Beruflich Dokumente

Kultur Dokumente

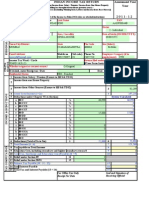

Assessment Year Indian Income Tax Return: I - Individual

Hochgeladen von

Manjunath YvOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assessment Year Indian Income Tax Return: I - Individual

Hochgeladen von

Manjunath YvCopyright:

Verfügbare Formate

FORM

INDIAN INCOME TAX RETURN

Assessment Year

ITR-1

First Name Flat / Door / Block No

[For Individuals having Income from Salary/ Pension/ family pension & Interest] (Please see Rule 12 of the Income Tax-Rules,1962) (Also see attached Instructions)

2 0 0 9 - 10

PAN

PERSONAL INFORMATION

Middle Name

Last Name Name of Premises / Building / Village Area / Locality Status

I - Individual Road / Street / Post Office Date of birth (DD/MM/YYYY) 00/00/0000 Pin Code Sex (Select) M-Male

Town/City/District

State

Email Address Designation of Assessing Officer (Ward / Circle)

(Std code) Phone No

FILING STATUS

Employer Category (if in employment) OTH Return filed under section 11 - u/s 139(1) [Pl see instruction 9(ii)]

Whether original or revised return?

O-Original

If revised, enter Receipt no / Date Revised Date RES - Resident Residential Status 1 Income chargeable under the Head Salaries(Salary/ Pension) 1 2 Income chargeable under the Head Other Sources a Family Pension 2a b Interest 2b c Total (2a + 2b) 2c 3 Gross Total Income (1+2c) 3 System Calculated 4 Deductions under Chapter VI A (Section) 4a a 80 C 0 4b b 80 CCC 0 4c c 80 CCD 0 4d d 80 D 0 4e e 80 DD 0 4f f 80 DDB 0 4g g 80 E 0 4h h 80 G 0 4i i 80 GG 0 4j j 80 GGA 0 4k k 80 GGC 0 4l l 80 U 0 m Total Deductions 4m 0 4m Do not Leave Blank Total Income (3 - 4m) 5 5 6 Net Agricultural Income (Enter only if greater than Rs. 5,000) 6 7 Aggregate Income (5 + 6) 7 8 a Tax payable on Aggregate Income 8a b Rebate in respect of Net Agricultural Income 8b 9a 0 9 a Tax payable on Total Income (8a-8b) b Surcharge on 9a 9b Education Cess, including secondary and c 9c higher secondary cess on (9a+9b) d Total Tax, Surcharge and Education Cess (Payable) (9a+9b+9c) 9d 10 0 10 Relief under Section 89 11 0 11 Relief under Section 90/91 12 Balance Tax Payable (9d - 10 - 11) 12 13 a Interest payable u/s 234 A 13a b Interest payable u/s 234 B 13b c Interest payable u/s 234 C 13c d Int payable(13a+13b+ 13c) 13d 14 Total Tax and Int. Payable(12+13d) 14 For Office Use Only Seal and Signature of Receipt No/ Date Receiving Official

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

TAX COMPUTATION

INCOME & DEDUCTIONS

0 0

0 0

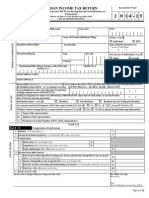

15 Taxes Paid 0 a Advance Tax (from item 23) 15a b TDS (column 7 of item 21 +column 7 15b 0 of item 22) 0 c Self Assessment Tax (item 23) 15c 0 d Total Taxes Paid (15a+15b+15c) 15d 0 16 Tax Payable (14-15d) (if 14 is greater than 15d,) 16 0 17 Refund (15d-14) if 15d is greater than 14 17 18 Enter your Bank Account number (Mandatory in case of refunds) No 19 Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 20 In case of direct deposit to your bank account give additional details MICR Code Type of Account(As applicable) Other Information (transactions reported through Annual Information Return) (Please see instruction 24 number-9(ii) for code) Sl Sl Code Amount (Rs) Code Amount (Rs) a b 001 002 0 0 c d 003 004 0 0 e f 005 006 0 0 g h 007 008 0 0 25 Tax-exempt interest income (for reporting purposes only) 0 VERIFICATION I, (full name in block letters), son/daughter of solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2009-10 Place Date Sign here -> PAN 26 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP Counter Signature of TRP REFUND TAXES PAID

27

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

21

Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)] Income Tax Deduction payable charg under eable (incl. PinCode under the Chapter surch. VI-A head and Salaries edn.cess) (4) (5) (6) Tax payable/ refundable (8)

Tax Deduction Account UTN (Unique Name of the SI.No Number Transaction Number) Employer (TAN) of the Employer (1) 1 2 3 (2) (9)

Address

City

State

Total tax Deducted

(3)

(7)

(Click + to add more rows to 22) TDS on Interest above. Do not delete blank rows. Blank rows will not be included In the ITR) 22 Details of Tax Deducted at Source on Interest [As per Form 16 A issued by Deductor(s)] Amount paid/ credited (4) Date of Payment / Credit (5) Amount out of (6) claimed for this year (7)

Tax Deduction Account UTN (Unique Name of the SI.No Number Transaction Number) Deductor (TAN) of the Deductor (1) 1 2 3 4 (2) (8)

Address

City

State

PinCode

Total tax Deducted

(3)

(6)

(Click + to add more rows to 22) TDS on Interest above. Do not delete blank rows. Blank rows will not be included In the ITR)

23 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Bank Detals & Branch Serial Date of Deposit BSR Code Number of Amount (Rs) Name of the (DD/MM/YYYY) Branch Challan Bank

(Click '+' to add more rows to 23) Tax Payments. Do not delete blank rows. Blank rows will not be included In the ITR)

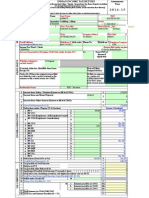

Tax and interest Calculator

A) B) C) D) E)

2009-10

Beta Version 1.0 This calculator takes inputs from this filled up utility. This calculator requires taxpayer to complete all schedules The Green cells below are as per the value entered in Part B TI/ TTI and the yellow cells adjacent are as per the Click on Recalculate in case any of the input values in the return are being changed, to view the recomputated tax After verifying and validating all input values, and generating the final computation, the sytem calculated values of Please note that to calculate interest , you need to complete acceptance of final computation of tax, surcharge and

S No Calculator for Tax, Surcharge 1 Total income after set off of losses and deductions Deduct : Special Rate incomes from above for arriving at Aggregate Income to be used in computation of Tax at 2 Normal Rate 3 Add : Net Agricultural Income for Rate Aggregate Income to be used for computation of Tax at 4 Normal Rate 5 Tax at Normal Rates 6 Rebate on Agricultural Income 7 Special Income as per Sch SI 8 Tax at Special Rate 9 Tax payable on Total Income 10 11 12 13 14 Surcharge Marginal Relief Net Surcharge Education Cess Gross Tax Liability

As entered 0

As Calculated 0

0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0 0

0 0 0

S No Calculator for Interest 14 Date of filing

As entered 31/07/2009

As Calculated (dd/mm/yyyy)

15 16 17 18 19

Enter date upto which interest is to be calculated Enter due date for filing of returns Interest u/s 234A Interest u/s 234B Interest u/s 234C

31/07/2009 31/07/2009 0 0 0

(dd/mm/yyyy) (dd/mm/yyyy) 0 0 0

Validate data before generating XML No of entries TDS on Salary 0 TDS on Interest 0 Tax Payments 0

1. Validate against each schedule the

count of no of entries.

3. In case this count does not match to

the entered number of entries, you may recheck the schedules, refer to instructions for filling up tables, and ensure that all entries are valid and completely entered.

2. This is required to confirm that the 4. Once this sheet is validated, you

total no of entries entered per schedule is valid and being generated in the final XML may click on Save XML to generate the XML file

If the no of entries are 0 In a schedule, there are mandatory fields For a row to be valid, these must be filled in. Also, do not skip blank rows

Das könnte Ihnen auch gefallen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- IT Return 2011 2012Dokument3 SeitenIT Return 2011 2012swapnil6121986Noch keine Bewertungen

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDokument11 SeitenITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNoch keine Bewertungen

- Form ITR-1Dokument3 SeitenForm ITR-1Rajeev PuthuparambilNoch keine Bewertungen

- Assessment Year Sahaj Indian Income Tax ReturnDokument7 SeitenAssessment Year Sahaj Indian Income Tax Returnrajshri58Noch keine Bewertungen

- Assessment Year Indian Income Tax Return SahajDokument7 SeitenAssessment Year Indian Income Tax Return SahajallipraNoch keine Bewertungen

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDokument3 SeitenAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNoch keine Bewertungen

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Dokument3 SeitenSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNoch keine Bewertungen

- Gross Total Income (1+2c) 4: System CalculatedDokument3 SeitenGross Total Income (1+2c) 4: System CalculatedDHARAMSONINoch keine Bewertungen

- 2013 Itr1 PR11Dokument9 Seiten2013 Itr1 PR11Akshay Kumar SahooNoch keine Bewertungen

- ITR Form 1Dokument7 SeitenITR Form 1gj29hereNoch keine Bewertungen

- Income TaxDokument6 SeitenIncome TaxKuldeep HoodaNoch keine Bewertungen

- Gross Total Income (1+2c) 4: Import Previous VersionDokument4 SeitenGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNoch keine Bewertungen

- Indian Income Tax Return Assessment Year SahajDokument7 SeitenIndian Income Tax Return Assessment Year SahajSubrata BiswasNoch keine Bewertungen

- ITR-2 Indian Income Tax Return: Part A-GENDokument12 SeitenITR-2 Indian Income Tax Return: Part A-GENMankamesachinNoch keine Bewertungen

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Dokument22 SeitenSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaNoch keine Bewertungen

- 2012 Itr1 Pr21Dokument5 Seiten2012 Itr1 Pr21MRLogan123Noch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument12 SeitenITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNoch keine Bewertungen

- 2011 - ITR2 - r6Dokument33 Seiten2011 - ITR2 - r6Bathina Srinivasa RaoNoch keine Bewertungen

- 2015 Itr1 PR3Dokument18 Seiten2015 Itr1 PR3shubham sharmaNoch keine Bewertungen

- Gross Total Income (1+2+3) 4: System CalculatedDokument8 SeitenGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNoch keine Bewertungen

- 2011 ITR1 r2Dokument3 Seiten2011 ITR1 r2Zafar IqbalNoch keine Bewertungen

- ITR-2 Indian Income Tax Return: Part A-GENDokument10 SeitenITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNoch keine Bewertungen

- Enter Necessary Data For Income Tax CalculationDokument15 SeitenEnter Necessary Data For Income Tax Calculationsa_mishraNoch keine Bewertungen

- V. N. Hari,: Sudhakar & Kumar AssociatesDokument28 SeitenV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument7 SeitenITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNoch keine Bewertungen

- BIR FormDokument4 SeitenBIR FormfyeahNoch keine Bewertungen

- Form 16, Tax Deduction at Source... Income Tax of IndiaDokument2 SeitenForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNoch keine Bewertungen

- 82202BIR Form 1702-MXDokument9 Seiten82202BIR Form 1702-MXRen A EleponioNoch keine Bewertungen

- ITR-3 Indian Income Tax Return: Part A-GENDokument8 SeitenITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNoch keine Bewertungen

- Scan 0001Dokument11 SeitenScan 0001Kimmie3050% (2)

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDokument6 SeitenImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahNoch keine Bewertungen

- Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialDokument10 SeitenSahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialAjit KumarNoch keine Bewertungen

- 1601 CDokument16 Seiten1601 CROGELIO QUIAZON100% (1)

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Dokument6 SeitenGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuNoch keine Bewertungen

- Tax Applicable (Tick One) 2 8 1Dokument7 SeitenTax Applicable (Tick One) 2 8 1Gaurav BajajNoch keine Bewertungen

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDokument42 Seiten2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Bir Form 1701Dokument12 SeitenBir Form 1701miles1280Noch keine Bewertungen

- 82202BIR Form 1702-MXDokument9 Seiten82202BIR Form 1702-MXJp AlvarezNoch keine Bewertungen

- 82255BIR Form 1701Dokument12 Seiten82255BIR Form 1701Leowell John G. RapaconNoch keine Bewertungen

- 2016 Itr4 PR3Dokument165 Seiten2016 Itr4 PR3TejasNoch keine Bewertungen

- Return ChallanDokument20 SeitenReturn Challansyedfaisal_sNoch keine Bewertungen

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryVon EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionVon EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2024, Professional EditionVon EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnVon EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNoch keine Bewertungen

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryVon EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- TAX1Dokument154 SeitenTAX1yani oraNoch keine Bewertungen

- Wages Vs IncomeDokument8 SeitenWages Vs Incomesakins9429Noch keine Bewertungen

- Trucks Quotation CrocoDokument1 SeiteTrucks Quotation Crocoelfigio gwekwerereNoch keine Bewertungen

- Sampark - As On - 01.09.19 PDFDokument549 SeitenSampark - As On - 01.09.19 PDFSunnyArya0% (1)

- Singapore Income Tax - KPMG GLOBALDokument14 SeitenSingapore Income Tax - KPMG GLOBALumi fitriaNoch keine Bewertungen

- Sales Tax System in IndiaDokument7 SeitenSales Tax System in IndiaKarthi_docNoch keine Bewertungen

- T BB NG XXXXXXX 4892Dokument1 SeiteT BB NG XXXXXXX 4892Vannali MaheshNoch keine Bewertungen

- Basic TaxationDokument45 SeitenBasic TaxationTessa De Claro89% (9)

- Sukhjeet Singh 2018-19 (Itr) PDFDokument1 SeiteSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNoch keine Bewertungen

- YesukoDokument1 SeiteYesukoraviNoch keine Bewertungen

- Final AnalyticsDokument10 SeitenFinal AnalyticsAries BautistaNoch keine Bewertungen

- Presentation of TaxationDokument10 SeitenPresentation of TaxationMaaz SiddiquiNoch keine Bewertungen

- Cs Ins 05 2021Dokument2 SeitenCs Ins 05 2021Sri CharanNoch keine Bewertungen

- New Jersey Tax Guide: Buying or Selling A Home in New JerseyDokument9 SeitenNew Jersey Tax Guide: Buying or Selling A Home in New Jerseynour abdallaNoch keine Bewertungen

- Statement 2: The Revocation of A Revenue Regulation Cannot Be Made Retroactive Even If The Reason For Its RevocationDokument4 SeitenStatement 2: The Revocation of A Revenue Regulation Cannot Be Made Retroactive Even If The Reason For Its RevocationRosemarie CruzNoch keine Bewertungen

- Sample Tax Question (Solution and Answer)Dokument18 SeitenSample Tax Question (Solution and Answer)FRITZ JANN CERANoch keine Bewertungen

- Tax CertificateDokument1 SeiteTax Certificateshakeel_idealNoch keine Bewertungen

- KCT002-68 Roof Steel Sola SystemsDokument1 SeiteKCT002-68 Roof Steel Sola SystemsThai chheanghourtNoch keine Bewertungen

- Order 1696151852963Dokument1 SeiteOrder 1696151852963trichysayeeNoch keine Bewertungen

- Tax Invoice: Total 1Dokument9 SeitenTax Invoice: Total 1ParthgautamNoch keine Bewertungen

- ACCA Paper F6 (UK) : NotesDokument60 SeitenACCA Paper F6 (UK) : NotesJean d'Amour FurahaNoch keine Bewertungen

- GSTDokument14 SeitenGSTsatwikaNoch keine Bewertungen

- Important Theory Qutions Income TaxDokument9 SeitenImportant Theory Qutions Income TaxPRANARITA BHOLNoch keine Bewertungen

- Verma EnterprisesDokument2 SeitenVerma EnterpriseskapilazarchitectsNoch keine Bewertungen

- BP Business Plan Financial Tables Jun14Dokument7 SeitenBP Business Plan Financial Tables Jun14ocalmaviliNoch keine Bewertungen

- Simple GST Invoice For Single Rate of Goods and ServicesDokument8 SeitenSimple GST Invoice For Single Rate of Goods and ServicesKM computer & online workNoch keine Bewertungen

- Develop Understanding of TaxationDokument19 SeitenDevelop Understanding of TaxationHenok Eosi83% (6)

- Period: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraDokument6 SeitenPeriod: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraNagesh AdumullaNoch keine Bewertungen

- Kuenzle Vs CIRDokument2 SeitenKuenzle Vs CIRHaroldDeLeon100% (1)