Beruflich Dokumente

Kultur Dokumente

Research Questionnaires

Hochgeladen von

Alli Olanrewaju DaudOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Research Questionnaires

Hochgeladen von

Alli Olanrewaju DaudCopyright:

Verfügbare Formate

Obafemi Awolowo University Faculty of Business Administrative MBA Executive, Ile-ife, Osun.

Dear Sir,

RESEARCH QUESTIONNAIRE I am final year MBA student of the above-mentioned University. I am conducting a research on topic The Effects of Micro Financing on SMEs Development in Nigeria. The Micro financing is a financial intermediation of fund to the active poor (including SMEs) in order to create economic benefits to the nations (Nigeria). The information obtained will be used for the purpose of the research only and also be treated with utmost confidentiality.

Part 1: Bio-data of respondent

Names: Sex: Age: (a) below 21yrs (b) below 40yrs (c) 41yrs and above Occupation: (a) Paid Employment Educational Qualification: SSCE ( ). OND/NCE ( ). HND/Bsc. ( ). Post-graduate ( ) Profession ( ). Vocational skills acquired (if any): . Your years of experience on the job/business:

You are to indicate in the table below the sector of the economy which your business belongs:

(b) Self employed

For self-employed only: is your business registered? (Yes) or (No)

SECTIONAL CLASSIFICATION Agriculture & Forestry Mining & Quarry Manufacturing & Food Processing Trade & Commerce Transport Real Estate & Construction Consumer/Personal Health Education Communication

Mark

Part 2

Section A

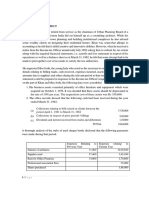

Please read carefully and tick (V) or (X) the appropriate option 1. Do you aware of micro finance bank existence in Nigeria? ( ) Yes ( ) No 2. Do you have bank account(s) with MFBs? ( ) Yes ( ) No 3. Do you aware of MFBs loan/credit products and opportunities available to SMEs? ( ) Yes ( ) No 4. Have you pursuit business loan from any Microfinance banks? ( ) Yes ( ) No 5. if the above is yes, indicate the amount ( ) #0 - #200,000 ( ) #201,000 -#500,000 ( )#501,000 & above 6. Did you meet up with the loan collateral required by MFBs ( ) Yes ( ) No

Section B

Please read carefully and tick (V) the appropriate option SA= strongly A= Agree U= Un-decided D= Disagree SD= Strongly S/N SA A 7 Did you agree that accessibility of Fund through MFIs

to SMEs is easier compare with other finance institutions?

SD

8 9 10

11 12 13 14 15 16

Did you agree that CBN policy on Single Oblique limit (i.e. specific amount to be given to single customers) affect MFBs lending capability? Do you agree that MFI loan procedures and evaluation process are easier compare with commercial banks? Do you agree that non sealing of Lending rate by CBN to MFBs would resulted to higher rate offer to customers compare with commercial banks rates? Do you agree that loan would actually aid your business to attain substantial market share? Do you agree that MFBs are more emphatic on collection of collateral securities from borrowers compare with other Finance institutions? Do you agree that most loans collected by SMEs owners were not purposefully utilised. Do you agree that MFBs relationship with SMEs creates employment opportunities in the economy? Do you agree that Percentage Level of SMEs Goals Achievement using MFIs Loans is higher compare with other finance institutions? Do you agree that MFIs Contributions meaningful towards SMEs Sales and Marketing Activities in Nigeria?

17 18

Do you agree that MFIs provide meaningful financial advisory to SMEs which increase their productivity Do you agree that improved amenities like power will reduce capital and operational expenditures of SMEs?

Das könnte Ihnen auch gefallen

- Microfinance Bank Proposal AjiboyeDokument12 SeitenMicrofinance Bank Proposal AjiboyeYkeOluyomi Olojo81% (16)

- Latif Khan PDFDokument2 SeitenLatif Khan PDFGaurav AroraNoch keine Bewertungen

- Basics of Micro FinanceDokument49 SeitenBasics of Micro FinanceFarasat Khan100% (1)

- Micro FinanceDokument33 SeitenMicro Financemohit katoleNoch keine Bewertungen

- The Functional Microfinance Bank: Strategies for SurvivalVon EverandThe Functional Microfinance Bank: Strategies for SurvivalNoch keine Bewertungen

- Not Profit Organisations - Additional Practice Que. Set - AnswersDokument13 SeitenNot Profit Organisations - Additional Practice Que. Set - AnswersRushikesh100% (1)

- QH1133Dokument8 SeitenQH1133Whitney KellyNoch keine Bewertungen

- AMFI Questionnaire For Due DiligenceDokument7 SeitenAMFI Questionnaire For Due DiligenceHarish Ruparel100% (2)

- Executive Summary: An Agency Always Helps To Sell A ProductDokument6 SeitenExecutive Summary: An Agency Always Helps To Sell A ProductKunal SarkarNoch keine Bewertungen

- Dissertation For Mba Finance StudentsDokument7 SeitenDissertation For Mba Finance StudentsBuyingPapersCanada100% (1)

- Take Home Final DEV572 Fall07Dokument2 SeitenTake Home Final DEV572 Fall07api-3733468Noch keine Bewertungen

- IFC SME Banking Guide 2009Dokument80 SeitenIFC SME Banking Guide 2009Chiemezie OhajiNoch keine Bewertungen

- Master Thesis Topics in Finance and BankingDokument8 SeitenMaster Thesis Topics in Finance and Bankingangeladominguezaurora100% (1)

- Performance of Non-Banking Financial Institute (NBFI) in BangladeshDokument78 SeitenPerformance of Non-Banking Financial Institute (NBFI) in BangladeshShohel AhmedNoch keine Bewertungen

- The Questionnaire For MebratuDokument5 SeitenThe Questionnaire For MebratuHope GoNoch keine Bewertungen

- PHD Thesis On Sme FinancingDokument8 SeitenPHD Thesis On Sme Financingmelodyriosstamford100% (2)

- Electa 1-4Dokument64 SeitenElecta 1-4OSSMANOU MUSTAPHANoch keine Bewertungen

- Banking Dissertation TitlesDokument6 SeitenBanking Dissertation TitlesCanIPaySomeoneToWriteMyPaperUK100% (1)

- MNGT 481 HandoutDokument9 SeitenMNGT 481 Handoutapi-313097217Noch keine Bewertungen

- Dissertation Report On Microfinance in IndiaDokument6 SeitenDissertation Report On Microfinance in IndiaPaySomeoneToDoMyPaperCorpusChristi100% (1)

- Recent Trend in Eating Behaviours of UndergraduatesDokument28 SeitenRecent Trend in Eating Behaviours of UndergraduatesIzzy ConceptsNoch keine Bewertungen

- Banking Sector Dissertation TopicsDokument6 SeitenBanking Sector Dissertation TopicsHelpOnWritingAPaperUK100% (1)

- Finance Dissertation Topics For MbaDokument7 SeitenFinance Dissertation Topics For MbaCollegePaperWritersUK100% (1)

- Uzh Master Thesis Banking and FinanceDokument4 SeitenUzh Master Thesis Banking and Financetracywilliamssalem100% (2)

- Master Thesis Investment BankingDokument6 SeitenMaster Thesis Investment Bankingf1t1febysil2100% (2)

- Finance Decument WPS OfficeDokument5 SeitenFinance Decument WPS Officevdav hadhNoch keine Bewertungen

- Dissertation On Retail and Commercial BankingDokument4 SeitenDissertation On Retail and Commercial BankingCustomPaperWritingServiceUK100% (1)

- Mba Banking and Finance Thesis TopicsDokument5 SeitenMba Banking and Finance Thesis Topicsleanneuhlsterlingheights100% (1)

- SMEPDokument14 SeitenSMEPsteveNoch keine Bewertungen

- Thesis Sme FinancingDokument4 SeitenThesis Sme Financingfjda52j0100% (2)

- Training Need of Insurance AgentsDokument10 SeitenTraining Need of Insurance Agentssshikhapari20Noch keine Bewertungen

- Youth Banking Conference 2014Dokument9 SeitenYouth Banking Conference 2014Tlhatlhobo MosienyaneNoch keine Bewertungen

- Dissertation Topics For Finance MbaDokument4 SeitenDissertation Topics For Finance MbaCheapCustomWrittenPapersDesMoines100% (1)

- Dissertation in Finance For MbaDokument8 SeitenDissertation in Finance For MbaFindSomeoneToWriteMyPaperLowell100% (1)

- Marketing ChannelDokument21 SeitenMarketing ChannelNikhil DubeyNoch keine Bewertungen

- Master Thesis Topics International FinanceDokument4 SeitenMaster Thesis Topics International Financekarenstocktontulsa100% (2)

- Entrepreneurship and Small Business Development (Buad 832)Dokument10 SeitenEntrepreneurship and Small Business Development (Buad 832)Denis ClementNoch keine Bewertungen

- Accounting: Finance Awash BankDokument12 SeitenAccounting: Finance Awash Banktilahun asmareNoch keine Bewertungen

- Customer Acquisition and Retention in Non-Banking Finance Companies (NBFC)Dokument13 SeitenCustomer Acquisition and Retention in Non-Banking Finance Companies (NBFC)Hashmi SutariyaNoch keine Bewertungen

- Thesis Topics For Banking and FinanceDokument8 SeitenThesis Topics For Banking and Financebsr3rf42100% (2)

- Dissertation On Smes FinancingDokument5 SeitenDissertation On Smes FinancingBuyPsychologyPapersTulsa100% (1)

- Mba Thesis Topics in Banking and FinanceDokument6 SeitenMba Thesis Topics in Banking and Financegj3vfex5100% (2)

- Synopsis Project ReportDokument6 SeitenSynopsis Project ReportNITIN SINGHNoch keine Bewertungen

- Thesis Banking ManagementDokument5 SeitenThesis Banking Managementangelagarciaalbuquerque100% (2)

- Credit Risk Dissertation TopicsDokument5 SeitenCredit Risk Dissertation TopicsPaperWritingServiceCollegeTulsa100% (1)

- Free Download Dissertation Reports FinanceDokument8 SeitenFree Download Dissertation Reports FinanceCustomWrittenPapersSingapore100% (1)

- Dissertation Retail BankingDokument6 SeitenDissertation Retail BankingPayToWritePapersCanada100% (1)

- Bank Efficiency DissertationDokument4 SeitenBank Efficiency DissertationCustomCollegePaperElgin100% (1)

- Research Papers Mba FinanceDokument5 SeitenResearch Papers Mba Financefyr9a7k6100% (1)

- Financing MicroDokument2 SeitenFinancing MicroKNOWLEDGE CREATORSNoch keine Bewertungen

- Note On 6 Courses For Ces-StcpDokument38 SeitenNote On 6 Courses For Ces-Stcpodededejoan7Noch keine Bewertungen

- Tina Kathatala FinalDokument13 SeitenTina Kathatala FinalSuket DarjiNoch keine Bewertungen

- Dissertation Report On E-BankingDokument8 SeitenDissertation Report On E-BankingCustomNotePaperNewYork100% (1)

- Promotional Role of Development Banks in IndiaDokument3 SeitenPromotional Role of Development Banks in IndiaRaman KumarNoch keine Bewertungen

- NCC Bank Term PaperDokument8 SeitenNCC Bank Term Paperafmzywxfelvqoj100% (1)

- Module 6 IBTDokument3 SeitenModule 6 IBTSha Sha100% (1)

- Thesis On SbiDokument8 SeitenThesis On Sbislqjdoikd100% (2)

- Mba Finance Thesis Topics 2014Dokument6 SeitenMba Finance Thesis Topics 2014qrhxvwljg100% (2)

- Abreham GaromsaDokument129 SeitenAbreham GaromsaTolesa WakgariNoch keine Bewertungen

- Dissertation Topics On Banking SectorDokument6 SeitenDissertation Topics On Banking SectorWriteMyPaperIn3HoursCanada100% (1)

- Credit Risk Management and Profitability ThesisDokument6 SeitenCredit Risk Management and Profitability ThesisCanIPaySomeoneToWriteMyPaperSingapore100% (2)

- Universiti Teknologi Mara Final Examination: CourseDokument7 SeitenUniversiti Teknologi Mara Final Examination: Coursemuhammad ali imranNoch keine Bewertungen

- Tom Brass Unfree Labour As Primitive AcumulationDokument16 SeitenTom Brass Unfree Labour As Primitive AcumulationMauro FazziniNoch keine Bewertungen

- The Challenges and Opportunities For Sustainable BDokument10 SeitenThe Challenges and Opportunities For Sustainable BThabaswini SNoch keine Bewertungen

- FoodpandaDokument10 SeitenFoodpandaMd. Solaiman Khan ShafiNoch keine Bewertungen

- 2018 - GAR Annual ReportDokument211 Seiten2018 - GAR Annual ReportKirstie ImeldaNoch keine Bewertungen

- Compromise, Arrangements, Reconstruction and AmalgamationDokument25 SeitenCompromise, Arrangements, Reconstruction and AmalgamationAshutosh Tiwari100% (1)

- Module 12 - Financial StatementsDokument3 SeitenModule 12 - Financial StatementsGeneen LouiseNoch keine Bewertungen

- Musembi 2017 Commercial BanksDokument82 SeitenMusembi 2017 Commercial Banksvenice paula navarroNoch keine Bewertungen

- Trident's Expertise V1.5Dokument17 SeitenTrident's Expertise V1.5tridentNoch keine Bewertungen

- Entreprunership Chapter 3Dokument12 SeitenEntreprunership Chapter 3fitsumNoch keine Bewertungen

- Hand Out NO 11 Clearing and SettlementDokument9 SeitenHand Out NO 11 Clearing and SettlementAbdul basitNoch keine Bewertungen

- Egyptian Processed Food Sector Development Strategy - ENDokument442 SeitenEgyptian Processed Food Sector Development Strategy - ENReyes Maria Kristina Victoria100% (1)

- Torres Kristine Bsa 2BDokument4 SeitenTorres Kristine Bsa 2Bkristine torresNoch keine Bewertungen

- The Global Interstate SystemDokument12 SeitenThe Global Interstate SystemGina GieNoch keine Bewertungen

- Phase 2 - 420 & 445Dokument60 SeitenPhase 2 - 420 & 445SNoch keine Bewertungen

- By Laws-SheDokument25 SeitenBy Laws-SheSherilyn CastilloNoch keine Bewertungen

- Mah Sing Group Berhad Annual Report 2018 Part 2 PDFDokument211 SeitenMah Sing Group Berhad Annual Report 2018 Part 2 PDFCheong Wei HaoNoch keine Bewertungen

- Bachelor of Business Administration Third Semester Regular Examination, Tabulation Sheet No. 3 September 2022Dokument210 SeitenBachelor of Business Administration Third Semester Regular Examination, Tabulation Sheet No. 3 September 2022sauravNoch keine Bewertungen

- INFOSYSDokument9 SeitenINFOSYSSai VasudevanNoch keine Bewertungen

- Advanced Financial Accounting & Reporting February 9, 2020Dokument8 SeitenAdvanced Financial Accounting & Reporting February 9, 2020Ric John Naquila CabilanNoch keine Bewertungen

- Engaging The Corporate Sector Narayana Murthy CommitteeDokument7 SeitenEngaging The Corporate Sector Narayana Murthy CommitteeMarco SNoch keine Bewertungen

- Assignment Strategic ManagementDokument9 SeitenAssignment Strategic ManagementHarpal PanesarNoch keine Bewertungen

- Forms and Activities of BusinessDokument45 SeitenForms and Activities of Businessandrea jane hinaNoch keine Bewertungen

- 1 Handbook of Business PlanningDokument326 Seiten1 Handbook of Business PlanningjddarreNoch keine Bewertungen

- Customer Relationship ManagementDokument5 SeitenCustomer Relationship ManagementAbhinandan JenaNoch keine Bewertungen

- Professional Photographer Bank StatementDokument6 SeitenProfessional Photographer Bank StatementDhiraj Kumar PradhanNoch keine Bewertungen