Beruflich Dokumente

Kultur Dokumente

City Developments Downgraded to Sell on Residential Uncertainties; Hotel Segment Remains Firm

Hochgeladen von

Jay NgOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

City Developments Downgraded to Sell on Residential Uncertainties; Hotel Segment Remains Firm

Hochgeladen von

Jay NgCopyright:

Verfügbare Formate

www.agco.

com

CITY DEVELOPMENTS LTD

DOWNGRADE TO SELL

March 1, 2012 Price: SGD 11.13 Singapore [Real Estate Management & Development] Ticker: [CIT SP] Market Cap: USD 7,202.9 m Outstanding Shares: 909.2 m Six Month Avg. Daily Trading Vol. (USD m): 12.6 52 Week High/Low: SGD 11.80 / SGD 8.50

Asian Sales Charlie Gushee Head of Global Equity Sales cgushee@agco.com 212-453-3511 Erik Lam elam@agco.com 212-453-3570 Sandra Sondak ssondakm@agco.com 212-453-3509 Duke Shin dshin@agco.com 212-453-3528 Anshuman Ray aray@agco.com 212-453-3546 Sandeep Seth sseth@agco.com 212-453-3530 Ailsa Carpenter acarpenter@agco.com 212-453-3507 Chris Dodson Japanese Sales cdodson@agco.com 212-453-3541 Trading 212-557-4444 Garth Ballantyne Head of Trading gballantyne@agco.com Geoffrey Gimber ggimber@agco.com David Sweet dsweet@agco.com Selim Sari ssari@agco.com Mike LoPiano mlopiano@agco.com Peter Peters ppeters@agco.com John Geron U.S. Trading jgeron@agco.com Fixed Income Tim Slaughter Head of Fixed Income tslaugher@agco.com

SELL

City Developments (CDL) reported 4Q11 PATMI of S$163m, down 32% YoY, mostly due to the absence of gains recognized from strata unit sales at Chinatown Point (present in year-ago quarter). As a result, FY11 PATMI cumulated to S$799m which was mostly within our expectations. FY11 topline came in at S$3,280m again in line with our FY11 forecast (S$3,301m). Net gearing improved to 21% (versus 29% in FY10) with a healthy cash balance of S$2.6b as of FY11. Total final dividends of 13 S-cents (5 cents special, 8 cents ordinary) were proposed. In FY11, CDL sold a total of 1,818 units for S$1,755m versus 1,559 units for S$2,115m in FY10. Management indicated that they would launch Robertson Quay (70 units) in Mar/Apr 12 and the landed site at Serangoon Garden Way (96 units) in Apr 12. It would also continue to expand its Chinese presence by injecting S$500m into CDL China for further acquisitions, in addition to the S$300m allocated in Aug 10. The hotel segment put up healthy numbers with M&Cs global RevPar up 5.8% YoY (constant currency terms), driven mainly by an increase in average room rates. M&Cs FY11 PATMI came in at GBP161m, up 67.3%. We expect numbers from hotels to stay relatively firm, particularly in London where hospitality assets are likely to outperform with the upcoming Olympic Games. While managements execution continues to be spot on, the share price has appreciated 25% YTD and we believe the risk-reward proposition appears unfavorable currently. Our fundamental view remains unchanged that uncertainties in the domestic residential sector persist, which could bear on CDL given its significant landbank of 5.56m sq ft. Downgrade to SELL. However, we raise our fair value estimate to S$8.92 (35% discount to RNAV) from S$8.38 previously as we update our model for latest M&C valuations and FY11 financials.

YE DEC 2013E 2012E 2011 2010 Revenue (SGD m) 3,604 3,400 3,281 3,103 EBITDA (SGD m) ----Net Income (SGD m) 680 672 799 784 Adj. EPS (SGD) 0.75 0.74 0.88 0.85 EV/EBITDA (X) ----P/E (X) 14.9 15.1 12.7 13.1 Div. Yield (%) 1.60 1.60 1.60 0.70

This report has been prepared by our correspondent named above on the date set forth above. This report was not prepared by Auerbach Grayson & Company. The correspondent named above and its research analysts are not members of the Financial Industry Regulatory Authority and are not subject to the FINRA Rules on Research Analysts and Research Reports and the attendant restrictions and required disclosures required by that rule.[If the report is to be distributed to more than U. S. Institutional Investors Auerbach Grayson & Company accepts responsibility for the contents of this report as provided for in SEC Releases and SEC staff no-action letters.] All persons receiving this report and wishing to buy or sell any of the securities discussed herein should do so through a representative of Auerbach Grayson & Company.Auerbach Grayson & Company and its affiliates do not own one per cent (1%) or more of any class of equity securities issued by any of the companies discussed in this report. Auerbach Grayson & Company and its affiliates have not received any investment banking compensation from any of the issuers discussed in this report in the past twelve months, and does not intend to seek or expect to receive investment banking compensation from any of the issuers discussed in this report in the next three (3) months. Auerbach Grayson & Company has not acted as manager or co-manager of any public offering of securities issued by any of the companies discussed in this report in the past three (3) years. Neither Auerbach Grayson & Company nor any of its officers own options, rights or warrants to purchase any of the securities of the issuers whose securities are discussed in this report. Auerbach Grayson & Company does not make a market in any of the securities discussed in this report, and it and its associated persons do not stand ready to buy from or sell to any customers, as principal, any of the securities discussed in this report.

Also view Auerbach Grayson Research on Reuters, Bloomberg, FirstCall, FactSet, CapitalIQ, and TheMarkets.com

If you use our research, please recognize us in your firm's broker vote

Singapore | Real Estate Management and Development

Asia Pacific Equity Research

CITY DEVELOPMENTS LTD | SELL

MARKET CAP: USD 8.1B AVG DAILY TURNOVER: USD 51M 1 Mar 2012 Company Update

DOWNGRADE TO SELL

4Q11 results in line Residential uncertainties persist Unfavorable risk-reward currently

SELL (downgrade)

Fair value add: 12m dividend forecast versus: Current price 12m total return forecast S$8.92 S$0.18 S$11.13 -18%

4Q11 results within expectations City Developments (CDL) reported 4Q11 PATMI of S$163m, down 32% YoY, mostly due to the absence of gains recognized from strata unit sales at Chinatown Point (present in year-ago quarter). As a result, FY11 PATMI cumulated to S$799m which was mostly within our expectations. FY11 topline came in at S$3,280m again in line with our FY11 forecast (S$3,301m). Net gearing improved to 21% (versus 29% in FY10) with a healthy cash balance of S$2.6b as of FY11. Total final dividends of 13 S-cents (5 cents special, 8 cents ordinary) were proposed. Healthy residential sales in FY11 In FY11, CDL sold a total of 1,818 units for S$1,755m versus 1,559 units for S$2,115m in FY10. Management indicated that they would launch Robertson Quay (70 units) in Mar/Apr 12 and the landed site at Serangoon Garden Way (96 units) in Apr 12. It would also continue to expand its Chinese presence by injecting S$500m into CDL China for further acquisitions, in addition to the S$300m allocated in Aug 10. Firm numbers for the hotel segment The hotel segment put up healthy numbers with M&Cs global RevPar up 5.8% YoY (constant currency terms), driven mainly by an increase in average room rates. M&Cs FY11 PATMI came in at GBP161m, up 67.3%. We expect numbers from hotels to stay relatively firm, particularly in London where hospitality assets are likely to outperform with the upcoming Olympic Games. Unfavorable risk-reward here downgrade to SELL While managements execution continues to be spot on, the share price has appreciated 25% YTD and we believe the risk-reward proposition appears unfavorable currently. Our fundamental view remains unchanged that uncertainties in the domestic residential sector persist, which could bear on CDL given its significant landbank of 5.56m sq ft. Downgrade to SELL. However, we raise our fair value estimate to S$8.92 (35% discount to RNAV) from S$8.38 previously as we update our model for latest M&C valuations and FY11 financials.

Analysts Eli Lee (Lead) +65 6531 98112 elilee@ocbc-research.com Kevin Tan +65 6531 9810 kevintan@ocbc-research.com

Key information Market cap. (m) Avg daily turnover (m) Avg daily vol. (m) 52-wk range (S$) Free float (%) Shares o/s. (m) Exchange BBRG ticker Reuters ticker ISIN code GICS Sector GICS Industry Top shareholder S$10,166 / USD8,126 S$64 / USD51 6.2 8.5 - 11.7995 68.0 909.3 SGX CIT SP CTDM.SI C09 Financials RE Mngt & Dev Aberdeen - 19.0% 1m 10 7 3m 16 4 12m 0 -1

Relative total return Company (%) STI-adjusted (%) Price performance chart

Shar e Pr i ce (S$ ) 12.28 11.16 10.04 8.93 7.81 6.70 Mar -11 Jun-11 Aug-11 `

Index Level 3400 3080 2760 2440 2120 1800 Nov-11 Feb-12

Fair Value

Sources: Bloomberg, OIR estimates

CIT SP

FSSTI

Key financial highlights Year ended 31 Dec (S$m) Revenue Cost of sales Gross profit Shareholders' profit EPS (S-cents) Cons. EPS (S-cents) PER (x) P/NAV (x) ROE (%) Net gearing (%) FY10 3,103.4 -1,450.7 1,652.7 784.0 84.8 na 13.1 1.6 12.5 29.2 FY11 3,280.5 -1,507.5 1,773.0 798.6 87.8 na 12.7 1.5 11.7 20.7 FY12F 3,400.3 -1,562.5 1,837.7 671.9 73.9 73.1 15.1 1.3 9.2 10.1 FY13F 3,604.3 -1,656.3 1,948.0 680.1 74.8 75.7 14.9 1.3 8.7 2.2

Industry-relative metrics

P er c ent i l e 0t h 25t h 50t h 75t h 100t h

M k t Cap B et a ROE PE PB

Company

I ndus t r y A v er age

Note: Industry universe defined as companies under identical GICS classification listed in the same exchange. Sources: Bloomberg, OIR estimates

Please refer to important disclosures at the back of this document.

MITA No. 019/06/2011

OCBC Investment Research Singapore Equities

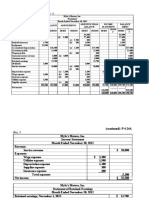

Exhibit 1: Quarterly financial highlights 4Q10 (S$m) Revenue Cost of sales Gross profit Other operating income Administrative expenses Other operating expenses Profit from operations Finance income Finance costs Share of associate profits (after-tax) Share of JV profits (after-tax) PBT Income tax PAT MI PATMI Sources: Company financials 671.6 -294.2 377.4 218.5 -125.4 -194.0 276.5 5.6 -19.4 10.8 36.9 310.3 -53.2 257.1 16.1 241.0 4Q11 (S$m) 721.5 -263.4 458.1 9.8 -116.0 -120.9 231.0 8.1 -18.7 14.6 11.4 246.3 -43.6 202.7 39.5 163.2 % Chg (YoY) 7.4% -10.4% 21.4% -95.5% -7.5% -37.7% -16.5% 44.6% -3.8% 35.5% -69.2% -20.6% -18.1% -21.1% 145.2% -32.3% 3Q11 (S$m) 805.8 -358.2 447.6 0.6 -126.7 -92.2 229.4 6.3 -21.2 4.5 -1.4 217.5 -29.3 188.2 56.1 132.1 % Chg (QoQ) -10.5% -26.5% 2.3% nm -8.4% 31.1% 0.7% 28.5% -11.8% 227.0% nm 13.2% 48.5% 7.7% -29.5% 23.6%

OCBC Investment Research Singapore Equities

Company financial highlights

Income statement Year ended 31 Dec (S$m) Revenue Cost of sales Gross profit Administrative expenses Profit from operations Net finance costs Share of JV's profits Profit before income tax Profit for the period Shareholders' profit

FY10 3,103.4 -1,450.7 1,652.7 -484.0 990.1 -33.1 93.3 1,067.5 865.4 784.0

FY11 3,280.5 -1,507.5 1,773.0 -490.2 1,127.4 -52.9 30.2 1,136.4 961.7 798.6

FY12F 3,400.3 -1,562.5 1,837.7 -508.1 1,025.3 -55.5 20.5 1,079.0 863.2 671.9

FY13F 3,604.3 -1,656.3 1,948.0 -538.6 1,086.8 -58.3 4.5 1,126.3 901.0 680.1

Balance sheet Year ended 31 Dec (S$m) Cash and bank balances Property, plant and equipment Development properties Total assets Debt Current liabilities excluding debt Total liabilities Shareholders equity Total equity Total equity and liabilities

FY09 1,873.8 3,410.4 3,311.2 13,962.8 4,205.3 1,238.1 5,982.5 6,262.5 7,980.3 13,962.8

FY10 2,603.0 3,313.2 3,243.9 14,962.5 4,405.8 1,342.7 6,266.5 6,826.8 8,696.0 14,962.5

FY11F 2,970.7 3,904.1 3,081.7 15,650.0 3,912.5 1,420.6 5,876.9 7,335.0 9,773.1 15,650.0

FY12F 3,725.9 3,962.4 2,927.6 15,784.8 3,946.2 1,502.1 6,019.3 7,851.5 9,765.6 15,784.8

Cash flow statement Year ended 31 Dec (S$m) Operating profit b/f WC change Changes in working capital Income tax paid Operating cash flow Investing cash flow Financing cash flow Net change in cash Cash at beginning of the year Other adjustments Cash at end of the year

FY09 896.8 -278.9 -105.9 512.1 371.0 34.6 917.6 980.1 -23.9 1,873.8

FY10 1,053.7 91.5 -162.2 983.0 52.7 -419.5 616.1 1,873.0 -1.5 2,487.6

FY11F 1,211.3 899.4 -107.9 2,002.8 -130.4 -1,389.3 483.1 2,487.6 0.0 2,970.7

FY12F 1,277.2 184.7 -112.6 1,349.3 -124.9 -469.2 755.2 2,970.7 0.0 3,725.9

Year ended 31 Dec (S$m) EPS (S-cents) NAV per share (S-cents) PER (x) P/NAV (x) Gross profit margin (%) Net profit margin (%) Net gearing (%) Dividend yield (%) ROE (%) ROA (%) Sources: Company, OIR forecasts

FY09 84.8 688.7 13.1 1.6 53.3 27.9 29.2 0.7 12.5 6.2

FY10 87.8 750.8 12.7 1.5 54.0 29.3 20.7 1.6 11.7 6.4

FY11F 73.9 858.7 15.1 1.3 54.0 25.4 10.1 1.6 9.2 5.5

FY12F 74.8 845.7 14.9 1.3 54.0 25.0 2.2 1.6 8.7 5.7

Company financial highlights

OCBC Investment Research Singapore Equities

SHAREHOLDING DECLARATION: The analyst/analysts who wrote this report hold NIL shares in the above security.

DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our written consent. This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations shall not be understood as neither given nor endorsed.

RATINGS AND RECOMMENDATIONS: - OCBC Investment Researchs (OIR) technical comments and recommendations are short-term and trading oriented. - OIRs fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIRs BUY rating indicates a total return in excess of 10% given the current price; a HOLD trading indicates total returns within +/-10% range; a SELL rating indicates total returns less than -10%. - For companies with less than S$150m market capitalization, OIRs BUY rating indicates a total return in excess of 30%; a HOLD trading indicates total returns within a +/-30% range; a SELL rating indicates total returns less than -30%.

Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd

Published by OCBC Investment Research Pte Ltd

Important disclosures

Auerbach Grayson & Company, LLC. 25West 45th Street New York, NY 10036 Telephone: (212) 557-4444 800 31-WORLD facsimile (212) 557-9066 www.agco.com Info@agco.com

Trading: Operations: Jonathan L. Auerbach David S. Grayson Sales: Gushee, Charlie - Managing Director, Global Equity Sales Carpenter, Ailsa - GEM Sales Castro, Elena - LATAM & Western European Sales Daoud, Michael - MENA Sales Dodson, Chris - Japan Sales Duzovalilar, Irem - Turkish Sales Fraser, Briggs - Swiss Equity Sales Geenen, Nils - Dutch Equity Sales Korolkevich, Kate - Ukrainian Sales Lam, Erik - Asian Sales Lueck, Stephan - Austrian & German Sales Lundin, Adam - Sub-Saharan Africa Sales Lundin, Johan - MENA & Sub-Saharan Africa Sales Mandel, Simon - EMEA Sales Ray, Anshuman - South Asian Sales Ross, Richard - Global Technical Research Rundolf, Oskar - MENA & Sub-Saharan Africa Sales Saner, Rene - Swiss Sales Sarman, Ugur - Turkish Sales Seth, Sandeep - South Asian Sales Shin, Duke - Asian Sales Sondak, Sandra - Asian Sales Trading: Ballantyne, Garth - Managing Director, Global Trading Cruz, Humberto - LATAM Trading Geron, John - U.S. Trading Gimber, Geoffrey - Asian Trading Iliozer, Sarkis - EMEA Trading LoPiano, Mike - Asian Trading Peters, Peter - Asian Trading Pollicino, Steve - EMEA Trading Register, Dane - European Trading Simon, Danielle - European Trading Sweet, David - Asian Trading Fixed Income: Slaughter, Tim - Managing Director, Global Fixed Income Information Systems & Research Services: Keefe, Kevin - Research Coordinator Sadek, Ismael - Information Technology Operations: Muller, Frank - Managing Director, Operations

(212) 557-4444 (212) 557-4478 (212) 453-3535 (212) 453-3553 cgushee@agco.com (212) 453-3511 acarpenter@agco.com (212) 453-3507 ecastro@agco.com (212) 453-3540 mdaoud@agco.com (212) 453-3586 cdodson@agco.com (212) 453-3541 iduzovalilar@agco.com (212) 453-3559 bfraser@agco.com (212) 453-3548 ngeenen@agco.com (212) 453-3520 kkorolkevich@agco.com (212) 453-3562 elam@agco.com (212) 453-3570 slueck@agco.com (212) 453-3538 alundin@agco.com (212) 453-3506 jlundin@agco.com (212) 453-3531 smandel@agco.com (212) 453-3571 aray@agco.com (212) 453-3546 rross@agco.com (212) 453-3575 orundolf@agco.com (212) 453-3510 rsaner@agco.com (212) 453-3526 usarman@agco.com (212) 453-3589 sseth@agco.com (212) 453-3530 dshin@agco.com (212) 453-3528 ssondak@agco.com (212) 453-3509 gballantyne@agco.com (212) 557-4444 hcruz@agco.com (212) 557-4444 jgeron@agco.com (212) 557-4444 ggimber@agco.com (212) 557-4444 siliozer@agco.com (212) 557-4444 mlopiano@agco.com (212) 453-4444 ppeters@agco.com (212) 453-4444 spollicino@agco.com (212) 557-4444 dregister@agco.com (212) 557-4444 dsimon@agco.com (212) 557-4444 dsweet@agco.com (212) 557-4444 tslaughter@agco.com (212) 453-3563 kkeefe@agco.com (212) 453-3549 isadek@agco.com (212) 453-3512 fmuller@agco.com (212) 453-3518

Das könnte Ihnen auch gefallen

- The REAL Book of Real EstateDokument513 SeitenThe REAL Book of Real Estateplatonmiraj471794% (32)

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDokument43 SeitenThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaNoch keine Bewertungen

- Accounting and Bookkeeping Business PlanDokument33 SeitenAccounting and Bookkeeping Business PlanmikeeeeeyNoch keine Bewertungen

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsVon EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Spilker Taxation of Business Entities 2013 4e SpilkerDokument99 SeitenSpilker Taxation of Business Entities 2013 4e SpilkerVanessa ThomasNoch keine Bewertungen

- Detailed Analysis Raises Questions About MBIA's Triple-A RatingDokument55 SeitenDetailed Analysis Raises Questions About MBIA's Triple-A Ratingjhsu6a21100% (1)

- Detailed Analysis Raises Questions About MBIA's Triple-A RatingDokument55 SeitenDetailed Analysis Raises Questions About MBIA's Triple-A Ratingjhsu6a21100% (1)

- Credit Suisse (Incl. NPV Build Up)Dokument23 SeitenCredit Suisse (Incl. NPV Build Up)rodskogjNoch keine Bewertungen

- OCBC Research Report 2013 July 9 by MacquarieDokument6 SeitenOCBC Research Report 2013 July 9 by MacquarietansillyNoch keine Bewertungen

- HKEX & LME 15june2012Dokument4 SeitenHKEX & LME 15june2012tansillyNoch keine Bewertungen

- Ho Bee Investment LTD: Positive 1Q2013 ResultsDokument9 SeitenHo Bee Investment LTD: Positive 1Q2013 ResultsphuawlNoch keine Bewertungen

- Audit of Prepayment and Intangible Asset: Problem 6-1Dokument42 SeitenAudit of Prepayment and Intangible Asset: Problem 6-1Un knownNoch keine Bewertungen

- JPMorgan Global Investment Banks 2010-09-08Dokument176 SeitenJPMorgan Global Investment Banks 2010-09-08francoib991905Noch keine Bewertungen

- 2010 May - Morning Pack (DBS Group) For Asian StocksDokument62 Seiten2010 May - Morning Pack (DBS Group) For Asian StocksShipforNoch keine Bewertungen

- Chapter 2 Cost Terms, Concepts, and Classifications PDFDokument2 SeitenChapter 2 Cost Terms, Concepts, and Classifications PDFsolomonaauNoch keine Bewertungen

- Morning Pack: Regional EquitiesDokument59 SeitenMorning Pack: Regional Equitiesmega_richNoch keine Bewertungen

- Financial Accounting Volume 1Dokument29 SeitenFinancial Accounting Volume 1Ferjeanie Bernandino100% (1)

- Wing Tai Holdings: 2QFY11 Results ReviewDokument4 SeitenWing Tai Holdings: 2QFY11 Results ReviewRaymond LuiNoch keine Bewertungen

- Singapore Container Firm Goodpack Research ReportDokument3 SeitenSingapore Container Firm Goodpack Research ReportventriaNoch keine Bewertungen

- Starhill Global REIT Ending 1Q14 On High NoteDokument6 SeitenStarhill Global REIT Ending 1Q14 On High NoteventriaNoch keine Bewertungen

- CromptonGreaves JRGSec 080211Dokument2 SeitenCromptonGreaves JRGSec 080211emailidabhiNoch keine Bewertungen

- Capital Mall TrustDokument7 SeitenCapital Mall TrustChan Weng HongNoch keine Bewertungen

- 2013-5-13 Big OcbcDokument5 Seiten2013-5-13 Big OcbcphuawlNoch keine Bewertungen

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Dokument2 SeitenBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNoch keine Bewertungen

- Reliance Infrastructure 091113 01Dokument4 SeitenReliance Infrastructure 091113 01Vishakha KhannaNoch keine Bewertungen

- TCS commentary stable, Seasonality to impact quarterDokument3 SeitenTCS commentary stable, Seasonality to impact quarterDarshan MaldeNoch keine Bewertungen

- SingTel Maintains Hold RatingDokument4 SeitenSingTel Maintains Hold Ratingscrib07Noch keine Bewertungen

- 2013-3-22 SREITs Roundup 2203131Dokument12 Seiten2013-3-22 SREITs Roundup 2203131phuawlNoch keine Bewertungen

- BIMBSec - Wah Seong Julimar 20120522Dokument2 SeitenBIMBSec - Wah Seong Julimar 20120522Bimb SecNoch keine Bewertungen

- Wired Daily: Singapore Traders SpectrumDokument9 SeitenWired Daily: Singapore Traders SpectrumBubblyDeliciousNoch keine Bewertungen

- Symphony LTD.: CompanyDokument4 SeitenSymphony LTD.: CompanyrohitcoepNoch keine Bewertungen

- Market Outlook 12th March 2012Dokument4 SeitenMarket Outlook 12th March 2012Angel BrokingNoch keine Bewertungen

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDokument4 SeitenGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNoch keine Bewertungen

- BIMBSec - Digi Company Update - 20120502Dokument3 SeitenBIMBSec - Digi Company Update - 20120502Bimb SecNoch keine Bewertungen

- Market Watch Daily 14.10Dokument1 SeiteMarket Watch Daily 14.10LBTodayNoch keine Bewertungen

- 7jul11 - Tiger AirwaysDokument3 Seiten7jul11 - Tiger AirwaysmelyeapNoch keine Bewertungen

- Wah Seong 4QFY11 20120223Dokument3 SeitenWah Seong 4QFY11 20120223Bimb SecNoch keine Bewertungen

- Sgreits 020911Dokument18 SeitenSgreits 020911Royston Tan Keng SanNoch keine Bewertungen

- 110516-OSK-1QFY11 Results Review - Affected by External FactorsDokument4 Seiten110516-OSK-1QFY11 Results Review - Affected by External FactorsTodd BenuNoch keine Bewertungen

- Graña y Montero S.A.A. - Update - FV at PEN 10.93 - NeutralDokument3 SeitenGraña y Montero S.A.A. - Update - FV at PEN 10.93 - NeutralJefferson Quiroz VillavicencioNoch keine Bewertungen

- Research: Sintex Industries LimitedDokument4 SeitenResearch: Sintex Industries LimitedMohd KaifNoch keine Bewertungen

- Cambridge Ind Trust - DBSDokument17 SeitenCambridge Ind Trust - DBSTerence Seah Pei ChuanNoch keine Bewertungen

- Market Outlook 20th March 2012Dokument3 SeitenMarket Outlook 20th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 23rd September 2011Dokument4 SeitenMarket Outlook 23rd September 2011Angel BrokingNoch keine Bewertungen

- Wilmar International: Outperform Price Target: SGD 4.15Dokument4 SeitenWilmar International: Outperform Price Target: SGD 4.15KofikoduahNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument4 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Ideas Troika 15 Jul 2015Dokument14 SeitenIdeas Troika 15 Jul 2015bodaiNoch keine Bewertungen

- Market Outlook 26th September 2011Dokument3 SeitenMarket Outlook 26th September 2011Angel BrokingNoch keine Bewertungen

- Citi Report CIBCDokument23 SeitenCiti Report CIBCinchoatehereNoch keine Bewertungen

- Singapore Equity Research | Ezion Holdings Shows ResilienceDokument5 SeitenSingapore Equity Research | Ezion Holdings Shows ResilienceventriaNoch keine Bewertungen

- BIMBSec - QL 4QFY12 Results Review 20120523Dokument3 SeitenBIMBSec - QL 4QFY12 Results Review 20120523Bimb SecNoch keine Bewertungen

- Ho Bee Investment LTD: Healthy Pre-Commitment For Office SpaceDokument9 SeitenHo Bee Investment LTD: Healthy Pre-Commitment For Office SpacephuawlNoch keine Bewertungen

- SPH Reit - Hold: Upholding Its StrengthDokument5 SeitenSPH Reit - Hold: Upholding Its StrengthventriaNoch keine Bewertungen

- TM 4QFY11 Results 20120227Dokument3 SeitenTM 4QFY11 Results 20120227Bimb SecNoch keine Bewertungen

- Kajaria Ceramics: Upgrade in Price TargetDokument4 SeitenKajaria Ceramics: Upgrade in Price TargetSudipta BoseNoch keine Bewertungen

- Rambling Souls - Axis Bank - Equity ReportDokument11 SeitenRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNoch keine Bewertungen

- Engineering Civilised Numbers: Yongnam HoldingsDokument5 SeitenEngineering Civilised Numbers: Yongnam HoldingsTerence Seah Pei ChuanNoch keine Bewertungen

- Media Chinese Intn'L: Company ReportDokument5 SeitenMedia Chinese Intn'L: Company ReportAlan Chan Tee SiongNoch keine Bewertungen

- Market Outlook 25th August 2011Dokument3 SeitenMarket Outlook 25th August 2011Angel BrokingNoch keine Bewertungen

- CardinalStone Research - Seplat Petroleum Development Corporation - Trading UpdateDokument5 SeitenCardinalStone Research - Seplat Petroleum Development Corporation - Trading UpdateDhameloolah LawalNoch keine Bewertungen

- SBI Offshore 1HFY2013 PresentationDokument17 SeitenSBI Offshore 1HFY2013 PresentationWeR1 Consultants Pte LtdNoch keine Bewertungen

- 2013-7-11 DBS Vickers Plantation CompaniesDokument8 Seiten2013-7-11 DBS Vickers Plantation CompaniesphuawlNoch keine Bewertungen

- BIMBSec - Bumi Armada Company Update - Deeper Into Caspian Sea - 20120417Dokument2 SeitenBIMBSec - Bumi Armada Company Update - Deeper Into Caspian Sea - 20120417Bimb SecNoch keine Bewertungen

- Market Outlook 20th September 2011Dokument4 SeitenMarket Outlook 20th September 2011Angel BrokingNoch keine Bewertungen

- Agathia GreysonDokument25 SeitenAgathia GreysonSaad FerozeNoch keine Bewertungen

- Larsen & ToubroDokument15 SeitenLarsen & ToubroAngel BrokingNoch keine Bewertungen

- Market Outlook 13th March 2012Dokument4 SeitenMarket Outlook 13th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 23rd August 2011Dokument3 SeitenMarket Outlook 23rd August 2011angelbrokingNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- The B's in The WorldDokument5 SeitenThe B's in The WorldJay NgNoch keine Bewertungen

- PT Siantar TopDokument3 SeitenPT Siantar TopJay NgNoch keine Bewertungen

- 4Dokument7 Seiten4Jay NgNoch keine Bewertungen

- Fkas ANSaDokument9 SeitenFkas ANSaJay NgNoch keine Bewertungen

- AsdDokument4 SeitenAsdJay NgNoch keine Bewertungen

- MSC+William+Blair+Conference+Presentation+June+10+2014 FINALDokument27 SeitenMSC+William+Blair+Conference+Presentation+June+10+2014 FINALJay NgNoch keine Bewertungen

- Fkas ANSaDokument9 SeitenFkas ANSaJay NgNoch keine Bewertungen

- The B's in The WorldDokument5 SeitenThe B's in The WorldJay NgNoch keine Bewertungen

- Fkas ANSaDokument9 SeitenFkas ANSaJay NgNoch keine Bewertungen

- -Dokument1 Seite-Jay NgNoch keine Bewertungen

- Fkas ANSaDokument9 SeitenFkas ANSaJay NgNoch keine Bewertungen

- DopingDokument29 SeitenDopingJay NgNoch keine Bewertungen

- -Dokument13 Seiten-Jay NgNoch keine Bewertungen

- -Dokument13 Seiten-Jay NgNoch keine Bewertungen

- CAT QuestionDokument2 SeitenCAT QuestionJay Ng0% (1)

- -Dokument4 Seiten-Jay NgNoch keine Bewertungen

- -Dokument13 Seiten-Jay NgNoch keine Bewertungen

- Market Pulse 120403 OIRDokument7 SeitenMarket Pulse 120403 OIRJay NgNoch keine Bewertungen

- Parco Menu: StarterDokument3 SeitenParco Menu: StarterJay NgNoch keine Bewertungen

- Total Access CommunicationsDokument8 SeitenTotal Access CommunicationsJay NgNoch keine Bewertungen

- HE6 - q1 - Mod3 - Preparing and Allocating of Family Budget - v2Dokument11 SeitenHE6 - q1 - Mod3 - Preparing and Allocating of Family Budget - v2Flexi Ilao ObisNoch keine Bewertungen

- Barangay Arzadon Office of The Sangguniang BarangayDokument31 SeitenBarangay Arzadon Office of The Sangguniang BarangayMark Francis SecretarioNoch keine Bewertungen

- Module 1.1 - Property, Plant and EquipmentDokument6 SeitenModule 1.1 - Property, Plant and EquipmentJaimell LimNoch keine Bewertungen

- How to Write a Business Plan in 40 CharactersDokument5 SeitenHow to Write a Business Plan in 40 CharactersSooraj MittalNoch keine Bewertungen

- Hindalco WC ProjectDokument80 SeitenHindalco WC ProjectKamleshwar Pokhrail100% (2)

- CRISIL's view on coverage ratiosDokument4 SeitenCRISIL's view on coverage ratiosAtibAhmedNoch keine Bewertungen

- Kurkure Project 1Dokument18 SeitenKurkure Project 1AbhishekNoch keine Bewertungen

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDokument10 SeitenKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINoch keine Bewertungen

- Soalan Sesi Libat Urus (SLU) Persatuan Majikan - MajikanDokument7 SeitenSoalan Sesi Libat Urus (SLU) Persatuan Majikan - MajikanrayvathyNoch keine Bewertungen

- Accounting Chapter 4 SolutionsDokument14 SeitenAccounting Chapter 4 Solutionsali sherNoch keine Bewertungen

- Accounting Standard-16: Borrowing CostsDokument19 SeitenAccounting Standard-16: Borrowing CostsGere TassewNoch keine Bewertungen

- Notes - Capital AllowanceDokument8 SeitenNotes - Capital AllowanceDIVA RTHININoch keine Bewertungen

- Chap 010Dokument50 SeitenChap 010mas azizNoch keine Bewertungen

- Ch6 Resource LocationDokument65 SeitenCh6 Resource LocationAhmad FarooqNoch keine Bewertungen

- Secretary of State: Audits DivisionDokument34 SeitenSecretary of State: Audits DivisionGiora RozmarinNoch keine Bewertungen

- ESTATE TAX PROBLEMSDokument6 SeitenESTATE TAX PROBLEMSZerjo CantalejoNoch keine Bewertungen

- Test Bank For Finance Applications and Theory 5th Edition by CornettDokument24 SeitenTest Bank For Finance Applications and Theory 5th Edition by CornettKaraKentygbc100% (48)

- Assignment AccountingDokument12 SeitenAssignment AccountingAslamJaved68Noch keine Bewertungen

- BA 99.1 - TheoriesDokument27 SeitenBA 99.1 - TheoriesMikaela LacabaNoch keine Bewertungen

- INCOME UNDER SALARIESDokument44 SeitenINCOME UNDER SALARIEShny0910Noch keine Bewertungen

- Literature Review On Cash Management SystemDokument8 SeitenLiterature Review On Cash Management Systemea98skah100% (1)

- Quizbee 2Dokument3 SeitenQuizbee 2Haizii PritziiNoch keine Bewertungen

- Exhibitor Manual CONTECH 2013 EngDokument49 SeitenExhibitor Manual CONTECH 2013 EngctyvteNoch keine Bewertungen