Beruflich Dokumente

Kultur Dokumente

Ejefas 23 08

Hochgeladen von

sumi1213Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ejefas 23 08

Hochgeladen von

sumi1213Copyright:

Verfügbare Formate

European Journal of Economics, Finance and Administrative Sciences ISSN 1450-2275 Issue 23 (2010) EuroJournals, Inc. 2010 http://www.eurojournals.

com

Factors Affecting Credit Card Uses: Evidence from Turkey Using Tobit Model

Halil Tunal Department of Economics, Faculty of Economics, stanbul University, Beyazt, stanbul, Turkey E-mail: htunali@istanbul.edu.tr , gmhtunali@gmail.com Tel: +530 592 95 68; Fax: +212 668 91 50 Ferda Yerdelen Tatolu Department of Econometrics, Faculty of Economics, stanbul University, Beyazt, stanbul, Turkey E-mail: yerdelen@istanbul.edu.tr Tel: +212 4400000 11652; Fax: +212 668 91 50 Abstract Credit cards, also called plastic money, have increasingly become an indispensable element for both consumers and sellers in last 20 years. Their usage has gone up dramatically all over the world and was not limited only to middle and upper income consumers. Credit cards issuers, especially banks, have entered into fierce competition with each others to be powerful in the credit card market that is rapidly improving. Selling more credit cards necessitates knowing strictly the main factors affecting credit card uses. In this paper we examine the factors affecting credit card uses of households in Turkey. For this purpose, 1300 surveys are conducted in the city of stanbul that can be accepted as a small sample of Turkey and questions are directed to household heads. The data obtained from the survey are analyzed with Tobit model to determine factors affecting credit card uses. The results show that credit card uses of households in Turkey are affected by social and personal as well as by economic factors. Our contribution is that we also use some independent variables not used until now in any other work and measure their effects on credit card uses. Keywords: Credit cards, survey data, households, Tobit model, Turkey.

1. Introduction

Credit cards, also called plastic money, increasingly replace money and become one of the indispensable elements of modern economies. Today, while technology improves with a high speed, especially banking sector stands out with its financial innovations like credit cards (Evans and Schmalensee, 1999). Although credit cards are used both for transaction and borrowing purposes, their usages also become widespread for many other reasons. For example using credit cards eliminates to carry cash with you, you can buy even if you have not money, you buy now but pay later, they enable you to buy on installments, you can also use credit cards in your business dealings and so on. Credit cards are internationally accepted instruments, so you can also use your credit cards abroad. Credit cards provide different benefits not only for consumers but also for sellers and for cards issuing firms especially for banks; for this reason they support their uses. Credit cards in banking sector were first issued in the USA in 1914 by Western Union and their uses spread in the 1950s. While credit card uses

88

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

provide banks with respect, risk equalizing, regular cash inflow, they also allow consumers to satisfy their needs without waiting, spread payments over time, buy on installments etc. Such benefits can change consumer habits and increase spending (Durkin, 2000). Moreover, for most households, credit cards in particular bankcards (i.e., Visa, Mastercard, Discover, and Optima cards), represent the leading source of credit (Chen and Tseng, 2005). Credit conditions are as effective on consumption as disposable income (Canner and Fergus, 1987; Bacchetta ve Gerlach, 1997; Berlin and Mester, 2004). Credit cards can replace cash or be a source of credit (Humphrey, 2004; Humphrey et al, 2006). Access to liquid credit, such as credit cards, can also ease the transition to self-employment (Blanchfiower and Oswald, 1998; Dunn and Holtz-Eakin, 2000). Many average consumers who use credit cards are actually business entrepreneurs who use the cards to finance small business (Lindh and Ohlsson, 1998). However households prefer more to use credit cards in shopping than in cash drawing (Calem and Mester, 1995). But reaching source of credit so easy can lead people to consume more and thus to borrow excessively (Rltzer, 2001). In a competitive market, banks transforme consumers to interest paying consumers by giving them divers incentives (Chakrvorti and Emmons, 2003; Akn et al., 2008a) and earn above-normal profits on credit cards because consumers pay higher interest rates on their outstanding credit cards debts than on other credit debts (Ausubel, 1991; Berlin and Mester, 2004). But there are also works (Nash and Sinkey, 1997) suggesting that credit card banks dont make extraordinary profits given the risks. In the literature this topic gave rise to discussions about whether or not credit card consumers act rationally. On the other hand there are some works arguing against the idea that credit card consumers act irrationally (Calem and Mester, 1995; Cargill and Wendel, 1996). Even tough borrowing on credit cards at high interest rates seems irrational, low transactions costs make credit cards attractive relative to bank loans (Brito and Hartley, 1995). Credit card users benefit from the liquidity services provided by credit cards and avoid some of the opportunity cost of holding money (Sinkey and Nash, 1993; Duca and Whitesell, 1995). Credit card uses decrease cash need and enable credit card users to use cash in short term investments. Moreover as credit cards provide liquidity in emergency, they also decrease precautionary money demand (Marcus, 1960; White, 1976). Thus credit card uses have also important effects on aggregate money demand (Akhand and Milbourne, 1986; Duca and Whitesell, 1995). On the other hand banks bear high costs for writing off bad cash-card debts which means high risk for banks (Paisittanand and Olson, 2006). Although Ausubel (1991) argues that credit cards interest rates depend on the cost of funds, there are other works suggesting that the effects of cost of funds on the credit card interest rates are not significant and credit card interest rates are determined by customer choices, competitive conditions, legal arrangements and loopholes (Pavel and Binkley, 1987; Mester, 1994; Aysan and Muslim, 2006; Akn et al, 2008b). But according to some works consumer switching costs are very effective on credit cards pricing (Canner and Luckett, 1992; Stango, 2002). In any case credit cards changed and made it easier for users to get credit (Japelli, 1990; Kennickell and Starr-McCluer, 1994; Gross, and Souleles, 1999, 2002). This also gave rise to increase in households spending and debts (Yoo, 1997, 1998; Schor, 1998). The significant portion of dept for many individuals seeking protection under the bankruptcy code in recent years is credit card debts (Moss, 1999). Many regulations have been enacted in credit cards markets to solve increasing credit card debt problems (Aysan and Yldz, 2007). Banks distribute too many credit cards to consumers without care for whether the consumer in question should have one or not. They give credit cards to consumers without adequate income mainly because they try to create volume. On the other hand, there are some consumers seeing credit cards as a lifestyle choice rather than a method of payment. These people generally hold more than one credit card. There are of course other reasons for holding more than one credit card even if they are not actively used (Kennickell, 1998; Lindley et al, 1989). One of the main reasons for holding credit cards not used is prestige and social status. On the other hand, active credit card users hold and use credit cards because they provide security, comfort, financial source etc. for the users (Chang and Hanna, 1992).

89

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

As a result, credit card usage has gone up dramatically in recent years for many reasons. There are a wide range of factors affecting credit card uses including economic, financial, personal and social ones (Cox and Jappelli, 1993; Chen and Devaney, 2001; Castranova and Hagstrom, 2004). In this research we are going to investigate factors affecting credit card uses of households in Turkey using Tobit model. There are works that investigated credit card uses in Turkey and some of them used public surveys in their research. Barker and Sekerkaya (1992) investigate globalization of credit card usage in Turkey and report that the middle age group is the most likely to hold and use credit cards. Kaynak and Harcar (2001) investigate consumer attitudes and intentions towards credit card ownership in Turkey and find that the age group between 36 and 45 is more likely to own credit cards than any other group. Torlak (2002) examines the impact of credit card uses on spending habits in the city of Eskiehir and find that credit cards are used mainly because they enable users to postpone their payments, access to credit and avoid carrying cash with them. Karamustafa and Bikes (2003) who statistically analyze data obtained from a survey conducted in the city of Nevehir find that easing shopping and providing financial sources are the main reasons for owning and using credit cards. They also find that using credit cards dont give rise to radical changes in consumption habits of credit card users but allow them to satisfy their deferred needs without waiting. There are also significant differences between all of dependent variables save for monthly income, marital status and gender in credit card uses. Durukan et al. (2005) investigate the impact of credit card installments on consumer spending habits in the city of Krkkale and find that credit card installment is the main factor for using credit cards, consumers are not sufficiently conscious, and have credit card debts equal to their average monthly expenses. Kurtulu and Nasr (2006) examine consumer behaviors of credit card users in an emerging market: Turkey. Structured questionnaire is used as a means of data collection and respondents answer the questionnaire directly. During the three-week exhibition of the questionnaire on the Internet, a total of 948 useable questionnaires are collected and used. The results of the study indicate that a significant portion of the Turkish cardholders use credit cards in clothing and shoe stores (89.3%), department stores (87%), petrol stations (85.6%) and supermarkets (81.8%). avus work (2006) concludes that credit cards in Turkey are mainly used by middle income family groups and in shopping, credit card uses increase as payment terms increase. Balance of account date and high limits are the main factors in credit card choices and 63 percent of credit card users are males. The survey study carried out by Ankara Chamber of Commerce (ATO, 2006) finds out information about the credit cards such as the number of credit card a card holder has, implemented interest rates, amount of credit card debt consumers have, expenses done with credit card and the problems caused by credit card uses. Uzgren et al. (2007) argue that the transaction volume of credit cards in Turkey is determined 99% by credit cards number, GDP per capita, inflation, POS and financial crises. Their investigation includes 19942004 period and multi-regression model is used. Tuay and Bagls work (2007) aims to determine the effects of credit cards on the expenses of card holders in the city of Burdur using a public survey. According to their work each family has 4 credit cards on the average, 82 percent of participants use credit cards in their expenditures, 44 percent think that credit cards provoke them to spend more than they need and credit cards expenses increase as family income increases. Altan and Gktrk (2007) analyze the impact of consumer expenditures by credit cards on aggregate private expenditure using multiple regression method. Disposable income, interest rates and inflation are independent variables and consumer expenditure by credit cards is dependent variable. They find that credit cards and disposable income are the first two factors affecting consumer expenditures respectively, on the other hand inflation and interest rates dont have any significant effect on consumer expenditures. Aan (2007) analyzes socio-economic features of credit card users with cluster method. Girginer et al. (2008) investigates credit card uses of University students using ANOVA Analysis and finds that 79 percent of them use credit cards. Clothing is in the front rank, health and entertainment are at the bottom of the list in credit cards spending.

90

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

Erdem (2008) investigates the factors that have impact on the intention of credit card use and probability of default by using data obtained from a survey study conducted in the city of Tokat. The structural equation models are used to meet the objectives. According to the findings, the factors that affect probability of credit card user default are total credit card debt to income ratio and the proportional payment of expenses with credit cards. The number of children, level of education, subjective norm, perceived behavioral control and attitude toward the behavior are found to be effective in the formation of the behavioral intention. Altan and Gktrk (2008) investigate relationships between socio-economic features and habits of credit card uses of civil servants in Turkey using data obtained from a public survey. Cengiz (2009) investigates the factors affecting the probability of changing existing credit cards of users in the cities of Trabzon, Ordu and Giresun with binary logistic regression analysis. Oktay et al. (2009) investigate factors that have impact on credit card ownership in the city of Erzurum with Logit model. They argue that job, average household income per month, payment method at shopping, usefulness of credit card and increasing the shopping tendency are statistically significant on credit card ownership.

2. Methodology

In econometric analysis, sometimes truncation occurs when some observations on both the dependent variable and regressors are lost. In effect, truncation occurs when the sample data is drawn from a subset of a larger population. James Tobin (1958) proposed the Tobit Model, if censoring occurs when data on the dependent variable is lost (or limited) but not data on the regressors. The dependent * variable is a latent (i.e. unobservable) variable yi . When a distribution is censored on the left, the observable variable yi is defined to be equal to otherwise. * * yi if yi > 0 yi = * 0 if yi 0

yi* = X i + ui

*

yi*

whenever the latent variable is above zero and zero

Here yi is a latent variable which linearly depends on Xi a vector of regressors, possibly including 1 for the intercept, which determines the relationship between the independent variable (or * vector) x and the latent variable yi (just as in a linear model). In addition, there is a normally

i

distributed error term ui to capture random influences on this relationship. yi* = X i + ui Sometimes a variation of the Tobit model is censoring at a value yL different from zero: yi* if yi* > yL yi = * yL if yi yL Tobit models can be estimated with maximum likelihood estimation, a general method for obtaining parameter estimates and performing statistical inference on the estimates. In this paper we examine the factors affecting credit cards uses of households living in the city of stanbul that can be accepted as a small sample of Turkey with Tobit model. For this purpose, 1300 surveys are conducted in stanbul and questions are directed to household heads. In our sample some household heads dont use any credit card. If the people dont use credit card, yi is defined to be equal * to zero, if the people use credit card, y is defined to be equal to yi which is the number of credit cards.

i

Independent variables in the survey can be classified in to four different categories: Personal Questions: Profession, gender, age, marital status, educational years, household size (number of persons in household), social security and habit of game of chance.

91

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

Income Questions: Total monthly income, annual income, frequency of getting income, frequency of drawing income from bank account and investment choices if monthly income increases by two times or more. Credit Card and Expenditure Questions: the main purpose of credit card use, whether using credit card increases expenditure, the rate of credit card expenditure in household total expenditure and the main factor affecting consumption decision. Questions about Saving and Investment: Whether using credit cards allow you to invest the unused portion of your monthly income for the time being in interest bearing financial instruments or earning assets, saving rate in household income and investment choices. After summarizing independent variable, descriptive statistics and results from Tobit model are analyzed.

3. Empirical Results

Descriptive statistics about each variable are exposed below. They are shown in Table 1. When we look at descriptive statistics about the dependent variable (the number of credit cards used), we see that the 30.2 percent of participants dont use credit cards. 28 percent of participants use one, 21.6 percent of participants use two, 10.1 percent of participants use three credit cards. While the number of credit cards used increases, the percent decreases. Fourteen percent of the participants are specialists, 13 percent are tradesmen, 12.7 percent are workers and the rest are in the other category. 26.8 percent of participants are 25-34 years old, 53.4 percent of participants are male, 62.5 percent are married, 52.2 percent are covered by Social Security Institution, near 50 percent play games of chance. The majority of participants (some 66.8 percent) have monthly income and 54.6 percent of participants have a monthly income of TL 1000-TL 5000; 44.8 percent of them draw their salary from their bank account in one go. The major investment choice if monthly income increases by two times or more is demand deposit (27.9 percent). For the 23.4 percent of participants, the most important reason for using credit card is the opportunity to pay by installments; for the 50 percent of participants, using credit card did not increase their expenditures; for the 46.5 percent, the most important factor determining their consumption decision is their needs. 61.6 percent of participants who use credit cards dont invest the unused portion of their monthly income for the time being in interest bearing financial instruments or earning assets. The majority of participants (33.3 percent) choose to invest in demand deposit. For there are many variables and the possibility of autocorrelation, independent variables are classified according to categories in cited questions groups in the methodology section, and 4 different models are created. These 4 models are estimated using Tobit model and estimation results are shown in Table 1. Variables affecting the number of credit cards used are shown in the first column of Table 1. A. Model 1: The Effect of Personal Factors on the Number of Credit Cards Used The LR statistic of the first model is significant and its Pseudo R2 is about 0.09. Personal factors as independent variables explain about 9 percent of the variation in the number of credit cards used. The personal factor variables that have significant effects on dependent variables are exposed below. Being tradesman and employer have a positive effect on the number of credit cards used. This result is consistent with the work of Lindh and Ohlsson (1998) mentioned above that many average consumers who use credit cards are actually business entrepreneurs who use the cards to finance small business. Being civil servant, retired and others have a negative effect on the number of credit cards used. These people generally have limited income. The retired are in the age group of 55 and more and they are not tech-savvy. For they are not familiar with new technologies they generally stay away from new technological products like credit cards.

92

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

Being aged 35-44 years and 45-54 years has a positive effect on the number of credit cards used. Being aged 55 and older has a negative effect on the number of credit cards used. These results are also consistent with the results above. Educational years have a positive effect on the number of credit cards used. High educated people are more interested in new technologies than low educated people. Their incomes are also higher than low educated people. Household size has a negative effect on the number of credit cards used. According to cross tabulation high income households (TL 5000 and more) include few persons. Having no social security affects negatively the number of credit cards used. These are low income people. Playing games of chance very scarcely, sometimes and very frequently have a positive effect on the number of credit cards used. B. Model 2: The Effect of Income on the Number of Credit Cards Used The LR statistic of the model is significant and its Pseudo R2 is about 0.07. Income variables as explanatory variables explain about 7 percent of the variation of the number of credit cards used. Having a monthly income of TL 0- TL 500 and TL 500- TL 1000 have a negative effect on the number of credit cards used. Having a monthly income of TL 5000- TL 10000 affects positively the number of credit cards used. Low income households are very careful in their spendings, they generally dont use credit cards because credit cards increase spending. The increase in total annual income affects positively the number of credit cards used. This result is consistent with the results above. Getting daily income (per diem) affects positively the number of credit cards used. According to cross tabulation these are tradesmen, they use credit cards in their business dealings. Investing in gold if monthly income increases by two times or more, affects negatively the number of credit cards used. Those investing in gold in Turkey are generally traditional Turkish women. They prefer gold because they have little savings and want to invest them in a safe instrument. Traditional people are also not willing to use new technological products like credit cards. On the other hand, investing in real estate and increasing consumption expenditure if monthly income increases by two times or more affect positively the number of credit cards used. Real estate investment requires high income and there is a positive relationship between high income and credit card uses. Increasing consumption expenditure naturally has a positive relationship with credit card uses. C. Model 3: The Effects of Credit Cards and Expenditures on the Number of Credit Cards Used. The LR statistic of the model is significant and its Pseudo R2 is about 0.05. Credit cards and expenditures which are explanatory variables explain approximately 5 percent of the variation in the number of credit cards used. The increase in the number of those saying that The main reason for me to use credit cards is that they eliminate to carry cash on me, the increase in the number of those saying that I buy now but pay later, the increase in the number of those saying that I use credit cards in my business dealings and holding credit cards as a status symbol or for security benefits affects positively the number of credit cards used. Other factors have a negative effect on the number of credit cards used. The increase in the number of those saying that Using credit cards increased my spending affects positively the number of credit cards used. The increase in the rate of payments by credit card in total payments affects positively the number of credit cards used. The increase in the number of those saying that The main factor determining my consumption decision are the proportionate share of prices of goods in my lifetime income, interest rate and my habits affects positively the number of credit cards used.

93

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

People determining their consumption decision according to their lifetime income use credit cards because credit cards allow them to satisfy their needs without waiting and they think that they can pay their credit card debts in the future with their future income. On the other hand, people for whom the main factor determining their consumption decision are their habits cant limit their consumption regarding their income, so credit cards allow them to consume with borrowing. D. Model 4: The Effect of Investments on the Number of Credit Cards Used. The LR statistic of the model is significant and its Pseudo R2 is about 0.03. The questions about investments explain approximately 3 percent of the variation in the number of credit cards used. The increase in the number of those saying that using credit cards allow me to invest the unused portion of my monthly income for the time being in interest bearing financial instruments or earning assets affects positively the number of credit cards used. This result shows that there is a relationship between credit card uses and money demand for short term. Credit cards allow these people to use cash in short term investments. The increase in the saving rate in household income affects positively the number of credit cards used. The Marginal propensity to save tends to increase at higher income levels. As mentioned above, the increase in total annual income affects positively the number of credit cards used. There is a big effect of investment choices on the number of credit cards used. Investing in gold has a negative effect on the number of credit cards used. Investing in Treasury bill and Government bond, real estate and stock exchange affect positively the number of credit cards used. As mentioned above, those investing in gold in Turkey are generally traditional Turkish women. They prefer gold because they have little savings and want to invest them in a safe instrument. Traditional people are not willing either to use new technological products like credit cards. On the other hand, those investing in Treasury bill, Government bond and stock exchange are generally modern people who are also willing to use modern technological products like credit cards. Investing in real estate requires high income and there is also a positive relationship between high income and credit card uses.

4. Summary and Concluding Remarks

In this paper, factors affecting credit cards uses are examined with Tobit (censored regression) model in the city of stanbul that can be accepted as a small sample of Turkey. According to results, being tradesman and being aged 35-44 years and 45-54 years affect positively the number of credit cards used. Barner and Sekerkaya (1992) and Kaynak and Harcar (2001) also find the same result. There is also a positive relationship between educational years, playing games of chance and the number of credit cards used. Household size and being civil servant, retired and other have a negative effect on the number of credit cards used. In Oktay et al. (2009)s paper also, job affects credit cards ownership. The high relationship between having no social security and the number of credit cards used draw attention. One of the important results is that there is a positive relationship between having a low monthly income and the number of credit cards used. Increase in total annual income and getting daily income also affect positively the number of credit cards used. Tuay and Bagl also find that credit cards expenses increase as family income increases. According to results of Oktay et al. (2009)s paper, average household income per month affect credit cards ownership. The increase in the number of those saying that The main reason for me to use credit card is that it eliminate to carry cash on me, the increase in the number of those saying that I buy now but pay later, the increase in the number of those saying that I use credit cards in my business dealings and holding credit cards as a status symbol or for security benefits affects positively the number of credit cards used. Torlak (2002) also finds that credit cards are used mainly because they enable users to postpone their payments, access to credit and avoid carrying cash with them. Karamustafa and Bikes (2003) find that easing shopping and providing financial sources are the main reasons for owning and using credit cards. The increase in the number of those saying that Using credit cards increased my spending affects positively the

94

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

number of credit cards used, but the coefficient is 0.20. Similarly, Karamustafa and Bikes (2003) find that the relationship between using credit cards and the consumption habits are weak. The increase in the rate of payments by credit card in total payments affects positively the number of credit cards used. The increase in the number of those saying that The main factor determining my consumption decision is the proportionate share of prices of goods in my lifetime income and my habits affects positively the number of credit cards used. The choice of investing in gold if the monthly income increases by two times or more has a negative effect on the number of credit cards used. The choice of investing in real estate and increasing consumption expenditure, if the monthly income increases by two times or more affect positively the number of credit cards used. The increase in the number of those saying that using credit cards allow me to invest the unused portion of my monthly income for the time being in interest bearing financial instruments or earning assets affects positively the number of credit cards used. An increase in the savings rates in household income affects positively the number of credit cards used. Moreover, investing in gold has a negative effect on the number of credit cards used. Investing in Treasury bill and Government bond, real estate and stock exchange affect positively the number of credit cards used. When we look at the results summed up above we see that they show similarities with other works results. Our contribution is that we also use some independent variables not used until now in any other work and measure their effects on credit card uses.

References

1] 2] 3] 4] 5] 6] 7] 8] 9] 10] 11] 12] 13] Akhand, H. A. and R. Milbourne, 1986. "Credit Cards and Aggregate Money Demand" Journal of Macroeconomics 8, Fall, pp.471-478. Akn, G. G., A.F. Aysan, G.I. Kara and L. Yldran, 2008a. Non-price competition in credit card markets through bundling and bank level benefits, MPRA Paper, University Library of Munich, Germany. http://www.econ.boun.edu.tr/pager/go.aspx?id=83&staffid=1004 Akn, G. G., A.F. Aysan, G.I. Kara and L. Yldran, 2008b. The Failure of Price Competition in the Turkish Credit Card Market, MPRA Paper, University Library of Munich, Germany. http://www.econ.boun.edu.tr/pager/go.aspx?id=83&staffid=1004 Altan, M. and .E. Gktrk, 2007. Trkiyede Kredi Kartlarnn Toplam zel Nihai Tketim Harcamalarna Etkisi: Bir oklu Regresyon Analizi Seluk niversitesi Sosyal Bilimler Enstits Dergisi, Say: 18, pp. 25-46. Altan, M. and .E. Gktrk, 2008. Trkiyede Memurlarn Kredi Kart Kullanm Alkanlklar zerine Bir Aratrma, Seluk niversitesi, Akehir MYO. Muhasebe ve Finansman Dergisi, vol:39, pp.110-127. Aan, Z., 2007. Kredi Kart Kullanan Mterilerin Sosyo Ekonomik zelliklerinin Kmeleme Analiziyle ncelenmesi, Dumlupnar niversitesi Sosyal Bilimler Dergisi, Say 17, pp.256267. ATO, 2006. Kredi Kartna Tketici Ne Diyor (http://www.atanot.org.tr/turkce/index9.html) . Ausubel, L.W., 1991. The Failure of Competition in the Credit Card Market, American Economic Review, vol: 81, Issue:1, March, p:50-81. Aysan A.F. and N.A. Muslim, 2006. The Failure of Competition in the Credit Card Market in Turkey: The New Empirical Evidence, Discussion Paper 2006/10, Turkish Economic Association. Aysan, A. F., and L. Yildiz, 2007. The Regulation of the Credit Card Market in Turkey, The International Research Journal of Finance and Economics, Vol.2, No.11, pp. 141-154. Bacchetta P. and S. Gerlach, 1997. Consumption and Credit Constraints: International Evidence, Journal of Monetary Economics, vol: 40, Issue:2, October, pp:207-238)

95 14] 15] 16] 17] 18] 19] 20] 21] 22] 23] 24] 25] 26] 27] 28] 29] 30] 31] 32] 33] 34]

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010) Barker, T. and Sekerkaya, A., 1992. Globalizaton of Credit Card Usage: The Case of a Developing Economy. International Journal of Bank Marketing, Vol.10, No.6, pp. 27-31. Berlin, M. and L.J. Mester, 1988. "Credit Card Rates and Consumer Search," Mimeo, Federal Reserve Bank of Phila-delphia, February. Berlin M. and l.. J. Mester, 2004. Credit Card Rates and Consumer Search, Review of Financial Economics, vol:13, Issue:1-2, pp:179-198. Blanchflower, D. G. and A. J. Oswald, 1998. "What Makes an Entrepreneur?" Journal of Labor Economics, 16(1), pp.26-60. Brito, D.L. and P. R. Hartley, 1995. "Consumer Rationality and Credit Cards," Journal of Political Economy, 103(2), 400-433, Calem P.S. and L.J. Mester, 1995. "Consumer Behavior and the Stickiness of Credit-Card Interest Rate", American Economic Review, vol:85, Issue:5, December, pp:1327-1336). Canner, G.B. and J.T. Fergus, 1987. "The Economic Effects of Proposed Ceilings on Credit Card Interest Rates," Federal Reserve Bulletin, January, 73, 1-13. Canner, G.B. and C. A. Luckett, 1992. "Developments in the Pricing of Credit Card Services," Federal Reserve Bulletin, 78(9), 652-666. Cargill T.F. and J. Wendel, 1996. "Bank Credit Cards: Consumer Irrationality versus Market Forces," Journal of Consumer Affairs, 30(2), 373-89. Castranova E. and P. Hagstrom, 2004. The Demand For Credit Cards: Evidence from The Survey of Consumer Finances, Economic Inquiry, Vol. 42, No. 2, April, pp.304-318. Cengiz, E., 2009. Bireylerin Kredi Kartlarn Deitirme Tutumlar Frat niversitesi Sosyal Bilimler Dergisi, Cilt: 19, Say: 2, pp: 179-196. Chakrvorti, S. and W.R. Emmons, 2003. Who Pays for Credit Cards? , Journals of Consumers Affairs, vol:37, Issue: 2, Winter, p:208-230. Chang, Y.R. and S. Hanna, 1992. Consumer Credit Search Behavior, Journal of Consumer Studies and Home Economics, Vol.16, pp. 207-227. Chen, Y., and Devaney, S. A., 2001. The effects of credit attitude and socioeconomic factors on credit card and installment debt, Journal of Consumer Affairs, Vol. 35, pp.162-179. Chen, H-M. and C-H., Tseng, 2005. The Performance of Marketing Alliance Between the Tourism Industry and Credit Card Issuing Banks in Taiwan, Tourism Management, vol: 26, Issue:1, February, pp:15-24. Cox, D. and Jappelli, T., 1993, The Effect of Borrowing Constraints on Consumer Liabilities, Journal of Money, Credit and Banking, Vol.25, pp. 197- 213. avu, M. F., 2006. Bireysel Finansmanin Temininde Kredi Kartlari: Trkiyede Kredi Karti Kullanimi zerine Bir Aratirma, Seluk niversitesi Sosyal Bilimler Enstits Dergisi, Eyll, Say:15, pp.173-189. Duca, J. V. and W. C. Whitesell, 1995. "Credit Cards and Money Demand: A Cross-Sectional Study," Journal of Money. Credit, and Banking, 27(2), 604-23. Dunn, T. and D. Holtz-Eakin, 2000. "Financial Capital, Human Capital, and the Transition to Self-Employment: Evidence from Intergenerational Links," Journal of Labor Economics, 18(2), pp. 282-305. Durkin, T.A., 2000. Credit Cards: Use and Consumer Attitudes: 1970-2000, Federal Reserve Bulletin, vol: 86, pp:621-634. Durukan, T., H. Elibol and M. zhavzal, 2005. Kredi Kartlarndaki Taksit Uygulamasnn Tketicinin Harcama Alkanlklar zerindeki Etkisini lmeye Ynelik Bir Aratrma: Krkkale li rnei, Selcuk Universitesi Sosyal Bilimler Enstitusu Dergisi, Say: 13, pp.143153. Erdem, C., 2008. Factors Affecting the Probability of Credit Card Default and the Intention of Card Use in Turkey International Research Journal of Finance and Economics, Issue 18, pp. 159-171.

35]

96 36] 37] 38] 39] 40] 41] 42] 43] 44] 45] 46] 47] 48] 49] 50] 51] 52] 53] 54] 55] 56] 57]

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010) Evans, D, S, and R, Schmalensee, 1999. Paying with Plastic: The Digital Revolution in Buying and Borrowing, Cambridge, MA: MIT Press. Girginer, N., A. Erken-elik and N.Ukun, 2008. Eskisehir Osmangazi niversitesi Iktisadi Ve Idari Bilimler Fakltesi grencilerinin Kredi Karti Kullanimlarina Ynelik Bir Arastirma, Anadolu niversitesi Sosyal Bilimler Dergisi, Cilt/Vol.:8- Say/No: 1 : 193208. Gross, D. and N. Souleles, 1999. "Consumer Response to Changes in Credit Supply: Evidence from Credit Card Data," Working Paper, Wharton. Gross, D. and N. Souleles, 2002. Do Liquidity Constraints and Interest Rates Matter for Consumer Behavior? Evidence from Credit Card Data The Quarterly Journal of Economics, Vol. 117, No. 1, February, pp. 149-185. Humphrey, D.B., 2004. Replacement of Cash by Cards in US Consumer Payments, Journal of Economics and Business, Vol: 56, Issue: 3, May-June pp: 211-225. Humphrey D.B. et al, 2006. Benefits From a Changing Payment Technology in European Banking, Journal of Banking and Finance, Vol: 30, Issue:6, pp:1631-1652. Jappelli, T., 1990. Who is Credit Constrained in the U.S. Economy, Quarterly Journal of Economics, CV, 219-234. Karamustafa K. and D.M. Bikes, 2003. Kredi Kart Sahip ve Kullanclarnn Kredi Kart Kullanmlarn Degerlendirmeye Ynelik Bir Arastrma: Nevsehir rnegi, Erciyes niversitesi Sosyal Bilimler Enstits Dergisi, Say: 15, Yl:2, pp.91-113. Kaynak, E. and Harcar, T., 2001. Consumers attitudes and intentions towards credit card usage in an advanced developing country, Journal of Financial Services Marketing, Vol. 6,No.1, pp. 24-39. Kennickell, A., 1998. Multiple Imputation in Survey of Consumer Finance, Federal Reserve Board SCF Bibliography, www.federalreserve.gov/pubs/oss/oss2/papers/imput 98.pdf. Kennickell, A. B. and M. Starr-McCluer, 1994. "Changes in Family Finances from 1989 to 1992: Evidence from the Survey of Consumer Finances," Federal Reserve Bulletin, October, 861-882. Kurtulu, K. and S. Nasr, 2006. Consumer Behavior of Credit Card Users in an Emerging Market, 6th Global Conference on Business & Economics, October 15-17, Gutman Conference Center, USA. Lindh, T. and H. Ohlsson, 1998. "Self-Employment and Wealth Inequality," Review of Income and Wealth, 44(1), pp. 25-42. Lindley, J. T., P. Rudolph and E. B. Selby, Jr., 1989. "Credit Card Possession and Use: Changes over Time." Journal of Economics and Business 41, May, pp.127-142. Marcus E., 1960. "The Impact of Credit Cards on Demand Deposit Utilization." Southern Economic Journal 26, April, pp.314- 316. Mester, L. J., 1994. "Why Are Credit Card Rates Sticky?," Economic Theory, Springer, vol. 4(4), pages 505-530, May. Moss, D., 1999. Credit Card Debt and the Bankruptcy Code, Journal of Asset Protection, 4, 6:52-59. Nash R. C. and J. F. Sinkey, 1997. "On Competition, Risk, and Hidden Assets in the Market for Bank Credit Cards," Journal of Banking and Finance, 21(1), pp. 89-112. Oktay, E., . zen and . Alkan, 2009. Kredi Kart Sahipliinde Etkili Olan Faktrlerin Aratrlmas: Erzurum rnei, Dokuz Eyll niversitesi ktisadi ve dari Bilimler Fakltesi Dergisi, Cilt:24, Say:2, pp.1-22. Paisittanand, S. and D.L. Olson, 2006. A Simulation Study of IT Outsourcing in the Credit Card Business, European Journal of Operation Research, vol:175, Issue:2, December, pp:1246-1261. Pavel, C. and P. Binkley 1987. "Cost and Competition in Bank Credit Cards," Eco-nomic Perspectives (Federal Reserve Bank of Chicago), March/April, 11, pp. 3-13.

97 58] 59] 60] 61] 62]

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010) Rltzer, G., 2001. Explorations in the Sosiology of Consumption: Fast Food, Credit Cards and Casinos, Sage Publiction Incorporated. Schor, J., 1998. The Overspent American: Upscaling, Downshifting and the New Consumer, New York: Basic Books. Sinkey, J. F. and R. C. Nash, 1993. "Assessing the Riskiness and Profitability of Credit-Card Banks," Journal of Financial Services Research, 7(2), 127-50. Stango, V., 2002. Pricing with Consumer Switching Costs: Evidence from the Credit Card Market, Journal of Industrial Economics, 50 (4), December, 475-492. Tobin, J., (1958). Liquidity Preference as Behavior Towards Risk, Review of Economic Studies, 25 (1), 6586.Torlak, ., 2002. Kredi Kart Kullanmnn Satnalma Alkanlklarna Etkileri zerine Eskiehirde Bir Aratrma, Ynetim/ stanbul niversitesi letme Fakltesi letme ktisad Enstits Dergisi, Yl:13, Say:41, pp.67-78. Tuay, O. and N. Bagl, 2007. nemli Bir Finansman Kayna Olarak Kredi Kartlar: Kredi Kartlarnn Kart Sahiplerinin Harcamalar zerindeki Etkisini Belirlemeye Ynelik Burdur linde Bir Aratrma, Sleyman Demirel niversitesi ktisadi ve dari Bilimler Fakltesi Dergisi, C.12, S.3 s.215-226. Uzgren, N., G. Ceylan and E. Uzgren, 2007. Trkiyede Kredi Kart Kullanmn Etkileyen Faktrleri Belirlemeye Ynelik Bir Model alsmas, Ynetim ve Ekonomi, Cilt: 14 Say: 2, pp.247-256. White K.J., 1976. "The Effect of Bank Credit Cards on the Household Transactions Demand for Money." Journal of Money Credit and Banking 8, February, pp. 51-61. Yoo, P. S., 1997. "Charging up a Mountain of Debt: Accounting for the Growth of Credit Card Debt," Federal Reserve Bank of St. Louis Review, 79(2), 3-13. Yoo, P. S., 1998. "Still Charging: The Growth of Credit Card Debt between 1992 and 1995," Federal Reserve Bank of St. Louis Review, 80(1), 19-27.

64]

65] 66] 67] 68]

Appendix

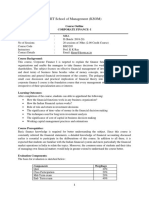

Table 1: Descriptive Statistics

Frequency 1300 393 364 281 131 70 36 8 9 3 1 2 1 1 1295 183 122 112 79 168 151 164 30.2 28.0 21.6 10.1 5.4 2.8 0.6 0.7 0.2 0.1 0.2 0.1 0.1 14.1 9.4 8.6 6.1 13.0 11.7 12.7 P.C. Percent Principal Category (P.C.)

VARIABLES The number of credit cards used (dependent variable) 0 1 2 3 4 5 6 7 8 9 10 15 18 Profession Specialist Manager Civil Servant Employer Tradesman Sale/Customer Representative Worker

98

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

83 85 148 1299 605 694 1294 268 349 324 251 102 1178 1292 807 485 1276 1292 278 675 183 156 1292 657 254 272 109 1272 65 340 710 113 28 16 1095 1276 144 103 853 5 171 1260 582 97 27 391 163 1294 363 314 239 34 104 82 27.9 24.2 18.4 2.6 8.0 6.3 P.C. 44.8 7.7 2.1 31.0 12.9 P.C. 11.3 8.1 66.8 0.4 13.4 21.5 52.2 14.2 12.1 50.9 19.7 21.1 8.4 5.0 26.2 54.6 8.7 2.2 1.2 P.C. 62.5 37.5 P.C. 6.4 6.6 11.4 46.6 53.4 20.6 26.8 24.9 19.3 7.8

Servant, office-boy, etc. Retired Other Gender Female Male Old 18-24 25-34 35-44 45-54 55 and more Educational Year (continuous variable) Marital Status Married Other Household size (continuous variable) Social Security Social Security Organization for Artisans and the Self-Employed Social Security Institution Retirement Fund No social security Games of Chance Never Very Scarcely Sometimes Very often Total Monthly Income 0-500 TL 500-1000 TL 1000-5000 TL 5000-10000 TL 10000-20000 TL 20000 TL or more Total Annual Income (000 TL, continuous variable) Frequency of getting income Daily Weekly Monthly Annual Irregular Frequency of drawing monthly income from bank account At one go Two equal parts Three equal parts When necessary No regular monthly income The investment choices if monthly income increases by two times or more Demand Deposit Time Deposit Gold Treasury bill and Government bond Real Estate Automobile

P.C.

P.C.

P.C.

P.C.

P.C.

99

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

34 124 930 206 163 48 304 73 56 59 21 934 467 467 1297 1295 308 28 167 57 15 602 118 925 124 801 1300 1114 433 308 215 41 74 15 28 Model 1 0.1151 -0.6658** 1.4985* 0.5097** -0.2918 -0.2598 -0.2968 -0.9437** 33.3 23.7 16.5 3.2 5.7 1.2 2.2 Model 2 P.C. 9.5 61.6 23.8 2.2 12.9 4.4 1.2 46.5 9.1 50 50 P.C. 15.8 12.5 3.7 23.4 5.6 4.3 4.5 1.6 2.6 9.5

Stock Exchange Increase in consumption expenditure The main reason for using credit card I eliminate to carry cash on me I can buy even if I have not money For security and prestige I can buy with installments I buy now but pay later I use credit card because I have no sufficient salary to live on for the time being I use credit cards in my business dealings Other Whether or not using credit cards increases your spending Yes No The rate of payment by credit card in total payment (%, continuous variable) The main factor affecting consumption decision The share of price of goods in my current income The share of price of goods in my lifetime income General economic condition Inflation Interest rate Needs Habits Does using credit cards allow you to invest the unused portion of your monthly income for the time being in interest bearing financial instruments or earning assets? Yes No The saving rate in household income Investment Choices Demand Deposit Time Deposit Gold Treasury bill and Government bond Real Estate Automobile Stock Exchange VARIABLES Profession Manager Civil Servant Employer Tradesman Sale/Customer Representative Worker Servant, office-boy, etc. Retired

P.C.

P.C.

P.C.

Model 3

Model 4

100

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

-0.9198* -0.1137 -0.2135 0.4983* 0.3645** -0.6421*** 0.1262* -0.1349 -0.1137** 0.2081 0.0168 -1.0378* 0.4870* 0.4709* 0.8323* -1.7952* -0.7138* 1.2908* 0.6502 -0.2587 0.0072* 0.7683* -0.2189 -0.6180 0.0702

Other Gender Female Old 18-24 35-44 45-54 55 and more Educational Year (continuous variable) Marital Status Other Household size (continuous variable) Social Security Social Security Organization for Artisans and the SelfEmployed Retirement Fund No social security Games of Chance Very Scarcely Sometimes Very often Total Monthly Income 0-500 TL 500-1000 TL 5000-10000 TL 10000-20000 TL 20000 TL or more Total Annual Income (000 TL, continuous variable) Frequency of getting income Daily Weekly Annual Irregular Frequency of drawing monthly income from bank account Two equal parts Three equal parts When necessary No regular monthly income The investment choices if monthly income increases by two times or more Time Deposit Gold Treasury bill and Government bond Real Estate Automobile Stock Exchange Increase in consumption expenditure The main reason for using credit card I eliminate to carry cash on me I can buy even if I have not money For security and prestige I buy now but pay later I use credit card because I have no sufficient salary to live on for the time being I use credit cards in my business dealings Other Whether or not using credit cards increases your spending

0.3207 0.0575 0.2321 -0.3332

-0.2231 -0.3265*** 0.2505 0.7127* -0.2263 0.2180 0.4167*** 0.3415** 0.1837 1.2980* 0.6053* 0.0460 1.8253* -0.9386

101

European Journal of Economics, Finance and Administrative Sciences - Issue 23 (2010)

0.1973** 0.8882* 0.0408 0.6076** 0.2244 0.0369 1.1287* 0.6268*

Yes The rate of payment by credit card in total payment (%, continuous variable) The main factor affecting consumption decision The share of price of goods in my current income The share of price of goods in my lifetime income General economic condition Inflation Interest rate Habits Does using credit cards allow you to invest the unused portion of your monthly income for the time being in interest bearing financial instruments or earning assets? Yes The saving rate in household income Investment Choices Time Deposit Gold Treasury bill and Government bond Real Estate Automobile Stock Exchange LR Statistics Pseudo R2 Number of Observation Left Censored Observation * indicates 99% significance level. ** indicates 95% significance level. *** indicates 90% significance level.

0.4369* 1.7878* -0.0517 -0.3427** 0.6962** 0.5498** 0.3944 0.8310** 81.93* 0.0264 817 27

346.31* 0.0858 1119 340

282.83* 0.0722 1065 294

179.02* 0.0520 921 27

Das könnte Ihnen auch gefallen

- Final Questionnaire Auto Saved)Dokument10 SeitenFinal Questionnaire Auto Saved)sumi1213Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- JobDokument2 SeitenJobsumi1213Noch keine Bewertungen

- Project TitleDokument1 SeiteProject Titlesumi1213Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Money MKT OperationDokument9 SeitenMoney MKT OperationRohan PatilNoch keine Bewertungen

- Financial Mangement-Midterm ExamDokument12 SeitenFinancial Mangement-Midterm ExamChaeminNoch keine Bewertungen

- Fs SP Bse MidcapDokument7 SeitenFs SP Bse MidcapRavishankarNoch keine Bewertungen

- TOA-valix (Vol.2) 2013 Ed. - CHAPTER 42 - SMEs - IMPAIRMENT OF ASSETSDokument2 SeitenTOA-valix (Vol.2) 2013 Ed. - CHAPTER 42 - SMEs - IMPAIRMENT OF ASSETSchimchimcoliNoch keine Bewertungen

- Treasury Securities in BangladeshDokument12 SeitenTreasury Securities in BangladeshAmit KumarNoch keine Bewertungen

- Overview of Working Capital Management and Cash ManagementDokument48 SeitenOverview of Working Capital Management and Cash ManagementChrisNoch keine Bewertungen

- Ushtrime Studente Tema 3, TezgjidhuraDokument25 SeitenUshtrime Studente Tema 3, TezgjidhuraAndi HoxhaNoch keine Bewertungen

- FIN619 FinalDokument95 SeitenFIN619 Finalqundeel.com80% (5)

- Cryptotrading Pro PDFDokument272 SeitenCryptotrading Pro PDF425acb100% (2)

- Sales Leaseback (Lessor)Dokument3 SeitenSales Leaseback (Lessor)Jb De GuzmanNoch keine Bewertungen

- JFC Income StatementDokument2 SeitenJFC Income StatementAngelie villanuevaNoch keine Bewertungen

- Angel One Margin Offer ScreenshotDokument2 SeitenAngel One Margin Offer ScreenshotRaj MittalNoch keine Bewertungen

- Chapter 3 Problems AnswersDokument11 SeitenChapter 3 Problems AnswersOyunboldEnkhzayaNoch keine Bewertungen

- Week 6 and Week 7Dokument49 SeitenWeek 6 and Week 7Muneeb AmanNoch keine Bewertungen

- MIDTERM FinMar 1Dokument11 SeitenMIDTERM FinMar 1Aira ArabitNoch keine Bewertungen

- Group Investment Plan AnalysisDokument28 SeitenGroup Investment Plan AnalysisAhGohNoch keine Bewertungen

- National Stock Exchange: Financial Market Regulations Project OnDokument11 SeitenNational Stock Exchange: Financial Market Regulations Project OnNehmat SethiNoch keine Bewertungen

- CH 07Dokument36 SeitenCH 07Suresh Devaraji100% (1)

- FM Revision Notes-CS ExeDokument39 SeitenFM Revision Notes-CS ExeAman Gutta100% (1)

- Share Khan BrokerageDokument56 SeitenShare Khan BrokerageMilan DhamatNoch keine Bewertungen

- New Microsoft Word DocumentDokument22 SeitenNew Microsoft Word DocumentAjay PandayNoch keine Bewertungen

- 5 564 5045 PL Milbank UpdatedDokument7 Seiten5 564 5045 PL Milbank UpdatedSky walkingNoch keine Bewertungen

- 12 x10 Financial Statement AnalysisDokument18 Seiten12 x10 Financial Statement AnalysisLouina YnciertoNoch keine Bewertungen

- KSOM Corporate Finance Course OutlineDokument3 SeitenKSOM Corporate Finance Course OutlineAkankshya PanigrahiNoch keine Bewertungen

- Asset allocation and investment objectivesDokument25 SeitenAsset allocation and investment objectivesyebegashetNoch keine Bewertungen

- 2024 Predictions - by Luke Belmar - by Luke Belmar - Dec, 2023 - MediumDokument3 Seiten2024 Predictions - by Luke Belmar - by Luke Belmar - Dec, 2023 - MediumAshish RaiNoch keine Bewertungen

- IAS 39 Financial InstrumentsDokument9 SeitenIAS 39 Financial InstrumentskwakyeNoch keine Bewertungen

- Lesson 8 Assessing and Selecting Capital Investment ProposalsDokument18 SeitenLesson 8 Assessing and Selecting Capital Investment Proposalsman ibe100% (1)

- Dupont Corporation: Sale of Performance Coatings Student Preparation GuideDokument1 SeiteDupont Corporation: Sale of Performance Coatings Student Preparation GuideTrade OnNoch keine Bewertungen

- ACC3201Dokument7 SeitenACC3201natlyhNoch keine Bewertungen