Beruflich Dokumente

Kultur Dokumente

Credit Rating Report

Hochgeladen von

Shahnaz86Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Credit Rating Report

Hochgeladen von

Shahnaz86Copyright:

Verfügbare Formate

Credit Rating Report

Grameenphone Limited

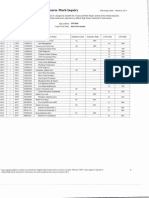

Particulars Grameenphone Limited BDT 13,905.00 million aggregate Fund based limit BDT 22,668.00 million aggregate non-fund based limit ST-Short Term Date of Rating: 05 January 2012 Validity: The Long Term rating is valid up to 31 December 2012 and the Short Term ratings are valid up to limit expiry date of respective credit facilities or 31 December 2012 whichever is earlier. Rating Based on: Audited financial statement up to 30 June 2011, bank liability position as on 30 September 2011, and other relevant quantitative as well as qualitative information up to the date of rating declaration. Methodology: CRABs Corporate Rating Methodology (www.crab.com.bd) Analysts: Sajjad-Bin-Siraj sbsiraj@crab.com.bd Md. Hussainul Islam Sajib sajib@crab.com.bd Financial Highlights: Financial highlights (Mil. BDT) H1 2011 Assets Revenue EBITDA Capital Expenditure Fund flow from operation (FFO) Retained cash flow (RCF) Free cash flow (FCF) Interest expense/(income) Total liabilities Equity PROFILE Grameenphone Limited (hereinafter referred to as GP or the Company) is a GSM based mobile its telecommunication service provider started (788.05) 61,824.85 45,716.72 (593.47) 61,470.31 48,031.83 The telecom sector of Bangladesh has been experiencing a healthy growth during recent years. The growth has been fueled by intense competition and subscriber base. While countrys tele-density stands at around 40.69% as of December 2010, there lie sound growth prospects for mobile operators. Pricing competition among the wireless operators has been intense and pressured operating margins as the markets are mostly maturing. In addition, average revenue per user in most markets has continued RATIONALE Credit Rating Agency of Bangladesh Limited (CRAB) has reaffirmed AAA (Pronounced as Triple A) rating of Grameenphone Ltd based on the recent performances. to decline, especially in emerging markets, as subscriber growth is coming from lowsegment users. However, threats from the smaller operators are expected to subside as their profitability and cash flows are vulnerable due to their low economics of scale and limited financial flexibility to weather the current economic turmoil. 27,738.82 17,384.39 8,081.38 107,541.57 43,404.14 21,980.78 4,179.80 2010 109,502.14 74,733.08 37,000.80 9,303.01 The AAA rating of GP is underpinned by its sustaining revenue growth, leading market position despite intense competition in the telecommunication industry of Bangladesh-a result of comprehensive network coverage, wide product range, increasing business volume, comfortable profit margins, positive cash flows and low credit risk profile. The rating recognizes the support of the sponsorTelenor a leading telecommunications company of Norway listed in the Oslo stock exchange having operation in Sweden, Denmark, Hungary, Russia, Ukraine, Serbia, Montenegro, Thailand, Malaysia, Pakistan and India with more than 174 million mobile subscriptions worldwide as of December 31, 2009. The rating of GP is further supported by the strengthening governance structure of GP emanating from oversight of its board and robust internal control framework. Ratings AAA ST-1 for Details ST-1 Remarks

operation on 26 March 1997. As of December 2010, GP had a subscriber base of 29.97 million ranking as the largest mobile operator in the telecommunication industry of Bangladesh. GPs cellular network in the country covers 98% of country's population through 13,000 base stations in more than 7,200 locations.

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 1 of 24

CRAB Rating Report

that resulted in expansion of both network coverage

Telecommunication

See Appendix-1

Grameenphone Ltd.

As a result, while we expect further erosion of operating margins, it will be at a moderate rate and major operators are likely to keep the margins at their previous level. GPs rating has been reaffirmed owing to its sustaining strong financial muscle, proactive strategy to capitalize on opportunity, continuity of its leadership in the market share of the telecommunication industry, its entrance in the capital market of Bangladesh, highly qualified management team, governance structures as well as the social responsibility it undertakes in its business operation in Bangladesh. GP has shown 14.45% growth in the top line in 2010 amounting to BDT 74,733.08 million, mainly supported by the promotional campaigns through 244% higher selling and distribution expenses than that of 2009 (BDT 8,487.23 million).GPs EBITDA margin has gone down in 2010 largely due to increase in selling and distribution expenses squeezing the EBITDA margin to 49.51% in 2010 from 57.04% in 2009. The decline in EBITDA margin can be traced out from the inflated EBITDA reported in 2009 and 2008 which actually resulted from high depreciation charged being carried down from high CAPEX in the period 2005-2009. The bottom line profitability has also been lower after tax; however, when compared with industry players it stands out to be in the leading position. GPs CAPEX have slowed down as its CAPEX/Revenue has been 12.45% in 2010 (2009: 24.46%, 2008:37.81%, 2007:56.11%). However, the CAPEX is likely to go up in 2011onwards as 2G license renewal falls due. GPs liquidity has been comfortable with positive free cash flows since 2008; fund from operation has been healthy too which indicates its good liquidity position and financial flexibility. However the Current ratio and quick ratio were reported as 0.69 times and 0.67times in 2010 as current liabilities dominated over current assets mainly due to income tax payable and provisions which together accounted for 23.67% of total assets. GPs leverage was also sound with very low debt burden a healthy Borrowed Fund to EBITDA of 0.14 times in 2010 and Borrowed fund to Equity of 0.11 times in 2010 that resulted after receiving IPO proceeds. The rating draws comfort from overall low credit risk profile of GP through its extensive debt servicing coverage position.

COMPANY PROFILE

Grameenphone Ltd. (GP) was the first company to introduce GSM technology in Bangladesh when it launched its services on 26 March 1997. GP is market leader in the cellular telecommunication industry of Bangladesh with a market share of 43.66% (Dec 2010) obtained cellular license on November 28, 1996 in Bangladesh from the Ministry of Posts and Telecommunications. GP is a joint venture enterprise between Telenor Mobile Communication AS (55.8%), a telecommunications service provider in Norway, and Grameen Telecom Corporation (34.2%), a non-profit sister concern of the internationally acclaimed micro-credit pioneer Grameen Bank. The other 10% shares belong to general retail and institutional investors. GPs cellular network in the country covers 98% of country's population through 13,000 base stations in more than 7,200 locations. The entire GP network is EDGE/GPRS enabled that provides its subscribers access to Internet and data services from anywhere within the coverage area. TELENOR MOBILE COMMUNICATIONS (TMC) TMC, a company organized under the laws of the kingdom of Norway, seeks to develop and invest in telecommunications solutions through direct and indirect ownership of companies and to enter into national and international alliances relating to telecommunications. It is a subsidiary of Telenor mobile holdings as and an affiliate of Telenor. Telenor as is the leading telecommunications company of Norway listed in the Oslo stock exchange. It owns 55.80% shares of Grameenphone Ltd. Telenor's strong international expansion in recent years has been based on leading-edge expertise, acquired in the Norwegian and Nordic markets, which are among the most highly developed technology markets in the world. It has substantial international operations in mobile telephony, satellite operations and pay television services. In addition to Norway and Bangladesh, Telenor owns mobile telephony companies in Sweden, Denmark, Hungary, Russia, Ukraine, Serbia, Montenegro, Thailand, Malaysia, Pakistan and India with more than 174 million mobile

www.crab.com.bd; www.crabrating.com

Page 2 of 24

Grameenphone Ltd

subscriptions worldwide as of December 31, 2009. Telenor uses the expertise it has gained in its home and international markets for the development of emerging markets like Bangladesh. As part of the conversion of Grameenphone from a private limited to a public limited company, Telenor mobile communications as transferred 10 shares each on may 31, 2007 to its three (3) affiliate organizations namely NYE Telenor Mobilecommunications II as, Norway; Telenor Asia Pte. Ltd., Singapore; and NYE Telenor Mobile communications III as, Norway. GRAMEEN TELECOM Grameen telecom, owns 34.20% of the shares of GP, is a not-for-profit company in Bangladesh, working in close collaboration with Grameen bank, winner of the Nobel peace prize for 2006 along with its founder Professor Muhammad Yunus. The internationally reputed bank for the poor has the most extensive rural banking network and expertise in microfinance. Grameen Telecoms mandate is to provide easy access to GSM cellular services in rural Bangladesh and creating new opportunities for income generation through self-employment by providing villagers, mostly to the poor rural women with access to modern information and communication-based technologies. As part of the conversion of Grameenphone from a private limited to a public limited company, Grameen Telecom transferred one share each on May 31, 2007 to its two affiliate organizations namely Grameen Kalyan and Grameen Shakti.

INDUSTRY OVERVIEW

High Regulatory Risk The regulatory body of telecom industry of Bangladesh Bangladesh Telecom Regulatory Commission (BTRC) dictates to a great extent on credit quality of the telecom issuers. The telecommunications industry of Bangladesh has paved away from the government-owned monopolies. The proliferation of wireless technologies and the global adoption of Internet Protocol (IP) transmissions, intense competition and growing fragmentation have rapidly reshaped the telecommunication industry that had been highly stable for over a century. The telecom industry is likely to remain subject to a high degree of government regulation and oversight because of the essential nature of the product, the demands for high service levels and the high capital costs associated with its infrastructure. This regulation in Bangladesh is dictated through guidelines for renewal of 2G licenses with new terms and conditions, revenue sharing and high license fees. Additional licenses for 3G will be floated at high cost as it has been the case with WIMAX operators as well as similar trends seen in neighbor Indias telecom market. Regulation further can take many forms and may include setting or approving the rates charged for service, determining the barriers surrounding the competitive environment, defining service territories, mandating interconnection and unbundling terms, setting net neutrality principles and enforcing various rules. From a credit standpoint, the regulators ability to mold the framework under which a telecommunications issuer operates is a major influence on credit quality, as it ultimately forms the foundation for the operators to generate returns on their investments. Regulators are keen to bring all telecos under the purview of listed public limited company. The process is on. Within next two to three years all the wireless operators are expected to be listed on the stock exchanges. The market leader GP got listed in the Bangladesh capital market on November 11, 2009. The issue was formally declared for trading on conclusion of signing of the Listing Agreement, which gave the go ahead for the GP shares to begin trading in the Dhaka and Chittagong stock exchanges the same day. Public subscriptions for shares of GP was the biggest public offer in Bangladesh history and mobilized a fund of BDT 4.86 billion with the allocation of nearly 69.5 million shares. The licenses of the four telecom operators, Grameenphone Ltd., Orascom Telecom Bangladesh Ltd., ROBI Axiata (BD) Ltd., and Citycell were due to be renewed in November 2011. The 3G license guideline has not yet been finalized by BTRC, which is also likely to cost a lot as it has been the case of WIMAX operators in Bangladesh and 3G

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 3 of 24

Grameenphone Ltd.

licensees in our neighboring country India. As a result CRAB perceives the regulatory risk of the telecom industry to be high which would affect the creditworthiness of the players through debt led CAPEX. Nevertheless, economic globalization and rapid technological advances are providing regulators with an opportunity to review previous telecommunications mandates. Competition will intensify While Internet Protocol transmission standards present incumbent operators with a tremendous opportunity to deploy new products and features, ongoing technological advancements will create new competitors and embolden existing competitors who lack the legacy cost structure (and in many cases, the service obligations) of the incumbents. This competition for customers is expected to limit pricing flexibility, which in combination with the incremental product development costs and higher marketing expenses, can lead to margin pressure. Wireless operators are themselves being impacted by additional spectrum sales that can increase the overall number of competitors and provide the foundation for the introduction of potentially competing technologies, like WiMAX and LTE. The competition is likely to remain fierce, as overall industry growth slows, phased out 2G licenses are renewed at a hefty cost, and operators brace for another level of capital spending to migrate to 3G technologies. Capital intensity will persist The capital intensive nature of the industry instigates significant investment in network infrastructure for maintenance and the introduction of new services to replace declining legacy products which is likely to be a permanent characteristic of the telecommunications industry. Despite the expanding use of telecommunications networks to deliver a broader array of service offerings the expanding capital spending to elevate the standards of emerging markets like Bangladesh will hinder free cash flow growth. Fast moving technological trends resulting to reduced asset life cycles; together with increased competition, the return on investment is likely to be less certain than has been the case for the industry historically. While the industrys participants range from still strong incumbent carriers to upstart competitors, the following factors are likely to dominate the operators. Consequently, telecommunications providers will need to increase spending on last mile, backhaul and distribution facilities. Wireline operators have a choice of upgrading the last mile copper wire connections to their end users, or deploying fiber connections. While upgrading the copper plant is generally less expensive and quicker to deploy, fiber-based networks are seen as future proof and are significantly less expensive than copper facilities to operate and maintain, once in place. Similar to their wireline brethren, wireless operators are facing a tremendous bandwidth surge, as data and video applications migrate onto wireless networks. Capital deployments in the wireless sector will generally be directed toward acquiring new licenses and enhancing coverage and maintain Quality of Service. Spectrum license acquisitions tend to be large, infrequent occurrences and are directly linked to the Company's long-term business strategy. The source for acquiring the license at auction or for renewal is likely to be from reserves or opting for further debt. In Bangladesh perspective, such license acquisition is likely to impact on leverage position of the operators. Mergers and acquisition activity expected to remain high Merger and acquisition activity in the telecommunications sector is expected to remain high globally. Based on the present penetration rate and high future potentiality, global large operators will find Bangladesh telecommunication market as an attractive investment place. To enter the market, they will find acquisition of existing license more lucrative than acquiring new licenses. In the long run it can be expected that merger and acquisition activity in the telecommunications sector could trigger due to: The benefits of scale and expansion into new markets (either geographically or product wise) will prompt more companies to supplement internal growth and development with acquisitions. The high fixed-cost nature of the industry offers tremendous synergy opportunities for acquirers, while industry consolidation still has ample capacity following a decade-long investment cycle and emergence of new competitors. While M&A activity can lead to revenue diversity and improved margins, debt-financed acquisition activity is a key credit risk that is likely to put pressure on ratings.

www.crab.com.bd; www.crabrating.com Page 4 of 24

Grameenphone Ltd

Telekom Malaysia International (Bangladesh) which commenced operations in Bangladesh in 1997 with the brand name AKTEL was taken over by joint venture between Axiata Group Berhad, Malaysia and NTT DOCOMO INC, Japan. The service name was rebranded as Robi and the company came to be known as Robi Axiata Limited on 28th March 2010. In January 2010, Bharti Airtel Limited, Asias leading integrated telecom services provider, acquired 70% stake in Warid Telecom, Bangladesh, a subsidiary of the UAE-based Abu Dhabi Group. While M&A activity can lead to revenue diversity and improved margins, debt-financed acquisition activity is a key credit risk that is likely to put pressure on future ratings. Market Growth The telephone market of Bangladesh is likely to remain highly profitable. Both markets (wire line and wireless market) are growing and the growth is likely to continue at a consistent rate for next few years i.e. 3-5 years. Industry growth rates, which are increasing, evidence a sector, which is likely overall to qualify as investment grade when considering this characteristic in isolation. Unlike the wireless segment, the growth of wire line segment would not accelerate, however, it is expected that the growth rate of wireline segment would be flat for next few years then it will be declining. The graph below depicts the total subscribers in million along with penetration rate from 2004 to 2010, where the Bangladeshi telecom market shows tremendous potential for growth. Year-to-Year growth rate of subscribers from 2007 to 2010 stands at 65%, 54%, 20% and 31%. Mobile penetration has already exceeded fixed line and is driving the bulk of the growth in terms of incremental subscribers. Chart 1 Mobile market growth

Mobile Market Growth 80 70

Subscribers in MIllion

40.69% 32.04% 32.77%

45% 40% 35% 30%

Penetration Rate

60 50 40 30

20 19.0%

25% 68.64 43.7

52.43

20% 15% 10% 5% 0%

12.0% 6.0% 3.0% 1.10 2002 1.80 2003 3.90 2004 8.90 2005 17.10 28.30

10 0

2006 Year

2007

2008

Penetration

2009

2010

Subscribers

As of December 2010, penetration reached at 40.69% (CRAB estimation), which CRAB earlier forecasted, would reach 40%-50% within the next couple of years. The subscriber growth is evident from the steep rise in the curve thus implying a positive outlook for the telecom operators in Bangladesh. In considering market growth CRAB breaks down the telecommunications industry into cellular, fixed line and integrated players. The regulator does not permit the license holders to operate both in wireline and wireless segment except BTTB, which operates in both. Fixed line growth rates are declining worldwide with many operators at best experiencing flat revenue. Generally a particular industrys own growth correlates closely with economic growth. The telco industrys growth is driven by continued strong organic expansion in the industry itself. The industry growth and its expected growth is at multiples of GDP growth, indicating the industry has not yet reached maturity. CRAB views that growth rates are sustainable. While assessing sustainability of the growth, assessment includes consideration on market demographics. Lower cellular penetration rate is also a good indicator of likely good medium-term growth prospects. Likewise, this situation represents a sound indicator that fixed line operators are likely to experience significant medium term revenue pressure as product substitution remains at an early stage.

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 5 of 24

Grameenphone Ltd.

The characteristics of the target market strongly influence the types of products adopted and the degree of per capita expenditure. On the surface, average revenue per user (ARPU), this correlates positively with per capita GDP and indicates future growth potentiality of the industry as a whole. Nevertheless, product innovation is more critical to sustain cellular growth rates, which are higher than those determined by solely looking at per capita GDP. Market Share GP has been the market leader at a stretch for more than a decade. The mobile telecommunication industry had 68.64 million subscribers in December 2010 of which GPs subscriber base stood at 29.97 million as of December 2010 which is 44% % of the total subscriber in the Industry. The six operators of the Industry had a cumulative net subscriber addition of 4.46 million in the period Jul09 Dec09, 6.15 million net addition in the period Jan10 Jun10, 7.80 million net subscriber additions in the period Jul10-Dec10, which shows a rising trend in mobile penetration. GP possessed an average month on month market share of 44% in the period Jan10 to Dec10. Table 1 Mobile Subscriber of Bangladesh (in million)

Operators/Month GP Robi Axiata Banglalink C itycell Teletalk Airtel Total Dec-07 Dec-08 Dec-09 16.48 20.99 23.26 6.4 8.2 9.29 7.08 10.33 13.87 1.41 1.81 1.95 0.85 0.98 1.07 2.15 2.33 2.99 34.37 44.64 52.43 Jul-10 26.276 11.326 16.804 1.996 1.147 3.296 60.85 Aug-10 Sep-10 27.922 28.654 11.473 11.707 17.549 18.107 1.975 1.907 1.127 1.183 3.42 3.581 63.466 65.139 Oct-10 Nov-10 28.487 28.843 11.845 12.059 18.408 18.843 1.933 1.873 1.224 1.204 3.666 3.797 65.563 66.619 Dec-10 29.97 12.368 19.327 1.811 1.211 3.956 68.643

Market share is important as barriers to entry remain high as it requires vast upfront capital costs to establish a robust network; market acceptance of the products or services of existing competitors. Table 2 Market share movement Operators/Month GP Robi Axiata Banglalink C itycell Teletalk Airtel Total

Jul-10 43% 19% 28% 3% 2% 5% 100%

Aug-10 Sep-10 44% 44% 18% 18% 28% 28% 3% 3% 2% 2% 5% 5% 100% 100%

Oct-10 43% 18% 28% 3% 2% 6% 100%

Nov-10 43% 18% 28% 3% 2% 6% 100%

Dec-10 44% 18% 28% 3% 2% 6% 100%

Month to month market share position reflects that ROBIs stable market share of 28% in from January 2010 to December 2010. On the other hand, Airtel has achieved 6%, OTBL 28%, GP 44%, Citycell 3%, Teletalk 2% market share as of December 2010. It is an indication of competitive market position where best service provider with low cost innovative products would be positioned best. The same picture is depicted from month on month subscriber growth rate, which is plotted below: Table 3 Month to Month Subscriber Growth Rate Operators/Month Jun-10 Jul-10 GP 3.56% -0.70% Robi Axiata 1.28% 2.04% Banglalink 3.27% 4.37% C itycell 0.00% 0.30% Teletalk -2.52% -1.12% Airtel 2.92% 3.97% Industry 2.78% 1.44%

Aug-10 6.26% 1.30% 4.43% -1.05% -1.74% 3.76% 4.31%

Sep-10 2.62% 2.04% 3.18% -3.44% 4.97% 4.71% 2.64%

Oct-10 Nov-10 -0.58% 1.25% 1.18% 1.81% 1.66% 2.36% 1.36% -3.10% 3.47% -1.63% 2.37% 3.57% 0.65% 1.61%

Dec-10 3.91% 2.56% 2.57% -3.31% 0.58% 4.19% 3.04%

In spite of intense competition, we note that GP still has steady and less volatile subscriber growth rate along with its new product offering combined with existing customer relationships. In addition, the mobile telecommunication industry still has potential to accelerate its revenue through diversification of service as a consequence of technological evolution with upcoming superior technology like 3G, wireless broadband etc.

www.crab.com.bd; www.crabrating.com

Page 6 of 24

Grameenphone Ltd

BUSINESS OVERVIEW

Business Model GPs business model dictates to a large degree its ability to generate and sustain operating cash flows and the stability of those flows. Diversification in GP has several different dimensions: product lines, customer segments and geographic reach, all of which enable GP to mitigate the effects of variation in demand or pricing in a given product or market. GPs diversified business model is robust because technological changes continue at a fast pace and an operator with strong wireless business is best positioned to evolve with such changes. The diversified player has a sounder platform for adopting a range of new products. It has the ability to strategically invest in emerging technologies and raise investments, depending on market acceptance of the new technologies, widening the opportunity for success. In assessing the level of competitive challenges, CRAB looks at, among other things, revenue trends, number of players, rate of access line change relative to demand growth as well as gross additions, churn levels and ARPU trends. GP is still a dominant provider of voice and data, with a heavy composition of enterprise customers and strong representation in the wireless market. Leadership Process The Human Resources Division in Grameenphone is geared to meet GPs human resource development and training needs. In spite of its multinational characteristics, it emphasizes more on building local expertise in the telecommunication sector. Local employees are continuously being trained to take on new challenging leadership roles within the organization and fill senior management positions. The process of leadership identification and development at GP begins during the annual appraisal dialogue. Different types of leadership development needs are identified and accordingly relevant development plans are recommended by the supervisors. Some of the leadership development plans include: training, coaching, new tasks/project work, job rotation, secondment in other Telenor operations abroad and others. GP has agreements with the Stockholm School of Economics in Sweden, the Singapore Institute of Management, the Hyderabad-based Indian School of Business and the British Council for providing Management Development training to GP employees. In addition, GP provides educational grants every year to 100 employees encouraging employees to go for higher education. Moreover, programs like communication skills, teamwork, teambuilding, and problem solving and decision-making courses are offered for different level of employees. For the current and upcoming leaders of GP, Telenor CORE Leadership Training is offered every year. This program is designed to help leaders fulfill GP leadership expectations by increasing skills in practical leadership and their motivation to lead. GP focuses on 6 core areas in order to be successful which include Attractive and Easy, Involved Community, Enabling Regulatory Environment, Energized People, Efficient Operation and Motivated and Efficient Business Partners. The Senior Management functions through Management Team, which comprises heads of different department and senior managers. The management values individual excellence as well as team outcome. Senior level management is strongly involved and behind quality improvement within the company. Management function involves planning, communicating, measuring, changing and mentoring. It has clear standard benchmark through which performance is measured and rewarded. Specific guidelines and standards are adopted as part of its leadership process for holding managers accountable for quality, including supervisors and others, which are designed for different levels and functions within the company. GP has defined its leadership expectations based on five intrinsic values of personal and professional conduct. The leadership expectations from the employees are specifically defined in the following manner: Integrity, Operational Excellence, Passion for Business, Change and Constant Renewal and Empowering People. Management is found very supportive and working to form teams throughout the company. Senior managers are communicating clearly the vision and goals behind quality improvement and how it must interact with customers, suppliers, employees, and others in the value chain.

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 7 of 24

Grameenphone Ltd.

Customer focus and continuous quality improvement process are effectively communicated to all employees within the company. The Code of Conduct it has adopted is followed and is applicable for all of its stakeholders, which is also monitored. Senior management is very committed to all continuous improvement efforts. Management and Strategy The effective and efficient management and defined strategy are the ingredients for GPs present strong position in the market. In support of the above, CRAB looks at the organizational structure of the organization, the less dependence of management team on one or more person as well as coherence of the team, the independence of the management from the Board of Directors, and good track record of the management till date in terms of building up solid business mix, maintaining operating efficiency and strengthening the GPs market position. Strategic Planning Strategic Planning process is based on at least next three years scenario analysis. Based on the midterm plan, it also chalks out annual plan at the beginning of each year. Strategic planning is used regularly to develop goals and objectives for improving quality. The organization has established a complete strategic plan for addressing quality improvement, including mission, vision, goals, specific tasks, targets and programs. All levels of the company participate in some form of strategic planning. Employees, suppliers, customers, and other stakeholder groups are actively engaged in strategic planning decisions. Management is found very involved in planning related activities. Overall planning is integrated into lower level planning at business unit levels and department levels for short-term and long-term decisions. Under the umbrella of Management Team, every department and unit has its own team who actively participates in decision-making process. The organization re-aligns or re-engineers the process from time to time to make sure it fits with strategies for work performance. The compensation packages include performance bonuses for every regular employee. Performance bonus is fixed considering companys performance and individual achievements. Company performance is measured through predefined Revenue Target, Market share position as well as EBITA Margin. Individual achievement measures through predefined goals set for each individual by the management as well as performance of the team. The management at the beginning of the year set departmental goals with high priority to low priority level. GP has a dedicated team named Business Intelligence Team which is responsible for collecting and monitoring the business dynamics of the teleco market. Strategic Planning process incorporates the behaviour of its competitors and based on it the brand and product design team offers competitive products and value added services from time to time. Strategic planning includes key performance indicators, surveys, benchmark data, and other quality information to ensure that strategic planning is strong and viable for all parts of the company. Operating plans are developed throughout the entire company, linked to the company's overall strategy. Managers are held accountable for meeting strategic goals. Information and Analysis Fully integrated and highly sophisticated MIS system ensures the high quality data management system of GP. From its fully automated data management system it generates Monthly Financial Report, Management Report, Monthly Executive Summary of the business and operation, ER Accounts, Monthly CAPEX Information, Monthly Divisional Profit and Loss Account, Monthly Divisional MIS, Mid Month Forecasted Financials, and Quarterly Group Cash Flow. All reports are part of decision-making process. Reports incorporate Actual position, Budget Provision and Variance Analysis. Quality related data is fully integrated and distributed easily within the organization. Processes for data and information management are timely, accurate, and useful throughout the entire company. Quality data is readily available for various processes within the company. Data is analyzed and transformed into useful information for identifying new opportunities for improvement. Benchmarks and comparisons are used to drive continuous quality improvements. The organization measures data through its MIS system related to customers, products, supplier performance, financial performance, and employee performance. Through checking the system it is found that data is useful and understandable for decision-making. System generated information is reliable and is distributed to decision

www.crab.com.bd; www.crabrating.com

Page 8 of 24

Grameenphone Ltd

makers on a timely basis. GP as part of its MIS system tracks Market and Statistical Information. It analyses: Monthly operator wise subscriber base and its market share position, market growth trend, operator wise net adds, market share net adds, penetration rate, annualized churn, gross add mixing, churn mixing, subscriber mixing, Minutes of usage, AMPU, APPM services, APPM Airtime, SMS positions, SMS per subscriber etc. GP uses external benchmarks and competitive data to drive improvements, operating performances and planning. Competitive data is also found very extensive. Through its Business Intelligence Team it collects key cost, financial, operating, and other data and translating it into useful information for employees and decision makers, which supports both operating and longterm planning decisions. Human Resources Capital Employee growth plans, including training programs, career development paths, evaluation / self-awareness processes, compensation, empowerment, and measurable results are fully implemented and integrated with strategic planning process. Human Resource Division is part of the Management Team. GP focuses on 6 core factors for its success one of which is Energized People. Very high levels of involvement by employees are visualised in day-to-day operations and planning the business. People work well within teams and across organizational functions. Strong recognition programs are in place for rewarding employees who improve quality. The organization is very sensitive to the needs and requirements of employees, working hard to make sure employees are productive and satisfied. Senior management and middle level managers are very supportive of strong human resource practices to build and develop employees. Work teams and groups are empowered, providing valuable improvements in almost every part of the business. Employees have quick access to data for analysis and sharing of information in most parts of the company. Employee ideas for making improvements is strongly encouraged and acted upon throughout most of the organization. Process Management Processes are well documented and controlled throughout the entire company. Practices are in place to consistently evaluate and improve processes. Critical processes are subject to rigid assessments on a regular basis. Analytical techniques are in place to identify and solve process management issues. Partnerships with suppliers and other stakeholders have been established to better manage processes for the benefit of all players. Design & Introduction of Products and Services: The organization systematically gather customer needs and desires, and then translate these customer inputs into revisions, modifications, and other standards for product and service bundling. Retained highest market share over the last 10 years is a clear indication of its success in product innovation and engineering. In 2010, GP restructured its product offering through package variants to suit different customer needs, for prepaid (Shohoj, Aapon Bondhu, along with Djuice), postpaid (Xplore), besides these there is business solutions targeted to cater corporate needs. In addition to the voice call, other services such as internet packages through EDGE/Data Services, Content Provider Services etc are also tailored considering the need of the customer. New products are launched through market survey and competitors move. To retain and grow its market share GP as its policy evaluate and tries to shorten design processes for new products and services. Production and Delivery Processes: The organization has control over processes, including control over variations and defects in processes that are used for producing and delivering products and services. The organization uses systematic and standard approach to evaluate processes for better quality, defects, and other operating performance attributes. Business and Support Service Processes: The organization manages quality control relates to routine business processes and support services such as human resources, finance, legal, payroll, public relations through pre defined goals and goal achievement indicators as well as variance analysis. The organization structure and its functionality ensure the check and balances among and between the departments and units. Both top down and bottom up feedback system, coherence of the team, compliance department dedicated for resolving grievances as well as quality linked performance bonus help the management to reduce error in business processes.

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 9 of 24

Grameenphone Ltd.

Supplier Quality: GP maintains its code of conduct for all of its stakeholders. It communicates quality standards and requirements to its suppliers and it has a quality assurance process to ensure that suppliers are meeting quality requirements. The Management Team evaluated the quality requirements of the suppliers. It has written procurement policies. The procurement policies are approved by the Board and the Board delegates financial and investment authority to the management based on its position. It was informed that GP at the beginning of the year make a budget of its next 12-month procurement and investment requirements and have it approved in the Board Meeting. Once approved, the management has the authority to implement it within time frame and as per budget (10%+). The organization has a cooperative relationship with its suppliers, including reward programs, certification and other policies, which in turn assist to build long-term relationships. Quality Assurance: The organization has internal audit department, which reports to the Board through CEO. The internal audit function encompasses on financial auditing and control. Besides, product and services audit including systems and processes are also under the purview of internal audit function. It is evident that organization practices regular follow up with assessments and effectively corrects the problem or resolves the issues that were identified. The process is also documented. Operating Results Customer satisfaction and other measurements clearly show high levels of customer satisfaction and loyalty. Overall trends are very positive when it comes to improving processes throughout the entire company, including processes that cut across business functions and stakeholder groups. Any negative trend is immediately acted upon with a plan for turning the trend around. Supplier data also shows strong positive trends in making improvements within the supply chain. Support services have shown solid results in making processes very efficient and effective. Most operating performance indicators are very positive. Comparative measurements and benchmarks reveal that the company is ranked in the top of the industry for most core processes. Most parts of the organization have demonstrated through measurement numerous improvements - better quality, higher productivity, and lower costs. Customer Satisfaction A complete set of customer metrics (surveys, focus groups, exit interviews, etc.) reveals very strong performance for meeting customer needs and requirements. Additionally, measurements are tracking customer repurchase patterns and other behavior relative to the competition and these measurements are also very favorable. Management is very focused on the customer, promoting programs that enhance customer relationships. Senior management is very receptive to new ideas on how to improve customer service. Specific customer related training is available and customers have easy to access resources for resolving their issues. Customer service and relationship training and development is mandated throughout the entire company. The organization is very customer driven, constantly trying to stay connected to the customer for improving quality and service. Products and services have reputations for quality in the eyes of the customer, leading to customer loyalty. Based on the above assessment CRABs qualitative assessment model indicates high quality operating environment prevails in GP. Franchise Value Franchise Value is a critical element in our analysis. The solidity of GPs market standing in telco industry indicates its very high franchise value. The solid and defensive franchise of GP underpins the ability of the institute to generate and sustain recurring earnings, to create economic value and, thus, to preserve and improve risk protection in its chosen market. As such, GP with strong franchise value would be in a better position to withstand prolonged difficult market conditions. Corporate Governance High quality corporate governance of GP reduces the likelihood of future problems and speeds remediation when problems occur. The management team effectively balance Board of Directors, shareholders, creditors and other stakeholders interests. The factors considered in evaluating corporate governance are:

www.crab.com.bd; www.crabrating.com

Page 10 of 24

Grameenphone Ltd

Ownership and Organizational Complexity GP, the largest telecommunications service provider in Bangladesh received its operating license in November 1996 and started its service from 26 March 1997 having shareholding both from local and foreign institutional entities. The Company has authorized capital of BDT 40,000.00 million divided into 4,000 million ordinary shares of BDT 10.00 each. Paid up capital is BDT 13,503.00 million divided into 1350.30 million shares of BDT 10.00 each. Table 4 Shareholding Position of GP as of 30 December 2009 Name of Shareholders Telenor Mobile Communications AS Grameen Telecom General Public and other institutions Total Number of Shares held 753,407,724 461,766,409 135,125,889 1,350,300,022 % of total shareholding 55.80 34.20 10.00 100.00

The Grameenphone network currently has more than 12,700 base stations in operation in over 7,200 locations, bringing almost the entire population under its coverage in all 64 districts. Board & Committees The Directors of the Board are appointed by the Shareholders in the Annual General Meeting (AGM) who are accountable to the Shareholders. The Board is responsible for guiding the Company towards the goal set by the Shareholders. The Board also ensures that Grameenphone Policies & Procedures and Codes of Conduct are implemented and maintained; and the Company adheres to generally accepted principles for the governance and effective control of Company activities. In addition to the other legal guidelines, the Grameenphone Board has also adopted Governance Guidelines for the Board for ensuring better governance in the work and the administration of the Board. The Board of Directors in Grameenphone is comprised of nine members including the Chairman who is elected from amongst the members. In compliance with the Corporate Governance Guidelines issued by the Securities and Exchange Commission (SEC) and as per the provision of the Articles of Association (AoA) of the Company, the Board of Directors in its 101st Board meeting held on March 19, 2010 appointed an Independent Director to the GP Board. The AoA requires the Board to meet at least four times a year and otherwise when duly called for in writing by a Board member or Shareholder. Dates for Board Meetings in the ensuing year are decided in advance and the notice of each Board Meeting is served in writing. Audit Committee The Grameenphone Audit Committee was established in late 2008 as a sub-committee of the Board and has jurisdiction over Grameenphone and its subsidiaries. The audit committee is comprised of three members of the Board including an independent Director. The Chief Executive Officer, the Chief Financial Officer, the Company Secretary and the Head of Internal Audit are permanent invitees to the Audit Committee meetings. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to internal control, financial reporting, risk management, auditing matters and GPs processes of monitoring compliance with applicable legal & regulatory requirements and the Code of Conduct. The Audit Committee Charter as approved by the Board defines the purpose, authority, composition, meetings, duties and responsibilities of the Audit Committee. Treasury Committee This committee consists of two representatives from shareholders and the CFO of GP. All significant financial matters which concern the Board are discussed in this committee in detail. The issues are ultimately forwarded to the Board for their final review and approval. Human Resources Committee This Committee consists of three members who are appointed by the GP Board . The Committee supports the Board in fulfilling its oversight responsibilities with respect to Human Resources policy, including employee performance, motivation, retention, succession matters and Codes of Conduct.

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 11 of 24

Grameenphone Ltd.

Health, Safety, Security and Environment Committee This Committee consists of three members who are appointed by the GP Board. The Committee supports the Board in fulfilling its legal and other obligations with respect to Health, Safety, Security and Environment (HSSE) issues. The Committee also assists the Board in obtaining assurance that appropriate systems are in place to mitigate HSSE risks in relation to the company, employees, vendors etc. Management Team (MT) The management team is the executive committee of Grameenphone managing the affairs of the company. The Management team consists of the CEO and other key leaders across the company. The CEO is the leader of the team. Management team endeavors to achieve the strategic goals & mission of the company set by the board of directors. The Management team meets on a weekly basis to monitor the business performance of the company.

Controls and risk management

The Board and the Management Team ensures the right Governance through following measures: Going Dynamic Management Model Going Dynamic is a strategic management model that focuses on relating strategic ambitions with actions and emphasizes on regular monitoring of the KPIs with a realistic predictive model (rolling forecast). This enables a forward-looking and action oriented approach towards managing the business. The resource allocations are dynamic and are based on the intended actions linked with the strategy. It aims to build a culture of freedom through responsibility and thereby inculcating an entrepreneurial mindset in the organization leading to increased responsiveness to surrounding changes. As opposed to traditional budgets where targets, resource allocation and forecasts are combined, the Going Dynamic concept manages the aforesaid three processes separately. By separating these three processes, the model tries to eliminate the "budget-gaming" and re-focuses on initiatives to minimize the gap between the targets (KPIs) and forecasts and drive business towards ambitions. The corporate level initiatives are cascaded down at divisional & individual levels and reviewed and monitored continuously against the forecasts, which serves as a radar screen, showing the future outcome of actions undertaken. Targets/KPIs are set on relative terms to reflect the changes in business environment and thus ensuring a performance culture focused on attainting strategic ambitions. Resource allocations are aligned with strategic ambitions through the setting of relative KPIs. Financial Reporting Transparency Grameenphone has strong financial reporting procedures in line with the requirements of International Financial Reporting Standard (IFRS), Bangladesh Accounting Standard (BAS) and other local legislations. In Grameenphone financial reports are generated from ERP (Enterprise Resource Planning) system. Apart from the statutory reporting, Grameenphone also maintains regular reporting to its group company Telenor which consolidates all its subsidiaries financial information in its consolidated Financial Statements. Management of Assets Grameenphone is continuously investing in telecom network and other related infrastructure in line with the Company Strategy. To maintain accountability and proper utilization of assets, it complies with clearly defined and approved policies starting from procurement, recording, reporting and up to the level of disposal of assets. To ensure proper safeguarding of assets, physical verification of network assets is conducted periodically on test basis and all risks relating to these assets are properly insured both locally and internationally. Statutory Audit Statutory Audit of the Company is governed by the Companies Act, 1994. The Companies Act explicitly provides guidelines for the appointment, scope of work and retirement of auditors. Shareholders appoint auditors and fix their remuneration in the Annual General Meeting. The auditors also carry out interim audit and review the quarterly financials of the Company. Internal Audit Internal Audit supports the Company to achieve its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of its risk management, control and governance processes. In order to

www.crab.com.bd; www.crabrating.com

Page 12 of 24

Grameenphone Ltd

ensure organizational independence of Internal Audit, the Head of Internal Audit reports functionally to the Audit Committee and administratively to the Chief Executive Officer. Grameenphone Internal Audit is empowered to carry out its activities in Grameenphone and its subsidiaries. Internal Audit activity is governed by the Internal Audit Charter, which is approved by the Board. Grameenphone Internal Audit department discharges its assurance and consulting activities through management of three distinct audit streams: Finance, Technology and General Business processes. Additionally, a separate team is responsible for quality assurance of internal audit activity. A risk-based annual audit plan is in place, which takes into consideration the strategic imperatives and major risks surrounding Grameenphone, while considering pervasive audit needs. Grameenphone Internal Audit also works closely with Telenor Group Internal Audit in sharing knowledge and resources to ensure achievement of internal audit deliverables. Internal Control Grameenphone has established a strong internal control as a part of good Corporate Governance. Board of Directors, Management, and Personnel of the Company ensure sound internal controls to provide reasonable assurance regarding the achievement of Company objectives in the areas of:

Five essential components of Internal Control; Control Environment, Risk Assessment, Control Activities, Information& Communication and Monitoring are embedded into the Governance culture of Grameenphone. Risk Management Risk Management at Grameenphone is concerned with earning competitive returns from the Companys various business activities at acceptable risk level. It supports the Companys competitiveness by developing a culture, practice and structure that systematically recognize and addresses future opportunities whilst managing adverse effects through recognizing risk and acting appropriately upon it. The Company has well defined risk management policy, procedures and processes to mitigate strategic and enterprise level risks. Further to address & manage risk, the Company also works on ensuring, Implementation & good practice of required policies & procedures Controls on different Revenue Assurance & Fraud Management functions

Sarbanes Oxley Compliance Grameenphone has its strong intention to retain solid Financial Accounting & Reporting platform by ensuring effective transactional flows across the Company. To achieve such target a strong set of control points in line with the principles of Internal Control over Financial Reporting (ICFR) has been successfully implemented. These controls are fully aligned with globally recognized apparatus, Sarbanes-Oxley Act 2002. Grameenphone has been SOX compliant for last four consecutive years 2006, 2007, 2008 and 2009. Compliance with Rules & Regulations of the Country As the leaders of a compliant Company, the Management Team of Grameenphone is accountable not only to its Board or Shareholders but also to various external regulatory bodies. These regulatory bodies maintain a close monitoring process on Grameenphone. In this context, the Company provides complete set of financial statements to the Securities and Exchange Commission (SEC), Stock Exchanges, National Board of Revenue (NBR), Registrar of Joint Stock Companies & Firms (RJSC), Bangladesh Telecommunication Regulatory Commission (BTRC) and the Board of Investment (BOI). In order to conduct day to day business Grameenphone has been rendering its best effort to comply with the existing applicable laws of the country as well as with the directives/guidelines of various Government Authorities. Business Continuity Management (BCM) Being the countrys largest communication solution provider Grameenphone feels an immense responsibility for its continuous operation under any circumstances. So to generate resilience in entire business operations

Page 13 of 24

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Grameenphone Ltd.

Grameenphone started practicing world class Business Continuity & Crisis Management since last year to avoid any kind of catastrophic situation and also to uphold the shareholders value. Business Continuity Management is a holistic management process that GP embeds in its business culture by this time with several different methodical approach including disaster recovery planning, business resumption contingency planning, and crisis management planning etc. Last year GP BCCM has reviewed all critical business processes and conducted Business Impact Analysis (BIA) of all these processes and its dependent technology & IT systems. Through this rigorous analysis GP has been able to find out the areas where it needs special attention. After successful completion of BIA, GP has formulated the BCM Strategy, Disaster Recovery Plan, Department of Continuity & Recovery plans. To enhance crisis management capability GP BCCM has also conducted international level Crisis Management Exercise last year at its own crisis management centre which is a separate location built only to handle the crisis or disastrous situations. Many internal & external observers from home and abroad have observed this unique exercise and appreciated this initiative of building robustness in management competence In BCCMs continuous journey it has got many initiatives like to foster business continuity management sense up to regional level, awareness development, practice, rehearse & maintain of entire BCM life cycle in true sense so that GP can leverage its business efficiency and generate more resilience to protect its shareholders value. Codes of Conduct Grameenphone has adopted a clearly defined Codes of Conduct approved by the Board of Directors for securing good business ethics and conduct in all aspects of the Companys activities. The Codes of Conduct are properly communicated to all the employees and others acting on behalf, who are strictly required to abide by it. Restrictions on dealings in GP Shares by Insiders The Company has established policy relating to trading in the GP shares by Directors, Employees and other Insiders. The securities laws also impose restrictions on similar sort of transactions. All the Insiders are prohibited from trading in the GP shares, while in possession of unpublished price sensitive information in relation to the Company during prescribed restricted trading period. Directors and Employees are also required to notify their intention to trade in the GP shares prior to execution of the same. Investors Relation (IR) As the largest public listed corporate house in Bangladesh, Grameenphone always pays great importance to its investors community and their information requirements. With the sincere desire to stay close with investors community, GP has recently established the Investor Relations Department which will bridge the gap between investors and the Company. Institutional investors, security analysts and other members of the professional financial community, have the right to know about GP, its developments and future directions on a broad basis. IR as a specialized department will keep in touch with Investors community on proactive basis and will feed in the pulse of the capital market to the management by maintaining required communication process. The IR department is being headed by Head of Investor Relations with reporting to the Chief Financial Officer. Communications with Shareholders The Company aims to be open and transparent with all stakeholders, including the owners of the Company the Shareholders. Information is communicated to the Shareholders regularly through a number of forums and publications. These include: Annual General Meeting of the Company Quarterly, Half-yearly and the Annual financial statements, which is also posted at Companys website Price Sensitive Disclosure and other disclosures to the SEC, Stock Exchanges and mass shareholders; and Companys website, where the Company announcements, media releases, previous years results etc. are posted under the Investors Relation section The Company has adopted a detailed policy on information disclosure and communication. In compliance with continuous disclosure requirements, the Companys policy is that Shareholders will be informed in a timely manner of all major developments that impact the business of the Company.

www.crab.com.bd; www.crabrating.com

Page 14 of 24

Grameenphone Ltd

Grameenphone believes in transparency and accountability to society as a whole through establishment of efficient and effective Corporate Governance procedure. It also believes that Corporate Governance is a journey not a destination and it needs to be continuously developed and adapted to meet the changing needs of a modern business. Management & Leadership Development GP views employees as their core asset. Pre set goal with performance measurement indicators plays a vital role for the management and leadership development. Telenor Development Process (TDP) has been adopted by GP since 2005. The TDP process aim to set direction, manage performance and develop individual, team and organizational capabilities to deliver business results. Annual management turnover rate is around 8-10% which is viewed a reasonable rate considering the large number of employees and brand strength of GP. Due to brand strength of GP, the employees of GP got the privilege to switch from other corporate in a higher position. Length of services of top management is also a good indicator of GPs high quality corporate environment. GP has a practice to conduct survey in every year where all the employees get the chance of expressing their independent views about the organization, their motivation, processes and improvement opportunities. Internal Value Creation (IVC) contributes to ensuring a fair, transparent and professional working environment in GP. Corporate Social Responsibility GP adopted a framework approach in CSR whereby it aims to play a role in the development process of Bangladesh by, in one hand, introducing services which will ensure higher access to information and public services, and on the other, launching development projects to provide assistance in meeting the basic needs of the poor people. In the process, to bring about sustainable change, GP identified 4 focus areas for possible intervention, i.e. Poverty alleviation, Healthcare, Empowerment, and Education.

Health

Safe Motherhood and Infant Care Project In partnership with Pathfinder International and USAID, Grameenphone has been supporting the Safe Motherhood and Infant Care program since May 2007. Under the program, free comprehensive primary healthcare services are provided to economically disadvantaged pregnant mothers and infants through 320 Smiling Sun clinics located in 61 districts around the country. From inception up to November 2010, 1,765,088 services have been provided to the economically disadvantaged mothers and infants under this program. Four clinic-on-wheels and ten ambulances were handed over to different NGOs of Smiling Sun Network, to increase the accessibility of maternal and infant healthcare services to the hard-to-reach economically disadvantaged population as well as to facilitate home delivery by skilled birth attendants. Under the project, 15,976 deliveries had been conducted by skilled professionals. Free Eye Care Camps Grameenphone, jointly with Sightsavers International, organized free Eye Camps to ensure eye-care services since 2007. In total, 24 such free eye-camps have been organized throughout the country and a total of 36,327 patients were given free eye care support, among them 4,743 patients were administered Intra Ocular lens or cataract surgeries.

Education

Grameen Shikhkha In collaboration with Grameen Shikhkha, an organization of Grameen Bank Family, Grameenphone provides scholarship tomeritorious but underprivileged students through a scholarship fund at different academic levels. Alokdeep, Non-Formal Primary School cum Cyclone Shelter Grameenphone, as part of its rehabilitation plans in the SIDR affected areas, provided financial assistance to build foureducation center-cum-cyclone shelters in the southern belt of the country. These cyclone shelters are used as non formal primary school throughout the year to provide non-formal primary education to underprivileged children of the locality.

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 15 of 24

Grameenphone Ltd.

Environment

GPs Climate project aims to reduce carbon emission, become environment friendly and create a momentum with the community and people. The ambition of the project is to reduce the overall companys carbon footprint by 30% within 2015. One of the major focus areas is to gain energy efficiency in Grameenphone Networks by implementing energy efficient base stations, DC ventilation system and alternative energy solutions. The target of the Company is to deploy solar power system in all the off-grid sites. Currently GP has 15 Green Base Stations and works are going on for deploying solar power system in another 140 sites.

Other Initiatives

Sponsoring Special Olympics Bangladesh GP became the sole sponsor of Special Olympic Bangladesh in 2007 when it provided necessary support and training for the atheletes to participate in the Special Olympics Games 2007 in Beijing, China. In October 2010, National Games of Special Olympic Bangladesh took place through which 80 athletes were selected. Athletes selected in 5th National games will be groomed and nurtured to participate in 2011 Special Olympics International Games to be held in Athens, Greece. Emergency Relief Works A total of 7,000 blankets were distributed in different regions of the country during the cold wave in December 2010. GP employees donated warm clothes and actively participated in the distribution of relief materials. Supporting E-health Ministry of Health and Family Welfare is currently working to implement the computer based health information system for gathering data from rural and other levels to central and sub-national levels. IT is also being scaled up to provide health services to the people through e-health. GP donated 200 computers to the Directorate General of Health Services of the Ministry of Health Services (DGHS) of Ministry of Health and Family Welfare. The computers will be used to digitize the Health Management Information System (HMIS) and to provide e-health services. Risk profile and risk management Due to its Corporate Social Responsibility initiatives GP is able to manage risks effectively which helps to reduce avoidable losses, identify new emerging issues and use positions of leadership as a means to gain competitive advantage. Competitiveness and market positioning Branding of GP draw consumers away from competitors and thereby improve profitability.

TECHNOLOGY

The global telecommunication industry has evolved significantly over the last 10 years, spurred on by regulatory liberalization, technological advancements and the availability of capital. We expect that rapid technological changes will continue to pressure the capital budgets of GP, which means increased risk of asset impairment or obsolescence. The cost of adopting new technology is significant, both in terms of capital required and the risk of failures, which constitutes a key ratings consideration. Alternatively, the analyst observed that there might be a business cost for failing to quickly adopt new technology before competition erodes the incumbents position. So the important features are the duration of development and introduction cycles for major technologies, which is assessed for its likely impact on product competitiveness. To this end asset utilization rate and Fixed Asset Turnover ratio are used to indicate the level of efficient asset utilization. Considering the level of asset size and scale of growth, 68.25% asset utilisation rate and 104.24% fixed asset turnover ratio as of 2010 is quite above that of its peer. Table 5 CAPEX and Revenue ~ Year Ended 31 December ~ (Mil BDT) (Months) CAPEX H1 2011 (6) 4,179.80 2010 (12) 9,303.01 2009 (12) 15,971.23 2008 (12) 23,201.19 2007 (12) 30,470.04

www.crab.com.bd; www.crabrating.com

Page 16 of 24

Grameenphone Ltd

Revenue CAPEX/Revenue (%)

43,404.14 9.63%

74,733.08 12.45%

65,299.57 24.46%

61,358.97 37.81%

54,303.21 56.11%

CRAB assesses the Companys technological risk starts with an evaluation of the lifetime service capabilities and scalability of the Companys existing network architecture. Because the telecom industry is very capital intensive and faces rapid technological innovation, the investment strategy is critical to its future prospects, which is found commensurate in line with present market dynamics. Capital expenditure as percentages of its revenue and the trend indicates that GP has cut down on its capital expenditure in 2010 as compared to its previous years; however, GP being ahead of network coverage as market leader has almost reached optimum level of CAPEX involvement for last few years.

OPERATING PERFORMANCE

GP had healthy revenue growth since its inception supported by its planned and comprehensive CAPEX which has supported its revenue growth. In 2010, the revenue reached at BDT 74,733.08 million from BDT 65,299.57 million in 2009, registering a commendable growth of around 14.45% mainly levered by 244% growth in distribution and selling expenses in 2010. In 2010 the subscriber base of GP stood at 29.97 million from 23.26 million in 2009, registering a growth of 28.85%. The growth has been supported by the big chunk of CAPEX incurred in the period 2005-2009. Table 6 Growth matrix ~ Year Ended 31 December ~ H1 2011 (Months) Revenue (Mil. BDT) Assets (Mil. BDT) Subscriber Base (in million) ARPU (BDT) Growth Rate Revenue Assets Subscriber Base 14.45% 0.31% 28.85% 6.42% 0.89% 10.81% 12.99% 22.31% 27.37% 18.98% 32.51% (6) 43,404.14 107,541.57 33.82 2010 (12) 74,733.08 109,502.14 29.97 231 2009 (12) 65,299.57 109,162.49 23.26 250 2008 (12) 61,358.97 108,194.45 20.99 262 2007 (12) 54,303.21 88,461.04 16.48 329

FINANCIAL STRENGTH ANALYSIS

Table 7 Profitability Ratios ~Year Ended 31 December~ H1 2011 (Months) EBITDA/Average Assets EBIT/Average Assets EBITDA/Sales ROA ROE (6) 20.25% 12.99% 50.64% 6.34% 14.92% 2010 (12) 34.45% 18.81% 49.51% 9.78% 22.29% 2009 (12) 34.27% 18.88% 57.04% 13.71% 29.84% 2008 (12) 31.01% 15.61% 49.70% 2.76% 10.82% 2007 (12) 35.00% 21.60% 50.02% 3.46% 11.72%

The sustaining growth of GPs revenue is commendable. GPs revenue grew by 14.45% in 2010 at the back of 6.82% in 2009 was supported by a growth in subscriber base in 2010 of 28.85% which was 10.81% in 2009, indicating that the revenue was supported by the by the changed package structure, which lead to higher subscriber acquisition although the ARPU has come down to BDT 231 in 2010 from BDT 250 in 2009. Revenue composition of GP was dominated by voice based prepaid client, the diversity of revenue sources of GP was comparatively well balanced as compared to other competitors in the industry. EBITDA margin has been 52.5% average in last five years although it has gone down to 49.51% in 2010 from 57.04% in 2009 contributed mainly by 244% increase in

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012 Page 17 of 24

Grameenphone Ltd.

Selling and distribution expenses that actually pushed up the revenue by promoting the new packages, GP branded handsets as well as data plans/cards launched by GP. The decline in EBITDA can also be explained by the rise in depreciation charged after the high CAPEX incurred in the period 2005-2009; however in 2010, the CAPEX has declined largely as GPs network coverage became extensive to serve the customer need. The ROA and ROE along with bottom line profitability indicators have shown slight decline in 2010 due to high distribution and selling expenses as well as SIM tax subsidy. Fixed asset utilization of GP has been quite high in 2010-104.24% compared to 82.36% in 2009. Further, CAPEX is due to occur for regulatory purpose of 2G license renewal, and 3G license acquisition as directed by BTRC. This is likely to squeeze the total asset utilization further in 2011which stands at 68.25% in 2010 against 59.82% in 2009. Table 8 Financial Indicators ~ Year Ended 31 December ~ (Mil. BDT) (Months) Capital Expenditure EBITDA EBIT Borrowed Fund Fund Flow from Operation (FFO) Retained Cash Flow (RCF) Free Cash Flow (FCF) Net Interest Expense / (Income) Total Liabilities Equity Assets H1 2011 (6) 4179.80 21980.78 14101.41 5214.89 14727.16 -788.05 61824.85 45716.72 107541.57 2010 (12) 9303.01 37000.80 20207.23 5175.50 27738.82 17,384.39 8,081.38 -593.47 61470.31 48031.83 109502.14 2009 (12) 15971.23 37245.20 20518.21 7041.03 31796.55 24928.32 8957.09 1920.44 59008.17 50154.33 109162.49 2008 (12) 23201.19 30494.11 15349.96 18883.99 18354.42 29217.65 6016.46 1805.25 80606.30 27588.16 108194.45 2007 (12) 30470.04 27162.84 16767.01 16383.54 13706.33 21162.78 -9307.27 948.49 62349.93 26111.11 88461.04

As perceived by CRAB from the financial indicators of GP, historically GP has had a steady and sustaining business growth compared to other players in the industry. Although GPs market share has been taken up by other operators due to tariff sensitive customer base, still GP dominates the market share with premium price packages; despite the fact of the losing market share, GP, however managed to keep a sound financial position with dominance of equity over borrowed fund since 2009 and as IPO proceeds entered the equity of GP, debts were offloaded to restore the credit worthiness at an optimum level. GP has been maintaining a comfortable cash flow in the last two years with positive FFO, RCF and FCF. GP has been spending low on its CAPEX 2009 and 2010 as its network coverage has become comprehensive which now requires maintenance much, rather than new setup. GPs flow of funds from operation continues to sustain on the back of steady revenue growth. Table 9 Leverage, Coverage & Cash Flow ~ Year Ended 31 December ~ H1 2011 (Months) FFO/Borrowed Fund (x) FCF/Borrowed Fund (x) RCF/Borrowed Fund(x) (FFO + Interest expenses)/Gross Int. Exp (x) (EBITDA-CAPEX)/Gross Int. Exp. (x) CAPEX/Depreciation Expense (x) Borrowed Fund/EBITDA (x) Borrowed Fund / Equity (x) FFO/Total Liabilities (x) FCF/Total Liabilities (x) RCF/Total Liabilities (x) Total Liabilities/EBITDA (x) (6) 2.82 n/a n/a 33.22 42.43 0.53 0.24 0.11 0.24 n/a n/a 2.81 2010 (12) 5.36 1.56 3.36 31.73 32.37 0.55 0.14 0.11 0.45 0.13 0.28 1.66 2009 (12) 4.52 1.27 3.54 17.75 11.20 0.95 0.19 0.14 0.54 0.15 0.42 1.58 2008 (12) 0.97 0.32 1.55 9.20 3.33 1.53 0.62 0.68 0.23 0.07 0.36 2.64 2007 (12) 0.84 -0.57 1.29 14.45 -3.26 2.93 0.60 0.63 0.22 -0.15 0.34 2.30

Page 18 of 24

www.crab.com.bd; www.crabrating.com

Grameenphone Ltd

Total Liabilities/Equity (x) Debt Ratio (Total Liabilities) (x) Equity to Assets (x) 0.57 0.43 0.56 0.44 0.54 0.46 0.75 0.25 0.70 0.30

CAPEX/Depreciation has declined in 2010 indicating the low CAPEX which led to low debt requirement and thus comfortable leverage status of the Company. GP leverage position is quite comfortable with Borrowed Fund to Equity of 0.11 times and 0.14 times in 2010 and 2009 respectively. Borrowed fund to EBITDA has been 0.14 times and 0.19 times in 2010 and 2009. The borrowed fund has been relatively low as GP got listed in the bourses and CAPEX has declining trend. Due to its comfortable cash flow the FFO/borrowed fund, FCF/Borrowed fund was reported positive in 2010 and 2009, altogether projecting a very low credit risk profile. The coverage position also shows extensive coverage of debt servicing obligation in 2009 and 2010 with (EBITDA-CAPEX)/Gross Interest Expense of 32.37 times and 11.2 times in 2010 and 2009 respectively. Table 10 Liquidity ~ Year Ended 31 December ~ H1 2011 (Months) Current Ratio (x) Quick Ratio (x) Inventory to Net Working Capital (x) Days of Inventory (days) Accounts Receivable Turnover (x) Average Collection period (days) Accounts payable period (days) (6) 0.67 0.66 -0.04 12 10.86 33 167 0.69 0.67 -0.06 8 14.24 25 102 0.57 0.56 -0.03 5 13.90 26 52 0.28 0.27 -0.01 5 14.80 24 43 0.18 0.16 -0.03 12 19.92 18 120 2010 2009 2008 2007

GPs working capital management has been devised to keep its cash flow at a comfortable position, however GPs payables days has been extended in 2010 to 102 days from 52 days in 2009. The current and quick ratios indicate the dominance of current liabilities over current assets where current liabilities comprised of mostly payables in form of provision, followed by tax payable. The working capital management of GP is quite aggressive which is supplemented by the flexibility derived from its access to short term external fund mainly caused by blockage of fund for the sake of provisions maintained and income tax payable which accounted for 9.3% and 14.37% of total assets respectively.

BANK LIABILITY STATUS OF GRAMEENPHONE LTD.

GP enjoys BDT 6,450.00 million funded limit and BDT 14,230.00 million non fund based limit from different banks. The summary of loans availed by GP is shown in Table 11. Table 11 Bank Liability Status of Grameenphone Ltd. (Facility Status as on 30th September 2011) (Mil. BDT) Name bank

Standard Chartered Bank Citibank N.A. HSBC Commercial Bank of Ceylon Eastern Bank Ltd Dutch Bangla Bank Ltd

of

the

Total facility Total facility 2000 2800 1600 750 2000 1600 Non-funded facility 1500 2800 1600 500 2000 1600 Funded facility 1500 2100 150 100 1000 685

Actual utilization Non-funded facility 339 333 183 10 1160 36 Funded facility 0 0 0 0 0 0 facility

Available facility Non-funded 1161 2467 1417 740 840 1564 Funded facility 1500 2100 150 100 1000 685

CRAB I CRAB Ratings on Corporate Credit Digest I February 29, 2012

Page 19 of 24

Grameenphone Ltd.

Pubali Bank Ltd. One Bank Limited Brac Bank Ltd. Dhaka Bank Ltd. Woori Bank Southeast Bank Ltd. The City Bank Ltd. Jamuna Bank Ltd. Trust Bank Ltd. MTBL UCBL Premier Bank Ltd. Bank Alfalah Prime Bank Ltd. Shahjalal Islami Bank Ltd.

2000 660 1300 1200 619 2800 1080 680 680 1,540 2,100 978 525 26,912

1000 660 1300 1200 414 1400 1080 680 400 890 2,100 978 525 37 4 22,668

1000 280 900 600 206 1400 420 280 280 650 900 419 225 13,095

0 96 78 0 323 91 890 4 10 294 14 734 144 4,739

0 0 0 0 0 0 0 0 0 0 0 0 0 0

2000 564 1222 1200 91 2709 190 676 390 1246 2086 244 381 21,188

1000 280 900 600 206 1400 420 280 280 650 900 419 225 13,095

Total

-END OF REPORT-

www.crab.com.bd; www.crabrating.com

Page 20 of 24

Grameenphone Ltd

APPENDIX-1

Bank Liability Status of Grameenphone Ltd. (Facility Status as on 30th September 2011) (Mil. BDT) Name bank

Standard Chartered Bank Citibank N.A. HSBC Commercial Bank of Ceylon Eastern Bank Ltd Dutch Bangla Bank Ltd Pubali Bank Ltd. One Bank Limited Brac Bank Ltd. Dhaka Bank Ltd. Woori Bank Southeast Bank Ltd. The City Bank Ltd. Jamuna Bank Ltd. Trust Bank Ltd. MTBL UCBL Premier Bank Ltd. Bank Alfalah Prime Bank Ltd. Shahjalal Islami Bank Ltd.

of

the

Total facility Total facility 2,000 2,800 1,600 750 2,000 1,600 2,000 660 1,300 1,200 619 2,800 1,080 680 680 1,540 2,100 978 525 26,912 Non-funded facility 1,500 2,800 1,600 500 2,000 1,600 1,000 660 1,300 1,200 414 1,400 1,080 680 400 890 2,100 978 525 37 4 22,668 Funded facility 1500 2100 150 100 1000 685 1000 280 900 600 206 1400 420 280 280 650 900 419 225 13,095

Actual utilization Non-funded facility 339 333 183 10 1160 36 0 96 78 0 323 91 890 4 10 294 14 734 144 4,739 Funded facility 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 facility