Beruflich Dokumente

Kultur Dokumente

BNM CC Guidelines

Hochgeladen von

David WongOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BNM CC Guidelines

Hochgeladen von

David WongCopyright:

Verfügbare Formate

NEW CREDIT CARD GUIDELINES ISSUED BY BANK NEGARA MALAYSIA FREQUENTLY ASKED QUESTIONS

We refer to the following Credit Card Guideline issued on 18 March 2011 by Bank Negara Malaysia on the new eligibility requirements to be a principal credit cardmember. With effect from 1 January 2012, Cardholders earning an annual income of RM36,000 per annum and below is only allowed to hold credit cards from a maximum of two (2) credit card issuers and the maximum credit limit of the particular cardholder shall not exceed two times (2x) of the cardholders monthly income In the event the Cardholders outstanding balance exceed the maximum credit limit, the Cardholder will be given a two (2) years grace period to repay the amount in excess of the maximum credit limit.

For your further clarification on these new guidelines, following are the Frequently Asked Questions (FAQ) to assist you. 1. How will these guidelines affect existing cardholders? For existing cardholders who are earning an annual income of RM36,000 and below, they are only allowed to hold credit cards from a maximum of 2 credit card issuers. Existing cardholders who are earning an annual income above RM36,000 will not be affected. 2. When will the requirement to hold credit card from a maximum of 2 issuers take effect? Existing cardholders who currently hold more than 2 cards will have until 31 December 2011 to select their preferred card issuers. 3. What happens if I do not make a selection of my preferred card issuers by 31 December 2011? Effective by 1st January 2012, cardholders who still hold credit cards from more than 2 card issuers, their eligibility will be reviewed by their issuers on the anniversary date of the card. Issuers shall not extend the credit card facility to the cardholder if the cardholder has fulfilled the quota of maximum 2 card issuers. Hence, it is important for you to update us with your latest income information so that you can continue to enjoy the privileges that come with your AEON credit card without any interruption.

4. What if my latest income has increased to more than RM36,000 per annum? If your latest income has increased to more than RM36,000 per annum, you are advised to provide AEON Credit Service with a copy of your latest income document before 31 December 2011 in order to enjoy uninterrupted usage of your AEON Credit Card. 5. What is the maximum credit limit granted to a cardholder who is earning an annual income of RM36,000 and below? According to the guidelines, the credit limit granted to a cardholder should not exceed 2 times of the cardholders monthly income. For example, if your monthly income is RM3,000, the credit limit granted to you will be RM6,000 per issuer subject to maximum of 2 issuers. 6. What happens if Im currently enjoying a credit limit of more than 2 times my monthly income? Effective 1st January 2012, if your annual income is RM36,000 and below and your current credit limit has exceeded 2 times your monthly income, your credit limit will be adjusted accordingly. A notification of your new credit limit will be sent to you. However, if your annual income has increased to more than RM36,000, we strongly advised you to update your latest income documents with us to avoid the reduction of the credit limit to your AEON Credit Card. 7. What will happen if my outstanding balance has exceeded the credit limit of 2 times of the monthly income? You will be given a grace period of at least 2 years to settle the outstanding balance of your credit card and there will be no over limit fee charged to your card account. However, AEON Credit Service is pleased to discuss with you on the payment options available and you are able to take advantage of our AEON iCash Personal Financing facility to assist in your payment. 8. How do I submit my latest income document to AEON Credit Service? You can submit via the following channels: Mail to: Customer Service Department Level 26, Menara Olympia, No 8 Jalan Raja Chulan, 50200 Kuala Lumpur 03-2070 2684 customer.service@aeonmalaysia.com.my

Fax: Email:

Drop at:

Any AEON Credit Branch (For your convenience, you may print your EPF statement at the EPF kiosks available in our branches)

To find out more, please contact our Customer Care Hotline at 03-2719 9999.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Adobe Scan Nov 8, 2023Dokument4 SeitenAdobe Scan Nov 8, 2023Dana IdelbiNoch keine Bewertungen

- Road Safety in IndiaDokument18 SeitenRoad Safety in IndiaRcbabhi RcbNoch keine Bewertungen

- 533 - Lucky Brimblecombe Fitzpatrick Referrals Invoice 1-88682Dokument1 Seite533 - Lucky Brimblecombe Fitzpatrick Referrals Invoice 1-88682himanshu kNoch keine Bewertungen

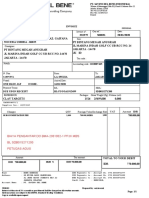

- Biaya Pengantar Do Bma-2001002-1 PPJK MBS PDFDokument1 SeiteBiaya Pengantar Do Bma-2001002-1 PPJK MBS PDFBella TanuNoch keine Bewertungen

- Digital Communication: Sujina UmmarDokument34 SeitenDigital Communication: Sujina UmmarsujinaummarNoch keine Bewertungen

- Amit Vadhadiya Saving Ac PDFDokument11 SeitenAmit Vadhadiya Saving Ac PDFKotadiya ChiragNoch keine Bewertungen

- Ibs Sungai Buloh 1 31/03/22Dokument9 SeitenIbs Sungai Buloh 1 31/03/22Muhammad FaizalNoch keine Bewertungen

- CreditDokument62 SeitenCreditapi-262728967Noch keine Bewertungen

- Final Project Retail BankingDokument62 SeitenFinal Project Retail Bankingsmartpk47% (17)

- A Y0pcxschDokument2 SeitenA Y0pcxschTaj AhmedNoch keine Bewertungen

- 3.4 Capacity-Level-of-ServiceDokument21 Seiten3.4 Capacity-Level-of-ServiceMikealla DavidNoch keine Bewertungen

- ISCA MCQs Chapter - 8 Emerging TechnologiesDokument13 SeitenISCA MCQs Chapter - 8 Emerging Technologiesgovarthan1976Noch keine Bewertungen

- Entity Enhanced Due DiligenceDokument3 SeitenEntity Enhanced Due Diligencevinodhdreams100% (1)

- Retail Products and Services of State Bank of IndiaDokument81 SeitenRetail Products and Services of State Bank of IndiaNishant Singh50% (2)

- Airtel Bill May'23Dokument10 SeitenAirtel Bill May'23kartik kathuriaNoch keine Bewertungen

- Ir21 Geomt 2022-01-28Dokument23 SeitenIr21 Geomt 2022-01-28Master MasterNoch keine Bewertungen

- HDFC Standard Life InsuranceDokument120 SeitenHDFC Standard Life InsuranceAyush PathakNoch keine Bewertungen

- Claim Process and Forms For PMJJBYDokument2 SeitenClaim Process and Forms For PMJJBYSibi ChakkaravarthyNoch keine Bewertungen

- Philippine-Clearing-House-Corporation ReportDokument32 SeitenPhilippine-Clearing-House-Corporation ReportJohn Carlo BuayNoch keine Bewertungen

- Master DataDokument32 SeitenMaster DataAshwini KanranjawanePasalkarNoch keine Bewertungen

- Master Module - Eresource 3GL ERP (ERP For Transportation)Dokument20 SeitenMaster Module - Eresource 3GL ERP (ERP For Transportation)Eresource EtradeNoch keine Bewertungen

- Goodsense 2-3.5 T Forklift Trucks Parts Catalog PDFDokument269 SeitenGoodsense 2-3.5 T Forklift Trucks Parts Catalog PDFpepeNoch keine Bewertungen

- UntitledDokument3 SeitenUntitledmenchie ann canlasNoch keine Bewertungen

- Navinon Possession NoticeDokument2 SeitenNavinon Possession NoticePriyanka ShembekarNoch keine Bewertungen

- FHKHKHDokument1 SeiteFHKHKHKara BrownNoch keine Bewertungen

- Asean Tourism ContactsDokument9 SeitenAsean Tourism ContactsShabori JainNoch keine Bewertungen

- Kartik Vivek Johar Bank StatementDokument13 SeitenKartik Vivek Johar Bank Statementjaxefa7669Noch keine Bewertungen

- Topic - Travelling and Transportation in UkraineDokument1 SeiteTopic - Travelling and Transportation in Ukrainechernikka daryaNoch keine Bewertungen

- ERP Demand Apr'21Dokument86 SeitenERP Demand Apr'21Being RonnieNoch keine Bewertungen

- Account Statement PDFDokument2 SeitenAccount Statement PDFVasantha KumarNoch keine Bewertungen