Beruflich Dokumente

Kultur Dokumente

ACCT 340 - Ch9Notes - Withanswers-2

Hochgeladen von

Alex MorrisonOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ACCT 340 - Ch9Notes - Withanswers-2

Hochgeladen von

Alex MorrisonCopyright:

Verfügbare Formate

ACCT 340: Chapter 9 Notes

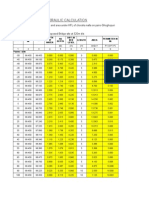

LOWER OF COST OR MARKET Inventories are reported at the lower of cost or market (LCM). For LCM purposes, market is defined as replacement cost, except that market should Not exceed the net realizable value (NRV). Not be less than NRV reduced by an allowance for an apprx normal profit margin (NRV-NP).

NRV provides a ceiling and NRV-NP a floor between which market must fall.

EXAMPLE: Memphis Wholesale Market applies lower-of-cost-or-market valuation to individual products and has collected the following data:

1. 2.

Determine the balance sheet inventory carrying value for Products A, B, and C. Determine the balance sheet inventory carrying value for Products A, B, and C assuming that Memphis Wholesale Market prepares its financial statements according to International Financial Reporting Standards.

THE GROSS PROFIT METHOD The gross profit method is useful in situations where estimates of inventory are desirable. In determining the cost of inventory that has been lost, stolen, or destroyed. In estimating inventory and cost of goods sold for interim reports, avoiding the expense of a physical inventory count. In auditors' testing of the overall reasonableness of inventory amounts reported by clients. In budgeting and forecasting. Provides only an approximation of inventory and is not acceptable for the preparation of annual financial statements. Estimates cost of goods sold by multiplying the period's net sales by a historical gross profit percentage and then subtracting that amount from net sales.

EXAMPLE: On March 17, 2011, a flood destroyed the entire inventory of Beatty Co. The following information

is available from its accounting records:

Required: Compute the estimated cost of inventory lost in the flood.

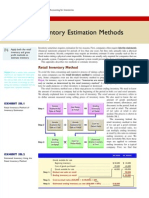

THE RETAIL INVENTORY METHOD Similar to the gross profit method, the retail inventory method relies on the relationship between cost and selling price to estimate ending inventory and cost of goods sold. Ideal for high-volume retailers selling many different items at low unit prices. The principal benefit is that a physical count of inventory is not required to estimate ending inventory and cost of goods sold. Provides a more accurate estimate than the gross profit method because its based on the current cost-toretail percentage rather than a historical gross profit percentage. A company must maintain records of inventory and purchases not only at cost but also at current selling price. Can be used for financial reporting and income tax purposes. The various cost flow methods (FIFO, LIFO, and average cost) can be explicitly incorporated into the estimation technique, as can an approximation of the lower of cost or market. EXAMPLE: Andover Stores uses the average cost retail method to estimate its ending inventory. Information as of June 30, 2011, is as follows:

Required: Use the retail method to estimate the June 30, 2011, inventory. INVENTORY ERRORS

The Barton Company uses a periodic inventory system. At the end of 2010, a mathematical error caused an $800,000 overstatement of ending inventory. Ending inventories for 2011 and 2012 are correctly determined. The way we correct this error depends on when the error is discovered. Assuming that the error is not discovered until after 2011, the 2010 and 2011 effects of the error, ignoring income tax effects, are shown below. The overstated and understated amounts are $800,000 in each instance. Analysis: 2010 Beginning inventory Plus: Net purchases Less: Ending inventory Cost of goods sold Revenues Less: Cost of goods sold Less: Other expenses Net income Retained earnings U = Understated O = Overstated 2011 Beginning inventory Plus: Net purchases O Less: Ending inventory U Cost of goods sold Revenues Less: Cost of goods sold Less: Other expenses Net income Retained earnings O

U O O

O U corrected

EXAMPLE: In the year 2011, the internal auditors of Goofy Co. discovered that goods costing $25 million that were purchased in December of 2010 were recorded for $20 million. The goods were properly measured in the December 31, 2010 ending physical inventory. Required: Prepare the journal entry needed in 2011 to correct the error. Also, briefly describe any other measures Goofy would take in connection with correcting the error. (Ignore Income Taxes)

TEACHING NOTES

Determine the balance sheet inventory carrying value for Products A, B, and C.

* Selling price less disposal costs **NRV less normal profit margin Determine the balance sheet inventory carrying value for Products A, B, and C assuming that Memphis Wholesale Market prepares its financial statements according to International Financial Reporting Standards.

* Selling price less disposal costs ** Lower of cost or NRV

Andover Stores uses the average cost retail method to estimate its ending inventory. Information as of June 30, 2011, is as follows:

Required: Use the retail method to estimate the June 30, 2011, inventory.

The 2010 financial statements that were incorrect as a result of the error would be retroactively restated to reflect the correct cost of goods sold, (income tax expense if taxes are considered), net income, accounts payable, and retained earnings when those statements are reported again for comparative purposes in the 2011 annual report. Because retained earnings is one of the incorrect accounts, the correction to that account is reported as a prior period adjustment to the 2011 retained earnings balance in the comparative statements of shareholders' equity. Also, a disclosure note should describe the nature of the error and the impact of its correction on each year's net income, income before extraordinary items, and earnings per share.

Das könnte Ihnen auch gefallen

- Accounting English IIDokument14 SeitenAccounting English IIJaprax LailyasNoch keine Bewertungen

- Financial Accounting and Reporting - Problems ReviewDokument5 SeitenFinancial Accounting and Reporting - Problems ReviewARIS100% (1)

- Kelompok 6 Chapter 6Dokument11 SeitenKelompok 6 Chapter 6leoni pannaNoch keine Bewertungen

- The Gross Profit Method For Estimated Ending InventoryDokument4 SeitenThe Gross Profit Method For Estimated Ending InventoryKeith Joanne Santiago100% (2)

- Accounting 101 - Reviewer (TEST QUIZ)Dokument18 SeitenAccounting 101 - Reviewer (TEST QUIZ)AuroraNoch keine Bewertungen

- Inventories - Inventory Estimation MethodsDokument17 SeitenInventories - Inventory Estimation MethodsmarkNoch keine Bewertungen

- q2 ProbDokument11 Seitenq2 ProbGamers HubNoch keine Bewertungen

- P2 - Installment SalesDokument3 SeitenP2 - Installment SalesKevin James Sedurifa OledanNoch keine Bewertungen

- CHAPTER Four NewDokument16 SeitenCHAPTER Four NewHace AdisNoch keine Bewertungen

- Intermediate I Chapter 8Dokument45 SeitenIntermediate I Chapter 8Aarti JNoch keine Bewertungen

- Cost of Goods Sold and Inventory PDFDokument69 SeitenCost of Goods Sold and Inventory PDFThành Steven100% (1)

- Chapter 6 PowerpointDokument34 SeitenChapter 6 Powerpointapi-248607804Noch keine Bewertungen

- AssesmentDokument14 SeitenAssesmentbhumi shuklaNoch keine Bewertungen

- Methods of Estimating InventoryDokument46 SeitenMethods of Estimating Inventoryone formanyNoch keine Bewertungen

- Lecture Notes On Inventory Estimation - 000Dokument4 SeitenLecture Notes On Inventory Estimation - 000judel ArielNoch keine Bewertungen

- Inventory LastDokument27 SeitenInventory LastNigus AyeleNoch keine Bewertungen

- Summary After MidDokument40 SeitenSummary After Midmc2hin9Noch keine Bewertungen

- Chapter 7Dokument46 SeitenChapter 7Awrangzeb AwrangNoch keine Bewertungen

- Accounting For Merchandising OperationsDokument13 SeitenAccounting For Merchandising OperationsAB Cloyd100% (1)

- Unit 2: Inventories: Special Valuation Methods 2.0 Aims and ObjectivesDokument17 SeitenUnit 2: Inventories: Special Valuation Methods 2.0 Aims and ObjectivesNesru SirajNoch keine Bewertungen

- Financial Accounting Practice and Review InventoryDokument3 SeitenFinancial Accounting Practice and Review Inventoryukandi rukmanaNoch keine Bewertungen

- CH 08Dokument38 SeitenCH 08مريمالرئيسي50% (4)

- Financial Accounting Estimating InventoryDokument3 SeitenFinancial Accounting Estimating Inventoryukandi rukmanaNoch keine Bewertungen

- 2666Dokument3 Seiten2666MaxNoch keine Bewertungen

- Samsung Electronics Accounts Receivable AnalysisDokument64 SeitenSamsung Electronics Accounts Receivable AnalysisSonali AgarwalNoch keine Bewertungen

- Valuation of Inventories: A Cost-Basis Approach ChapterDokument53 SeitenValuation of Inventories: A Cost-Basis Approach ChapterCorliss Ko100% (3)

- Kieso 15e SGV1 Ch09Dokument30 SeitenKieso 15e SGV1 Ch09anilegna99Noch keine Bewertungen

- Inventory Valuation Special MethodsDokument30 SeitenInventory Valuation Special Methodsyebegashet100% (1)

- Test BanksDokument3 SeitenTest BanksLevi OrtizNoch keine Bewertungen

- Chapter 8 PDFDokument62 SeitenChapter 8 PDFgetasewNoch keine Bewertungen

- Incomplete RecordsDokument13 SeitenIncomplete RecordsSylvan Muzumbwe MakondoNoch keine Bewertungen

- 15 1312MH CH09 PDFDokument17 Seiten15 1312MH CH09 PDFAntora HoqueNoch keine Bewertungen

- IA 1 Quiz 3 InventoriesDokument11 SeitenIA 1 Quiz 3 InventoriesJo HarahNoch keine Bewertungen

- Valuation of Inventories: A Cost-Basis ApproachDokument36 SeitenValuation of Inventories: A Cost-Basis ApproachjulsNoch keine Bewertungen

- INVENTORY VALUATIONDokument13 SeitenINVENTORY VALUATIONSumit SahuNoch keine Bewertungen

- Valuation of Inventories: A Cost-Basis Approach: Chapter Learning ObjectivesDokument38 SeitenValuation of Inventories: A Cost-Basis Approach: Chapter Learning ObjectivesmicahventuresNoch keine Bewertungen

- (At) 01 - Preface, Framework, EtcDokument8 Seiten(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Acct II Chapter 1Dokument10 SeitenAcct II Chapter 1mubarek oumerNoch keine Bewertungen

- Inventory EstimationDokument4 SeitenInventory EstimationShy Ng0% (1)

- A2 Sample Chapter Inventory ValuationDokument19 SeitenA2 Sample Chapter Inventory ValuationIlmi Dewi ANoch keine Bewertungen

- Accounting Final ExamDokument6 SeitenAccounting Final ExamKarim Abdel Salam Elzahby100% (1)

- Final Accounts NotesDokument6 SeitenFinal Accounts NotesVinay K TanguturNoch keine Bewertungen

- 2016030f4150712chap 8 AssignmentDokument3 Seiten2016030f4150712chap 8 AssignmentReynante Dap-ogNoch keine Bewertungen

- Handouts Acctg 1 - MerchandisingDokument13 SeitenHandouts Acctg 1 - MerchandisingJoannah Marie OliverosNoch keine Bewertungen

- How To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterDokument16 SeitenHow To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterSiti Asma MohamadNoch keine Bewertungen

- 20 MINUTE QUIZ ANSWERSDokument7 Seiten20 MINUTE QUIZ ANSWERSTohidul Kabir0% (1)

- INTACC DQsDokument9 SeitenINTACC DQsMa. Alessandra BautistaNoch keine Bewertungen

- Exercise For Chapter 5 6Dokument16 SeitenExercise For Chapter 5 6Ngọc Ánh VũNoch keine Bewertungen

- Accounting for Merchandising BusinessesDokument38 SeitenAccounting for Merchandising BusinessesJeffrey JosephNoch keine Bewertungen

- Accounting for Merchandising Business OverviewDokument57 SeitenAccounting for Merchandising Business OverviewAliaJustineIlagan100% (1)

- Unit V Study GuideDokument4 SeitenUnit V Study GuideVirginia TownzenNoch keine Bewertungen

- Inventories 1Dokument32 SeitenInventories 1Summer Star100% (1)

- Accounting For Manager DDokument315 SeitenAccounting For Manager DPRASANJIT MISHRANoch keine Bewertungen

- Week 08 - 02 - Module 19 - Accounting For InventoriesDokument17 SeitenWeek 08 - 02 - Module 19 - Accounting For Inventories지마리Noch keine Bewertungen

- Inventory ValuationDokument19 SeitenInventory ValuationJohn Patterson100% (1)

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDokument14 SeitenACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNoch keine Bewertungen

- Accounting For InventoryDokument3 SeitenAccounting For InventoryReika OgaliscoNoch keine Bewertungen

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryVon EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursVon EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNoch keine Bewertungen

- LAB REPORT 2-HINGED ARCH (Reference)Dokument11 SeitenLAB REPORT 2-HINGED ARCH (Reference)jajenNoch keine Bewertungen

- Hubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliDokument12 SeitenHubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliRirisNoch keine Bewertungen

- Chapter 7 Sampling & Sampling DistributionDokument43 SeitenChapter 7 Sampling & Sampling DistributionTitis SiswoyoNoch keine Bewertungen

- Worksheet A: Teacher's Notes: Level 2 (Upper Intermediate - Advanced)Dokument9 SeitenWorksheet A: Teacher's Notes: Level 2 (Upper Intermediate - Advanced)Elena SinisiNoch keine Bewertungen

- Prosedur Penggajian: Payroll ProcedureDokument5 SeitenProsedur Penggajian: Payroll ProcedureVira TrianaNoch keine Bewertungen

- Wells Fargo Preferred CheckingDokument4 SeitenWells Fargo Preferred Checkingjames50% (2)

- 08 - Chapter 1 PDFDokument18 Seiten08 - Chapter 1 PDFRadhika BhargavaNoch keine Bewertungen

- Chapter Seven: Activity Analysis, Cost Behavior, and Cost EstimationDokument72 SeitenChapter Seven: Activity Analysis, Cost Behavior, and Cost EstimationEka PubyNoch keine Bewertungen

- Accounting TransactionsDokument6 SeitenAccounting TransactionsCelyn DeañoNoch keine Bewertungen

- Articol Indicatori de PerformantaDokument12 SeitenArticol Indicatori de PerformantaAdrianaMihaiNoch keine Bewertungen

- HypertextDokument3 SeitenHypertextivyjoyNoch keine Bewertungen

- It Complaint Management SystemDokument26 SeitenIt Complaint Management SystemKapil GargNoch keine Bewertungen

- LSP1 circuit board component layout and schematicDokument1 SeiteLSP1 circuit board component layout and schematicEvely BlenggoNoch keine Bewertungen

- A Comparative Study of Engine Mounting System For NVH ImprovementDokument8 SeitenA Comparative Study of Engine Mounting System For NVH ImprovementIndranil BhattacharyyaNoch keine Bewertungen

- Sator N Pavloff N Couedel L Statistical PhysicsDokument451 SeitenSator N Pavloff N Couedel L Statistical PhysicsStrahinja Donic100% (1)

- The Kerdi Shower Book: John P. BridgeDokument7 SeitenThe Kerdi Shower Book: John P. BridgeTima ShpilkerNoch keine Bewertungen

- San Beda University College of Law Semester, School Year 2021-2022 Course SyllabusDokument47 SeitenSan Beda University College of Law Semester, School Year 2021-2022 Course SyllabusJabezNoch keine Bewertungen

- Engine Oil Pump PM3516 3516B Power Module NBR00001-UPDokument3 SeitenEngine Oil Pump PM3516 3516B Power Module NBR00001-UPFaresNoch keine Bewertungen

- 349 Advance Us CT Boiler DesDokument6 Seiten349 Advance Us CT Boiler DesRobin IndiaNoch keine Bewertungen

- Wiring 87T E01Dokument4 SeitenWiring 87T E01Hau NguyenNoch keine Bewertungen

- Metrology Public PDFDokument9 SeitenMetrology Public PDFLeopoldo TescumNoch keine Bewertungen

- Chapter 26 STAINING OF MUSCLE AND BONE - Group3Dokument6 SeitenChapter 26 STAINING OF MUSCLE AND BONE - Group3Krizelle Vine RosalNoch keine Bewertungen

- TDS - J TOWhead D60Dokument1 SeiteTDS - J TOWhead D60TahirNoch keine Bewertungen

- Test General Product Support Assessment (MOSL1)Dokument21 SeitenTest General Product Support Assessment (MOSL1)Romeo67% (3)

- TCS Case StudyDokument21 SeitenTCS Case StudyJahnvi Manek0% (1)

- The Freshwater BiomeDokument3 SeitenThe Freshwater BiomedlpurposNoch keine Bewertungen

- Dialog+ 2016 - BrochureDokument6 SeitenDialog+ 2016 - BrochureirmaNoch keine Bewertungen

- BRM 2.Dokument10 SeitenBRM 2.Sehar AzharNoch keine Bewertungen

- Hydraulic CaculationDokument66 SeitenHydraulic CaculationgagajainNoch keine Bewertungen

- B1 exam preparation tipsDokument4 SeitenB1 exam preparation tipsAnanth Divakaruni67% (6)