Beruflich Dokumente

Kultur Dokumente

Indian Banking & The Road Ahead

Hochgeladen von

Viral ShahOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indian Banking & The Road Ahead

Hochgeladen von

Viral ShahCopyright:

Verfügbare Formate

2011

Indian Banking: Current Status & The Road Ahead

Opportunities & Challenges

Viral Shah 61052 FLAME School of Business 29-Sep-11

Indian Banking: Current Status & The Road Ahead

Table of Contents Sr. No.

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17

Contents

Overview of Indian Banking Structure of Indian Banking History of Indian Banking Current Scenario of Indian Banking Indian Banking: Trends & Developments Indian Banking: Key Statistics Comparing Indian Banks with Chinese Banks Indian Banking Sector Key Drivers Micro Finance in India Universal Banking in India Concerns faced by Indian Banks Trends of the future Opportunities provided by Indian Banking How to meet the challenges faced by Indian Banks Imperatives for Government and Regulations Conclusion Bibliography

Page No.

2 2 5 9 10 12 14 15 15 18 21 24 26 29 31 32 32

Viral Shah 61052

2|Page

Indian Banking: Current Status & The Road Ahead

Overview of the Banking Sector

The banking system in India is significantly different from that of other Asian nations because of the countrys unique geographic, social, and economic characteristics. India has a large population and land size, a diverse culture, and extreme disparities in income, which are marked among its regions. There are high levels of illiteracy among a large percentage of its population but, at the same time, the country has a large reservoir of managerial and technologically advanced talents. Between about 30 and 35 percent of the population resides in metro and urban cities and the rest is spread in several semi-urban and rural centres. The countrys economic policy framework combines socialistic and capitalistic features with a heavy bias towards public sector investment. India has followed the path of growth-led exports rather than the export-led growth of other Asian economies, with emphasis on self-reliance through import substitution. These features are reflected in the structure, size, and diversity of the countrys banking and financial sector. The banking system has had to serve the goals of economic policies enunciated in successive five year development plans, particularly concerning equitable income distribution, balanced regional economic growth, and the reduction and elimination of private sector monopolies in trade and industry. In order for the banking industry to serve as an instrument of state policy, it was subjected to various nationalization schemes in different phases (1955, 1969, and 1980). As a result, banking remained internationally isolated because of preoccupations with domestic priorities, especially massive branch expansion and attracting more people to the system. Moreover, the sector has been assigned the role of providing support to other economic sectors such as agriculture, small-scale industries.

Structure of the Indian Banking System

The Indian Banking industry, which is governed by the Banking Regulation Act of India, 1949 can be broadly classified into two major categories, non-scheduled banks and scheduled banks. Scheduled banks comprise commercial banks and the co-operative banks. In terms of ownership, commercial banks can be further grouped into nationalized banks, the State Bank of India and its group banks, regional rural banks and private sector banks (the old/ new domestic and foreign). These banks have over 84,000 branches spread across the country.

Viral Shah 61052

3|Page

Indian Banking: Current Status & The Road Ahead

Structure of organized Banking in India

Source: Wikipedia

Viral Shah 61052

4|Page

Indian Banking: Current Status & The Road Ahead

Distribution of the number of offices of commercial banks

Sources: Annual RBI review

In the year 2010 total bank branches are 84,604 as compared to 10131 in the year 1970. Rural branches were 3063 in 1970 which increased to 32494 in the year 2010. Rural area branches increased by 10 fold and metropolitan branches increase by more than 14 fold. In the year 1990-91 share of public bank was 90.05 percent which has come down to 70.5 percent in the year 2006-07. At the same time market share of private bank increased to 29.5 percent in the year 2006-07 from 9.95 in 1990-91.

Viral Shah 61052

5|Page

Indian Banking: Current Status & The Road Ahead

History of Banking in India

Pre Independence Era

In, India the ancient Hindu scriptures refer to money lending activities in the Vedic period. In India, in The Ramayana and The Mahabharata eras, banking had become a full fledged activity and during the Smriti period which followed the Vedic period and Epic age, the business of banking was carried on by the members of the Vaish community. Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India which started in 1786, and the Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. Indian merchants in Calcutta established the Union Bank in 1839, but it failed in 1848 as consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India. The presidency banks dominated banking in India but there were also some exchange banks and a number of Indian joint stock banks. All these banks operated in different segments of the economy. The exchange banks, mostly owned by Europeans, concentrated on financing foreign trade. Indian joint stock banks were generally undercapitalized and lacked the experience and maturity to compete with the presidency and exchange banks. The first entirely Indian joint stock bank was the Oudh Commercial Bank, established in 1881 in Faizabad. It failed in 1958. The next was the Punjab National Bank, established in Lahore in 1895, which has survived to the present and is now one of the largest banks in India.

Post Independence Era

In the post-independence period, India observed the emergence of large number of institutions for providing finance to different sectors of the economy. There were two nationalizations of banks in India, one in 1969 and the other in 1980. The entry activities of private sector and foreign banks were restricted through branch licensing and regulation norms.

Viral Shah 61052

6|Page

Indian Banking: Current Status & The Road Ahead

The Government of India played an active part on the economic activities of the nation through the Industrial policy adopted in 1948. This resulted in the GOI taking steps to regulate the Banking sector: The Reserve Bank of India, India's central banking authority, was nationalized on January 1, 1949 under the terms of the Reserve Bank of India (Transfer to Public Ownership) Act, 1948. In 1949, the Banking Regulation Act was enacted which empowered the Reserve Bank of India (RBI) "to regulate, control, and inspect the banks in India." The Banking Regulation Act also provided that no new bank or branch of an existing bank could be opened without a license from the RBI, and no two banks could have common directors.

Nationalization of Banks

India marched towards the establishment of public sector banking through the progressive nationalization of commercial banks. There were three phases of bank nationalization: Nationalization of Imperial Bank of India in1955 and its seven associate banks in 1959-60. Nationalizations of the 14 major commercial banks in 1969. Nationalization of 6 more commercial banks in 1980. On July 1, 1955 the Government of India nationalized the Imperial Bank of India and converted it into the State Bank of India. The establishment of the State Bank of India was a pioneering attempt in introducing public sector banking in the country. Later on in 1959-60, seven subsidiary State Banks were also nationalized to form the SBI Group.

Viral Shah 61052

7|Page

Indian Banking: Current Status & The Road Ahead

For a short period during December 1967 to June 1969, the Government of India pursued the policy of control of banks, aiming at an equitable and purposeful distribution of credit towards developmental needs. In short, nationalization of banks implied a bold and major economic step in the process of banking reforms in the country. It has resulted in the evolution of public sector banking.

Liberalization of Banks

In the early 1990s, the then NarasimhaRao government embarked on a policy of liberalization, licensing a small number of private banks. These came to be known as New Generation tech-savvy banks, and included Global Trust Bank (the first of such new generation banks to be set up), which later amalgamated with Oriental Bank of Commerce, Axis Bank(earlier as UTI Bank), ICICI Bank and HDFC Bank. This move, along with the rapid growth in the economy of India, revitalized the banking sector in India, which has seen rapid growth with strong contribution from all the three sectors of banks, namely, government banks, private banks and foreign banks.

The 1991 report of the Narasimham Committee served as the basis for the initial banking sector reforms. In the following years, reforms covered the areas of interest rate deregulation, directed credit rules, statutory pre-emption and entry deregulation for both domestic and foreign banks. The objective of banking sector reforms was in line with the overall goals of the 1991 economic reforms of opening the economy, giving a greater role to the markets in setting prices and allocating resources, and increasing the role of the private sector. Recommendations of Narasimham committee: 1. Establishment of 4 tier hierarchy for the banking structure with 3 to 4 large banks at the top and rural banks at bottom mainly engaged in agriculture and allied activities. 2. The supervisory functions over banks and financial institutions can be assigned to a quasiautonomous body sponsored by RBI. 3. Phased achievement of 8 % capital adequacy ratio. Abolition of branch licensing policy. Phased reduction in Statutory Liquidity Ratio. Deregulation of interest rates which are related to the bank rate. Competition among financial institutions on a syndicating or participating approach.

Viral Shah 61052

8|Page

Indian Banking: Current Status & The Road Ahead

4. Delegation of direct lending activity of the IDBI to a separate corporate body. Proper classification of assets and full disclosure and transparency of accounts of banks and other financial institutions. 5. Setting up Asset Reconstruction Fund to make over a portion of the loan portfolio of banks whose recovery has become difficulty The most important reforms that followed the banking liberalization were as follows: 1. Statutory Pre-emptions- The degree of financial repression in the Indian banking sector was significantly reduced with the lowering of the CRR and SLR, which were regarded as one of the main causes of the low profitability and high interest rate spreads in the banking system. 2. Priority Sector Lending-Besides the high level of statutory pre-emption, the priority sector advances were identified as one of the major reasons for the below average profitability of Indian banks. The Narasimham Committee therefore recommended a reduction from 40% to 10%. 3. Interest Rate liberalization-Prior to the reforms, interest rates were a tool of crosssubsidization between different sectors of the economy. To achieve this objective, the interest rate structure had grown increasingly complex with both lending and deposit rates set by the RBI. The deregulation of interest rates was a major component of the banking sector reforms that aimed at promoting financial savings and growth of the organized financial system. 4. Entry Barriers-Before the start of the 1991 reforms, there was little effective competition in the Indian banking system for at least two reasons. First, the detailed prescriptions of the RBI concerning for example the setting of interest rates left the banks with limited degrees of freedom to differentiate themselves in the marketplace. Second, India had strict entry restrictions for new banks, which effectively shielded the incumbents from competition. Through the lowering of entry barriers competition significantly increased and seven new private sector banks entered the market between 1994 and 2000. 5. Prudential Norms-The report of the Narasimham Committee was the basis for the strengthening of prudential norms and the supervisory framework. Starting with the guidelines on income recognition, asset classification, provisioning and capital adequacy the RBI issued in 1992/93, there have been continuous efforts to enhance the transparency and accountability of the banking sector. The improvements of the prudential and supervisory framework were accompanied by a paradigm shift from micro-regulation of the banking sector to a strategy of macro-management. The Basel Accords were adopted in April 1992.

Viral Shah 61052

9|Page

Indian Banking: Current Status & The Road Ahead

Current Scenario of Indian Banking

The Indian banking sector comprises of 27 state sector banks, besides a number of private as well as co-operative sector players. The banking sector in India has made significant progress in the last five years the growth is well reflected through parameters including profitability, annual credit growth, and decline in nonperforming assets (NPAs). In the last decade, the sector witnessed many positive developments, as policy makers which comprise the Reserve Bank of India (RBI), Ministry of Finance and associated government and financial sector regulatory entities, made several distinguished efforts to improve regulation. Worth noting is the fact that Indias banking sector has been one of the very few ones that have actually been able to maintain resilience without much impact on the growth process. Growth in the sector has been favoured by factors including low default ratio, strong economic growth, central banks regular intervention and pre-emptive adjustment of monetary policy. Currently the industry is in a transition phase. On one hand, the PSBs, which are the mainstay of the Indian Banking system, are in the process of shedding their flab in terms of excessive manpower, excessive non Performing Assets (NPAs) and excessive governmental equity, while on the other hand the private sector banks are consolidating themselves through Mergers & Acquisitions (M&A). PSBs, which currently account for more than 70% of the total banking industry assets are saddled with NPAs (Rs 7347 crore in 2010), falling revenues from traditional sources, lack of modern technology and a massive workforce while the new private sector banks are forging ahead and rewriting the traditional banking business model by way of their sheer innovation and service. The PSBs are of course currently working out challenging strategies even as 20 percent of their massive employee strength has dwindled in the wake of the successful VRS. The private players however cannot match the PSBs great reach, size and access to low cost deposits. Therefore one of the means for them to combat the PSBs has been through the merger and acquisition (M&A) route. Over the last two years, the industry has witnessed several such instances. Private sector Banks have pioneered internet banking, phone banking, anywhere banking, mobile banking, debit cards, Automatic Teller Machines (ATMs) and combined various other services and integrated them into the mainstream banking arena, while the PSBs are still

Viral Shah 61052

10 | Page

Indian Banking: Current Status & The Road Ahead

grappling with disgruntled employees in the aftermath of successful VRS schemes. Also, following Indias commitment to the WTO agreement in respect of the services sector, foreign banks, including both new and the existing ones, have been permitted to open up to 12 branches a year with effect from 1998-99 as against the earlier stipulation of 8 branches.

Indian Banking: Trends & Developments

The last three decades have demonstrated a significant increase in the size, spread and scope of activities of banks in India. The business profile of banks has changed significantly to include non-traditional activities such as merchant banking, new financial services, mutual funds, etc. The evolution from class banking to mass banking and rising customer focus is immensely changing the landscape of Indian banking.

Payments and banking transactions through mobile phones in India are likely to reach US$350 billion by 2015, according to global management consulting firm, The Boston Consulting Group (BCG). This, in turn, will provide banks, telecom operators, device makers and service providers an opportunity to earn fee income of US$4.5 billion

With an objective of increasing the financial inclusion, the SBI has opened 21 new branches, besides, 101 new Automatic Teller Machines (ATMs) and 400 green channel counters.

Around 350,000 villages spanning the entire India would have access to financial services offered by banks in the next two financial years, according to a plan given by banks to the RBI. RBI has directed banks to ensure that 223,473 villages have access to basic financial services by March 2012

Three local banks have partnered with a global financial technology firm - Polaris Software with its headquarters in India - to establish a joint venture IT Company in Bangladesh. The company would start with providing software solutions to these three banks before selling customised services to other banks, non-bank financial institutions and insurance companies.

Indian Banks have made noteworthy strides post the reforms it implemented after the adoption of Basel I norms post 1992. According to RBI guidelines all Indian Banks have now migrated to the Basel II norms and have achieved a minimum Tier I capital ratio of 6%.

The Reserve Bank of India (RBI), has allowed foreign players to set up branches in rural India and take over weak banks with an investment of up to 74 per cent.

Some of the biggest names in global financial services and banks like Credit Suisse, Rabo Group and ANZ are seeking a banking licence in India. The RBI has, in recent months, given

Viral Shah 61052

11 | Page

Indian Banking: Current Status & The Road Ahead

fresh banking licences to UBS - Switzerland's largest bank, Dresdner Bank and United Overseas Bank. Progress of Banks in India: At a glance

Sources: BCG Analysis The total assets of Indian Banking Industry has increased more than five times between March 2000 and March 2010, from US $ 250 billion to more than $1.3 trillion, registering a CAGR growth of 18% compared to average GDP growth of 7.2% during the same period. Consequently the ratio of commercial banking assets to GDP increased to nearly 100%. The business of banks to GDP ratio has almost doubled- from 68% to 135%.The growth has been profitable with improvement in efficiency and productivity. The return on assets of scheduled commercial banks (SCBs) was 0.6% in 2000-01 and increased to 1.1% by 2009-10. Gross non-performing assets to gross advances declined to 2.5% from 11.4%, reflecting improved asset quality. The capital strength, as measured by the capital adequacy ratio, has also improved from 11.4% in 2000-01 to 14.6% in 2009-10. Banks have added more than 14000 branches and 41000 ATMs to their network in the last decade, besides broadening the scope of delivery channels to internet banking, mobile banking and call centre. Banks have rolled out technology to the advantage of the customers. The growth of Indian banks in the last decade was much higher than its preceding decade and there is no doubt that the present decade would offer even more exciting opportunities.

Viral Shah 61052

12 | Page

Indian Banking: Current Status & The Road Ahead

Indian Banking: Key Statistics

The banking sector in India is well capitalised, with capital ratios being above the global average. The average tier-1 Capital Adequacy Ratio (CAR) of the Indian banking industry is above 10 per cent compared to the Basel III norm of 8.5 per cent including the contingency buffer. Moreover, the Reserve Bank of India, in its Financial Stability Report (FSR) has also asserted that the sector remains well capitalised with both core capital adequacy and leverage ratios at comfortable level. Efficient internal capital generation, fairly active capital markets, and strong support from the government ensured good capitalisation for most banks. The overall CAR reached 14 per cent as on March 31, 2011. High levels of public deposits also ensured a comfortable liquidity profile. The total assets size of the banking industry rose by more than five times between March 2000 and March 2010 - from US$ 250 billion to more than US$ 1.3 trillion - a Compound Annual Growth Rate (CAGR) of 18 per cent compared to the average GDP growth of 7.2 per cent during the same period. During the last five years, while the annual rate of credit growth was 23 per cent, profitability was maintained at around 15 per cent. While the Indian banking sector is characterised by the presence of a large number of players, top 10 banks accounted for a significant 57 per cent share of the total credit as on March 31, 2011. Nationalised banks accounted for 52.2 per cent of the aggregate deposits, with State Bank of India (SBI) and its Associates accounting for 22.1 per cent. The share of new private sector banks, foreign banks, old private sector banks, and regional rural banks in aggregate deposits was 13.3 per cent, 4.8 per cent, 4.6 per cent and 3.0 per cent, respectively, according to RBIs Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks, December 2010. With respect to gross bank credit, nationalised banks had the highest share of 51.6 per cent in the total bank credit. They were followed by SBI and its associates at 22.7 per cent and new private sector banks at 13.7 per cent. Foreign banks, old private sector banks and regional

Viral Shah 61052

13 | Page

Indian Banking: Current Status & The Road Ahead

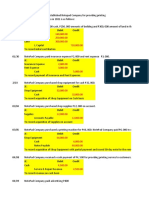

rural banks had comparatively lower shares in the total bank credit at 5.1 per cent, 4.5 per cent and 2.5 per cent, respectively. India's foreign exchange reserves were US$ 314.6 billion as on July 8, 2011, according to the data in the weekly statistical supplement (WSS) released by RBI. Indian banks increases their loan books by 19.9 per cent year-on- year (y-o-y) as of July 1, 2011, according to the central bank's WSS. Deposits rose by 18.4 per cent from a year earlier. Snapshot of Performance of Scheduled Commercial Banks

Sources: PWC Research

Viral Shah 61052

14 | Page

Indian Banking: Current Status & The Road Ahead

Comparing Indian Banking with China

Size- In terms of size Chinas largest bank (Bank of China) is the 11th largest bank in the

world compared to SBI which stands at 93rd. In terms of asset base, Bank of China is over four and a half times bigger than SBI. Its asset base stands at $516 bn compared to SBIs $110 bn. When it comes to Tier I capital Bank of China has $34.8 bn against SBIs $5.8 bn. The top four banks in China, which hold the top four position in Asia also had a Tier I capital of $95 bn- almost three times the capital base of entire Indian Banking industry. Similarly the asset base of the four is $2095 bn, almost four times that of Indian Banks. The collective Tier I capital of 77 Indian Banks was $ 33.7 bn and total asset size was $ 533 bn. If we look at the worlds top 10 banks, the comparison becomes even more glaring. Citigroup, the worlds biggest banking conglomerate, had a Tier I capital worth $ 74 bn with an asset base $1484 bn. Each of the Banks in the global top 10 list has a higher capital and asset base than the entire Indian Banking sector.

Returns on Asset- Despite being small on capital and asset base, Indian banks are way

ahead of their global counterpart when it comes to return on assets. Among the top four Chinese Banks only China Construction Bank has an ROA of 1.29 as against 1.53 for Indian Bank, best amongst Indian banks. Indian Bank is followed by Canara Bank & Andhra bank. Majority of the top 10 global giants have an ROA of less than 1.

Non Performing Assets- An indicator of banking efficiency and industry health is the

Non Performing Assets (NPAs). On this count Indian Banks are way ahead of their Chinese counterparts and on par with their global peers. Global ratio of NPAs to total assets ranges from 0.3% to 3% in developed countries to 10% in Latin American countries. This is in stark contrast to majority of Indian Banks whos net NPAs are less than 1.5%.

Notwithstanding intense competition the expansionary phase of the economy is expected to provide ample opportunities for growth of the banking sector. The growth trajectory, adherence to global best practices and risk management norms are likely to catapult Indian Banking onto the global map, making them a force to reckon with.

Viral Shah 61052

15 | Page

Indian Banking: Current Status & The Road Ahead

Indian Banking Sector Key Drivers

The banking sector in India is expected to have another good year during 2011-12, with growth being propelled by factors such as good economic growth, favourable demographics and low penetration, according to a report titled Indian banks are likely to ride an economic growth wave, by research firm Standard & Poors.

The countrys economy grew by 8.5 per cent in the last fiscal and the government expects the growth impetus to continue this year as well More than 50 per cent of Indias population is under the age of 30 years, which is a major target group for banks

Penetration of banking services in the country remains low. The government has set targets to provide banking facilities to all areas with a population of over 2,000 by March, 2012.

Micro Finance in India

Viral Shah 61052

16 | Page

Indian Banking: Current Status & The Road Ahead

Banking Policy in rural India can be divided into four phases First Phase- The first phase was right after the nationalization of Indias 14 major commercial banks in 1969. The objective of the nationalization of banks was for the state to gain access to new liquidity, particularly among the rich farmers, in the countryside. New objectives for rural banking were declared and were termed as social and development banking Second Phase (late 1970 and early 1980) - This was a period when the rhetoric of land reform was finally discarded by the ruling classes themselves, and the major instruments of official anti-poverty policy were launched for the creation of employment. Thus began a period of directed credit, during which credit was directed towards the weaker sections. Third Phase- This phase, which began in 1991, is that of liberalization. It was recommended that interest rates be deregulated, and capital adequacy norms should be changed to compete with banks globally. Fourth Phase- The current financing policies introduced by RBI to outreach or to penetrate through vast section of population. In November 2005, policies to include all segments of market were incubated.

Future of Micro-finance in India

The Reserve Bank of India in October 2010 set up a Sub-Committee of its Central Board of Directors to study the issues and concerns in microfinance sector, under the Chairmanship of Shri Y H Malegam, a senior member on the Reserve Banks Central Board of Directors. The Sub-Committee has recommended creation of a separate category of NBFCs operating in the microfinance sector to be designated as NBFC-MFIs. To qualify as a NBFC-MFI, the Sub-Committee has stated that the NBFC should be a company which provides financial services pre-dominantly to low-income borrowers, with loans of small amounts, for shortterms, on unsecured basis, mainly for income-generating activities, with repayment schedules which are more frequent than those normally stipulated by commercial banks and which further satisfies the regulations specified in that behalf. The Sub-Committee has also recommended some additional qualifications for NBFC to be classified as NBFC-MFI. These are: 1. The NBFC-MFI will hold not less than 90% of its total assets (other than cash and bank balances and money market instruments) in the form of qualifying assets.

Viral Shah 61052

17 | Page

Indian Banking: Current Status & The Road Ahead

2. There are limits of an annual family income of Rs.50,000 and an individual ceiling on loans to a single borrower of Rs.25,000 3. Not less than 75% of the loans given by the MFI should be for income-generating purposes. 4. There is a restriction on the other services to be provided by the MFI which has to be in accordance with the type of service and the maximum percentage of total income as may be prescribed. The Sub-Committee has recommended that bank lending to NBFCs which qualify as NBFCMFIs will be entitled to priority lending status. With regard to the interest chargeable to the borrower, the Sub-Committee has recommended an average margin cap of 10 per cent for MFIs having a loan portfolio of Rs. 100 crore and of 12 per cent for smaller MFIs and a cap of 24% for interest on individual loans. The Sub-committee has made a number of recommendations to mitigate the problems of multiple-lending, over borrowing, ghost borrowers and coercive methods of recovery. These include: 1. A borrower can be a member of only one Self-Help Group (SHG) or a Joint Liability Group (JLG) 2. Not more than two MFIs can lend to a single borrower 3. There should be a minimum period of moratorium between the disbursement of loan and the commencement of recovery 4. The tenure of the loan must vary with its amount 5. A Credit Information Bureau has to be established 6. The primary responsibility for avoidance of coercive methods of recovery must lie with the MFI and its management 7. The Reserve Bank must prepare a draft Customer Protection Code to be adopted by all MFIs 8. There must be grievance redressal procedures and establishment of ombudsmen 9. All MFIs must observe a specified Code of Corporate Governance

Micro Finance (Development and Regulation) Bill 2010

While reviewing the proposed Micro Finance (Development and Regulation) Bill 2010, the Sub- Committee has recommended that entities governed by the proposed Act should not be allowed to do business of providing thrift services. It has also suggested that NBFC-MFIs should be exempted from the State Money Lending Acts and also that if the

Viral Shah 61052

18 | Page

Indian Banking: Current Status & The Road Ahead

recommendations of the Sub-Committee are accepted; the need for the Andhra Pradesh Micro Finance Institutions (Regulation of Money Lending) Act will not survive.

Drivers for Banks entrance into Microfinance Internal factors

Profit Risk Diversification Excess Liquidity Image Building Cross marketing opportunities Bank leadership Social Responsibility Compatibility with bank strategy or other lines of business

External Factors

Large microenterprise and low-income market Competition Trend or Fad Regulations Donor or Government initiative Market pressure on margin Desertation of traditional Clients

Universal Banking in India

As per the World Bank, "In Universal Banking, large banks operate extensive network of branches, provide many different services, hold several claims on firms(including equity and debt) and participate directly in the Corporat e Governance of firms that rely on the banks for funding or as insurance underwriters". In India Development Financial Institutions (DFIs) and refinancing institutions (RFIs) were meeting specific sectoral needs and also providing long-term

resources at concessional terms, while the commercial banks in general were accepting deposits and providing working capital finance to industry, trade and agriculture. Consequent to the liberalisation and deregulation of financial sector, there has been blurring of distinction between commercial and investment banks. On December 8 th , Reserve Bank of India constituted a Working group under the chairmanship of S.H.Khan to bring about greater clarity in the respective roles of banks and financial institutes for greater harmonisation of facilities and obligations.

Viral Shah 61052

19 | Page

Indian Banking: Current Status & The Road Ahead

SWOT Analysis of Universal Banking in India

Strengths

Economies of Scale- The main advantage of Universal Banking is that it results in greater economic efficiency in the form of lower cost, higher output and better products. This will help banks reduce costs and thereby improve spreads. Profitable Diversion- By diversifying the activities banks can use its expertize in one type of financial service in providing other types. So it entails less cost of performing one function by seprate entities. Resource Mobilization- A bank possesses the information on the risk characteristics of the clients, which it can use to pursue other activities with the same client. A data collection about the market trends, risk and returns associated with portfolios of Mutual Funds, diversifiable and non diversifiable risk analysis, etc are useful for other clients and information seekers. Easy Marketing in the foundation of Brand name- A bank has an existing network of branches, which can act as shops for selling productslike Insurance, Mutual Fund without much efforts on marketing, as the branch will act here as a parent company or source. In this way a bank can reach the remotest client without having to take recourse ton an agent. One Stop Shopping- The idea of one stop shopping saves a lot of transaction costs and increases the speed of economic activities. It is beneficial for the bank as well as customers. Investor Friendly Activities- Another manifestation of Universal Banking is bank holding stakes in a firm. A banks equity holding in a borrower firm, acts as a signal for other investors on to the health of the firm, since the lending bank is in a better position to monitor the firms activities.

Weakness

Grey Area of Universal Bank- The path of Universal Banking for DFIs is strewn with obstacles. The biggest one is overcoming the differences in regulatory requirements for a bank and DFI. Unlike banks, DFIs are not required to keep a portion of their deposits as cash reserves. No Expertise in long term lending- In the case of traditional project finance an area where DFIs tread carefully, becoming a bank may not make a big difference. Project finance and Infrastructure Finance are generally long gestation projects and would require DFIs to

Viral Shah 61052

20 | Page

Indian Banking: Current Status & The Road Ahead

borrow long term. Therefore, the transformation into a bank may not be of great assistance in lending long-term. NPA Problem remained intact- The most serious problem DFIs have had to encounter is bad loans or Non Performing Assets (NPA). For the DFIs and Universal Banking installation of cutting-edge-technology in operations are unlikely to improve the situation concerning NPAs. Most of the NPAs came out of loans to commodity sectors, such as steel, chemicals, textiles, etc. The improper use of DFI funds by project promoters, a sharp change in operating environment and poor appraisals by DFIs combined to destroy the viability of some projects. So, instead of improving the situation Universal Banking may worsen the situation.

Threats

Big Empire- Universal banking is an outcome of the mergers and acquisitions in the banking sector. The Finance Ministry is also empathetic towards it. But there will be big empires which may put the economy in a problem. Universal Banks will be the largest banks, by their asset base, income level and profitability there is a danger of Price Distortion It might take place by manipulating interests of the bank for their self interest motive instead of social interest. There is a threat to the overall quality of the products of the banks because of the possibility of turning all the strengths of the Universal Banking into weaknesses. If the banks are not prudent enough, deposit rates could shoot up and thus affect profits. To increase profits quickly banks may go in for riskier business, which could lead to a full in asset quality. Disintermediation and securitization could further affect the business of banks

Opportunities

To increase efficiency and productivity- Liberalization offers opportunities to banks. Now, the focus will be on profits rather than on the size of balance sheet. Fee based incomes will be more attractive than mobilizing deposits, which lead to lower cost funds. To face the increased competition, banks will need to improve their efficiency and productivity, which will lead to new products and better services. To get more exposure in the global markets- In terms of total capital base and asset size Indian banks have to cover a lot of ground against their global peers. Except SBI none of the Indian Banks feature in the list of Top 100 Banks of the world. In order to enter into the top 100, these banks require huge capital and will need to acquire lot of mass in their operations. Here is the real need for universal banking.

Viral Shah 61052

21 | Page

Indian Banking: Current Status & The Road Ahead

Concerns faced by Indian Banks

Change is the only constant feature in this dynamic world and banking is not an exception. The changes staring in the face of bankers relates to the fundamental way of banking-which is going through rapid transformation in todays world. Adjust, adapt and change should be the key mantra. The major challenges faced by banks today are as follows Financial Inclusion- Financial inclusion is about credible access to appropriate financial products and services needed by vulnerable groups such as weaker sections and low income groups at an affordable cost in a fair and transparent manner from mainstream institutional players. The biggest concern facing Indian Banking today pertains to rising expectations from banks to find an economically viable solution for financial inclusion. While the expectations from banks are high, the government is also looking at non banking industry. Already additional competition is planned in the form of new banking licenses being issued to corporate houses. Transition from class banking to mass banking and increased customer focus is drastically changing the landscape of Indian banking. Expansion of retail banking has a lot of potential as contribution of retail loans to GDP stands merely at 6% in India vis--vis 15% in China and 24% in Thailand. The most important aspect to financial inclusion, according to a survey of Banks conducted by FICCI was Cost effective credit delivery mechanism. This was followed by identifying needs and developing relevant financial products, demographic knowledge & strong local relations and ensuring adequate returns on capital employed. Human Resource threat faced by PSU banks- The public sector banks enter the next decade with the same expectations as their private sector peers but with a severe disadvantage in human resources. The HR challenge of public sector banks has reached a tipping point. Due to a legacy of several decades, the public sector banks will witness unprecedented loss of skills and competencies in form of retiring senior and middle management executives over the next few years. That coupled with the need for large scale reskilling, attracting and retaining fresh talent, controlling the growing employee costs, and introduction of performance discipline are significant challenges.

Viral Shah 61052

22 | Page

Indian Banking: Current Status & The Road Ahead

Demographic Risk

Sources: BCG Analysis The most imminent HR challenge is of demographic risk. The second challenge facing PSU banks today is induction of large number of fresh employees to retain their competitive edge. Manpower productivity among PSU banks is very low. Revenue per employee of PSU banks Rs 20 lakh compared to revenue per employee of ICICI banks which stands at Rs 44 lakh. The average cost/employee of public sector banks which used is to be lower than private banks has been steadily rising and has risen above that of private banks. Manpower productivity across banks

Sources: BCG Analysis

Viral Shah 61052

23 | Page

Indian Banking: Current Status & The Road Ahead

High NPA levels- The banking industry has a high level of non-performing assets (NPAs) to contend with. High NPAs raise the cost of bank operations and thereby the spread and efforts need to be made to bring these down. However, a balance has to be drawn between the reduction in NPAs on one hand and ensuring adequate supply of credit to the economy on the other. Excessive pressure on banks to reduce NPAs is likely to lend to a high degree of selectivity in the credit disbursal process and consequently, a reduction of the total level of credit as dictated by the growth of deposits. The rate of reduction of NPAs will therefore have to be fairly gradual keeping in mind the notional lending risks associated with the Indian economy and the speed at which debt recovery and settlement processes operate. Advent of Liberalization & Globalization- Globalisation has brought about fierce competitive pressures on Indian banks from international banks. In order to compete with the new entrants effectively, Indian commercial banks need to possess matching financial muscle, and size has therefore assumed criticality. However in the days of virtual banking, the size of a bank measured by its branch network may not be as important as the size of its balance sheet. Indian banks would therefore have to acquire a competitive size. Mergers and acquisitions route provides a quick step forward in this direction offering opportunities to share synergies and reduce the cost of product development and delivery. Deregulation: This continuous deregulation has made the Banking market extremely competitive with greater autonomy, operational flexibility and decontrolled interest rate and liberalized norms for foreign exchange. The deregulation of the industry coupled with decontrol in interest rates has led to entry of a number of players in the banking industry. At the same time reduced corporate credit off take thanks to sluggish economy has resulted in large number of competitors batting for the same pie. Implementation of IFRS- An issue that is going to cast spell over the financial sector players is the compliance with IFRS. Globalization of financial markets has meant an increased focus on international standards in accounting and has intensified efforts towards a single set of high quality, globally acceptable set of accounting standards. The IFRS convergence process will involve significant challenges for the banking system in general. Banks would need to upgrade their infrastructure, including IT and human resources, to face the complexities and challenges of IFRS. Some major technical issues arising for Indian banks during the convergence process would be differences between the IFRS and current regulatory guidelines on classification and measurement of financial assets, focus in the standard on the business model followed by banks and the challenges for management in

Viral Shah 61052

24 | Page

Indian Banking: Current Status & The Road Ahead

this area, application of fair values for transactions where not much guidance is available in India in terms of market practices or benchmarks, and expected changes in impairment rules. Capital- Even though Indian Banks are reasonably well capitalized today, banks will be facing the challenge of growing their business due to capital constraints. Post-crisis, regulators worldwide are discussing a macro-prudential framework that would involve a regulatory policy focused on the system as a whole, rather than individual players. Capital buffers are an extremely important component of the new macro-prudential regulatory framework. The new framework aims at improving both quality and quantity of capital. Banks are already suffering from inadequacy of capital as the return on such capital does not encourage new investors. Era of cheap capital is over and investors are also wary of the volatility of returns. Newer instruments and techniques would be required to attract investors. While creation of enabling conditions for capital flow to the sector would continue to remain on the top of the reform agenda, banks would need to grow their balance sheets by raising capital from the markets rather than count on government. Considering the back-to-basics common equity focus of Basel II, growing bank balance sheets will increasingly pose the challenge of balancing interests of shareholder and depositors/ financial stability. Other Challenges and concerns faced by Indian banking today, include Credit risk, Derivatives, Currencies, Fraud, Money Laundering, Political Interference, Dependence on technology, Liquidity, Credit Spreads and Macro economic trends

Trends of the future

Going by the experience of commercial banks in other countries, the following trend is may tend to dominate the future course of banking development in India Greater specialization by banks in different niches of the market such as retail, agriculture, export and the small-scale and corporate sector; Greater reliance on non-fund business such as advisory and consultancy services, guarantee and custody services Greater overlap in product coverage between commercial banks and non-bank financial institutions

Viral Shah 61052

25 | Page

Indian Banking: Current Status & The Road Ahead

Greater financial disintermediation with large companies accessing securitised debt domestically and from financial markets abroad. Greater Banking penetration with projected growth rates between 15%-20% during the period between the years 2011-12 to 2015-16. The idea of global expansion is fast catching up with Indian banks and this trend is likely to continue in future too. The idea of creating bigger banks to catch up with global peers is likely to see Indian Banks looking outside India for greener pastures. Majority of the Bankers feel that there is scope for new entrants in the Indian Banking industry. With only 30-35% of the population financially included there is scope to accommodate new players. With the licensing to corporates being considered by RBI, Indian banking is likely to see new entrants in the future. Greater play by banks in profitable sectors of the future like Forex management, Derivates trading, Bancassurance, Wealth management etc. The most profitable sectors for banks in the coming years are likely to be Infrastructure, Retail loans, SMEs, IT & Telecom, Services, Biotech and Real estate. Consolidation of operations continues to remain an important factor for banks as they seek to improve their level of efficiency and correspondingly profitability. The need of the hour is consolidation of smaller banks with larger banks. This can be kick-started by merging the associate state banks with State bank of India. The focus of Indian Banks in the future is likely to shift from Asset Management to Asset Liability Management. Banks flocking the capital markets to raise capital to meet adequacy norms and to meet the ever increasing costs associated with expansion.

Viral Shah 61052

26 | Page

Indian Banking: Current Status & The Road Ahead

Opportunities provided by Indian Banking

India has a huge and untapped potential for banks to explore and provide enhanced geographic coverage to the unbanked areas. Counted as one of the prime emerging markets, there is a robust demand of banking services in India. India is governed by strong growth fundamentals, which is eminently reflected in the macroeconomic situation of the country. In

Viral Shah 61052

27 | Page

Indian Banking: Current Status & The Road Ahead

addition, policy measures undertaken by the government have helped India withstand the crisis and turn towards a quick recovery. India could become the worlds third largest economy by purchasing power parity (PPP), overtaking Japan in 2012. India could also rise from relatively low levels today to emerge as third largest domestic banking market in the world by 2040. Major opportunities which could arise for banks in the next decade are as follows Mortgages likely to cross Rs 40 trillion by 2020- Mortgages typify the retail banking opportunity in an economy. The total mortgages in the books of the banks have grown from 1.5 percent to 10 percent of the total bank advances, in a period of ten years. The ratio of total outstanding mortgages, including the Housing Finance Companies (HFCs) to the GDP is currently 7.7 percent. If by 2020, this ratio were to reach 20 percent, a number similar to that of China, we could expect the mortgage industry growing at an average rate of over 20 percent during the next decade.

Sources: BCG Analysis Wealth Management will be a big business with 10X growth- Going forward, wealth is expected to get further concentrated in the hands of a few. The top band of income distribution is expected to grow most rapidly over the next decade. By 2020, the top 5 percent households, predominantly residing in the metros and Tier I cities, will account for 30 percent of the total disposable income. Wealth management services will be demanded by the nouveau rich and will be an integral part of the product portfolio for both, private as well as public sector banks.

Viral Shah 61052

28 | Page

Indian Banking: Current Status & The Road Ahead

The Next Billion will be the largest segment- The income group right below the middle class in the annual house hold income range of Rs 90,000 to Rs 200,000 per annum will be the largest group of customers. These customers will be profitably served only with low cost business models having low break even ticket size of business. The next decade would witness banks experimenting with different low cost business models, smaller cost effective branches and new use of technology to serve this segment profitably. Mobile banking to see huge growth and will redefine transaction banking paradigmComparing with usage pattern in US, the significant potential in online and phone channels is apparent. However, India may evolve differently. The penetration of internet and broad band access in India has been low so far. However, with the advent of mobile banking, the access to banking facilities could completely get revolutionized over the next decade. Even if 2530 percent of mobile users have GPRS / 3G activated, there would be 250 million to 300 million customers who would access banking services over the mobile. Investment banking will grow over tenfold- Investment banking will be among the fastest growing segments in the banking industry rising from 4 percent to 7 percent of the entire corporate banking revenue pool. The larger corporate customers expect to demand higher support for international expansion and mergers and acquisitions over next decade. Investment banking will be among the fastest growing segments in the banking industry rising from 4 percent to 7 percent of the entire corporate banking revenue pool. The larger corporate customers expect to demand higher support for international expansion and mergers and acquisitions over next decade. Infrastructure financing to hit over Rs 20 trillion on commercial banks books- A report by BCG expects infrastructure financing to cross Rs 20 trillion by 2020. As India continues to rely on private funding for infrastructure development, infrastructure will occupy a larger share of the balance sheets. Opportunity in micro, small and medium enterprises (MSME) - Micro, small and medium enterprises (MSME) have played a very significant role in India achieving its current robust overall economic growth. These enterprises are future of any economy. SMEs also enhance inclusive growth by the manner in which they evolve, leverage local resources and innovate to create products and services. This sector accounts for 45 per cent of the manufactured output, 8 per cent of the GDP, 40 per cent of all exports from the country and employs nearly 65.9 million people which is next only to the agriculture sector. The

Viral Shah 61052

29 | Page

Indian Banking: Current Status & The Road Ahead

opportunity for banks lie in the fact that only 4-5% of MSMEs are covered by institutional funding given that approximately 95% of villages are not covered by banks. To tap the ever increasing opportunities and help in wealth creation, RBI is considering issuing new Banking licences to corporate houses for the first time since 2004 (Kotak Bank and Yes Bank).

How to meet challenges faced by Indian banks

The major question being asked is with so many constraints and problems, whether Indian Banks will be able to tap the exciting opportunities being thrown at them. The answer is an emphatic yes because banking is highly regulated. But the important question is how? New Banking Licences- RBI must take long term view of the policy and craft appropriate policy responses. RBI must have the latitude to raise interest rates when others want cheap credit and rein in risky financial practices when others want easy profits. While progress on macro and micro-prudential regulations will be the key for moving forward, some work is still needed from the regulators in providing guidance to the market in instituting a mechanism in the area of managing not only several known unknowns but also a number of unknown unknowns. Information Technology & Cyber Laws- In the field of technology based banking, information technology and electronic fund transfer system have emerged as the twin pillars of modern banking development. To meet these changes some systemic changes are urgently required. Cyber laws and other procedures which are commensurate with modern technology based banking have to be put in place immediately and sufficient regulatory mechanism has to be instituted so that the fast strides in banking automation does not go on undesirable lines. Core Banking Solutions- The future would require banks to have increased business agility and operational efficiency, which makes the implementation of Core Banking Systems (CBS) by banks increasingly important. Consolidation- Consolidation of operations continues to remain an important factor for banks as they seek to improve their level of efficiency and correspondingly profitability. Consolidation in the banking industry has remained crucial to ensuring technological progress, excess retention capacity, emerging opportunities and deregulation of various functional and product restrictions. Consolidation is unavoidable if Indian banks are to become a force to reckon with in the near future. One must keep in mind that the largest bank of China is five times the size of the five largest banks of India.

Viral Shah 61052

30 | Page

Indian Banking: Current Status & The Road Ahead

Talent Management- Unwinding decades of legacy requires a concerted and determined effort. Public sector banks with their unique and complex position require a very careful orchestration of a series of initiatives that are built concurrently on performance discipline and staff motivation. Banks can develop a 3-5 year programme for Talent Management. Banks should focus on steady talent acquisition. This can be done by creating a brand that appeals to young recruits. Banks can also look at Performance Management systems to evaluate the performance of its employees. Banks especially PSUs should focus on systematic succession planning and career management as in the recent past there has been exit by large number of top executives. Conflicting concurrent demands- Conventional HR interventions will not be effective

Sources: BCG Analysis Financial Inclusion- The future of democratic polity and social harmony of India rests on the premise of inclusive growth. Financial inclusion is a crucial driver for such growth. The political leadership is looking at the banking industry to deliver on this promise over the next few years.

Viral Shah 61052

31 | Page

Indian Banking: Current Status & The Road Ahead

Imperatives for the Government and Regulations

Banks and non banks alike need state support and positive regulatory encouragement to undertake initiatives highlighted here to address the challenges and help the nation actualize the promise of the decade. The recommended list below is of issues that emerge as most important and urgent from the analysis of issues put forth in this report. Deepen Wholesale Debt Market with Top Priority- Vibrant wholesale debt markets will enable financial services industry assist India more wholesomely. Banks will find reasons to focus on, often neglected, SME segment. Infrastructure finance from appropriate long term sources will ease ALM risk on banks books. Enhance Economic Viability of Financial Inclusion- While the primary responsibility is upon the banks to innovate and experiment, the government and the regulator can accelerate the evolution through interventions and encouragement. Continued Emphasis to Revitalize Rural Cooperative Banking InstitutionsGovernment is already spending over Rs 14,000 crore to revitalize rural cooperative institutions under the Vaidyanathan Committee Scheme (VCI). This is a historic opportunity to once and for all pull cooperative banks out of dysfunction. Enable NABARD to Play Pivotal Role in Rural Infrastructure Development- Financial inclusion alone is not sufficient to drive inclusive economic growth. Economic activity in the local area (especially rural) has to be given fillip through concurrent multi disciplinary interventions embedded around core infrastructure development projects. There are multiple state sponsored financial institutions that are involved in rural infrastructure financing but none with sufficient breadth of expertise, depth in balance sheet, and backing from government. NABARD comes closest to an ideal institution for this purpose given its range of expertise, heritage in development financing and collaborative operating model. NABARD is the conduit for channelling RIDF funds to states. But they are hardly enough. NABARD needs to be enabled as pivotal institution for rural infrastructure financing and development. Spur HR transformation in PSU Banks- While the PSB themselves needs to start a concerted program to recharge their HR, the government needs to create supportive environment to accelerate the change. Also the government in consultation with RBI should look to separate the chair of CMD in PSU banks into two positions. This will facilitate better implementation of work and help chairman concentrate on more strategic functions.

Viral Shah 61052

32 | Page

Indian Banking: Current Status & The Road Ahead

Conclusion

The growth story of the Indian banking industry showcases vast opportunity, and it is imperative to appreciate the attractiveness of this sector. Further, the granting of additional banking licenses to private sector players and NBFCs manifests huge opportunity for the sector as a whole. Opening up of the banking sector will definitely ensure increased competition and will help in reaching out to the un-banked population of India. Strong performance of the banking sector over the past few years and future growth potential succeeds in attracting new entrants to the industry, although challenges remain in the form of maintaining asset quality, risk management, compliance with new accounting standards, use of technology and better customer experience.

Bibliography

www.en.wikipedia.org www.iba.org.in www.rbi.org.in www.ficci.com\ www.scribd.com www.slideshare.net Indian Banking Overview- Mckinsey & Company Impact on Indian Banking- Rohit Tandon Destination India for Banking- PWC Indian Banking 2020- BCG Banking System Survey- FICCI Indian Banking: A promising future MV Nair Indian Banking 2010- Mckinsey & Company Banking Industry- A case of India- S Kushwaha Banking & BeyondVision 2020 Rohit Sarkar 19th Triennial Conference- C Rangrajan Emerging Challenges for Indian Banking- C Rangrajan

Viral Shah 61052

33 | Page

Das könnte Ihnen auch gefallen

- Research Proposal On BankingDokument23 SeitenResearch Proposal On Bankingrujuta88% (8)

- Tutorial 5Dokument2 SeitenTutorial 5Aqilah Nur15Noch keine Bewertungen

- Financial Planning and ForecastingDokument40 SeitenFinancial Planning and ForecastingannafuentesNoch keine Bewertungen

- Financial Inclusion FinalDokument54 SeitenFinancial Inclusion FinalSOHAM DESAINoch keine Bewertungen

- Project Report On Working Capital Assessment CANARA BANKDokument73 SeitenProject Report On Working Capital Assessment CANARA BANKAsrar67% (6)

- Banking and Finance in IndiaDokument48 SeitenBanking and Finance in Indiajags1156Noch keine Bewertungen

- Introduction To Indian Banking IndustryDokument20 SeitenIntroduction To Indian Banking IndustrypatilujwNoch keine Bewertungen

- Indian Banking Industry: IDBI Bank ING Vyasa Bank SBI Allahabad BankDokument8 SeitenIndian Banking Industry: IDBI Bank ING Vyasa Bank SBI Allahabad Bankaditisharma305292Noch keine Bewertungen

- A Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloreDokument73 SeitenA Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloresukanyaNoch keine Bewertungen

- All AttachDokument10 SeitenAll Attachkp93singhNoch keine Bewertungen

- 1.1 Introduction To Industry Introduction To The BanksDokument72 Seiten1.1 Introduction To Industry Introduction To The BankssdafcNoch keine Bewertungen

- Introduction ToDokument44 SeitenIntroduction ToYash SoniNoch keine Bewertungen

- And Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANDokument246 SeitenAnd Long Term" Which Is Accomplished During The Training Bank of Baroda, SME LOANkanchanmbmNoch keine Bewertungen

- Universal BankingDokument50 SeitenUniversal BankingBennett CheenathNoch keine Bewertungen

- 7v 2 SecuritizationDokument47 Seiten7v 2 SecuritizationafanNoch keine Bewertungen

- Chapter - 1 An Introduction To Indian Banking SystemDokument27 SeitenChapter - 1 An Introduction To Indian Banking Systemprasad pawleNoch keine Bewertungen

- Q. 4 There Are Three Different Phases in The History of Banking in India.Dokument4 SeitenQ. 4 There Are Three Different Phases in The History of Banking in India.MAHENDRA SHIVAJI DHENAKNoch keine Bewertungen

- Banking History: A Flashback Into Past. Banking System in Indian Context. Issues in Banking System. Introduction To Credit and RiskDokument84 SeitenBanking History: A Flashback Into Past. Banking System in Indian Context. Issues in Banking System. Introduction To Credit and RiskMinhaz Iqbal HazarikaNoch keine Bewertungen

- 4cb2indian Banking SystemDokument12 Seiten4cb2indian Banking SystemAnkit GodreNoch keine Bewertungen

- Project On Job SatisfcationDokument84 SeitenProject On Job Satisfcationnamitaahuja2006Noch keine Bewertungen

- Balance Sheet Analysis of Dhanlaxmi Bank and SibDokument44 SeitenBalance Sheet Analysis of Dhanlaxmi Bank and SibRahul RaveendranNoch keine Bewertungen

- Bankins System in India HistoryDokument9 SeitenBankins System in India HistoryHappy SinghNoch keine Bewertungen

- Overview Of.. Banking Sector in IndiaDokument14 SeitenOverview Of.. Banking Sector in IndiaTushar GaikwadNoch keine Bewertungen

- Chapter 1Dokument37 SeitenChapter 1Kalyan Reddy AnuguNoch keine Bewertungen

- A Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloreDokument73 SeitenA Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloredeepikavemulaNoch keine Bewertungen

- Money Market InstrumentDokument58 SeitenMoney Market InstrumentNinad PatilNoch keine Bewertungen

- TH THDokument34 SeitenTH THpmmppmNoch keine Bewertungen

- Mathematics - Banking For Icse Grade 10 ProjectsDokument24 SeitenMathematics - Banking For Icse Grade 10 ProjectsFluffy Worm31% (16)

- Project: G I B SDokument26 SeitenProject: G I B Srohit utekarNoch keine Bewertungen

- History: Calcutta Allahabad BankDokument5 SeitenHistory: Calcutta Allahabad BankRucha PilgaonkarNoch keine Bewertungen

- Banking in IndiaDokument7 SeitenBanking in IndiaAnkit JainNoch keine Bewertungen

- Khushabu Singh B 66Dokument24 SeitenKhushabu Singh B 66smellsinghNoch keine Bewertungen

- Abhishek Sarkar SipDokument3 SeitenAbhishek Sarkar SipAbhishek SarkarNoch keine Bewertungen

- Term Paper: Topic: Study On Private and Public Sector BankDokument23 SeitenTerm Paper: Topic: Study On Private and Public Sector BankniharikatyagiNoch keine Bewertungen

- Indian Financial Structure and MarketingDokument34 SeitenIndian Financial Structure and MarketingSujit KumarNoch keine Bewertungen

- Banking in IndiaDokument7 SeitenBanking in IndiaLakshmi NagurNoch keine Bewertungen

- Corporation Bank MP Birla InternshipDokument20 SeitenCorporation Bank MP Birla InternshipsrikanthkgNoch keine Bewertungen

- Banking & InsuranceDokument114 SeitenBanking & Insurancemdawaiskhan89Noch keine Bewertungen

- Afanawari Project @Dokument55 SeitenAfanawari Project @Vivek SatviNoch keine Bewertungen

- Comparative Study Between Two BanksDokument26 SeitenComparative Study Between Two BanksAnupam SinghNoch keine Bewertungen

- Chapter-1: 1.1. An Overview of Banking IndustryDokument14 SeitenChapter-1: 1.1. An Overview of Banking IndustryDipanjan DasNoch keine Bewertungen

- Banking Sector in India - A ReviewDokument8 SeitenBanking Sector in India - A ReviewHarshvardhan SurekaNoch keine Bewertungen

- Banking Sector in India - A ReviewDokument8 SeitenBanking Sector in India - A ReviewSandeep Singh BhandariNoch keine Bewertungen

- Banking Sector in India - A ReviewDokument8 SeitenBanking Sector in India - A ReviewSandeep Singh BhandariNoch keine Bewertungen

- Banking System and Structure in India Evolution of Indian BanksDokument61 SeitenBanking System and Structure in India Evolution of Indian BanksTrilok IndiNoch keine Bewertungen

- Banking in India Originated in The Last Decades of The 18th CenturyDokument5 SeitenBanking in India Originated in The Last Decades of The 18th CenturycharadvabhavinNoch keine Bewertungen

- Indian Banking Industry: Challenges and Opportunities: Dr. Krishna A. GoyalDokument11 SeitenIndian Banking Industry: Challenges and Opportunities: Dr. Krishna A. GoyalKalyan VsNoch keine Bewertungen

- Tybbi Comparative Study of Strategy Implemented in BankDokument37 SeitenTybbi Comparative Study of Strategy Implemented in BankPranav ViraNoch keine Bewertungen

- Marketing ResearchDokument39 SeitenMarketing ResearchHarpreet SinghNoch keine Bewertungen

- 10 Chapter 3Dokument47 Seiten10 Chapter 3Abhishek DhakanNoch keine Bewertungen

- Role of Banks in Indian EconomyDokument36 SeitenRole of Banks in Indian Economymandar84% (45)

- I. Evolution of Banking in IndiaDokument19 SeitenI. Evolution of Banking in IndiajyotsnandNoch keine Bewertungen

- International Management Institute, Kolkata: Summer Internship ReportDokument51 SeitenInternational Management Institute, Kolkata: Summer Internship ReportjujuspiNoch keine Bewertungen

- E-BANKING SERVICE HDFC ProjectDokument65 SeitenE-BANKING SERVICE HDFC ProjectSri KamalNoch keine Bewertungen

- Indian Banking Industry: Challenges and Opportuniti EsDokument24 SeitenIndian Banking Industry: Challenges and Opportuniti EsdelmaNoch keine Bewertungen

- BanksDokument120 SeitenBankskoshycjNoch keine Bewertungen

- Project ReportDokument39 SeitenProject ReportVishnu vinayNoch keine Bewertungen

- Banking Sector-Industry AnalysisDokument9 SeitenBanking Sector-Industry Analysisbiswarup4463Noch keine Bewertungen

- Insurance & Bank Marketing: Indian Banking SystemDokument14 SeitenInsurance & Bank Marketing: Indian Banking SystemTapala BhaskarNoch keine Bewertungen

- Evolution of Banking - 1Dokument10 SeitenEvolution of Banking - 1RohanNoch keine Bewertungen

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- DLP L06 - Four Types of Financial RatiosDokument5 SeitenDLP L06 - Four Types of Financial RatiosMarquez, Lynn Andrea L.Noch keine Bewertungen

- pc102 - Final ProjectW13 - Ramon GutierrezDokument10 Seitenpc102 - Final ProjectW13 - Ramon GutierrezEJ LacdaoNoch keine Bewertungen

- Porter's Five Forces Model ReferenceDokument3 SeitenPorter's Five Forces Model ReferenceKumardeep SinghaNoch keine Bewertungen

- Accounting Book 1 Lupisan Baysa Answer KeyDokument176 SeitenAccounting Book 1 Lupisan Baysa Answer KeyAngel ChuaNoch keine Bewertungen

- AM 20482 Key Information Document CFD ETF AM UKDokument3 SeitenAM 20482 Key Information Document CFD ETF AM UKTensonNoch keine Bewertungen

- 4 Cash Flow Diagram Equation of ValueDokument3 Seiten4 Cash Flow Diagram Equation of ValueKarl FaderoNoch keine Bewertungen

- Basic AccoDokument27 SeitenBasic AccoJasmine ActaNoch keine Bewertungen

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2018Dokument8 SeitenLebanese Association of Certified Public Accountants - IFRS July Exam 2018jad NasserNoch keine Bewertungen

- Admas University College Faculty of Business Department of AccountingDokument3 SeitenAdmas University College Faculty of Business Department of AccountingtemedebereNoch keine Bewertungen

- Cps Tax Form Format For 23-24Dokument11 SeitenCps Tax Form Format For 23-24sr91919Noch keine Bewertungen

- Comprehensive Problem-Analysis of TransactionDokument43 SeitenComprehensive Problem-Analysis of TransactionJoanna DandasanNoch keine Bewertungen

- New Policy Correspondence - M0017065801Dokument10 SeitenNew Policy Correspondence - M0017065801DawnNoch keine Bewertungen

- Module 2 Answer KeyDokument10 SeitenModule 2 Answer KeyJeffrey Lois Sereño MaestradoNoch keine Bewertungen

- Home Loan - Tax Benefit - 2Dokument3 SeitenHome Loan - Tax Benefit - 2Rajesh KumarNoch keine Bewertungen

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDokument6 SeitenPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariNoch keine Bewertungen

- Ghana Commercial BankDokument1 SeiteGhana Commercial Bankapi-3728882100% (2)

- P & G (SCF)Dokument3 SeitenP & G (SCF)Alisha Anand [JKBS]Noch keine Bewertungen

- Fintech Company:Paytm: 1.financial Statements and Records of CompanyDokument7 SeitenFintech Company:Paytm: 1.financial Statements and Records of CompanyAnkita NighutNoch keine Bewertungen

- IndemnityDokument10 SeitenIndemnityAstik TripathiNoch keine Bewertungen

- Synergy Accounting Manual Guide (V5.1)Dokument92 SeitenSynergy Accounting Manual Guide (V5.1)JM Bariani HouseNoch keine Bewertungen

- Advanced Accounting-2 Company: HoldingDokument20 SeitenAdvanced Accounting-2 Company: HoldingTB AhmedNoch keine Bewertungen

- Foreign Exchange Transaction Against RupiahDokument5 SeitenForeign Exchange Transaction Against RupiahErick MulijadiNoch keine Bewertungen

- Job-Order Costing and Cost Assignment With Absorption Costing SystemsDokument50 SeitenJob-Order Costing and Cost Assignment With Absorption Costing SystemsAnh Quan NguyenNoch keine Bewertungen

- Layers Egg Production Business Plan FinancialsDokument11 SeitenLayers Egg Production Business Plan FinancialsTinashe RunganoNoch keine Bewertungen

- Accounts KV MaterialDokument109 SeitenAccounts KV MaterialDiya Khandelwal100% (1)

- Auditing 1Dokument9 SeitenAuditing 1Vanessa BatallaNoch keine Bewertungen

- Cm1 Assignment Y1 q2 - Solution (Final)Dokument55 SeitenCm1 Assignment Y1 q2 - Solution (Final)Swapnil SinghNoch keine Bewertungen

- Traders Royal Bank v. Sps. Castanares DigestDokument2 SeitenTraders Royal Bank v. Sps. Castanares DigestBenedict EstrellaNoch keine Bewertungen