Beruflich Dokumente

Kultur Dokumente

Vodafone

Hochgeladen von

Kaushal ShroffOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Vodafone

Hochgeladen von

Kaushal ShroffCopyright:

Verfügbare Formate

Finance Minister Pranab Mukherjees controversial move to amend the Income tax act with retrospective effect from

1962 , to bring under its ambit of taxation all overseas merger and acquisition deals, remains a flawed decision on two fronts. Firstly, it sends out a strong signal of executive bullying. The move by Mukherjee goes a long way in undermining the legal process and the rule of law in the country. Seeking to move an executive amendment in the Income Tax Act, post the Vodafone judgment is akin to upending the Vodafone order passed by the Supreme Court. The entire focus of tax legislation today is to clamp down on tax avoidance which resort to various artificial and coloured devices. The need is to differentiate strategic tax planning from tax avoidance. Even with the Mcdowells case, it was held that tax planning might be

legitimate within the framework of law and only avoidance of tax by resorting to dubious methods is to discouraged. However, Mukherjee by passing a blanket resolution has in one stroke removed all space for any rational and strategic tax planning. The move, if adopted, will put all merger and acquisition deals post 1962 under the income tax scanner, and will most probably end up damaging the investor climate in India. Justice Radhakrishanan, while recording his judgment in the Vodafone matter, incidentally speaks on the necessity of FDI in India. He states: The question involved in this case is of considerable public importance, especially on FDI, which is indispensable for a growing economy like India. Foreign investments in India are generally rounded through the countries with whom India had entered into treaties. Overseas investments in Joint Ventures(JV) and Wholly Owned Subsidiaries(WOS) have been recognized as important avenues of global business in India. The Justice further records the institutions most likely to use the instrument of off-shore finance, which include international companies, individuals, investors and others and capital flows through FDI, Portfolio Debt Investment and Foreign Potfolio Equity Investment. Secondly, the negative impact of such a move could very well go beyond the possible revenue benefits that can accrue to the kitty of the government. With the investment atmosphere running at quite a low and the markets just barely managing to recover from the shock of the 2008 recession scenario, Mukherjee would deal a deadly blow to market sentiment in general and will succeed in scaring long-term, infrastructure oriented projects in India.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- ScribdDokument1 SeiteScribdKaushal ShroffNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- FICA Reading Room CatalogDokument4.307 SeitenFICA Reading Room CatalogKaushal ShroffNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Indian Science CongressDokument5 SeitenIndian Science CongressKaushal ShroffNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Indian Science CongressDokument5 SeitenIndian Science CongressKaushal ShroffNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- See Annexure 80Dokument10 SeitenSee Annexure 80Kaushal ShroffNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

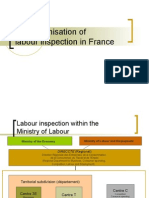

- L'Organisation de L'inspection Du Travail en France - EN - ReluDokument11 SeitenL'Organisation de L'inspection Du Travail en France - EN - ReluKaushal ShroffNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Indian Science CongressDokument5 SeitenIndian Science CongressKaushal ShroffNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Thank YouDokument1 SeiteThank YouKaushal ShroffNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Thank YouDokument1 SeiteThank YouKaushal ShroffNoch keine Bewertungen

- InfinityDokument1 SeiteInfinityKaushal ShroffNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dip PNoch keine Bewertungen

- SanyaDokument2 SeitenSanyavishnuNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Ita Uk 2007Dokument773 SeitenIta Uk 2007Nabilah ShahidanNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Pearsons Federal Taxation 2017 Corporations Partnerships 30Th Full ChapterDokument41 SeitenPearsons Federal Taxation 2017 Corporations Partnerships 30Th Full Chaptermargret.brennan669100% (28)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Chapter 8.ADokument18 SeitenChapter 8.AtawfiqhanifmawaniNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Chapter 04 NotesDokument5 SeitenChapter 04 NotesNik Nur MunirahNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Assessing Ethiopia's GVC StrategyDokument3 SeitenAssessing Ethiopia's GVC Strategyweronika hulewiczNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Completing a W-8BEN form for tax purposesDokument2 SeitenCompleting a W-8BEN form for tax purposesJay100% (2)

- Chapter 01 Introduction To Corporate FinanceDokument26 SeitenChapter 01 Introduction To Corporate Financeelongoria2780% (1)

- G.R. No. 207843Dokument5 SeitenG.R. No. 207843sofiaqueenNoch keine Bewertungen

- A System Dynamics Analysis of Boom and Bust in The Shrimp Aquaculture IndustryDokument20 SeitenA System Dynamics Analysis of Boom and Bust in The Shrimp Aquaculture IndustryRanulfoNoch keine Bewertungen

- Commissioner of Income-Tax Vs Gangadhar Sikaria Family Trust ... On 1 June, 1982Dokument9 SeitenCommissioner of Income-Tax Vs Gangadhar Sikaria Family Trust ... On 1 June, 1982Venkatesh JakkurNoch keine Bewertungen

- PLB - EnglishDokument16 SeitenPLB - Englishsetyabudi bowolaksonoNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Limitations I Nthe Power To TaxDokument3 SeitenLimitations I Nthe Power To TaxJoshua AmahitNoch keine Bewertungen

- Assess Financial Standing with Balance SheetDokument3 SeitenAssess Financial Standing with Balance SheetHrithik SaxenaNoch keine Bewertungen

- FELS Energy, Inc. vs. Province of Batangas (G.R. No. 168557)Dokument23 SeitenFELS Energy, Inc. vs. Province of Batangas (G.R. No. 168557)aitoomuchtvNoch keine Bewertungen

- Panchshil Domestic Bill-JuneDokument60 SeitenPanchshil Domestic Bill-JuneUJJWALNoch keine Bewertungen

- 1801 Estate Tax Return FormDokument2 Seiten1801 Estate Tax Return FormMay DinagaNoch keine Bewertungen

- Payslip June Regular BatsQue MRPDokument11 SeitenPayslip June Regular BatsQue MRPBrandon BorromeoNoch keine Bewertungen

- MEPCO GST No. details electricity billDokument1 SeiteMEPCO GST No. details electricity billArslan RiazNoch keine Bewertungen

- GeM Bidding 4911222Dokument19 SeitenGeM Bidding 4911222Dhanraj ParmarNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Zlib - Pub - The Economics of Property and Planning Future ValueDokument231 SeitenZlib - Pub - The Economics of Property and Planning Future ValueAinun Devi AlfiaNoch keine Bewertungen

- Chapter IVDokument88 SeitenChapter IVNesri Yaya100% (1)

- Reform Match Muller Van Severen Prices enDokument6 SeitenReform Match Muller Van Severen Prices enPedro Bento d'AlmeidaNoch keine Bewertungen

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Dokument2 SeitenForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Arihant SNAP Mock Set 2Dokument13 SeitenArihant SNAP Mock Set 2Arvind KNoch keine Bewertungen

- 61 Yale LJ14Dokument32 Seiten61 Yale LJ14Bruno IankowskiNoch keine Bewertungen

- Level 1 CISIDokument26 SeitenLevel 1 CISISukruth GupthaNoch keine Bewertungen

- ACT Bill PDFDokument2 SeitenACT Bill PDFQertyNoch keine Bewertungen

- Latimes BooksDokument134 SeitenLatimes BooksmNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)