Beruflich Dokumente

Kultur Dokumente

Marriott Excel

Hochgeladen von

Robert Sunho LeeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Marriott Excel

Hochgeladen von

Robert Sunho LeeCopyright:

Verfügbare Formate

Marriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703

This courseware was prepared solely as the basis for class discussion. Cases are not intended to serve as endorsements, sources of primary data, or illustrations of effective or ineffective management. Copyright 2007 President and Fellows of Harvard College. No part of this product may be reproduced, stored in a retrieval system, used in a spreadsheet or transmitted in any form or by any meanselectronic, mechanical, photocopying, recording or othewisewithout the permission of the Harvard Business School.

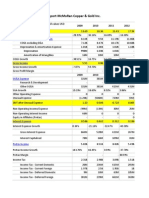

Marriott Corporation Based on No Spin-out of Marriott International Financial Projections

Change the highlighted numbers only Annual growth of $ sales through existing units (assuming general inflation of 3% per year) 1982-1989 Average 7.6% Available for sale at Dec. 1991 $ 1,524 $ $

5.4% Forecast 1992 5.0% 1993 5.5% 1994 5.8% 1995 6.0%

EBIT % Sales

Assets Sales ($ millions) Common Dividend Per Share

1992 100 $ 0.28 $

1993 120 $ 0.28 $

1994 150 $ 0.28 $

1995 180 0.28

Sales EBIT Interest (net) Pre-tax profits Tax @ 41% Net income Preferred dividend Net income, common Shares outstanding (millions) Earnings per share Times Interest earned Statement of Cash Flows: Cash Flow from Operating Activities Net income Depreciation Change in net working capital Total from Operating Activities Cash Flow from Investing Activities Capital expenditures Sale of assets Total from Investing Activities Cash Flow from Financing Activities Preferred dividend Common dividend Total Cash Available for Debt Repayment Cumulative Debt Repayment

1991 8,331 $ 367 222 145 63 82 6 76 94.5 0.80 $ 1.7

1992 8,781 $ 439 206 233 95 137 17 120 93.6 1.28 $ 2.1 1992

1993 9,255 $ 509 197 312 128 184 17 167 93.6 1.78 $ 2.6 1993 184 $ 270 0 454 (350) 120 (230) (17) (26) (43) 181 295

1994 9,755 $ 566 183 383 157 226 17 209 93.6 2.23 $ 3.1 1994 226 $ 270 0 496 (350) 150 (200) (17) (26) (43) 253 547

1995 10,282 617 163 454 186 268 17 251 93.6 2.68 3.8 1995 268 270 0 538 (350) 180 (170) (17) (26) (43) 325 872

137 $ 270 0 407 (350) 100 (250) (17) (26) (43) 114 114

Partial Balance Sheet Interest bearing debt Owner's equity Total Capital Debt as % capital

$ $

12/31/1991 3,031 $ 679 3,710 $ 82%

1992 2,917 $ 773 3,690 $ 79%

1993 2,736 $ 914 3,650 $ 75%

1994 2,484 $ 1,096 3,580 $ 69%

1995 2,159 1,321 3,480 62%

Das könnte Ihnen auch gefallen

- Excel File Exhibits For Marriott CaseDokument18 SeitenExcel File Exhibits For Marriott Caset3ddyme123Noch keine Bewertungen

- Marriott Case FinalDokument17 SeitenMarriott Case FinalFabia BourdaNoch keine Bewertungen

- Marriott CorporationDokument7 SeitenMarriott Corporationparth2kNoch keine Bewertungen

- Project Chariot IpDokument7 SeitenProject Chariot Ipapi-544118373Noch keine Bewertungen

- Marriott Case Study Solution - Antesh Kumar - EPGP-13A-021Dokument3 SeitenMarriott Case Study Solution - Antesh Kumar - EPGP-13A-021Antesh SinghNoch keine Bewertungen

- Marriott Corporation (A) : Case Study and AnalysisDokument6 SeitenMarriott Corporation (A) : Case Study and AnalysisChe hareNoch keine Bewertungen

- Marriott Case AnalysisDokument3 SeitenMarriott Case AnalysisNikhil ThaparNoch keine Bewertungen

- Marriott Case - Dakota ChristensenDokument5 SeitenMarriott Case - Dakota Christensendchristensen5Noch keine Bewertungen

- Project ChariotDokument6 SeitenProject ChariotRavina PuniaNoch keine Bewertungen

- "Marriott Corporation" Case Analysis: (Submitted by Group H)Dokument6 Seiten"Marriott Corporation" Case Analysis: (Submitted by Group H)Chahat ShahNoch keine Bewertungen

- Marriott Corporation (Project Chariot) : Case AnalysisDokument5 SeitenMarriott Corporation (Project Chariot) : Case AnalysisChe hareNoch keine Bewertungen

- Marriott SolutionDokument3 SeitenMarriott Solutiondlealsmes100% (1)

- Marriott Corporation Case SolutionDokument4 SeitenMarriott Corporation Case SolutionccfieldNoch keine Bewertungen

- Mariott Hotel Case SolutionsDokument2 SeitenMariott Hotel Case SolutionsACF201450% (2)

- Mariott Wacc Cost of Capital DivisionalDokument6 SeitenMariott Wacc Cost of Capital DivisionalSuprabhat TiwariNoch keine Bewertungen

- Marriot Corporation Case SolutionDokument5 SeitenMarriot Corporation Case Solutionmanoj1jsrNoch keine Bewertungen

- Marriott Solutions WACC LodgingDokument3 SeitenMarriott Solutions WACC LodgingPabloCaicedoArellanoNoch keine Bewertungen

- Marriott Solution FinalDokument20 SeitenMarriott Solution FinalBharani Sai PrasanaNoch keine Bewertungen

- Midland Case CalculationsDokument24 SeitenMidland Case CalculationsSharry_xxx60% (5)

- MarriotDokument3 SeitenMarriotNaman SharmaNoch keine Bewertungen

- Marriot CaseDokument15 SeitenMarriot CaseArsh00100% (7)

- 01 - Midland AnalysisDokument7 Seiten01 - Midland AnalysisBadr Iftikhar100% (1)

- Marriott Corporation (A)Dokument4 SeitenMarriott Corporation (A)Ilya KNoch keine Bewertungen

- Marriott Corporation Case SolutionDokument6 SeitenMarriott Corporation Case Solutionanon_671448363Noch keine Bewertungen

- Midland Energy A1Dokument30 SeitenMidland Energy A1CarsonNoch keine Bewertungen

- Case Analysis - Compania de Telefonos de ChileDokument4 SeitenCase Analysis - Compania de Telefonos de ChileSubrata BasakNoch keine Bewertungen

- Marriott Corporation - K - AbridgedDokument9 SeitenMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- Midland Energy Resources FinalDokument5 SeitenMidland Energy Resources FinalpradeepNoch keine Bewertungen

- Airthread ValuationDokument19 SeitenAirthread Valuation45ss28Noch keine Bewertungen

- Nabisco - Sol v0.1 PDFDokument13 SeitenNabisco - Sol v0.1 PDFMohit Khandelwal100% (1)

- Marriot "The Cost of Capital"Dokument7 SeitenMarriot "The Cost of Capital"dindo_waeNoch keine Bewertungen

- Marriott Corporation Case SolutionDokument4 SeitenMarriott Corporation Case SolutionAsif RahmanNoch keine Bewertungen

- Midland CaseDokument8 SeitenMidland CaseDevansh RaiNoch keine Bewertungen

- Marriott Corporation Case SolutionDokument9 SeitenMarriott Corporation Case SolutionZaim Zain100% (2)

- Marriott CorporationDokument9 SeitenMarriott CorporationMichelle Rodríguez100% (1)

- Marriott (2) ..Dokument13 SeitenMarriott (2) ..veninsssssNoch keine Bewertungen

- Yell Case Exhibits Growth RatesDokument12 SeitenYell Case Exhibits Growth RatesJames MorinNoch keine Bewertungen

- Mariott Case SolnDokument7 SeitenMariott Case SolnSurbhi JainNoch keine Bewertungen

- Sampa Video Inc.Dokument8 SeitenSampa Video Inc.alina8763Noch keine Bewertungen

- Marriott Corporation (Project Chariot) : Case AnalysisDokument5 SeitenMarriott Corporation (Project Chariot) : Case AnalysisStefan RadisavljevicNoch keine Bewertungen

- Marriot Corporation - Cost of CapitalDokument3 SeitenMarriot Corporation - Cost of CapitalInderpreet Singh Saini100% (17)

- RJR Nabisco ValuationDokument33 SeitenRJR Nabisco ValuationKrishna Chaitanya KothapalliNoch keine Bewertungen

- Case Analysis - Mariott CorpDokument8 SeitenCase Analysis - Mariott CorpratishmayankNoch keine Bewertungen

- Midland CaseDokument5 SeitenMidland CaseJessica Bill100% (3)

- Hampton Machine Tool CompanyDokument2 SeitenHampton Machine Tool CompanySam Sheehan100% (1)

- Presentation Marriott Case StudyDokument22 SeitenPresentation Marriott Case StudySharoon Javedd100% (1)

- Case Study Hertz CorporationDokument27 SeitenCase Study Hertz CorporationprajeshguptaNoch keine Bewertungen

- Marriot Corp. Finance Case StudyDokument5 SeitenMarriot Corp. Finance Case StudyJuanNoch keine Bewertungen

- Wikler Case Competition PowerpointDokument16 SeitenWikler Case Competition Powerpointbtlala0% (1)

- Mariott Corp AnalysisDokument14 SeitenMariott Corp AnalysisvarjinNoch keine Bewertungen

- Caso 4 MarriotDokument12 SeitenCaso 4 MarriotbxuffyNoch keine Bewertungen

- Group 3-Case 1Dokument3 SeitenGroup 3-Case 1Yuki Chen100% (1)

- Uv0052 XLS EngDokument14 SeitenUv0052 XLS EngAngel ThomasNoch keine Bewertungen

- Mindtree ValuationDokument74 SeitenMindtree ValuationAmit RanderNoch keine Bewertungen

- Q2FY2013 InvestorsDokument31 SeitenQ2FY2013 InvestorsRajesh NaiduNoch keine Bewertungen

- XLS EngDokument21 SeitenXLS EngRudra BarotNoch keine Bewertungen

- Sears Vs Wal-Mart Case ExhibitsDokument8 SeitenSears Vs Wal-Mart Case ExhibitscharlietoneyNoch keine Bewertungen

- UST Debt Policy SpreadsheetDokument9 SeitenUST Debt Policy Spreadsheetjchodgson0% (2)

- Copia de FCXDokument16 SeitenCopia de FCXWalter Valencia BarrigaNoch keine Bewertungen

- Copycooperative Financial Ratio Calculator 2011Dokument10 SeitenCopycooperative Financial Ratio Calculator 2011Selly SeftiantiNoch keine Bewertungen

- Triton ARDokument106 SeitenTriton ARRobert Sunho LeeNoch keine Bewertungen

- Samsung Electro-Mechanics Co., Ltd. and Its SubsidiariesDokument77 SeitenSamsung Electro-Mechanics Co., Ltd. and Its SubsidiariesRobert Sunho LeeNoch keine Bewertungen

- 2015 Lgar EngDokument23 Seiten2015 Lgar EngHuma ShahzadiNoch keine Bewertungen

- 2018 Audit Report (Consolidated)Dokument84 Seiten2018 Audit Report (Consolidated)Robert Sunho LeeNoch keine Bewertungen

- Enesco ArDokument200 SeitenEnesco ArRobert Sunho LeeNoch keine Bewertungen

- Ocean Outdoor HY19 ResultsDokument35 SeitenOcean Outdoor HY19 ResultsRobert Sunho LeeNoch keine Bewertungen

- 2018 Audit Report (Consolidated)Dokument84 Seiten2018 Audit Report (Consolidated)Robert Sunho LeeNoch keine Bewertungen

- LG Annual Report 2017 enDokument44 SeitenLG Annual Report 2017 enjunaid sumra100% (1)

- Introduction To Project FinanceDokument128 SeitenIntroduction To Project FinanceHoward McCarthy100% (1)

- RedhatDokument216 SeitenRedhatRobert Sunho LeeNoch keine Bewertungen

- Danaher Annual Report 2018Dokument154 SeitenDanaher Annual Report 2018Robert Sunho LeeNoch keine Bewertungen

- 2019 02 25 Danaher To Acquire The Biopharma Business of General Electric Life Sciences For 21 4 BillionDokument3 Seiten2019 02 25 Danaher To Acquire The Biopharma Business of General Electric Life Sciences For 21 4 BillionRobert Sunho LeeNoch keine Bewertungen

- Introduction To Project FinanceDokument128 SeitenIntroduction To Project FinanceHoward McCarthy100% (1)

- 2017 Business Quarter04Dokument271 Seiten2017 Business Quarter04Robert Sunho LeeNoch keine Bewertungen

- Kellogg Employment Report 2008Dokument56 SeitenKellogg Employment Report 2008djmerlin3Noch keine Bewertungen

- 2018ARDokument255 Seiten2018ARRobert Sunho LeeNoch keine Bewertungen

- 2018ARDokument255 Seiten2018ARRobert Sunho LeeNoch keine Bewertungen

- 2018AR - Facts and FiguresDokument37 Seiten2018AR - Facts and FiguresRobert Sunho LeeNoch keine Bewertungen

- Semrep 2015 06 30 en 00 2015 09 01 5077884 PDFDokument196 SeitenSemrep 2015 06 30 en 00 2015 09 01 5077884 PDFRobert Sunho LeeNoch keine Bewertungen

- Danaher Annual Report 2018Dokument154 SeitenDanaher Annual Report 2018Robert Sunho LeeNoch keine Bewertungen

- LSEG - Refinitiv RNS 1aug2019Dokument25 SeitenLSEG - Refinitiv RNS 1aug2019LouisDiMariaNoch keine Bewertungen

- USC MBA Employment Report 2018Dokument4 SeitenUSC MBA Employment Report 2018Robert Sunho LeeNoch keine Bewertungen

- Augat v. AegisDokument7 SeitenAugat v. AegisRobert Sunho LeeNoch keine Bewertungen

- World Economic Forum, "From The Margins To The Main Stream", Sep 19, 2013.Dokument40 SeitenWorld Economic Forum, "From The Margins To The Main Stream", Sep 19, 2013.Glenn ViklundNoch keine Bewertungen

- Practice Questions For FinalDokument3 SeitenPractice Questions For FinalRobert Sunho LeeNoch keine Bewertungen

- Management and Development Model For Open Standards (BOMOS) Version 2 Part 1: The FundamentalsDokument128 SeitenManagement and Development Model For Open Standards (BOMOS) Version 2 Part 1: The FundamentalsRobert Sunho LeeNoch keine Bewertungen

- Arbitrage and Replication: Foundations of Financial Markets Class 9Dokument15 SeitenArbitrage and Replication: Foundations of Financial Markets Class 9Robert Sunho LeeNoch keine Bewertungen

- Marriott ExcelDokument2 SeitenMarriott ExcelRobert Sunho LeeNoch keine Bewertungen