Beruflich Dokumente

Kultur Dokumente

Group Assignment 3

Hochgeladen von

Jamie HardingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Group Assignment 3

Hochgeladen von

Jamie HardingCopyright:

Verfügbare Formate

Group 6

Assignment # 3

4-3-2012

Royce Rapacchietta Paul Silverstone Jamie Harding James Williams Dominic Ciotti Camilie OMalley Braydan Benedetti 1. Outline the entire agreement by paragraph, providing just a 2-3 word summary of each paragraph.

- Card Agreement Contract

Your Account

Abide by this agreement Authorized Users: Responsible for Authorized Users Revolving Credit Limit: Fluctuating credit limit Balance Transfers: Subject to Standard APR Checks: Use to transfer Billing Statement: Amount you owe

APRs:

Account APRs: see Pricing information table Variable APRs Based on Prime: Fluctuating APR Penalty APR: Penalty for late payments Effect of APR Increases: APR may increase

Interest Charges Based on APRs

Interest Charges: Impose interest charges When Interest Charges Begin: Charges begin 1st day Grace Period on Purchases: Payment in full Calculation of Interest Charges Daily Balance Method (Including Current Transactions): Calculation of interest Balance Subject to Interest Rate: Daily Balance

Fees

Annual Membership Fee: Yearly Membership Fee Transaction Fee for Balance Transfers: Fee for Balance Transfers Transaction Fee for Cash Advances: Fee for Cash Advances Transaction Fee for Foreign Purchases: Fee International Purchases Late Fee: Fee for Late Payment Returned Payment Fee: Fee for returned Payment

Group 6

Assignment # 3

4-3-2012

Stop Payment on Case Convenience Check Fee: Stop Payment Fee

Information on Foreign Currency Conversion: Currency rates vary

Payments: Must Pay Minimum Due

Application of Payments: Higher APR gets payment Payment Instructions: Rights to accepting payments Optional Pay by Phone Service: Payment by Phone

Credit Reporting: Report to Credit Agencies Information Sharing: Sharing your information Changes to this Agreement: Right to change agreement Default: Failure to comply Refusal of the Card, Closed Accounts, and Related Provisions

Refusal of the Card: No transaction is guaranteed Preauthorized Charges: No transaction is guaranteed Lost or Stolen Cards, Account Numbers, or Cash Convenience and Balance Transfer Checks: Contact if Stolen information Closing Your Account: Must repay balance Closing Secured Accounts: Certificate of Deposit

Arbitration: Dispute Binding Arbitration Agreement to Arbitrate: Binding arbitration claims Claims Covered

What claims are subject to arbitration: Claims subject to arbitration Whose claims are subject to arbitration: All claims subject to arbitration What time frame applies to Claims subject to arbitration: Past, Present or Future Broadest Interpretation: Interpretation of arbitration provision What about claims filed in small claims court: Not subject to arbitration What about debt collections: No arbitration needed

How Arbitration Works

Group 6

Assignment # 3

4-3-2012

How does a party initiate arbitration: Pick a firm What procedures and law are applicable in arbitration: Card Agreement prevails Who pays: Person files pays Who can be a party: Any individual or entity When is an arbitration award final: Arbitrator declares final

Survival and Severability of Terms: Life of Terms Governing Law and Enforcing our Rights

Governing Law: Federal law prevails Enforcing this agreement: We enforce rights Collection Costs: Liable for collection costs Assignment: May assign rights

For Further Information: Contact them What to do if you find a mistake on your statement: Write a letter What will happen after we receive your letter

When we receive your letter, we must do two things: Must correct errors While we investigate whether or not there has been an error: Cannot collect amount After we finish our investigation, one of two things will happen: Payment may/may not be due

Your Rights if you are dissatisfied with your credit card purchases: May dispute

purchase

2. Explain how Citibank may make a report on your credit under this agreement. Where is that found? - This information is found under the credit reporting section on page 8. Citibank may make a report to credit bureaus if you have late payments, missed payments or other defaults on your account. This could reflect on your credit report. 3. Explain the most surprising aspect of this agreement and state why. -The most surprising aspect of this credit card agreement would be all the hidden fees. These are of a surprise to me because I would not think of a credit card having fees for such things as Transaction Fee for Foreign Purchases or Returned Payment Fee. I think it an outrage that a credit card company would have such ridiculous charges.

Das könnte Ihnen auch gefallen

- Streetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityVon EverandStreetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityBewertung: 5 von 5 Sternen5/5 (1)

- PayPal User AgreementDokument42 SeitenPayPal User AgreementJason TiongcoNoch keine Bewertungen

- CC DCBDokument7 SeitenCC DCBHugo DivalNoch keine Bewertungen

- 2 Amex Platinum ContractDokument8 Seiten2 Amex Platinum ContractterencehkyungNoch keine Bewertungen

- Vanquis Credit Card Agreement and Full TermsDokument9 SeitenVanquis Credit Card Agreement and Full TermsAnonymous TpBLcskeypNoch keine Bewertungen

- When You Get Your BillDokument2 SeitenWhen You Get Your BillFlaviub23Noch keine Bewertungen

- Build Card Military Lending Act Cardholder AgreementDokument8 SeitenBuild Card Military Lending Act Cardholder Agreementprateekmehta92Noch keine Bewertungen

- Rightrespcc EngDokument20 SeitenRightrespcc Engapi-200845891Noch keine Bewertungen

- Credit Card 3Dokument8 SeitenCredit Card 3api-285960909Noch keine Bewertungen

- Boa CardDokument5 SeitenBoa Cardapi-285069637100% (1)

- Target Redcards Target Credit Card AgreementDokument5 SeitenTarget Redcards Target Credit Card Agreementapi-285771275Noch keine Bewertungen

- User Agreement For PayPal ServicesDokument44 SeitenUser Agreement For PayPal ServicesAbilash ReddyNoch keine Bewertungen

- PricingDokument3 SeitenPricingapi-285145795Noch keine Bewertungen

- Payment Information Summary of Account ActivityDokument3 SeitenPayment Information Summary of Account ActivityTyrone J PalmerNoch keine Bewertungen

- Orchard Bank 288451024 - AgreementNPI2701ADokument15 SeitenOrchard Bank 288451024 - AgreementNPI2701AKestrel1940Noch keine Bewertungen

- Destiny 200Dokument11 SeitenDestiny 200Jeanine WallaceNoch keine Bewertungen

- Card 2 InfoDokument4 SeitenCard 2 Infoapi-285069637Noch keine Bewertungen

- Disclosure RetrieverDokument30 SeitenDisclosure RetrievermattloyaltyNoch keine Bewertungen

- Pd10239 0112 Secci Granite Web U v7Dokument8 SeitenPd10239 0112 Secci Granite Web U v7patmolloy2009Noch keine Bewertungen

- 01-19-2016 PDFDokument4 Seiten01-19-2016 PDFAnonymous 1AcflUxYCNoch keine Bewertungen

- Account Opening DisclosuresDokument7 SeitenAccount Opening Disclosures4cydfngkt9Noch keine Bewertungen

- Chase AgreementDokument30 SeitenChase AgreementDijana MitrovicNoch keine Bewertungen

- Indigo 602Dokument15 SeitenIndigo 602OneNationNoch keine Bewertungen

- Cardmemmber AgreementDokument11 SeitenCardmemmber AgreementBrandon RossNoch keine Bewertungen

- Business Debit DisclosureDokument5 SeitenBusiness Debit DisclosureashleyNoch keine Bewertungen

- VN 04 Credit Cards FaqDokument5 SeitenVN 04 Credit Cards FaqdhakaeurekaNoch keine Bewertungen

- Credit Cards: Personal FinanceDokument36 SeitenCredit Cards: Personal FinanceAmara MaduagwuNoch keine Bewertungen

- Cashback World Elite enDokument60 SeitenCashback World Elite enwojif99909Noch keine Bewertungen

- Account Opening DisclosuresDokument8 SeitenAccount Opening Disclosuresitsadozie2Noch keine Bewertungen

- Statement Apr 2012Dokument14 SeitenStatement Apr 2012ksj5368100% (2)

- CH 7 PresentationDokument32 SeitenCH 7 PresentationJes KnehansNoch keine Bewertungen

- Egypt Debtor PolicyDokument13 SeitenEgypt Debtor PolicyKhaled SherifNoch keine Bewertungen

- Secured Personal Terms enDokument8 SeitenSecured Personal Terms enluiscelis01Noch keine Bewertungen

- Account Opening DisclosuresDokument7 SeitenAccount Opening DisclosuresLauren EgasNoch keine Bewertungen

- BN Credit Cards v11Dokument41 SeitenBN Credit Cards v11shekharsap284Noch keine Bewertungen

- Most Important Terms & ConditionsDokument75 SeitenMost Important Terms & Conditionsjamin2020Noch keine Bewertungen

- Credit ControlDokument7 SeitenCredit ControlFaina NaqviNoch keine Bewertungen

- Merrick Bank Unsecured AgreementDokument2 SeitenMerrick Bank Unsecured AgreementNneka Ojimba100% (1)

- Charge BackDokument4 SeitenCharge Backapi-3713147Noch keine Bewertungen

- Client Account MaintenanceDokument18 SeitenClient Account MaintenanceNirajanNoch keine Bewertungen

- STMNT 112013 9773Dokument3 SeitenSTMNT 112013 9773redbird77100% (1)

- Account Opening DisclosuresDokument8 SeitenAccount Opening DisclosuresEliseu Simplicio de OliveiraNoch keine Bewertungen

- Cardmember Agreement - Carte Blanche CardDokument10 SeitenCardmember Agreement - Carte Blanche CardEric WeiNoch keine Bewertungen

- Chap1 Ho1 CreditDokument4 SeitenChap1 Ho1 CreditsarahhNoch keine Bewertungen

- 05-Cont Chase PDFDokument1 Seite05-Cont Chase PDFPlus CompNoch keine Bewertungen

- Account Opening DisclosuresDokument7 SeitenAccount Opening Disclosuressarahjroberts049Noch keine Bewertungen

- Interest Rates and Interest ChargesDokument5 SeitenInterest Rates and Interest ChargesAlex LagunesNoch keine Bewertungen

- Account Opening DisclosuresDokument7 SeitenAccount Opening DisclosuresMarcus Wilson100% (1)

- Account Opening DisclosuresDokument9 SeitenAccount Opening DisclosuresEAZY CHARNoch keine Bewertungen

- Contact Details Modification Form Federal BankDokument16 SeitenContact Details Modification Form Federal BankSidhi KodurNoch keine Bewertungen

- 11-13-2015 PDFDokument4 Seiten11-13-2015 PDFAnonymous ZgROrLNLCjNoch keine Bewertungen

- Interest Rates and Interest ChargesDokument11 SeitenInterest Rates and Interest ChargesRonald BlosserNoch keine Bewertungen

- Chargeback PresentationDokument10 SeitenChargeback PresentationDaniel PireNoch keine Bewertungen

- Disclosure 26339 en-USDokument5 SeitenDisclosure 26339 en-USjeremyallan6969Noch keine Bewertungen

- Milestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesDokument4 SeitenMilestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesMatthew BassNoch keine Bewertungen

- Tesco Credit AgreementDokument25 SeitenTesco Credit AgreementM.r. KhanNoch keine Bewertungen

- New Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member How To Reach Us Customer ServiceDokument3 SeitenNew Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member How To Reach Us Customer ServiceChadd ThompsonNoch keine Bewertungen

- Wells Fargo Advisors Premium Rewards Visa Signature CardDokument13 SeitenWells Fargo Advisors Premium Rewards Visa Signature CardRalph YoungNoch keine Bewertungen

- BD Silver Gold Credit Card Terms Conditions BrochureDokument8 SeitenBD Silver Gold Credit Card Terms Conditions Brochurehasan raisNoch keine Bewertungen

- Citibank InformationDokument4 SeitenCitibank Informationapi-285960909Noch keine Bewertungen

- Cash On DemandDokument124 SeitenCash On DemandInnocent Sunday100% (2)

- Cap3 Problems ContDokument1 SeiteCap3 Problems ContProf. LUIS BENITEZNoch keine Bewertungen

- National Stock Exchange of IndiaDokument22 SeitenNational Stock Exchange of IndiaParesh Narayan BagweNoch keine Bewertungen

- The Asian Currency Crisis: A Case StudyDokument7 SeitenThe Asian Currency Crisis: A Case StudyTantanLeNoch keine Bewertungen

- Book Review "In Defense of Public Debt", by Barry Eichengreen, Asmaa El-Ganainy, Rui Esteves, and Kris JamesDokument13 SeitenBook Review "In Defense of Public Debt", by Barry Eichengreen, Asmaa El-Ganainy, Rui Esteves, and Kris JamesDavid SeijoNoch keine Bewertungen

- 11 Chapter 3 (Working Capital Aspects)Dokument30 Seiten11 Chapter 3 (Working Capital Aspects)Abin VargheseNoch keine Bewertungen

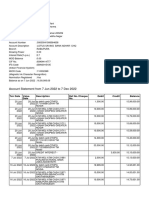

- Account Statement From 7 Jun 2022 To 7 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument3 SeitenAccount Statement From 7 Jun 2022 To 7 Dec 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRdb TalkNoch keine Bewertungen

- Rebuilding Zimbabwe's Microfinance SectorDokument25 SeitenRebuilding Zimbabwe's Microfinance SectorBengt PostNoch keine Bewertungen

- 1.0 Executive Summary: 1.1 ObjectivesDokument5 Seiten1.0 Executive Summary: 1.1 Objectivesethnan lNoch keine Bewertungen

- Intermediate Financial Accounting II 1 1Dokument146 SeitenIntermediate Financial Accounting II 1 1natinaelbahiru74Noch keine Bewertungen

- What If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGADokument10 SeitenWhat If Gafa Replaced Traditional Banks?: Translation: Wency-Wenceslas MOUNDOUNGAMike BurdickNoch keine Bewertungen

- Chapter Ten: Planning For Capital InvestmentsDokument42 SeitenChapter Ten: Planning For Capital InvestmentsGab BautistaNoch keine Bewertungen

- Para Banking: - Shraddha Damania - Mihir Mehta - Charmi Morakhia - Vikas Mehta - Noman Agashiwala Group 3Dokument32 SeitenPara Banking: - Shraddha Damania - Mihir Mehta - Charmi Morakhia - Vikas Mehta - Noman Agashiwala Group 3Nidhi VermaNoch keine Bewertungen

- DepreciationDokument14 SeitenDepreciationEdielyn VillarandaNoch keine Bewertungen

- Class On Pay Fixation in 8th April.Dokument118 SeitenClass On Pay Fixation in 8th April.Crick CompactNoch keine Bewertungen

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDokument3 SeitenDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNoch keine Bewertungen

- What's New Viewer - SAP S - 4HANADokument570 SeitenWhat's New Viewer - SAP S - 4HANAEnrique MarquezNoch keine Bewertungen

- Accounting CaDokument9 SeitenAccounting CatejaswiNoch keine Bewertungen

- Laura Zapatería Lougon - UNIT 8-VOCABULARY EXERCISES ON BANKINGDokument4 SeitenLaura Zapatería Lougon - UNIT 8-VOCABULARY EXERCISES ON BANKINGLaura ZapateríaNoch keine Bewertungen

- Chernigov Complete Guide With Secrets From Monasteries Past and Minerals - EgDokument474 SeitenChernigov Complete Guide With Secrets From Monasteries Past and Minerals - EgO TΣΑΡΟΣ ΤΗΣ ΑΝΤΙΒΑΡΥΤΗΤΑΣ ΛΙΑΠΗΣ ΠΑΝΑΓΙΩΤΗΣNoch keine Bewertungen

- Blockchain Technology: Application in Indian Banking SectorDokument14 SeitenBlockchain Technology: Application in Indian Banking Sectorabhishek0902Noch keine Bewertungen

- Funding African InfrastructureDokument4 SeitenFunding African InfrastructureKofikoduahNoch keine Bewertungen

- 0integrated Accounting: Financial Accounting & Reporting (P1)Dokument32 Seiten0integrated Accounting: Financial Accounting & Reporting (P1)Jochelle Anne PaetNoch keine Bewertungen

- CEECONO Lecture 7Dokument28 SeitenCEECONO Lecture 7Lyle Dominic AtienzaNoch keine Bewertungen

- Musharakah Mutanaqisah As An Islamic Financing Alternative To BBADokument3 SeitenMusharakah Mutanaqisah As An Islamic Financing Alternative To BBAhakimi1568Noch keine Bewertungen

- Flowchart Real Property TaxDokument1 SeiteFlowchart Real Property TaxPrincess Mae SamborioNoch keine Bewertungen

- Lasu Direct Entry Past QuestionsDokument43 SeitenLasu Direct Entry Past QuestionsSandra GkbchallNoch keine Bewertungen

- Analysis of The Financial Strategies of Grameen BankDokument22 SeitenAnalysis of The Financial Strategies of Grameen BankSha D ManNoch keine Bewertungen

- Full Download Ebook PDF Modern Advanced Accounting in Canada 9th Canadian Edition PDFDokument41 SeitenFull Download Ebook PDF Modern Advanced Accounting in Canada 9th Canadian Edition PDFheather.philipps242100% (28)

- 10 - Pas 20 - Government GrantsDokument4 Seiten10 - Pas 20 - Government GrantsAbbygail Michelle TalaveraNoch keine Bewertungen

- Law of Contract Made Simple for LaymenVon EverandLaw of Contract Made Simple for LaymenBewertung: 4.5 von 5 Sternen4.5/5 (9)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseVon EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNoch keine Bewertungen

- How to Win Your Case In Traffic Court Without a LawyerVon EverandHow to Win Your Case In Traffic Court Without a LawyerBewertung: 4 von 5 Sternen4/5 (5)

- Learn the Essentials of Business Law in 15 DaysVon EverandLearn the Essentials of Business Law in 15 DaysBewertung: 4 von 5 Sternen4/5 (13)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowVon EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowBewertung: 1 von 5 Sternen1/5 (1)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterVon EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNoch keine Bewertungen

- Contracts: The Essential Business Desk ReferenceVon EverandContracts: The Essential Business Desk ReferenceBewertung: 4 von 5 Sternen4/5 (15)

- How to Win Your Case in Small Claims Court Without a LawyerVon EverandHow to Win Your Case in Small Claims Court Without a LawyerBewertung: 5 von 5 Sternen5/5 (1)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityVon EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNoch keine Bewertungen

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsVon EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNoch keine Bewertungen

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreVon EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetVon EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNoch keine Bewertungen

- Technical Theater for Nontechnical People: Second EditionVon EverandTechnical Theater for Nontechnical People: Second EditionNoch keine Bewertungen

- How to Improvise a Full-Length Play: The Art of Spontaneous TheaterVon EverandHow to Improvise a Full-Length Play: The Art of Spontaneous TheaterNoch keine Bewertungen

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersVon EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersBewertung: 5 von 5 Sternen5/5 (1)

- The Certified Master Contract AdministratorVon EverandThe Certified Master Contract AdministratorBewertung: 5 von 5 Sternen5/5 (1)