Beruflich Dokumente

Kultur Dokumente

Second Period Interim Financial Report For Fiscal Year 2011-2012 - Ocr

Hochgeladen von

SaveAdultEdOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Second Period Interim Financial Report For Fiscal Year 2011-2012 - Ocr

Hochgeladen von

SaveAdultEdCopyright:

Verfügbare Formate

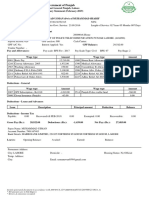

INTEROFFICE CORRESP()NDENCE

Los Unified School I)istrict

Office of the Chief Financial Off:leer

BMrd of Education RepOI"t

No.

For 3/13/12 Bourd Meeting

!viembers, Board of Education DATE; February 27, 2012

Dr. John E. Deasy,

Megan K, ReiHy

Chief Financial

L:.."' ... lI ...... L' FOR BOAR)) ITEl\f 188-11/12 -l\1ARCH 13,2012

SECOND INTERIlVi REPOR'rFOR FISCAL YEAR

correspondence provides an update on the status of the Second Interim

.... ,u ... "cu which be proposed for approval at the March 13

th

Board

meeting.

is the of three tlnancial reports for fiscal 2011-12 and

must include expenditure. and cash balance inforrnation through

January 3 L 2012. The process required Accounting and Budget Services

staff to prepare this report is lengthy invol'ves the compilation of of the

Districf s financial infonnation and analysis of the data. As a result,

the report and accompanying inforrnativewill be submitted to the Board

regular subn1ission date. The documents will be delivered to you by March

8, 2.

'I'he Report will indicate that the District \vill be able to meet its f1nancial

obligations for 2011-12. as has been case in last several

years, also anticipates that Board \\I'i11 be requested to "'''''''' ",","I.,,,.

"qualiHcd." which means that, in light deficits, the District may not

be able to nleet its financial for 2012-13 2013-2014.

Please call Megan ReiHy at (213) 241-7888 if you wish background briefing on

Report.

c: King

David Hohnquist

Aquino

Crain

Luis Buendia

LOS ANGELES UNIFIED SCHOOL DISTRICT

Inter-Office Correspondence

Office of the Chief Financial Officer

Board of Education Report

No. 188 - 11112

For 03/13/12 Board Meeting

TO: Members, Board of Education

INFORMATIVE

DATE: March 13, 2012

Dr. John E. Deasy, Superintendent

FROM: Megan K. ReillY:'

Chief Financial Officer

SUBJECT: 2011-12 SECOND INTERIM FINANCIAL REPORT

This informative provides a background overview of the 2011-12 Second Interim Financial Report ("Report"),

which, under Education Code sections 42130 and 42131, is to be submitted to the Los Angeles County Office of

Education ("LACOE"). The Report contains current fiscal year revenue, expenditure, and cash projections for

the General Fund and funds impacting the General Fund. The Board is requested to certify the District's

financial condition as qualified, meaning the District may not be able to meet its financial obligations for 2011-

12 and the two out-years. In addition, the Report contains a multi-year projection and fiscal stabilization plan

for 2012-13.

I. MAJOR HIGHLIGHTS

The District will be able to meet its financial commitments in 2011-12 and meet the 50/0 General Fund

ending balance requirement set forth in the District's Budget and Finance Policy.

The projected unassigned/unappropriated ending balance is $74.6 million, which is an increase of $56.5

million from $18.1 million at First Interim. All of the unassigned ending balance has been assumed to

support expenditures for 2012-13.

The General Fund (Restricted and Unrestricted combined) cash balance is projected to be $173.6 million at

the end of2011-12. Inter-fund borrowing is projected to be necessary at various points towards the end of

the year. In addition, an estimated cash offset of $68.8 million from redevelopment property taxes that State

is relying upon is uncertain and cannot be depended on for cash flow purposes in 2011-2012.

The out-years show cumulative deficits for 2012-13 and 2013-14 of negative $377 million and negative

$976 million, respectively. A fiscal stabilization plan for 2012-13 is attached.

II. CHANGES IN REVENUES, EXPENDITURES, AND ENDING BALANCE

Decrease in 2011-12 Projected Revenues - Since First Interim, there has been a $20.6 million decrease

in projected revenues for General Fund - Unrestricted. This decrease has taken into account the State

mid-year reduction triggers of $31.6 million, net of higher ADA revenue of $8.3 million. In addition,

other federal reimbursement revenue sources decreased by $9 million, offset by an increase in State

Lottery Revenue of $5.8 million.

Members, Board of Education

Dr. John E. Deasy, Superintendent

March 13,2012

2011-12 SECOND INTERIM FINANCIAL REPORT

Page 2 of4

Increase in 2011-12 Projected Expenditures - Expenditures for General Fund - Unrestricted are higher

by $26.4 million. The main reason for this increase is that furlough savings are uncertain and cannot be

factored into expenditure savings. This expenditure increase is offset by lower Health and Welfare

contributions of $15.4 million, due to lower participation.

Increase in Projected Net Contributions/Transfers - The General Fund contributions to restricted

programs increased by $14.4 million. The primary reasons are an offset for the presumption of

furloughs in categorical programs and higher operating cost in some programs. Interfund transfers to

Special Education Program and Cafeteria Fund increased by $11.8 million and $7.9 million,

respectively. Conversely, transfers into the Federal Early Retirement Reimbursement Program and for

COP Debt Service declined by $7.8 million.

Decrease in Ending Balance - The projected total ending balance was lower by $54.0 million. The

additional increase in unassigned/unappropriated balance of $56.5 million has been factored in the 2012-

13 budget.

Components of Ending Balance (in millions)

General Fund - Unrestricted

Fiscal Year 2011-12

Second First

Interim Interim

Nonspendable $9.5 $9.5

Assigned 357.9 468.3

Unassigned-Reserve for Economic

Uncertainties 65.4 65.4

Unassigned/Unappropriated 74.6 18.1

2011-12 Ending Balance $507.3 $561.3

Variance

$0.0

(110.4)

0.0

56.5

$54.0

Assigned Ending Balance: Certain account balances remain available to schools and offices for

future use. Carryover accounts include school donation accounts, per pupil school discretionary

accounts, school determined needs funds, new school opening funds, funds reserved for fire damage,

reserve for funding the District's OPEB liability. The assigned fund balance (i.e. carryovers) at

Second Interim is lower than the First Interim by $110.4 million. The main factor is the release of

$91.8 million of the revenue uncertainty reserve to cover the mid-year trigger cuts and furlough

elimination.

Members, Board of Education

Dr. John E. Deasy, Superintendent

March 13,2012

2011-12 SECOND INTERIM FINANCIAL REPORT

Page 3 of 4

III. 2011-12 PROJECTED CASH BALANCE

The projected cash balance for the General Fund will be $173.6 million. This is net of a positive

$119.3 million restricted cash balance and $54.3 million unrestricted cash balance as a result of

interfund borrowing from other funds. Two significant changes since First Interim are the

uncertainty of $68.5 million in additional redevelopment property taxes and changes in furlough

savings.

IV. 2012-13 AND 2013-14 UNRESTRICTED GENERAL FUND (OUT-YEAR PROJECTIONS)

The Second Interim projection results in a deficit of$377 million and $976.5 million for 2012-13 and

2013-14, respectively. A higher beginning balance, decreases in expenditures and changes in the

assumptions about the State triggers led to a projected net improvement of $180 million in 2012-13.

.. Decreased Revenues - There is a slight decrease in revenue of $2.3 million in 2012-13 and a net

decrease in revenue of$11 million in 2013-14. The changes in revenue estimates include the

following:

.. Zero cost of living adjustment (COLA) is assumed for 2012-13 and 2013-14.

.. Increase in lottery revenue due to a lottery rate changes of$7.3 million in 2012-13 and $6.6

million in 2013-14.

.. Decrease in Medical Administrative Activities revenue of $5.2 million due to reduce

participant.

.. Decrease in K-3 class size revenue of$4.5 million in 2012-13 and 2013-14.

.. Estimated revenue limit decrease of $21.8 million due to changes in Kindergarten enrollment in

2013-14.

.. Decreased Expenditures Unrestricted expenditures have decreased by $ 22.3 million and $28.8

million in 2012-13 and 2013-14, respectively. The changes in expenditure estimates include the

following:

.. Decrease in salary of $7.9 million based on the 2011-12 Second Interim salary estimate.

.. Employee benefit cost decreased $22.5 million and $24.5 million in 2012-13 and 2013-14,

respectively. This is due to a decrease in health and welfare cost contributions and PERS rate

changes.

.. Decrease in expenditures of $8.0 million attributable to changes in kindergarten enrollment.

.. Decrease in expenditures is offset by the cost of parcel tax of $3.9 million, summer schools for

2012-13 of $1 million, cost of splitting schools of $2.8 million, and changes in indirect cost of

$6 million.

.. 2011-12 State Trigger Assumptions -2012-13 Second Interim deficit assumed a $7.1 million revenue

limit impact with the Transportation revenue to be ongoing in 2012-13 but eliminated in 2013-14. The

estimated revenues do not contain any Weighted Student formula impact to the District.

Members, Board of Education

Dr. John E. Deasy, Superintendent

March 13,2012

2011-12 SECOND INTERIM FINANCIAL REPORT

Page 4 of 4

Released Prior Year Deferrals - Revenue associated with cash deferrals in 2011-12 and 2012-13

($334 million and $333 million) is used to support expenditures in 2012-13 and 2013-14. Part of the

2011-12 cash deferrals was used to offset the impact of the 2011-12 Trigger reduction of $3l.6 million

and loss of savings from furlough of $60.2 million.

Anticipated 2012-13 State Trigger - The 2012-13 estimated budget deficit does not include the $370

to $470 per ADA 2012-13 state trigger reduction in the event that the Governor's initiative does not

pass.

It is important to note that there is still a great uncertainty regarding the out-year revenue projections due to the

trigger language included in the Governor's Proposed January 2012-13 Budget. There is still the added

uncertainty as to the impact of the proposed Weighted Student formula to the District.

The Legislative Analyst Office (LAO) estimates that the State general fund may be $6.5 billion lower and its

revenue estimate resulting froin the Governor's initiative continues to be lower than the administration's.

Accordingly, if any of this lower revenue forecast proves to be accurate, the State will need to identify

additional solutions and/or revenue s to balance 2012-13 State Budget.

Attached is a list of proposed balancing alternatives. Attachment B is a chart that describes the various

alternatives that the District has to balance the projected deficit for 2012-13. Also included in Attachment B is a

list of balancing solutions in the event that the District is unsuccessful in pursuing any of the other alternatives.

Please contact me at 213-241-7888 or Matt Hill, Chief Strategy Officer at 213-241-7000 should you have any

questions.

c: Michelle King

Dave Holmquist

Jefferson Crain

Matt Hill

Luis Buendia

Tony Atienza

Report Number:

Date:

Subject:

Responsible Staff:

Name

Office/Division

Telephone No.

BOARD REPORT

Action Proposed:

Background:

LOS ANGELES UNIFIED SCHOOL DISTRICT

Board of Education Report

188-11112

March 13,2012

2011-12 Second Interim Report and Fiscal Stabilization Plan

Megan Reilly

Office of the Chief Financial Officer

213-241-7888

Staff requests that the Board approve the 2011-12 Second Interim

Financial Report, which contains a "qualified" certification (enclosed

herewith as attachment "A"), and attached Fiscal Stabilization Plan

(Attachment "B"). A qualified certification signifies that the District,

based on current projections, may not be able to meet its financial

obligations for the current or two subsequent fiscal years.

Under Education Code Sections 35035(g), 42130 and 42131" District

staff must prepare and submit interim financial reports for certain funds

must be prepared and submitted to the governing board at intervals

throughout the fiscal year. These interim financial reportscertify to the

County Superintendent of Schools, the State Controller, and the State

Superintendent of Public Instruction whether the District is able to meet

its financial obligations for the remainder of the fiscal year and the next

two fiscal years, using one of three certification scenarios:

A positive certification indicates that based on current projections, the

district will meet its financial obligations for the current fiscal year

and two subsequent years.

A qualified certification indicates that the district may not be able to

Ineet its financial obligations for the current and two subsequent fiscal

years.

A negative certification indicates that the district will not be able to

Ineet its financial obligations for the current and subsequent fiscal

year.

In addition, the Los Angeles County Office of Education (LACOE) has

requested that the Board approve to finalize the options it will consider in

order to meet its reserve requirements in 2012-13 and 2013-14 as part of

Bd. of Ed Rpt No. 188-11112 Page 1 of 4 Board of Education

March 13,2012

LOS ANGELES UNIFIED SCHOOL DISTRICT

Board of Education Report

Expected Outcomes:

Board Options and

Consequences:

the updated fiscal stabilization plan, by March 15,2012, for inclusion with

the Second Interim Report.

The District will file its Second Interim Financial Report and be in

compliance with Education Code Requirements.

The Board may choose to adopt a positive certification only if it

determines that the District will meet its financial obligations in the

current year and two subsequent years.

The Board may choose to adopt a qualified certification of financial

condition based on the current projections if it determines that the District

mayor may not meet its financial obligations in the current year or two

subsequent years.

The Board may choose to adopt a negative certification if the Board finds

that the District will not be able to meet its financial obligations in the

current year or the subsequent year.

A district with a qualified or negative certification at the second interim

period may not, in that fiscal year or the next fiscal year, issue non-voter

approved debt unless the County Superintendent determines that the

District can make repayment of such debt issuance. LACOE may also

impose various sanctions or restrictions on districts that fail to deal with

financial issues raised in interim reports. Finally, rating agencies may

consider interim reports when making or revising credit ratings.

LACOE will review the District's certification. It has the authority and

responsibility to change the certification if it determines that the District

certification was not appropriate.

Policy Implications: Certification of the District's 2011-12 Second Interim Financial Report

will comply with Education Code and LACOE requirements.

Budget Impact: This report includes the required budget adjustments to restore and

maintain reserves at the required level without using balancing methods

not within the District's control.

Issues and Analysis: None

Attachments:

Bd. of Ed Rpt No. 188-11112 Page 2 of 4 Board of Education

March 13,2012

LOS ANGELES UNIFIED SCHOOL DISTRICT

Board of Education Report

iJx Informative

Desegregation

Impact Statement

Bd. of Ed Rpt No. 188-11112 Page 3 of 4 Board of Education

March 13,2012

as to

as to k',)riln,c.i' .. ""u,-,,- staternent.

Bd. No. 8 8 ~ 1 1 / l 2 4of4

March J 3; 2012

Los Angeles

Unified School

District's

2012-13 Budget

Balancing Plan

REDUCTION PLAN *

ADDITIONAL

RESOURCES TO

SCHOOLS

RESTORATIONS

(Total - $390 Million)

Attachment B

Page 1 of 3

*Note: $390 million reduction plan is to address the Second Interim Deficit of $377 million and

to allocate $13.7 million of additional resources to schools.

fISCAL YEAR 2012-13 fISCAL STABILIZATION PLAN (OPTION 4) ATTACHMENT B Page 2 of 3

Occuoatlonal Center I-'roe:ram

Afterschool Youth Services Programs $ $ 6.9 322

$ 18.1 I $ 1$ 18.1 I 720 I 1,219 I 1,939 I Elimination of General Fund support to Early Childhood Ed beyond

program-generated revenues

$ 3.3 I $ - $ 3.3 14 - 14 Implement MyPay initiative and expedite personnel investigations

$ - $ 3.8 16 - 16 Funding expires in 12-13.

Financial Managers

1$ 2.7 I $

- $ 2.7 - 43 43 Reduction of Financial Managers. Each middle schoo! will share a

Financial Manager with one other site.

Gifted Program

1$ 2.4 I $

- $ 2.4 - - Reduce support to schools for School for Advanced Studies and Gifted

and Talented Education programs.

High School Support Services-SLC Auxiliary $ 7.3 $ - $ 7.3 57 10 67 Reductions to Athletics, Small Learning Communities, Academic

Lead Teachers, Academic Decathlon, Decathlon and Science Centers.

$ 5.2 $

,Is $ 1.7 $

National Board Cert - Differentials $ 10. $ $ 10. Differentials to be covered with appropriate categorical funding

Nurses 1$ 4.2 $ 4.2 $ Redesign of the nursing allocation model from school-type allocation

to enrollment based allocation.

Ongoing & Major Maintenance 1$ 16.91 $ 1$ 16.91 1171 117 !consolidate of Maint Units to further reduce supervisory and

overhead requirements, reductions in journeyman (trades) and

gardeners.

\\Fsl\depts\Budget Services\2012-13 Budget Development\Budget Plan December\Stabilization List CRM 20120308 V3 tab 2P Fiscla Plan

3/8/2012 6:31 PM

FISCAL YEAR 2012-13 FISCAL STABILIZATION PLAN (OPTION 4) ATTACHMENT B Page 3 of 3

Closure and/or consolidation of option sites. Reduction of resources

allocated to option sites.

0.4 I I Reduction of the budget used to pay for additional psychologist time

on cam

3.3 28 15 43 Elimination of discretionary resources to non Title I schools.

$ 45.4 $ $ 45.4 786 43 829 Includes clerical and TPA allocation attributable to SRLDP enrollment

$ 2.1 $ $ 2.1 1 131 81 20 I Reduced resources for Beginning Teacher Support and Assessment;

may result in program elimination

ze by 6

1$

63.31 $ 63.31 $

I

Teachers - Increase Grade 4-5 (6) class size

3

Teachers - Increase Grades 6-8 class size byj $ 6.41 $ 6.41 $

1

Teachers -Increase Grades 9-10 class size I $ $ $

Teachers - Increase Grades 11-12 class size I $ $ $

$ 34.9 $ 29.9 I $ 5. I 141 14 I Reduction to transpotation required by state funding reductions to the

rts intervention for grades 6-8 at middle

\\Fsl\depts\Budget Services\2012-13 Budget Development\Budget Plan December\Stabilization List CRM 20120308 V3 tab 2P Fiscla Plan

3/8/2012 6:31 PM

Attachment A

LOS ANGELES UNIFIED

SCHOOL DISTRICT

2011-12

SECOND

INTERIM

FINANCIAL

REPORT

Los Angeles Unified

Los Angeles County

Second Interim

DISTRICT CERTIFICATION OF INTERIM REPORT

For the Fiscal Year 2011-12

NOTICE OF CRITERIA AND STANDARDS REVIEW. This interim report was based upon and reviewed using the

state-adopted Criteria and Standards. (Pursuant to Education Code (EC) sections 33129 and 42130)

19 64733 0000000

Form CI

Signed: _ .._________ ._. ______________ . ______ _

Date: ____________ __

District Superintendent or Designee

NOTICE OF INTERIM REVIEW. All action shall be taken on this report during a regular or authorized special

meeting of the governing board.

To the County Superintendent of Schools:

This interim report and certification of financial condition are hereby filed by the governing board

of the school district. (Pursuant to EC Section 42131)

Meeting Date: ...:..:..:....=-=--'-'-'....:..1....::::::...::......:..=..._________ _ Signed: ____ .. _._ ..__ . _______ .. __ .....~

President of the Governing Board

CERTIFICATION OF FINANCIAL CONDITION

POSITIVE CERTIFICATION

As President of the Governing Board of this school district, I certify that based upon current projections this

district will meet its financial obligations for the current fiscal year and subsequent two fiscal years.

QUALIFIED CERTIFICATION

As President of the Governing Board of this school district, I certify that based upon current projections this

district may not meet its financial obligations for the current fiscal year or two subsequent fiscal years.

NEGATIVE CERTIFICATION

As President of the Governing Board of this school district, I certify that based upon current projections this

district will be unable to meet its financial obligations for the remainder of the current fiscal year or for the

subsequent fiscal year.

Contact person for additional information on the interim report:

Name: ___ ~ _______________ __

Telephone: ->-=...:...........<c...:..:....-'-"--'--'--'-"-_______ . __

Title: Interim Controller E-mail: luis.buendia@lausd.net

Criteria and Standards Review Summary

The following summary is automatically completed based on data provided in the Criteria and Standards Review

form (Form 01 CSI). Criteria and standards that are "Not Met," and supplemental information and additional fiscal

indicators that are "Yes," may indicate areas of potential concern, which could affect the interim report certification,

and should be carefully reviewed.

CRITERIA AND STANDARDS

1 '1 Average Daily -:-A-tt-e-n-:-da-n-c-e-.----F-u-n-d""'-e-:-d-A-D,--A-for any of the current or two subsequent fiscal years has

not changed by more than two percent since first interim.

California Dept of Education

SACS Financial Reporting Software .. 2011.2.0

File: ci (Rev 05124/2011) Page 1 of 3 Printed 318/2012 9:16 AM

Los Angeles Unified

Los Angeles County

Second Interim

DISTRICT CERTIFICATION OF INTERIM REPORT

For the Fiscal Year 2011-12

CRITERIA AND STANDARDS (continued)

2 Enrollment

3 ADA to Enrollment

4 Revenue Limit

5 Salaries and Benefits

6a Other Revenues

6b Other Expenditures

I

7a Deferred Maintenance

7b Ongoing and Major

Maintenance Account

8 Deficit Spending

9a Fund Balance

9b Cash Balance

10 Reserves

SUPPLEMENTAL INFORMATION

S1 CU111I118t:11l Liabilities

S2 Using One-time Revenues

to Fund Ongoing

Expenditures

S3 Temporary Interfund

Borrowings

S4 Contingent Revenues

S5 Contributions

California Dept of Education

SACS Financial Reporting Software - 2011,2,0

File, ci (Rev 05/24/2011)

Projected enrollment for any of the current or two subsequent fiscal

years has not changed by more than two percent since first interim.

Projected second period (P-2) ADA to enrollment ratio for the current

and two subsequent fiscal years is consistent with historical ratios.

Projected revenue limit for any of the current or two subsequent fiscal

years has not changed by more than two percent since first interim.

Projected ratio of total unrestricted salaries and benefits to total

unrestricted general fund expenditures has not changed by more

than the standard for the current and two subsequent fiscal years.

Projected operating revenues (federal, other state, other local) for the

current and two subsequent fiscal years have not changed by more

than five percent since first interim.

Projected operating expenditures (books and supplies, services and

other expenditures) for the current and two subsequent fiscal years

have not changed by more than five percent since first interim.

SBX34 (Chapter 12, Statutes of 2009), as amended by SB 70

(Chapter 7, Statutes of 2011), eliminates the local match requirement

for Deferred Maintenance from 2008-09 through 2014-15. Therefore,

this item has been inactivated for that period.

If applicable, changes occurring since first interim meet the required

contribution to the ongoing and major maintenance account (i.e.,

restricted maintenance account).

Unrestricted deficit spending, if any, has not exceeded the standard

in any of the current or two subsequent fiscal years.

Projected general fund balance will be positive at the end of the

current and two subsequent fiscal years.

Projected general fund cash balance will be positive at the end of the

current fiscal year.

Available reserves (e.g., reserve for economic uncertainties,

unassigned/unappropriated amounts) meet minimum requirements

for the current and two subsequent fiscal years.

Have any known or contingent liabilities (e.g., financial or program

audits, litigation, state compliance reviews) occurred since first

interim that may impact the budget?

Are there ongoing general fund expenditures funded with one-time

revenues that have changed since first interim by more than five

percent?

Are there projected temporary borrowings between funds?

Are any projected revenues for any of the current or two subsequent

fiscal years contingent on reauthorization by the local government,

special legislation, or other definitive act (e.g., parcel tax, forest

reserves)?

Have contributions from unrestricted to restricted resources, or

transfers to or from the general fund to cover operating deficits,

changed since first interim by more than $20,000 and more than 5%

for any of the current or two subsequent fiscal years?

Page 2 of 3

Met

X

X

X

X

X

X

No

X

X

X

I

19647330000000

Form CI

Not

Met

X

X

X

X

X

Yes

X

Printed: 318/2012 916 AM

Los Angeles Unified

Los Angeles County

Second Interim

DISTRICT CERTIFICATION OF INTERIM REPORT

For the Fiscal Year 2011-12

SUPPLEMENTAL INFORMATION (continued)

S6 Long-term Commitments

S7a Postemployment Benefits

Other than Pensions

S7b Other Self-insurance

I

Benefits

S8 Status of Labor Agreements

-------------------------------

S8 Labor Agreement Budget

Revisions

S9 Status of Other Funds

I

ADDITIONAL FISCAL INDICATORS

A1 Negative Cash Flow

A2 I ndependent Position

Control

A3 Declining Enrollment

A4 New Charter Schools

Impacting District

Enrollment

A5 Salary Increases Exceed

COLA

A6 Uncapped Health Benefits

A7 Independent Financial

System

A8 Fiscal Distress Reports

A9 Change of CBO or

Superintendent

California Dept of Education

SACS Financial Reporting Software - 2011.2.0

File: ci (Rev 05124/2011)

Does the district have long-term (multiyear) commitments or debt

agreements?

If yes, have annual payments for the current or two subsequent

fiscal years increased over prior year's (2010-11) annual

payment?

If yes, will funding sources used to pay long-term commitments

decrease or expire prior to the end of the commitment period, or

are they one-time sources?

Does the district provide postemployment benefits other than

pensions (OPEB)?

If yes, have there been changes since first interim in OPEB

liabilities?

I

Does the district operate any self-insurance programs (e.g., workers'

I

com pensation)?

If yes, have there been changes since first interim in self-

insurance liabilities?

As of second interim projections, are salary and benefit negotiations

still unsettled for:

Certificated? (Section S8A, Line 1 b)

Classified? (Section S8B, Line 1 b)

Management/supervisor/confidential? (Section S8C, Line 1 b)

r----------------------------------------------------------------

For negotiations settled since first interim, per Government Code

Section 3547.5(c), are budget revisions still needed to meet the costs

of the collective bargaining agreement(s) for:

Certificated? (Section S8A, Line 3)

Classified? (Section S8B, Line 3)

Are any funds other than the general fund projected to -have a

negative fund balance at the end of the current fiscal year?

Do cash flow projections show that the district will end the current

fiscal year with a negative cash balance in the general fund?

Is personnel position control independent from the payroll system?

Is enrollment decreasing in both the prior and current fiscal years?

Are any new charter schools operating in district boundaries that are

impacting the district's enrollment, either in the prior or current fiscal

year?

Has the district entered into a bargaining agreement where any of the

current or subsequent fiscal years of the agreement would result in

salary increases that are expected to exceed the projected state

funded cost-of-living adjustment?

Does the district provide uncapped (100% employer paid) health

benefits for current or retired employees?

Is the district's financial system independent from the county office

system?

Does the district have any reports that in-dicate fiscal distress? If yes,

provide copies to the CaE, pursuant to EC 42127.6(a).

Have there been personnel changes in the superintendent or chief

business official (CBO) positions within the last 12 months?

Page 3 of 3

No

X

X

X

X

X

n/a

n/a

X

No

X

I

X

X

X

19647330000000

Form CI

Yes

X

X

X

X

--

X

Yes

X

i

I X

X

X

X

I

Printed: 318/2012 916AM

Second Interim Financial RepOli

FY 2011 -2012

TABLE OF CONTENTS

General Fund Summary - Unrestricted/Restricted

General Fund Comments on Significant Differences

General Fund Average Daily Attendance

General Fund - Revenue Limit Summary

General Fund - Assumptions

General Fund - Cash Flow Worksheet and Assumptions

General Fund - Multiyear Projections for FY 2012-13 & FY 2013-14

General Fund Multiyear Assumptions

General Fund - Criteria and Standards Review (Form 01 CSI)

Glossary

Page

1- 24

25 -26

27 - 28

29 - 30

31- 34

35 - 38

39 -44

45 -48

CS 1 - 26

Los Angeles Unified

Los Angeles County

2011-12 Second Interim

General Fund

Summary - UnrestrictedlRestricted

Revenues, Expenditures, and Changes in Fund Balance

19 64733 0000000

Form011

I Board Approved i Projected Year Difference i % Diff !

Object ' Original Budget 'I Operating Budget 'I Actuals To Date Totals (Col B & D) (E/B)

______________________ __ ____ ____ __ __ __ __ -+ __

;A. REVENUES I I

1) Revenue Limit Sources

2) Federal Revenue

3) Other State Revenue

4) Other Local Revenue

5)TOTAL,REVENUES

B. EXPENDITURES

801 I 7!8c,d" I (",61ge1 07, 00)1

8100-8299l ____ ___ __

8300-8599 L98,846.QO i _1 1 (3,OQ7,298.65)1

8600-8799 i124,142_,594.QO; 1A3,30,(331.00j 47

1

348,148.38J 128,080,101.00 !

--. -- ---r

6,104,061,230.00 i 6,004,078,162.00 I 3,044,861,103,56' 5,833,815,251,351

i

1) Certificated Salaries 1000-19991 __ 11,276,733.00

2) Classified Salaries 2000-2999) _131?,H?,E3_60.0Q) 823.,41J&?LQQf(11,268,4?LQ02i_

3) Employee Benefits 3000-3999 I

4) Books and Supplies 4000-4999 1,1 j -'7.

5

"',5;;9,00;

5) Services and Other Operating Expenditures 5000-5999 _ __ 240L6Ji:3L837.(3t( __ __t()4,9391-8?1()Qi

6) Capital Outlay 6000-6999 43.,882,32_6,00 j 85,81,46.00! _ J8,233,41916 !-- _ f 31,86?,36.00 I

7) Other Outgo (excluding Transfers of Indirect 7100-7299 Iii I !

Costs) 7400-7499 I 5,580,778.00 I 5,583,307.00; 138,067.891 :3,92'7,8(3,OOj 2,555J21 00 i

I

-9&o;oi

-13,,!/oi

-0.2%1

-107%

37.1%1

45.8%j

8) Other Outgo - Transfers of Indirect Costs 7300-7399. .. (26,602,577.00)\ (26,802,568.00) (108,760,48). (26,529.:343:OO) (273,22500): )00/01

c- ____ EXPEND1Il,JRES __________________ . _______________ . ____ .:..:.0:.:;0-+1_____ --+ ___ -'!

C. EXCESS (DEFICIENCY) OF REVENUES I

OVER EXPENDITURES BEFORE OTHER i,'[ ,.

1 __ FINANCING SOURCES AND USES (ASB9) + 8,004,328.00 I (175,640,694.00)1 (91.685,117.58)1 (94,867,327.64-_____ -+-____ 1

:D. OTHER FINANCING SOURCES/USES ' I [ I i 1,'

1) Interfund Transfers

a) Transfers In

b) Transfers Out

2) Other Sources/Uses

a) Sources

b) Uses

3) Contributions

4) TOTAL, OTHER FINANCING SOURCESIUSES

:;alifornia Dept of Education

3ACS Financial Reporting Software - 2011.2.0

:ile: fundi-a (Rev 06107(2011)

I I : i I ! 35.7%

c::

i I I: I'

8930-8979 f _'?,91Q,00.Q,QDI_ 18,<l1Q,OOQ,QO r-,3MHOLj- 'Looj _0.

0

%1

7630-7699 0.00 ' 0.00 I 0.00 0.00 ! 00%:

I - . ...---- f

8980-8999 1 0.00 ; 0.00 0.00 0.00 i 0.00

. ______ (78,047,005.00)1 (31,519,263.19)1 ____ ---'-__ _

Page 1

1

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

E. NET INCREASE (DECREASE) IN FUND

BALANCE (C + 04)

F. FUND BALANCE, RESERVES

1) Beginning Fund Balance

a) As of July 1 Unaudited

b) Audit Adjustments

c) As of July 1 - Audited (F1 a + F1 b)

d) Other Restatements

e) Adjusted Beginning Balance (Fic + F1d)

2) Ending Balance, June 30 (E + Fie)

Components of Ending Fund Balance

a) Nonspendable

Revolving Cash

Stores

Prepaid Expenditures

All Others

b) Restricted

c) Committed

Stabilization Arrangements

Other Commitments

d) Assigned

Other Assignments

2011-12 Second Interim

General Fund

Summary - Unrestricted/Restricted

Revenues, Expenditures, and Changes in Fund Balance

9791

9793

9795

9711

9712

9713

9719

9740

9750

9760

9780

2,802,437.00

7,968,092.00 I

0.00 I

():OO i

I

.. -_Q:QQ ._. __. ___ (J.Q()

_ .. _JL()()

375,033,986.65[1

i

e) UnaSSigned/Unappropriated . I I

Reserve for Economic Uncertainties 9789 i 65,375,78

9

.OO 1 6!3]5]80.00 I

Amount ________ -L... _______ QJ2Q.L __ 27,048,332.71 I

Dept of Education

3ACS Financial Reporting Software - 2011.2.0

:lIe: fundi-a (Rev 06/07/2011) Page 2

__

___

___

70,"624,981 c84 j

I

2,892,678.00 i

y,523,64;:1

0:()9i

I

1--------------

I

i

"<>,375,780,0_0 I

19 64733 0000000

Form Oil

___ ________ ._. ___ .

2

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

___________ ---,-"R:..es;:.;o=-:u::.:r:..c;:.;e-=C-=o-=d:..es=-

i.

REVENUE LIMIT SOURCES

Principal Apportionment

State Aid - Current Year

Charter Schools General Purpose Entitlement - State Aid

State Aid - Prior Years

Tax Relief Subventions

Homeowners' Exemptions

Timber Yield Tax

Other Subventions/In-Lieu Taxes

County & District Taxes

Secured Roll Taxes

Unsecured Roll Taxes

Prior Years' Taxes

Supplemental Taxes

Education Revenue Augmentation

Fund (ERAF)

Community Redevelopment Funds

(SB 617/699/1992)

Penalties and Interest from

Delinquent Taxes

Miscellaneous Funds (EC 41604)

Royalties and Bonuses

Other In-Lieu Taxes

Less: Non-Revenue Limit

(50%) Adjustment

Subtotal, Revenue Limit Sources

Revenue Limit Transfers

Unrestricted Revenue Limit

Transfers - Current Year

Continuation Education ADA Transfer

Community Day Schools Transfer

Special Education ADA Transfer

All Other Revenue Limit

Transfers - Current Year

PERS Reduction Transfer

0000

2200

2430

6500

All Other

Transfers to Charter Schools in Lieu of Property Taxes

Property Taxes Transfers

Revenue Limit Transfers - Prior Years

TOTALJBr::Vi::NUE LIMIT SOUgCE?

. FEDERAL REVENUE

Maintenance and Operations

Special Education Entitlement

Special Education Discretionary Grants

Child Nutrition Programs

Forest Reserve Funds

Flood Control Funds

Wildlife Reserve Funds

FEMA

Interagency Contracts Between LEAs

Pass-Through Revenues from Federal Sources

NCLBII,A,S,A,(incL ARRA)

:alifornia Dept of Education

:ACS Financial Reporting Software 2011.2.0

ile: fundi-a (Rev 06/07/2011)

3000-3299,4000-

4139,4201-4215,

461Q,5510

2011-12 Second Interim

General Fund

Summary - Unrestricted/Restricted

Revenues, Expenditures, and Changes in Fund Balance

19 64733 0000000

Form Oil

Object

Codes

8011

8015

8019

8021

8022

8029

8041

8042

8043

8044

8045

8047

8048

8081

8082

8089

8091

8091

8091

8091

8091

8092

8096

8097

8099

8110

8181

8182

8220

8260

8270

8280

8281

8285

8287

8290

r

I

i

I

! Board Approved i

Original Budget I Operating Budget i Actuals To Date

(A) I (B) I (C)

I 1

i

I

Projected Year

Totals

(D)

2,159J81J1??Q().[. ?,1]Qt71.1,5.90:00) 1J46J4Q,7?9 ..QCLi ... g,994&!,908,OO ..

Difference

(Col B & D)

(E)

% Diff

(E/B)

(F)

27,516,756.00 I 50,831,078.00 I

. .._- " .......... "1"-- .......... ..... . .... "-1' ' .......... ,.CC ' .1.. -C: ..C. : .O_L. ...

0.00 i 0.00

.65A4!,E31.?cO_

0

! i.

--r ... -._].

I I

0.00 I Q.Qoj

--1

. _.Q ... o.Oj. ___ . ___ OJ)Q :1

i 1,3g ,,,,001

.0001 O.OO!

73,942.09. . 5,!sQ9,!3.f:!!'00 i (5,956,643.07 i.

I

747,49!,67600 I l 410,090,82218f 747,01!S,08900!

32,613,291.00 I :,39,274,6Q9.06

.t;'8,6!?,3!:3c.00 __ .43JA1,!83. 79 : __ , II.

I

1?,05? .. f3

9

.1.gol. . f3J

8

2,3,?3LQQi . 3.JQ?8,64:6.

6

1 QJ!611.6.6.!OOI 352,929.001_

21 ,21 2g ,00 I 94'1, 997J1m'

9.0%1

1

1

1

-H8.g

o

/01

I'

3,000"":::

I

I

I

I

l

I

I

f

I

i I I

1Q&!QQ9-

r

... _. ___ 000 .. __ ._ .... __ . .0.:99.( JO.&I.Q.9.0

t

- __ 10,6]()cOQ\ .....

:::j :::l(5'3

3

::1 (5,33:::1 ON:::

I 1

3,1 3,097,!S4J.c139.00i1,6,9L:3!3.1.62E):64! f _ (29,6,91,47500)1.

I

(181,

18 .001

7,895,149.00 .. f ....

j ..

i

0.00 I

18,392,61:3:00 1...

0.00 I

- '1

151

I .6, 00

.(11 ?J20Q.}Q:3 .. QQ)l_ ....

. ____. ____ 0: og

I

I

{99,851 ,086.00) i.. (16,8,908,1115.00)J

10,115,954.00 I 19,X83,823:00 l

0.

00

1

85,115

5

,9.45:

0

01 . 11g,1,21,292,00j

I

1,451.4

1

9:

0

0

1,391,180.00 i.

0.00 I

.

I

I

() .. Q9+Q:oOL_.QOSLI_

(i4,::,::::)j

.-.... - ... -() .OOf .9:

90

l 9.

0

Q.l

0.00 [1 __ Q.QQ.j 0.00 I goO 1 __ . .():()QJ

3 007 90

.. 9-6 .. 1 .. -2-0-0 2 993 159 024 00 I 1 ...,.647.,456 ... , ..7.7 .. 8 ......2 ...:.6 .......

,

1. I I

, ...... L ..... _ ......... , .... ,., .. _ .. : ..... 1 _ ..... 2,969,,5:,39,9.1]'()0 I {23,61 9,107.0()J,

i I

. gO.0_.9.

00

I

22,J03.4,4l0'()()j

() :Q.O.j . .Ogo !

9._1 __ CLOQ i

1

703,395.00 i

1,490,743.00 I

0.00 j

651,992,317. 00 1

Page 3

2,130,41_400 1

1.9.1:3,17Q.o9ol

Qgo1

i

I

I

62,163!.54,OOi

.0,

09

1

... E3,:3()0.JQ1J2

9,01.

.. Q:9Qj

. Q:oo.j.

0,00 I.

(127,826.00)1

798,69,6.53j

.O.OQ!

22()'E)36,Q1Q86j

3

.1,710,112.9,+

I

0.00 i

I

0.00 I

(4 ,4()9,92; ,;-O)r

.(4,801,3.15.QO)1

1

0.00 I

0.00 I

_().ooL

0.00 I

-._.- 1-

0,1()?,875,()().1

0.001

i

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

2011-12 Second Interim

General Fund

Summary UnrestrictedlRestricted

Revenues, Expenditures, and Changes in Fund Balance

19 64733 0000000

Form 011

-------'----------------------------------------------------,-------------r-------------,-------------,-------------,-----------

I

Board Approved

Original Budget Operating Budget

i Deseri tion Resource Codes

Vocational and Applied Technology Education 3500-3699

I Safe and Drug Free Schools 3700-3799

Other Federal Revenue (inc!. ARRA) All Other

i TOTAL,

'OTHER STATE REVENUE

Other State Apportionments

Community Day School Additional Funding

Current Year

Prior Years

ROCIP Entitlement

Current Year

Prior Years

Special Education Master Plan

Current Year

Prior Years

Home-to-School Transportation

Economic Impact Aid

Spec. Ed. Transportation

All Other State Apportionments - Current Year

All Other State Apportionments - Prior Years

Year Round School Incentive

Class Size Reduction, K-3

Child Nutrition Programs

Mandated Costs Reimbursements

Lottery Unrestricted and Instructional Materi.

Tax Relief Subventions

Restricted Levies - Other

Homeowners' Exemptions

Other Subventions/ln-Lieu Taxes

Pass-Through Revenues from State Sources

School Based Coordination Program

Drug/AlcohollTobacco Funds

Healthy Start

Class Size Reduction Facilities

School Community Violence

Prevention Grant

Quality Education Investment Act

All Other State Revenue

TOTAL, OTHER S1 ATE REVENUE

OTHER LOCAL REVENUE

Other Local Revenue

County and District Taxes

Other Restricted Levies

Secured Roll

Unsecured Roll

Prior Years' Taxes

Supplemental Taxes

Non-Ad Valorem Taxes

Parcel Taxes

Other

Community Redevelopment Funds

}'l.Qt

California Dept of Education

SACS Financial Reporting Software - 2011.2.0

File fundi-a (Rev 06/07/2011)

2430

2430

6355-6360

6355-6360

6500

6500

7230

7090-7091

7240

All Other

All Other

7250

6650-6690

6240

6200

7391

7400

All Other

Object

Codes

8290

8290

8290

8311

8319

8311

8319

8311

8319

8311

8311

8311

8311

8319

8425

8434

8520

8550

8560

8575

8576

8587

8590

8590

8590

8590

8590

8590

8590

8615

8616

8617

8618

8621

8622

A B

'I

346,409.00 i

I

0,00 I

",-1-

i

I

, J?, ()3.,oOj 35,()3.98

- _'1

I

,():OO-! ,,():()Qf

0,00 io,-oO 0.00 i

"'r 1- , 'r'

35.L??:L754c00-t __16,31?L848.00I'

130,616,068.00 I" . 13Q,2_43,?6L{)0_; n,tj.6,J06,26L

,40, 156,17(3:90i ,18,466,?4000;

I

2 ....,.3 ......5 ...0 ......,00.'. 0 ........:0 ... 0 .......' .. ' ..

_ , ___ 0,00_

.. 1

_ 12,1?,,:,}_67,,O()j_ __ ?,474.,()6:,),QQ_f

366,993,231.00

0.

001

,

,35,475,7_.00 i

129,14,?66,OO:

40, .. i

?&96,853.00

Il

lo- ___0.91, ,_ _4?.B.1?3_.ClCll

,

' _Clgo L _ O.oOi

T ,"" I

, , . ___ L

1 __ 1?,O_Q,3,6.()Q.+ ____ _1,Cl();3.l6?I3,goJ

--.

85,.30Z,4J2.0Q . BMl-'U300_1_ 7Q,I1.,522

N

1

9.7,3.5.8,583.00

i I

I

I

I

i

I 0.00

O.O()j 0.00 I ---I

g,go I O:()OjO,ogl

O,goi o,gg I

0.001 _().QO: 0.00 I

31,12.0Q.L,

691,452,00

Page 4

S1,7gQO L.

Q.OO,

_50,801.60 !

438,938.23 j

0,00 \

0.00

0,00

0.00

0.00

51,752.00

256,726,00

4

358,038,98

O.go

f-

0,0.0 l

(1081.996.00)1

C1,()97,301.00)_i

i

(115,067,46400)1

10Z2Z,001

_Q09

0.00 I

1 L9?3,43Q:9()i

O.()O

O,O()

0,00

0,00

1

_

I

0.00 i

O

O

.i

96,580,094.37.j

(3,007,2086511

,

N,Elw;

.0,0%

0,0%

0.0%

-65.0%

0.0%1

I

,11.4%1

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

Resource Codes

Penalties and Interest from Delinquent Non-Revenue

Limit Taxes

Sales

Sale of Equipment/Supplies

Sale of Publications

Food Service Sales

All Other Sales

Leases and Rentals

Interest

Net Increase (Decrease) in the Fair Value of Investments

Fees and Contracts

Adult Education Fees

Non-Resident Students

Transportation Fees From Individuals

Transportation Services

Interagency Services

MitigationlDeveloper Fees

All Other Fees and Contracts

Other local Revenue

7230,7240

All Other

Plus: Misc Funds Non-Revenue Limit (50%) Adjustment

Pass-Through Revenues From Local Sources

All Other local Revenue

Tuition

All Other Transfers In

Transfers Of Apportionments

Special Education SELPA Transfers

From Districts or Charter Schools

From County Offices

From JPAs

ROC/P Transfers

From Districts or Charter Schools

From County Offices

From JPAs

Other Transfers of Apportionments

From Districts or Charter Schools

From County Offices

From JPAs

All Other Transfers In from All Others

TOTAL, OTHER

TOTAL, REVENUES

:alifornia Dept of Education

ACS Financial Reporting Software - 2011.2.0

ile: fundi-a (Rev 06/07/2011)

6500

6500

6500

6360

6360

6360

All Other

All Other

All Other

2011-12 Second Interim

General Fund

Summary - Unrestricted/Restricted

19 64733 0000000

Form 011

Revenues, Expenditures, and Changes in Fund Balance

Object

Codes

8629

8631

8632

8634

8639

8650

8660

8662

8671

8672

8675

8677

8677

8681

8689

8691

8697

8699

8710

8781-8783

8791

8792

8793

8791

8792

8793

8791

8792

8793

8799

37(),000,OO_!

0.00 l

1

_O.OO!

375,000.00 I

-_. __ ..... [

0.00 i

-"-,

403,911.64 !

- r

_OOC))_

0.90

40,00000 i ..... 40,000.00

1

49J()00,OQj

f---- . - 10,?4?!21,ELOQII' ---,--, ."--,

20,70200000 I -- __ __ _ . ____-',.L .. =.:::.::::lj __._. __ . ___'.-' ...' .. '.: __

0.00 i ... ______ . ____ ._ _____ . O,_OQ_l .0:001

-..... ______. ___ .. _._. __. o::L. ._ ",001

O,OO!

0.00

0.00 I

o.ooi

19, 74,934,OO I

150,052.00 i

0.00 :

5,OQO,00 i

0.00 I

-I

23,653,240.00 i

_1__

0

.00 1

1

0,00

J?,989pOg,OOJ ____ 8,2E3191500 I

i 1

248,364.001 248,364.

0

01

0.00 0.901

Page 5

379,000.00 1

0 . .001_ 0.00 !

0.00

5,000.00 I

0.00 ;

I

10,368,543,54L

_9.,ooj,.

4.01\

225,813.0Qj

I

0.00 l

5

0,00.

5,000.00 i

0.00 i

24,392,684.00:

i

0.

0

91.

0.001

73,130,992.00 i

---""1

24,3400 I

Q.QO:'

0.00

0.00

0.00

0.00 ;

739,444.00 :

0,1

0,001

I

0!5,15,983,OO)1

0.001

0,00;

OO%i

0,0%

0,0%,

0.0%1

3.1%

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

2011-12 Second Interim

General Fund

Summary - UnrestrictedlRestricted

Revenues, Expenditures, and Changes in Fund Balance

19 64733 0000000

Form Oil

I Board Approved : Projected Year Difference % Diff

Object I Original Budget i Operating Budget i Actuals To Date Totals (Col B 8. D) (E/B)

______________________ ____ ____ __ ____ ____

iCERTIFICATED SALARIES

Certificated Teachers' Salaries

Certificated Pupil Support Salaries

Certificated Supervisors' and Administrators' Salaries

Other Certificated Salaries

TOTAl.,., c;ERIlflC;A

iCLASSIFIED SALARIES

Classified Instructional Salaries

Classified Support Salaries

I Classified Supervisors' and Administrators' Salaries

Clerical, Technical and Office Salaries

Other Classified Salaries

TOTAJ,

: EMPLG-YEE BENEFITS

STRS

PERS

OASDI/Medicare/Alternative

Health and Welfare Benefits

Unemployment Insurance

Workers' Compensation

OPEB, Allocated

OPEB, Active Employees

PERS Reduction

Other Employee Benefits

i BOOKS AND SUPPLIES

Approved Textbooks and Core Curricula Materials

Books and Other Reference Materials

I Materials and Supplies

Noncapitalized Equipment

i Food

I

I

ISERVICES AND OTHER OPERATING EXPENDITURES

Subagreements for Services

Travel and Conferences

Dues and Memberships

Insurance

Operations and Housekeeping Services

Rentals, Leases, Repairs, and Noncapitalized Improvements

Transfers of Direct Costs

Transfers of Direct Costs - Interfund

ProfessionallConsulting Services and

Operating Expenditures

Communications

TOTAL, SERVICES AND OTHER

OPERATING EXPENDITUBJ=S

California Dept of Education

SACS Financial Reporting Software - 2011.2.0

File fundi-a (Rev 06107/2011)

1100

1200

1300

i I

2,n9,139,640.00J 2, 5,768,047.00 i

___ _ __ _{4,459,005.0Q}!

i __ __ Jl,66,070.Qoi

1900 ____ 11-- ___ 00 t--- __ 1H,8_8AAI?:9Q+ _____4, J_EE_8_2.,?tiZ:QQ QO) 1

I 2

7

.00 --'1"7

6

,733,0

0

i--

2100

2200

2300

2400

2900

3101-3102

3201-3202

3301-3302

3401-3402

3501-3502

3601-3602

3701-3702

3751-3752

3801-3802

3901-3902

4100

4200

4300

4400

4700

5100

5200

5300

5400-5450

5500

5600

5710

5750

5800

5900

I. 222Jl55"5.3JlQ1 (9,713,699,od

259,I77,2..oo 258,I?9'?I6_,OO+ J6.?.i54'?F7 284,Q14J3ti.QOi (25,114,859.00)1

18,l)89,42.0Q 20,829, 755.00 656,555.00 i

. __ 2W.L),15.()Q .. 1 2.13,891,4l.00i 11,527,879.00

4?,816,14J:2 1 8_2,346,}Q.QO 11,375,697.00

794_,81],844.001 812,.142,660.00 (__ 462,715,763.63J 823,411,O7.00 i (11,268,4?7.00)[

I

211,810,49Q.Q.O'i

94,146,521.00 !

-1

21SA05,826.00 1_ 12A,551,535,671.21 8,1.33.JQ80o.l

93,98Q, 705.00

{2,727,482 ,00) II

(4, ,364,00) I

100,762,244.001

-,.-------,.- --j

575,805

1

8.4,OO I

61, 291.c!3..9.00 I

104,022,649

0

i 54,480,070.

24

1 98,21},6.t

8

Q.Qi

_ 558,7A9,7nQO t

1

r

16,237,831QO i

6?J4:,368.00 ___ glil_8&5041 i 6Q,_347,1?l:QQ

I

2,399,239.00 :

.

205,765.00 i

----- - - -- i

3J86,S)6400 I _ 36,2,?4.7? I

I I

__90 I -278,479,?A9:

00

I '. ..-.'.'43 ..-42._ ... 42 __ . ..030.:.00ti.'007 ...I'.' i - I

r .. ... _.

11, M1J,1 '1

1

. I. ! __ 4439M5900

I I I I

i -- ____ ___ 8L4g9_2J99_f{22,02Q,614002!_

1 ,999,4:i2 00 1 _2,.2lQ&01:QO_.f__ J.!,?83.49 ._

297,177,90600 236,208,823 00 147,362,387.00 i 88,846,436.00 II

- 1 7;;' ;8,050 161 186=" ...: .. .. : .._ .....: .... .. _... ,(1 ,642.QQ)

454,95900 j 657,987 00 '.' ,,236,91l.00.:

35,440

1

t20.00 313,620,Q7900 I Q7.9 I 24.6,07tiL520.00j., 6!,s44,559,OOr

I I

i I

?8,105,??.OQ.j , i

8,515,916.00 i

----.. 1

I

445,942.00

29,377,373.00

110,321,108.00 I

i

I

0.00 I

--I

__ Q,QOi

I

551,603.00;

29,377,663.00 l

110,453,801.00 I

_ 60,975,666. QO I

, - 0.

09

1

O:OQ: __ _

I

5,716,058.50

403,818.28

7,209,128.00 .

50,377,952.09

22JJi5t247.41

0,00

!

o __ Qol

! I

314:9_0-L_ ____

1___2?L96Jti1:3 . .oQ_j ___

819,]9AL?ttO_QJ ,

Page 6

_ (212,:36.?,144.00)!

6,501,66?001

589 ,86Q. QO

23,916,

106,936,858.00. i

I

45,410,659.00 l

Q,ooi_

,_O . .oOi

3,599,304.00)

(38,257.00)1

5,460,940.00 i

3,516,943.00 I

15,565,007.00

0.00

__?:112_??,O?7- 0Q_!11Q,414,18?QO I

__J1,216,154.00)i

I I

L1Q.4,939,821.00 I

6

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

i CAPITAL OUTLAY

Land

Land Improvements

Buildings and Improvements of Buildings

Books and Media for New School Libraries

or Major Expansion of School Libraries

Equipment

1 Equipment Replacement

TOTAL, CAPITAL OUTLAY

Resource Codes

!OTHER OUTGO (excluding Transfers of Indirect Costs)

Tuition

Tuition for Instruction Under Interdistrict

Attendance Agreements

State Special Schools

Tuition, Excess Costs, and/or Deficit Payments

Payments to Districts or Charter Schools

Payments to County Offices

Payments to JPAs

Transfers of Pass-Through Revenues

To Districts or Charter Schools

To County Offices

To JPAs

Special Education SELPA Transfers of Apportionments

To Districts or Charter Schools 6500

To County Offices

To JPAs

ROC/P Transfers of Apportionments

To Districts or Charter Schools

To County Offices

To JPAs

Other Transfers of Apportionments

All Other Transfers

All Other Transfers Out to All Others

Debt Service

Debt Service - Interest

Other Debt Service - Principal

6500

6500

6360

6360

6360

All Other

OTHER gUTGO(e)(cluding Transfers ()f/lldirect9gsts)

OTHER OUTGO - TRANSFERS OF INDIRECT COSTS

Transfers of Indirect Costs

Transfers of Indirect Costs - Interfund

I TOTAL,QItjERQU_Tt.7Q - TRAt\jFE':R$

i

_

California Dept of Education

SACS Financial Reporting Software - 2011.2.0

:::ile: fundi-a (Rev 06/07/2011)

2011-12 Second Interim

General Fund

Summary - Unrestricted/Restricted

Revenues, Expenditures, and Changes in Fund Balance

Object

Codes

19 64733 0000000

Form Oil

_!)89%i.

.. 1}0.2!o;

6100

6170

6200

__

_(/{752 1.002j

...c+ ........... ,." = .. ' ... , .. ---= ....,-=+- .... 1_

6300

6400

6500

7110

7130

7141

7142

7143

7211

7212

7213

7221

7222

7223

7221

7222

7223

7221-7223

7281-7283

7299

7438

7439

7310

7350

43,882

J

326.00

384,487.00 .

I

..

2.,522,801,93

I

o.ooi

1a8,OElZ.89i

198,00..000,

I

. 1 1 64(),

08

ti,QO I

o.,QQ.) _.. . ........... _ 0.00 i _a.QO.l

(2.6-LElQ2.,E)lLQQ)i- (26,802,568.00)1 .fIO, ___

---lj: ... .. ..

6,09_<3,.Q5E3,!)()2 ... QQLEl,1 19,71?,8JElQO I _ I

Page 7

7

_1],307,26_8.00 \

(538,112,00)i

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

INTERFUND TRANSFERS

INTERFUND TRANSFERS IN

From: Special Reserve Fund

From: Bond Interest and

Redemption Fund

Other Authorized Interfund Transfers In

INTERFUND TRANSFERS OUT

To: Child Development Fund

, To: Special Reserve Fund

To: State School Building Fund/

County School Facilities Fund

To: Deferred Maintenance Fund

To: Cafeteria Fund

Other Authorized Interfund Transfers Out

(b) TOTAL,INTERFUND TRANSFERS OUT

'OTHER SOURCES/USES

SOURCES

State Apportionments

Emergency Apportionments

Proceeds

Proceeds from Sale/Lease-

Purchase of Land/Buildings

Other Sources

Transfers from Funds of

Lapsed/Reorganized LEAs

Long-Term Debt Proceeds

Proceeds from Certificates

of Participation

Proceeds from Capital Leases

Proceeds from Lease Revenue Bonds

All Other Financing Sources

(c) TOTAL, SOURCES

USES

Transfers of Funds from

Lapsed/Reorganized LEAs

All Other Financing Uses

(d) TOTAL, USES

CONTRIBUTIONS

Contributions from Unrestricted Revenues

Contributions from Restricted Revenues

Transfers of Restricted Balances

;alifornia Dept of Education

;ACS Financial Reporting Software - 2011.2.0

'ile: fundi-a (Rev 06/07/2011)

2011-12 Second Interim

General Fund

Summary - Unrestricted/Restricted

Revenues, Expenditures, and Changes in Fund Balance

8912

8914

8919

7611

7612

7613

7615

7616

7619

8931

8953

8965

8971

8972

8973

8979

7651

7699

8980

8990

8997

0.00

1,0(34,00000

0,00

17,?46,000.oq.L

I

18,91 C W o o . O O ~

.0,001

D,OQi

O,OO!

Page 8

47,960,349.00

103,051,201.00

22,236,550.00

.000

,000

45,994,79200 i

128,215,321.00 .

8

19 64733 0000000

Form Oil

0.0

0

i

688,09600

2,173,641001

I

I

(4:,488,752.00)1

. i

090 i

i

0.001

OW:

(22,640,925.00)1

1,965,55700 I-

(25,164,120.00):

0.00

0.00

0.0%

0.0%

0.0%'

0.0%

Printed: 3/8/2012 826 AM

Los Angeles Unified

Los Angeles County

i

II

i Description

r!A. REVENUES

1) Revenue Limit Sources

2) Federal Revenue

3) Other State Revenue

4) Other Local Revenue

i

I B. EXPENDITURES

I

1) Certificated Salaries

2) Classified Salaries

3) Employee Benefits

4) Books and Supplies

5) Services and Other Operating Expenditures

6) Capital Outlay

7) Other Outgo (excluding Transfers of Indirect

Costs)

8) Other Outgo Transfers of Indirect Costs

Resource Codes

2011-12 Second Interim

General Fund

Unrestricted (Resources 0000-1999)

Revenues, Expenditures, and Changes in Fund Balance

19 64733 0000000

Form Oil

Actuals To Date I

I

Board Approved Projected Year Difference

Object Original Budget Operating Budget Totals

i

(Col B & D)

1

Codes (A) (B) (C) I (D)

I

(E)

I

I

I

1

I

I I 1 I

8010-8099 11 __ 2,826, __ 1,547L()Q?,E312'2 I .. I_ (22,17,9],OO)j

8100-8299 I 22,925,000,00

8300-8599

8600-8799 I 4, + i 548.25800 ,

Iii I i

:::::

3000-3999 _.- _ ,(314,133,00 J

i

],9(36, '[34:09Q I

. (9,125,QO,OO)i

27,435j 824,OO i

4000-4999 i 13.:2,580,?4:.QO l ... 137,597,775,QQ_; __

[-

5000-5999 1_ 20z,5n r _ 49,418,353,OQ_1

6000.6999\ _18,242,25rQO i g72,5Q4,OOi 9,639,862,52 f _2:3,559,5Z:3,90 I 30,168,931:Q9i

71007299 ! I 1 ; I I

i--?Lt)8

Q

,n--Qo+ ____ J:3,067-'8_9_11_ _ __ 3,02

7

&8600+ Z,555J

2

1,OO !

_ 041,11,414:OQ21 _

% Diff

(E/B)

(F)

I ___ EXPEN.:.:D::...:I.:.TU;::..Rc.;:E=-S=--______________ _____ -t---__ ---,

Ic. EXCESS (DEFICIENCY) OF REVENUES

: OVER EXPENDITURES BEFORE OTHER

FINANCING SOURCES AND USES A5 - B9

OTHER FINANCING SOURCES/USES

1) Interfund Transfers

a) Transfers In

b) Transfers Out

2) Other SourceslUses

a) Sources

b) Uses

3) Contributions

TOTAL, OTHER FINANCING SOURCES/USES

Dept of Education

;ACS Financial Reporting Software - 2011.2.0

'He: fundi-a (Rev 06107/2011)

939,191,682,00

I

8900-8929 f- . __ . O.:OQj

i

76007629 i

I .

8930-89791 18 ,910

7630-7699 f 0:09)

8980-8999 l {816,612,591 ,8711

I (1,011,321,188,87)1

Page 1

I

749,724,639,00 I

I

___ O,go J.

103,051,201,00 i

-.-------- -----1

18,9J_0,Q90,QO[

0,00 i

{820,855,093.36)1

(904,996,294.36)1

251,396,718.84

31,699,727,20 I

II

!

0.00 I

-

(526,268,000,19)1

800,778,722,37

O,()O

1

18,910,000,00 !

- .. - . 1

0.00 '

.... t

{820y 214,274.21 )j

(929,519,595.21 )1

9

0.00 0.0%

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

2011-12 Second Interim

General Fund

Unrestricted (Resources 0000-1999)

Revenues, Expenditures, and Changes in Fund Balance

I

i Board Approved I

19 64733 0000000

Form 011

% Diff

Object Original Budget I Operating Budget I

________________________ __ __ ____ -+i ____ ____ rl

IE. NET INCREASE (DECREASE) IN FUND

! BALANCE (C + D4)

IF. FUND BALANCE, RESERVES

1) Beginning Fund Balance

a) As of July 1 - Unaudited

b) Audit Adjustments

c) As of July 1 - Audited (F1a + F1 b)

d) Other Restatements

e) Adjusted Beginning Balance (F1c + F1d)

2) Ending Balance, June 30 (E + F1e)

Components of Ending Fund Balance

a) Nonspendable

Revolving Cash

Stores

Prepaid Expenditures

All Others

b) Restricted

c) Committed

Stabilization Arrangements

Other Commitments

d) Assigned

Other Assignments

e) Unassigned/Unappropriated

Reserve for Economic Uncertainties

Unassigned/Unappropriated Amount

::;alifornia Dept of Education

SACS Financial Reporting Software 2011.2.0

=ile: fundi-a (Rev 06/07/2011)

9791

9793

9795

9711

9712

9713

9719

9740

9750

9760

9780

9789

9790

I

. --,,3],1I0,66072 ___

0.00 i 000 I

(86,480,995 16)1

I 63?L1ZO,Q}2

1

1 __ ___

I I

f .. __ M,,<,67B_00

L 6,983,556.0ol __

----

Q.QoJ 0.00 i

OOOi ORO I

o.Qo! o cOo I

I

...

0.00 I 27,048,332.71 i

Page 2

--- .. _

i:,' .. _._, ..

! ____

__ 5_,()9,3942_1

i __ 63.6J3E3,191,8_

r--5g1 1

i

0.00

I ().gQ

I

I

.. __

1 ___

I

10

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

tion

I REVENUE LIMIT SOURCES

Principal Apportionment

State Aid Current Year

Resource Codes

Charter Schools General Purpose Entitlement - State Aid

State Aid - Prior Years

Tax Relief Subventions

Homeowners' Exemptions

Timber Yield Tax

Other Subventions/In-Lieu Taxes

County & District Taxes

Secured Roll Taxes

Unsecured Roll Taxes

Prior Years' Taxes

Supplemental Taxes

Education Revenue Augmentation

Fund (ERAF)

Community Redevelopment Funds

(SB 617/699/1992)

Penalties and Interest from

Delinquent Taxes

Miscellaneous Funds (EC 41604)

Royalties and Bonuses

Other In-Lieu Taxes

Less: Non-Revenue Limit

(50%) Adjustment

Subtgtal,

Revenue Limit Transfers

Unrestricted Revenue Limit

Transfers - Current Year

Continuation Education ADA Transfer

Community Day Schools Transfer

Special Education ADA Transfer

All Other Revenue Limit

Transfers - Current Year

PERS Reduction Transfer

0000

2200

2430

6500

All Other

Transfers to Charter Schools in Lieu of Property Taxes

Property Taxes Transfers

Revenue Limit Transfers - Prior Years

FEDERAL REVENUE

Maintenance and Operations

Special. Education Entitlement

Special Education Discretionary Grants

Child Nutrition Programs

Forest Reserve Funds

Flood Control Funds

Wildlife Reserve Funds

FEMA

Interagency Contracts Between LEAs

Pass-Through Revenues from Federal Sources

ARRAl

California Dept of Education

SACS Financial Reporting Software - 2011.2.0

File: fundi-a (Rev 06/07/2011)

3000-3299,4000-

4139,4201-4215,

410, !3JO

2011-12 Second Interim

General Fund

Unrestricted (Resources 0000-1999)

Revenues, Expenditures, and Changes in Fund Balance

19647330000000

Form Oil

Object

Codes

8011

8015

8019

8021

8022

8029

8041

8042

8043

8044

8045

8047

8048

8081

8082

8089

8091

8091

8091

8091

8091

8092

8096

8097

8099

8110

8181

8182

8220

8260

8270

8280

8281

8285

8287

8?9()_

'I

1

I

I

.J.-, '_,1.-, 5.il,.J,-,1,lL 12, .2. ,9_01

_65

L

447,642,.9Q_

0.00 i

7,355,09'7.00 !

5,OQ,887.00

0.00 i

5,956,643:07 i

i

0.00 :

.

___ .'1,2'74, 1,QQJ_

-.. - -.-,--.-- r'-

I

I

__ 1,362,

o.oQi

,

__!3,599,881.ooL

0.00 r

-I

Q.OQ\

0.00

.7 _73.

2

..dLn4.go [ 4",.1,.010.-. .. ,2.,-... 1 ... 8.,-.1I,.. 7 47"015, 14,64 7,3SS c091

3?,g?9tOO i 3Q,2Z.1,699:06 ___ _ g.OOI

1__ 58'672'373'00

l

i 58,186, 778.00 ___ _

1

:_ : -.-,:.. :. . .__3})88 ,8

4

,6i-- ___ - 4.0%

. ___ .'. _. JJ.4,117J?il,Q()li_ , -148:0%

I I

I

,

.?,OOQLQ.Q.9,0Q _I

I

. ().Qol

I

I

10,670.00 I

---"-r

0.00 i

___ (,33.Q()}

Page 3

3,QQQ,QQO,90 1_

OgOI

I

},?2,755. 43 1

I

2,734,279,221

Q:9.0,.i __

I

_____ (),0.9 ,\_ ... , .. ___ . ___ __

0.00 I

---1

I

0.00

o.QOt--

__

!

!

_71J371 .OO\

I

_0-,-00

I

10,670:0.9;

0.00 I

.'" -----1-

I

1-

:.

.11

68,137,515.00

O.OO_f

10,670 . .00 ;

o.O()i

(5,335,002L

{29,()91A7.OO)j

._1,451,41000)

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

OTHER STATE REVENUE

Other State Apportionments

Community Day School Additional Funding

Current Year

Prior Years

ROCIP Entitlement

Current Year

Prior Years

Special Education Master Plan

Current Year

Prior Years

Home-to-School Transportation

Economic Impact Aid

Spec. Ed. Transportation

All Other State Apportionments - Current Year

All Other State Apportionments - Prior Years

Year Round School Incentive

Class Size Reduction, K-3

Child Nutrition Programs

Mandated Costs Reimbursements

Lottery - Unrestricted and Instructional Materials

Tax Relief Subventions

Restricted Levies - Other

Homeowners' Exemptions

Other Subventions/ln-Lieu Taxes

Pass-Through Revenues from State Sources

School Based Coordination Program

Drugl AlcohollT obacco Funds

Healthy Start

Class Size Reduction Facilities

School Community Violence

Prevention Grant

Quality Education Investment Act

All Other State Revenue

TOTAL, OTHERSTATE RE\iENUE

OTHER LOCAL REVENUE

Other Local Revenue

County and District Taxes

Other Restricted Levies

Secured Roll

Unsecured Roll

Prior Years' Taxes

Supplemental Taxes

Non-Ad Valorem Taxes

Parcel Taxes

Other

Community Redevelopment Funds

NotSubjecttoRL

California Dept of Education

SACS Financial Reporting Software - 2011.2.0

File: fundi-a (Rev 06/07/2011)

2430

2430

6355-6360

6355-6360

6500

6500

7230

7090-7091

7240

All Other

All Other

7250

6650-6690

6240

6200

7391

7400

All Other

2011-12 Second Interim

General Fund

Unrestricted (Resources 0000-1999)

Revenues, Expenditures, and Changes in Fund Balance

8311

8319

8311

8319

8311

8319

8311

8311

8311

8311

8319

8425

8434

8520

8550

8560

8575

8576

8587

8590

8590

8590

8590

8590

8590

8590

8615

8616

8617

8618

8621

8622

Page 4

.717,634)976.00

1,079,029,939.00

423,239,950,.32

534,577,750.11

I

19 64733 0000000

Form011

. (115,Q67,44,00)i

% Diff

(E/S)

(F)

. ...... : ..C.C :.C.".,

106J27.QO I

I

0.00 I

0.00

5,915,97200

0.00

830,004,378.37 j 112,369,402.37

--- "--"--- 1

1,081

1

915,741.37 2,885,802.37

.0.00.

12

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

Penalties and Interest from Delinquent Non-Revenue

Limit Taxes

Sales

Sale of Equipment/Supplies

Sale of Publications

Food Service Sales

All Other Sales

Leases and Rentals

Interest

Net Increase (Decrease) in the Fair Value of Investments

Fees and Contracts

Adult Education Fees

Non-Resident Students

Transportation Fees From Individuals

Transportation Services

Interagency Services

Mitigation/Developer Fees

All Other Fees and Contracts

Other Local Revenue

7230, 7240

All Other

Plus: Misc Funds Non-Revenue Limit (50%) Adjustment

Pass-Through Revenues From Local Sources

All Other Local Revenue

Tuition

All Other Transfers In

Transfers Of Apportionments

Special Education SELPA Transfers

From Districts or Charter Schools

From County Offices

From JPAs

ROC/P Transfers

From Districts or Charter Schools

From County Offices

From JPAs

Other Transfers of Apportionments

From Districts or Charter Schools

From County Offices

From JPAs

All Other Transfers In from All Others

REVENUE,

California Dept of Education

SACS Financial Reporting Software 2011.2.0

File: fundi-a (Rev 06/07/2011)

6500

6500

6500

6360

6360

6360

All Other

All Other

All Other

2011-12 Second Interim

General Fund

Unrestricted (Resources 0000-1999)

Revenues, Expenditures, and Changes in Fund Balance

8629

8631

8632

8634

8639

8650

8660

8662

8671

8672

8675

8677

8677

8681

8689

8691

8697

8699

8710

8781-8783

8791

8792

8793

8791

8792

8793

8791

8792

8793

8799

Original Budget

(Al

Board Approved

Operating Budget

(B)

r

OWl

,O,.()OI_

I

0.00

44,002.1212:90 j

0.00 !

I

0.09J

Page 5

0.00

0.00

,44,,2..51,2.12.:00

Actuals To Date

IC)

0.00 I

().Qoj

0,001

Projected Year

Totals

13

(D)

4()!),00Q,09

_0.00

0.00 .

0.00

a.o()

2.4,3_92,684.00

19 64733 0000000

Form 011

Difference

(Col B & OJ

(E)

30,000.00 :

--'--' I

_ 0001

,goo

0,00 ;

358,t? 16. 00 i

_0.00 i

0.00 I

665,650.00

0.00_

1

0.00 '

0,0%:

3:6%

Printed: 3/8/2012 8:26 AM

Los Angeles Unified

Los Angeles County

CERTIFICATED SALARIES

Certificated Teachers' Salaries

I Certificated Pupil Support Salaries

Certificated Supervisors' and Administrators' Salaries

Other Certificated Salaries

!CLASSIFIED SALARIES

Classified Instructional Salaries

Classified Support Salaries

Classified Supervisors' and Administrators' Salaries

Clerical, Technical and Office Salaries

Other Classified Salaries

TOTAL, CLASSIFIED SALARIES

: EMPLOYEE BENEFITS

STRS

PERS

OASDl/Medicare/Alternative

Health and Welfare Benefits

Unemployment Insurance

Workers' Compensation

OPEB, Allocated

OPEB, Active Employees

PERS Reduction

Other Employee Benefits

TQTA1,EMELQYEE BENEFIT?

I BOOKS AND SUPPLIES

Approved Textbooks and Core Curricula Materials

Books and Other Reference Materials

Materials and Supplies

Noncapitalized Equipment

Food

TOTAL,BQ()KSANDSUPE1IES

SERVICES AND OTHER OPERATING EXPENDITURES

Subagreements for Services

Travel and Conferences

Dues and Memberships

Insurance

Operations and Housekeeping Services

Rentals, Leases, Repairs, and Noncapitalized Improvements

Transfers of Direct Costs

Transfers of Direct Costs - Interfund

Professional/Consulting Services and

Operating Expenditures

Communications

TOTAL, SERVICES AND OTHER

, OPERATING EXPE:f\JDITURES

Dept of Education

3ACS Financial Reporting Software - 2011,2,0

=ile: fundi-a (Rev 06/07/2011)

2011-12 Second Interim

General Fund