Beruflich Dokumente

Kultur Dokumente

Chapter 3 Short Answer

Hochgeladen von

morgan.bertoneOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 3 Short Answer

Hochgeladen von

morgan.bertoneCopyright:

Verfügbare Formate

Morgan Bertone Chapter 3 Advanced Accounting

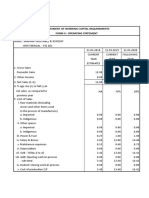

1. a. The parent accrues income when earned by the subsidiary and dividend receipts are recorded as a reduction in the investment account. The excess of fair value are amortized or an intra-entity transaction reflects the parents financial records. Advantage: provided [arent accurate information concerning subsidiarys impact on consolidated totals and disadvantage is it is usually complicated to apply b. The initial method recognizes only the subsidiarys dividends as income while the assets balance remains at acquisition-records date. The advantage is it is simple and provides a measure of cash flows between two companies. c. Partial equity method, the parent accrues the subsidiarys income as earned but does not record adjustments that might be required by excess fair-value amortizations or intra-entity transfers. Advantage is it is easier to apply then equity but the disadvantage is that in many cases the parents income is reasonable approximation of the consolidated totals. 2. a. Equipment is taken on by the parent company and the subsidiary balances are included after adjusting for the acquisition-date fair values. May need to be depreciated. b. Investment in Williams, asset account by parent is eliminated so that it is zero. c. Dividends Paid- income is recognized by is eliminated and is replaces by subsidiaries the revenues and expenses d. Goodwill- the original fair value allocation is included. e. Revenues- parent revenues are included and subsidiaries revenues are included but only for the period since the acquisition. f. Expenses- Parent expenses are included and subsidiary expenses are included on for the period since the acquisition. Amortization expenses are included. g. Common Stock- parent balances only are included although they will have been adjusted at the acquisition date if stock was issued. h. Net Income or retained earning only the parent balance is included. 3. When a parent company used the equity method both the parent net income and retained earning account balances the consolidated totals because the stockholders equity section of the balance sheet is being written off to the investment account as well as the assets they have been accrued for depreciation and amortization. The investment account is increased by the income and decreased by the dividends. All these journals entries create the number being equal to the consolidated totals. 4. The necessity is removing amortization is that the income needs to be accrued by the amortization meaning that the income would be overstated if you did not take the amortization

out. Your expenses would be overstated therefore the accountant need to do income less expense to come up with the I journal entry number. 5. The necessity of this entry is to accrue the net effect of the subsidiarys operations for the prior years and to reflect the two years of amortization expense. Therefore the net incomes in prior years are subtracted from the original investment to come up with number for that journal entry. The equity method does not do this because for the other two entries it is essential that the entry adjust the opening retained earnings of the acquiring company to the balance, it would have been in the equity method was applied. 6. The debt will be handled by intra-entity transfers therefore they will be removed for the consideration in any subsequent period. The journal entries in SADIE will remove all the intraentity receivables and payables. 7. The investment account is continually adjusted for the income and dividends for each of the six years they have owned the company. It also includes the amortization and depreciation expenses. It is adjusted to continually adjust to reflect the ownership of the acquired company. 10. A contingent payment is accounted for as a liability because the company must estimate the fair value of the liability for the future. They can estimate it by looking at will it actually be paid, how many times will it be paid, and factor for time value of money. If they dont put it on their books as a liability they are overstating their assets and understating their liabilities. 11. Push down accounting is used when the subsidiaries adjust their account balances to recognize the allocations and goodwill stemming from the parent acquisition. Subsequent amortization is recorded in the subsidiary as an expense. The rationale for the push down is it is required by the SEC for separate statements of the subsidiary only when no substantial outside ownership exists.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Case 1:: Industrial Industrial Capitalist CapitalistDokument3 SeitenCase 1:: Industrial Industrial Capitalist CapitalistAnonnNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Finance KEOWN CH4 NotesDokument8 SeitenFinance KEOWN CH4 NotesJeongBin ParkNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Section 3 Group 14 IocDokument5 SeitenSection 3 Group 14 IocRachit Jaiswal MBA21Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- List of International Financial Reporting Standards - WikipediaDokument17 SeitenList of International Financial Reporting Standards - WikipediaHiyas ng SilanganNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- FR Question BankDokument348 SeitenFR Question BankSajjad Hosen Pavel50% (2)

- Advanced aCCOUNTING 2 SOLMAN PDFDokument418 SeitenAdvanced aCCOUNTING 2 SOLMAN PDF杉山未来100% (1)

- Strategic Management 3rd Edition Rothaermel Test Bank DownloadDokument120 SeitenStrategic Management 3rd Edition Rothaermel Test Bank DownloadFrancine Lalinde100% (23)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- University of Santo Tomas Alfredo M. Velayo College of AccountancyDokument4 SeitenUniversity of Santo Tomas Alfredo M. Velayo College of AccountancyChni Gals0% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Chapter 23 Current Cost AccountingDokument24 SeitenChapter 23 Current Cost AccountingElaine Fiona VillafuerteNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDokument8 SeitenDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Seatwork 01 Audit of Intangible Assets - ReviewDokument4 SeitenSeatwork 01 Audit of Intangible Assets - ReviewDan Andrei BongoNoch keine Bewertungen

- Bba Amity AccountsDokument1 SeiteBba Amity AccountsDeepak BatraNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Strategies Affecting Stock MarketDokument9 SeitenStrategies Affecting Stock MarketAditya Kanchan BarasNoch keine Bewertungen

- Batch 17 1st Preboard (P1)Dokument13 SeitenBatch 17 1st Preboard (P1)Jericho Pedragosa100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Financial Accounting TheoryDokument14 SeitenFinancial Accounting TheoryNimalanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Laporan Keuangan PT Elang Mahkota Teknologi TBK 30 PDFDokument143 SeitenLaporan Keuangan PT Elang Mahkota Teknologi TBK 30 PDFRAHUL YADATAMANoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Transactions 1Dokument9 SeitenTransactions 1Mikaela Jean0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Theory and Practice of Investment ManagementDokument17 SeitenThe Theory and Practice of Investment ManagementTri RamadhanNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Barth, M.E., Landsman, W.R. & Wahlen, J.M. (1995). Fair value accounting: Effects on banks’ earnings volatility, regulatory capital and value of contractual cash flows. Journal of Banking and Finance, 19, 577-605.Dokument29 SeitenBarth, M.E., Landsman, W.R. & Wahlen, J.M. (1995). Fair value accounting: Effects on banks’ earnings volatility, regulatory capital and value of contractual cash flows. Journal of Banking and Finance, 19, 577-605.Marchelyn PongsapanNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Tutorial 6 (Week 7) QUESTIONDokument7 SeitenTutorial 6 (Week 7) QUESTIONJahmesNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Problem 23-16Dokument9 SeitenProblem 23-16anneliban499Noch keine Bewertungen

- Ppe ExerciseDokument8 SeitenPpe ExerciseNajihah NordinNoch keine Bewertungen

- Sums On Cash Flow StatementDokument5 SeitenSums On Cash Flow StatementAstha ParmanandkaNoch keine Bewertungen

- PA - Group Assignment T1.2022Dokument3 SeitenPA - Group Assignment T1.2022Phan Phúc NguyênNoch keine Bewertungen

- CH 1 MCQ AccDokument12 SeitenCH 1 MCQ AccAmit GuptaNoch keine Bewertungen

- Assessment of Working Capital Requirements Form Ii: Operating StatementDokument12 SeitenAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNoch keine Bewertungen

- Quiz On Stock ValuationDokument2 SeitenQuiz On Stock ValuationJesse John A. Corpuz0% (1)

- Chapter 18Dokument38 SeitenChapter 18Kad SaadNoch keine Bewertungen

- Chapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesDokument14 SeitenChapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesAnshumaan SinghNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Bram 2016Dokument270 SeitenBram 2016Frederick SimanjuntakNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)