Beruflich Dokumente

Kultur Dokumente

Student Spending Behavior

Hochgeladen von

Ika GhozaliOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Student Spending Behavior

Hochgeladen von

Ika GhozaliCopyright:

Verfügbare Formate

Articles & Analysis

College Student Spending Behavior

By all accounts, the cost of college has risen dramatically in the past 15 years. Prices for tuition, fees, and books have risen by 5 to 10% (and sometimes more) annually for years. Prices of colleges vary, depending on the type of school a student attends (private/public, two year, four year). According to the College Board, students can expect to pay between $231 and $1,114 more in tuition and fees this year, on average, than last year. The average cost for college tuition, room, board and other expenses ranges from: $10,367 for a two-year community college to $17,740 for a public four year college to $26,070 for a private four year college (Source: American Council on Education, 2004). As these costs have risen, an equally dramatic rise in the availability of grants, aid and loans has made college much more affordable than most news articles would lead you to believe. Nearly a third of all students pay less than $4,000 per year for tuition and fees, and nearly 70% pay less than $8,000 (Source: The College Board, 2004).

2004 ODonnell & Associates, LLC

The team, the techniques & the tenacity to deliver results

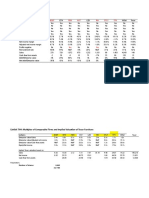

College Student Spending Behavior Financial aid and grants are available to more students than ever before. Most full time students receive financial aid (72%), grant funding (59%) and/or a loan (45%) to offset the cost of college. Experts estimate that students pay about one-third of the actual costs of a college education. The following chart shows the average aid package for a full time student in 1999-2000 (the most recent year that data was available):

Average Aid for Full Time Students

$10,000 $8,000 $6,000 $4,000 $2,000 $Financial Aid Grants Loans $4,949 $8,474 $5,473

(Source: American Council on Education) We have also found that todays students have more discretionary income than ever before. Different studies report that students have between $600 and $1,100 a month in discretionary spending. The following table shows our estimate of the typical full-time, four-year public college students spending behavior:

2004 ODonnell & Associates, LLC

Page 2

College Student Spending Behavior

Annual Student Spending

$25,000

$20,000

$749 $786 $1,643 $4,081

$15,000 $5,582 $10,000

$5,000

$8,400

$-

Discretionary Other expenses

1 Room/board Books & supplies

Tuition and fees Transportation

(Sources: Chronicle of Higher Education, Almanac, 2003-4; Campusclients.com; Student Advantage) Nearly 40% of their spending is on discretionary items. Many sources state that college students spend over $20 billion annually. The vast majority of college students have a job, a cell-phone and a computer. By most accounts, they spend more money online than any other demographic group in our country. Overall, today's students have money to spend on products that appeal to them. Why do students have more discretionary spending than ever? Much of this can be explained by the changing demographics of todays students. Less than half (43%) of college students are 18-21 2004 ODonnell & Associates, LLC Page 3

College Student Spending Behavior years old. The typical college student is in her mid-twenties (57% are women), either lives at home or on campus, and has a job. Students dont feel the need to complete college in 4 consecutive years, and many fluctuate between full-time and part-time study over a period of 5 to 7 years. Changing majors often adds a year, or even more to the course of study. And, most students dont settle into their majors in their first year of school. Students and faculty often complain about the cost of textbooks and educational materials. In the past decade, as the cost of books has risen, increasing numbers of students have chosen NOT to buy a textbook for a class. Recently, we have seen a surge in student entrepreneurial efforts to find alternative low-cost textbooks; students are importing books from China or India (where they are priced at less than half the US price) and selling them to their colleagues. ODonnell & Associates has conducted research in the higher education market for over fourteen years, and in that time, we have talked to thousands of students. Most are shrewd consumers of their education. And, most see college as the means to the goal of a job and future financial security. They are quite willing to spend money on technology and materials that will help them succeed. Textbooks increasingly fail to meet that success criterion. Given that textbooks represent about 4% of student spendingone tenth of their discretionary cash-we question the resistance to buying them. Why do so many students perceive the required textbook to be an optional expense? We think that the answer lies in the marketing and packaging of the textbook. In a study that ODonnell & Associates completed for the Association of American Publishers in the mid-1990s, we found a significant gap between faculty and student attitudes about textbooks. Faculty told us that they were endorsing the textbook; but students often did not perceive a strong endorsement. This gap has only widened in recent years. As textbooks have gotten longer, faculty tend to assign less of the book; students then question the need to buy the book. Most of todays students have used computers throughout their educational life. They are much more comfortable than their professors with mixing media in a learning environment. While students have always complained that textbooks are boring, their expectations of a more interactive environment have increased in recent years. We believe that the publishers have a great opportunity to boost sales by completely rethinking the way that textbook materials are packaged, marketed and delivered to students.

2004 ODonnell & Associates, LLC

Page 4

Das könnte Ihnen auch gefallen

- Financial Literacy of High School Students: Lewis MandellDokument2 SeitenFinancial Literacy of High School Students: Lewis MandellDUDE RYANNoch keine Bewertungen

- IT Saving & Spending PDFDokument3 SeitenIT Saving & Spending PDFNandani SharmaNoch keine Bewertungen

- Review of Related LiteratureDokument22 SeitenReview of Related Literatures o d a p o pNoch keine Bewertungen

- Financial Literacy and Management of Junior High SchoolDokument20 SeitenFinancial Literacy and Management of Junior High SchoolJianne AbinalesNoch keine Bewertungen

- Reviews of Related LiteratureDokument7 SeitenReviews of Related LiteratureShereen Grace GaniboNoch keine Bewertungen

- Philippine Women's College of Davao Strategies in BudgetingDokument14 SeitenPhilippine Women's College of Davao Strategies in BudgetingKarl NepomucenoNoch keine Bewertungen

- Chapter 2Dokument11 SeitenChapter 2Josalyn Cervantes AbudaNoch keine Bewertungen

- Saving Habit in Unisza StudentDokument16 SeitenSaving Habit in Unisza StudentRj Firdaus Ramli75% (4)

- A Correlational Study About Consumer's Age and Their Consuming Buying BehaviorDokument16 SeitenA Correlational Study About Consumer's Age and Their Consuming Buying BehavioryespleaseeNoch keine Bewertungen

- Please Follow The Format For The TITLE PAGEDokument14 SeitenPlease Follow The Format For The TITLE PAGEjay-ar dimaculanganNoch keine Bewertungen

- Financial LiteracyDokument13 SeitenFinancial LiteracyMaica Amoyo MadeloNoch keine Bewertungen

- CHAPTER 2 Tvl-HeDokument3 SeitenCHAPTER 2 Tvl-HeNicolette Dayrit Dela PenaNoch keine Bewertungen

- Perception of Grade 11 Students of Pulo Senior High School On Financial Status in Relation To Academic PerformanceDokument19 SeitenPerception of Grade 11 Students of Pulo Senior High School On Financial Status in Relation To Academic PerformanceChristine MalayoNoch keine Bewertungen

- Research Ii.1 1Dokument20 SeitenResearch Ii.1 1Jhomer CastroNoch keine Bewertungen

- Students That Are Given The Responsibility To Manage Their Own Expenses Coupled With A Higher Cost of Education Puts The Students in A Situation That It Is Vital To Live On A Restricted BudgetDokument3 SeitenStudents That Are Given The Responsibility To Manage Their Own Expenses Coupled With A Higher Cost of Education Puts The Students in A Situation That It Is Vital To Live On A Restricted BudgetchristineNoch keine Bewertungen

- The Impact of Financial Literacy On Budgeting Management Among Abm StudentsDokument12 SeitenThe Impact of Financial Literacy On Budgeting Management Among Abm StudentsDatu Abdullah Sangki MpsNoch keine Bewertungen

- Abanes The Factors Affecting The Budgeting Skills and Spending Behavior Among Senior High School Students of Thy Covenant Montessori School in S.Y. 2019 2020Dokument27 SeitenAbanes The Factors Affecting The Budgeting Skills and Spending Behavior Among Senior High School Students of Thy Covenant Montessori School in S.Y. 2019 2020Bjarne Lex Francis AgbonNoch keine Bewertungen

- Correlation of Spending Habits of Grade 11 Studets To Their Financial Literacy in WITI. II AIONDokument11 SeitenCorrelation of Spending Habits of Grade 11 Studets To Their Financial Literacy in WITI. II AIONrainier reoladaNoch keine Bewertungen

- The Relationship Between Money Allowance and Budgeting Skills of Abm Students in Holy Nazarene Christian School Year 2023-2024Dokument19 SeitenThe Relationship Between Money Allowance and Budgeting Skills of Abm Students in Holy Nazarene Christian School Year 2023-2024neilcasupang1Noch keine Bewertungen

- Income and Consumption On Rice of Filipino FamiliesDokument45 SeitenIncome and Consumption On Rice of Filipino FamiliesAnika Uy100% (1)

- Theoritical Ba Proj SpendingDokument2 SeitenTheoritical Ba Proj Spendingrajeena BabuNoch keine Bewertungen

- Weekly Allowance and Academic Performance in Grade 12 StudentDokument11 SeitenWeekly Allowance and Academic Performance in Grade 12 StudentMary Jean Dela CruzNoch keine Bewertungen

- Chapter 2 Review Related LiteratureDokument4 SeitenChapter 2 Review Related LiteratureJanida Basman DalidigNoch keine Bewertungen

- Group 1 - Chapter 1-Pr Leader (Ceriño, Prince Lorence)Dokument76 SeitenGroup 1 - Chapter 1-Pr Leader (Ceriño, Prince Lorence)Prince Lorence Sultones Ceriño100% (1)

- Saving and SpendingDokument3 SeitenSaving and SpendingRaenessa FranciscoNoch keine Bewertungen

- Final Copy of Research 2Dokument63 SeitenFinal Copy of Research 2Juvelle Cudal100% (1)

- Review of Related LiteratureDokument6 SeitenReview of Related LiteraturewilfredandrewagustinNoch keine Bewertungen

- Financial LiteracyDokument43 SeitenFinancial LiteracyCoke HampaihNoch keine Bewertungen

- Financial Goals and Saving Habits of Senior High StudentsDokument1 SeiteFinancial Goals and Saving Habits of Senior High StudentsJude LeinNoch keine Bewertungen

- A Comparative Study About The Spending HDokument93 SeitenA Comparative Study About The Spending HNicole DumaranNoch keine Bewertungen

- Effects of Inflation Rate ResearchDokument15 SeitenEffects of Inflation Rate ResearchSheraine TrientaNoch keine Bewertungen

- Final Na Jud YessssssssssssssDokument28 SeitenFinal Na Jud YessssssssssssssMarven Jonas DoblonNoch keine Bewertungen

- Improving Financial Literacy of 1 Year Students in College Through Financialmanagement PracticesDokument15 SeitenImproving Financial Literacy of 1 Year Students in College Through Financialmanagement PracticesReah Jane GrengiaNoch keine Bewertungen

- 5 Reasons Filipinos Dont Save MoneyDokument2 Seiten5 Reasons Filipinos Dont Save MoneyFreitzNoch keine Bewertungen

- Effects of Accounting Subject On The Mental Health of ABM StudentsDokument24 SeitenEffects of Accounting Subject On The Mental Health of ABM StudentsNicole Tonog AretañoNoch keine Bewertungen

- REVISED Personal Financial Wellness of Grade 12 Accountancy Business and Management LICEO Students 4Dokument82 SeitenREVISED Personal Financial Wellness of Grade 12 Accountancy Business and Management LICEO Students 4Rae SlaughterNoch keine Bewertungen

- Effects of Inflation in Stock Market Among The Vendors of Libertad MarketDokument11 SeitenEffects of Inflation in Stock Market Among The Vendors of Libertad MarketNichole Ann FediloNoch keine Bewertungen

- Research TitleDokument4 SeitenResearch Titlejason repaldaNoch keine Bewertungen

- Personal Budgeting Research ProperDokument46 SeitenPersonal Budgeting Research ProperKrislynNoch keine Bewertungen

- Spending Habits of Financial Mangement StudentsDokument2 SeitenSpending Habits of Financial Mangement Studentsmaria roseNoch keine Bewertungen

- Impact of Inflation Research InstitutionalDokument6 SeitenImpact of Inflation Research InstitutionalVamie SamasNoch keine Bewertungen

- TheLevelofSpendingHabitsamongAccountancyBusinessandManagementStudentsofTacurongNationalHighSchoolBasisforProgramIntervention PDFDokument48 SeitenTheLevelofSpendingHabitsamongAccountancyBusinessandManagementStudentsofTacurongNationalHighSchoolBasisforProgramIntervention PDFJosie GimenaNoch keine Bewertungen

- Spending and BehaviorDokument5 SeitenSpending and BehaviorJulius Neil Robin100% (1)

- Group 1 - Chapter 1Dokument18 SeitenGroup 1 - Chapter 1Jp CombisNoch keine Bewertungen

- Expenses and Savings: Allocating The Daily Allowance of Abm Students of Labangal National Senior HighschoolDokument15 SeitenExpenses and Savings: Allocating The Daily Allowance of Abm Students of Labangal National Senior HighschoolALPHA KOKAKNoch keine Bewertungen

- Effects of Inflation On BSHM Students ofDokument4 SeitenEffects of Inflation On BSHM Students ofRoe FranialNoch keine Bewertungen

- RESEARCH PAPER EditedDokument34 SeitenRESEARCH PAPER EditedJericho ArinesNoch keine Bewertungen

- School Fee Related Literature ReviewDokument14 SeitenSchool Fee Related Literature Reviewissaalhassan turayNoch keine Bewertungen

- Philippine Christian University Union High School of Manila Senior High SchoolDokument24 SeitenPhilippine Christian University Union High School of Manila Senior High SchoolDaniela Mae Pangilinan100% (1)

- Chapter I 03 08 23Dokument15 SeitenChapter I 03 08 23Michael AtienzaNoch keine Bewertungen

- A Research On The Allowance and Budgeting of Grade 12 Students in Asist Main CDokument26 SeitenA Research On The Allowance and Budgeting of Grade 12 Students in Asist Main Cndeez9598Noch keine Bewertungen

- RRL Need To PrintDokument9 SeitenRRL Need To PrintMaribeth AmitNoch keine Bewertungen

- Keywords:-Financial Literacy, Financial Behavior, LocusDokument10 SeitenKeywords:-Financial Literacy, Financial Behavior, LocusInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Chapter 1Dokument14 SeitenChapter 1Van Frederick PortugalNoch keine Bewertungen

- Group 1 Kaye PRDokument6 SeitenGroup 1 Kaye PRJazreen Kylle Gonzales DiazNoch keine Bewertungen

- Final Chapter 1Dokument53 SeitenFinal Chapter 1tonioNoch keine Bewertungen

- Research CompleteDokument36 SeitenResearch CompletePavitra MohanNoch keine Bewertungen

- Budgeting and Spending Behavior Among Teachers of MSEUF Lucena City 3Dokument45 SeitenBudgeting and Spending Behavior Among Teachers of MSEUF Lucena City 3jp javelosaNoch keine Bewertungen

- College Planning for Gifted Students: Choosing and Getting into the Right CollegeVon EverandCollege Planning for Gifted Students: Choosing and Getting into the Right CollegeBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Are University Textbooks MoreDokument2 SeitenAre University Textbooks MoreAhmad MalikNoch keine Bewertungen

- Powerpoint Report PledgeDokument12 SeitenPowerpoint Report PledgeElysia PerezNoch keine Bewertungen

- NpaDokument22 SeitenNpaDeepika VermaNoch keine Bewertungen

- Sample Quiz KEY1Dokument6 SeitenSample Quiz KEY1ElaineJrV-IgotNoch keine Bewertungen

- Business in Portuguese BICDokument26 SeitenBusiness in Portuguese BICRadu Victor TapuNoch keine Bewertungen

- Sample IB Economics Internal Assessment Commentary - MacroDokument3 SeitenSample IB Economics Internal Assessment Commentary - MacroUday SethiNoch keine Bewertungen

- Australian Unity Rebate FormDokument2 SeitenAustralian Unity Rebate FormpmarteeneNoch keine Bewertungen

- Teuer B DataDokument41 SeitenTeuer B DataAishwary Gupta100% (1)

- Accounting 2 Week 1 4 LPDokument33 SeitenAccounting 2 Week 1 4 LPMewifell100% (1)

- Wikborg Global Offshore Projects DEC15Dokument13 SeitenWikborg Global Offshore Projects DEC15sam ignarskiNoch keine Bewertungen

- HSBC ProjectDokument48 SeitenHSBC ProjectPooja MishraNoch keine Bewertungen

- UST Case Study As of 1993: March 2016Dokument19 SeitenUST Case Study As of 1993: March 2016KshitishNoch keine Bewertungen

- CheatsheetDokument2 SeitenCheatsheetSafi NurulNoch keine Bewertungen

- Final Prospectus - PIK LSE IPODokument333 SeitenFinal Prospectus - PIK LSE IPObiblionat8373Noch keine Bewertungen

- FINANCIAL RISK MANAGEMENT TEST 1 AnswersDokument2 SeitenFINANCIAL RISK MANAGEMENT TEST 1 AnswersLang TranNoch keine Bewertungen

- Nism PGPSM Placements Batch 2012 13Dokument24 SeitenNism PGPSM Placements Batch 2012 13P.A. Vinay KumarNoch keine Bewertungen

- Investment and VC Funds Acting in SEE RegionDokument72 SeitenInvestment and VC Funds Acting in SEE Regionpaul_costasNoch keine Bewertungen

- Evaluation of Investment Project Using IRR and NPVDokument6 SeitenEvaluation of Investment Project Using IRR and NPVchew97Noch keine Bewertungen

- JDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Dokument2 SeitenJDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Antoinette MoederNoch keine Bewertungen

- Nego Digest Week 2Dokument13 SeitenNego Digest Week 2Rufino Gerard MorenoNoch keine Bewertungen

- Exercises1 BFNDC002 Time Value of Money - Simon, JusthineDokument13 SeitenExercises1 BFNDC002 Time Value of Money - Simon, JusthineJohn Dexter SimonNoch keine Bewertungen

- Fundamentals of Trade FinanceDokument9 SeitenFundamentals of Trade FinanceMohammed SuhaleNoch keine Bewertungen

- Basics of Engineering Economy, 1e: CHAPTER 12 Solutions ManualDokument15 SeitenBasics of Engineering Economy, 1e: CHAPTER 12 Solutions Manualttufan1Noch keine Bewertungen

- Admission Capital AdjustmentsDokument6 SeitenAdmission Capital AdjustmentsHamza MudassirNoch keine Bewertungen

- What Is A Financial Intermediary (Final)Dokument6 SeitenWhat Is A Financial Intermediary (Final)Mark PlancaNoch keine Bewertungen

- Concept Paper in English For Academic and Professional PurposesDokument7 SeitenConcept Paper in English For Academic and Professional PurposesFrancis LeaNoch keine Bewertungen

- DRM-CLASSWORK - 16th JuneDokument3 SeitenDRM-CLASSWORK - 16th JuneSaransh MishraNoch keine Bewertungen

- DO - 163 - S2015 - DupaDokument12 SeitenDO - 163 - S2015 - DupaRay Ramilo100% (1)

- Agricultural Project Planning Module-IIDokument96 SeitenAgricultural Project Planning Module-IIGetaneh SeifuNoch keine Bewertungen

- HDFC Multi Cap Fund With App Form Dated November 2 2021Dokument4 SeitenHDFC Multi Cap Fund With App Form Dated November 2 2021hnevkarNoch keine Bewertungen

- Ebook Percuma Tfs Price Action TradingDokument7 SeitenEbook Percuma Tfs Price Action TradingMUHAMMAD AL AMIN AZMANNoch keine Bewertungen