Beruflich Dokumente

Kultur Dokumente

Technical Report 3rd April 2012

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Technical Report 3rd April 2012

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Technical Research | April 03, 2012

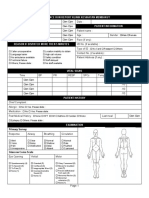

Daily Technical Report Sensex (17478) / NIFTY (5318)

Yesterday, indices opened marginally higher and but traded with thin volumes throughout the trading session to close marginally above the 5300 mark. On sectoral front, Consumer Durables, Power and Capital Goods counters were among the major gainers, whereas Oil & Gas and Metal ended with a nominal loss. The advance to decline ratio was strongly in favor of advancing counters (A=1932 D=849) (Source www.bseindia.com)

Exhibit 1: Nifty Daily Chart

Formation:

The 200-day SMA (Simple Moving Average) and 20day EMA (Exponential Moving Average) have now shifted to 17100 / 5150 and 17380 / 5284, respectively. The 20-Week EMA is placed at 17200 / 5200 level. We are witnessing a Downward Sloping Trend Line

resistance around 17630 / 5365 level. The daily RSI-Smoothened momentum oscillator has

Source: Falcon

given a positive crossover.

Trading strategy:

As expected, the week began on a positive note and indices managed to hold on to their initial opening gains. This has resulted in a daily closing well above the 20 day EMA, which shows optimism amongst market participants. We are also now observing a positive crossover in RSISmoothened oscillator. Considering the global cues, it is likely that our markets will open on a positive note. Thus if Indices sustain above yesterdays high of 17530 / 5332 they are likely to rally further towards 17630 17700 / 5365 5400 levels. On the downside, 17382 17250 / 5278 5250 levels should ideally provide decent support for the markets in coming trading session.

Actionable points:

View Expected Targets Support Levels Bullish Above 5332 5365 5400 5278 5250

For Private Circulation Only |

Technical Research | April 03, 2012

Bank Nifty Outlook - (10305)

Yesterday, Bank Nifty opened on a flat note and traded in a narrow range to close near the highest point of the day. The positive crossover in RSI and Stochastic momentum oscillator on the daily chart mentioned in our previous report is still intact. Thus we expect the positive momentum to continue in the coming session and index is likely to test 10425 - 10580 levels. On the downside only a move below 10210 will signal a fall in positive momentum. In this case the Bank Nifty is then likely to drift towards 10130 10080 levels. Exhibit 2: Bank Nifty Daily Chart

Actionable points:

View Expected Targets Support Levels Bullish Above 10322 10425 10580 10210 10130 10080

Source: Falcon

For Private Circulation Only |

Technical Research | April 03, 2012

Positive Bias:

Positive Above 201 103 Expected Target 210 111

Stock Name Educomp Vip Inds

CMP 199.5 102.5

5 Day EMA 195 100

20 Day EMA 198 102

Remarks View will change below 192.5 View will change below 98

For Private Circulation Only |

Technical Research | April 03, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 17,316 5,257 10,129 1,313 166 1,112 1,603 335 251 671 325 302 332 196 1,707 368 467 668 511 2,016 124 401 876 133 2,812 224 532 80 540 1,282 692 1,313 161 262 911 107 444 83 732 575 116 94 2,084 189 257 108 555 25 273 98 462 1,159 433 S1 17,397 5,287 10,217 1,327 169 1,133 1,629 338 256 679 333 305 336 202 1,723 373 484 676 520 2,037 126 404 883 134 2,831 226 537 82 548 1,307 701 1,326 164 266 920 108 451 84 736 594 119 95 2,107 191 515 109 564 25 275 99 467 1,177 438 PIVOT 17,464 5,309 10,269 1,349 171 1,147 1,662 340 259 689 338 308 340 206 1,748 377 495 680 525 2,055 128 406 888 135 2,860 227 546 84 554 1,322 708 1,345 166 269 931 109 461 85 743 606 121 96 2,123 193 257 110 571 26 278 101 472 1,188 441 R1 17,545 5,340 10,358 1,364 174 1,169 1,689 343 264 697 346 311 345 212 1,764 381 512 688 534 2,076 130 408 895 136 2,879 228 551 86 562 1,347 717 1,358 169 273 940 109 469 86 748 625 124 97 2,146 195 515 111 580 26 279 102 477 1,206 446 R2 17,611 5,362 10,410 1,386 176 1,183 1,722 345 267 707 351 314 348 216 1,790 386 522 692 539 2,093 132 411 900 138 2,908 230 560 88 568 1,362 723 1,377 171 276 951 110 478 87 755 636 126 98 2,162 198 257 113 587 27 282 103 482 1,217 449

Technical Research Team

For Private Circulation Only |

Technical Research | April 03, 2012 Technical Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com Research Team: 022-3952 6600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past.

Sebi Registration No: INB 010996539

For Private Circulation Only |

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Tribal Banditry in Ottoman Ayntab (1690-1730)Dokument191 SeitenTribal Banditry in Ottoman Ayntab (1690-1730)Mahir DemirNoch keine Bewertungen

- 13 Adsorption of Congo Red A Basic Dye by ZnFe-CO3Dokument10 Seiten13 Adsorption of Congo Red A Basic Dye by ZnFe-CO3Jorellie PetalverNoch keine Bewertungen

- Oracle - Prep4sure.1z0 068.v2016!07!12.by - Lana.60qDokument49 SeitenOracle - Prep4sure.1z0 068.v2016!07!12.by - Lana.60qLuis AlfredoNoch keine Bewertungen

- LTE Networks Engineering Track Syllabus Overview - 23 - 24Dokument4 SeitenLTE Networks Engineering Track Syllabus Overview - 23 - 24Mohamed SamiNoch keine Bewertungen

- Linguistics Is Descriptive, Not Prescriptive.: Prescriptive Grammar. Prescriptive Rules Tell You HowDokument2 SeitenLinguistics Is Descriptive, Not Prescriptive.: Prescriptive Grammar. Prescriptive Rules Tell You HowMonette Rivera Villanueva100% (1)

- Salads: 300 Salad Recipes For Rapid Weight Loss & Clean Eating (PDFDrive) PDFDokument1.092 SeitenSalads: 300 Salad Recipes For Rapid Weight Loss & Clean Eating (PDFDrive) PDFDebora PanzarellaNoch keine Bewertungen

- II 2022 06 Baena-Rojas CanoDokument11 SeitenII 2022 06 Baena-Rojas CanoSebastian GaonaNoch keine Bewertungen

- Opc PPT FinalDokument22 SeitenOpc PPT FinalnischalaNoch keine Bewertungen

- NDY 9332v3Dokument8 SeitenNDY 9332v3sulphurdioxideNoch keine Bewertungen

- Homework 1 W13 SolutionDokument5 SeitenHomework 1 W13 SolutionSuzuhara EmiriNoch keine Bewertungen

- Chapter3 Elasticity and ForecastingDokument25 SeitenChapter3 Elasticity and ForecastingGee JoeNoch keine Bewertungen

- Countries EXCESS DEATHS All Ages - 15nov2021Dokument21 SeitenCountries EXCESS DEATHS All Ages - 15nov2021robaksNoch keine Bewertungen

- Roleplayer: The Accused Enchanted ItemsDokument68 SeitenRoleplayer: The Accused Enchanted ItemsBarbie Turic100% (1)

- PR KehumasanDokument14 SeitenPR KehumasanImamNoch keine Bewertungen

- Week 7 Sex Limited InfluencedDokument19 SeitenWeek 7 Sex Limited InfluencedLorelyn VillamorNoch keine Bewertungen

- Task 3 - LPDokument21 SeitenTask 3 - LPTan S YeeNoch keine Bewertungen

- DC 7 BrochureDokument4 SeitenDC 7 Brochures_a_r_r_yNoch keine Bewertungen

- Proceeding of Rasce 2015Dokument245 SeitenProceeding of Rasce 2015Alex ChristopherNoch keine Bewertungen

- Ozone Therapy - A Clinical Review A. M. Elvis and J. S. EktaDokument5 SeitenOzone Therapy - A Clinical Review A. M. Elvis and J. S. Ektatahuti696Noch keine Bewertungen

- 1.technical Specifications (Piling)Dokument15 Seiten1.technical Specifications (Piling)Kunal Panchal100% (2)

- Appendix - Pcmc2Dokument8 SeitenAppendix - Pcmc2Siva PNoch keine Bewertungen

- V737 OverheadDokument50 SeitenV737 OverheadnewahNoch keine Bewertungen

- Application Activity Based Costing (Abc) System As An Alternative For Improving Accuracy of Production CostDokument19 SeitenApplication Activity Based Costing (Abc) System As An Alternative For Improving Accuracy of Production CostM Agus SudrajatNoch keine Bewertungen

- Borang Ambulans CallDokument2 SeitenBorang Ambulans Callleo89azman100% (1)

- 7400 IC SeriesDokument16 Seiten7400 IC SeriesRaj ZalariaNoch keine Bewertungen

- Spesifikasi PM710Dokument73 SeitenSpesifikasi PM710Phan'iphan'Noch keine Bewertungen

- 18 June 2020 12:03: New Section 1 Page 1Dokument4 Seiten18 June 2020 12:03: New Section 1 Page 1KarthikNayakaNoch keine Bewertungen

- Post Appraisal InterviewDokument3 SeitenPost Appraisal InterviewNidhi D100% (1)

- School of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1Dokument2 SeitenSchool of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1STEM Education Vung TauNoch keine Bewertungen

- Kahneman & Tversky Origin of Behavioural EconomicsDokument25 SeitenKahneman & Tversky Origin of Behavioural EconomicsIan Hughes100% (1)