Beruflich Dokumente

Kultur Dokumente

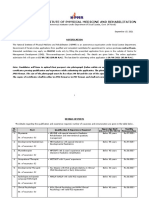

Insurance Claims Details

Hochgeladen von

Karan BeriOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Insurance Claims Details

Hochgeladen von

Karan BeriCopyright:

Verfügbare Formate

Selection of Risk Purpose of Selection Proposal should be accepted or not Rate of premium (Amt.

of risk) Classification of Risk and Determination of Premium Avoid adverse selections.

Factors Affecting Risk Age (Minimum and maximum) Build ( Heights, Weight, Chest, etc.) Physical condition Medical examination Personal History health record, habits, occupations etc. Family History Occupation- Drivers job, chemical industry, income, etc. Residence good climate Present Habits Gender Economical Status Defence Services Nationality

Sources of Risk Information - The proposal form - Medical examination - Agents report - The Inspection report Independent agency - Private friends report - Family Physician Report - Neighbors and Business Associates Measurement of Risk Purpose: Fixation of premium - VALUE OF SERVICE (Utility of insurance to each cant be determined, Higher premium will not attract business. - COST OF SERVICE - Expenses of business + small profit (No loss, no gain) - Cost of claim - Cost of Administration (Fixed and recurring) Cost of Claim - Forecasting of death is very important - experience of medical science - Experience of past record Can we calculate the time of death on the basis of experience of past death record? Ans: Death of one life can not be forecasted but no. of death from a group of persons of the same age can be forecasted on the basis of 1. Theory of probability 2. Law of large numbers. Theory of probability - Certainty occurrence of death is 100% ( occurrence of any event) - Simple Probability Mutually exclusive event known as simple probability Ex: At the age of 40 years, 2 persons die out of 10,000 persons Probability of death of a person who is of 40 years can be expressed as

2/10,000 = .02% or .0002 of units. - Compound Probability Multiplication is applied when the probability of the combined happening of two or more independent events. Ex. Age 40 - probability .0002 Age 42 - probability .0003 .0002 x .0003 = .0000006

Law of Large Numbers - Accuracy of data - The large no. of units Claim Management - Claim mgt is related to efficiency of the organization - Speed, courtesy, fairness, level of service are related to claim management - It affects the customer satisfaction - Goodwill of the organization - result in cash outflow - Correctly assume the claim files a. Claim with fraud attitude b. Claims filed due to incorrect interpretations of clauses in the policy documents. Motor insurance claims have become major threat to the survival of the co. Most of insurance companies have separate claim department in which they have Claim administration Hierarchical structure in form of authority (in monetary limit)

Claim Settlement procedures in general insurance 1. Loss or damage should be reported to insurer immediately 2. Complete claim form along with an estimate of the loss has to be submitted 3. Inspection to the damaged items to assess the loss 4. specialist licensed surveyor will deputed in case of major loss (loss more than Rs. 20,000 under section 64 UM of insurance act) 5. Investigation that loss or damage has occurred or not due to an insured peril. Fire Insurance Claim Copies of the Policy complete with terms, conditions and warranties. Claim form duly completed by the insured. Survey report should include Indication of the cause of loss Establishment of liability Assessment of loss Confirmation of compliance of policy terms, conditions and warranties. Admissibility of the claim Photographs Police reports Fire Brigade report

Motor Insurance Claims - Claim form

Registration certificate Driving License Load challan Fitness certificate Report to police Survey report In Damage claim, estimate of repairs.

Med claim (Hospitalization) Duly completed claim form Bills, receipts, and discharge card Cash memos from hospital Bills from chemist Receipts and pathological test reports Surgeon bill and receipt.

Claim Management in Life Insurance Life insurance claim can be categorized as 1. Maturity claims 2. Death Claim Certain features are common to life insurance claimPolicy must be in force at the time of claim Insured must be covered by the policy Nothing was outstanding to the insurer at the time of claim The claim is covered by the policy A scrutiny from legal angle.

Maturity Claims - Endowment polices including money back policies. - Payable sum assured and bonuses - Document required Policy document, Age proof, Deed of assignment, Discharge form. Death Claims If the insured dies before the expiry of the term of the policy, it is called as death claim. The death of the life assured has to be intimated in writing to the insurer. In case of claims by death, after receipt of intimation of death, the following documents are required. Policy document Deed of assignment / reassignment Proof of age, if age is not already admitted Certificate of death Legal evidence of title if policy is not assign to nominated Form of discharge executed and property witnessed.

If the claim has occurred with 3 years. Statement from the last medical attendant, from hospital, from the person who has attended the funeral, from employer. Insurance Underwriting Insurance underwriters evaluate the risk and exposures of potential clients. They decide how much coverage the client should receive, how much they should pay for it, or whether even to accept the risk and insure them. Underwriting involves measuring risk exposure and determining the premium that needs to be charged to insure that risk. The function of the underwriter is to acquire or to "write" business that will make the insurance company

money, and to protect the company's book of business from risks that they feel will make a loss. In simple terms, it is the process of issuing insurance policies.

Classification of risks - Physical Hazard (Age, Sex, Build, Physical Conditions, Personal History, Family History) - Occupational Hazard (Nature of Job) - Moral hazard (Intentions of the proposer) Data for underwriting - Proposal form - Medical Examination - Agent or officer report Decision may be one the following Accept as proposed Accept with extra premium Accept with modify terms Accept with specific clause Postpone for specific period Decline (risk is too heavy to be covered)

Recent Trends (Constantly under review) - Person who would not have been insured some forty years ago are now insurable - Collect the information of habit - Lower premium rate for working women.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- (CTRL) The Finders' Keeper: An Interview With Marion PettieDokument10 Seiten(CTRL) The Finders' Keeper: An Interview With Marion PettieSolomanTrismosin100% (2)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Simple Linear Regression Analysis: Mcgraw-Hill/IrwinDokument16 SeitenSimple Linear Regression Analysis: Mcgraw-Hill/IrwinNaeem AyazNoch keine Bewertungen

- KFC 225 Installation ManualDokument2 SeitenKFC 225 Installation Manualsunarya0% (1)

- ProfessionalresumeDokument1 SeiteProfessionalresumeapi-299002718Noch keine Bewertungen

- Faust Part Two - Johann Wolfgang Von GoetheDokument401 SeitenFaust Part Two - Johann Wolfgang Von GoetherharsianiNoch keine Bewertungen

- Imam Zainul Abideen (RA) 'S Service To The Poor and DestituteDokument3 SeitenImam Zainul Abideen (RA) 'S Service To The Poor and DestituteShoyab11Noch keine Bewertungen

- Introduction and Overview: "Calculus I" Is Divided Into Five Chapters. Sequences and Series Are Introduced in Chapter 1Dokument1 SeiteIntroduction and Overview: "Calculus I" Is Divided Into Five Chapters. Sequences and Series Are Introduced in Chapter 1mangalvao2009Noch keine Bewertungen

- Stephen Law Morality Without GodDokument9 SeitenStephen Law Morality Without GodJiReH MeCuaNoch keine Bewertungen

- 4.dynamic Analysis of Earth Quake Resistante Steel FrameDokument28 Seiten4.dynamic Analysis of Earth Quake Resistante Steel FrameRusdiwal JundullahNoch keine Bewertungen

- Adventures in Parenting RevDokument67 SeitenAdventures in Parenting Revmakj_828049Noch keine Bewertungen

- Bahasa Inggris XIIDokument1 SeiteBahasa Inggris XIIclaudiaomega.pNoch keine Bewertungen

- Breast Cancer ChemotherapyDokument7 SeitenBreast Cancer Chemotherapydini kusmaharaniNoch keine Bewertungen

- Development of A Single Axis Tilting QuadcopterDokument4 SeitenDevelopment of A Single Axis Tilting QuadcopterbasavasagarNoch keine Bewertungen

- NIPMR Notification v3Dokument3 SeitenNIPMR Notification v3maneeshaNoch keine Bewertungen

- Norman 2017Dokument7 SeitenNorman 2017Lee HaeunNoch keine Bewertungen

- CNS Drugs Pharmaceutical Form Therapeutic Group: 6mg, 8mgDokument7 SeitenCNS Drugs Pharmaceutical Form Therapeutic Group: 6mg, 8mgCha GabrielNoch keine Bewertungen

- Di Franco Amended Factum 2021-05-03Dokument30 SeitenDi Franco Amended Factum 2021-05-03Michael BueckertNoch keine Bewertungen

- Activity 2Dokument2 SeitenActivity 2cesar jimenezNoch keine Bewertungen

- They Cried MonsterDokument13 SeitenThey Cried MonstermassuroNoch keine Bewertungen

- Afghanistan Law Bibliography 3rd EdDokument28 SeitenAfghanistan Law Bibliography 3rd EdTim MathewsNoch keine Bewertungen

- Durability Problems of 20 Century Reinforced Concrete Heritage Structures and Their RestorationsDokument120 SeitenDurability Problems of 20 Century Reinforced Concrete Heritage Structures and Their RestorationsManjunath ShepurNoch keine Bewertungen

- Shostakovich: Symphony No. 13Dokument16 SeitenShostakovich: Symphony No. 13Bol DigNoch keine Bewertungen

- SKI Report2008 - 50 2Dokument46 SeitenSKI Report2008 - 50 2nada safitriNoch keine Bewertungen

- Zone Raiders (Sci Fi 28mm)Dokument49 SeitenZone Raiders (Sci Fi 28mm)Burrps Burrpington100% (3)

- PDF Certificacion 3dsmaxDokument2 SeitenPDF Certificacion 3dsmaxAriel Carrasco AlmanzaNoch keine Bewertungen

- Science Fiction FilmsDokument5 SeitenScience Fiction Filmsapi-483055750Noch keine Bewertungen

- Creativity & Innovation Brainstorming TechniquesDokument50 SeitenCreativity & Innovation Brainstorming TechniquesFirdhaus SakaffNoch keine Bewertungen

- The Magical Number SevenDokument3 SeitenThe Magical Number SevenfazlayNoch keine Bewertungen