Beruflich Dokumente

Kultur Dokumente

Butler Excel Sheets (Group 2)

Hochgeladen von

Nathan ClarkinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Butler Excel Sheets (Group 2)

Hochgeladen von

Nathan ClarkinCopyright:

Verfügbare Formate

Butler Lumber Company

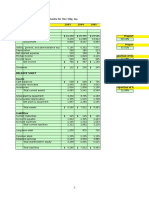

BUTLER LUMBER COMPANY EXHIBIT 1 Operating Expenses for Years Ending December 31, 1988-1990, and for First Quarter 1991 (thousands of dollars) 1988 Net sales Cost of goods sold: Beginning inventory Purchases Ending inventory Total cost of goods sold Gross Profit Operating expenses Interest expense Net income before income taxes Provision for income taxes Net income $1,697 $183 $1,278 $1,461 $239 $1,222 $475 $425 $13 $37 $6 $31 1989 $2,013 $239 $1,524 $1,763 $326 $1,437 $576 $515 $20 $41 $7 $34 1990 $2,694 $326 $2,042 $2,368 $418 $1,950 $744 $658 $33 $53 $9 $44 1st Qtr 1991 $718 $418 $660 $1,078 $556 $522 $196 $175 $10 $11 $2 $9

a. In the first quarter of 1990 sales were $698,000 and net income was $7,000. b. Operating expenses include a cash salary for Mr. Butler of $75,000 in 1988, $85,000 in 1989, $95,000 in 1990, and $22,000 in the first quarter of 1991. Mr. Butler also received some of the perquisites commonly taken by owners of privately held businesses.

Butler Lumber Company

BUTLER LUMBER COMPANY EXHIBIT 2 Balance Sheets at December 31, 1988-1990, and March 31, 1991 (thousands of dollars) 1st Qrtr 1988 1989 1990 1991 Cash Accounts receivable, net Inventory Current assets Property, net Total assets Notes payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current portion Current liabilities Long-term debt Total liabilities Net worth Total liabilities & net worth $58 $171 $239 $468 $126 $594 $0 $105 $0 $124 $24 $7 $260 $64 $324 $270 $594 $49 $222 $325 $596 $140 $736 $146 $0 $0 $192 $30 $7 $375 $57 $432 $304 $736 $41 $317 $418 $776 $157 $933 $233 $0 $0 $256 $39 $7 $535 $50 $585 $348 $933 $31 $345 $556 $932 $162 $1,094 $247 $0 $157 $243 $36 $7 $690 $47 $737 $357 $1,094

BUTLER LUMBER COMPANY

1988 Percent of sales Purchases Cost of goods sold Operating expenses Cash Accounts receivable Inventory Fixed assets (net) Total assets Percent of total assets Current liabilities Long-term liabilities Equity Current ratio Quick Ratio Cash Ratio Return on sales (margin) Return on assets Return on equity Sustainable Growth: Margin Asset Turnover Leverage (using bop equity) Retention ratio G-star Actual Growth (Sales) Actual Growth (Assets) 1989 1990 Average

75.3% 72.0% 25.0% 3.4% 10.1% 14.1% 7.4% 35.0%

75.7% 71.4% 25.6% 2.4% 11.0% 16.1% 7.0% 36.6%

75.8% 72.4% 24.4% 1.5% 11.8% 15.5% 5.8% 34.6%

75.6% 71.9% 25.0% 2.5% 11.0% 15.2% 6.7% 35.4%

43.8% 10.8% 45.5% 1.80 0.88 0.22 1.8% 5.2% 11.5%

51.0% 7.7% 41.3% 1.59 0.72 0.13 1.7% 4.6% 11.2%

57.3% 5.4% 37.3% 1.45 0.67 0.08 1.6% 4.7% 12.6%

50.7% 8.0% 41.4% 1.61 0.76 0.14 1.7% 4.9% 11.8%

1.83% 2.86

1.69% 2.74 2.73 1.00 12.59% 18.62% 23.91%

1.63% 2.89 3.07 1.00 14.47% 33.83% 26.77%

BUTLER LUMBER CO.

Projected income statement for 1991 (thousands of dollars) 1991 Net sales Cost of goods sold: Beginning inventory Purchases Ending inventory Total cost of goods sold Gross Profit Operating expenses Operating Profit Purchase Discounts* Interest expense** Net income before income taxes Provision for income taxes Net income $ 3,600 $418 $2,736 $3,154 $562 $2,592 $1,008 $900 $108 $42 $53 $97 $21 $76

Assumptions Value $ 3,600

76%

72% 25% 2% 10.50% 34%

Projected balance sheet for December 31, 1991 (thousands of dollars) 1991 Assets: Cash $54 Accounts recievable, net (12% of sales) $432 Inventory $562 Current Assets $1,048 Property, net $216 Total Assets $1,264 Liabilities: Accounts payable Accrued expenses Long-term debt, current portion Bank note payable (plug) Current Liabilities Long-term debt Total Liabilities Net worth Total Liabilities plus net worth

1.50% 12%

6%

$75 $54 7 $661 $797 $43 $840 $424 $1,264

10 1.50% 7 ROA ROE ROBE

5.99% 17.87% 21.76%

BUTLER LUMBER CO.

Projected income statement for 1991 (thousands of dollars) 1991 Net sales Cost of goods sold: Beginning inventory Purchases Ending inventory Total cost of goods sold Gross Profit Operating expenses Operating Profit Purchase Discounts* Interest expense** Net income before income taxes Provision for income taxes Net income $ 3,084 $418 $2,344 $2,762 $541 $2,220 $864 $771 $93 $34 $48 $78 $15 $63

Assumptions Value 1990 Growth adjusted for Sustainability

76%

72% 25% 2% 10.50% 34%

Projected balance sheet for December 31, 1991 (thousands of dollars) 1991 Assets: Cash $46 Accounts recievable, net (12% of sales) $370 Inventory $541 Current Assets $958 Property, net $185 Total Assets $1,143 Liabilities: Accounts payable Accrued expenses Long-term debt, current portion Bank note payable (plug) Current Liabilities Long-term debt Total Liabilities Net worth Total Liabilities plus net worth

1.50% 12%

6%

$64 $46 7 $571 $688 $43 $731 $411 $1,143

10 1.50% 7 ROA ROE ROBE

1990 Growth adjusted for Sustainability

5.56% 15.43% 18.24%

BUTLER LUMBER CO.

Projected income statement for 1991 (thousands of dollars) 1991 Net sales Cost of goods sold: Beginning inventory Purchases Ending inventory Total cost of goods sold Gross Profit Operating expenses Operating Profit Purchase Discounts* Interest expense** Net income before income taxes Provision for income taxes Net income $ 4,000 $418 $3,040 $3,458 $578 $2,880 $1,120 $1,000 $120 $48 $56 $111 $26 $85

Assumptions Value Assuming growth over expected level

76%

72% 25% 2% 10.50% 34%

Projected balance sheet for December 31, 1991 (thousands of dollars) 1991 Assets: Cash $60 Accounts recievable, net (12% of sales) $480 Inventory $578 Current Assets $1,118 Property, net $240 Total Assets $1,358 Liabilities: Accounts payable Accrued expenses Long-term debt, current portion Bank note payable (plug) Current Liabilities Long-term debt Total Liabilities Net worth Total Liabilities plus net worth

1.50% 12%

6%

$83 $60 7 $731 $882 $43 $925 $433 $1,358

10 1.50% 7 ROA ROE ROBE

Assuming growth over expected level

6.28% 19.67% 24.49%

BUTLER LUMBER CO.

Projected income statement for 1991 (thousands of dollars) 1991 Net sales Cost of goods sold: Beginning inventory Purchases Ending inventory Total cost of goods sold Gross Profit Operating expenses Operating Profit Purchase Discounts* Interest expense** Net income before income taxes Provision for income taxes Net income $ 2,694 $418 $2,047 $2,465 $526 $1,940 $754 $674 $81 $28 $44 $64 $11 $53

Assumptions Value $ 3,600

76%

72% 25% 2% 10.50% 34%

Projected balance sheet for December 31, 1991 (thousands of dollars) 1991 Assets: Cash $40 Accounts recievable, net (12% of sales) $323 Inventory $526 Current Assets $889 Property, net $162 Total Assets $1,051 Liabilities: Accounts payable Accrued expenses Long-term debt, current portion Bank note payable (plug) Current Liabilities Long-term debt Total Liabilities Net worth Total Liabilities plus net worth

1.50% 12%

6%

$56 $40 7 $503 $607 $43 $650 $401 $1,051

10 1.50% 7 ROA ROE ROBE

Growth Rate 0.00%

5.06% 13.26% 15.29%

Das könnte Ihnen auch gefallen

- (S3) Butler Lumber - EnGDokument11 Seiten(S3) Butler Lumber - EnGdavidinmexicoNoch keine Bewertungen

- Butler CaseDokument12 SeitenButler CaseJosh BenjaminNoch keine Bewertungen

- Group2 - Clarkson Lumber Company Case AnalysisDokument3 SeitenGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNoch keine Bewertungen

- Glaxo ItaliaDokument11 SeitenGlaxo ItaliaLizeth RamirezNoch keine Bewertungen

- Butler Lumber - Pro Forma - Balance and Income StatementDokument4 SeitenButler Lumber - Pro Forma - Balance and Income StatementJack Benjamin83% (6)

- Assignment 7 - Clarkson LumberDokument5 SeitenAssignment 7 - Clarkson Lumbertesttest1Noch keine Bewertungen

- Case Analysis of Butler Lumber Company's Financial PerformanceDokument14 SeitenCase Analysis of Butler Lumber Company's Financial PerformanceSangeet SaritaNoch keine Bewertungen

- Butler Lumber Operating Statements and Balance Sheets 1988-1991Dokument17 SeitenButler Lumber Operating Statements and Balance Sheets 1988-1991karan_w3Noch keine Bewertungen

- Jones Electrical DistributionDokument4 SeitenJones Electrical Distributioncagc333Noch keine Bewertungen

- Butler Lumber CompanyDokument8 SeitenButler Lumber CompanyAnmol ChopraNoch keine Bewertungen

- Tire City Spreadsheet SolutionDokument7 SeitenTire City Spreadsheet SolutionSyed Ali MurtuzaNoch keine Bewertungen

- Butler Lumber Case Study Solution: Assess Financial Situation & Loan RequestDokument8 SeitenButler Lumber Case Study Solution: Assess Financial Situation & Loan RequestBagus Be WeNoch keine Bewertungen

- RockboroDokument4 SeitenRockboromNoch keine Bewertungen

- KPMG - Target Operating ModelDokument2 SeitenKPMG - Target Operating ModelSudip Dasgupta100% (1)

- Group 5 PresentationDokument73 SeitenGroup 5 PresentationSourabh Arora100% (4)

- Butler Lumber Company Financial ProjectionsDokument8 SeitenButler Lumber Company Financial ProjectionsHadi KhawajaNoch keine Bewertungen

- Income Statement and Balance Sheet Analysis 1988-1991Dokument1 SeiteIncome Statement and Balance Sheet Analysis 1988-1991arnab.for.ever9439100% (1)

- Butler Lumber Company Financials 1988-1991Dokument7 SeitenButler Lumber Company Financials 1988-1991Sam Rosenbaum100% (1)

- Butler Lumber CaseDokument14 SeitenButler Lumber CaseSamarth Mewada83% (6)

- Butler Lumber Company Funding AnalysisDokument2 SeitenButler Lumber Company Funding AnalysisDucNoch keine Bewertungen

- Butler Lumber Case SolutionDokument4 SeitenButler Lumber Case SolutionCharleneNoch keine Bewertungen

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDokument5 SeitenCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNoch keine Bewertungen

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokument23 SeitenParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNoch keine Bewertungen

- Butler Lumber Case SolutionDokument4 SeitenButler Lumber Case SolutionPierre Heneine86% (7)

- Case: Blaine Kitchenware, IncDokument5 SeitenCase: Blaine Kitchenware, IncWilliam NgNoch keine Bewertungen

- Butler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsDokument2 SeitenButler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsJem JemNoch keine Bewertungen

- Clarkson Lumber Cash Flows and Pro FormaDokument6 SeitenClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNoch keine Bewertungen

- Play Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Dokument16 SeitenPlay Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Brian Balagot100% (3)

- Butler Lumber Case DiscussionDokument3 SeitenButler Lumber Case DiscussionJayzie Li100% (1)

- Butler Lumber Final First DraftDokument12 SeitenButler Lumber Final First DraftAdit Swarup100% (2)

- Inside Job Movie ReviewDokument4 SeitenInside Job Movie ReviewThomas Cornelius AfableNoch keine Bewertungen

- FM Butler Grup 2Dokument10 SeitenFM Butler Grup 2Anna Dewi Wijayanto100% (1)

- Butler Lumber CaseDokument4 SeitenButler Lumber CaseLovin SeeNoch keine Bewertungen

- Butler Lumber CompanyDokument4 SeitenButler Lumber Companynickiminaj221421Noch keine Bewertungen

- Butler Lumber 1Dokument6 SeitenButler Lumber 1Bhavna Singh33% (3)

- ButlerDokument9 SeitenButler2013studyNoch keine Bewertungen

- Case Study - Destin Brass Products CoDokument6 SeitenCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNoch keine Bewertungen

- Hansson Private Label Income Statement and Financial AnalysisDokument14 SeitenHansson Private Label Income Statement and Financial Analysisdenden007Noch keine Bewertungen

- Butler Lumber SuggestionsDokument2 SeitenButler Lumber Suggestionsmannu.abhimanyu3098Noch keine Bewertungen

- Exhibits of Blaine Kitchenware, Inc - CaseDokument6 SeitenExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- FAR NotesDokument11 SeitenFAR NotesJhem Montoya OlendanNoch keine Bewertungen

- Acquisition Analysis and RecommendationsDokument49 SeitenAcquisition Analysis and RecommendationsAnkitSawhneyNoch keine Bewertungen

- Blaine Excel HWDokument5 SeitenBlaine Excel HWBoone LewisNoch keine Bewertungen

- Stuart Daw questions costing approach transaction basisDokument2 SeitenStuart Daw questions costing approach transaction basisMike ChhabraNoch keine Bewertungen

- Estimating Funds Requirements Butler Lumber CompanyDokument18 SeitenEstimating Funds Requirements Butler Lumber CompanyNabab Shirajuddoula71% (7)

- The Logical Trader Applying A Method To The Madness PDFDokument137 SeitenThe Logical Trader Applying A Method To The Madness PDFJose GuzmanNoch keine Bewertungen

- Financial analysis of company shares and earningsDokument1 SeiteFinancial analysis of company shares and earningsRoderick Jackson JrNoch keine Bewertungen

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDokument24 SeitenAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- Hampton Machine Tool CompanyDokument6 SeitenHampton Machine Tool CompanyClaudia Torres50% (2)

- Analysis Butler Lumber CompanyDokument3 SeitenAnalysis Butler Lumber CompanyRoberto LlerenaNoch keine Bewertungen

- Butler Lumber CoDokument2 SeitenButler Lumber Cokumarsharma123Noch keine Bewertungen

- Hanson CaseDokument7 SeitenHanson CaseLe PhamNoch keine Bewertungen

- BKI's Capital Structure and Payout PoliciesDokument4 SeitenBKI's Capital Structure and Payout Policieschintan MehtaNoch keine Bewertungen

- Calculation of Blain Kitchenware CaseDokument2 SeitenCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Blaine Kitchenware IncDokument4 SeitenBlaine Kitchenware IncUmair ahmedNoch keine Bewertungen

- CASE SUMMARY Waltham Oil and LubesDokument2 SeitenCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNoch keine Bewertungen

- Clarkson Lumber Company (7.0)Dokument17 SeitenClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Pacific Grove Spice CompanyDokument3 SeitenPacific Grove Spice CompanyLaura JavelaNoch keine Bewertungen

- Cadillac Cody CaseDokument13 SeitenCadillac Cody CaseKiran CheriyanNoch keine Bewertungen

- Team 9A Case Analysis of Harris Seafoods Cash Flows and ValuationDokument2 SeitenTeam 9A Case Analysis of Harris Seafoods Cash Flows and ValuationNadia Iqbal100% (1)

- Blaine Kitchenware: Case Exhibit 1Dokument15 SeitenBlaine Kitchenware: Case Exhibit 1Fahad AliNoch keine Bewertungen

- Butler Lumber Company Income Statements and Projections 1988-1991Dokument8 SeitenButler Lumber Company Income Statements and Projections 1988-1991puspemoltuNoch keine Bewertungen

- Bob's Bicycles - Master Budget 2010Dokument28 SeitenBob's Bicycles - Master Budget 2010Jonathan Slonim100% (2)

- Nasdaq Aaon 2011Dokument72 SeitenNasdaq Aaon 2011gaja babaNoch keine Bewertungen

- 18 - Short-Term Finance and PlanningDokument19 Seiten18 - Short-Term Finance and Planninggabisan1087Noch keine Bewertungen

- EY-IFRS-FS-20 - Part 2Dokument50 SeitenEY-IFRS-FS-20 - Part 2Hung LeNoch keine Bewertungen

- Transfer PricingDokument12 SeitenTransfer PricingMark Lorenz100% (1)

- How To Apply For A Rental Property - Rent - Ray White AscotDokument2 SeitenHow To Apply For A Rental Property - Rent - Ray White AscotRRWERERRNoch keine Bewertungen

- Spring 2006Dokument40 SeitenSpring 2006ed bookerNoch keine Bewertungen

- KV Recruitment 2013Dokument345 SeitenKV Recruitment 2013asmee17860Noch keine Bewertungen

- Finance ProblemsDokument5 SeitenFinance Problemsstannis69420Noch keine Bewertungen

- HTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFDokument99 SeitenHTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFДмитрий ЮхановNoch keine Bewertungen

- Accounting For CorporationDokument5 SeitenAccounting For CorporationZariyah RiegoNoch keine Bewertungen

- Scotia Aria Progressive Defend Portfolio - Premium Series: Global Equity BalancedDokument2 SeitenScotia Aria Progressive Defend Portfolio - Premium Series: Global Equity BalancedChrisNoch keine Bewertungen

- Direction Ranking Blood RelationDokument23 SeitenDirection Ranking Blood RelationdjNoch keine Bewertungen

- Palepu - Chapter 5Dokument33 SeitenPalepu - Chapter 5Dương Quốc TuấnNoch keine Bewertungen

- CH 09Dokument22 SeitenCH 09Yooo100% (1)

- Lembar Jawaban 1 UPK (Kevin J)Dokument12 SeitenLembar Jawaban 1 UPK (Kevin J)kevin jonathanNoch keine Bewertungen

- Chapter 6Dokument17 SeitenChapter 6MM M83% (6)

- BonanzaDokument2 SeitenBonanzaMaster HusainNoch keine Bewertungen

- Reauthorization of The National Flood Insurance ProgramDokument137 SeitenReauthorization of The National Flood Insurance ProgramScribd Government DocsNoch keine Bewertungen

- PFRS 16 Lease Accounting GuideDokument2 SeitenPFRS 16 Lease Accounting GuideQueen ValleNoch keine Bewertungen

- Research ProposalDokument49 SeitenResearch ProposalAmanuel HawiNoch keine Bewertungen

- Xisaab XidhDokument1 SeiteXisaab XidhAbdiNoch keine Bewertungen

- Example For Chapter 2 (FABM2)Dokument10 SeitenExample For Chapter 2 (FABM2)Althea BañaciaNoch keine Bewertungen

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDokument6 SeitenCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaNoch keine Bewertungen

- Essentials of a Contract - Formation, Validity, Performance & DischargeDokument25 SeitenEssentials of a Contract - Formation, Validity, Performance & Dischargesjkushwaha21100% (1)

- Duty Free v1Dokument76 SeitenDuty Free v1Vasu SrinivasNoch keine Bewertungen

- 216 - JSAW Annual Report 2013 14Dokument137 Seiten216 - JSAW Annual Report 2013 14utalentNoch keine Bewertungen

- Financial AidDokument1 SeiteFinancial Aidshb100% (1)