of countries.

The situation where a project has two or more IRRs.

Municipal Bonds

Bonds issued by state and local governments.

Mutually Exclusive Projects

A set of projects where only one can be accepted.

marginal Cost of Capital (MCC) Schedule

A graph that relates the firm's weighted average cost of each dollar of capital to the total amount of new capital raised.

Natural Hedges

Situations in which aggregate risk can be reduced by derivatives transactions between two parties.

Net Cash Flow

18

The actual net cash, as opposed to accounting net income, that a firm generates during some specified period.

Net Float

The difference between our checkbook balance and the balance shown on the bank's books. Net Present Value (NPV) Method A method of ranking investment proposals using the NPV, which is equal to the present value of future net cash flows, discounted at the marginal cost of capital.

Net Present Value Profile

A graph showing the relationship between a project's NPV and the firm's cost of capital.

Net Working Capital

Current assets minus current liabilities.

Nominal (Quoted) Risk-Free Rate, kRF

The rate of interest on a security that is free of all risk: kRFis proxied by the T-bill rate or the T-bond rate. kRF includes an inflation premium.

Nominal (Quoted, or Stated) Interest Rate Normal (Constant) Growth

The contracted, or quoted, or stated, interest rate.

Growth which is expected to continue into the foreseeable future at about the same rate as that of the economy as a whole; g is a constant.

Normal Profits/Rates of Return

Those profits and rates of return that are close to the average for all firms and are just sufficient to attract capital

Off Balance Sheet Financing

Financing in which the assets and liabilities involved do not appear on the firm's balance sheet.

Operating Company Operating Lease

A subsidiary of a holding company operated as a separate legal entity.

A lease under which the lessor maintains and finances the property; also called a service lease.

Operating Leverage Operating Merger

The extent to which fixed costs are used in a firm's operations.

A merger in which operations of the firms involved are integrated in hope of achieving synergistic benefits.

Operation Cash Flow

That cash flow which arises from normal operations; the difference between sales revenues and cash operation expenses, after taxes on operation income.

19

Opportunity Cost

The return on the best alternative use of an asset, or the highest return that will not be earned if funds are invested in a particular project.

Optimal Dividend Policy

The dividend policy that strikes a balance between current dividends and future growth and maximizes the firm's stock price.

Option

A contract which gives its holder the right to buy (or sell) an asset at a predetermined price within a specified period of time.

Ordinary (Deferred) Annuity

An annuity whose payments occur at the end of each period.

Organized Security Exchange

A formal organization, having a tangible physical location, that facilitates trading in designated ("listed") securities. The two major U.S. security exchanges are New York Stock Exchange (NYSE) and the American Stock Exchange (AMEX).

Organized Security Exchanges

Formal organizations having tangible physical locations that conduct auction markets in designated ("listed") securities. The two major U.S. stock exchanges are the New York Stock Exchange (NYSE) and the American Stock Exchange (AMEX).

Original Issue Discount Bond Original Maturity Out-Sourcing Outflow

Any bond originally offered at a price below its par value.

The number of years to maturity at the time a bond is issued.

The practice of purchasing components rather than making them in-house.

A cash deposit, cost, or amount paid. Has a minus sign.

Over-the-Counter (OTC) Market Over-the-Counter Market

The network of dealers that provides for trading in unlisted securities.

A large collection of brokers and dealers, connected electronically by telephones and computers, that provides for trading in unlisted securities.

PVAn

The present value of an annuity of n periods.

Par Value

The face value of a stock or bond.

Parent Company

20

A holding company; a firm which controls another firm by owning a large block of its stock.

Partnership

An unincorporated business owned by two or more persons.

Payback Period

The length of time required for an investment's net revenues to cover its cost.

Payment (PMT) Payment Date

This term designates equal cash flows coming at regular intervals.

The date on which a firm actually mails dividend checks.

Pegged Exchange Rate

Occurs when a country establishes a fixed exchange rate with another major currency; consequently, values of pegged currencies move together over time.

Perfect Hedge

Occurs when the gain or loss on the hedged transaction exactly offsets the loss or gain on the unhedged position.

Performance Shares

Stock which is awarded to executives on the basis of the company's performance.

Permanent Current Assets Perpetuity Poison Pill

Current assets that a firm must carry even at the trough of its cycles.

A stream of equal payments expected to continue forever.

An action which will seriously hurt a company if it is acquired by another.

Political Risk

Potential actions by a host government which would reduce the value of a company's investment.

Post-Audit

A comparison of the actual versus the expected results for a given capital project.

Precautionary Balance

A cash balance held in reserve for random, unforeseen fluctuations in cash inflow and outflows.

Preemptive Right

A provision in the corporate charter or bylaws that gives common stockholders the right to purchase on a pro rata basis new issues of common stock (or convertible securities).

Premium Bond

A bond that sells above its par value; occurs whenever the going rate of interest falls below the coupon rate.

21

Premium on Forward Rate Present Value (PV)

The situation when the spot rate is greater than the forward rate.

The value today of a future cash flow or series of cash flows. Present Value Interest Factor for an Annuity (PVIFAi,n) The present value interest factor for an annuity of n periods discounted at i percent.

Present Value Interest Factor for i and n (PVIFi,n)

The present value of $1 due n periods in the future discounted at i percent per period.

Price/Earning (P/E) Ratio

The ratio of the price per share to earnings per share; shows the dollar amount investors will pay for $1 of current earnings.

Primary Market

The market in which firms issue new securities to raise corporate capital.

Primary Markets Prime Rate

Markets in which corporations raise capital by issuing new securities.

A published interest rate charged by commercial banks to large, strong borrowers.

Probability Distribution

A listing of all possible outcomes, or events, with a probability (chance of occurrence) assigned to each outcome.

Production Opportunities

The returns available within an economy from investments in productive (cashgenerating) assets.

Professional Corporation (Pro Association)

A type of corporation common among professional that provides most of the benefits of incorporation but does not relieve the participants of malpractice.

Profit Margin on Sales

This ratio measures income per dollar of sales; it is calculated by dividing net income by sales.

Profit Maximization Profitability Ratios

The maximization of the firm's net income.

A group of ratios which show the combined effects of liquidity, asset management, and debts on operating results.

Progressive Tax

22

A tax system where the tax rate is higher on higher incomes. The personal income tax in the United States, which goes form 0 percent on the lowest increments of income to 39.6 percent, is progressive.

Project Cost of Capital, kp

The risk-adjusted cost of capital for an individual project.

Promissory Note

A document specifying the terms and conditions of a loan including the amount, interest rate, and repayment schedule.

Proxy

A document gibing one person the authority to act for another, typically the power to vote share of common stock.

Proxy Fight

An attempt by a person or group to gain control of a firm by getting its stockholders to grant that person or group the authority to vote their shares to place a new management into office.

Proxy Fight

An attempt to gain control of a firm by soliciting stockholders to vote for a new management team.

Publicly Owned Corporation

A corporation that is owned by a relatively large number of individuals who are not actively involved in its management.

Purchasing Power Parity

The relationship where the same products cost roughly the same amount in different countries after taking into account the exchange rate.

Pure Play Method

An approach used for estimating the beta of a project in which a firm (1) identifies several companies whose only business is the product in question, (2) calculates the beta for each firm, and then (3) averages the betas to find an approximation to its own projects beta.

Put Option

An option to sell a share of stock at a certain price within a specified period.

Quick (Acid Test) Ratio

This ratio is calculated by deducting inventories from current assets and dividing the remainder by current liabilities

Real Risk-Free Rate of Interest, k*

The rate of interest that would exist on default-free U.S. Treasury securities if no inflation were expected.

Realized Rate of Return, -k

The return that was actually earned during some past period. The actual return (k) usually turns out to be different from the expected return (^k).

23

Red-Line Method

An inventory control procedure in which a red line is drawn around the inside of an inventory-stocked bin to indicate the reorder point level.

Regular, or Simple, Interest

The situation when interest is not compounded, that is, interest is not earned on interest.

Reinvestment Rate Assumption

The assumption that cash flows from a project can be reinvested (1) at the cost of capital, if using the NPV method, or (2) at the internal rate of return, if using the IRR method.

Reinvestment Rate Risk

The risk that a decline in interest rates will lead to lower income when bonds mature and funds are reinvested.

Reinvestment Rate Risk

The risk that a decline in interest rates will lead to a decline in income from a bond portfolio.

Relaxed Current Asset Investment Policy

A policy under which relatively large amounts of cash, marketable securities, and inventories are carried and under which sales are stimulated by a liberal credit policy, resulting in a high level of receivables.

Relevant Cash Flows Relevant Risk

The specific cash flows that should be considered in a capital budgeting decision.

The risk of a security that cannot be diversified away, or its market risk. This reflects a security's contribution to the riskiness of a portfolio.

Repatriation of Earnings

The process of sending cash flows from a foreign subsidiary back to the parent company.

Replacement Analysis

An analysis involving the decision of whether or not to replace an existing asset with a new asset.

Replacement Chain(Common Life)Approach

A method of comparing projects of unequal lives which assumes that each project can be repeated as many times as necessary to reach a common life span; the NPVs over this life span are then compared, and the project with the higher common life NPV is chosen.

Required Rate of Return, ks

The minimum rate of return on a common stock that a stockholder considers acceptable.

Reserve Borrowing Capacity

24

The ability to borrow money at a reasonable cost when good investment opportunities arise . Firms often use less debt than specified by the MM optimal capital structure to ensure that they can obtain debt capital later if they need to.

Residual Dividend Model

A model in which the dividend paid is set equal to the actual earnings minus the amount of retained earnings necessary to finance the firm's optimal capital budget.

Residual Value

The value of leased property at the end of the lease term.

Restricted Current Asset Investment Policy

A policy under which holdings of cash, securities, inventories, and receivables are minimized.

Retained Earnings

That portion of the firm's earnings that has been saved rather than paid out as dividends.

Return on Common Equity (ROE)

The ratio of net income to common equity; measures the rate of return on common stockholders' investment.

Return on Total Assets (ROA) Revaluation

The ratio of net income to total assets.

The process of officially increasing the value of a country's currency relative to other currencies.

Revolving Credit Agreement Risk

A formal, committed line of credit extended by a bank or other lending institution.

In a financial market context, the chance that an investment will not provide the expected return.

Risk

The chance that some unfavorable event will occur.

Risk Aversion

Risk-averse investors dislike risk and require higher rates of return as an inducement to buy riskier securities.

Risk Management

Involves the management of unpredictable events that have adverse consequences for the firm.

Risk Premium, RP

The difference between the expected rate of return on a given risky asset and that on a less risky asset.

25

Risk-Adjusted Discount Rate

The discount rate that applies to a particular risky stream of income; the riskier the project's income stream, the higher the discount rate.

S Corporation

A small corporation which, under Subchapter S of the Internal Revenue Code, elects to be taxed as a proprietorship or a partnership yet retains limited liability and other benefits of the corporate form of organization.

Sale and Leaseback

An arrangement whereby a firm sells land, buildings, or equipment and simultaneously leases the property back for a specified period under specific terms.

Sales Forecast

A forecast of a firm's unit and dollar sales for some future period; it is generally based on recent sales trends plus forecasts of the economic prospects for the nation, region, industry, and so forth.

Scenario Analysis

A risk analysis technique in which "bad" and " good" sets of financial circumstances are compared with a most likely, or base-case, situation.

Seasonal Dating

Terms used to induce customers to buy early by not requiring payment until the purchaser's selling season, regardless of when the goods are shipped.

Secondary Market

The market in which "used" stocks are traded after they have been issued by corporations.

Secondary Markets

Markets in which securities and financial assets are traded among investors after they have been issued by corporations.

Secured Loan

A loan backed by collateral, often inventories or receivables.

Security Market Line (SML)

The line on a graph that shows the relationship between risk as measured by beta and the required rate of return for individual securities.

Semiannual Compounding

The arithmetic process of determining the final value of a cash flow or series of cash flows when interest is added twice a year.

Sensitivity Analysis

A risk analysis technique in which key variables are changed one at a time and the resulting changes in the NPV and IRR are observed.

Short Hedges Signal

Futures contracts are sold to guard against price declines.

26

An action taken by a firm's management which provides clues to investors about how management views the firm's prospects.

Sinking Fund Provision

A provision in a bond contract that requires the issuer to retire a portion of the bond issue each year.

Social Responsibility

The concept that businesses should be actively concerned with the welfare of society at large.

Sole Proprietorship Speculation

An unincorporated business owned by one individual.

With futures, it involves betting future price movements.

Speculative Balance

A cash balance that is held to enable the firm to take advantage of any bargain purchases that might arise.

Spin-Off

A divestiture in which the stock of a subsidiary is given to the parent company's stockholders.

Spontaneously Generated Funds Spot Rate

Funds that are obtained automatically from routine business transactions.

The effective exchange rate for a foreign currency for delivery on (approximately) the current day.

Stand -Alone Risk

The risk an investor would face if he or she held only one asset Stand-alone risk is one part of "total risk," with the other part being risk which can be eliminated through diversification.

Stand-Alone Risk

The risk an asset would have if it were a firm's only asset and if investors owned only one stock. It is measured by the variability of the asset's expected returns.

Standard Deviation

A statistical measure of the variability of a set of observations.

Statement of Cash Flows

A statement reporting the impact of a firm's operating, investing, and financing activities on cash flows over an accounting period.

Statement of Retained Earnings

A statement reporting how much of the firm's earnings were retained in the business rather than paid out in dividends. The figure for retained earnings that

27

appears here is the sum of the annual retained earnings for each year of the firm's history.

Stepped-Up Exercise Price

An exercise price that is specified to rise if a warrant is exercised after a designated date.

Stock Dividend

A dividend paid in the form of additional shares of stock rather than in cash.

Stock Repurchase

A transaction in which a firm buys back shares of its own stock, thereby decreasing share outstanding, increasing EPS, and, often, increasing the stock price.

Stock Split

An action taken by a firm to increase the number of share outstanding, such as doubling the number of share outstanding by giving each stockholder two new share for each one formerly held.

Stockholder Wealth Maximization

The primary goal for management decision; considers the risk and timing associated with expected earnings per share in order to maximize the price of the firm's common stock.

Strategic Business Plan

A long-run plan which outlines in broad terms the firm's basic strategy for the next 5 to 10 years.

Stretching Accounts Payable Strike (Exercise) Price

The practice of deliberately paying late.

The price that must be paid for a share of common stock when an option is exercised.

Structured Note

A debt obligation derived from another debt obligation.

Subordinated Debentures

A bond having a claim on assets only after the senior debt has been paid off in the event of liquidation.

Sunk Cost

A cash outlay that has already been incurred and which cannot be recovered regardless of whether the project is accepted or rejected.

Supernormal (Nonconstant) Growth

The part of the life cycle of a firm in which it grows much faster than the economy as a whole.

Swap

Two parties agree to exchange obligations to make specified payment streams.

28

Symmetric Information

The situation in which investors and managers have identical information about firms' prospects.

Synchronized Cash Flows

A situation in which inflows coincide with outflows, thereby permitting a firm to hold low transactions balances.

Synergy

The condition wherein the whole is greater than the sum of its parts; in a synergistic merger, the postmerger value exceeds the sum of the separate companies' premerger values.

Takeover

An action whereby a person or group succeeds in ousting a firm's management and taking control of the company . Target (Optimal) Capital Structure The percentages of debt, preferred stock, and common equity that will maximize the firm's stock price.

Target Capital Structure

The mix of debt, preferred stock, and common equity with which the firm plans to raise capital.

Target Cash Balance

The desired cash balance that a firm plans to maintain in order to conduct business.

Target Company

A firm that another company seeks to acquire.

Target Payout Ratio

The percentage of net income paid out as cash dividends.

Tax Loss Carry-Back and Carry-Forward

Ordinary corporate operation losses can be carried backward for 3 years or forward for 15 years to offset taxable income in a given year.

Taxable Income

Gross income minus exemptions and allowable deductions as set forth in the Tax Code.

Temporary Current Assets Tend Analysis

Current assets that fluctuate with seasonal or cyclical variations in sales.

An analysis of a firm's financial ratios over time; used to estimate the likelihood of improvement or deterioration in its financial situation.

Tender Offer

29

The offer of one firm to buy the stock of another by going directly to the stockholders, frequently (but not always) over the opposition of the target company's management.

Term Structure of Interest Rates Terminal Value

The relationship between bond yields and maturities.

The future value of an uneven cash flow stream.

Time Line

An important tool used in time value of money analysis; it is a graphical representation used to show the timing of cash flows.

Time Preferences for Consumption

The preferences of consumers for current consumption as opposed to saving forfuture consumption.

Times-Interest-Earned (TIE) Ratio

The ratio of earnings before interest and taxes (EBIT) to interest charges; measures the ability of the firm to meet its annual interest payments.

Times-Interest-Earned (TIE) Ratio

A ratio that measures the firm's ability to meet its annual interest obligations calculated by dividing earnings before interest and taxes by interest charges: TIE = EBIT/I.

Total Assets Turnover Ratio Trade Credit

The ratio calculated by dividing sales by total assets.

Debt arising from credit sales and recorded as an account receivable by the seller and as an account payable by the buyer.

Trade Deficit

A situation where a country imports more than it exports.

Trade Discount

A price reduction that suppliers offer customer for early payment of bills.

Transactions Balance

A cash balance associated with payments and collection; the balance necessary for day-to-day operations.

Treasury Bonds

Bonds issued by there federal government, sometimes referred to as government bonds.

Two-Bin Method

An inventory control procedure in which an order is placed when one of two inventory-stocked bins is empty.

Uneven Cash Flow Stream

30

A series of cash flows in which the amount varies from one period to the next

Variance

The square of the standard deviation.

Vertical Merger

A merger between a firm and one of its suppliers or customers.

Warrant

A long-term option to buy a stated number of shares of common stock at specified price.

Warrant

A long-term option to buy a stated number of shares of common stock at a specified price.

Weighted Average Cost of Capital, WACC

A weighted average of the component costs of debt, preferred stock, and common equity.

White Knight

A company that is acceptable to the management of a firm under threat of a hostile takeover.

Working Capital

A firm's investment in short-term assets--cash, marketable securities, inventory, and accounts receivable.

Working Capital Policy

Basic policy decision regarding (1) target levels for each category of current assets and (2) how current assets will be financed.

Worst-Case Scenario

An analysis in which all the input variables are set at their worst reasonably forecasted values.

Yield Curve

A graph showing the relationship between bond yields and maturities.

Yield to Call (YTC)

The rate of return earned on a bond if it is called before its maturity date.

Yield to Maturity (YTM) Zero Coupon Bond

The rate of return earned on a bond if it is held to maturity.

A bond that pays no annual interest but is sold at a discount below par, thus providing compensation to investors in the form of capital appreciation.

31

Zero Growth Stock

A common stock whose future dividends are not expected to grow at all; that is g=0.

32

Das könnte Ihnen auch gefallen

- Financial Management Key TermsDokument36 SeitenFinancial Management Key TermsMurli SavitaNoch keine Bewertungen

- Corporate Finance Glossary ExplainedDokument10 SeitenCorporate Finance Glossary Explainedanmol2590Noch keine Bewertungen

- Glossário de Finanças CorporativasDokument26 SeitenGlossário de Finanças CorporativasheinigeibNoch keine Bewertungen

- Glossary Final MDM PDFDokument17 SeitenGlossary Final MDM PDFDeepak ShekhawatNoch keine Bewertungen

- 10KSB Glossary 2016 - 2 - 1Dokument8 Seiten10KSB Glossary 2016 - 2 - 1Kevin TaboasNoch keine Bewertungen

- Finance Terms ExplainedDokument3 SeitenFinance Terms Explainedkalpaa sharmaNoch keine Bewertungen

- Glossary of ValuationDokument7 SeitenGlossary of Valuationveda20100% (1)

- Glossary: A Type of Preferred Stock Where The Dividends Issued Will Vary With A Benchmark, Most Often A T-Bill RateDokument14 SeitenGlossary: A Type of Preferred Stock Where The Dividends Issued Will Vary With A Benchmark, Most Often A T-Bill Ratepun33tNoch keine Bewertungen

- NikitaDokument28 SeitenNikitaPradeep NaharNoch keine Bewertungen

- Corporate Finance GlocarryDokument20 SeitenCorporate Finance GlocarryNaren PandianNoch keine Bewertungen

- Corporate Finance Terminology GlossaryDokument100 SeitenCorporate Finance Terminology GlossaryDeepu JoseNoch keine Bewertungen

- Glossary of Terms: Accounts Payable (Payables)Dokument18 SeitenGlossary of Terms: Accounts Payable (Payables)sameer patel07Noch keine Bewertungen

- Accounting ConceptsDokument16 SeitenAccounting ConceptsMani Bhargavi KommareddyNoch keine Bewertungen

- Capital ComponentDokument3 SeitenCapital ComponentShahid QayumNoch keine Bewertungen

- BCOM 111 Topic Analysis and Interpretation of Financial StatementsDokument13 SeitenBCOM 111 Topic Analysis and Interpretation of Financial Statementskitderoger_391648570Noch keine Bewertungen

- Chapter 18 - ShanaDokument8 SeitenChapter 18 - ShanaHanz SadiaNoch keine Bewertungen

- Investment Banking Technical KnowledgeDokument5 SeitenInvestment Banking Technical KnowledgeJack JacintoNoch keine Bewertungen

- IS Definitions v2Dokument13 SeitenIS Definitions v2Ajith VNoch keine Bewertungen

- Banking Update: Terminologies in Banking: CBOA Chennai RegionDokument20 SeitenBanking Update: Terminologies in Banking: CBOA Chennai RegionSanjeet MohantyNoch keine Bewertungen

- Financial TermsDokument12 SeitenFinancial TermsMasudRanaNoch keine Bewertungen

- Financial Accounting GlossaryDokument5 SeitenFinancial Accounting GlossaryDheeraj SunthaNoch keine Bewertungen

- Dividend Discount ModelDokument9 SeitenDividend Discount ModelVatsal SinghNoch keine Bewertungen

- Ch03 - Financial Statements and Ratio AnalysisDokument26 SeitenCh03 - Financial Statements and Ratio Analysisaccswc21Noch keine Bewertungen

- What Are The Disadvantages of The Perpetual and Period Inventory System?Dokument4 SeitenWhat Are The Disadvantages of The Perpetual and Period Inventory System?Siwei TangNoch keine Bewertungen

- Glossary of Fi Nancial TermsDokument11 SeitenGlossary of Fi Nancial TermsArun VishnuNoch keine Bewertungen

- Our ProjectDokument7 SeitenOur ProjectYoussef samirNoch keine Bewertungen

- COMPLETE STOCK MARKET DICTNOARY - by VSL (RexonaVn - Com)Dokument455 SeitenCOMPLETE STOCK MARKET DICTNOARY - by VSL (RexonaVn - Com)Ernest Ay.Noch keine Bewertungen

- Chapter 2Dokument6 SeitenChapter 2Anonymous 5aaAT38pZkNoch keine Bewertungen

- Terminal ValueDokument2 SeitenTerminal ValueOusmanNoch keine Bewertungen

- My Project Faisal (DR Farooq Ajaz)Dokument8 SeitenMy Project Faisal (DR Farooq Ajaz)Jahangir AhmedNoch keine Bewertungen

- Financial Strategic MeasuresDokument17 SeitenFinancial Strategic MeasuresVIVEK KUMARNoch keine Bewertungen

- Chapter 5 Stock AND Equity ValuationDokument9 SeitenChapter 5 Stock AND Equity Valuationtame kibruNoch keine Bewertungen

- CFA L1 GlossaryDokument35 SeitenCFA L1 Glossaryanindita.nag68Noch keine Bewertungen

- Key Financial Ratios Calculation and ResultDokument4 SeitenKey Financial Ratios Calculation and Resultgib999Noch keine Bewertungen

- Gyaan Kosh Term 3 Corporate Finance SummaryDokument10 SeitenGyaan Kosh Term 3 Corporate Finance SummaryAnuj AgarwalNoch keine Bewertungen

- Performance of A Company?: How To Deal With Questions On Assessing TheDokument5 SeitenPerformance of A Company?: How To Deal With Questions On Assessing TheABUAMMAR60Noch keine Bewertungen

- Technical Interview Questions - MenakaDokument15 SeitenTechnical Interview Questions - Menakajohnathan_alexande_1Noch keine Bewertungen

- CHAPTER 3 NOTESDokument3 SeitenCHAPTER 3 NOTESLeonardo WenceslaoNoch keine Bewertungen

- Job InterviewDokument21 SeitenJob InterviewMaruf AhmedNoch keine Bewertungen

- 2023 L1 GlossaryDokument40 Seiten2023 L1 Glossarycryellow8Noch keine Bewertungen

- Cash Management - Definition and Factors Determining Cash NeedsDokument6 SeitenCash Management - Definition and Factors Determining Cash NeedsMeetali PrasadNoch keine Bewertungen

- Financial Ratio MBA Complete ChapterDokument19 SeitenFinancial Ratio MBA Complete ChapterDhruv100% (1)

- Pre Test Dan Quiz 1 2Dokument9 SeitenPre Test Dan Quiz 1 2Devenda Kartika RoffandiNoch keine Bewertungen

- Finance Definitions1Dokument14 SeitenFinance Definitions1Arjun SanghviNoch keine Bewertungen

- F.M AssignmentDokument7 SeitenF.M AssignmentHashmi SutariyaNoch keine Bewertungen

- Acc Imp Points 2Dokument10 SeitenAcc Imp Points 2AnilisaNoch keine Bewertungen

- Chapter Four: The Cost of Capital 4.1. The Concept of Cost of CapitalDokument9 SeitenChapter Four: The Cost of Capital 4.1. The Concept of Cost of Capitalmelat felekeNoch keine Bewertungen

- Ratio Analysis: RatiosDokument6 SeitenRatio Analysis: RatiosDasun LakshithNoch keine Bewertungen

- Chapter 3 Solutions & NotesDokument17 SeitenChapter 3 Solutions & NotesStudy PinkNoch keine Bewertungen

- Finance Management Notes MbaDokument12 SeitenFinance Management Notes MbaSandeep Kumar SahaNoch keine Bewertungen

- Ratio AnalysisDokument17 SeitenRatio AnalysisFrank Agbeko TorhoNoch keine Bewertungen

- Discounted Cash Flow ModelDokument21 SeitenDiscounted Cash Flow Modelvaibhavsachdeva0326Noch keine Bewertungen

- Module 2Dokument27 SeitenModule 2MADHURINoch keine Bewertungen

- 25 MBA Finance Interview QuestionsDokument23 Seiten25 MBA Finance Interview QuestionsArpit MalviyaNoch keine Bewertungen

- What Are the Benefits of Issuing Common StockDokument6 SeitenWhat Are the Benefits of Issuing Common StockawaljanNoch keine Bewertungen

- Foundations of Financial Ratio AnalysisDokument49 SeitenFoundations of Financial Ratio AnalysisAnna MahmudNoch keine Bewertungen

- Financial aspects of utility regulationDokument9 SeitenFinancial aspects of utility regulationmohd_rosman_3Noch keine Bewertungen

- Understanding Financial Statements (Review and Analysis of Straub's Book)Von EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Bewertung: 5 von 5 Sternen5/5 (5)

- T&D Mid Trim Exam Pankaj Lahoty (B-17)Dokument1 SeiteT&D Mid Trim Exam Pankaj Lahoty (B-17)financedataNoch keine Bewertungen

- Product and Brand ManagementDokument33 SeitenProduct and Brand Managementsab2010Noch keine Bewertungen

- Light PenDokument3 SeitenLight PenfinancedataNoch keine Bewertungen

- Geert Hotstede's 5 DimentionsDokument7 SeitenGeert Hotstede's 5 DimentionsfinancedataNoch keine Bewertungen

- GD TopicsDokument1 SeiteGD TopicsfinancedataNoch keine Bewertungen

- SM ProjectDokument1 SeiteSM ProjectfinancedataNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument2 SeitenNew Microsoft Office Word DocumentfinancedataNoch keine Bewertungen

- Mago V SunDokument8 SeitenMago V SunMatthew Evan EstevesNoch keine Bewertungen

- Leadership and Decision Making Presentation HCS 475Dokument14 SeitenLeadership and Decision Making Presentation HCS 475Tamekia Hatter0% (1)

- Assistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyDokument2 SeitenAssistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyKathrynJaneRipleyNoch keine Bewertungen

- Hitt Chapter 2Dokument18 SeitenHitt Chapter 2Ami KallalNoch keine Bewertungen

- Assign 2 Management AccountingDokument10 SeitenAssign 2 Management AccountingRamin Mostamer ZiaNoch keine Bewertungen

- MSA-1 Syllabus Winter 2022 Financial Reporting AuditDokument14 SeitenMSA-1 Syllabus Winter 2022 Financial Reporting AuditHammad Hussain QureshiNoch keine Bewertungen

- Coca-Cola Union Dispute Over Redundancy ProgramDokument11 SeitenCoca-Cola Union Dispute Over Redundancy ProgramNullumCrimen NullumPoena SineLegeNoch keine Bewertungen

- Abdullah Al MamunDokument2 SeitenAbdullah Al MamunMamunBgcNoch keine Bewertungen

- Eap Counselling: Outcomes, Impact & Return On Investment.: Paul J Flanagan & Jeffrey OtsDokument11 SeitenEap Counselling: Outcomes, Impact & Return On Investment.: Paul J Flanagan & Jeffrey OtsPavan KumarNoch keine Bewertungen

- CFI 3 Statement Model CompleteDokument9 SeitenCFI 3 Statement Model CompleteshashankNoch keine Bewertungen

- Transforming HR with Technology ExpertiseDokument2 SeitenTransforming HR with Technology ExpertiseAdventurous FreakNoch keine Bewertungen

- BCMT Module 3 - Tech4ED Center ManagementDokument46 SeitenBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSNoch keine Bewertungen

- Lion Dates PDFDokument20 SeitenLion Dates PDFIKRAMULLAHNoch keine Bewertungen

- Objectives and Phases of Operational AuditsDokument12 SeitenObjectives and Phases of Operational AuditsChloe Anne TorresNoch keine Bewertungen

- Qam Project 103Dokument4 SeitenQam Project 103Roshan KumarNoch keine Bewertungen

- Search Suggestions: Popular Searches: Cost Accounting CoursesDokument21 SeitenSearch Suggestions: Popular Searches: Cost Accounting CoursesYassi CurtisNoch keine Bewertungen

- Jedi Mind Tricks: How To Get $700,000 of Advertising For $10,000Dokument5 SeitenJedi Mind Tricks: How To Get $700,000 of Advertising For $10,000dario_james_1Noch keine Bewertungen

- PRTC-FINAL PB - Answer Key 10.21 PDFDokument38 SeitenPRTC-FINAL PB - Answer Key 10.21 PDFLuna VNoch keine Bewertungen

- Colgate DCF ModelDokument19 SeitenColgate DCF Modelshubham9308Noch keine Bewertungen

- Group Presentation Guides: Real Company Analysis Improvement InitiativesDokument9 SeitenGroup Presentation Guides: Real Company Analysis Improvement InitiativesVy LêNoch keine Bewertungen

- Memorandum Opinion and Order For Solar Titan USADokument38 SeitenMemorandum Opinion and Order For Solar Titan USAWBIR Channel 10Noch keine Bewertungen

- 1625426853empresas Que Emitiram Vistos de Trabalho Na Irlanda - Jul 2021Dokument76 Seiten1625426853empresas Que Emitiram Vistos de Trabalho Na Irlanda - Jul 2021Marina Fenato Mariani XuNoch keine Bewertungen

- Ias 16 PpeDokument168 SeitenIas 16 PpeValeria PetrovNoch keine Bewertungen

- Sales Commission Quick Guide LS Retail NAV 6.3Dokument28 SeitenSales Commission Quick Guide LS Retail NAV 6.3sangeeth_kNoch keine Bewertungen

- MMX Intro DocumentDokument37 SeitenMMX Intro DocumentNaomi KangNoch keine Bewertungen

- Fundamentals of Financial StatementsDokument13 SeitenFundamentals of Financial StatementsJuvilyn Cariaga FelipeNoch keine Bewertungen

- Market Faliure: Presenter: Topic: Key MessageDokument8 SeitenMarket Faliure: Presenter: Topic: Key MessagedelimaNoch keine Bewertungen

- Analyzing A Case StudyDokument9 SeitenAnalyzing A Case StudyRana Fathiya KusumaNoch keine Bewertungen

- Kotler Chapter 14Dokument33 SeitenKotler Chapter 14ratih95100% (1)