Beruflich Dokumente

Kultur Dokumente

Form No 16

Hochgeladen von

Rabiul KhanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form No 16

Hochgeladen von

Rabiul KhanCopyright:

Verfügbare Formate

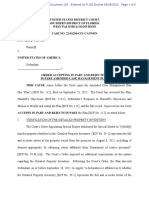

FORM NO.

16 [See rule 31(1)(a)] Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source from income chargeable under the head Salaries Name and address of the Employer Name and designation of the Employee

PAN No. of the Deductor

TAN No. of the Deductor

PAN No. of the Employee Period Assessment Year

Acknowledgement Nos. of all quarterly statements of TDS under sub-section (3) of section 200 as provided by TIN Facilitation Centre or NSDL web-site Quarter Acknowledgement No.

From

To

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED 1 Gross Salary (a) (b) Salary as per provisions contained in sec.17(1) Value of perquisites u/s 17(2) (as per Form No.12BB, wherever applicable) Rs Rs

(c) (d) 2

Profits in lieu of salary under section 17(3)(as per Form Rs No.12BB, wherever applicable) Total Rs Rs Rs Rs Rs Rs

Less: Allowance to the extent exempt u/s 10

3 4

Balance(1-2) Deductions : (a) (b) (c) Standard deduction Entertainment allowance Tax on employment Rs. Rs. Rs. Rs

5 6

Aggregate of 4(a) to (c) Income chargeable under the head 'salaries' (3-5)

Rs

Add: Any other income reported by the employee

Rs Rs Rs Rs Rs

8 9

Gross total income (6+7) Deductions under Chapter VIA Gross Amount (a) (b) (c) (d) Rs Rs Rs Rs Qualifying Amount Rs Rs Rs Rs Deductible Amount Rs Rs Rs Rs

Rs Rs Rs Rs

10 11 12 13

Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Rebate and relief under Chapter VIII I. Under section 88 (please specify) Gross Amount (a) (b) (c) (d) (e) Rs Rs Rs Rs Rs Qualifying Amount Rs Rs Rs Rs Rs Rs Rs Rs Rs Tax rebate/ relief

(f) Total [(a) Rs to (e)] II (a) (b) III Under section 88B Under section 88C

Under section 89 (attach details)

14 15 16 17

Aggregate of tax rebates and relief at 13 above [I(f) + II(a)+ II(b) + III] Tax payable (12-14) and surcharge thereon Less: Tax deducted at source Tax payable/refundable (15-16)

Rs Rs Rs Rs

I _____________________________________, son/daughter of _________________________________ working in the capacity of ________________________________________ (designation) do hereby certify that a sum of Rs. ____________________________ [Rupees ____________________________________________ _____________________________________________________________________________ (in words)] has been deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true and correct based on the books of accounts, documents and other available records.

Date Place Signature of person responsible for deduction of tax Full Name Designation

13

Rebate and relief under Chapter VIII I. Under section 88 (please specify) Gross Amount (a) (b) (c) (d) (e) Rs Rs Rs Rs Rs Qualifying Amount Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Tax rebate/ relief

(f) Total [(a) Rs to (e)] II (a) (b) III 14 15 16 17 Under section 88B Under section 88C

Under section 89 (attach details)

Aggregate of tax rebates and relief at 13 above [I(f) + II(a)+ II(b) + III] Tax payable (12-14) and surcharge thereon Less: Tax deducted at source Tax payable/refundable (15-16)

I _____________________________________, son/daughter of _________________________________ working in the capacity of ________________________________________ (designation) do hereby certify that a sum of Rs. ____________________________ [Rupees ____________________________________________ _____________________________________________________________________________ (in words)] has been deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true and correct based on the books of accounts, documents and other available records. Place Date Designation Signature of person responsible for deduction of tax Full Name

Das könnte Ihnen auch gefallen

- Napoleon BonaparteDokument11 SeitenNapoleon BonaparteChido MorganNoch keine Bewertungen

- ContractDokument2 SeitenContractmoh_heidari90Noch keine Bewertungen

- Ra 11201 - Dhsud ActDokument19 SeitenRa 11201 - Dhsud ActRomela Eleria GasesNoch keine Bewertungen

- Preliminary Injunction CASESDokument11 SeitenPreliminary Injunction CASESCarl MontemayorNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Form 16 651746Dokument4 SeitenForm 16 651746Arslan1112Noch keine Bewertungen

- Uniform Civil CodeDokument27 SeitenUniform Civil CodeREKHA SINGH100% (2)

- Form 16 Word FormatDokument4 SeitenForm 16 Word FormatVenkee SaiNoch keine Bewertungen

- Limanch-O Hotel Vs City of Olongapo GR No. 185121 (2010)Dokument7 SeitenLimanch-O Hotel Vs City of Olongapo GR No. 185121 (2010)braindead_91Noch keine Bewertungen

- Vilando V HRETDokument11 SeitenVilando V HRETred gynNoch keine Bewertungen

- Midterm Notes - CONSTI LAW 1Dokument10 SeitenMidterm Notes - CONSTI LAW 1Adrian Jeremiah VargasNoch keine Bewertungen

- Form 16 FormatDokument2 SeitenForm 16 FormatParthVanjaraNoch keine Bewertungen

- Cir Vs Manning Case DigestDokument2 SeitenCir Vs Manning Case DigestJesse Joe LagonNoch keine Bewertungen

- CD Acord vs. ZamoraDokument2 SeitenCD Acord vs. ZamoraJane Sudario100% (2)

- Form 16Dokument6 SeitenForm 16Pulkit Gupta100% (1)

- Form 16Dokument3 SeitenForm 16api-247505461Noch keine Bewertungen

- Form 16Dokument2 SeitenForm 16jwadje1Noch keine Bewertungen

- Form 16Dokument2 SeitenForm 16Hari Krishnan ElangovanNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16orkid2100Noch keine Bewertungen

- Form No. 16: Finotax 1 of 3Dokument3 SeitenForm No. 16: Finotax 1 of 3dugdugdugdugiNoch keine Bewertungen

- New Form 16 AY 11 12Dokument4 SeitenNew Form 16 AY 11 12Sushma Kaza DuggarajuNoch keine Bewertungen

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDokument2 SeitenForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamNoch keine Bewertungen

- Form No 16 in Excel With FormuleDokument3 SeitenForm No 16 in Excel With FormuleSayal Ji33% (6)

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument4 SeitenForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16Ravi DesaiNoch keine Bewertungen

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Dokument3 SeitenLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Noch keine Bewertungen

- Form 16 For The AY 2017-18Dokument4 SeitenForm 16 For The AY 2017-18Suman HalderNoch keine Bewertungen

- Form 16, Tax Deduction at Source... Income Tax of IndiaDokument2 SeitenForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNoch keine Bewertungen

- 1 Form 16 16a LatestDokument25 Seiten1 Form 16 16a LatestNishant GhaseNoch keine Bewertungen

- Form 16Dokument4 SeitenForm 16Aruna Kadge JhaNoch keine Bewertungen

- Form 16Dokument3 SeitenForm 16Bijay TiwariNoch keine Bewertungen

- Income Tax Calculation: Name: S. Ram Mohan ReddyDokument6 SeitenIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNoch keine Bewertungen

- Cit (TDS) : Emp CodeDokument3 SeitenCit (TDS) : Emp CodeMahaveer DhelariyaNoch keine Bewertungen

- Form No 16Dokument4 SeitenForm No 16Md ZhidNoch keine Bewertungen

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Dokument4 SeitenPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNoch keine Bewertungen

- A SimDokument4 SeitenA Simsana_rautNoch keine Bewertungen

- Form 16 Part A: WWW - Taxguru.inDokument10 SeitenForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNoch keine Bewertungen

- (See Rule 31 (1) (A) ) : Form No. 16Dokument8 Seiten(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNoch keine Bewertungen

- 6-3-569/1, Surana House Somajiguda, Hyderabad-83Dokument2 Seiten6-3-569/1, Surana House Somajiguda, Hyderabad-83seshu18098951Noch keine Bewertungen

- ITR-2 Indian Income Tax Return: Part A-GENDokument10 SeitenITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16balaramappana2Noch keine Bewertungen

- 2011 - ITR2 - r6Dokument33 Seiten2011 - ITR2 - r6Bathina Srinivasa RaoNoch keine Bewertungen

- Summary of Tax Deducted at Source: TotalDokument2 SeitenSummary of Tax Deducted at Source: Totaladithya604Noch keine Bewertungen

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDokument7 SeitenItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument8 SeitenITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNoch keine Bewertungen

- Form No 16 - Ay0607Dokument4 SeitenForm No 16 - Ay0607api-3705645100% (1)

- Itr 62 Form 16Dokument4 SeitenItr 62 Form 16Hardik ShahNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996Noch keine Bewertungen

- Form 16 in Excel Format For AY 2020 21Dokument8 SeitenForm 16 in Excel Format For AY 2020 21Vikas PattnaikNoch keine Bewertungen

- (-) Rebate U/s 88D/88B/88C/88/10 (13A) /HBL Int. PaidDokument5 Seiten(-) Rebate U/s 88D/88B/88C/88/10 (13A) /HBL Int. PaidSomnath ChakrabortyNoch keine Bewertungen

- Indian Numbering SystemDokument8 SeitenIndian Numbering SystemelangomduNoch keine Bewertungen

- Form 16 Excel FormatDokument12 SeitenForm 16 Excel Formatankeet3Noch keine Bewertungen

- R.V. Nerurkar High School - Form 16 1Dokument180 SeitenR.V. Nerurkar High School - Form 16 1rvnjcNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENAvani GadaNoch keine Bewertungen

- Form16.pdf HIRA PDFDokument2 SeitenForm16.pdf HIRA PDFSuchitra BakulyNoch keine Bewertungen

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Dokument2 SeitenGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNoch keine Bewertungen

- Form 16Dokument3 SeitenForm 16Vikas PandyaNoch keine Bewertungen

- Form 16Dokument4 SeitenForm 16neel721507Noch keine Bewertungen

- Form ITR-1Dokument3 SeitenForm ITR-1Rajeev PuthuparambilNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNoch keine Bewertungen

- ANU - The 2006 Military Takeover in Fiji A Coup To End All Coups - Fraenkel and Firth and Lal EdsDokument486 SeitenANU - The 2006 Military Takeover in Fiji A Coup To End All Coups - Fraenkel and Firth and Lal EdsIntelligentsiya HqNoch keine Bewertungen

- Invitation Brochure 8th RMLNLU SCC Online® International Media Law Moot Court Competition 2020Dokument23 SeitenInvitation Brochure 8th RMLNLU SCC Online® International Media Law Moot Court Competition 2020Kumar AniruddhaNoch keine Bewertungen

- Amar Singh Vs Union of IndiaDokument18 SeitenAmar Singh Vs Union of IndiajonamjonamNoch keine Bewertungen

- Affirmative Action LawDokument11 SeitenAffirmative Action LawVed VyasNoch keine Bewertungen

- Management. 3rd Edition. Marblehead, MA: John Wiley & SonsDokument3 SeitenManagement. 3rd Edition. Marblehead, MA: John Wiley & SonsRESMENNoch keine Bewertungen

- Outline of The Blueprint by Derek JohnsonDokument25 SeitenOutline of The Blueprint by Derek JohnsonRandy-Layne RomeoNoch keine Bewertungen

- Intro PPT 2 - CHAPTER 2 - CRIMINAL JUSTICE SYSTEMDokument19 SeitenIntro PPT 2 - CHAPTER 2 - CRIMINAL JUSTICE SYSTEMKenneth PuguonNoch keine Bewertungen

- USHII Final Exam ReviewDokument6 SeitenUSHII Final Exam Reviewzpat_630Noch keine Bewertungen

- Cannon Overrules DearieDokument6 SeitenCannon Overrules DearieIgor DeryshNoch keine Bewertungen

- Final Result of Udc Under Transport Department 2019Dokument1 SeiteFinal Result of Udc Under Transport Department 2019Hmingsanga HauhnarNoch keine Bewertungen

- Tax Estate Exercise 3Dokument6 SeitenTax Estate Exercise 3scfsdNoch keine Bewertungen

- B V Kiran & Co Firm Registration Number 016337S: (See Regulation 190)Dokument7 SeitenB V Kiran & Co Firm Registration Number 016337S: (See Regulation 190)Kiran KumarNoch keine Bewertungen

- Ra 7691Dokument23 SeitenRa 7691Elenita OrdaNoch keine Bewertungen

- Legal Process NotesDokument168 SeitenLegal Process NotesFaith100% (2)

- U.S. v. Stuart Carson El Al. (Declaration of Professor Michael Koehler)Dokument152 SeitenU.S. v. Stuart Carson El Al. (Declaration of Professor Michael Koehler)Mike KoehlerNoch keine Bewertungen

- Japanese Aggression and The Emperor, 1931-1941Dokument41 SeitenJapanese Aggression and The Emperor, 1931-1941Lorenzo FabriziNoch keine Bewertungen

- Youth Disrupted: Effects of U.S. Drone Strikes On Children in Targeted AreasDokument11 SeitenYouth Disrupted: Effects of U.S. Drone Strikes On Children in Targeted AreasWarCostsNoch keine Bewertungen

- Contract Case AnalysisDokument8 SeitenContract Case AnalysisNORZADIAN DOMAINNoch keine Bewertungen

- Freedom Fighter Fasc Il I Ties 2012Dokument170 SeitenFreedom Fighter Fasc Il I Ties 2012Kaushik PkaushikNoch keine Bewertungen

- Pil FinalDokument16 SeitenPil FinalAnbalagan VNoch keine Bewertungen