Beruflich Dokumente

Kultur Dokumente

Major Banks Private

Hochgeladen von

Yashesh PatelOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Major Banks Private

Hochgeladen von

Yashesh PatelCopyright:

Verfügbare Formate

Hdfc

To be eligible for a HDFC Two Wheeler loan, you need to:

Be a salaried or self-employed individual. Be between the age of 21 years (at the time of application) and <= 65 years (at the end of the loan tenor). Earn a minimum gross income of Rs. 54,000/- p.a., if you reside in Mumbai, Delhi, Chennai, Bangalore, Calcutta, Pune and Rs. 42,000/- p.a. for all other cities. Reside for at least 1 year in the city. Reside for at least 1 year at the given residence address (in case of transfer from other location with less than 1 year at current location - please provide relevant documents to the bank during loan approval stage). Be working for at least 1 year. Have a phone at your residence or office.

If you are eligible for a HDFC Bank Two Wheeler Loan, you can apply simply by submitting just the following documents:

Proof of Identity: Any one of Passport Copy/ Photo Credit card- front & reverse/ Voters ID card/ Driving License/ PAN card/ Copy of Company ID card of MNC/ Public Ltd./ PSU/ Govt. company/ Ration Card (If Photo is given). Address Proof: Any one of Passport Copy/ Voters ID card/ Driving License/ Rental agreement/ Telephone Bill/ Electricity bill/ Gas Connection Bills/ Ration Card/ Sale deed/ Property purchase agreement/ Credit Card billing statement (latest)/ LIC policy/ Letter from Company or Company provided Accommodation (List of the company's as per the Banks List- ID card of MNC/ Public Ltd.,/ PSU/ Govt. Company Containing the residence address), Address proof in the name of the applicant's Spouse or parents name is acceptable. Income Proof: For Salaried : Latest Salary slip for Govt. employees; If Salary slip is not available, Only salary certificate to be accepted with deductions, For Partnership/ Proprietary firms & Pvt. Ltd. Co's- Salary Certificate to be accepted with the following mitigants: Salary Certificate to clearly state the deductions, Name & Designation of the authorized signatory. For Self-Employed: Copy of the latest I. T. return.

Icici

Service Charges for Existing Loans

Description of Charges Amortisation Schedule Charges Charges for late payment (loans) Cheque return charges Cheque Swap Charges Duplicate NOC Charges Prepayment Statement Charges Prepayment Charges

Two Wheeler Loans Rs. 200/- per Schedule 2% per month on the outstanding installment Rs. 200/- per Cheque return Rs. 500/- per transaction Rs. 200/- per NOC Rs. 100/- per Statement Lower of the two amount given below: 1) 4% of principal outstanding or 2) Interest outstanding for unexpired period of the

loan Revalidation of NOC charges Non Refundable Loan Processing Fees Statement of Account Charges Prepayment Options Charges for changing from fixed to floating rates of interest Charges for changing from floating to fixed rates of interest Rs. 200/- per NOC 0.25%* Rs. 200/- per Statement Part prepayment of the loan is not allowed Prepayment is allowed after 6 months from the disbursement of the loan Not Applicable Not Applicable

Note : 1) Service Tax and other Government tax, levies, etc applicable as per the prevailing rate may be charged over and above these charges at the discretion of ICICI Bank. 2) The charges or fees given in above table are subject to change and the one recorded in agreement will be binding over the site. 3) Interest Reset clause: Not Applicable.

Induslnd

o o

Features & Benefits Easy Payment option Direct debit from Indusind Savings/ Current Account or Post dated cheques

o o o o o o o o o

Eligibility Salaried Individual (SI): You should be employed for a minimum of 3 years and with the current employer for a minimum period of 1 year. Your minimum gross salary should be Rs.8,000/- per month Your net monthly take-home salary should be at least 3 times of the monthly installment. You should be within 60 years of age. You should be residing at the current address for a minimum of 2 years. Self Employed Professional/ Non-Professional (SEP/SENP): You should be in business for a minimum of 3 years and in current business for a minimum period of 2 years. Your minimum profit should be Rs.1,00,000/- p.a. You should be within 60 years of age. Your current place of residence should be occupied for a minimum of 2 years.

o o o

Documentation Age proof Identity Proof. Proof of Residence.

o o o o o o o

Salary slips for the last 3 months (SI) / copies of Income Tax Return and computation of Income for the last 2 years as filed (SEP/SENP) and Balance Sheet & Profit and Loss accounts duly audited. Form 16 for latest year Proof of two years of employment. Last 6 months bank statement of the salary credit account along with all/any other bank accounts held (SI) / of primary bank account (SEP/SENP). Proof of Business (SEP/SENP). Telephone bill of office & residence . Application Form duly filled / recent passport size photograph affixed Any other relevant documentation that would be sought by the Bank depending upon your specific profile

Das könnte Ihnen auch gefallen

- Data2 Dapimage 1409021911 CreditCardApplication1409021911Dokument4 SeitenData2 Dapimage 1409021911 CreditCardApplication1409021911Michel ThompsonNoch keine Bewertungen

- Bank ValuationDokument29 SeitenBank ValuationMarc Rubinstein100% (9)

- Personal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouDokument12 SeitenPersonal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouAmmabagavan 666Noch keine Bewertungen

- Personal Details: Application No: TFS/PB/BE/ / ..Dokument4 SeitenPersonal Details: Application No: TFS/PB/BE/ / ..Shishir SaxenaNoch keine Bewertungen

- Personal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouDokument12 SeitenPersonal Loan: Benefits Availing Personal Loan From HDB Can Have A Lot of Benefits For YouLingesh GobichettipalayamNoch keine Bewertungen

- Vehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDokument17 SeitenVehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDr.K.PadmanabhanNoch keine Bewertungen

- Uni-Statement Account SummaryDokument6 SeitenUni-Statement Account SummaryjameNoch keine Bewertungen

- UK and US inflation rates compared from 1973 to 2001Dokument6 SeitenUK and US inflation rates compared from 1973 to 2001Bùi Hà LinhNoch keine Bewertungen

- Transfer $3,000 to a customer in the U.SDokument1 SeiteTransfer $3,000 to a customer in the U.SPyero Talone100% (1)

- Sbi Car LoanDokument10 SeitenSbi Car LoanShweta Yashwant Chalke100% (2)

- Estmt - 2023 01 19Dokument4 SeitenEstmt - 2023 01 19phillip davisNoch keine Bewertungen

- Consumer Durable Application FormDokument2 SeitenConsumer Durable Application FormBrenda CoxNoch keine Bewertungen

- Non Face To Face Account Opening FormDokument10 SeitenNon Face To Face Account Opening FormAlvin Samuel PandianNoch keine Bewertungen

- Citibank Credit CardDokument6 SeitenCitibank Credit CardgjvoraNoch keine Bewertungen

- ICICI Bank Car Loans Primary DetailsDokument11 SeitenICICI Bank Car Loans Primary DetailsAastha PandeyNoch keine Bewertungen

- Personal loan details letterDokument4 SeitenPersonal loan details letterchelladuraik25% (4)

- PVB: Philippine Bank for Veterans and Their FamiliesDokument34 SeitenPVB: Philippine Bank for Veterans and Their FamiliesAhnJelloNoch keine Bewertungen

- BPI Vs CA Assigned Case DigestDokument1 SeiteBPI Vs CA Assigned Case DigestJocelyn Yemyem Mantilla Veloso100% (2)

- About CimbDokument7 SeitenAbout CimbShahmin HalimiNoch keine Bewertungen

- Chapter 1 IntroDokument10 SeitenChapter 1 IntrosanyakathuriaNoch keine Bewertungen

- SBI & AXIS BANK Home LOANS INFORMATIONDokument57 SeitenSBI & AXIS BANK Home LOANS INFORMATIONSakshi KadamNoch keine Bewertungen

- CC Two-Wheeler-LoansDokument29 SeitenCC Two-Wheeler-LoansRight ClickNoch keine Bewertungen

- Policy Criteria Review May 2011Dokument5 SeitenPolicy Criteria Review May 2011api-99058398Noch keine Bewertungen

- Consumer Finance at Bank AlfalahDokument29 SeitenConsumer Finance at Bank AlfalahSana Khan100% (2)

- Patna Retail Assets CentreDokument31 SeitenPatna Retail Assets CentreSatyajit BanerjeeNoch keine Bewertungen

- HDFC Personal LoanDokument3 SeitenHDFC Personal LoanmohammadtaufeequeNoch keine Bewertungen

- MBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit SchemesDokument68 SeitenMBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit Schemeszargar100% (1)

- Terms of State Bank of IndiaDokument5 SeitenTerms of State Bank of IndiaexperinmentNoch keine Bewertungen

- Nepal Bank LimitedDokument9 SeitenNepal Bank LimitedSuman ThakuriNoch keine Bewertungen

- 5062 Policy Payout FormDokument2 Seiten5062 Policy Payout Formbpd21Noch keine Bewertungen

- Nmims New LeafletDokument2 SeitenNmims New LeafletGagan kr. SinghNoch keine Bewertungen

- Bank's Mudra Loan FormDokument4 SeitenBank's Mudra Loan FormRAM NAIDU CHOPPANoch keine Bewertungen

- HDB Loans StudyDokument34 SeitenHDB Loans StudyMounicaNoch keine Bewertungen

- Apply for Mudra Loan OnlineDokument4 SeitenApply for Mudra Loan OnlineSureshNoch keine Bewertungen

- Loan SBPPDokument46 SeitenLoan SBPPDrasti DesaiNoch keine Bewertungen

- Sagar & AnandDokument9 SeitenSagar & AnandAnand ChavanNoch keine Bewertungen

- Policy cancellation form guideDokument2 SeitenPolicy cancellation form guideteja_praveenNoch keine Bewertungen

- Link ClickDokument2 SeitenLink ClickSukh BrarNoch keine Bewertungen

- Icici Car LoanDokument11 SeitenIcici Car LoanmaniNoch keine Bewertungen

- Jennylyn Pascualjepascual@bpi.com.ph8845-6925Dokument2 SeitenJennylyn Pascualjepascual@bpi.com.ph8845-6925Adrian FranciscoNoch keine Bewertungen

- Icici Doc ReqdDokument2 SeitenIcici Doc ReqdSagar SoniNoch keine Bewertungen

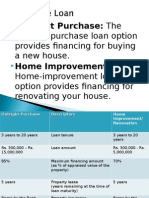

- Outright Purchase: TheDokument14 SeitenOutright Purchase: TheMuhammad Umair KhalidNoch keine Bewertungen

- Eligibility:: Please Click Retail Credit Interest RatesDokument8 SeitenEligibility:: Please Click Retail Credit Interest RatesPriya S MurthyNoch keine Bewertungen

- Salary Dost Credit Policy: Loan Limit and TenureDokument11 SeitenSalary Dost Credit Policy: Loan Limit and TenureAlpesh KuleNoch keine Bewertungen

- Loan FlyerDokument2 SeitenLoan FlyerSameera VithanageNoch keine Bewertungen

- Policy Surrender Form PDFDokument2 SeitenPolicy Surrender Form PDF1012804201Noch keine Bewertungen

- Terms & Conditions of Consumer Loans: 1. EligibilityDokument2 SeitenTerms & Conditions of Consumer Loans: 1. Eligibilityprasad89_balaNoch keine Bewertungen

- Definition of 'Retail Banking'Dokument5 SeitenDefinition of 'Retail Banking'bhumikasab7Noch keine Bewertungen

- Requirements On Car Loan FacilityDokument2 SeitenRequirements On Car Loan FacilityKarl Kenneth FloresNoch keine Bewertungen

- Lic Ecs Mandate Form EnglishDokument3 SeitenLic Ecs Mandate Form EnglishpajipitarNoch keine Bewertungen

- Highlights of Education Loan To Iim StudentsDokument4 SeitenHighlights of Education Loan To Iim StudentsChinkal NagpalNoch keine Bewertungen

- sop2Dokument4 Seitensop2Lalu VsNoch keine Bewertungen

- Documents Required Salaried Home LoanDokument2 SeitenDocuments Required Salaried Home Loansiva.mtncNoch keine Bewertungen

- Eligibility: Specific Eligibility Criteria Are As FollowsDokument2 SeitenEligibility: Specific Eligibility Criteria Are As FollowsbboysupremoNoch keine Bewertungen

- BOP CarGar FAQsDokument3 SeitenBOP CarGar FAQsCh Ahmed MahmoodNoch keine Bewertungen

- SBI Business LoanDokument12 SeitenSBI Business LoanAjit SamalNoch keine Bewertungen

- Sources of Long Term Funds From HSBC BankDokument16 SeitenSources of Long Term Funds From HSBC Bankadilhussain_876Noch keine Bewertungen

- HBL Islamic Homefinance: Key FeaturesDokument6 SeitenHBL Islamic Homefinance: Key FeaturesaftabNoch keine Bewertungen

- MITC Commercial Credit Card v12 September 2021Dokument22 SeitenMITC Commercial Credit Card v12 September 2021Anjalidevi TNoch keine Bewertungen

- Srinath 123Dokument69 SeitenSrinath 123hullur_srinath62633Noch keine Bewertungen

- Checklist for Home Loan ApplicationDokument2 SeitenChecklist for Home Loan ApplicationAarthi PadmanabhanNoch keine Bewertungen

- Home Loan AssistanceDokument2 SeitenHome Loan AssistancedashNoch keine Bewertungen

- Most Important Terms & ConditionsDokument6 SeitenMost Important Terms & ConditionsshanmarsNoch keine Bewertungen

- Updated One Pager Spl - Dsa-1Dokument1 SeiteUpdated One Pager Spl - Dsa-1Vishal BawaneNoch keine Bewertungen

- Loan Policy CFLDokument3 SeitenLoan Policy CFLsumit rathoreNoch keine Bewertungen

- Application For POSB Loan Assist Plus: Eligibility Important Information To Take NoteDokument3 SeitenApplication For POSB Loan Assist Plus: Eligibility Important Information To Take NoteinabansNoch keine Bewertungen

- Profile - Dr. Shiva Narayan PHDDokument3 SeitenProfile - Dr. Shiva Narayan PHDDr. Shiva NarayanNoch keine Bewertungen

- BBCCC Dividend Deposit Authorization FormDokument1 SeiteBBCCC Dividend Deposit Authorization FormJhesterson BantasanNoch keine Bewertungen

- No:-1900235370 - Issue Date 24.10.2022: Alliance Broadband Services Pvt. LTDDokument1 SeiteNo:-1900235370 - Issue Date 24.10.2022: Alliance Broadband Services Pvt. LTDSandeep SinghNoch keine Bewertungen

- Mortgage AccountsDokument16 SeitenMortgage Accountsvasanth kumarNoch keine Bewertungen

- Title: 198, Tesma405, IJEAST PDFDokument9 SeitenTitle: 198, Tesma405, IJEAST PDFShr BnNoch keine Bewertungen

- Soneri Bank Internship+ (Marketing)Dokument66 SeitenSoneri Bank Internship+ (Marketing)qaisranisahibNoch keine Bewertungen

- Test Bank Fin 220 Chap008 - CompressDokument43 SeitenTest Bank Fin 220 Chap008 - CompressRey Josh RicamaraNoch keine Bewertungen

- Customer Satisfaction with HSBC ATM ServicesDokument19 SeitenCustomer Satisfaction with HSBC ATM Servicesnamnh0307Noch keine Bewertungen

- AC Power Booster - SBI PO CLERK BOB PO 2018 PDFDokument112 SeitenAC Power Booster - SBI PO CLERK BOB PO 2018 PDFPrathyusha KunaparajuNoch keine Bewertungen

- Internship ReportDokument49 SeitenInternship ReportRafid HossainNoch keine Bewertungen

- Swiss Bank Project GuideDokument37 SeitenSwiss Bank Project GuideDhwani RajyaguruNoch keine Bewertungen

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Dokument50 SeitenBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNoch keine Bewertungen

- AXIS BANK Project Word FileDokument28 SeitenAXIS BANK Project Word Fileअक्षय गोयलNoch keine Bewertungen

- Ranjana Kumar, Former CEO Indian Bank Ranjana Kumar Was The First Woman CEO ofDokument5 SeitenRanjana Kumar, Former CEO Indian Bank Ranjana Kumar Was The First Woman CEO ofAkansha RathoreNoch keine Bewertungen

- Aeon MP Payment RequestDokument2 SeitenAeon MP Payment RequestRyanNoch keine Bewertungen

- Principles of Finance for Business LeadersDokument28 SeitenPrinciples of Finance for Business LeadersYannah HidalgoNoch keine Bewertungen

- Paypal Case Study 2020Dokument1 SeitePaypal Case Study 2020RyanNoch keine Bewertungen

- Disbursal advice loan detailsDokument2 SeitenDisbursal advice loan detailsNaman ModNoch keine Bewertungen

- (A) A Cheque Which Had Originally Been Crossed Is Presented To You For Payment at The Counter Bearing The Remark "Crossing Cancelled" Below The Crossing Under The Drawer's InitialsDokument10 Seiten(A) A Cheque Which Had Originally Been Crossed Is Presented To You For Payment at The Counter Bearing The Remark "Crossing Cancelled" Below The Crossing Under The Drawer's InitialsSajid IslamNoch keine Bewertungen

- CHAPTER 6 ZICA InterestDokument45 SeitenCHAPTER 6 ZICA InterestDixie CheeloNoch keine Bewertungen

- DBS Deposit GuideDokument20 SeitenDBS Deposit GuideSee Wang YapNoch keine Bewertungen

- Foreign Currency Accounts ICICI BankDokument13 SeitenForeign Currency Accounts ICICI BankbahlkartikNoch keine Bewertungen