Beruflich Dokumente

Kultur Dokumente

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good and The Gold Standard Is Bad

Hochgeladen von

jake_olsen70Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good and The Gold Standard Is Bad

Hochgeladen von

jake_olsen70Copyright:

Verfügbare Formate

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

Ben Bernanke has decided that he needs to teach all of us why the Federal Reserve is 20 good for America and about why the gold standard is bad. On Tuesday, Bernanke tweets delivered the first of four planned lectures to a group of students at George Washington retweet University. But that lecture was not just for the benefit of those students. Officials at the Fed have long planned for this lecture series to be an opportunity for Bernanke to "educate" the American people about the Federal Reserve. The classroom was absolutely packed with reporters and just about every major news organization is running a story about this first lecture. So the Federal Reserve is definitely getting the publicity that it was hoping for. You can see the slides from the presentation that Bernanke gave to the students right here. It is pretty obvious that one of the primary goals of this first lecture was to attack those that have been critical of the Fed over the past few years. In doing so, Bernanke "stretched" the truth on more than one occasion. The entire event was staged to make Bernanke and the Federal Reserve look as good as possible. Prior to his arrival, the students gathered for the lecture were actually instructed to applaud Bernanke....

The 30 undergraduates at George Washington University sent up a round of applause. It was, they'd been told beforehand, "appropriate, even encouraged, to politely applaud" Tuesday's guest lecturer.

But as noted above, this lecture was not for the benefit of those students. A USA Today article even admitted that "addressing the public directly" was one of the real goals of this lecture....

For Bernanke, the GW lectures serve a dual function: They give him a chance to reprise the role of professor he played for more than two decades, first at Stanford and then at Princeton, where he eventually chaired the economics department. And they give him a way to expand his mission of demystifying the Fed. As part of that campaign, Bernanke became the first Fed chief to hold regular news conferences and conduct town-hall meetings. In addressing the public directly, Bernanke has also sought to neutralize attacks on the Fed, some of them from Republican presidential candidates.

So what did Bernanke actually say during the lecture? Well, you can read all of the slides right here, but the following are some of the highlights.... On page 6 of the presentation, Bernanke makes the following claim....

"A central bank is not an ordinary commercial bank, but a government agency."

Well, that is quite interesting considering the fact that the Federal Reserve has argued in court that the Federal Reserve Bank of New York is not an agency of the federal government and that the various Federal Reserve banks around the country are private corporations with private funding. So did the Federal Reserve lie to the court or is Ben Bernanke lying to us? And what other "agency" of the federal government is owned by private banks? It is even admitted that the individual member banks own shares of stock in the various Federal Reserve banks on the Federal Reserve website....

The twelve regional Federal Reserve Banks, which were established by Congress as the operating arms of the nation's central banking system, are organized much like private corporations--possibly leading to some confusion about "ownership." For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year.

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad

Page 1 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

The Federal Reserve always talks about how it must be "independent" and "above politics", but when they start getting criticized they always want to seek shelter under the wing of the federal government. It really is disgusting. On page 7 of the presentation, the following statement is made....

"All central banks strive for low and stable inflation; most also try to promote stable growth in output and employment."

Well, on both counts the Federal Reserve has failed miserably. Right now, if inflation was measured the same way that it was back in 1980, the annual rate of inflation would be more than 10 percent. And when you take a longer view of things, the inflation that the Federal Reserve has manufactured has been absolutely horrific. Even using the doctored inflation numbers that the Federal Reserve gives us, the U.S. dollar has still lost 83 percent of its value since 1970. The truth is that inflation is a "hidden tax" that is constantly destroying the value of every single dollar that you and I hold. Those that attempt to save money for the future or for retirement are deeply penalized under such a system. As far as employment goes, the total number of workers that are "officially" unemployed in the United States is larger than the entire population of Portugal. The average duration of unemployment is hovering near an all-time record high and almost every measure of government dependence is at an all-time record high. So the Federal Reserve is failing at the exact things that Bernanke claims that it is supposed to be doing. But instead of directly addressing many of the specific criticisms that have been leveled at the Fed, Bernanke instead chose to spend much of his lecture talking about the problems with adopting a gold standard. The following are statements that were pulled directly off of the slides he used during his speech.... -"The gold standard sets the money supply and price level generally with limited central bank intervention." -"The strength of a gold standard is its greatest weakness too: Because the money supply is determined by the supply of gold, it cannot be adjusted in response to changing economic conditions." -"All countries on the gold standard are forced to maintain fixed exchange rates. As a result, the effects of bad policies in one country can be transmitted to other countries if both are on the gold standard." -"If not perfectly credible, a gold standard is subject to speculative attack and ultimate collapse as people try to exchange paper money for gold." -"The gold standard did not prevent frequent financial panics." -"Although the gold standard promoted price stability over the very long run, over the medium run it sometimes caused periods of inflation and deflation." -"In the second half of the 19th century, a global shortage of gold reduced the U.S. money supply and caused deflation (falling prices). Farmers were squeezed between declining prices for crops and the fixed dollar payments for their mortgages and other debts." Bernanke spent more time on the gold standard during his speech than on anything else. At one point during the lecture, Bernanke made the following statement....

"To have a gold standard, you have to go to South Africa or someplace and dig up tons of gold and move it to New York and put it in the basement of the Federal Reserve Bank of New York and that's a lot of effort and work"

Bernanke even blamed the gold standard for the Great Depression. On a slide entitled "Monetary Policy in the Great Depression", Bernanke made the following claims.... The Feds tight monetary policy led to sharply falling prices and steep declines in output and employment. The effects of policy errors here and abroad were transmitted globally through the gold standard. The Fed kept money tight in part because it wanted to preserve the gold standard. When FDR abandoned the gold standard in 1933, monetary policy became less tight and deflation stopped. Bernanke seems to want to frame the debate over monetary policy is such a way that the American people are given only two alternative systems to consider: the Federal Reserve and a gold standard. But the truth is that there are a vast array of both "hard money" and "soft money" systems that would not include a central bank or a gold standard at all. So the truth is that the American people would have many different systems to choose from if they wanted to shut down the Federal Reserve and set up something new. In the past the U.S. government has issued debt-free money and it could certainly do so again.

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad

Page 2 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

But in his lecture, Bernanke did not even mention how the Federal Reserve creates money or how whenever new money is created more debt is created. Under the Federal Reserve system, the money supply is designed to continually increase, and whenever more money is created more debt is also created. In a previous article I discussed how more money is created on the federal level....

For example, whenever the U.S. government wants to spend more money than it takes in (which happens constantly), it has to go ask the Federal Reserve for it. The federal government gives U.S. Treasury bonds to the Federal Reserve, and the Federal Reserve gives the U.S. government "Federal Reserve Notes" in return. Usually this is just done electronically. So where does the Federal Reserve get the Federal Reserve Notes? It just creates them out of thin air. Wouldn't you like to be able to create money out of thin air? Instead of issuing money directly, the U.S. government lets the Federal Reserve create it out of thin air and then the U.S. government borrows it. Talk about stupid.

The designers of the Federal Reserve system intended to trap the U.S. government in a debt spiral that would expand perpetually. So has their design worked? Well, just look at the chart below....

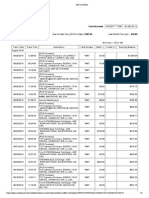

Today, the U.S. national debt is more than 5000 times larger than it was when the Federal Reserve was first created. So I guess you could say that the results have been spectacular. The Federal Reserve system also greatly favors the big Wall Street banks that it is designed to serve. When those big banks get into trouble, the Federal Reserve snaps into action. According to a limited GAO audit of Fed transactions during the last financial crisis, $16.1 trillion in secret loans were made by the Federal Reserve to the big Wall Street banks between December 1, 2007 and July 21, 2010. The following list is taken directly from page 131 of the GAO audit report and it shows which banks received money from the Fed.... Citigroup - $2.513 trillion Morgan Stanley - $2.041 trillion Merrill Lynch - $1.949 trillion Bank of America - $1.344 trillion Barclays PLC - $868 billion Bear Sterns - $853 billion Goldman Sachs - $814 billion Royal Bank of Scotland - $541 billion JP Morgan Chase - $391 billion Deutsche Bank - $354 billion UBS - $287 billion Credit Suisse - $262 billion Lehman Brothers - $183 billion Bank of Scotland - $181 billion BNP Paribas - $175 billion Wells Fargo - $159 billion Dexia - $159 billion

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 3 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Dexia - $159 billion Wachovia - $142 billion Dresdner Bank - $135 billion Societe Generale - $124 billion "All Other Borrowers" - $2.639 trillion What about all the rest of us? Did we get bailed out? No, we were told that if Wall Street was rescued that the benefits would trickle down to the rest of us. Unfortunately, that has not exactly worked out. In article, after article, after article I have detailed the horrible economic suffering that the American people are still going through. But what Bernanke and the Fed have done is create inflation in commodities such as oil which is affecting the household finances of nearly everyone in America. The average price of a gallon of gasoline in the United States is now up to $3.87. That is an all-time record high for the month of March. So far in 2012, the price of gasoline in the United States has risen by 17 percent. Thanks Bernanke. Over the past several decades, every time there has been a major spike in gasoline prices in the United States, a recession has always followed. If you doubt this, just check out this amazing chart. So will we soon see another recession? If we are lucky. Hopefully the next downturn will not be a full-blown depression. The truth is that the Federal Reserve does not help us avoid booms and busts. Rather, it creates them. The Fed was at the heart of the housing bubble which helped bring on the last financial crisis when it crashed, and the current ultra-low interest rate policies of the Fed are creating more bubbles which will have devastating long-term consequences. So Bernanke does not have anything to be proud of, and his track record has been absolutely nightmarish. Hopefully the American people will not believe the propaganda and will take an honest look at the Federal Reserve. When you take an honest look at the Federal Reserve, there is only one rational conclusion: Congress should shut it down, lock the doors and throw away the key.

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad

Page 4 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere:

March 20th, 2012 | Tags: Ben Bernanke, Bernanke, Debt, Educate, George Washington University, Gold, Gold Standard, University | Category: Federal Reserve

40 Weird Facts About The United States That Are Almost Too Crazy To Believe

39 comments to Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

Chris

March 20th, 2012 at 3:41 pm ! Reply The designers of the Federal Reserve system intended to trap the U.S. government in a debt spiral that would expand perpetually. Actually I doubt this is true. I would think they knew from the start that what they were setting up was not sustainable and could not go on perpetually. It would lead to final collapse and a solution to the problem which they could offer in return for cancelling all the debt. The question is what will be their solution?

Save the Republic

March 21st, 2012 at 12:39 am ! Reply Dont doubt it. The people who designed the Fed are almost certainly dead already, so how could they even have had an interest in providing the solution? The design was basically to enrich themselves by charging the country a fee to use its own money. The more money the country uses, the more money in fees they make. The only real solution is for the government to take back control of issuing currency and tell the Fed we arent paying them, or that we are setting the new currency at a much higher value against the present federal reserve note, something like $1 new=$100,000 old. I doubt this is going to happen until total collapse, because this money printing has enabled the select few to live the good life on the backs of the multitudes of people fighting against the tide of inflation.

Chris S

March 21st, 2012 at 6:43 am ! Reply The Designers of the Federal Reserve system (and its other central banking cousins, the IMF, the BIS and the World Bank) created these systems PRIMARILY to provide them selves (the banking class) with the unlimited funding (printing money) necessary to do what they have done throughout history First provoke, then fund BOTH sides of every major war. Look at the end of WW2. It was the birth of Israel (the Bankers base of operations) and the birthplace of the UN/NATO (more power/wealth consolidation into an unelected bureaucracy with GLOBAL authority) Every major war leads to the same thing more power, more money into FEWER hands. It is no accident or coincidence that WW1 started 1 year after the creation of the Federal Reserve The Fed allowed the bankers the ability to print money (creating it out of thin air) and this provided the massive funding they need to start WW1. The END GAME? WW3 where billions die, and out of the ashes will rise an UNELECTED, UNACCOUNTABLE world wide authority. A true global government, rendering the remaining living people Serfs to the banking class. Were almost there. Society goes through a 9 stage process over roughly 200 years From bondage to spiritual faith; from spiritual faith to great courage; from courage to liberty; from liberty to abundance; from abundance to selfishness; from selfishness to complacency; from complacency to apathy; from apathy to dependence; from dependency back again into bondage. In our present Plutocracy we have just made the transition from complacency to national apathy ~ which will surely be followed by dependence on the state and eventually bondage by the state. Cheers. And *********** Ben Bernake. He is nothing but a bold face lying snake, put in place to keep you all APATHETIC to the reality of whats going on around you.

jox

March 21st, 2012 at 8:09 am ! Reply Very good point and question. Im sure you have an educated guess about what that solution is going to look like, and Id really like to hear it.

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 5 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Cleo

March 20th, 2012 at 3:56 pm ! Reply If you think inflation is bad now, just wait a few months. If youre not prepped already, still some time to do it.

Anony

March 20th, 2012 at 4:26 pm ! Reply Iran Says Gold Is Money Casey Research: Trading in gold rather than a fiat currency is cashless http://www.caseyresearch.com/articles/iran-says-gold-money

Chris S

March 21st, 2012 at 6:50 am ! Reply Gold/Silver IS money. Always was, always will be. Gold is infinitely more valuable than FIAT PAPER Currency. Having dollar tied to Gold/Silver PROTECTED its value. As soon as you were taken off the Gold Standard and your paper currency was backed by nothing but Bernakes word, the dollar has fallen drastically in value. Hell, your dollar is now worth LESS than the Canadian Dollar! (a nation of only 30 million people!) The Federal Reserve is the single largest problem in the USA. The same year it was created it brought the income tax along with it. (stealing half your wages to pay the DEBT for BORROWING money from the PRIVATELY owned Fed money which used to be printed Interest free by congress) Americans need to understand the banking system better than a 3rd grader and maybe the USA wouldnt be on the verge of becoming the first UNdeveloped nation the world has ever seen.

Kevin2

March 20th, 2012 at 4:33 pm ! Reply This act shows how frightened they are. The tactic they are using with deception does not work in the internet age. Every time they state in public a falsehood theyre on the record stating a lie. They press the flesh attempting to gain creditability and in the process loose more and more.

Antonio Gonzalez

March 20th, 2012 at 5:25 pm ! Reply Congress should shut it down, lock the doors and throw away the key. They cant do that, because everyone in congress are making money with the federal reserve.

i'vegivenup

March 20th, 2012 at 8:32 pm ! Reply Its not that they cant do itits that they dont want to do it

Ben is at it again

March 20th, 2012 at 6:06 pm ! Reply Michaels articles are right on time Im guessing you all just read this recent news Helicopter Ben is at again Los Angeles Time Fed Is Ready to Act If Europe Falters Again: Ben Bernanke CNBC.com "2 hours ago" Fed Chairman Ben Bernanke said Europes financial troubles have eased, but added the US central bank would be ready to act if conditions worsened again, according to written testimony to Congress released late Tuesday.

Scott

March 20th, 2012 at 6:31 pm ! Reply What is the Federal Reserve? Its a private banking cartel which is about as Federal as Federal Express. See: The American Dream The Monster from Jekyll Island

Horse

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 6 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Horse

March 20th, 2012 at 6:44 pm ! Reply Really he looks like a bum in a suit.

1stVArifleman

March 20th, 2012 at 6:44 pm ! Reply The United States Federal Reserves Bank: A fully owned division of the Rothchilds Cabal. Also, it is neither American (owned by foreigners), its not Federal (private corporation), it has no reserves (it prints all FRN out of thin air, but it does horde huge gold holding from countries it has manipulated), and it is not a Bank (you cant deposit money, withdraw money, or ask for a loan at a Federal Reserve Bank). The Aldrich, Rockefeller, Morgan, Warburg, and Rothschild families will be a true test to the theory of karma, for there direct involvement and manipulation of the FEDs creation, only a most disastrous end for this cabal would there ever be even the hint of justice. I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. Thomas Jefferson Paper is poverty,it is only the ghost of money and not money itself. Thomas Jefferson It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars. Thomas Jefferson History records that the money changers [(international bankers/Rothschild Family)] have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling the money and its issuance. James Madison Whoever controls the volume of money in our country is absolute master of all industry and commerceand when you realize that the entire system is very easily controlled, one way or another by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate. James Garfield (stated in 1881 two weeks before his assassination) Let me issue and control a nations money and I care not who writes the laws. Mayer Amschel Rothschild I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man who controls Britains money supply controls the British Empire, and I control the British money supply. Nathan Mayer Rothschild I am the most unhappy man. I have unwittingly ruined my country. A great industrial nation is now controlled by its system of credit. We are no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men. Woodrow Wilson A world banking system was being set up hereA superstate controlled by international bankersActing together to enslave the world for their own pleasure. The Fed has usurped the government. Louis McFadden The [Federal Reserve] Act establishes the most gigantic trust on earth. When the President signs this Bill, the invisible government of the monetary power will be legalized.The greatest crime of the ages is perpetrated by this banking and currency bill. Charles Lindbergh LONG LIVE THE CONSTITUTIONAL REPUBLIC! SIC SEMPER TYRANNIS!

the trade

March 20th, 2012 at 6:53 pm ! Reply Treasures sold off last week giving a 33 basis point rise in i-rates. This is is a significant rise in one week. If the sell off in treasury accelerates things can get out of hand in very short order. The US rolls its debt between 4-5 years so a simple 50 bp point rise in five year yields equates to $75 billion in additional annual debt service. Rising yields pose a bigger threat to the U.S. than terrorism or a nuclear Iran.

Lennie Pike

March 20th, 2012 at 6:55 pm ! Reply First of all, I think the first picture of him was sufficient, and even it was way too large. A cartoon caricature of him in some silly outfit would be a lot easier to look at. Of the seven reasons he gave for the gold standard being a bad thing, one was true, but it was a wonderful thing and not a bad thing, and one was both true and false. The way he phrased the both true and false reason was meant to mislead so I will call that one a lie a very clever lie. All the rest were untrue so I will call all of those lies also knowing very well the type of people these thugs are. Untruths can be made in error or may be a matter of honest opinion lies are intentional untruths when one knows the truth.

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 7 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

#1 The true one: The gold standard sets the money supply and price level with generally limited central bank intervention. No!, on second thought, that one is also a lie. No central bank at all is necessary with a gold standard it was the word limited he threw in there that threw me off because most of it was true. Man, can these mobsters lie or what! Maybe hes just making subliminal suggestions setting the scene for his mob to administer a gold standard if it comes to that (it wont) not a good idea. How can he account for saying the part that was true the gold supply sets the money supply and price level, and also say elsewhere in his speech, To have a gold standard you have to go to South Africa or someplace and dig up tons of gold and move it to New York and put it in the basement of the Federal Reserve Bank of New York and thats a lot of effort and work.? Because if that had to happen for a gold standard to exist, (not) it would then be the Federal Reserve that set the money supply and price level wouldnt it, since all of the gold would be in their possession?!!!! For him to make that statement he has to have either a lot of chutzpah or be a total idiot, but the highest ranking criminals in the world are not idiots. These assholes say ridiculous things I think just to have fun with us they think we are idiots and by now why wouldnt they think that but to me its more like were gangsters screwing you, whataya gonna do about it? #2 The one that is both true and false, but still a lie its like theyre unable to ever say something thats not a lie! Although the gold standard promoted price stability over the very long run, over the medium run, it sometimes caused periods of inflation and deflation. True, except he failed to specify HOW MUCH inflation and deflation. Levels of deflation were very low and steady because gold is rare and when wealth is created through work, more things came into existence with pretty near the same amount of money as before so of course prices had to fall a little SO WHAT?!!! that is totally irrelevant. Prices fell, but they fell very slowly and steadily you could estimate what prices would be ten years out into the future which is great for business planning, and those prices would be very close to present day prices. At the same time people steadily gained real wealth that would last and not be confiscated by people like him when the credit spigot got cut off. Also there was zero chance of the craziness that is going on today with bailouts and too big to fail banks totally out of control and destroying everything. Economic growth was steady but real, under a gold standard and the ones who created the economic wealth were able to keep what they worked for themselves not have it swindled from them. No other monetary system other than physical coin will work from the most precious metal down to copper or nickel unless another type of money can be guaranteed to be backed by it, which is highly unlikely. Under a gold standard the ability to wage war is limited, and government can not grow into a monster but then none of the goals of western central bankers would be possible.

Save the Republic

March 21st, 2012 at 1:15 am ! Reply You always seem to get it. About #1: What he is saying is there would be no need for the Fed to exist (which is true), and he is trying to brainwash people into believing that they are sooooo necessary that not having them as a major influence in our currency would be a bad thing (not). And I do believe he threw in the limited intervention thing as an alternative option to keep them in the process if somehow there was a possibilty of them being abolished, that they would keep the door open to keep their hooks in it. Also, I think people need to get to the root of the Too big too fail label. I think it is also meant to deceive, to give the impression that not letting these institutions fail is somehow benefitting the rest of us. I dont think theyre benefitting us at all now. They supposedly couldnt fail because we needed them to lend money to keep the economy going, but from what I hear, they are just taking the money the Fed creates and keeping it, or only loaning it to other corporate giants to make profits, which arent being made by American jobs. I think we should start calling them by a different label, something like Too big to not have exhorbitant profits or Too rich to not get richer. Maybe there should be a contest somehow to find a name that labels them more truthfully, so that all Americans would understand why these companies are really being protected.

Sid Davis

March 20th, 2012 at 7:39 pm ! Reply It is true that the Federal Reserve does not exist to make a profit for itself. It exist to provide reserves to the Commercial Banks so that they can create money out of thin air against these reserves to loan out to people, businesses, and governments. Banks dont loan you money they take in from other customers as is commonly believed; if this were true the M2 money supply could not have gone from $50 billion in 1932 to $9,757 today. If they just loaned you other peoples money the supply today would still be $50 billion. These loans of newly created money the Commercial Banks make result in a huge transfer of wealth to themselves from people, businesses, and governments. This is nothing more than the use of the monetary system to make us indentured servants of the Commercial Banks. The consequence of this system, in addition to enslaving the public, is to create boom, followed by bust as first the newly created money (bank credit) is spent, fueling economic expansion and price increases, and later as the required debt repayments drain this fuel from the economy causing contraction, unemployment, and debt crisis. Clearly this system has already destroyed the purchasing power of money (bank credit) as compared to 1913 when it began, and as we face the inevitable financial collapse at the end of the road where the system either implodes in debt, bank, and deflationary collapse or in debt, bank and hyper-inflationary collapse, we also face social chaos. Out of the ashes of this debacle we are faced with a struggle to either restore sound, honest money in the form of gold and silver coins, or fall further into subjugation with some form of fiat money imposed on us by those currently in power as they attempt to continue this system of master/slave. These times are yet another cross road in the freedom/subjugation struggle that has plagued mankind from the beginning of civilization. We are not free if we are indentured servants of banks, other corporations with privilege, and government. I fully expect that the struggle will erupt into violence within the decade and that the current peaceful effort of Ron Paul will turn out to be just the early stage of this effort to restore freedom. So few really comprehend the nature of our current monetary system. This must be true, because otherwise, we would already have had an uprising.

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 8 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Kevin2

March 21st, 2012 at 6:14 am ! Reply Sid Davis Very well written its understandable for the uneducated . May I pass it on in E mails?

Michael

March 20th, 2012 at 8:48 pm ! Reply Chris, I think their solution will be what they are doing in Greece. Medicare, Social Security, Food Stamps, Unemployment, Pensions, and every other government program, except for defense, will be cut to pay off the holders of US debt. In addition, Obama will seize private property under the guise of national emergency and give that away as well. Last Friday evening, President Obama signed an Executive Order giving him the power to implement martial law in the US. The National Defense Resources Preparedness Executive Order will give Obama the power to seize the countries resources in a time of crisis or peace http://www.infowars.com/we-are-already-living-under-martial-law-alex-jones-reports/

McKinley Morganfield

March 20th, 2012 at 8:59 pm ! Reply These are such easy questions. So did the Federal Reserve lie to the court or is Ben Bernanke lying to us? He lies all the time, truth never escapes his lips. And what other agency of the federal government is owned by private banks? The legislative and executive branches. The strength of a gold standard is its greatest weakness too: Because the money supply is determined by the supply of gold, it cannot be adjusted in response to changing economic conditions. No, that is a lie. Under a gold standard the money supply is determined by the market value of gold. (Note: Im not in favor of a strict adherence to a gold standard.) When FDR abandoned the gold standard in 1933, monetary policy became less tight and deflation stopped. Another lie and a grand omission. Promptly after abandoning the gold standard FDR issued an executive order banning private citizens from owning gold coins and bullion, and confiscated gold from safety deposit boxes all across the country. People were paid in currency at the price of gold at that time. Then FDR set the price of gold at 5 times higher than what the government paid for it, thereby reaping a windfall profit for DC. The FED, with the tacit approval of congress and the president, has monetized the national debt (private & public). History shows that is a one way street leading to disaster.

Tappedops

March 20th, 2012 at 9:28 pm ! Reply Dont make me say it again dont get mad get even and if you cant figure out how to do that, then you deserve what your getting

VegasBob

March 20th, 2012 at 10:12 pm ! Reply To paraphrase Harry S Truman, Bernanke is a shifty-eyedliar, who talks out of both sides of his mouth and lies out of both sides too.

Pat

March 20th, 2012 at 11:11 pm ! Reply I have written two funny articles about what Ben Bernanke and Lil Wayne, the Hip Hop artist have in common. Also I have a CBC reporter claiming that gold is worthless because It is not backed by anything. Go to: http://goldenladyfun.blogspot.com to see the video articles Blitty Bling Bling, October, 19, 2011 and Gold Stupidity dated September 29, 2011.

Save the Republic

March 21st, 2012 at 1:16 am ! Reply This guy looks like Jon Corzines little brother.

Save the Republic

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-a-about-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 9 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

Save the Republic

March 21st, 2012 at 1:46 am ! Reply I am so tired of this already. Its been 3 1/2 years with no hope of a real recovery, and the people that are running the show are still playing the same song from the lifeboat as the ship sinks and water is up to the rest of our necks. Try as best you can to starve the system that gives them power. It may be the only way for you and I to have any influence in what is happening to us at all. It is not always possible, and some may be able to starve it more than others. Here are some ways, if you think of more, lets hear them. 1)Work for cash or pay in cash whenever you can. This keeps cash from circulating through the banking system, and taxes from the government, which is corrupt and has given the ability to these banks to rob us, all so they can benefit from the kickbacks. 2)If you cant work for cash, maybe barter some services. 3)Buy used goods when you need something. The quality of older stuff is generally better than the junk they are selling now, and it doesnt give money to the Too big to not get richer corporations that have sent our jobs to other countries (even if its a used imported item, its better than bringing in another imported item). Once again, no taxes to the self-serving government, and you will probably save money on the item, money you could use to pay for inflated food or gasoline that you must buy. 4)If you have to buy from a store, at least try to find something made in USA. At least youll know its helping someone like yourself receive an income from working, rather than them losing their job too (which would increase burden on the government, which then increases the need for more money printing, which causes more inflation, etc., etc.). 5)Maybe you can make things yourself, rather than buy them. Better to save a few bucks and not give money to the greedy corporations and have to pay sales tax too. If we all step up, maybe we can starve the beast enough to make it listen, perhaps change. If not, at least you can feel good knowing youre not contributing to an already bad situation, and you may actually help bring the lifestyle of the leeches that feed on us down just a little. Wouldnt that feel good?

Mariposa Do Oro

March 21st, 2012 at 1:49 am ! Reply Lets see what another and still living Fed Chairman has to say about gold, shall we? http://www.amerigold.com/the_seer/index.php?content_id=42 In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. This is the shabby secret of the welfare statists tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists antagonism toward the gold standard. by Alan Greenspan 1967

Wind Turbines

March 21st, 2012 at 5:01 am ! Reply Excellent article as always, Michael. It seems Ben and the Fed are grasping at straws now. The only thing that needs correction in this article is where you wrote : So will we soon see another recession? and the only reason it needs correction is because we are still in one that we have never gotten out of, and which is getting worse and going full steam ahead to a full blown depression.

Michael

March 21st, 2012 at 5:34 am ! Reply Bernanke is not completly wrong .. but currently there is not a single magic answer pour the global crisis !!!! there is not enough gold supply for everybody in the world, and currently, china buy gold a lot .., but the debt money paradigm is also over !!! There is too much virtual money in the world .. we go to deflation. money, currency must have a standard !!!! but Which ??? in fact, WE DON T CARE !!!! In germany, in 1923, the Rentenmark was a currency backed by industrial assets. It was a truly valuable currency until 1948

Kathy Smith

March 21st, 2012 at 6:32 am ! Reply And when they lock the door make sure all of the Bernanke clan is inside shut the door & then throw away the key!

Euart

March 21st, 2012 at 6:59 am ! Reply

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-aabout-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad

Page 10 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

I like this qoute:To have a gold standard, you have to go to South Africa or someplace and dig up tons of gold and move it to New York and put it in the basement of the Federal Reserve Bank of New York and thats a lot of effort and work Whatever we use as a medium of exchange, there SHOULD be alot of effort and work behind it to obtain it. Any true wealth should be gained from your labor and/or knowledge. Our whole concept of what is wealth and what it takes to create real wealth is off base nowadays, atleast for most people. So, yes, Gold would fit as true wealth and a medium of exchange. We could use other mediums of exchange at the same time as well and a person could exchange their objects(mediums of exchange objects) for currency at a government outlet or bank if you want to call it that. But the currency would ONLY BE ISSUSED for the mediums of exchange that would consist of true wealth objects that were obtained through your labor and/or knowledge. This exchange for currency in this way would only be necessary so people dont have to carry around large or heavy mediums of exchange IF they didnt want to. In a way it is similar to a barter system. For example, what do people barter with? Objects/goods they obtained through their labor, ie animals, crops, lumber, etc. And no Bernanke, all the gold WOULD NOT be in the basement of the Federal Reserve or in government hands for that matter. What an arrogant statement for him to make.

Bob Marshall

March 21st, 2012 at 7:16 am ! Reply YouTube is full of speeches in which Ben Bernanke states that the government has not control over the federal reserve because it is not a part of the government.He also states that no one can tell them what to do until congress changes that and he didnt see that happening.

Prepared Pastor

March 21st, 2012 at 7:33 am ! Reply Learn to live with as little cash as possible: 1. Be able to heat and cook with wood or solar. 2. Harvest water for free and develop a private sewer system. 3. Grow as much food as you can including rabbits and chickens. 4. A digital antenna & signal booster will bring in plenty of free TV. 5. My $1,500 89 diesel truck will run on recycled vegetable or motor oil in a pinch. 6. Habitable foreclosures are selling at auction for a few thousand dollars. Watch my video for more info about that.

Zedge Hero

March 21st, 2012 at 7:41 am ! Reply On the housing market Ben was spot on as always I dont know what yur talking about, hes never been wrong or even a little off. Look On February 15, 2006, Fed Chairman Bernanke said: The housing market has been very strong for the past few years . . . . It seems to be the case, there are some straws in the wind, that housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise, but not at the pace that they had been rising. So we expect the housing market to cool, but not to change very sharply. On February 15, 2007, Fed Chairman Bernanke said: The weakness in housing market activity and the slower appreciation of house prices do not seem to have spilled over to any significant extent to other sectors of the economy. On March 28, 2007, Fed Chairman Bernanke said: The impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained. On May 17, 2007, Fed Chairman Bernanke said: We do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. On February 27, 2008, Fed Chairman Bernanke said: By later this year, housing will stop being such a big drag directly on GDP . . . . I am satisfied with the general approach that were currently taking. Ok so maybe a little off, Ok so maybe weathermen are better indicators of whats to happen, but they dont call him B.S. Bernake for nothing! I used to have such hate for Benny, now I realize that he just might be one of the best comedians of all time, cause everything that comes out of his mouth is a complete #%$@$*!joke.

PAUL LEO FASO

March 21st, 2012 at 7:51 am ! Reply There is a corrupt history to the current attempt by the Federal Reserve Bank and its Chairman, Ben Bernanke to try deceive the American people on the issue of real money and their criminal charade of fictional authority. Congress was clearly delegated the power and authority to regulate and maintain the true value of the coin within the scope and purview of Article I, Section 10, Clause 1, of the ordained Constitution(1787), and further, under the corresponding duty and obligation to maintain gold and silver Coin and Foreign Coin at and within the necessary and proper equal weights and measures clause. (see also: Bible, Dueteronomy,Chapter 25, verses 13-16, Proverbs, Chapter 16, verse 11, Public Law 97-289,96 Stat,1211). Congressman Louis T. McFadden was correct in May 23, 1933, to bring formal charges against the Board of Governors of the Federal Reserve Bank, the Comptroller of the Currency and the Secretary of the United States Treasury for criminal acts. Today, the R.I.C.O. ACT can embrace this monumental conspiracy which has completely debauched our currency under the false pretense of a national emergency created out of a declared bankruptcy of the United States of America by President Roosevelt in March 9, 1933. Executive

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-aabout-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad Page 11 of 12

Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad

3/21/12 2:49 PM

national emergency created out of a declared bankruptcy of the United States of America by President Roosevelt in March 9, 1933. Executive orders; 6073, 6102, 6111,& 6220 and continues to this very day. This permanent STATE OF EMERGENCY was instituted, formed within the Union through gross usurpations, abridgements, malfeasance and continuing breech of legal duties by members of the Federal Government, with contrivance, misrepresentation, conversion, fraud, and avarice by the Federal Reserve Bank. Furthermore, today, this private, non government, criminal banking syndicate should face a class action lawsuit on behalf of 300 million Americans who have been financially sodomized by this affront to our sovereign nation and our liberty. Recently, Bloomberg News, under the freedom of information act, won the case against the private Federal Reserve Bank to reveal their contested audits. This victory in the Federal Court leaves legal precedent to continue to press the Federal Reserve Bank in a class action lawsuit, seize their assets and throw them off the bus. Follow the link for the plan; http://www.zerohedge.com/print/365866 We need a corrupt central bank, like we need cancer.

rolf rogde

March 21st, 2012 at 7:56 am ! Reply bring back the OTTOMAN EMPIRE!

bob smith

March 21st, 2012 at 8:03 am ! Reply The gold standard only sorta worked when the price of gold was internationally fixed. Even then, it didnt prevent inflation, because the real cause of inflation is the government (or the FED in our case) printing money whenever they want it (without telling us), and adding to the money supply. Today, the price of gold is not fixed and is subject to speculation, so it fluctuates constantly. What sense does it make to lock the value of your fiat paper currency into another fiat metal currently whose value fluctuates more than the paper? Whats going on with the economy and our money today is a history that has repeated itself many times. The problem is that the cost of building and maintaining an empire always exceeds the return on investment. So governments keep finding it necessary to manufacture more and more money, which dilutes the value of the money. And the reason they do this is because its all about whos in control and who is controlled, the rich vs. the rest. In the end, greed always wins, and manages to eat its young in the process.

The Ring of Fire and The California BIG ONE. L.A. Marzulli's Blog

March 21st, 2012 at 8:14 am ! Reply [...] Ben Bernanke Tries To Convince America That The Federal Reserve Is Good And The Gold Standard Is Bad [...]

Sunshine

March 21st, 2012 at 9:59 am ! Reply Economics In Everyday Life by Kennard E. Goodman head of the social studies dept, West Technical High School Cleveland Ohio, and William L. Moore. Principal of the John Hay High School Cleveland, Ohio. Copyright 1955. Do they teach economics in Schools anymore? Or upon nearing graduation do the cc cards litter the kids mailboxes and student loan officers are at the ready to help the poor kids find education debt? Back in the day, according to the above mentioned high school textbook, kids learned that inflation meant there was in circulation an amount of $ in excess than could be redeemed in metal. A country may print $ with reckless disregard for the metal reserves in its treasury. Printing press $ also known as fiat finally becomes worthless and its cited Germany, Austria and Russia serve as examples. For all that quantitative easing is there precious metal to back it up, somewhere. I dont know, maybe they are using wampum instead. Dollar has about as much value now, anyway, in terms of what it will buy. In any event, the old schoolbook is in its entirety is an interesting and enlightening read if anyone cares to look it up. Wonder if ben read it?

40 Weird Facts About The United States That Are Almost Too Crazy To Believe

http://theeconomiccollapseblog.com/archives/ben-bernanke-lectures-aabout-why-the-federal-reserve-is-good-and-the-gold-standard-is-bad

Page 12 of 12

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Financial Accounting and Reporting Chapter 4 Problem 3Dokument1 SeiteFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaNoch keine Bewertungen

- How to retrieve refunded amounts from ARN numbersDokument4 SeitenHow to retrieve refunded amounts from ARN numbersEng Muhammad Afzal AlmaniNoch keine Bewertungen

- Why Hayek Was Wrong On Concurrent CurrenciesDokument12 SeitenWhy Hayek Was Wrong On Concurrent CurrenciesKrzysiek RembiaszNoch keine Bewertungen

- Assignment (ERD) : Cairo University Faculty of Computers and Information Information Systems Department Database Systems 1Dokument4 SeitenAssignment (ERD) : Cairo University Faculty of Computers and Information Information Systems Department Database Systems 1Apricot BlueberryNoch keine Bewertungen

- My Card Place PDFDokument3 SeitenMy Card Place PDFDIGITAL PATRIOTSNoch keine Bewertungen

- Mother 4 343 Dongaon (1933) 23rd Aug 2013Dokument172 SeitenMother 4 343 Dongaon (1933) 23rd Aug 2013माझ्या मनातलेNoch keine Bewertungen

- AgostoDokument6 SeitenAgostodakpi479Noch keine Bewertungen

- 129 - Mitsubishi V MitsubishiDokument8 Seiten129 - Mitsubishi V MitsubishiMarioneMaeThiamNoch keine Bewertungen

- Merchant BankingDokument23 SeitenMerchant Bankingmukeshdilse100% (1)

- Quarterly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDokument1 SeiteQuarterly Value-Added Tax Declaration: Kawanihan NG Rentas Internaschiahwalousette100% (1)

- 9 January Current Affairs Quiz by Target Study IQDokument35 Seiten9 January Current Affairs Quiz by Target Study IQSonu SinghNoch keine Bewertungen

- Top NCD Picks and Analysis for May 2014Dokument1 SeiteTop NCD Picks and Analysis for May 2014shobhaNoch keine Bewertungen

- F.2. Basic Bank Documents and Terminologies Related To BankDokument28 SeitenF.2. Basic Bank Documents and Terminologies Related To BankSecret DeityNoch keine Bewertungen

- BSP ReactionDokument1 SeiteBSP ReactionReymond Lovendino100% (2)

- Exp 1Dokument2 SeitenExp 1Amey Pashte50% (2)

- Deutsche Bank IP & ID special transfer SWIFT messageDokument5 SeitenDeutsche Bank IP & ID special transfer SWIFT messagehamid nabizade100% (3)

- Third Party Car Insurance Policy PDFDokument15 SeitenThird Party Car Insurance Policy PDFWasimNoch keine Bewertungen

- Accounts 11Dokument120 SeitenAccounts 11Thakur Manu PratapNoch keine Bewertungen

- HCL It City Lucknow Private LimitedDokument10 SeitenHCL It City Lucknow Private Limitedmathur1995Noch keine Bewertungen

- Providing safe drinking water across Srikakulam districtDokument14 SeitenProviding safe drinking water across Srikakulam districtSatyendraYadavNoch keine Bewertungen

- Factory Accounting (Online Material) PDFDokument31 SeitenFactory Accounting (Online Material) PDFramkumar100% (1)

- Baf3106 Banking Law and Practice - CatDokument7 SeitenBaf3106 Banking Law and Practice - Catmusajames100% (1)

- Estmt - 2018 11 13Dokument8 SeitenEstmt - 2018 11 13Luis RodriguezNoch keine Bewertungen

- Top State Bank Customers in DelhiDokument56 SeitenTop State Bank Customers in Delhidoon devbhoomi realtorsNoch keine Bewertungen

- OpTransactionHistoryUX524 08 2023Dokument2 SeitenOpTransactionHistoryUX524 08 2023Praveen SainiNoch keine Bewertungen

- 310 Supreme Court Reports AnnotatedDokument10 Seiten310 Supreme Court Reports AnnotatedNinaNoch keine Bewertungen

- HDFC Bank Mumbai 4W Online AuctionDokument22 SeitenHDFC Bank Mumbai 4W Online AuctionatulNoch keine Bewertungen

- Credit InitiationDokument20 SeitenCredit InitiationSahil Vyas100% (1)

- Comparing JPMorgan Chase and MAIB Banking ServicesDokument7 SeitenComparing JPMorgan Chase and MAIB Banking ServicesCatalina PinzariNoch keine Bewertungen

- Bank Statement2023 12 02 15 56 04 7980Dokument5 SeitenBank Statement2023 12 02 15 56 04 7980kazeemshaikNoch keine Bewertungen