Beruflich Dokumente

Kultur Dokumente

Apparel Trends October Consumer Behavior Report

Hochgeladen von

Shafiq UrRehmanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Apparel Trends October Consumer Behavior Report

Hochgeladen von

Shafiq UrRehmanCopyright:

Verfügbare Formate

Consumer Behavior Report

Apparel Trends

Overview

Report Highlights

The most important factor that motivates online consumers to purchase clothing or footwear online is discounted prices (31%), closely followed by easy return policies (27%) and free shipping offers (26%). During the current economic downturn, 66% of online respondents indicated that they sometimes purchase online when asked to describe how they shop for clothing. Similarly, 53% of shoppers also indicated purchasing online for footwear. 79% of male shoppers agree that a positive aspect of shopping for clothing online is I know my size and it saves me time and money, while only 67% of female shoppers agree. 74% of female shoppers browse for clothing online even if they do not plan to purchase, compared to 64% of male shoppers. 47% of online consumers indicate that on average, they will return one of every five clothing or footwear purchases. More than a quarter (28%) of online consumers indicate never having returned an item purchased online. 61% of online consumers indicate that they need to try on their clothes prior to purchasing. Another 29% of online consumers suggest a need for immediate gratification: I dont like waiting for my clothing purchases to ship.

What is the Consumer Behavior Report?

The Consumer Behavior Report is designed to give merchants, media and industry analysts insight into shopping trends, pricing and market share. Each month, a different topic will be the focus of the report.

What is the Apparel Trends Report?

The Apparel Trends report examines attitudes towards shopping for apparel products online. This report also captures online purchasing preferences for clothing and footwear. The data included in this report is from the Apparel Survey that was conducted from October 6 to October 20, 2008 and based on 1,850 online comparison shoppers. The report is supported with online shopping traffic data sourced from Market Reporter, a statistical database that tracks actual consumer shopping behavior on PriceGrabber.com. PriceGrabber.com is a major shopping comparison engine, with more than 26 million unique users per month and up-to-date daily pricing of products supplied by more than 13,000 sellers. PriceGrabber.com recently launched the free shipping site http://FreeShipping.PriceGrabber.com/ to provide consumers with comparison shopping tools for evaluating free shipping offers on almost 6 million products from more than 1,000 retailers.

CONSUMER BEHAVIOR REPORT 2008

Apparel Trends

In October 2008, PriceGrabber.com conducted the online Apparel Survey of 1,850 respondents to examine shopping and purchasing behavior for online clothing and footwear. Within this report, PriceGrabber.com monitors trends in the online apparel market, and profiles male and female online clothing shopping and purchasing behavior. Due to all the economic uncertainty, online consumers are spending more consciously and some are turning to online retailers for relief savings, convenience and breadth of selection.

Apparel Consumer Market Trends

According to the 2008 PriceGrabber.com Apparel Survey, nearly three quarters (73 percent) of online consumers indicate that they have purchased clothing and/or footwear online. More specifically, 63 percent have purchased clothing and 48 percent have purchased footwear, while 27 percent have not purchased clothing or footwear online [See Table 1].

[Table 1] Have you e ve r purchas e d clothing or footw e ar ? 63% 48% Clothing 27% Footw ear None of the above

in C lo th

ve w ear e abo F oot o f th N one

Source: PriceGrabber.com Apparel Survey, 10/06//08-10/20/08; Sample size: n=1,421 US online buyers

In spite of current economic challenges facing consumers and deflating consumer confidence, shopping for clothing and footwear online continues to stay on the radar for the majority of online consumers. During the current economic downturn, 66% of online respondents indicated that they sometimes purchase online when asked to describe how they shop for clothing. Similarly, 53% of shoppers also indicated purchasing online for footwear. [See Table 2, Table 3].

[Table 2] W hich of these statements accurately describes how you are shopping for clothing?

28% 6%

I always purchas e online I s om etim es purchas e online I never purchas e online

66%

Source: PriceGrabber.com Apparel Survey, 10/06//08-10/20/08 Sample size: n=1,333 US online buyers

CONSUMER BEHAVIOR REPORT 2008

[Table 3] W hich of the se sta teme nts a ccurately describe s how you are shopping for footw ea r? I always 6% 42% purchas e online

I s om etim es purchas e online

53%

I never purchas e online

Source: PriceGrabber.com Apparel Survey, 10/06//08-10/20/08 Sample size: n=1,301 US online buyers

It boils down to all aspects of price when it comes to motivating consumers to purchase clothing and footwear online. The most important factor that motivates online consumers to purchase clothing or footwear online is discounted prices (31 percent), closely followed by easy return policies (27 percent) and free shipping offers (26 percent) [See Table 4]. Sixteen percent of consumers indicate assurance of correct size most likely to avoid returning the item; however, size is only one aspect quality, texture and color all matter to shoppers.

[Table 4] W hich of the follow ing is the most important factor that w ould motivate you to purchase clothing or footw ear online? 31% 26% Free shipping Free, easy return policy Assurance of correct size Discounted prices

16%

27%

Source: PriceGrabber.com Apparel Survey, 10/06//08-10/20/08 Sample size: Table 2 n=1,248 US online buyers

Over one third of online consumers choose to sacrifice convenience over savings. Thirty-five percent of online consumers refuse to pay shipping for online clothing purchases when they can go to a nearby store. Consumers return online orders as a last resort. Three quarters of consumers rarely, if ever, return online purchases of clothing or footwear. Forty-seven percent of online consumers indicate that on average, they will return one of every five clothing or footwear purchases. More than a quarter (28 percent) of online consumers indicate never having returned an item purchased online [See Table 5].

CONSUMER BEHAVIOR REPORT 2008

[Table 5] If you purchase clothing or footw ear online, how often do you return purchases?

Never Rarely (1 of 5 item s ) Som etim es (2 of 5 item s ) Often (3 of 5 item s ) Alm os t always (4 of 5 item s )

28% 47% 17% 5% 3%

Source: PriceGrabber.com Apparel Survey, 10/06//08-10/20/08 Sample size: Table 2 n=1,203 US online buyers

Apparel Market Trends

The consumers final decision to purchase is largely contingent on their overall comfort with the online browsing and purchase process. A consumers personal comfort level includes, but is not limited to, online navigation confidence, price points, sizing familiarity and retailer familiarity. According to PriceGrabber.coms Apparel Survey, the majority of online consumers (65 percent) feel comfortable purchasing clothing from online retailers. Although consumers indicate feeling less comfortable purchasing footwear than clothing online, the majority (51 percent) feels comfortable purchasing footwear from online retailers [See Table 6].

[Table 6] Overall, are you comfortable or uncomfortable with purchasing clothing or footw ear online?

65% 35% 51% 49%

Comf ort level purchasing Comf ort level purchasing clothing online f ootw ear online Comf ortable Uncomf ortable

Source: PriceGrabber.com Apparel Survey, 10/06//08-10/20/08; Sample size: n=1,398 US online clothing buyers; n=1,396 US online footwear buyers

Consumers visit clothing and footwear categories that are easiest to shop. PriceGrabber.coms internal data warehouse, Market Reporter, shows that in the last year, the most popular mens and womens sub-categories within the Clothing Channel are: womens boots, handbags, dresses, sandals, coats, jackets and mens athletic shoes, jackets and casual shoes. The following online sub-categories show that the most attractive average price points to mainstream consumers are under $350 [See Table 7].

CONSUMER BEHAVIOR REPORT 2008

[Table 7] Popular Clothing Categories on PriceGrabber.com Top 10 Categories in the Clothing Channel September 2007- 08* Women's Boots Women's Handbags Women's Dresses Women's Sandals Men's Athletic Shoes Women's Coats Men's Jackets Men's Casual Shoes Sunglasses Women's Jackets Average Price September 2007- 08** $125 $316 $116 $69 $73 $167 $144 $79 $135 $120

Rank 1 2 3 4 5 6 7 8 9 10

Source: 2008 PriceGrabber.com Market Reporter *Ranking for Clothing Channel Sub-categories based on clickthrus to merchants from 10/21/2007 to 10/21/08 *Average price based on sub-category average from 9/2007 to 9/2008

The data suggests that the categories most shopped in the Clothing Channel are those that require general or familiar sizing measurements. Sixty-one percent of online consumers indicate that they need to try on their clothes prior to purchasing. Another 29 percent of online consumers suggest a need for immediate gratification: I dont like waiting for my clothing purchases to ship.

Male versus Female: Online Clothing Shopping Profile

Everyone shops differently. One might expect men and women to have significant differences in online shopping behavior, but in fact, they show similarities.

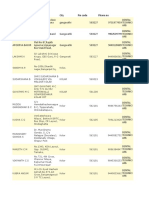

[Table 10] Clothing Shopper Profile by Gender

Overall Female Male

Do you spend time shopping/browsing online for CLOTHING even if you dont plan to purchase? Yes No

68% 32% 87% 13%

74% 26% 88% 12%

64% 36% 87% 13%

Overall, are you comfortable or uncomfortable with purchasing CLOTHING online? Comfortable Uncomfortable

Do you agree with any of the following positive aspects of shopping and purchasing CLOTHING online? Select all that apply I know my size and it saves me time and money I feel more relaxed when purchasing clothing online versus in-store It provides anonymity and the chance to try clothing on at home

73% 31% 17%

67% 36% 22%

79% 26% 13%

Source: PriceGrabber.com Apparel Survey live from 10/06/2007 to 10/20/08 Sample (n) = 896, US online buyers who indicate having purchased clothing online

CONSUMER BEHAVIOR REPORT 2008

Key gender differences in shopping and purchasing clothing online [See Table 10]: 74 percent of female shoppers browse for clothing online even if they do not plan to purchase, compared to 64 percent of male shoppers. 79 percent of male shoppers agree that a positive aspect of shopping for clothing online is I know my size and it saves me time and money, while only 67 percent of female shoppers agree. 36 percent of female shoppers feel more relaxed when purchasing clothing online versus in-store compared to 26 percent of male shoppers. 22 percent of female shoppers say shopping online for clothes provides anonymity and the chance to try clothing on at home compared to only 13 percent of male shoppers.

Disclaimer

The data, market trends and analysis in this report were prepared by PriceGrabber.com. The data included in this report is sourced from the consumer behavior Apparel Survey fielded between October 6, 2008 and October 20, 2008 and the 2008 Market Reporter database. The maximum sampling error for the Apparel Survey results based on the sample of 1,850 respondents is +/ 3.36 percentage points at the 95% confidence level. This report may not be reproduced, distributed or published by any person for any purpose without PriceGrabber.coms prior written consent. Please cite source when quoting. Source: PriceGrabber.com For media inquiries, to schedule phone interviews, or for journalists who would like to request additional data and/or a custom survey for their needs, please contact Carolyn Chiang by phone at (415) 365-0397 or by email at Carolyn.Chiang@bitepr.com.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Risk Management ProcessDokument17 SeitenRisk Management ProcessUntuk Kegiatan100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Philippine Stock Exchange: Head, Disclosure DepartmentDokument58 SeitenPhilippine Stock Exchange: Head, Disclosure DepartmentAnonymous 01pQbZUMMNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Principles of ManagementDokument107 SeitenPrinciples of ManagementalchemistNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Terminal Injustice - Ambush AttackDokument2 SeitenTerminal Injustice - Ambush AttackAllen Carlton Jr.Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- United States v. Vincent Williams, 4th Cir. (2014)Dokument11 SeitenUnited States v. Vincent Williams, 4th Cir. (2014)Scribd Government DocsNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 2016 VTN Issue 026Dokument24 Seiten2016 VTN Issue 026Bounna PhoumalavongNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- EPS For OPAPRU Executives - Ao24jan2024Dokument3 SeitenEPS For OPAPRU Executives - Ao24jan2024rinafenellere.opapruNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- TS06C Jibril, Garba 5915Dokument13 SeitenTS06C Jibril, Garba 5915Umar SunusiNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Review On The Political Awareness of Senior High School Students of St. Paul University ManilaDokument34 SeitenA Review On The Political Awareness of Senior High School Students of St. Paul University ManilaAloisia Rem RoxasNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Profile - Sudip SahaDokument2 SeitenProfile - Sudip Sahasudipsinthee1Noch keine Bewertungen

- Application To Visit Australia For Tourism: or Other Recreational ActivitiesDokument13 SeitenApplication To Visit Australia For Tourism: or Other Recreational ActivitiesZoran H. VukchichNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- RrlmatirxDokument4 SeitenRrlmatirxJohn Linard AninggaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Dentapdf-Free1 1-524 1-200Dokument200 SeitenDentapdf-Free1 1-524 1-200Shivam SNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Lesson 2 - BasicDokument7 SeitenLesson 2 - BasicMichael MccormickNoch keine Bewertungen

- 6 Habits of True Strategic ThinkersDokument64 Seiten6 Habits of True Strategic ThinkersPraveen Kumar JhaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Revised WHD Quiz 2023 Flyer PDFDokument5 SeitenRevised WHD Quiz 2023 Flyer PDFDevkesh ByadwalNoch keine Bewertungen

- Christmas Phrasal VerbsDokument2 SeitenChristmas Phrasal VerbsannaNoch keine Bewertungen

- Cover LetterDokument2 SeitenCover LetterAditya Singh0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Tulip ManiaDokument37 SeitenTulip Maniasmile010Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- G.R. No. L-15363: Bruno, Rufa Mae RDokument2 SeitenG.R. No. L-15363: Bruno, Rufa Mae Rglaide lojeroNoch keine Bewertungen

- Learning CompetenciesDokument44 SeitenLearning CompetenciesJeson GalgoNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Municipal Development Plan 1996 - 2001Dokument217 SeitenMunicipal Development Plan 1996 - 2001TineNoch keine Bewertungen

- Type Certificate Data Sheet: No. EASA.R.100Dokument9 SeitenType Certificate Data Sheet: No. EASA.R.100SauliusNoch keine Bewertungen

- Cover LetterDokument2 SeitenCover LetterGeorgy Khalatov100% (4)

- Gazette Issued Detailing Functions Under Namal's New MinistryDokument5 SeitenGazette Issued Detailing Functions Under Namal's New MinistryDarshana Sanjeewa0% (2)

- Chapter 6-Contracting PartiesDokument49 SeitenChapter 6-Contracting PartiesNUR AISYAH NABILA RASHIMYNoch keine Bewertungen

- Released Complaint 2016Dokument22 SeitenReleased Complaint 2016Modern PsychologistNoch keine Bewertungen

- COWASH Federal Admin Manual v11 PDFDokument26 SeitenCOWASH Federal Admin Manual v11 PDFmaleriNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- AR Reserve Invoice - 20005152 - 20200609 - 094424Dokument1 SeiteAR Reserve Invoice - 20005152 - 20200609 - 094424shady masoodNoch keine Bewertungen

- Problem Set 2Dokument2 SeitenProblem Set 2nskabra0% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)