Beruflich Dokumente

Kultur Dokumente

Republican Party of Minnesota 525 Park Street SUITE 250 ST. PAUL, MN 55103 (651) 222-0022

Hochgeladen von

c_c_mitchellOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Republican Party of Minnesota 525 Park Street SUITE 250 ST. PAUL, MN 55103 (651) 222-0022

Hochgeladen von

c_c_mitchellCopyright:

Verfügbare Formate

REPUBLICAN PARTY OF MINNESOTA 525 PARK STREET SUITE 250 ST.

PAUL, MN 55103 (651) 222-0022

CONFIDENTIAL

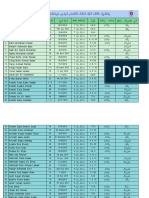

March 16, 2012 MEMORANDUM FOR FILES: TREASURERS REPORT-MARCH EXECUTIVE COMMITTEE MEETING, RPM FINANCIAL STATEMENTS AS OF FEBRUARY 29, 2012 FOR THE MONTH AND YEAR-TO-DATE THEN ENDED FR: BRON J. SCHERER, CPA, SECRETARY-TREASURER, REPUBLICAN PARTY OF MINNESOTA TO: REPUBLICAN PARTY OF MINNESOTA EXECUTIVE COMMITTEE OVERVIEW: The purpose of this memorandum is to discuss the finance position, results of operations and changes in financial position for the Republican Party of Minnesota (RPM or the Party) as of February 29, 2012 and for the two months and year-to-date then ended. See accompanying financial statements and detailed schedules for additional information. The accompanying statements of revenues and expenses and related supplemental schedules include year-to-date as well as monthly reporting periods for your review. FINANCIAL POSITION: As of February 29, 2012, RPM cash balances were approximately $27,000 as compared to a book overdraft of approximately $24,000 as of December 31, 2011. This is obviously a substantial improvement over the two month period. However, as most of the Partys financial activity flows through the Federal account, it is important to note that there is still a book overdraft of approximately $7,000 in such account as of February 29, 2012 (but again, a substantial improvement from December 31, 2011 when such balance reflected a Federal book overdraft of approximately $44,000). One other factor to consider is that in either March or April of 2012, there are a fair number of older, dated outstanding checks that either must be written off or will be cancelled, then reissued as a final attempt to get the payee to cash such checks. Ultimately, if not cashed and

such expenditures reversed, our book cash balances will improve to that extent. We are working with Counsel as to disposition of un-cashed contribution refund checks (generally remitted to the U.S. Treasury) and as to other un-cashed checks. We also have a substantial cash transfer required (approximately $70,000) due to prior period federal and state cost allocation adjustments that will move cash from the federal to the state account. This transfer (or transfers), which is expected to occur in June or early July of this year, will be partially offset with re-allocated personnel costs, previously accounted for as exclusively federal expenditures, but now partially allocated to state activities based upon guidance received from the Minnesota State Campaign Finance and Public Disclosure Board staff. We continue to make our required debt service payments, retiring the F.E.C. penalty note ($15,000 monthly) and the Alliance Bank note payable at approximately $3,500 monthly (principal reduction). Trade accounts payable grew slightly from January 31st to February 29th from approximately $957,000 to approximately $982,000, respectively (approximately 80% allocated to federal activity). There is nothing unusual to report here other than what has already been discussed except that we continue to be in a precarious working capital position. Consequently, please note that we are not paying our office lease rent payment currently (but have been in discussions with our landlord) and have not yet negotiated long-term payment schedules and/or negotiated settlements relating to most of the vendors on the accounts payable aging (see accompanying financial statements and schedules for summary accounts payable aging reports as of February 29 and January 31, 2012). We continue to refine our monthly accounting period closing process which has been somewhat of a challenge given the many cooks in the kitchen. Our monthly reporting procedures are substantially more complicated due to the federal and state transaction reporting requirements that are not always in accordance with generally accepted accounting principles. Further, staff and our outside compliance firm, F.E.C. Cardinals are not yet used to the new procedures Ive set up to require a firm closing date after which no entries can be made to prior periods. This is obviously necessary so that reports issued to the Executive Committee are indeed final. In that regard, please note a small difference in the January 2012 results of operations and certain balance sheet amounts as of January 31, 2011 due to a late (while immaterial) posting issue. As the months go on, well have this process working effectively. OPERATIONS: For the month ended February 29, 2012, RPM incurred a loss of approximately $8,000 but for the year-to-date period then ended has earned approximately $34,000. A key fact to take away from the accompanying Statements of Revenues and Expenses is that while net revenues (contributions and other income, net of related fund raising expenses) are substantially below budget for the fiscal month of February and on a year-to-date basis ($155,000 and $125,000 negative variances, respectively), total expenses are also below budget ($74,000 and $66,000

for the month and year-to-date ended February 29, 2012, respectively), partially offsetting the negative net revenue variance. Such financial results caused a negative variance in net earnings for the year as actual earnings were less than the budget on a year-to-date basis by approximately $58,000 ($81,000 for the month of February 2012). Having said this, I believe its a fair statement to remind us that the 2012 five month budget was perhaps not prepared in a detailed manner, certainly on a month to month basis and thus we shouldnt be focused solely on actual to budget results at least only over two months. Fund raising is the key and we need to generate adequate (substantial) net earnings every month in order to not only retire our debt, but to retire our significant trade accounts payable balance as referred to above. Finally, the importance of Major Donor programs historically and on-going cannot be over-emphasized, as again reflected in both January and February 2012 results of operations. Finally, as I referenced at the February 2012 Executive Committee meeting, I had not had a chance to review the 2012, five month budget in detail prior to publishing the January 2012 financial statements. A significant data entry error was discovered subsequently that had overstated the reported budget amounts reflected in the January 2012 financial statements. Such error has been corrected and is now reflected properly for both the months of January and February 2012 in the accompanying financial statement report. We need to be working on our 2012 stub period (June 2012-December 2012) and preferably a 2013 budget soon. Also, as noted at the February Executive Committee meeting, there are two months office rent expense reflected in the January 2012 financial statements (for January and February 2012). Again, we are working to clean up our monthly closing process to assure all period expenses are reflected in the proper month. I did not re-state the January financial statements due to consistency reporting issues with previously filed F.E.C reports but had we done so, both January and February would have had an excess of revenues over expenses (net income). Full-time-equivalents (FTEs) and contributor number information are not yet available. We will add in future reports. OTHER ACTIVITIES: We continue to be very busy in the Finance Department with not only our day to day activities including the essential fund raising processes that are critical to the short and long-term success of the RPM, but continue to make progress in terms of implementing new accounting and reporting processes, procedures and internal controls as will be more formally documented via the RPM Financial Controls Committee documents to follow prior to the RPM State Convention in May. We have filed all 2011 monthly F.E.C amendments as well as the amended Minnesota State Campaign Finance and Public Disclosure Board (CFB) year-end reports for 2011 and 2010. We are working closely through counsel and directly with the F.E.C. and C.F.B on a number of

reporting issues such as proper accounting and disclosure of invoices not received in the case of CFB reporting and personnel cost allocations between federal and state accounts, among others. We have responded in writing to both the federal CREW complaint and the CFB Common Cause complaint as well as additional requests for information from the CFB in this regard. Finally, I want to commend Mr. Ron Huettl, Finance Director for his professionalism and his day to day commitment to helping me implement the new processes referred to above. Bob Wyant, our outside accountant has done great, detailed work to get our supporting documentation, vendor analysis and general ledger in good order. Also, much thanks goes to our outside federal and state compliance legal counsel(s) and to Mr. Mike Vekich for his assistance in dealing with several of our more troublesome past due vendor accounts as well as other matters. I apologize for not being able to attend the March 2012 Executive Committee meeting. Please do not hesitate to contact me anytime with your questions and comments.

Das könnte Ihnen auch gefallen

- EMCEE ScriptDokument3 SeitenEMCEE ScriptSunshine Garson84% (31)

- Before The Judge - Roger EDokument26 SeitenBefore The Judge - Roger ELexLuther1776100% (4)

- TO 1C-130H-2-33GS-00-1: Lighting SystemDokument430 SeitenTO 1C-130H-2-33GS-00-1: Lighting SystemLuis Francisco Montenegro Garcia100% (1)

- Chillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266Dokument31 SeitenChillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266mostafaabdelrazikNoch keine Bewertungen

- ThesisDokument44 SeitenThesisjagritiNoch keine Bewertungen

- Stephentown Audit by NYS ComptrollerDokument19 SeitenStephentown Audit by NYS ComptrollereppelmannrNoch keine Bewertungen

- 2011 Quick StartDokument24 Seiten2011 Quick StartNick ReismanNoch keine Bewertungen

- HUD Audit ReportDokument126 SeitenHUD Audit ReportIVN.us EditorNoch keine Bewertungen

- Houston Works Audit ResponseDokument45 SeitenHouston Works Audit ResponseTexas Watchdog100% (1)

- Budget Response FY 2012 FINALDokument17 SeitenBudget Response FY 2012 FINALCeleste KatzNoch keine Bewertungen

- Nov 2010 Financial Plan InstructionsDokument2 SeitenNov 2010 Financial Plan InstructionsCeleste KatzNoch keine Bewertungen

- Income Tax Practical FAQDokument4 SeitenIncome Tax Practical FAQHasidul Islam ImranNoch keine Bewertungen

- Office of The State Comptroller: Executive SummaryDokument12 SeitenOffice of The State Comptroller: Executive SummaryNick ReismanNoch keine Bewertungen

- United States General Accounting Office Washington, DC 20548Dokument15 SeitenUnited States General Accounting Office Washington, DC 20548Cucumber IsHealthy96Noch keine Bewertungen

- ACCT567 W2 CaseStudyDokument6 SeitenACCT567 W2 CaseStudyPetra0% (1)

- Dutchess County AuditDokument15 SeitenDutchess County AuditDaily FreemanNoch keine Bewertungen

- What Is Meant by R2R? R2R Plays A Vital Role in The Company, Collecting Data and PostingDokument12 SeitenWhat Is Meant by R2R? R2R Plays A Vital Role in The Company, Collecting Data and PostingRAM SUBBAREDDYNoch keine Bewertungen

- Miami Dade County, Florida Appropriations General Obligation Joint Criteria Miscellaneous Tax Moral ObligationDokument7 SeitenMiami Dade County, Florida Appropriations General Obligation Joint Criteria Miscellaneous Tax Moral ObligationTim ElfrinkNoch keine Bewertungen

- Introduction To Adjusting Entries DDokument14 SeitenIntroduction To Adjusting Entries DYuj Cuares Cervantes100% (1)

- Dumont 2010 Audit ReportDokument112 SeitenDumont 2010 Audit ReportA Better Dumont (NJ, USA)Noch keine Bewertungen

- Multiplan Empreendimentos Imobiliários S.ADokument126 SeitenMultiplan Empreendimentos Imobiliários S.AMultiplan RINoch keine Bewertungen

- 2014-15 Financial Plan Enacted BudgetDokument37 Seiten2014-15 Financial Plan Enacted BudgetjspectorNoch keine Bewertungen

- 2016owsleyfec PRDokument10 Seiten2016owsleyfec PRLynnette CooneyNoch keine Bewertungen

- Quarterly Budget Report: City of ChicagoDokument14 SeitenQuarterly Budget Report: City of ChicagoZoe GallandNoch keine Bewertungen

- Nihal Joshi - SOPDokument6 SeitenNihal Joshi - SOPNihal JoshiNoch keine Bewertungen

- Mount Pleasant AuditDokument14 SeitenMount Pleasant AuditCara MatthewsNoch keine Bewertungen

- Controller Accounting Manager Non Profit in NYC NY Resume Mila BudilovskayaDokument2 SeitenController Accounting Manager Non Profit in NYC NY Resume Mila BudilovskayaMilaBudilovskayaNoch keine Bewertungen

- Accrual Accounting ProcessDokument52 SeitenAccrual Accounting ProcessAnanda RamanNoch keine Bewertungen

- 2021ElliottFEC PRDokument12 Seiten2021ElliottFEC PRWYMT TelevisionNoch keine Bewertungen

- FHA 2010 Independent AuditDokument78 SeitenFHA 2010 Independent AuditJylly JakesNoch keine Bewertungen

- Rev Review Memo June 2014Dokument1 SeiteRev Review Memo June 2014tom_scheckNoch keine Bewertungen

- Livingston County Adopted Budget (2023)Dokument401 SeitenLivingston County Adopted Budget (2023)Watertown Daily TimesNoch keine Bewertungen

- Quickstart 2013-14Dokument29 SeitenQuickstart 2013-14Nick ReismanNoch keine Bewertungen

- Lakeport City Council - Final BudgetDokument119 SeitenLakeport City Council - Final BudgetLakeCoNewsNoch keine Bewertungen

- Review of FY 2013 Mid-Year Budget Monitoring ReportDokument22 SeitenReview of FY 2013 Mid-Year Budget Monitoring Reportapi-27500850Noch keine Bewertungen

- Parkway East Audit 2011Dokument32 SeitenParkway East Audit 2011the kingfishNoch keine Bewertungen

- August 18 2011 FD MemoDokument8 SeitenAugust 18 2011 FD MemoMy-Acts Of-SeditionNoch keine Bewertungen

- Financial Accounting Ch05Dokument28 SeitenFinancial Accounting Ch05Diana FuNoch keine Bewertungen

- Report On The State Fiscal Year 2014 - 15 Enacted Budget Financial Plan and The Capital Program and Financing PlanDokument37 SeitenReport On The State Fiscal Year 2014 - 15 Enacted Budget Financial Plan and The Capital Program and Financing PlanRick KarlinNoch keine Bewertungen

- Audit 2011Dokument60 SeitenAudit 2011salidaschoolsNoch keine Bewertungen

- 2013 Revenue Collections Memo Feb 2013Dokument1 Seite2013 Revenue Collections Memo Feb 2013tom_scheckNoch keine Bewertungen

- Audited ReportDokument34 SeitenAudited Reportcares_2012Noch keine Bewertungen

- NY CashflowcrunchDokument8 SeitenNY CashflowcrunchZerohedgeNoch keine Bewertungen

- New York State: Financial Plan For Fiscal Year 2012 First Quarterly UpdateDokument28 SeitenNew York State: Financial Plan For Fiscal Year 2012 First Quarterly UpdateNick ReismanNoch keine Bewertungen

- Chapter Four Monthly ReportsDokument34 SeitenChapter Four Monthly ReportsGirmaNoch keine Bewertungen

- 2018BreathittFFES PRDokument11 Seiten2018BreathittFFES PRWYMT TelevisionNoch keine Bewertungen

- Description: Tags: DirectloanmonthDokument2 SeitenDescription: Tags: Directloanmonthanon-675914Noch keine Bewertungen

- Sample Management Discussion and Analysis (MD&A)Dokument11 SeitenSample Management Discussion and Analysis (MD&A)anon_74283448Noch keine Bewertungen

- Leon County District School Board: For The Fiscal Year Ended June 30, 2011Dokument85 SeitenLeon County District School Board: For The Fiscal Year Ended June 30, 2011ChrisNoch keine Bewertungen

- Information BsDokument6 SeitenInformation BsFrankieNoch keine Bewertungen

- Office of The State Comptroller: Executive SummaryDokument12 SeitenOffice of The State Comptroller: Executive SummaryJon CampbellNoch keine Bewertungen

- Pamelia AuditDokument21 SeitenPamelia AuditWatertown Daily TimesNoch keine Bewertungen

- January 2010 Financial Plan LetterDokument2 SeitenJanuary 2010 Financial Plan LetterElizabeth BenjaminNoch keine Bewertungen

- Everett School District Audit Exit Conference DocumentDokument6 SeitenEverett School District Audit Exit Conference DocumentJessica OlsonNoch keine Bewertungen

- Funds Flow StatementDokument3 SeitenFunds Flow StatementKalappa LavanyaNoch keine Bewertungen

- Case StudyDokument6 SeitenCase StudyErik PetersonNoch keine Bewertungen

- Governor Withholding ReportDokument4 SeitenGovernor Withholding ReportColumbia Daily TribuneNoch keine Bewertungen

- Shandaken Payroll AuditDokument15 SeitenShandaken Payroll AuditDaily FreemanNoch keine Bewertungen

- CH 11Dokument3 SeitenCH 11vivienNoch keine Bewertungen

- Commission of Inquiry Report 4 - 4Dokument8 SeitenCommission of Inquiry Report 4 - 4michael_olson6605Noch keine Bewertungen

- 2016 17 Enacted Budget Report PDFDokument74 Seiten2016 17 Enacted Budget Report PDFNick ReismanNoch keine Bewertungen

- June 2012 Business Entity Concept: Accounting ImplicationsDokument5 SeitenJune 2012 Business Entity Concept: Accounting ImplicationsAnonymous NSNpGa3T93Noch keine Bewertungen

- Economic & Budget Forecast Workbook: Economic workbook with worksheetVon EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNoch keine Bewertungen

- Dda 2020Dokument32 SeitenDda 2020GetGuidanceNoch keine Bewertungen

- Travisa India ETA v5Dokument4 SeitenTravisa India ETA v5Chamith KarunadharaNoch keine Bewertungen

- NPS Completed ProjectDokument53 SeitenNPS Completed ProjectAkshitha KulalNoch keine Bewertungen

- EAD-533 Topic 3 - Clinical Field Experience A - Leadership AssessmentDokument4 SeitenEAD-533 Topic 3 - Clinical Field Experience A - Leadership Assessmentefrain silvaNoch keine Bewertungen

- Analysis of Business EnvironmentDokument6 SeitenAnalysis of Business EnvironmentLapi Boy MicsNoch keine Bewertungen

- Letter To Singaravelu by M N Roy 1925Dokument1 SeiteLetter To Singaravelu by M N Roy 1925Avinash BhaleNoch keine Bewertungen

- Susan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDokument2 SeitenSusan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDouglas MuthNoch keine Bewertungen

- Savage Worlds - Space 1889 - London Bridge Has Fallen Down PDFDokument29 SeitenSavage Worlds - Space 1889 - London Bridge Has Fallen Down PDFPablo Franco100% (6)

- Fillomena, Harrold T.: ObjectiveDokument3 SeitenFillomena, Harrold T.: ObjectiveHarrold FillomenaNoch keine Bewertungen

- Au L 53229 Introduction To Persuasive Text Powerpoint - Ver - 1Dokument13 SeitenAu L 53229 Introduction To Persuasive Text Powerpoint - Ver - 1Gacha Path:3Noch keine Bewertungen

- Chapter 2 - AuditDokument26 SeitenChapter 2 - AuditMisshtaCNoch keine Bewertungen

- Upcoming Book of Hotel LeelaDokument295 SeitenUpcoming Book of Hotel LeelaAshok Kr MurmuNoch keine Bewertungen

- Facts:: Topic: Serious Misconduct and Wilfull DisobedienceDokument3 SeitenFacts:: Topic: Serious Misconduct and Wilfull DisobedienceRochelle Othin Odsinada MarquesesNoch keine Bewertungen

- PPG Melc 4Dokument17 SeitenPPG Melc 4Jov EstradaNoch keine Bewertungen

- EIB Pan-European Guarantee Fund - Methodological NoteDokument6 SeitenEIB Pan-European Guarantee Fund - Methodological NoteJimmy SisaNoch keine Bewertungen

- SheenaDokument5 SeitenSheenamahamed hassan kuusoowNoch keine Bewertungen

- (Bloom's Modern Critical Views) (2000)Dokument267 Seiten(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- Variable Costing Case Part A SolutionDokument3 SeitenVariable Costing Case Part A SolutionG, BNoch keine Bewertungen

- Open Quruan 2023 ListDokument6 SeitenOpen Quruan 2023 ListMohamed LaamirNoch keine Bewertungen

- Sailpoint Training Understanding ReportDokument2 SeitenSailpoint Training Understanding ReportKunalGuptaNoch keine Bewertungen

- Tail Lamp Left PDFDokument1 SeiteTail Lamp Left PDFFrancis RodrigueNoch keine Bewertungen

- Metaphors of GlobalizationDokument3 SeitenMetaphors of GlobalizationShara Christile ColanggoNoch keine Bewertungen

- Distribution Logistics Report 2H 2020Dokument21 SeitenDistribution Logistics Report 2H 2020IleanaNoch keine Bewertungen

- SiswaDokument5 SeitenSiswaNurkholis MajidNoch keine Bewertungen

- EthicsDokument11 SeitenEthicsFaizanul HaqNoch keine Bewertungen