Beruflich Dokumente

Kultur Dokumente

Texoma Regional Economic Dashboard Report 4Qtr 2011

Hochgeladen von

TCOG Community & Economic DevelopmentCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Texoma Regional Economic Dashboard Report 4Qtr 2011

Hochgeladen von

TCOG Community & Economic DevelopmentCopyright:

Verfügbare Formate

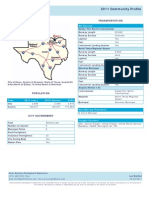

Texoma Regional Economic Dashboard Baseline Report March 22, 2012

Purpose: The Texoma Regional Economic Dashboard project is designed to inform Workforce Development, Economic Development, and Regional Planning professionals about the economic condition of the Texoma Workforce Development Area. This dashboard will allow the partners, and other interested parties a better understanding of the regions economy in order to plan for the future, identify strengths and weaknesses, and apply for grants to execute projects that improve the regions infrastructure, services, and workforce and economic development systems. The dashboard provides historical perspective on a number of traditional and non-traditional data points, gathered from multiple sources. These data points come from several strategically identified types in order to give a more complete picture of the Texoma Region. The data and analysis will help with the development of Workforce Solutions Texomas Strategic Plan; the Comprehensive Economic Development Strategy (CEDS); work plans for Economic Development Entities; strategic plans for counties, cities, and school districts in the Region, as well as important labor market information for employers and job seekers. Definition of the Region: For the purpose of the baseline report, the Texoma Region is defined as Cooke, Fannin, and Grayson Counties in Texas. Plans are underway to gather data from a portion of Southeast Oklahoma in the near future to get a better picture of the Texoma Labor Shed. Report Format: Cover Page The report includes a cover page which shows a graphic representation for each of the indicators included in the report. These graphics represent how each of the indicators changed in the period covered. = The indicator improved = The indicator remained basically unchanged = The indicator declined Graphs The remainder of the report is a series of graphs which represent the mature data points used to create the report. Each of the graphs are dynamic, and the data set represented can be changed to allow more in-depth analysis by the user. For the purpose of the release, the data points used are representative of the region.

Methodology: Because no single indicator should be considered a barometer for a regional economy, the dashboard project aligns multiple economic indicators to create a more accurate picture of the overall health of the Texoma Regional economy. The indicators used come from four broad categories; Employment Related Indicators, Public Assistance Related Indicators, Spending Related Indicators, and Miscellaneous Indicators. The data presented is based on a comparison of the same indicators during the same period in the previous quarter, and the same period in the previous year. Employment Related Indicators include: Civilian Labor Force The labor force includes all persons classified as employed or unemployed. Employed persons - Persons 16 years and over in the civilian non-institutional population who, (a) did any work at all (at least 1 hour) as paid employees; worked in their own business, profession, or on their own farm, or worked 15 hours or more as unpaid workers in an enterprise operated by a member of the family; and (b) all those who were not working but who had jobs or businesses from which they were temporarily absent. Unemployed persons Persons aged 16 years and older who had no employment, were available for work, and had made specific efforts to find employment. Unemployment Rate The unemployment rate represents the number unemployed as a percent of the labor force. Public Assistance Indicators include: TANF Enrollment The total number of designated groups of people certified to receive Temporary Assistance to Needy Families (TANF) cash benefits as of cutoff in the month. A case can include more than one person. SNAP Enrollment The total number of designated groups of people certified to receive Supplemental Nutrition Assistance Program (SNAP) benefits as of cutoff in the month. A case can include more than one person. Spending Related Indicators include: Sales Tax Allocations The Sales Tax Allocations Report presents data about local sales and use tax allocation payments to local sales taxing jurisdictions. These net payments represent monies identified for the local jurisdictions by quarter. Hotel/Motel Taxable Sales The Hotel/Motel Taxable Sales Report presents hotel occupancy taxable receipts for hotels on a quarterly basis. These numbers are inclusive of hotels that file monthly as well as those that file quarterly.

For each of the indicators used, a threshold of change was set in order to determine if the indicator improved, remained basically unchanged, or declined. The thresholds are as follows: Indicator Civilian Labor Force Unemployment Rate TANF Enrollment SNAP Enrollment Sales Tax Allocations Hotel/Motel Taxable Sales Project Partners: The partners involved in the project are Workforce Solutions Texoma, Texoma Council of Governments, and Denison Development Alliance. The three project partners are each responsible for certain data elements. Once the data is processed, the team analyzes the data together. Each team member is able to add their expertise and perspective to the data in order to produce a full analysis. Historical Perspective: In the United States, the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) is generally seen as the authority for dating US recessions. The NBER defines an economic recession as: "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." Almost universally, academics, economists, policy makers, and businesses defer to the determination by the NBER for the precise dating of a recession's onset and end. There is no argument the United States, Texas, and the Texoma Region have experienced challenging economic times in the recent past. However; exactly when the Nation, the State, or the Region actually entered into a Recession is a matter of debate. For the purpose of this report, the team researched this question, and has determined: United States: According to the NBER, the US was in a recession from December, 2007 until June, 2009. A number of economic indicators continued their downward trend until January, 2010. Texas: According to both the Federal Reserve and Economist Ray Perryman the Texas economic downturn started in late summer, 2008 probably August. Sources lead the team to believe the recession in Texas ended in June, 2009, though a number of indicators continued their downward trend until December, 2009. Numerous economists agree Texas is either leading, or closely following, the country out of the recession. Type of Change Increase or decrease in the number of people. Increase or decrease in the percentage rate. Increase or decrease in number of cases. Increase or decrease in number of cases. Increase or decrease in total dollars. Increase or decrease in total dollars. Threshold +/- 500 +/- 0.25% +/- 50 +/- 500 +/- 0.5% +/- 3.0%

Texoma Region: By analyzing the data points, the team has determined the Texoma Region has experienced an economy very similar to the State of Texas, and therefore entered a recession in late 2008 or early 2009, and remained in recession until late 2009. In creating this baseline report, the team gathered, aligned, and analyzed economic data back to 1998. Annual Analysis, 2011: Based on the data collected, and the analysis of the team, it appears the overall economic health of the Region is better than it was this time last year. This is based on several factors. Civilian Labor Force is up from 93,387 in the 4th Qtr. 2010, to 94,456 in the 4th Qtr. 2011. Unemployment Rate is down from 8.0% in the 4th Qtr. 2010, to 7.2% in the 4th Qtr. 2011. TANF Enrollment is down from 793 in the 4th Qtr. 2010, to 742 in the 4th Qtr. 2011. SNAP Enrollment does not show a significant change 31,148 in the 4th Qtr. 2010, 31,066 in the 4th Qtr. 2011. Sales Tax Allocations are up from $6,429,640.53 in the 4th Qtr. 2010, to $7,217,337.53 in the 4th Qtr. 2011. Hotel/Motel Taxable Sales are up from $4,783,783.24 in the 4th Qtr. 2010, to $5,835,735.41 in the 4th Qtr. 2011. Overall, the region is showing improvement in 2011, over 2010. Most Recent Quarter Analysis, 4th Qtr., 2011 Based on the data collected, and the analysis of the team, it appears the overall economic health of the Region is better than it was this time last quarter. This is based on several factors. Civilian Labor Force does not show a significant change 94,447 in the 3rd Qtr. 2011, to 94,456 in the 4th Qtr. 2011. Unemployment Rate is down from 8.4% in the 3rd Qtr. 2011, to 7.2% in the 4th Qtr. 2011. TANF Enrollment is up from 680 in the 3rd Qtr. 2011, to 742 in the 4th Qtr. 2011. SNAP Enrollment does not show a significant change 30,787 in the 3rd Qtr. 2011, 31,066 in the 4th Qtr. 2011. Sales Tax Allocations are up from $7,130,461.08 in the 3rd Qtr. 2011, to $7,217,337.53 in the 4th Qtr. 2011.

Hotel/Motel Taxable Sales are down from $7,176,872.12 in the 3rd Qtr. 2011, to $5,835,735.41 in the 4th Qtr. 2011. This downturn is due to normal seasonality, and is slightly less than for the same Qtr. In the last 2 years. Overall, the region is showing improvement in 4th Qtr. 2011, over 3rd Qtr. 2011. Future Releases: The Texoma Regional Economic Dashboard will be released in two formats, a quarterly report that will contain analysis of indicators available on a quarterly basis at minimum, and an annual report that will contain analysis of the quarterly indicators and additional indicators available on an annual basis at minimum.

Das könnte Ihnen auch gefallen

- Social Entrepreneurship For Poverty AlleviationDokument1 SeiteSocial Entrepreneurship For Poverty AlleviationTCOG Community & Economic DevelopmentNoch keine Bewertungen

- Texoma Health OutcomesDokument1 SeiteTexoma Health OutcomesTCOG Community & Economic DevelopmentNoch keine Bewertungen

- Texoma Health OutcomesDokument1 SeiteTexoma Health OutcomesTCOG Community & Economic DevelopmentNoch keine Bewertungen

- Texoma Diversity IncreasesDokument1 SeiteTexoma Diversity IncreasesTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Pottsboro ProfileDokument5 Seiten2011 Pottsboro ProfileTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Howe ProfileDokument5 Seiten2011 Howe ProfileTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Ladonia ProfileDokument5 Seiten2011 Ladonia ProfileTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Muenster ProfileDokument5 Seiten2011 Muenster ProfileTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Gainesville ProfileDokument5 Seiten2011 Gainesville ProfileTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Bonham ProfileDokument5 Seiten2011 Bonham ProfileTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 TCOG Annual ReportDokument22 Seiten2011 TCOG Annual ReportTCOG Community & Economic DevelopmentNoch keine Bewertungen

- 2011 Sherman-Denison Labor Shed StudyDokument18 Seiten2011 Sherman-Denison Labor Shed StudyTCOG Community & Economic DevelopmentNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Yield Curve and TheoriesDokument9 SeitenYield Curve and TheorieskalukollasjpNoch keine Bewertungen

- 1 - Black-Scholes Model PresentationDokument21 Seiten1 - Black-Scholes Model PresentationHammad ur Rab MianNoch keine Bewertungen

- Actuarial EconomicsDokument52 SeitenActuarial EconomicsRavi Shankar VermaNoch keine Bewertungen

- Practice Multiple Choice QuestionsDokument5 SeitenPractice Multiple Choice QuestionsAshford ThomNoch keine Bewertungen

- Chapter 1 Why Are Financial Institutions Special?Dokument10 SeitenChapter 1 Why Are Financial Institutions Special?A_Students67% (6)

- Stats Book SfuDokument354 SeitenStats Book SfuDaniel Sánchez100% (1)

- Financial Debt CrisisDokument56 SeitenFinancial Debt CrisisasthaNoch keine Bewertungen

- G10 Economics STB 2023 WebDokument190 SeitenG10 Economics STB 2023 WebBarzala CarcarNoch keine Bewertungen

- Guiding Principles of Monetary Administration by The Bangko SentralDokument8 SeitenGuiding Principles of Monetary Administration by The Bangko SentralEuphoria BTSNoch keine Bewertungen

- Derivatives & Risk Management SyllabusDokument2 SeitenDerivatives & Risk Management SyllabusDivyeshNoch keine Bewertungen

- RIN Detergent - To Position or RepositionDokument28 SeitenRIN Detergent - To Position or RepositionYasir Mehmood50% (2)

- Resume 2019Dokument1 SeiteResume 2019api-284589809Noch keine Bewertungen

- Capital Budgeting and Risk AnalysisDokument16 SeitenCapital Budgeting and Risk AnalysisBansil AaronNoch keine Bewertungen

- Solutions To A2StudyPack2012Dokument21 SeitenSolutions To A2StudyPack2012Juncheng WuNoch keine Bewertungen

- Hee 2Dokument9 SeitenHee 2Zinab albyyodNoch keine Bewertungen

- Cattle Pen Fattening Business Project Proposal: Promoter: - Beruf Fattening PLCDokument39 SeitenCattle Pen Fattening Business Project Proposal: Promoter: - Beruf Fattening PLCDereje Abera90% (39)

- Financial Risk Management SolutionDokument8 SeitenFinancial Risk Management SolutionWakas KhalidNoch keine Bewertungen

- TestDokument14 SeitenTesthonest0988Noch keine Bewertungen

- 2007 Ny Chotai I7Dokument7 Seiten2007 Ny Chotai I7Matthew BrownNoch keine Bewertungen

- Marketing GurusDokument2 SeitenMarketing GurusHafeez SabirNoch keine Bewertungen

- Market Capitalization (Often Market Cap) Is A Measurement of Size of A Business EnterpriseDokument4 SeitenMarket Capitalization (Often Market Cap) Is A Measurement of Size of A Business EnterpriseAnshuman SaikiaNoch keine Bewertungen

- Standard Costing With Solutions: SolutionDokument3 SeitenStandard Costing With Solutions: Solution777priyankaNoch keine Bewertungen

- Dynamic ReplicationDokument20 SeitenDynamic ReplicationAtiahNoch keine Bewertungen

- Why Study Management (1) 3Dokument2 SeitenWhy Study Management (1) 3iyun KNNoch keine Bewertungen

- Toán Ứng Dụng Giáo TrìnhDokument123 SeitenToán Ứng Dụng Giáo TrìnhHoàng SơnNoch keine Bewertungen

- Product MarketingDokument2 SeitenProduct MarketingAmirul AzwanNoch keine Bewertungen

- Instant Noodles in Thai MarketDokument12 SeitenInstant Noodles in Thai MarketMaiBằng100% (1)

- Case Study-Precision WorldwideDokument7 SeitenCase Study-Precision WorldwideJustin Doh100% (3)

- Reference BikashDokument15 SeitenReference Bikashroman0% (1)

- Fundamentals of AccountingDokument7 SeitenFundamentals of AccountingNoor FatimaNoch keine Bewertungen