Beruflich Dokumente

Kultur Dokumente

Prohibition of Riba

Hochgeladen von

ابو حفصOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Prohibition of Riba

Hochgeladen von

ابو حفصCopyright:

Verfügbare Formate

African Journal of Business Management Vol. 5(5), pp. 1763-1767, 4 March, 2011 Available online at http://www.academicjournals.

org/AJBM ISSN 1993-8233 2011 Academic Journals

Full Length Research Paper

Islamic banking and prohibition of Riba/interest

Ashfaq Ahmad1*, Kashif-ur-Rehman2 and Asad Afzal Humayoun3

Department of Business Administration, University of Sargodha, Pakistan. Department of Management Sciences, Iqra University, Islamabad, Pakistan. 3 Foundation University Institute of Engineering and Management Sciences (FUIEMS), Foundation University, Islamabad, Pakistan.

2 1

Accepted 30 August, 2010

The 21st century came with blending of threats and opportunities due to the inception of Islamic banking practices across the globe. Islamic and conventional banking could be differentiated due to interest, risk sharing and objectivity. This study describes the Islamic instruction regarding Islamic banking and prohibition of Riba/interest, and also presents a glossary regarding prohibition of Riba/interest in the light of the Holy Quran and Sunnah (Ahadith). It depicts the superiority of Islamic banking as interest free banking over conventional banking (interest based banking) due to its long lasting benefits. Islamic banking is desirable because it promotes cooperation and mutual benefit oriented behavior among different stakeholders with the assurance of a welfare oriented society. This study attempts to differentiate Islamic banking from conventional banking on the basis of interest. Key words: Islamic banking, Riba, Holy Quran, Sunnah, prohibition of interest. INTRODUCTION The basic aim of Islamic banking is to perform interestfree activities based on principles of Shariah and carry out only Halaal (permissible) transactions. The most important feature of Islamic banking is the sharing of risk among the investors, the bank and the borrowers. Islamic banking focuses on fairness and freedom as a centrally controlled and individually managed system according to the instructions of Allah Almighty. Islam is a complete code of life that is built upon the instructions given by the Allah Almighty and practices of the holy prophet Muhammad (peace be upon him). The holy Quran is the written instructions of Allah Almighty for humans. It covers all aspects of human life and all types of activities (that is, religious, social and economic) that are performed for the success in this life and in the life hereafter. There are clear instructions about Haalal and Haraam. Islam is a universal faith that promotes brotherhood, social equality and fairness in economic activities for the welfare of the mankind (Chapra, 1985). It was proved that equity participation has a great potential for larger profits along with benefits of decentralized decision-making (Wieltzman, 1984; 1985). Equity contract is superior to debt contract due to a number of benefits. It improves the profitability of business units by eliminating the limitations as imposed by debt. Furthermore, equity based banking contracts stimulate the investment in the economy (Haque and Mirakhor, 1986). Riba, interest, or usury is strictly prohibited in Islam as dealing with Riba-based transactions means declaring war with Allah Almighty and His Messenger (Muhammad, peace be upon him) Sura-e-Al-Bakara (2:279). Islam is defined as total submission to Allah Almighty without any condition. It is a complete code of life that consists upon the instructions of Allah Almighty and the practices of the Holy Prophet Muhammad (Peace be upon him). Everyone in this world performs religious, social and economic activities in one's life. But most of the times social and economic activities are originated and linked with the religious activities. Islam provides a comprehensive set of instructions to face any challenge. Economic activities reflect the earning and spending pattern of people, which is closely associated with religion in the form of being permissible (Halaal) or forbidden (Haraam). Interest by definition is an additional amount paid/ received on the principal amount according to an agreement due to a time period attached thereof. Even a single additional penny on the principal amount or any

*Corresponding author. E-mail: ashfaquos@gmail.com.

1764

Afr. J. Bus. Manage.

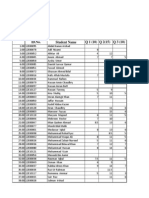

Table 1. Difference between Islamic and Conventional Bank.

Main difference Principles

Islamic bank Islamic banks follow the Principles of Shariah given by Allah Almighty to perform operations and activities. Profit, service charges and consultancy fee is the main source of earnings of Islamic banks. Profit is variable which may be negative in case of loss.

Conventional bank Conventional banks follow manmade principles to perform operations and activities.

Source of earnings

Interest is the main source of income for conventional banks that is charged on different types of loans/products. (Difference between interests charged from borrowers and paid to depositors). It assures a predetermined rate of interest. Risk is fully transferred to others.

Risk sharing

Risk is shared among borrower, lender and bank. It aims at maximizing the profit but subject to principles of Shariah. Islamic bank works as a trading concern to generate its income.

Profit maximization

It aims at maximizing the profit without any restriction even at the cost of other stakeholders. It generates income as financial intermediary. Its prime goal is the maximization of shareholders value at any cost. Income of conventional bank is constant even if business borrowers suffer from loss because it charges fixed rate of interest irrespective of profit volume.

Objectives

Nature of earnings

Income of Islamic banks varies depending upon business borrowers and environment. It may be negative in case of loss.

other benefit attached with this transaction is considered as Riba (Rehman, 1993). Islamic and conventional banking could be differentiated on the basis of objectives, risk sharing and interest based transaction (Ahmad et al., 2010). The main differences between Islamic and conventional bank are summarized in Table 1. Uzair (1976) has presented the working structure of Islamic bank and developed a mechanism to cope with the challenges of risk and interest. Risk of loss is a potential threat that creates obstacles for productive activities in the economy. The study suggested that Islamic banks could help to reduce risk to enhance productive activities in the economy. It is reported that different stakeholders dealing with Islamic bank are risk neutral and actively engaged in productive activities according to profit and loss based contracts (Siddiqui, 1973). Friedman (1969) suggested that a nominal zero interest rate is necessary condition for optimal allocation of resource. It was found that zero interest rate is required and sufficient for allocative efficiency by investigation within general equilibrium models (Wilson, 1979; Cole and Kocherlakota, 1998). Literature also supported that interest-free (profit and loss sharing) system is viable and superior to an interest-based system (Chapra, 1985; Mirakhor, 1997). It is reported that Islamic banks perform better as compared to conventional banks due to higher perception of service quality in Pakistan (Ahmad et al., 2010). Similarly, a stronger positive relationship is

reported between service quality and customer satisfaction among customers of Islamic banks (Ahmad, Rehaman and Saif, 2010). Al-Jarhi and Iqbal (2001) defined Riba with reference to Sharia'h scholars as anything (big or small), pecuniary or non-pecuniary, in excess of the principal on a loan that must be paid by the borrower to the lender along with the principal as a condition (stipulated or by the custom), of the loan or for an extension in its maturity. It is referred as Riba-al-qard or Riba-al-Quran that is known as interest on loans in recent age. Islam prohibits all types of Riba not only on loans but also on other transactions as Riba-al-fadl that is linked with an exchange of commodeties. Similarly, interest is prohibited on all type of activities that is, whether it is paid/received on consumption or production activities. Most interestingly, it was also reported that the performance of Islamic banks meets the international standards in terms of profitability (Iqbal et al., 1998). Table 2 reveals the definition of terms used in this study. PROHIBITION OF INTEREST Interest based activities are strictly prohibited in Islam as it is ordered by the Allah Almighty in the Holy Quran. In Islam, religious, social and economic activities have strong ties with each other, so economic activities (that is,

Wu and Yeh

1765

Table 2. Definition of terms.

Term Shariah Quran Sunnah Zakat Riba

Definition The Path, term of Islamic law consists of Islamic instructions based on the Holy Quran and Sunnah). The holy book of Muslims, delivered by Allah Almighty on His last prophet Muhammad (peace be upon him). The example of the Prophet Muhammad as contained in his hadiths, or sayings, including his actions and silent approval of actions done in his presence. Compulsory annual payment/contribution by Muslims according to Islamic principles. Interest, usury or any additional benefit than principal amount.

earning and spending pattern of any individual) should be in line with the Islamic principles. Banks are actively engaged in different economic activities by developing a liaison among various stakeholders for financial and productive ventures. Banking activities must be interestfree and purely according to principles of Shariah for the welfare of the all segments of the society. The Holy Quran has clear instructions regarding business and trading activities as earnings from trade (Bai) is halal but interest (Riba) based activities are Haraam. Banking activities are the part of economic activities and Islam allows Riba-free banking only. PROHIBITION OF INTEREST IN THE HOLY QURAN Riba is prohibited step by step by Allah Almighty by conveying its pros and cons in the Sura-e-Rome (30:39) and finally declared Haraam in the Sura-e-Al-Bakara (2:275). The following verses of the Holy Quran clearly reflect the instructions regarding Riba. That which ye given in Riba in order that it may increase on (other) people's property hath no increase with Allah; but that which ye give in charity; seeking Allah's countenance, hath increase manifold (30:39). This is the first stage, to convey the pros and cons of Riba. In this verse, Allah Almighty disclosed the pros and cons of Riba and ordered to spread charity. People only consider extrinsic characteristics of Riba to increase their capital manifold and ignores the intrinsic fatal outcome of Riba. It is strongly recommended that Muslims must frequently distribute charity, Zakat and donations among deserving people for sake of increase in your income and success in this life and in the life hereafter. That they took Riba, though they were forbidden; and that they devoured men's substance wrongfully. We have prepared for those among them who reject faith, a grievous punishment (4:161). This holy verse shows the historical perspectives of Riba.

There is always a segment of people even in the previous nations of the world, who practices Riba-based activities and eat the property of others in an unlawful and unethical manner. These people are warned for exemplary trial and bad consequences of their deeds. O ye who believe! Devour not Riba, doubled and multiplied; but fear Allah; that ye may (really) prosper. Fear the fire, which is prepared for those who reject faith. And obey Allah and the Messenger; that ye may obtain mercy (3:130-2). This holy verse makes a strong foundation for the prohibition of Riba by declaring it as unwanted activity. The people are ordered to stop eating the earnings from Riba and follow the instructions of Allah Almighty. It rejects manifold increase in the Riba and warns the people. It also inspires the human being to be obedient to Allah Almighty for ultimate success. Those who devour Riba will not stand except as stands one whom the evil one by his touch hath driven to madness. That is because they say: Trade is like Riba'. But Allah hath permitted trade and forbidden Riba. Those who after receiving direction from their Lord, desist, shall be pardoned for the past; their case is for Allah (to judge). But those who repeat (the offence) are companions of the fire; they will abide therein (forever) (2:275). These verses show the final prohibition of Riba by the Creator of this universe. The persons who eat Riba are like those that are touched by Satan and became unsound in mind. They foolishly argue that trade is like Riba. But trade is declared Halaal and Riba is haram by Allah Almighty. Allah will deprive Riba of all blessing, but will give increase for deeds of charity; for He loved not creatures ungrateful and wicked (2:276). Allah Almighty does not bestow blessings upon Ribabased activities and orders to stop them, as He dislikes the violent. But there are uncountable blessings attached

1766

Afr. J. Bus. Manage.

with the deeds of charity and sadaqaat. O ye who believe! Fear Allah and give up what remains of your demand for Riba, if ye are indeed believers (2:278). If you do it not, take notice of war from Allah and His Messenger. But if ye turn back, ye shall have your capital sums. Deal not unjustly, and ye shall not be dealt with unjustly (2:279). These verses are related to desired post prohibition behavior of believers. Believers of Allah Almighty are required to waive the interest due to them by borrowers and recover only principal amount. If the debtor is in a difficulty, grant him time till it is easy for him to repay. But if ye remit it by way of charity, that is best for you, if ye only knew (2:280). And fear the Day when ye shall be brought back to Allah. Then shall every soul be paid what it earned, and none shall be dealt with unjustly (2:281). Finally, these verses are the best examples to promote a sense of brotherhood and collective welfare through cooperation. This is because in these verses we can clearly see that the values of tolerance, understanding and empathy are being promoted. These verses also educate us to not to be too obsessed with the accumulation of wealth. Indeed it reminds us that our life is just a journey to the eternity and therefore what should matter most in our life is the accumulation of Allahs pleasure and not the accumulation of wealth for the sake of wealth alone.

PROHIBITION (AHADITH)

OF

INTEREST

IN

THE

SUNNAH

The Holy Prophet (Peace be upon him) gave us a complete code of life that covers all aspect of human life (that is, religious, social, and economic activities). Islam as a religion of peace, brotherhood and cooperation has its prime concern of being totally submissive to Allah. Islam ensures complete success in this life and the hereafter by following the instructions of the Holy Quran and Sunnah (practices of the holy Prophet MuhammadPeace be upon him). The holy Quran has clearly declared an interest as Haraam and people are prohibited to practice it. Similarly, the Holy Prophet Muhammad (Peace be upon him) discouraged interest based activities and strictly prohibited to practice it. Prohibition of Riba is depicted from following Ahadith. Abu Saad al Khudri (R.A) narrated that the Holy Prophet (Peace be upon him) said: Gold for gold, silver

for silver, wheat for wheat, barley for barley, dates for dates and salt for salt, like for like, payment being made hand by hand. If anyone gives more or asks for more, he has dealt in Riba. The receiver and giver are equally guilty (Muslim). This hadith specifies the six commodities to be exchanged at equal and alike. Two of them are represented as money commodity while others are staple food items. Abu Hurayrah (R.A) narrated that the Holy Prophet (Peace be upon him), said: There will certainly come a time for mankind when everyone will take Riba and if he does not do so, its dust will reach him (Abu Daud). This hadith indicates the frequency and excess of Riba in the economy. It was estimated that there will be a time when every transaction would involve the interest/Riba directly or indirectly. Jabir (R.A) narrated that the Holy Prophet (Peace be upon him), cursed the receiver and the payer of Riba, the one who records it and who witnesses to the transaction and said: They are all alike (in guilt) (Trimizi). This hadith reflects the badness of Riba and involvement of different parties in Riba based transactions. The holy prophet Muhammad (peace be upon him) cursed the four parties that is, receiver, payer, witness and the person who document it. It shows that all the parties equally participated in sin. Ans Ibn Malik (R.A) narrated that the Holy Prophet (Peace be upon him), said: When one of you grants a loan and the borrower offers him a dish, he should not accept it; and if the borrower offers a ride on an animal, he should not ride, unless the two of them have been previously accustomed to exchanging such favors mutually (Kitab al Buyua). It reflects the careful treatment of monetary transaction to control Riba in the economy. It indicates that any excessive amount or even additional benefit and facility than the principal amount could be the part of Riba. Abu Hurayrah (R.A) narrated that the Holy Prophet (Peace be upon him), said: On the night of Ascension I came upon people whose stomachs were like houses with snakes visible from the outside. I asked Gabriel (A.S.) who they were. He replied that they were people who had received Riba (Musnad Ahmed). It indicates the terrible results of Riba based activities. The holy prophet Muhammad (peace be upon him) explains the punishments for the people that were engaged in Riba oriented transactions. Abu Hurayrah (R.A) narrated that the Holy Prophet (Peace be upon him), said: Allah would be justified in not allowing four persons to enter paradise or to taste its blessings; he who drinks habitually, he who takes Riba, he who usurps an orphan's property without right, and he who is undutiful to his parents (Kitab al Buyua). Similarly, this hadith shows the punishments for the bad deeds in this world including Riba. It reveals that receipt and payment of Riba is an unwanted activity that may lead towards curse and punishment.

Wu and Yeh

1767

SUMMARY AND CONCLUDING REMARKS Inception of Islamic banking across the globe requires a study to differentiate the Islamic and conventional banking system. Human beings perform religious, social and economic activities according to their specific environment. In Islam, social and economic activities are closely tied with religious activities. Every Muslim is required to execute only those activities which are permissible (Halaal) and must refrain from prohibited (Haraam) deeds. The basic source of Islamic instructions is the Holy Quran and the Sunnah. Islam allows trade oriented activities in the society for the collective well being. On the other hand, Riba/interest oriented transacttions are strictly prohibited in Islam. This study presented a glossary regarding prohibition of Riba/interest in the light of the Holy Quran and Sunnah (Ahadith). It depicts the superiority of Islamic banking as interest free banking over the conventional banking (interest based banking) due to its long lasting benefits. Islamic banking is desirable because it promotes cooperation and mutual benefit oriented behavior among different stakeholders with assurance of welfare oriented society. This study attempts to differentiate Islamic banking from the conventional banking on the basis of interest.

REFERENCES Ahmad A, Rehman K, Saif MI (2010). Islamic Banking Experience of Pakistan: Comparison of Islamic and Conventional Banks. Int. J. Bus. Manage., 5 (2): 137-144.

Ahmad A, Rehman K., Saif MI, Safwan, MN (2010). An Empirical Investigation of Islamic Banking in Pakistan based on Perception of Service Quality. Afr. J. Bus. Manage., 4(6), 1185-1193. Chapra MU (1985). Towards A Just Monetary System, Leicester: The Islamic Foundation. Cole HL, Kocherlakota N (1998). Zero Nominal Interest Rates: Why theyre good and get them. Fed. Reserve Bank Minneapolis Q., 22: 210. Friedman M (1969). The optimum quantity of money, The Optimum Quantity of Money and Other Essays. Chicago: Aldine, pp. 1-50. Haque NU, Mirakhor A (1986). Optimal profit-sharing contracts and investment in an interest-free Islamic economy. World Bank and IMF, Washington, DC. Iqbal M, Ahmed A and Khan T (1998). Challenges facing Islamic Banking. Islamic Research Training Institute. Occasional Paper No.1, King Fahad National Library. Mirakhor, A. (1997). Progress and Challenges of Islamic Banking. Rev. Islamic Econ., 4(2): 1-11. Rehman G (1993). Prohibition of Riba-An Analysis of Different Kinds of Riba), Institute of Maarif-e Islami, Mansoora, Lahore, Pakistan. Siddiqui MN (1973). Banking Without Interest, Lahore: Islamic Publication. Uzair, M. (1976). Some Conceptual and Practical Aspects of InterestFree Banking. Studies in Islamic Economics. Pp. 37-57. Wieltzman M (1984). The Share Economy. Harvard University Press, Cambridge, M.A. Wieltzman M (1985). Profit sharing as macroeconomic policy, Am. Econ. Rev., pp.41-45. Wilson C (1979). An Infinite Horizon Model with Money. In: Jerry R.G. and Jose`, A.S., (eds.), General Equilibrium, Growth and Trade. New York: Academic Press. pp. 81-104.

Das könnte Ihnen auch gefallen

- Article1380698950 - Ahmad Et Al 2Dokument5 SeitenArticle1380698950 - Ahmad Et Al 2sam chNoch keine Bewertungen

- Islamic Banking and Prohibition of Riba/Interest: African Journal of Business Management March 2011Dokument6 SeitenIslamic Banking and Prohibition of Riba/Interest: African Journal of Business Management March 2011MusaabZakirNoch keine Bewertungen

- Islamic Banking and Prohibition of Riba/interest: African Journal of Business Management March 2011Dokument6 SeitenIslamic Banking and Prohibition of Riba/interest: African Journal of Business Management March 2011Khalil HussainiNoch keine Bewertungen

- Principles and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Dokument19 SeitenPrinciples and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Dr. Julius B. BertilloNoch keine Bewertungen

- F Per 2012 InternationalDokument5 SeitenF Per 2012 InternationalBrandy LeeNoch keine Bewertungen

- The Role of Islamic Financial Systems and Banking Institutions in Global Economic RecoveryDokument41 SeitenThe Role of Islamic Financial Systems and Banking Institutions in Global Economic Recoveryjhulz0763Noch keine Bewertungen

- Islamic Banks and Wealth CreationDokument18 SeitenIslamic Banks and Wealth CreationShariff MohamedNoch keine Bewertungen

- Islamic Banking Assignment FINAL DRAFTDokument54 SeitenIslamic Banking Assignment FINAL DRAFTZuher ShaikhNoch keine Bewertungen

- MBR 2015 06 Bilal+Ahmad+MalikDokument16 SeitenMBR 2015 06 Bilal+Ahmad+MalikMalik Gazi BilalNoch keine Bewertungen

- Itroduction BankingDokument8 SeitenItroduction BankingusmansulemanNoch keine Bewertungen

- Parallelism between Interest and Profit Rates ComparedDokument9 SeitenParallelism between Interest and Profit Rates ComparedSayed Sharif HashimiNoch keine Bewertungen

- Interet Free Islamic Banks Vs Interest Based Conventional BanksDokument15 SeitenInteret Free Islamic Banks Vs Interest Based Conventional BanksabidhasanNoch keine Bewertungen

- An Empirical SurveyDokument26 SeitenAn Empirical SurveyRafiqul IslamNoch keine Bewertungen

- 6179-Article Text-15651-1-10-20190217Dokument10 Seiten6179-Article Text-15651-1-10-20190217Habib Sultan KhelNoch keine Bewertungen

- Islamic Financing Arrangements Used in Islamic Banking: Author: Ehsan ZarrokhDokument25 SeitenIslamic Financing Arrangements Used in Islamic Banking: Author: Ehsan ZarrokhD'n Hafiz DraegonoidNoch keine Bewertungen

- Significance.104 SairDokument6 SeitenSignificance.104 SairSyed sair SheraziNoch keine Bewertungen

- Islamic Finance: An Attractive New Way of Financial IntermediationDokument24 SeitenIslamic Finance: An Attractive New Way of Financial IntermediationHanisa HanzNoch keine Bewertungen

- Name AQIB BBHM-F19-067 BBA-5ADokument5 SeitenName AQIB BBHM-F19-067 BBA-5AJabbar GondalNoch keine Bewertungen

- Factors Determining Success of Islamic Banking in PakistanDokument17 SeitenFactors Determining Success of Islamic Banking in PakistanahsanzoyaahsanNoch keine Bewertungen

- Social Reporting by Islamic BanksDokument24 SeitenSocial Reporting by Islamic BanksAyman Ahmed CheemaNoch keine Bewertungen

- Islamic Banking Ideal N RealityDokument19 SeitenIslamic Banking Ideal N RealityIbnu TaimiyyahNoch keine Bewertungen

- IntroductionDokument21 SeitenIntroductionmuhammad jaffarNoch keine Bewertungen

- THE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Dokument5 SeitenTHE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Ahmed Jan DahriNoch keine Bewertungen

- THE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Dokument5 SeitenTHE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Ahmed Jan DahriNoch keine Bewertungen

- Sustainability 10 00637 PDFDokument11 SeitenSustainability 10 00637 PDFDila Estu KinasihNoch keine Bewertungen

- Islamic Finance: and Its Ability To Adapt To Changes in The Outside WorldDokument9 SeitenIslamic Finance: and Its Ability To Adapt To Changes in The Outside WorldUsman TallatNoch keine Bewertungen

- Islam Ethicsand Social Responsability FinalDokument14 SeitenIslam Ethicsand Social Responsability Finalbharatjha1732002Noch keine Bewertungen

- Imperatives of Financial Innovation For Islamic BanksDokument10 SeitenImperatives of Financial Innovation For Islamic BanksAria RanggabumiNoch keine Bewertungen

- Financial Transactions in Islamic Banking Are Viable Alternatives To TheDokument16 SeitenFinancial Transactions in Islamic Banking Are Viable Alternatives To Themohamed saidNoch keine Bewertungen

- Islamic Finance SystemDokument4 SeitenIslamic Finance SystemShahinNoch keine Bewertungen

- Comparative Study of Islamic Banking 19Dokument26 SeitenComparative Study of Islamic Banking 19Luqman SafdarNoch keine Bewertungen

- Dusuki 2012 - The Framework of Etical and Social Responibility For Islamic FinanceDokument19 SeitenDusuki 2012 - The Framework of Etical and Social Responibility For Islamic FinanceAnisaNoch keine Bewertungen

- Islamic Economy Option: SWOT Case Study Analysis: Suzanna El MassahDokument22 SeitenIslamic Economy Option: SWOT Case Study Analysis: Suzanna El MassahAhmed AchichNoch keine Bewertungen

- Evaluating The Financial Performance of PDFDokument6 SeitenEvaluating The Financial Performance of PDFMehwish ZahoorNoch keine Bewertungen

- Islamic Banking Fosters Entrepreneurship Through Profit-SharingDokument40 SeitenIslamic Banking Fosters Entrepreneurship Through Profit-SharingNaveed AhmedNoch keine Bewertungen

- Financial Contracts, Credit Risk and Performance of Islamic BankingDokument22 SeitenFinancial Contracts, Credit Risk and Performance of Islamic BankingUmer KiyaniNoch keine Bewertungen

- Bakig PerformaceDokument15 SeitenBakig PerformaceTahir HanifNoch keine Bewertungen

- Isalmic Financial SystemDokument11 SeitenIsalmic Financial System✬ SHANZA MALIK ✬Noch keine Bewertungen

- The Islamic Economic System As A Model For The World To FollowDokument5 SeitenThe Islamic Economic System As A Model For The World To FollowZ_JahangeerNoch keine Bewertungen

- "Shari'a", and The Exact Literal Translation of "Shari'a" Is "A Clear Path To Be Followed andDokument7 Seiten"Shari'a", and The Exact Literal Translation of "Shari'a" Is "A Clear Path To Be Followed andJohn Marc ChullNoch keine Bewertungen

- 4 - Iftakhar Ahmad ArticalDokument21 Seiten4 - Iftakhar Ahmad ArticalHind AmhaouchNoch keine Bewertungen

- Maqasid Al Shariah in Islamic Finance An OverviewDokument22 SeitenMaqasid Al Shariah in Islamic Finance An Overviewmirzalkw100% (1)

- Impediments To The Growth of Islamic Banking and Financial Systems UIBMC (Full Text)Dokument16 SeitenImpediments To The Growth of Islamic Banking and Financial Systems UIBMC (Full Text)Shakeel AhmadNoch keine Bewertungen

- Chapter OneDokument8 SeitenChapter OneZainab IbrahimNoch keine Bewertungen

- RibaDokument10 SeitenRibaRamadhan FumoNoch keine Bewertungen

- School of Post Graduate Studies Nasarawa State University Keffi Faculty of Administration Department of AccountingDokument22 SeitenSchool of Post Graduate Studies Nasarawa State University Keffi Faculty of Administration Department of AccountingAbdullahiNoch keine Bewertungen

- Article On Economic Growth of Indonesia With Islamic BankingDokument24 SeitenArticle On Economic Growth of Indonesia With Islamic BankingMahnoor KamranNoch keine Bewertungen

- Interest Free Banking A Case Study in Pakistan 198Dokument12 SeitenInterest Free Banking A Case Study in Pakistan 198Fatima AnoodNoch keine Bewertungen

- The Future of Islamic Finance: A Reflection Based On Maqāćid Al-SharąăahDokument14 SeitenThe Future of Islamic Finance: A Reflection Based On Maqāćid Al-SharąăahFaizan ChNoch keine Bewertungen

- Article Muamalah Eva Yunijar HarahapDokument4 SeitenArticle Muamalah Eva Yunijar HarahapEvaa HarahapNoch keine Bewertungen

- Maqasid Al Shariah in Islamic FinanceDokument22 SeitenMaqasid Al Shariah in Islamic Financemiaser 1986Noch keine Bewertungen

- Nature, Scope and Feasibility of Islamic Banking in India: AbhinavDokument6 SeitenNature, Scope and Feasibility of Islamic Banking in India: AbhinavAnonymous 7Un6mnqJzNNoch keine Bewertungen

- Riba, Profit and Islamic Rate Aand Market EquilibriumDokument31 SeitenRiba, Profit and Islamic Rate Aand Market EquilibriumNurhidayatul AqmaNoch keine Bewertungen

- Article 4Dokument22 SeitenArticle 4Heap Ke XinNoch keine Bewertungen

- Islamic Banking Products: Regulations, Issues and ChallengesDokument12 SeitenIslamic Banking Products: Regulations, Issues and Challengesnur atyraNoch keine Bewertungen

- The Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceVon EverandThe Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceNoch keine Bewertungen

- Theoretical Studies in Islamic Banking and FinanceVon EverandTheoretical Studies in Islamic Banking and FinanceBewertung: 5 von 5 Sternen5/5 (1)

- Exports of Pakistan September: Textile & Clothing 57% Food 15% Other Sector 12% Maunfacturing 11% Minerals & Metals 5%Dokument2 SeitenExports of Pakistan September: Textile & Clothing 57% Food 15% Other Sector 12% Maunfacturing 11% Minerals & Metals 5%Alina MalikNoch keine Bewertungen

- Cambric 2014 Order SheetDokument1 SeiteCambric 2014 Order SheetAlina MalikNoch keine Bewertungen

- Currency Management and Accounts: SBP BSC (Bank) An Overview of PerformanceDokument11 SeitenCurrency Management and Accounts: SBP BSC (Bank) An Overview of PerformanceSabyasachi MohapatraNoch keine Bewertungen

- History Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resDokument7 SeitenHistory Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resAlina MalikNoch keine Bewertungen

- Mausummery Lawn - Cambric 2014 Franchisee:: Code Design ColorsDokument3 SeitenMausummery Lawn - Cambric 2014 Franchisee:: Code Design ColorsAlina MalikNoch keine Bewertungen

- History Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resDokument7 SeitenHistory Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resAlina MalikNoch keine Bewertungen

- Job Application FormDokument1 SeiteJob Application Formupstar_mughalNoch keine Bewertungen

- Mausummery Lawn - Cambric 2014 Franchis Shahzad EME: Total AmountDokument3 SeitenMausummery Lawn - Cambric 2014 Franchis Shahzad EME: Total AmountAlina MalikNoch keine Bewertungen

- Ensuring Fair Testing Through Established StandardsDokument9 SeitenEnsuring Fair Testing Through Established StandardsAlina MalikNoch keine Bewertungen

- gre/2014/special-Quadrilaterals-On-The-Gre/ Feb 4, 2014 - ... and The Facts That You Should Know. These Will Allow You To Answer Questions Quickly and Understand The Basic Nature of These Shapes.Dokument6 Seitengre/2014/special-Quadrilaterals-On-The-Gre/ Feb 4, 2014 - ... and The Facts That You Should Know. These Will Allow You To Answer Questions Quickly and Understand The Basic Nature of These Shapes.Alina MalikNoch keine Bewertungen

- First Name Surname: Dd/Mm/YyyyDokument2 SeitenFirst Name Surname: Dd/Mm/YyyyAlina MalikNoch keine Bewertungen

- Report 14pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...Dokument1 SeiteReport 14pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...Alina MalikNoch keine Bewertungen

- Banking MBA For Professionals I Sec B Quizzes Spring Semester 2013 Part IIDokument12 SeitenBanking MBA For Professionals I Sec B Quizzes Spring Semester 2013 Part IIAlina MalikNoch keine Bewertungen

- SDFDokument3 SeitenSDFAlina MalikNoch keine Bewertungen

- CRlecture AsdasdDokument13 SeitenCRlecture AsdasdAlina MalikNoch keine Bewertungen

- Hedging The Risk of Portfolio by Using Index Option ContractDokument3 SeitenHedging The Risk of Portfolio by Using Index Option ContractAlina MalikNoch keine Bewertungen

- Hedging The Risk of Portfolio by Using Index Option ContractDokument3 SeitenHedging The Risk of Portfolio by Using Index Option ContractAlina MalikNoch keine Bewertungen

- Supply Chain Management Group Names 2Dokument3 SeitenSupply Chain Management Group Names 2Alina MalikNoch keine Bewertungen

- Admission Application FormLSEDokument10 SeitenAdmission Application FormLSEAlina MalikNoch keine Bewertungen

- Market Portfolio (18 - 22 FEB) : Reasons For Having A Bullish Trend On KSE-100 Index On 22nd February 2013Dokument6 SeitenMarket Portfolio (18 - 22 FEB) : Reasons For Having A Bullish Trend On KSE-100 Index On 22nd February 2013Alina MalikNoch keine Bewertungen

- Assignment 2Dokument11 SeitenAssignment 2Alina MalikNoch keine Bewertungen

- Admission Application FormLSEDokument10 SeitenAdmission Application FormLSEAlina MalikNoch keine Bewertungen