Beruflich Dokumente

Kultur Dokumente

Sterlite Technologies Limited (STEOPT) : Well Placed in High Growth Markets

Hochgeladen von

sourabh_chowdhury_1Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sterlite Technologies Limited (STEOPT) : Well Placed in High Growth Markets

Hochgeladen von

sourabh_chowdhury_1Copyright:

Verfügbare Formate

Initiating Coverage

October 5, 2010

Rating Matrix

Rating Target Target Period Potential Upside : : : : Strong Buy Rs 125 12 months 32%

Sterlite Technologies Limited (STEOPT)

Well placed in high growth markets

FY12E 19.5 18.3 19.1

Rs 95

YoY Growth (%)

FY09 Total Revenues EBITDA Net Profit 35.8 17.4 -10.0 FY10E 6.2 62.7 171.4 FY11E 22.2 25.0 32.7

Current & Target Multiple (x)

FY09 P/E EV/EBITDA P/BV Target P/E Target EV EBITDA Target P/BV 17.4 16.2 2.5 22.8 10.4 3.2 FY10E 13.8 9.3 3.7 18.0 12.0 4.8 FY11E 10.9 7.1 2.7 14.2 9.7 3.6 FY12E 9.1 5.6 2.1 12.0 7.9 2.8

Niche technology, aggressive expansion plans and vertical integration make Sterlite Technologies Ltd (STL) a key beneficiary of the increased investment in the global telecom and power sectors. STL is the largest player in the domestic fibre optics and power conductor markets and among the top 5 global players in both segments. With the manufacturing capacity expansion under way, we expect the companys position to further strengthen in FY11E-12E. We are initiating coverage on the stock with a STRONG BUY rating.

Strong market position; revenue growth expected to be robust

STL enjoys an enviable position in the industry due to the sectors (telecom and power both high growth areas) and markets (India, China and Africa) served by the company. In FY10, 77% of the companys revenues were from India. We believe STL is well-placed to secure significant fibre optic cables orders from domestic telecom companies as they would witness robust subscriber addition, introduce 3G/BWA services and grow their broadband subscriber base. Furthermore, the company has a 7% share in the Chinese fibre optic market, which presents attractive opportunities. In the power sector, we expect STL to enjoy robust revenue growth in FY11E-12E fuelled by its strong market position (25% share in India and 14% in Africa) and significant investment planned by PGCIL to develop the power T&D infrastructure.

Stock Metrics

Bloomberg Code Reuters Code Face Value (Rs) Promoters Holding Market Cap (Rs cr) 52 week H/L Sensex Average volumes SOTL IN STTE.BO 2 50 3,384 124/50 20,450 514,349

Aggressive capacity expansion in place

The company is rapidly expanding its manufacturing capacity, which will make it the largest power conductor manufacturer globally (FY11E) and among the top 3 manufacturers of fibre optic cables (FY12E). The total capex for the expansion is ~Rs 390 crore and will be funded through internal accruals. With the expanded capacity and robust demand in the telecom sector, we estimate the share of the high-margin telecom products and solutions segment in STLs total revenues will rise to 42% in FY12E (vs. 37% in FY10).

Price movement

160 120 (R s) 80 40 0 A ug-09 6,000 4,500 3,000 1,500 0 Dec-09

STL

(In d ex)

Valuation

At the CMP of Rs 95, the stock is trading at a P/E of 10.9x in FY11E and 9.1x in FY12E earnings respectively. We have valued the stock at FY12E P/E of 12x, which is higher than average P/E of STLs global peers and derived a target price of Rs 125/share. We believe the premium valuation is justified given STLs strong industry position, expansion plans and superior margins.

A pr-10

Nifty (RHS)

A ug-10

Comparable return matrix (%)

Stock return (%) STL Corning Inc Furukawa General Cable Prysmian 1M -8.4 -11.7 -16.2 -5.0 -5.7 3M -4.4 0.0 -17.9 -20.1 1.4 6M 12.1 -4.5 -24.9 -4.9 -2.2 12M 81.0 10.6 -17.7 -31.4 -0.1

Exhibit 1: Key Financials*

F Y 08 F Y 09 1,686 2,289 199 234 101 91 15.4 17.6 20.0 22.8 20.0 16.4 2.9 2.5 21.1 15.3 14.7 16.5 Source: Company, ICICIdirect.com Research, *Standalone financials (R s C ro re) To tal R even u es E B ITD A Net P ro fit P E (x) Targ et P E (x) E V /E B ITD A (x) P /B V (x) R o NW (x) R o C E (% ) F Y 10E 2,432 381 246 13.9 18.0 9.4 3.7 32.0 27.8 F Y 11E 2,972 476 327 11.0 14.2 7.2 2.8 29.5 27.5 F Y 12E 3,551 563 389 9.3 12.0 5.7 2.2 26.3 25.4

Analysts name Chirag Shah

shah.chirag@icicisecurities.com

Sanjay Manyal

Sanjay.manyal@icicisecurities.com

ICICIdirect.com | Equity Research

Sterlite Technologies Limited (STEOPT)

Shareholding pattern (Q1FY11)

Shareholder Promoters Institutional Investors Other Investors General Public Holding (%) 50.2 19.6 7.9 22.3

Company Background

Sterlite Technologies Limited (STL), formerly Sterlite Optical Technologies (SOT), was established in July 2001 after the demerger of the telecom division of Sterlite Industries Ltd (SIL). In July 2006, STL acquired the transmission line business of SIL to foray into the power transmission cables business. The company operates through two business segments: power transmission and telecom products & solutions, with the former constituting ~63% of standalone revenues in FY10. In FY10, 77% of STLs revenues were derived from the domestic market. The company operates in a niche technology area and has a portfolio of 26 patents in India and abroad (as on March 31, 2010).

19.6

Promoter & Institutional holding trend (%)

60 45 (%) 30 15 0 Q2FY10 Q3FY10 Promoter Q4FY10 FI & MF Q1FY11 43.5 19.1 43.5 20.4 50.2 50.2

17.3

In the power transmission conductor market, STL has ~25% share in India and ~14% share in Africa. After its capacity expansion (200,000 MT in FY11E vs. 160,000 in FY10), STL would become the largest manufacturer of power conductors in the world. In the optical fibre and cable market, STL enjoys a 45% share in India and 7% share in China (for optical fibres). After the completion of its capacity expansion plans, STL is expected to be ranked among the top three global fibre optic manufactures by FY12E. STL is the only vertically integrated optical fibre manufacturer in India and Asia (excluding Japan). Further, it is one of the few fully integrated optical fibre manufacturers globally. Fuelled by the strong performance in both segments, STLs revenues have grown at 27% CAGR in FY07-FY10 to Rs 2,432 crore. The companys power transmission revenue growth was robust at 25% CAGR in FY07FY10 to Rs 1,525 crore driven by the aggressive targets set for power transmission capacity addition in India in the XIth (FY07-12) Plan. The revenues from the telecom products and solutions market segment grew at 30% CAGR in FY07-FY10 to Rs 907 crore driven by network capacity additions and upgradation by STLs domestic and international clients in the telecom sector. In FY10, international revenues accounted for 23% of STLs total revenues. International revenues have grown at 75% CAGR in FY05-10 to Rs 554 crore with Europe, China and Africa being the key markets. Headquartered in Pune, with staff strength of 850, the companys manufacturing facilities are located in Aurangabad, Dadra, Hardwar, Piparia and Rakholi. The company has sales and marketing offices in the US, the UK, Russia, China, South Africa and India.

Exhibit 2: CAGR of 27% in revenues in FY07-10

3,000 (R s cro re) 2,250 1,500 750 0 FY 05 FY 06 FY 07 Pow er

Source: Company, ICICIdirect.com Research

Exhibit 3: and CAGR of 69% of PAT in FY07-10

300 225 (R s cro re) 150 75 41 10 0 FY 05 FY 06 FY 07 FY 08 FY 09 FY 10 51 246

101

89

FY 08

FY 09

FY 10

Telecom

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 2

Sterlite Technologies Limited (STEOPT)

Exhibit 5: Evolution of STL

Exhibit 4: Steady growth of STLs order book

6,000 SOTL formed after demerger from 5,000 Sterlite Industries Ltd 4,000 (R s C ro re) 3,000 2,000 1,000 2002 0 FY 07 Acquisition of power transmission Optical fibre capacity Source: Company, ICICIdirect.com Research from SIL expanded to 1 mn km Started integration & managed Fibre optic capacity services business expanded to 4 mn km

China, UK offices opened Offices started in Thailand, Russia & UAE Optical fibre 5,000 capacity expanded to 12mn km Power conductor capacity increased to 160,000 MT

Copper telecom cables facility started

Optical fibre facility started

Structured data cables facility started Office started in US 3,000

4,000

2,000

1988

1992

1995

1997

2000

2004

2006

2007

2008

2009

FY 08

FY 09 Optic fibre capacity expanded to 6 mn km

FY 10

Fibre optic cables facility started

Power conductor capacity to 115,000 MT

Company name changed to Sterlite Technologies Limited

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 3

Sterlite Technologies Limited (STEOPT)

Investment Rationale

Revival of global cable market after slowdown in 2008-09

Strong growth fundamentals for the global cables industry driven by the improved macroeconomic environment and investment expected in the global telecom and power sectors

The global cable industry had revenues of US$122 billion in 2009, with power cables accounting for 67% of sales followed by communication (20%) and winding wires (13%). After enjoying robust volume growth in 2003-07 (5% CAGR) fuelled by sustained investment in power and telecom sectors globally, there was an abrupt halt in the growth momentum in 2008-09 due to the impact of the global economic crisis. Consequently, volume sales grew by a mere 1% in 2008 and contracted by 8% in 2009 (according to global consultancy CRU). Despite the slowdown, the demand for fibre optic cables continued to witness robust growth in 2008-09 driven by the near doubling of Chinese demand (87% to 73 mn km). The decision of the Chinese government to award 3G mobile licenses in early 2009 resulted in telecom companies upgrading network infrastructure, driving demand for fibre optic cables. On the other hand, fibre optic demand was weak in 2009 in the key markets of North America (-14%) and Europe (-17%). With the global economy gaining steam, the global cable industry is likely to witness 6% growth in volume sales in 2010 despite the expected slowdown in China (as per CRU). Global fibre optic cables volumes sales are expected to decline by 2.5% in 2010 due to lower Chinese demand. We believe that despite the short-term concerns on industry growth the growth fundamentals of the industry are intact driven by the improved macroeconomic environment and sustained infrastructure investment by governments in the power and telecom sectors. With several developed economies (US, Japan, Korea, etc) committing to implement fibre to home (FTTH) networks, demand for fibre optic cables is likely to remain robust. In China and India, the sustained addition of mobile subscribers will result in higher number of towers and base stations (consequently resulting in higher demand for fibre optic cables).

Exhibit 6: Energy sector dominates global cable industry sales

Wire 13% Fibre O ptic 6% Data Cables 10% Telecom Cables 4% Pow er Cables 30%

Source: CRU, ICICIdirect.com Research Global sales (2009): USD 122 bn

Exhibit 7: Fibre optic cables sales to marginally decline in 2010

180 135 (mn km) 90 45 0 2008

G lobal

L V Energy 37%

2009

China India

2010

2011

2012

E urope

North America

Source: Industry, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 4

Sterlite Technologies Limited (STEOPT)

Growth of global telecom industry driven by China and India

Growing mobile subscriber base, data usage on mobile devices and broadband internet necessitates investment to build network infrastructure, driving fibre optic demand

With STLs telecom segment revenues dominated by India (63% in FY10) and China (19%), we believe the telecom sector outlook for these two large and fast growing markets is critical for sustaining the companys growth in the future. The global mobile subscriber base stood at 4.7 billion as on December 2009 (25% CAGR in 1999-2009) while the broadband internet subscribers base stood at 480 million (61% CAGR in 1999-2009). China and India are large markets with a share of 27% (mobile subscribers) and 23% (broadband internet subscribers). Led by China and India, nearly 2 billion mobile subscribers are expected to be added over the next four or five years. This opens up a plethora of opportunities for manufacturers of telecom cables (especially fibre optic cables). In addition to the larger mobile subscriber base, increased data usage on mobile devices (viewing video, accessing emails, gaming, etc) and growing popularity of broadband internet has put tremendous pressure on existing networks, thus fuelling investment in high capacity network infrastructure. Fuelled by increased network traffic emanating from higher data usage, the global internet protocol (IP) traffic is expected to grow at 34% CAGR in CY09-14 to 62.4 exabyte/month (vs. 49% CAGR in CY0509). This will necessitate significant investment to build and upgrade network infrastructure. China will continue to maintain a dominant position in optic fibre demand (~40% share in CY12E according to CRU).

Exhibit 8: Robust growth in global IP traffic to continue

80 (E xab yte p er m o n th ) 62.4 60 40 20 2.9 0 C Y 05 C Y 06 C Y 07 C Y 08 C Y 09 C Y 10E C Y 11E C Y 12E C Y 13E C Y 14E 4.1 14.3 19.9 37.3 27.8 6.5 10.1 48.7

Source: Cisco VNI, ICICIdirect.com Research

Sustained capex by Chinese and Indian telecom companies

Capex by Chinese telecom companies is likely to be lower in CY10 due to the high spending in CY09

Indian telecom companies are likely to increase their capex in FY11E, led by Bharti Airtel and Idea Cellular, on the back of 3G rollout by domestic companies and continued subscriber base addition (15 lakh new subscribers per month). On the other hand, the capex guidance for the next year by key Chinese telecom companies, China Telecom, China Mobile and China Unicom, indicate a slowdown in spending primarily due to the large investments in the previous year to support the 3G rollout. However, we believe the changing capex mix of Chinese companies towards broadband and internet access (higher fibre optics demand) is good news for STL. Furthermore, we expect that the policy of the Chinese government of building fibre broadband ports across the country by the end of CY11 will favourably impact the demand for optical fibre cables.

ICICIdirect.com | Equity Research

Page 5

Sterlite Technologies Limited (STEOPT)

Exhibit 9: Indian telecom companies expected to increase capex in FY11E

($ bn) Bharti Airtel Idea Cellular Reliance com. FY10 1.7 1.2 0.8 FY11E 5.3 2.3 2.6

Exhibit 10: Capex by Chinese companies likely to decline in CY10E

($ bn) China Telecom China Mobile China Unicom CY09 55.7 19.0 16.5 CY10E 57.2 18.0 10.8

Source: ICICIdirect.com Research

Source: Industry, ICICIdirect.com Research

STL Among top 5 players in the global fibre optic cables market

Manufacturing capacity expansion in FY10-12E will place STL among the top 3 global players in the optical fibre segment

With a share of 45% in the domestic fibre optic cables market and global leadership position (one of the top 5 global players), we believe that STL is especially well positioned in the telecom sector. The company plans to raise its manufacturing capacity of optical fibre to 20 mn km by FY12E (12 mn km in FY10 and 4 mn km in FY07) and fibre optic cables to 6 mn fkm by FY12E (4 mn fkm in FY10 and 3.2 mn fkm in FY07), placing it among the top 3 global players. Our confidence in STL is reinforced by its strong focus on the high growth India and China markets. STL has a 7% market share in fibre optics in China. Fuelled by the growing bandwidth requirements from the burgeoning wireless and broadband subscriber base and introduction of 3G services, we expect substantial investment in China and India, resulting in robust demand for fibre optic cables. On the other hand, plans by international telecom companies to build fibre-to-the-node and fibre-to-the-home (FTTH) networks and the anticipated launch of 4G services in developed economies is driving capex for fibre deployment. In FY10, international sales contributed 37% of STLs telecom segment revenues. Consequently, we project that STLs telecom products & services segment revenues will grow at 29% CAGR in FY10-12E to Rs 1,499 crore fuelled by robust demand in India and China and the companys expanded manufacturing capacity. The positive outlook for the telecom products & services segment bodes well for STLs profitability. EBITDA margin was 21.8% for the segment in FY10 vs. 13.5% for the power transmission conductors segment. This was further boosted by the growing focus on the high-margin fibre optic products. Consequently, we expect STLs overall EBITDA margin to be in the 16% range in FY11E-12E.

Exhibit 11: STL plans to double fibre manufacturing in FY10-12E

20,000 (T h o u san d fib er K m ) 15,000

Exhibit 12: will lead to growth at 29% CAGR in telecom revenues

1,600 1,200 800 400 0

F Y 05 F Y 06 F Y 07 F Y 08 F Y 09 F Y 10 F Y 11E F Y 12E

1,499 1,196 816 907

10,000 5,000 0

F Y 05 F Y 06 F Y 07 F Y 08 F Y 09 F Y 10 F Y 11E F Y 12E

(R s C ro re)

547 327

635 414

O ptical f iber capacity

Source: Company, ICICIdirect.com Research

Fiber optic cables capacity

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 6

Sterlite Technologies Limited (STEOPT)

Exhibit 13: Reducing share of copper telecom cables in revenues

100 75 (% ) 50 25 0

33 1 4 -7 46 1 9 43 35 26 1 3 22 27 1 3 4 0 40 42 1 1 7 3 1 5 31 1 36 1 0 29 25 0 34 8 26 32 0 34 6 25

Exhibit 14: High EBITDA margin of telecom segment to be sustained

24.0 18.0 12.9 (% ) 12.0 6.0 0.0 FY 05 FY 07 FY 09 FY 11E 11.7 21.8 22.4 21.5

12.7 13.7

13.4

37 1 5

35

FY 05

Optical Fiber

FY 07

FY 09

FY 11E

Fiber Optic cables Broadband Access Networks

Copper Telecom Cables Others

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

Strong relationship with BSNL In our view, STLs strong relationship with BSNL is positive for the company given the latters plans to connect FTTX to 7 million subscribers by the end of FY15E, translating into demand of ~15.8 mn km of fibre in FY10-15E. Recently, STL secured a Rs 372-crore contract from BSNL for enabling an FTTH network based on GPON technology, which is capable of providing high-speed internet, IPTV solutions, VoIP and other value added services to ~5,00,000 subscribers.

Exhibit 15: Significant demand for fibre from BSNLs FTTX deployment

4.4 (m illio n km o f F T T x fib er) 3.3 2.2 1.2 1.1 0.0

F Y 10 F Y 11E F Y 12E F Y 13E F Y 14E F Y 15E

4.0

4.0

4.1

1.9

0.6

Source: Industry, ICICIdirect.com Research

Foray into managed services market The recent order inflows of STL indicate a foray into the domestic managed services market, a high growth opportunity for the company (but with fierce competition). In November 2009, STL announced a contract with MTNL wherein it will provide end-to-end solutions (project management, installation and deployment, network operations, network maintenance, integration and testing) for the latters launch of prepaid broadband services for residential and enterprise customers in Mumbai. We believe the order opens up a plethora of opportunities for STL in the domestic managed services market, with an estimated market of US$3 billion/annum.

ICICIdirect.com | Equity Research

Page 7

Sterlite Technologies Limited (STEOPT)

Assumptions Telecom products & solutions For STL, we expect robust volume sales growth of optic fibres and fibre optic cables in FY10-12E at 62% CAGR and 25% CAGR, respectively. Higher volumes will be driven by the strong capex plans by STLs clients and the companys expanded manufacturing capacity. We have modelled a 5% annual decline in average realisation in FY10-12E due to the excess industry capacity. For the copper telecom segment, we have forecasted an annual volume sales decline of 5% in FY11E-12E as we expect customers to increasingly shift towards high bandwidth optic fibre cables.

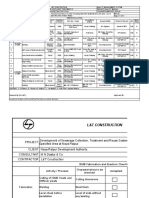

Exhibit 16: Telecom products & solutions - Assumptions table

FY07 O ptical Fiber Volum e (KM ) % YoY Realisation (Rs/KM ) % YoY G ross Sales (Rs crore) % YoY Fiber O ptic cables Volum e (FKM ) % YoY Realisation (Rs/FKM ) % YoY G ross Sales (Rs crore) % YoY Copper Telecom Cables Volum e (CKM ) % YoY Realisation (Rs/C KM ) % YoY G ross Sales (Rs crore) % YoY Broadband Access N etw orks G ross Sales (Rs crore) % YoY O thers G ross Sales (Rs crore) % YoY O verall Net sales (Rs crore) % YoY EBITD A (Rs crore) % of net sales 53 12.7 414 635 53.5 87 13.7 816 28.5 109 13.4 907 11.2 198 21.8 1,196 31.8 268 22.4 1,499 25.4 322 21.5 18 9 -51.3 25 193.5 5 -79.2 5 0.0 5 0.0 0 116 82978.6 126 8.7 340 168.8 425 25.0 531 25.0 180 884 2,034,450 2,720,553 33.7 1,062 20.2 289 60.7 2,817,033 3.5 962 -9.4 271 -6.2 844,214 -70.0 1,149 19.3 97 -64.2 802,003 -5.0 1,206 5.0 97 -0.3 761,903 -5.0 1,266 5.0 96 -0.2 157 1,306 1,201,289 1,552,907 29.3 1,208 -7.5 188 19.6 2,804,094 80.6 1,132 -6.2 318 69.3 2,685,010 -4.2 1,016 -10.3 273 -14.1 3,356,263 25.0 965 -5.0 324 18.8 4,195,328 25.0 917 -5.0 385 18.8 97 358 2,723,213 2,632,767 -3.3 339 -5.2 89 -8.4 3,616,583 37.4 355 4.8 129 43.9 5,389,573 49.0 434 22.2 234 82.2 9,701,231 80.0 413 -5.0 400 71.0 14,066,786 45.0 392 -5.0 551 37.8 FY08 FY09 FY10 FY 11E FY 12E

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 8

Sterlite Technologies Limited (STEOPT)

Investment in power sector fuelled by growing power demand

Domestic power demand is expected to be robust driven by sustained economic growth

The domestic market constituted 86% of the revenues of STLs power transmission conductors segment in FY10. The remaining revenues came from Africa (8%) and the Middle East (5%). In India, high power sector investment is needed to sustain the robust economic growth witnessed in the past. According to the IMF, the Indian economy is expected to grow at 8.1% CAGR in FY10-15E (vs. 8.2% CAGR in FY05-10). Growth of power demand has been robust in the last decade (5% CAGR in FY00-10 to 118 GW) driven by the economic expansion, industrial sector development and higher power generation capacity. However, India continues to reel under supply side constraints, with a peak load deficit of ~13% in FY10. Growth of power demand is expected to remain strong at 9% CAGR in FY10-17E according to the Central Electricity Authority (CEA). This necessitates substantial investment in power generation, distribution and transmission capacities to satiate the expected rise in per capita consumption of electricity.

Exhibit 17: CAGR of 5% in domestic power demand in FY00-10

140 105 (G W) 73 70 35 0 F Y 00 F Y 01 F Y 02 F Y 03 F Y 04 F Y 05 F Y 06 F Y 07 F Y 08 F Y 09 F Y 10 81 85 88 93 101 109 110 118

Exhibit 18: and high power deficit exists in India*

16.0 12.0 (% ) 8.0 4.0 0.0 F Y 00 F Y 01 F Y 02 F Y 03 F Y 04 F Y 05 F Y 06 F Y 07 F Y 08 F Y 09 F Y 10

78

78

Source: CEA, ICICIdirect.com Research

Source: CEA, ICICIdirect.com Research, *Measured by peak load deficit

An opportunity of Rs 31,500 crore exists in the XIth Plan for power conductors (STLs target market in the power segment)

Large investment in T&D due to aggressive XI-XII plan targets The government has set aggressive power generation capacity addition targets in the XIth (FY07-12) and XIIth (FY12-17) plans. Capacity of 179 GW is targeted to be added during the period. This is higher than the 132 GW capacity created since Indias independence. Such aggressive power generation capacity expansion will also require significant investments for creating transmission and distribution (T&D) networks (~50% of the total power sector investment). For the XIth Plan, the market for power conductors (STLs target market in the power sector) is worth Rs 31,500 crore. The scale of opportunity is set to become even larger in the XIIth plan, with the governments target of raising power sector investment vis--vis the XIth plan targets. According to the CEA, Indias transmission capacity is targeted to increase by 53-61% during the XIIth plan to 448,852-473,852 cable kilometre (ckm). The growth comes after the aggressive targets set for the XIth Plan (48% to 293,852 ckm).

ICICIdirect.com | Equity Research

Page 9

Sterlite Technologies Limited (STEOPT)

Exhibit 19: Power conductors constitute a market of Rs 31,500 crore in the XIth Plan Rs 837,000 crore Power opportunity

Rs 410,900 crore CPPs Generation T&D

Rs 427,000 crore

Rs 140,000 crore Transmission Distribution

Rs 287,000 crore

EPC projects

LV equipment

Cables

Metres

Rs 91,000 crore Transmission line Substation

Rs 49,000 crore

Tower package

Rs 55,000 crore

Conductors

Rs 31,500 crore

Insulator

Rs 4,500 crore

Transformer

Substation package

Insulator

Source: Company, ICICIdirect.com Research

Expansion of power conductor manufacturing capacity to 200,000 MT by FY12E will fuel revenues of the power transmission conductors segment

STLs leadership position in the domestic power conductor market STL is Indias largest power conductor manufacturer with ~25% share in the domestic conductor market. It is set to become the largest global player subsequent to its capacity expansion. The manufacturing capacity will be raised to 200,000 MT power transmission conductors by FY11E (vs. 160,000 MT capacity in FY10). Currently, a majority of STLs revenues in the power sector comes from Power Grid Corporation (PGCIL) and state electricity boards. Domestic power transmission major PGCIL is STLs largest customer in this segment with 54% share (as on Q1FY11) in the latters overall order book. PGCIL had aggressive capex plans during the XIth Plan (Rs 55,000 crore on transmission schemes vs. Rs 18,186 crore in the Xth Plan). Of this, the company has invested Rs 25,440 crore in the first three years of the XIth Plan while an outlay of Rs 12,900 crore is planned for FY11E. The remaining investment of Rs 16,700 crore will take place in FY12E (based on the quantum of generation capacity added). Furthermore, PGCIL plans to invest Rs 64,000 crore over the next five or six years (in addition to XIth Plan investment targets) for building nine high-capacity transmission super highways. This presents a large market opportunity for STL as it is one of PGCILs major vendors. In this backdrop, we project STLs power transmission segment revenues will grow at 16% CAGR in FY10-12E to Rs 2,051 crore. Revenue growth

ICICIdirect.com | Equity Research

Page 10

Sterlite Technologies Limited (STEOPT)

will be primarily driven by higher volume sales and growth in realisation (due to higher aluminium prices).

Exhibit 20: Power conductor capacity to be raised to 200,000 MT by FY12E

240,000 180,000 (MT ) 120,000 60,000 0

F Y 07 F Y 08 F Y 09 F Y 10 F Y 11E F Y 12E

Exhibit 21: Growing revenues of power transmission conductor segment

2,400 1,800 1,200 600 0

F Y 07 F Y 08 F Y 09 F Y 10 F Y 11E F Y 12E

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

Foray into EPC projects to provide long-term revenue streams

STLs foray into the EPC domain of the power transmission sector provides long-term revenue opportunities

Besides supplying power conductors, STL has recently forayed into the EPC segment wherein it will establish two 400 KV double circuit transmission lines that would connect Assam, West Bengal and Bihar. The ultra-mega transmission project (UMTP), on a build, own, operate and maintain (BOOM) basis, was secured from Power Finance Corporation Limited (PFC). The deployment of this mega transmission project is expected to require a capex of Rs 900-1,000 crore (with equity contribution in the order of 25-30%) spread over a period of three years. Thereafter, the project is likely to be operated by STL for at least 22 years, providing the company a stable revenue stream. However, we have not incorporated revenues from this project into our estimates due to limited information on the same. As the government is expected to award 14 transmission projects worth nearly Rs 20,000 crore, STL will have the opportunity to bid for more projects and generate additional revenues from this business line. According to the management, the company expects to generate RoE of 15-20% from its investment in the transmission project.

ICICIdirect.com | Equity Research

(R s cro re)

Page 11

Sterlite Technologies Limited (STEOPT)

Assumptions Power transmission conductors We expect volume sales of the power transmission conductor segment to grow at 10.5% in FY10-12E driven by the aggressive targets set by the government to expand the T&D infrastructure in India. We have modelled a 5% annual growth in average realisation in FY11E-12E, in line with rising commodities prices in the global markets.

Exhibit 22: Power transmission conductors - Assumptions table

FY07 Volume (MT) % YoY Realisation (Rs/MT) % YoY Gross Sales (Rs crore % YoY Net sales (Rs crore) % YoY EBITDA (Rs crore) % of net sales 63 8.0 784 849 138,618 61,238 FY08 82,658 35.0 130,728 -5.7 1,081 27.3 1,050 33.9 114 10.9 FY09 110,645 33.9 137,443 5.1 1,521 40.7 1,473 40.2 131 8.9 FY10 124,572 12.6 124,141 -9.7 1,546 1.7 1,525 3.5 206 13.5 FY11E 138,180 10.9 130,348 5.0 1,801 16.5 1,776 16.5 231 13.0 FY12E 151,998 10.0 136,866 5.0 2,080 15.5 2,051 15.5 267 13.0

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 12

Sterlite Technologies Limited (STEOPT)

Vertical integration contributes to higher margins than peers STL has vertically integrated operations in both the telecom and power segments, thus providing it a natural cost advantage vis--vis peers (domestic and international). The company has a fully integrated optical fibre manufacturing facility, the only such facility outside the US, France and Japan. STL has a presence across the entire value-chain from production of glass to the production of fibre optic cables, contributing to the company generating higher operating margins than international peers (Furukawa, General Cable Corp, Prysmian SPA and Draka).

Exhibit 23: Fully integrated optical fibre manufacturing facility

STLs presence across the fibre optic manufacturing value chain allows the company to generate higher margins than its global peers Silicon (Mines) Power

SiCl4 (Chemical)

Hydrogen

Oxygen

Glass (Core rod + Cladding)

Preform

Fibre

Cables

Source: Company, ICICIdirect.com Research

STL is the largest manufacturer of power conductors globally. In this segment also, the company has a fully integrated manufacturing facility from mining of aluminium to manufacturing of power conductors. STL has a reliable supplier of aluminium in the form of Sterlite Industries Ltd (SIL). SIL is a sister concern of STL and supplies aluminium to the latter at market prices.

ICICIdirect.com | Equity Research

Page 13

Sterlite Technologies Limited (STEOPT)

Exhibit 24: Fully integrated power conductor facility

Aluminium ingots Aluminium ingots Aluminium molten metal Aluminium molten metal

Rolling mill

Aluminium / alloy rods Aluminium / alloy rods

Steel core Steel core

Al / Alloy wires Al / Alloy wires

Fibre in SS tube Fibre in SS tube

Conductors ACSR / AAAC / ACSS Conductors ACSR / AAAC / ACSS Source: Company, ICICIdirect.com Research

OPGW cables OPGW cables

Higher profitability enjoyed by STL compared to international peers Among international peers, over the last four or five years, STL has enjoyed higher revenue growth (45% CAGR in FY06-10) and operating profit (76% CAGR) driven by its focus on the high growth in the India and Chinese markets and rapidly expanding capabilities (foray into fibre optic market, capacity expansion). In our view, the companys vertically integrated manufacturing facilities and operations in the low cost country (India) have played an important part in STL improving its margin profile over the years. Majority of STLs peers have a more diverse product range catering to multiple segments (telecom, energy, electronics, auto, etc). On deeper analysis of segment-wise EBIT margins, we have observed that STL even enjoys significantly higher margins compared to its international peers in both the telecom and energy segments. This could also be due to higher proportion of revenues of peers coming from the sale of hardware and equipment in addition to the reasons listed above.

ICICIdirect.com | Equity Research

Page 14

Sterlite Technologies Limited (STEOPT)

Exhibit 25: Higher growth of revenues and profitability of STL vis--vis international peers in FY09-10

F Y 06 F Y 07 F Y 08 F Y 09 F Y 10 C A G R (F Y 0 6 -1 0)

C o rn in g In c .

S a le s ( $ m n) O pe ra ting profit ($ m n) O pe ra ting m a rg in (% ) P A T ( $ m n) 4 ,5 7 9 576 1 2 .6 585 5 ,1 7 4 835 1 6 .1 1 ,8 5 5 5 ,8 6 0 1 ,0 6 6 1 8 .2 2 ,1 5 0 5 ,9 4 8 1 ,5 2 0 2 5 .6 5 ,2 5 7 5 ,3 9 5 389 7 .2 2 ,0 0 8 3 6 .1 4 .2 -9 .3

G e n e ral C a ble s C o rp .

S a le s ( $ m n) O pe ra ting profit ( $ m n) O pe ra ting m a rg in (% ) P A T ( $ m n) 2 ,3 8 1 99 4 .1 39 3 ,6 6 5 236 6 .4 134 4 ,6 1 5 341 7 .4 192 6 ,2 3 0 421 6 .8 189 4 ,3 8 5 250 5 .7 109 2 9 .0 1 6 .5 2 6 .2

D ra k a H o ldin g

S a le s (EU R m n) O pe ra ting profit (EU R m n) O pe ra ting m a rg in (% ) P A T (EU R m n) P ry s m ia n S A S a le s (EU R m n) O pe ra ting profit (EU R m n) O pe ra ting m a rg in (% ) P A T (EU R m n) 1 ,6 7 0 34 2 .0 -2 9 5 ,0 5 8 258 5 .1 89 5 ,1 6 9 508 9 .8 300 5 ,1 8 3 380 7 .3 237 3 ,7 6 3 386 1 0 .3 248 NA 2 2 .5 8 4 .1 2 ,3 3 5 38 1 .6 6 3 ,1 7 4 72 2 .3 27 3 ,8 5 4 199 5 .2 127 4 ,1 3 8 139 3 .4 101 2 ,8 4 9 12 0 .4 -2 5 NA 5 .1 -2 4 .7

N exan SA

S a le s (EU R m n) O pe ra ting profit (EU R m n) O pe ra ting m a rg in (% ) P A T (EU R m n) 4 ,2 6 3 289 6 .8 162 4 ,4 4 3 364 8 .2 243 4 ,8 2 1 361 7 .5 189 4 ,7 7 6 209 4 .4 83 4 ,0 2 6 152 3 .8 7 -5 4 .4 -1 .4 -1 4 .8

F u ru ka w a E lec tric C o .

S a le s (J P Y m n) O pe ra ting profit (J P Y m n) O pe ra ting m a rg in (% ) P A T (J P Y m n) 8 7 2 ,5 3 5 1 0 ,5 7 1 1 .2 2 5 ,5 1 0 1 ,1 0 4 ,7 0 9 5 2 ,8 1 1 4 .8 2 9 ,7 6 7 1 ,1 7 4 ,2 4 7 3 9 ,5 7 1 3 .4 1 5 ,2 9 2 1 ,0 3 2 ,8 0 7 -8 ,3 0 1 -0 .8 -3 7 ,4 0 4 8 0 9 ,6 9 3 7 ,3 7 4 0 .9 9 ,7 0 5 -2 1 .5 -1 .9 -8 .6

S u m ito m o E le ctric In du s tries

S a le s (J P Y m n) O pe ra ting profit (J P Y m n) O pe ra ting m a rg in (% ) P A T (J P Y m n) 2 ,0 0 7 ,1 3 4 8 9 ,1 3 8 4 .4 5 8 ,3 4 6 2 ,3 8 4 ,3 9 5 1 1 6 ,1 0 4 4 .9 7 6 ,0 2 9 2 ,5 4 0 ,8 5 8 1 3 0 ,5 1 5 5 .1 8 7 ,8 0 4 2 ,1 2 1 ,9 7 8 2 6 ,8 8 0 1 .3 1 7 ,2 3 7 1 ,8 3 6 ,3 5 2 2 9 ,9 8 2 1 .6 2 8 ,7 0 8 -1 6 .2 -2 .2 -2 3 .8

S terlite T ec h n o lo gie s

S a le s (R s c rore ) O pe ra ting profit (R s c rore ) O pe ra ting m a rg in (% ) P A T (R s c rore ) 547 35 6 .4 41 1 ,1 9 8 82 6 .9 51 1 ,6 8 6 162 9 .6 101 2 ,2 8 9 192 8 .4 91 2 ,4 3 2 333 1 3 .7 246 5 6 .7 4 5 .2 7 5 .8

Source: Industry, ICICIdirect.com Research, Year ending for Corning Inc, General cables, Draka Holding, Prysmian SA, Nexan SA is Dec 31. We have compared CY09 revenues of these companies with FY10 revenues of STL (similar methodology followed in the previous years).

ICICIdirect.com | Equity Research

Page 15

Sterlite Technologies Limited (STEOPT)

Exhibit 26: and higher profitability on a segment-wise basis also

EBIT margin (%) Company Telecom segment Energy segment

Draka Holding Prysmian SA Nexan SA Furukawa Electric Co. Sumitomo Electric Industries Sterlite Technologies (STL)*

3.6 6.1 5.4 7.3 1.3 21.8

4.8 9.3 6.8 1.8 1.9 13.5

Source: Industry, ICICIdirect.com Research, *Segment-wise EBITDA margins available for STL

ICICIdirect.com | Equity Research

Page 16

Sterlite Technologies Limited (STEOPT)

Risks and concerns

Lower capex may result in lower revenue growth

An external shock in the global economy could result in telecom and power companies cutting down their capex plans. This could result in lower-than-expected order inflows for STL (and lower revenues).

Volatility of commodity prices may result in margin contraction

Although a majority of STLs contracts have a price variation clause, significant volatility of commodity prices can adversely impact STLs margins. In FY10, aluminium, copper rods and steel accounted for ~73% of the total raw material expenses, with aluminium accounting for a majority of costs (~63% of the total raw material expenses). According to our sensitivity analysis on changes in raw material/sales (RM/sales) ratio on STLs EPS, we estimate that a 100 bps movement on the RM/sales ratio on either side would result in an EPS volatility of 6% in FY11E and 7.5% in FY12E, respectively, vis--vis our base case.

Exhibit 27: RM/sales ratio higher by 100 bps results in 6% lower EPS in FY11E (vs. base case)

FY11E Base case EBITDA EPS 476 8.8 FY12E 563 10.4

RM/Sales +100bp our estimate

EBITDA EPS

451 8.2

527 9.6

RM/Sales -100bp our estimates

EBITDA EPS

502 9.3

600 11.2

Source: Company, ICICIdirect.com Research

Exchange rate volatility may result in lower earnings

A significant volatility in exchange rates could adversely impact STLs earnings as international revenues accounted for 23% of the total revenues in FY10. Additionally, in FY10, ~36% of raw materials by total value were imported.

New technological developments may affect fibre optic demand

A majority of telecom companies in developed countries are deploying fibre optic networks to provide higher bandwidth to customers. However, new technologies, like Docsis 3.0, are fast gaining ground as it allows transfer of data at high speed (and at a lower cost compared to fibre optic cables). Increased penetration of new technologies could adversely impact FTTX penetration levels, which are the long-term growth drivers for fibre optic volumes.

ICICIdirect.com | Equity Research

Page 17

Sterlite Technologies Limited (STEOPT)

Financials

Revenues to grow at 21% CAGR in FY10-12E

We estimate STLs revenues will grow at 21% CAGR in FY10-12E to Rs 3,551 crore. The topline will be fuelled by robust growth of volume sales in both segments. With the companys strong presence in the Indian and Chinese fibre optic markets, we project that telecom products & services segment revenues will grow at 29% CAGR in FY10-12E to Rs 1,499 crore. Consequently, the segments share in total revenues is expected to increase to 42% in FY12E (vs. 37% in FY10).

Exhibit 28: Revenues to grow at 21% CAGR in FY10-12E

4,000 3,000 2,000 1,000 0

F Y 05 F Y 06 F Y 07 F Y 08 F Y 09 F Y 10 F Y 11E F Y 12E

Exhibit 29: Telecom segment share in revenues to rise in FY11E-12E

3,551 100 75 50 25 0

1 00 1 00 65 62 64 63 60 58 35 38 36 37 40 42

2,972 2,289 2,432 1,686 1,198 327 547

(R s cro re)

F Y 05

F Y 06

F Y 07

F Y 08

F Y 09

F Y 10

F Y 11E

54 46

Power

Telecom

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

EBITDA margins projected to be stable

We expect STL to sustain its EBITDA margin in the 16% range. Margins will be protected as a majority of the companys orders are with cost escalation clauses. Our margin assumptions are conservative given the higher contribution in revenues of the high-margin telecom products & services segment (EBITDA margin of 21.8% in FY10 vs. 13.5% for the power transmission segment). Thus, an upside case exists for our assumptions. EBITDA is estimated to grow at 22% CAGR in FY10-12E to Rs 563 crore (vs. 38% CAGR in FY08-10).

Exhibit 30: EBITDA margin expected to remain stable in FY11E-12E

600 450 (R s cro re) 300 150 0

F Y 05 F Y 06 F Y 07 F Y 08 F Y 09 F Y 10 F Y 11E F Y 12E

Exhibit 31: High contribution of power segment in EBITDA to continue

100 75 (% )

46 1 00 1 00 54 57 54 51 45 43 46 49 55

20 15 (% ) 10 5 0

50 25 0

F Y 05

F Y 06

F Y 07

F Y 08

F Y 09

F Y 10

F Y 11E

EBITDA

EBITDA Margin (RHS)

Power

Telecom

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 18

F Y 12E

F Y 12E

Sterlite Technologies Limited (STEOPT)

Return ratios expected to decline in FY11E-12E

With the expected commissioning of the new manufacturing capacity in FY11E-12E, we expect the RoCE and RoNW to marginally decline due to the lower capacity utilisation rates (and lower asset utilisation rate) and the expected conversion of Esops to equity.

Exhibit 32: Return ratios to decline in FY11E-12E

36.0 27.0 (% ) 18.0 14.7 9.0 0.0 FY 08 FY 09 FY 10

RoCE

32.0 27.8

29.5 27.5

26.3 25.4

21.1

16.5 15.3

FY 11E

RoNW

FY 12E

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 19

Sterlite Technologies Limited (STEOPT)

Valuations

We have valued STL at 12x FY12E P/E to derive a target price of Rs 125/share. The valuation is at a premium to its international peers

At the CMP of Rs 95, the stock is trading at a P/E of 10.9x in FY11E and 9.1x in FY12E earnings, respectively. We have valued the stock at an FY12E P/E of 12x, which is higher than average P/E of STLs global peers and derived a target price of Rs 125/share. We believe the premium valuation is justified given STLs strong industry position, expansion plans and superior margins. We are initiating coverage on the stock with STRONG BUY rating.

Exhibit 33: STL - P/E band chart

150 100 (Rs) 50 0 Mar-07 Price

Sep-07

Mar-08 Average

Sep-08

Mar-09 13.1x

Sep-09 2.3x

Mar-10

Sep-10

Source: Company, ICICIdirect.com Research

Exhibit 34: STL - EV/EBITDA band

5000 3750 (Rs Crore 2500 1250 0 Mar-07

Sep-07 9.6x

Mar-08

Sep-08 6.4x

Mar-09 3.2x

Sep-09

Mar-10 EV

Sep-10

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 20

Sterlite Technologies Limited (STEOPT)

Exhibit 35: Peer valuation

CMP LCU* Sterlite Technologies Limited (INR) Corning Inc (USD) Furukawa Electric Company Limited (J General Cable Corp. (USD) Prysmian (EUR) Rs 95 USD 18 JPY 302 USD 26 EUR 13 Market Cap Rs Crore 3,373 126,129 30,167 8,373 18,758 P/E (x) FY11E 10.9 8.5 12.9 11.7 12.6 FY12E 9.1 8.9 10.6 9.6 10.2 EV/EBITDA (x) FY11E 7.1 10.1 6.5 5.1 7.7 FY12E 5.6 9.6 6.1 4.5 6.6 P/BV (x) FY11E 2.7 1.8 1.4 0.9 3.9 FY12E 2.1 1.5 1.2 0.8 3.1

Source: Company, ICICIdirect.com Research, *Local Currency Units

ICICIdirect.com | Equity Research

Page 21

Sterlite Technologies Limited (STEOPT)

Financials

Exhibit 36: Profit & loss account*

Rs Crore Total Revenues Growth (%) Op. Expenditure EBITDA Growth (%) Depreciation EBIT Interest Other Income Extraordinary Item PBT Growth (%) Tax Rep. PAT before MI Minority Interest (MI) Rep. PAT after MI Adjustments Adj. Net Profit Growth (%) FY08 1,686 40.7 1,486 199 72.4 37 162 36 4 0 130 145.9 30 101 0 101 0 101 98.0 FY09 2,289 35.8 2,055 234 17.4 43 192 90 7 0 108 -17.3 19 89 0 89 2 91 -10.0 FY10 2,432 6.2 2,051 381 62.7 48 333 38 23 0 317 194.4 71 246 0 246 0 246 171.4 FY11E 2,972 22.2 2,495 476 25.0 54 423 39 23 0 407 28.2 80 327 0 327 0 327 32.7 FY12E 3,551 19.5 2,987 563 18.3 60 503 43 26 0 486 19.4 97 389 0 389 0 389 19.1

Source: Company, ICICIdirect.com Research, *Standalone financials

Exhibit 37: Balance sheet*

Rs Crore Equity Capital Reserves & Surplus Shareholder's Fund Borrowings Unsecured Loans Deferred Tax Liability Source of Funds Gross Block Less: Acc. Depreciation Net Block Capital WIP Net Fixed Assets Intangible Assets Investments Cash Trade Receivables Loans & Advances Inventory Total Current Asset Current Liab. & Prov. Net Current Asset P&L Account Application of Funds FY08 32 507 540 663 0 38 1,240.8 918 395 523 36 559 1 6 89 519 169 219 996 322 675 0 1,240.8 FY09 32 589 621 497 0 56 1,173.5 975 431 545 111 656 1 92 78 546 201 100 925 501 425 0 1,173.5 FY10 71 845 916 358 0 60 1,334.4 1,084 467 617 57 674 10 106 210 629 157 171 1,166 621 545 0 1,334.4 FY11E 74 1,225 1,299 500 0 60 1,859.4 1,149 519 630 192 822 8 106 512 774 192 210 1,689 765 924 0 1,859.4 FY12E 75 1,583 1,658 500 0 60 2,217.9 1,349 578 771 142 913 6 106 702 926 229 252 2,109 916 1,192 0 2,217.9

Source: Company, ICICIdirect.com Research, *Standalone financials

ICICIdirect.com | Equity Research

Page 22

Sterlite Technologies Limited (STEOPT)

Exhibit 38: Cash flow statement*

Rs Crore Net Profit before Tax Other Non Cash Exp Depreciation Direct Tax Paid Other Non Cash Inc Other Items CF before change in WC Inc./Dec. In WC CF from Operations Pur. of Fix Assets Pur. of Inv CF from Investing Inc./(Dec.) in Debt Inc./(Dec.) in Net Worth Others CF from Financing Opening Cash Balance Closing Cash Balance FY08 130 0 37 2 4 36 198 -163 35 -110 0 -105 77 29 -44 62 79 89 FY09 108 0 43 3 7 90 232 217 449 -132 -86 -212 -167 1 -100 -265 89 78 FY10 317 0 48 67 23 38 314 -39 275 -64 -14 -55 -138 71 -59 -126 78 210 FY11E 407 0 54 81 23 39 396 -77 319 -200 0 -177 142 100 -82 160 210 512 FY12E 486 0 60 97 26 43 466 -79 388 -150 0 -124 0 8 -81 -73 512 702

Source: Company, ICICIdirect.com Research, *Standalone financials

Exhibit 39: Key ratios*

Y -o -Y G ro wth (% ) To tal R even u es E B ITDA Ad j. Net P ro fit C as h E P S Net Wo rth F Y 08 40.7 72.4 98.0 56.7 29.5 F Y 09 35.8 17.4 -10.0 0.4 15.1 F Y 10 6.2 62.7 171.4 -0.4 47.5 F Y 11E 22.2 25.0 32.7 23.1 41.8 F Y 12E 19.5 18.3 19.1 17.8 27.6

Source: Company, ICICIdirect.com Research, *Standalone financials

Exhibit 40: Key ratios*

F Y 08 R aw Material E m p lo yee E xp en d itu re E ffective Tax R ate P ro fitab ility R atio s (%) E B ITDA Marg in P AT Marg in P er S h are D ata (R s ) R even u e p er s h are B o o k V alu e C as h p er s h are E PS C as h E P S DPS 72.2 2.5 22.8 F Y 09 74.1 2.2 17.9 F Y 10 66.0 2.4 22.5 F Y 11E 65.4 2.8 19.7 (% ) F Y 12E 65.7 2.6 20.0

11.8 6.0

10.2 3.9

15.7 10.1

16.0 11.0

15.9 11.0

104.6 33.5 5.5 6.3 8.6 0.4

141.9 38.5 4.8 5.5 8.6 0.5

68.4 25.8 5.9 6.9 8.6 0.5

79.8 34.9 13.7 8.8 10.5 1.0

95.0 44.4 18.8 10.4 12.4 0.9

Source: Company, ICICIdirect.com Research, *Standalone financials

ICICIdirect.com | Equity Research

Page 23

Sterlite Technologies Limited (STEOPT)

Exhibit 41: Key ratios*

Return Ratios RoNW ROCE ROIC Financial Health Ratio Operating CF (Rs Cr) FCF (Rs Cr) Cap. Emp. (Rs Cr) Debt to Equity (x) Debt to Cap. Emp. (x) Interest Coverage (x) Debt to EBITDA (x) DuPont Ratio Analysis PAT/PBT PBT/EBIT EBIT/Net Sales Net Sales/Total Asset Total Asset/NW FY08 21.1 14.7 7.7 35 -103 1,203 1.2 0.6 4.5 3.3 77.2 80.4 9.6 149.6 2.3 FY09 15.3 16.5 7.3 449 300 1,118 0.8 0.4 2.1 2.1 82.1 56.3 8.4 189.6 1.9 FY10 32.0 27.8 17.7 275 206 1,274 0.4 0.3 8.7 0.9 77.5 95.4 13.7 193.9 1.5 FY11E 29.5 27.5 15.7 319 119 1,800 0.4 0.3 10.8 1.1 80.3 96.3 14.2 186.1 1.4 (%) FY12E 26.3 25.4 16.2 388 238 2,158 0.3 0.2 11.8 0.9 80.0 96.6 14.2 174.2 1.3 (x times) FY12E 33.6 23.7 87.4 79.4 2.3 (Rs crore) FY12E 563 97 466 -150 -79 238 (x times) FY12E 9.1 5.6 0.9 0.9 2.1

Working Capital Working Cap./Revenues (%) Inventory turnover Debtor turnover Creditor turnover Current Ratio

FY08 40.0 36.7 103.1 54.5 3.1

FY09 18.6 25.5 84.9 62.4 1.8

FY10 22.4 20.4 88.2 78.8 1.9

FY11E 31.1 23.4 86.2 78.2 2.2

FCF Calculation EBITDA Less: Tax NOPLAT Capex Change in working cap. FCF

FY08 199 30 170 -110 -163 -103

FY09 234 19 215 -132 217 300

FY10 381 71 310 -64 -39 206

FY11E 476 80 396 -200 -77 119

Valuation PE (x) EV/EBITDA (x) EV/Sales (x) Dividend Yield (%) Price/BV (x)

FY08 15.2 19.8 2.3 0.4 2.8

FY09 17.4 16.2 1.7 0.5 2.5

FY10 13.8 9.3 1.5 0.5 3.7

FY11E 10.9 7.1 1.1 1.0 2.7

Source: Company, ICICIdirect.com Research, *Standalone financials

ICICIdirect.com | Equity Research

Page 24

Sterlite Technologies Limited (STEOPT)

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Add, Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: 20% or more; Buy: Between 10% and 20%; Add: Up to 10%; Reduce: Up to -10% Sell: -10% or more; Pankaj Pandey Head Research ICICIdirect.com Research Desk, ICICI Securities Limited, 7th Floor, Akruti Centre Point, MIDC Main Road, Marol Naka, Andheri (East) Mumbai 400 093 research@icicidirect.com ANALYST CERTIFICATION

We /I, Chirag Shah PGDBM, Sanjay Manyal MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

pankaj.pandey@icicisecurities.com

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and employees (ICICI Securities and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. ICICI Securities and affiliates expect to receive compensation from the companies mentioned in the report within a period of three months following the date of publication of the research report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that Chirag Shah PGDBM, Sanjay Manyal MBA research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that Chirag Shah PGDBM, Sanjay Manyal MBA research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use of information contained in the report prior to the publication thereof. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICIdirect.com | Equity Research

Page 25

Das könnte Ihnen auch gefallen

- GTL Infrastructure LTD: Key Financial IndicatorsDokument4 SeitenGTL Infrastructure LTD: Key Financial IndicatorsMehakBatlaNoch keine Bewertungen

- Finolex Cables, 1Q FY 2014Dokument14 SeitenFinolex Cables, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Value Research Stock Advisor - Sterlite TechnologiesDokument32 SeitenValue Research Stock Advisor - Sterlite TechnologiesjesprileNoch keine Bewertungen

- Finolex Cables: Performance HighlightsDokument10 SeitenFinolex Cables: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Bharti Airtel Result UpdatedDokument13 SeitenBharti Airtel Result UpdatedAngel BrokingNoch keine Bewertungen

- Top PicksDokument7 SeitenTop PicksKarthik KoutharapuNoch keine Bewertungen

- Singtel SWOTDokument4 SeitenSingtel SWOTSally TeoNoch keine Bewertungen

- Cooper INdustriesDokument119 SeitenCooper INdustriesbodiemcdNoch keine Bewertungen

- Osk Report Regional Telco Update Hold The Line Please 20130312 IDjw336244637513e806e5c635Dokument16 SeitenOsk Report Regional Telco Update Hold The Line Please 20130312 IDjw336244637513e806e5c635Znj101Noch keine Bewertungen

- RHB Equity 360° - 12 October 2010 (Plantation, Globetronics Technical: Kulim, IOI, Sime, Genting Plant, CPO)Dokument4 SeitenRHB Equity 360° - 12 October 2010 (Plantation, Globetronics Technical: Kulim, IOI, Sime, Genting Plant, CPO)Rhb InvestNoch keine Bewertungen

- STL - Presentation Oct 13, 2014.V1Dokument29 SeitenSTL - Presentation Oct 13, 2014.V1SUKHSAGAR1969Noch keine Bewertungen

- Adhigrahan IMTGhaziabad ThreeMusketeersDokument11 SeitenAdhigrahan IMTGhaziabad ThreeMusketeersnagesh_kashyapNoch keine Bewertungen

- Telecom Sector: "Rural Penetration Drives Growth": TelecomsectorDokument57 SeitenTelecom Sector: "Rural Penetration Drives Growth": TelecomsectorkotharidhimantNoch keine Bewertungen

- Cost Management Key For 2012: Ksa Telecom SectorDokument13 SeitenCost Management Key For 2012: Ksa Telecom Sectorapi-192935904Noch keine Bewertungen

- Videocon Industries LTD: Key Financial IndicatorsDokument4 SeitenVideocon Industries LTD: Key Financial IndicatorsryreddyNoch keine Bewertungen

- Corp LTD: (GMDV)Dokument5 SeitenCorp LTD: (GMDV)api-234474152Noch keine Bewertungen

- Havells (India) LTD: Key Financial IndicatorsDokument4 SeitenHavells (India) LTD: Key Financial IndicatorsShivu BiradarNoch keine Bewertungen

- Analysis Telecom IndustryDokument9 SeitenAnalysis Telecom IndustryRamesh SinghNoch keine Bewertungen

- Sharekhan Top Picks: October 01, 2011Dokument7 SeitenSharekhan Top Picks: October 01, 2011harsha_iitmNoch keine Bewertungen

- Fiber Optic Cable World Summary: Market Values & Financials by CountryVon EverandFiber Optic Cable World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Assignment OF Security Anaylsis AND Portfolio Management: Submitted byDokument15 SeitenAssignment OF Security Anaylsis AND Portfolio Management: Submitted byHarry HArmanNoch keine Bewertungen

- CRISIL Research Ier Report Sterlite Technologies 2012Dokument28 SeitenCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNoch keine Bewertungen

- ENG NKEA Electrical EletronicsDokument18 SeitenENG NKEA Electrical EletronicsMu'izz KaharNoch keine Bewertungen

- KEC International - JainMatrix Investments - Feb2012Dokument7 SeitenKEC International - JainMatrix Investments - Feb2012Punit JainNoch keine Bewertungen

- Sharp Corporation: Company ProfileDokument9 SeitenSharp Corporation: Company ProfileVivi Sabrina BaswedanNoch keine Bewertungen

- Madhucon Projects Result UpdatedDokument14 SeitenMadhucon Projects Result UpdatedAngel BrokingNoch keine Bewertungen

- Telecom Sector: NTP 2011 - A Non-EventDokument3 SeitenTelecom Sector: NTP 2011 - A Non-EventAngel BrokingNoch keine Bewertungen

- IDC GTI - Program Overview Oct 2013Dokument20 SeitenIDC GTI - Program Overview Oct 2013Venkatesh MahaleNoch keine Bewertungen

- Bharti Airtel: Performance HighlightsDokument12 SeitenBharti Airtel: Performance HighlightsPil SungNoch keine Bewertungen

- Finolex Cables-Initiating Coverage 22 Apr 2014Dokument9 SeitenFinolex Cables-Initiating Coverage 22 Apr 2014sanjeevpandaNoch keine Bewertungen

- Tata Communications LTD: Key Financial IndicatorsDokument4 SeitenTata Communications LTD: Key Financial IndicatorsDeepak AswalNoch keine Bewertungen

- Update - Reliance Jio - The Game Changer - December 2018Dokument5 SeitenUpdate - Reliance Jio - The Game Changer - December 2018NLDFNANoch keine Bewertungen

- Summary - Telecom Sector .DecryptedKLRDokument7 SeitenSummary - Telecom Sector .DecryptedKLRSaranya VillaNoch keine Bewertungen

- IDirect TelecomSectorUpdate Aug16Dokument9 SeitenIDirect TelecomSectorUpdate Aug16arun_algoNoch keine Bewertungen

- 20110603-BNP Paribas-China Equipment - The Speed of LightDokument64 Seiten20110603-BNP Paribas-China Equipment - The Speed of LightHarry YuenNoch keine Bewertungen

- SSTL Strategy UpdateDokument18 SeitenSSTL Strategy UpdateAnatinSkyNoch keine Bewertungen

- Market Outlook 11th October 2011Dokument5 SeitenMarket Outlook 11th October 2011Angel BrokingNoch keine Bewertungen

- Strategic Management TPG Telecom - EditedDokument14 SeitenStrategic Management TPG Telecom - EditedRupesh MaharjanNoch keine Bewertungen

- Sector Compendium Oct2013Dokument68 SeitenSector Compendium Oct2013Abhishek SinghNoch keine Bewertungen

- DataMonitor - Panasonic Electric Works Co - 2010Dokument10 SeitenDataMonitor - Panasonic Electric Works Co - 2010Matt OvendenNoch keine Bewertungen

- Zacks Cisco Csco 09 12Dokument10 SeitenZacks Cisco Csco 09 12derek_2010Noch keine Bewertungen

- BPL LTD: Key Financial IndicatorsDokument4 SeitenBPL LTD: Key Financial IndicatorsakkuekNoch keine Bewertungen

- IL&FS Transportation Networks: Performance HighlightsDokument14 SeitenIL&FS Transportation Networks: Performance HighlightsAngel BrokingNoch keine Bewertungen

- ROKKO Holdings 2010 Annual ReportDokument103 SeitenROKKO Holdings 2010 Annual ReportWeR1 Consultants Pte LtdNoch keine Bewertungen

- Technocraft Industries (India) : Crafting Value Global Leader at Attractive PriceDokument8 SeitenTechnocraft Industries (India) : Crafting Value Global Leader at Attractive PricesanjeevpandaNoch keine Bewertungen

- Ll& FS Transportation NetworksDokument14 SeitenLl& FS Transportation NetworksAngel BrokingNoch keine Bewertungen

- Honeywell Automation 2009 ReportDokument4 SeitenHoneywell Automation 2009 ReportmworahNoch keine Bewertungen

- Wonik MaterialsDokument16 SeitenWonik MaterialsHằng ĐinhNoch keine Bewertungen

- Astra Microwave Products LTD: Exponential Growth On The Way!Dokument5 SeitenAstra Microwave Products LTD: Exponential Growth On The Way!api-234474152Noch keine Bewertungen

- Bharti 2airtel 1227851581611151 8Dokument49 SeitenBharti 2airtel 1227851581611151 8Kartik. SolankiNoch keine Bewertungen

- Idea Cellular: Performance HighlightsDokument13 SeitenIdea Cellular: Performance HighlightsAngel BrokingNoch keine Bewertungen

- CRG Ambhit CapitalDokument25 SeitenCRG Ambhit Capitalsidhanti26Noch keine Bewertungen

- Bharti Airtel Limited - SWOT AnalysisDokument3 SeitenBharti Airtel Limited - SWOT AnalysisAkash GuptaNoch keine Bewertungen

- Market Outlook 27th February 2012Dokument5 SeitenMarket Outlook 27th February 2012Angel BrokingNoch keine Bewertungen

- ICICIdirect Tele-Tracker September2010Dokument5 SeitenICICIdirect Tele-Tracker September2010akshah2306Noch keine Bewertungen

- The Final WRK of VytillaDokument57 SeitenThe Final WRK of VytillasanzzhereNoch keine Bewertungen

- Bharti Airtel Result UpdatedDokument13 SeitenBharti Airtel Result UpdatedAngel BrokingNoch keine Bewertungen

- ROKKO Holdings 2011 Annual ReportDokument117 SeitenROKKO Holdings 2011 Annual ReportWeR1 Consultants Pte LtdNoch keine Bewertungen

- Satellite Telecommunications Lines World Summary: Market Values & Financials by CountryVon EverandSatellite Telecommunications Lines World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- India PDFDokument132 SeitenIndia PDFsourabh_chowdhury_1Noch keine Bewertungen

- 39 Commodity Trading at A Strategic CrossroadDokument0 Seiten39 Commodity Trading at A Strategic Crossroadsunnyg84Noch keine Bewertungen

- CB Survey Bingo FinalDokument7 SeitenCB Survey Bingo Finalsourabh_chowdhury_1Noch keine Bewertungen

- BAT Sample QuestionsDokument6 SeitenBAT Sample Questionssourabh_chowdhury_1Noch keine Bewertungen

- BAT Sample QuestionsDokument6 SeitenBAT Sample Questionssourabh_chowdhury_1Noch keine Bewertungen

- BAT Sample QuestionsDokument6 SeitenBAT Sample Questionssourabh_chowdhury_1Noch keine Bewertungen

- 1.161000 702010 New Perspectives 2ndedDokument43 Seiten1.161000 702010 New Perspectives 2ndedbimobimoprabowoNoch keine Bewertungen

- Philhis 1blm Group 6 ReportDokument19 SeitenPhilhis 1blm Group 6 Reporttaehyung trashNoch keine Bewertungen

- 1500 Series: Pull Force Range: 10-12 Lbs (44-53 N) Hold Force Range: 19-28 Lbs (85-125 N)Dokument2 Seiten1500 Series: Pull Force Range: 10-12 Lbs (44-53 N) Hold Force Range: 19-28 Lbs (85-125 N)Mario FloresNoch keine Bewertungen

- International Freight 01Dokument5 SeitenInternational Freight 01mature.ones1043Noch keine Bewertungen

- Enzymes IntroDokument33 SeitenEnzymes IntropragyasimsNoch keine Bewertungen

- UAV Design TrainingDokument17 SeitenUAV Design TrainingPritam AshutoshNoch keine Bewertungen

- Bossypants Autobiography and Womens SelvesDokument26 SeitenBossypants Autobiography and Womens SelvesCamila Paz GutiérrezNoch keine Bewertungen

- The Comma Rules Conversion 15 SlidesDokument15 SeitenThe Comma Rules Conversion 15 SlidesToh Choon HongNoch keine Bewertungen

- Transparency and Digitalization in The Public Administration of RomaniaDokument8 SeitenTransparency and Digitalization in The Public Administration of RomaniaMădălina MarincaşNoch keine Bewertungen

- MolnarDokument8 SeitenMolnarMaDzik MaDzikowskaNoch keine Bewertungen

- BSH 7005-15Dokument129 SeitenBSH 7005-15Mark InnesNoch keine Bewertungen

- Priest, Graham - The Logic of The Catuskoti (2010)Dokument31 SeitenPriest, Graham - The Logic of The Catuskoti (2010)Alan Ruiz100% (1)

- EQ JOURNAL 2 - AsioDokument3 SeitenEQ JOURNAL 2 - AsioemanNoch keine Bewertungen

- Rotating Equipment & ServiceDokument12 SeitenRotating Equipment & Servicenurkasih119Noch keine Bewertungen

- Resistance & Resistivity: Question Paper 1Dokument15 SeitenResistance & Resistivity: Question Paper 1leon19730% (1)

- [18476228 - Organization, Technology and Management in Construction_ an International Journal] Adaptive Reuse_ an Innovative Approach for Generating Sustainable Values for Historic Buildings in Developing CountriesDokument15 Seiten[18476228 - Organization, Technology and Management in Construction_ an International Journal] Adaptive Reuse_ an Innovative Approach for Generating Sustainable Values for Historic Buildings in Developing Countrieslohithsarath bethalaNoch keine Bewertungen

- Rights of Parents in IslamDokument11 SeitenRights of Parents in Islamstoneage989100% (2)

- Final MS Access Project Class-10Dokument17 SeitenFinal MS Access Project Class-10aaas44% (9)

- E-Mobility and SafetyDokument77 SeitenE-Mobility and SafetySantosh KumarNoch keine Bewertungen

- G1000 Us 1014 PDFDokument820 SeitenG1000 Us 1014 PDFLuís Miguel RomãoNoch keine Bewertungen

- MDI - Good Fellas - ScriptDokument20 SeitenMDI - Good Fellas - ScriptRahulSamaddarNoch keine Bewertungen

- S Setting Value, C Check Value) OT Outside Tolerance (X Is Set)Dokument1 SeiteS Setting Value, C Check Value) OT Outside Tolerance (X Is Set)BaytolgaNoch keine Bewertungen

- Algorithms For Automatic Modulation Recognition of Communication Signals-Asoke K, Nandi, E.E AzzouzDokument6 SeitenAlgorithms For Automatic Modulation Recognition of Communication Signals-Asoke K, Nandi, E.E AzzouzGONGNoch keine Bewertungen

- I Pmtea 2020 HandoutDokument94 SeitenI Pmtea 2020 HandoutAbhijeet Dutta100% (1)

- Loop Types and ExamplesDokument19 SeitenLoop Types and ExamplesSurendran K SurendranNoch keine Bewertungen

- ACCA F2 2012 NotesDokument18 SeitenACCA F2 2012 NotesThe ExP GroupNoch keine Bewertungen

- DAA UNIT 1 - FinalDokument38 SeitenDAA UNIT 1 - FinalkarthickamsecNoch keine Bewertungen

- Etextbook PDF For Pharmacology Connections To Nursing Practice 3rd EditionDokument61 SeitenEtextbook PDF For Pharmacology Connections To Nursing Practice 3rd Editionkarla.woodruff22798% (45)

- Hannah Mancoll - Research Paper Template - 3071692Dokument14 SeitenHannah Mancoll - Research Paper Template - 3071692api-538205445Noch keine Bewertungen

- Ismb ItpDokument3 SeitenIsmb ItpKumar AbhishekNoch keine Bewertungen

![[18476228 - Organization, Technology and Management in Construction_ an International Journal] Adaptive Reuse_ an Innovative Approach for Generating Sustainable Values for Historic Buildings in Developing Countries](https://imgv2-2-f.scribdassets.com/img/document/422064728/149x198/344a5742a7/1565947342?v=1)