Beruflich Dokumente

Kultur Dokumente

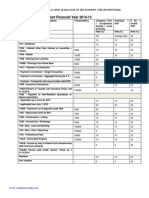

TDS Rate Chart Financial Year 2012-13

Hochgeladen von

jeet2211Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TDS Rate Chart Financial Year 2012-13

Hochgeladen von

jeet2211Copyright:

Verfügbare Formate

TDS RATE CHART FINANCIAL YEAR 2012-13 (ASSESSMENT YEAR 13-14) Sl. Section Of Nature of Payment No.

Act in brief 1 192 Salaries Cut Off Amount Rate %

01.04.2012 01.07.2012 HUF/IND Others Salary income must be Average Rate more then exemption limit after deductions. 5000 10000 10 10 10 10 10 10

2 3 4

4A

5 6 7 8 9 10 11 12 13 14

15

16

Interest on 2500 debentures 194 Deemed dividend 194A Interest other than Int 10000 on securities (by Bank) 194A Interest other than Int. 5000 on securities (By others) 194B Lottery / Cross Word 10000 Puzzle 194BB Winnings from Horse 5000 Race 194C(1) Contracts 30000 194C(2) Sub-contracts/ 30000 Advertisements 194D Insurance 20000 Commission 194EE Paymentsout of 2500 deposits under NSS 194F Repurchase of units 1000 by MF/UTI 194G Commission on sale 1000 of lottery tickets 194H Commission or 5000 Brokerage 194I Rent (Land & 180000 building) Rent (P & M , 180000 Equipment, furniture & fittings) 194J Professional/Technical 30000 charges/Royalty & Non-compete fees 194J(1)(ba) Any remuneration or NA commission paid to 193

5000

10

10

10000 5000 30000 30000 20000 2500 1000 1000 5000 180000 180000

30 30 1 1 10 20 20 10 10 10 2

30 30 2 2 10 20 10 10 10 2

30000

10

10

NIL

10

10

17 194LA

18 194LLA

director of the company(Effective from 1 July 2012) Compensation on 100000 acquisition of immovable property Payment on transfer NA of certain immovable property other than agricultural land (applicable only if amount exceeds : (a) INR 50 lakhs in case such property is situated in a specified urban agglomeration; or(b) INR 20 lakhs in case such property is situated in any other area) (Effective from 1 October 2012)

200000

10

10

(a) INR 50 1 lakhs in case such property is situated in a specified urban agglomeration; or(b) INR 20 lakhs in case such property is situated in any other area) (Effective from 1 October 2012)

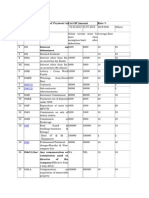

TCS Rates for the FY 2012-13

The Tax Collection at Source Rates for the Financial Year 2013-13 is tabulated below: Sl.No. Nature of Goods 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 Alcoholic liquor for human Consumption Tendu leaves Timber obtained under forest lease Timber obtained by any mode other than a forest lease Any other forest produce not being timber or tendu leaves Scrap Parking lot Toll plaza Mining & Quarrying Minerals, being coal or lignite or iron ore Bullion or jewellery (if the sale consideration is paid in cash exceeding INR 2 lakhs) Rates in % 01.04.2012 1 5 2.5 2.5 2.5 1 2 2 2 NA NA

01.07.2012 1 5 2.5 2.5 2.5 1 2 2 2 1 1

No Education Cess on payment made to resident-Education Cess is not deductible/collectible at source in case of resident Individual/HUF /Firm/ AOP/ BOI/ Domestic Company in respect of payment of income other than salary. Education Cess @ 2% plus secondary & Higher Education Cess @ 1% is deductible at source in case of non-residents and foreign company. Surcharge on Income-tax - Surcharge on Income-tax is not deductible/collectible at source in case of individual/ HUF /Firm/ AOP / BOI/Domestic Company in respect of payment of income other than salary. Due date for furnishing TDS return for the last quarter of the financial year has been modified to 15th May (from earlier 15th June). The revised due dates for furnishing TDS return are Sl. No. 1. 2. 3. 4. Date of ending of the quarter of the financial year 30th June 30th September 31st December 31st March Due date 15th July of the financial year 15th October of the financial year 15th January of the financial year 15th May of the financial year immediately following the financial year in which deduction is made

Due date for furnishing TDS certificate to the employee or deductee or payee is revised as under : Sl. No. 1. Periodicity of furnishing TDS certificate (Form Annual

Category Salary No.16)

Due date By 31st day of May of the financial year immediately following the financial year in which the income was paid and tax deducted Within fifteen days from the due date for furnishing the statement of TDS

2.

NonSalary(Form No.16A)

Quarterly

Due Date for Payment of March 2012 -The time limit for deposit of TDS for the entire month of March is rationalized to 30 April instead of two separate time limits viz. 7 April for TDS up to 30 March and 31 May for TDS as of 31 March.

Das könnte Ihnen auch gefallen

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionVon EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNoch keine Bewertungen

- The Ultimate Construction Accounting Guide: How To Drive Steady, Profitable Business GrowthDokument17 SeitenThe Ultimate Construction Accounting Guide: How To Drive Steady, Profitable Business GrowthJavier ContrerasNoch keine Bewertungen

- Fluor Corp International Assignment Policy 2009 PDFDokument42 SeitenFluor Corp International Assignment Policy 2009 PDFRoberto Carvalho100% (1)

- P2P.deal MemoDokument4 SeitenP2P.deal MemoC9886MBNoch keine Bewertungen

- Consultant Agreement ,,,, MumbaiDokument3 SeitenConsultant Agreement ,,,, MumbaiangelgoswamiNoch keine Bewertungen

- The Negotiable Instruments Law CodalDokument12 SeitenThe Negotiable Instruments Law CodalAleezah Gertrude RaymundoNoch keine Bewertungen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Philex Mining Vs CirDokument2 SeitenPhilex Mining Vs CirKim Lorenzo CalatravaNoch keine Bewertungen

- Basic Principles of Taxation-1Dokument82 SeitenBasic Principles of Taxation-1Abby Gail Tiongson83% (6)

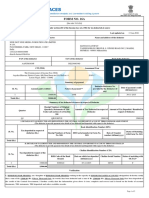

- BIR 1702Q FormDokument3 SeitenBIR 1702Q FormyellahfellahNoch keine Bewertungen

- Kaushik Sarkar Form 16 DynProDokument5 SeitenKaushik Sarkar Form 16 DynProKaushik SarkarNoch keine Bewertungen

- Tax Deducted at SourceDokument29 SeitenTax Deducted at SourceChaitany Joshi0% (2)

- Chapter 5: Audit of Property, Plant & EquipmentDokument121 SeitenChapter 5: Audit of Property, Plant & EquipmentShaneen AdorableNoch keine Bewertungen

- International Taxation In Nepal Tips To Foreign InvestorsVon EverandInternational Taxation In Nepal Tips To Foreign InvestorsNoch keine Bewertungen

- Peak Garage Doors IncDokument2 SeitenPeak Garage Doors IncVikasBhatNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605John Louise Tan100% (1)

- Obligations and Contracts ReviewerDokument8 SeitenObligations and Contracts ReviewerYu ChanNoch keine Bewertungen

- 40 Rapanut vs. Court of AppealsDokument2 Seiten40 Rapanut vs. Court of AppealsJemNoch keine Bewertungen

- TDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14Dokument2 SeitenTDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14CaCs Piyush SarupriaNoch keine Bewertungen

- Tds Rate Chart Fy 2014-15 Ay 2015-16Dokument26 SeitenTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86Noch keine Bewertungen

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDokument11 SeitenTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86Noch keine Bewertungen

- Tds Rates Chart ADokument2 SeitenTds Rates Chart AshivshenoyNoch keine Bewertungen

- TDS Rate Financial Year 13-14Dokument10 SeitenTDS Rate Financial Year 13-14Heena AgreNoch keine Bewertungen

- Tds BookletDokument22 SeitenTds BookletSanjayThakkarNoch keine Bewertungen

- Introduction To TDS:-: Tax Deducted at SourceDokument3 SeitenIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14Noch keine Bewertungen

- Tds Rate ChartDokument49 SeitenTds Rate ChartSANJEEVNoch keine Bewertungen

- With Holding Tax RatesDokument3 SeitenWith Holding Tax Ratesvenkat6299Noch keine Bewertungen

- Revised TDS Rate Chart (FY 2009-10)Dokument1 SeiteRevised TDS Rate Chart (FY 2009-10)haldharkNoch keine Bewertungen

- Accounts & Taxations Interview Related NotesDokument5 SeitenAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNoch keine Bewertungen

- TDS Chart FY 2010-11 & FY 2011-12Dokument1 SeiteTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToAstro Shalleneder GoyalNoch keine Bewertungen

- A) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Dokument17 SeitenA) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Sonika GuptaNoch keine Bewertungen

- Direct Tax Code: Ms. Ankita AgrawalDokument16 SeitenDirect Tax Code: Ms. Ankita AgrawalPooja SwamyNoch keine Bewertungen

- Payment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumDokument1 SeitePayment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumMadhan RajNoch keine Bewertungen

- ACN 4135: Taxation: Income From Other SourcesDokument11 SeitenACN 4135: Taxation: Income From Other SourcesHasibur RahmanNoch keine Bewertungen

- Sl. No Section of Act Nature of Payment in Brief Threshold Limit Rate %Dokument8 SeitenSl. No Section of Act Nature of Payment in Brief Threshold Limit Rate %amit2201Noch keine Bewertungen

- TDS 3Dokument16 SeitenTDS 3payal AgrawalNoch keine Bewertungen

- Tax PlanningDokument6 SeitenTax PlanningprasadNoch keine Bewertungen

- Form Sr. Instruction Instructions For Filling in Return Form & Wealth StatementDokument8 SeitenForm Sr. Instruction Instructions For Filling in Return Form & Wealth StatementajgondalNoch keine Bewertungen

- For Individual and Other Taxpayers (Other Than Company) : IT-11GADokument9 SeitenFor Individual and Other Taxpayers (Other Than Company) : IT-11GAsojol747412Noch keine Bewertungen

- Videoton Autoelektronika KFTDokument2 SeitenVideoton Autoelektronika KFTAleksandar BjelicaNoch keine Bewertungen

- 8 Taxation of NRDokument8 Seiten8 Taxation of NRchandrakantchainani606Noch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToMohammed MohieNoch keine Bewertungen

- Sl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersDokument4 SeitenSl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersLisa StewartNoch keine Bewertungen

- For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Dokument6 SeitenFor Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Savoir PenNoch keine Bewertungen

- FKMPS9021Q Q3 2016-17Dokument2 SeitenFKMPS9021Q Q3 2016-17Hannan SatopayNoch keine Bewertungen

- Changes in TDS Limits - F Y 2010-11Dokument1 SeiteChanges in TDS Limits - F Y 2010-11Ronak RanaNoch keine Bewertungen

- 53.income Tax Compliance Check ListDokument5 Seiten53.income Tax Compliance Check ListmercatuzNoch keine Bewertungen

- TDS TRS GST (2) 20211228151919Dokument38 SeitenTDS TRS GST (2) 20211228151919Rishi PriyadarshiNoch keine Bewertungen

- Bir 1600Dokument13 SeitenBir 1600Adelaida TuazonNoch keine Bewertungen

- TDS Tax Deduction at Source: Prepared By: Visharad ShuklaDokument25 SeitenTDS Tax Deduction at Source: Prepared By: Visharad ShuklaPriyanshi GandhiNoch keine Bewertungen

- Compliance Calendar 2013-14Dokument1 SeiteCompliance Calendar 2013-14Amitmil MbbsNoch keine Bewertungen

- Tax Deducted at Source (TDS)Dokument7 SeitenTax Deducted at Source (TDS)Rupali SinghNoch keine Bewertungen

- Module-1: Basic Concepts and DefinitionsDokument35 SeitenModule-1: Basic Concepts and Definitions2VX20BA091Noch keine Bewertungen

- Hand BookDokument82 SeitenHand Booknmshamim7750Noch keine Bewertungen

- Tax ReturnDokument7 SeitenTax Returnsyedfaisal_sNoch keine Bewertungen

- Payment Form: Kawanihan NG Rentas InternasDokument3 SeitenPayment Form: Kawanihan NG Rentas InternasMikylla HuertasNoch keine Bewertungen

- Payment Form: Kawanihan NG Rentas InternasDokument3 SeitenPayment Form: Kawanihan NG Rentas InternasYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- ANF5ADokument9 SeitenANF5ACharles JacobNoch keine Bewertungen

- TDS Rate Chart PDFDokument2 SeitenTDS Rate Chart PDFjdhamdeep07Noch keine Bewertungen

- Bir Form 1702-ExDokument7 SeitenBir Form 1702-ExdignaNoch keine Bewertungen

- Itr 62 Form 16Dokument4 SeitenItr 62 Form 16Hardik ShahNoch keine Bewertungen

- Business Taxation AssignmentDokument7 SeitenBusiness Taxation AssignmentThe Social KarkhanaNoch keine Bewertungen

- Individual Paper Income Tax Return 2016Dokument39 SeitenIndividual Paper Income Tax Return 2016aarizahmadNoch keine Bewertungen

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDokument3 SeitenTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNoch keine Bewertungen

- Form16fy10 11Dokument3 SeitenForm16fy10 11atishroyNoch keine Bewertungen

- June Magazine - 2008Dokument28 SeitenJune Magazine - 2008api-26644987Noch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Daimler Ir Annual Financialstatements Entity 2017 PDFDokument55 SeitenDaimler Ir Annual Financialstatements Entity 2017 PDFGate Bennet4Noch keine Bewertungen

- Annual-Report-2017-18 ZomatoDokument26 SeitenAnnual-Report-2017-18 ZomatoMs Pillai Renuka Devi IPENoch keine Bewertungen

- Structure of SentenceDokument23 SeitenStructure of Sentencemaimai8721100% (1)

- Meaning of Royalties and Fees For Technical ServicesDokument13 SeitenMeaning of Royalties and Fees For Technical ServicesTripathi OjNoch keine Bewertungen

- Recruitment People of The Philippines, Appellee, vs. ALELIE TOLENTINO A.K.A. "Alelie Tolentino y Hernandez," AppellantDokument6 SeitenRecruitment People of The Philippines, Appellee, vs. ALELIE TOLENTINO A.K.A. "Alelie Tolentino y Hernandez," AppellantailynvdsNoch keine Bewertungen

- English - DHL-DGF-MEA Supplier RFI Form Template (English) v2.0Dokument17 SeitenEnglish - DHL-DGF-MEA Supplier RFI Form Template (English) v2.0scpkaiser11Noch keine Bewertungen

- ABC V CalumpangDokument15 SeitenABC V CalumpangUni MoonbiNoch keine Bewertungen

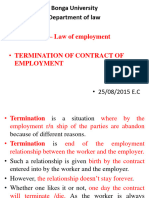

- Termiatio PptyDokument36 SeitenTermiatio PptyMadonna MdNoch keine Bewertungen

- GST Charts - Nov, 2020-Dec, 2020. PDFDokument44 SeitenGST Charts - Nov, 2020-Dec, 2020. PDFKomal ShahaNoch keine Bewertungen

- Rent 4Dokument3 SeitenRent 4Sangram PandaNoch keine Bewertungen

- Consolidated Building Maintenance v. AsprecDokument15 SeitenConsolidated Building Maintenance v. AsprecPaolo Ervin PerezNoch keine Bewertungen

- Strictly Private and Confidential!Dokument9 SeitenStrictly Private and Confidential!thực phẩm MANANoch keine Bewertungen

- Wing Membership Term and FeesDokument6 SeitenWing Membership Term and FeesThe WingNoch keine Bewertungen

- Income From SalaryDokument16 SeitenIncome From SalaryGurpreet Singh100% (1)

- The City of Calgary Total Compensation Review ReportDokument71 SeitenThe City of Calgary Total Compensation Review ReportAdam ToyNoch keine Bewertungen

- HR Chapter 12Dokument4 SeitenHR Chapter 12Gwenn PosoNoch keine Bewertungen

- Abbott Lab V Alcaraz Case DigestDokument3 SeitenAbbott Lab V Alcaraz Case Digestyasuren20% (1)

- Full Prepayment Trial Calculation (Company)Dokument1 SeiteFull Prepayment Trial Calculation (Company)muripande pandeNoch keine Bewertungen

- Amazon India Candidate InformationDokument6 SeitenAmazon India Candidate Informationvshrivastava_5100% (1)