Beruflich Dokumente

Kultur Dokumente

Farhat Project

Hochgeladen von

Abdur Rafe Al-AwlakiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Farhat Project

Hochgeladen von

Abdur Rafe Al-AwlakiCopyright:

Verfügbare Formate

MONEY MARKET & ITS INSTRUMENTS

BABA GHULAM SHAH BADSHAH UNIVERSITY

MONEY MARKET & ITS PRODUCTS

SUMMER TRAINING PROJECT

J&K BANK

Under the supervision of: Mr. SYED GAZANFAR Mr. GAURAV SEHGAL

Submitted By: FARHAT RASHID 49-MBA-08

SCHOOL OF MANAGEMENT STUDIES B G S B UNIVERSITY, Rajouri (2009)

MONEY MARKET & ITS INSTRUMENTS

ACKNOWLEDGEMENT

I am extremely thankful to my project guide Mr. Syed Gazanfar (Senior Treasury Officer) for providing me the required guidance and valuable suggestions during my project work. I am also thankful to all of the staff members and class mate s of University, for steering me through the difficult times I encountered throughout the development of this project.

Last but not the least I would also like to express my sincere gratitude to everyone who has contributed to the successful completion of this project.

THANK ONE AND ALL.

CERTIFICATE OF ORGINALITY

MONEY MARKET & ITS INSTRUMENTS

This is to certify that Ms Farhat Rashid d/o Ab Rashid Mir student of BGSB University Rajouri J&K has completed her summer training project on the topic MONEY MARKET INSTRUMENTS. During her summer training she proved to be an effective and sincere student and we wish her all the best in her future endeavor.

Mr. SYED GAZANFAR (A.EXECUTIVE) INVESTMENT DEPARTMENT

MONEY MARKET & ITS INSTRUMENTS

EXECUTIVE SUMMARY The basic aim of this project was to analyze the Money market instruments interacting with the officials of investment department directly. The performance of J&K Bank is dependent on its investment operations as around one third of the banks funds are deployed in various investment avenues. Investment Department takes care of all macro-economic affairs and is also responsible for maintaining statutory requirements (CRR and SLR). The project will provide readers a conceptual view about Money Market Instruments. Hope this research will help the readers to get acquainted with the subject matter.

MONEY MARKET & ITS INSTRUMENTS

ABOUT J&K BANK

THE JAMMU AND KASHMIR BANK IS ONE OF THE FASTEST GROWING BANKS IN INDIA WITH A NETWORK OF MORE THAN 561 BRANCHES SPREAD ACROSS THE COUNTRY OFFERING WORLD CLASS BANKING PRODUCTS/SERVICES TO ITS CUSTOMERS. TODAY THE BANK HAS

STATUS OF VALUE DRIVEN ORGANIZATION AND IS ALWAYS WORKING TOWARDS BUILDING TRUST WITH SHAREHOLDERS, AND EMPLOYEES, DIVERSE

CUSTOMERS,

BORROWERS,

REGULATORS,

OTHER

STAKEHOLDERS FOR WHICH IT HAS ADOPTED A STRATEGY DIRECTED TO DEVELOPING A SOUND FOUNDATION OF RELATIONSHIP AND TRUST AIMED AT ACHIEVING EXCELLENCE, WHICH OF COURSE COMES FROM THE WOMBS OF GOOD CORPORATE GOVERNANCE. GOOD GOVERNANCE IS A SOURCE OF COMPETITIVE ADVANTAGE AND A CRITICAL INPUT FOR ACHIEVING EXCELLENCE IN ALL PURSUITS. JK BANK CONSIDERS GOOD CORPORATE GOVERNANCE AS THE SINE QUA NON OF A GOOD BANKING SYSTEM AND HAS ADOPTED A POLICY BASED ON ALL THE FOUR PILLARS OF GOOD AND GOVERNANCE -TRANSPARENCY, VALUE, ENABLING IT DISCL OSURE, TO PRACTICE

ACCOUNTABILITY

TRUSTEESHIP, TRANSPARENCY, FAIRNESS AND CONTROL LEADING TO STAKEHOLDER DELIGHT, ENHANCED SHARE VALUE AND ETHICAL

CORPORATE CITIZENSHIP. IT ALSO ENSURES THAT BANK IS MANAGED BY AN INDEPENDENT AND HIGH LY QUALIFIED BOARD FOLLOWING BEST GLOBALLY ACCEPTED PRACTICES, TRANSPARENT DISCLOSURE AND EMPOWERMENT. ASPIRATIONS BESIDES ENSURING TO MEET SHAREHOLDERS THE

AND

SOCIETAL

EXPECTATIONS

FOLLOWING

PRINCIPLES OF MANAGEMENT EXECUTIVE FREEDOM TO DRIVE THE BANK FORWARD OF WITHOUT EFFECTIVE UNDUE RESTRAINTS BUT THE WITH THE

FRAMEWORK

ACCOUNTABILITY.

EXCELLENCE

ACHIEVED BY BANK IN ITS OPERATIONS STEMMING FROM THE ROOTS OF VOLUNTARY GOVERNANCE HAS NOT GONE UNRECOGNIZED AND

MONEY MARKET & ITS INSTRUMENTS BANK HAS RECENTLY BAGGED THREE VERY PRESTIGIO US AWARDS FOR FAIR BUSINESS PRACTICES AND COMMITMENT TO SOCIAL

OBLIGATIONS.

CORPORATE GOVERNANCE J&K Bank has been committed to all the basic tenets of good Corporate Governance well before t he Securities and Exchange Board of India and the Stock Exchanges pursuant to Clause 49 of the Listing Agreement mandated these. Now, it is our Endeavour to go beyond the letter of the Corporate Governance codes and apply it innovatively in a more meaningf ul manner thereby making it relevant to the organization that is operating in a specific environment, which is different from the generic Anglo -Saxon one. In line with the vision, J&K Bank wants to use Corporate Governance innovatively in a transitional ec onomy like Jammu and Kashmir. The Bank wants to use Corporate Governance as an instrument of economic and social transformation. In due course, we would set our self targets of social and economic reporting as a part of annual disclosures. This will help u s conceptualize and contextualize the form and content of Corporate Governance in a developing state. Given the fact that J&K Bank is and is seen as a great success of public -private partnership, our Bank as a business is expected to play a role in socia l transformation of the economy. This lends urgency to implementation of good governance practices which go beyond the Corporate Governance code. Operating in an environment that is emerging from a situation of civil strife, the issue of Corporate Governan ce assumes a different and greater relevance. We, as the prime corporation of Jammu and Kashmir, have a vested interest in making the state a safe place for business. J&K Bank has a key role to play in providing public and private services, financial

infrastructure and employment. As such, the efficiency and accountability of the corporation is a matter of both private and public interest, and governance, therefore, comes at the top of the agenda. The fact that the bank is state owned but professionally man aged, having a large size of international investors, governance is critical. For us Corporate Governance is concerned with the

MONEY MARKET & ITS INSTRUMENTS systems of laws, regulations, and practices, which will promote enterprise, ensure accountability and trigger performance. The J &K Bank, for one, stands for being more accountable, practice self -policing and make financial transactions

transparent and constitutional. The directors of J&K Bank have make it an engine of social transformation. As an eminent corporate jurist (Chancello r William T. Allen) from US says, A corporate director has civic responsibility. The people, who accept this responsibility, do it conscientiously and well deserve our respect as they are serving a nation. But those who as directors are passive and view their role as mere advisers, are pliable and pleasant but do not insist on a real monitors role, do small service to anyone and deserve little respect. Our directors belong to the former category.

MONEY MARKET & ITS INSTRUMENTS

Vision of J&K Bank

The Bank's vision is to be financially sound, profitable, growth and technology oriented, committed to building and maximizing sustainable value for all its stakeholders. The Bank is committed to achieve healthy growth in profitability and simultaneously to remain consisten t with the Bank's risk appetite and at the same time ensuring the highest levels of ethical standards, professional integrity and regulatory compliance. To catalyze economic transformation and capitalize on growth. The vision is to engender and catalyze economic transformation of Jammu and Kashmir and capitalize from the growth induced financial prosperity thus engineered. The bank aspires to make Jammu and Kashmir the most prosperous state in the country, by helping create a new financial architecture for the J&K economy, at the center of which will be the J&K Bank.

Mission Statement

J&K Banks mission is two -fold: To provide the people of J&K international quality financial service and solutions and to be a super -specialist bank in the rest of the coun try. The two together will make us the most profitable bank in the country.

MONEY MARKET & ITS INSTRUMENTS

BANK S PROFILE

Jammu & Kashmir Bank was founded on October 1, 1938 and commenced business from July 4, 1939. The Jammu & Kashmir Bank Limited has been the first of its nature and composition as a state owned bank in the country. The

Bank was established as a semi State Bank with participation in capital by state and the public under the control of state government.

The bank has to face serious problems at the branc hes time of independence when out of its total of its total Mirpur fell to the other of ten branches two branches of Muzaffarabad and side of the line of control (now Pakistan occupied

Kashmir) along with cash and other assets. Following the extension of central laws to the state of Jammu & Kashmir, the bank was defined as a government company as per the provisions of Indian Companies Act 1956.

Today, Jammu and Kashmir Bank is one of the fastest growing banks in India with a network of more than 500 bran ches/offices spread across the country offering world class banking products/services to its customers. The Bank recently bagged three very prestigious awards for fair business practices and commitment to social obligations.

SPECIAL FEATURES OF THE BANK

1. 2. 3. Incorporated in 1938 as a Limited Liability Company. Governed by Companies Act and Banking Regulation Act of India. Regulated by Reserve Bank of India (RBI) and securities exchange Board of India (SEBI). 4. 5. 6. Listed on both National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). 53% of the totals share are owned by Government of Jammu and Kashmir Government. Rated P1 by Standard and Poor_ CRISIL connoting highest degree of safety.

MONEY MARKET & ITS INSTRUMENTS 7. Four decades of uninterrupted Profitability and dividends.

BOARD OF DIRECTORS

1. Dr Haseeb Draboo Chairman 2. Mr. M.S Verma Director 3. Mr. G.P Gupta Director 4. Mr. B.B Vyas (I.A.S) Director 5. Mr.A.K.Mehta Executive Director 6. Mr. Abdul Majid Mir Executive Director 7. Mr. G.M. Dug Director 8. Mr. B.L. Dogra Director

MONEY MARKET & ITS INSTRUMENTS

Functions of the Board

J&K Banks Board plays a pivotal role in ensuring good governance. Its style of functioning is democratic. The members of the board have always had complete freedom to express their opinion and decisions are taken on the basis of a consensus arrived at after detailed discussion. The members are also free to bring up any matter for discussion at the board meetings with the permission of the Chairman.

The day-to-day management of the Company is conducted by the Chairman and C.E.O subject to the supervision and control of the Board of the Directors. The functions performed by the the Board of the bank for efficient and effective utilization of resources at their disposal to achieve the goals, visualized, interalia, include setting Corporate Missions, Laying down Corporate Philosphy,

formulation of strategic and other Business Plans, Laying down of control measures and compliance with Laws and Regulations.

Unique Characteristics: One of a kind

1. Private sector Bank despite government holding 53 per cent of equity. 2. Sole banker and lender of last resort to the Government of J & K. 3. Plan and non -plan funds, taxes and non-tax revenues routed through the bank. 4. Salaries of Government officials disbursed by the Bank. 5. Only private sector bank designated as agent of RBI for banking. 6. Carries out banking business of the Central Government. 7. Collects taxes pertaining to Central Board of Direct Taxes in J & K.

MONEY MARKET & ITS INSTRUMENTS

Brand Identity

The new identity for J&K Bank is a visual representation of the Banks philosophy and business strategy. The three colored squares represent the regions of Jammu, Kashmir and Ladakh. The counter -form created by the interaction of the squares is a falcon with outstretched wings a symbol of power and empowerment.

The synergy between the three regions propels the bank towards new horizons. Green signifies growth and renewal, blue conveys stability and unity, and red represents energy and power. All these attributes are integrated and assimilated in the white counter -form.

MONEY MARKET & ITS INSTRUMENTS

ORGANIZATION STRUCTURE (investments)

Treasury Operations 1. Objectives

Main objectives of a bank Treasury is to maximum the returns with optimum risk, this will improve the profitability of the bank and thereby create value for its shareholders. Returns are associated with risks. High risk-business gives high returns while low/zero risk yield only low/ nil returns. It should be the Endeavour of treasury to maximize the profit with in the given policy laminations. How ever profits are associated with risks, therefore treasury has to see that as for as possible, the risk associated with are totally hedged. Control and minimizing the risk faced by the Bank is another objective of the Treasury. It has to ensure that the Bank is not unnecessarily exposed to risks, liquidity risks, market risks, funding risks, currency risks, which should be effectively managed/hedged by the Treasury. With diminished margins and increased completion for high quality business on account of financial system reforms/ liberalization, there has been intense pressure on a Bank to increase profitability. In a changed circumstances. The focus has shifted towards maintaining maximizing the spreads (Net interest margin) and control of risks, for which the treasury should contribute by various techniques/operations like sourcing of low cost funds by accessing diverse range of markets and entities with liquidity. Treasury should play a vital role in increasing the fee income of the bank through activities like trading in stock and securities etc.

MONEY MARKET & ITS INSTRUMENTS

Treasury function is also to be regarded as a service to the rest of the business. It has to manage the residual funds to the bank, funds left after deploying in the core activity to the bank, by developing it appropriately, treasury, thus, is to be regarded as, from line in the sense that it either makes profit in its own right or supports other areas of he banks business to make profit (or minimize losses) The treasury should also play a role, direct or indirect, in almost all the heads, both on the Asset and liability sides, in the balance sheet. May be it is for raising resources (Funding of assts) when there is need for liquidity or for deployment in profitable avenues (Asset creation) when there is surplus liquidity. Balance sheet management is yet another important function of the Treasury. At the macro level when the domestic market/economy is integrating with the global economy, it is needless to emphasize the need for integration of the macro level units. Most commercial banks had already realized the fact and integrated their domestic treasury. It is in this context; J&K Bank also integrated the functions of treasury and set up an integrated Treasury under one roof with the following objective: Proximity enables dealers remains informed of the development in other markets.

MONEY MARKET & ITS INSTRUMENTS

Divergences in money and forex markets often give arbitrage opportunities. Possibility of development / mobilization of resources at better yield. An intergraded treasury plays a vital part of any commercial banks activities. It front-ends the bank in the inter bank and financial be they money, gilt, bond, equity, foreign exchanges or derivatives.

1. Major Functions In a backdrop of above objectives, the responsibilities of the treasury cannot be recognized with any particular set of functions because its encompasses, directly or indirectly, almost all activities of the Bank. However the principal functional responsibility of the treasury is the current asset / liability management (Which includes Reserves management) and investments of the Bank. Our treasury has to proactive and participative and not only react to internal thoughts and ideas of the ma management. An efficient Treasury is thus always a profit center for the bank. In view of the above, major responsibilities/ functions of the treasury includes A) Domestic Treasury Function a. Reserve Management b. Cash Management

MONEY MARKET & ITS INSTRUMENTS

c. Liquidity Management d. Investment Portfolio Management e. Portfolio Management on behalf of clients f. Control and risk Management g. Guiding ALCO/ALM B) i) ii) iii) iv) v) vi) Foreign Exchange Dealing Branch Function as a A category Maintain Nostro accounts Cover up operations for Merchants business Inter-bank forex dealing Trading in foreign currencies Arrange foreign currency funds for leading to Corporates vii) viii) Foreign investment Coordinate with domestic segment for fund management. ix) C) Explore various arbitrage opportunities. Derivative Business Domestic Derivative Segment 1. 2. Interest rate derivatives. Futures & Options

Forex Derivatives 1. Forward exchange contracts

MONEY MARKET & ITS INSTRUMENTS

2.

Currency futures & Options

2.

Financial sectors The various financial markets available to a treasury are as under: a) b) c) d) Money market. Debt market. Capital marker and Foreign exchange market.

Money Market Money market is a market for short-term money and financial assets that are near substitutes for money. Short term means generally period up to one year and near substitute to money is used to denote any financial assets which can be easily & quickly converted into money without much loss and with minimum transaction cost thus, money market straddles only a short term debt instruments which are transferable by endorsement and negotiation like certificates of deposit, commercial paper, participation certificates, commercial bills eligible for re-discount, treasury bills etc.

Debt market Debt market facilitates efficient financial intermediation as they use market mechanism for allocating and pricing of credit. The debt

MONEY MARKET & ITS INSTRUMENTS

market deals in term debt paper of Government of India (dated securities), corporate debt (NCDs, bonds .An intergraded treasury plays a vital part of any commercial banks activities. It front-ends the bank in the inter bank and financial be they money, gilt, bond, equity, foreign exchanges or derivatives. Capital market Capital market deals in instruments which allows users of funds to directly raise funds from the investors instead of sourcing the funds from intermediaries like banks, financial institutions etc. In vary simple terms, Capital is described as owners stake or investment in the business. The investors (shareholders) are rewarded by way of dividend (in case the profits are adequate). Foreign Exchange market Purchase or sale of one nation currency in exchange for another is conducted in a market setting called foreign exchange market. Foreign exchange makes possible international transaction such as import and export and the movement of capital between countries. The value of one foreign currency in the relation to another is defined by the exchange rate. As such, broader spectrum of Treasury Management encompasses the following Domestic Treasury Operation. Foreign Exchange treasury operations Derivatives

MONEY MARKET & ITS INSTRUMENTS

CATEGORIZATION

The entire investment portfolio of the bank has to be classified under three categories: as per RBI guidelines issued. These categories are 1) held to maturity (HTM), 2) available for sale for sale (AHS) and 3) held for trading (HFT). A. Held for maturity: The investment under this category have to be kept up to 24% of banks total investments. The Deptt, may as allowed by RBI keep under these category securities less than 24% at its discretion but it should not exceed 40%. However, for the purpose of ceiling the following investments can be kept under this category but will not be counted for the purpose of ceiling. a) Re-capitalization bonds of Govt. of India b) Invests in subsidiaries and joint ventures. c)invests in bonds/debentures deemed to be in the nature of an advance ( as defined in the above referred to RBI circular) profit on sale of investments in this category shall be first taken to profit and loss account and there after appropriated to capital reserves account. Loss on sale in these investments shall be recognized in profit & loss account. B. Available for sale (AFS):- The bank is having the freedom to

decide the extent of holdings under AFS and held for trading categories. This has to be decided by the central treasury after considering various

MONEY MARKET & ITS INSTRUMENTS

aspects such as basis of intent, trading strategy, risk management capabilities, tax planning, manpower skill and capital position etc. the securities acquired by the bank with the intention to trade by taking advantage of short term. Price interest rate movement will be classified under held for trading. These securities are to be sold within 90 days. If the department is not in a position to sell it within 90 days due to exceptional. Circumstances such as tight liquidity conditions or extreme volatility or market becoming un-directional, the security may be shifted to AFS category. The securities, which do not fall within HTM and HFT categories, have to be classified under AFS categories. In the previous section a detailed analysis of various markets has already been performed. We turn now to specific analysis of particular security market. We begin by analysis debt securities. A debt security is a claim on a specified periodic stream of income. Debt securities are often called fixed income securities because they promise either a fixed stream of income or a stream of income that is determined according to a specified formula. These securities have the advantage of being relatively easy to understand because the payment formulas are specified in advance. Risk considerations are minimal as long as the issuer of the security is sufficiently creditworthy. Therefore those

MONEY MARKET & ITS INSTRUMENTS

securities are a convenient starting point for our analysis of the universe of potential investment vehicles.

CALL MONEY LENDING/BORROWING Product Description

Call money is overnight (or till the next working day) borrowing or lending. Call Money is a money market instrument wherein funds are borrowed/lent for a tenor of one day/overnight (excluding Sundays/holidays). It is not backed by collateral.

RBI LIMIT ON CALL MONEY LENDING/ BORROWING

On a fortnightly average basis, lending (including notice money should not exceed 25% of their capital funds however banks are allowed to lend a maximum of 50% of their capital funds on any one day, during a fortnight. On a fortnightly average basis, borrowing (including notice money) should not exceed 100% of capital funds (i.e., sum of tier1 and Tier2 capital) of latest audited balance sheet. However banks are allowed to borrow a maximum of 125% of their capital funds on any day, during a fortnight.

MONEY MARKET & ITS INSTRUMENTS

COUNTER PARTY EXPOSURE LIMITS

While lending in call money /short term deposits the treasury has to take care of counter party exposure limits. The individual bank wise limits have been last fixed and approved by the Board. These limits are to be reviewed every year on the financial strength of these counter parties. In this connection the management has asked the treasury to develop a scientific module that can analyze the qualitative as well as quantitave parameters of the counter party for arriving at a genuine limit.

TRANSACTION PROCESS AND RESTRICTIONS

The borrower of funds will collect through/cheque and hand over the deposit receipt to the lender on the value date of the deal. On the due date, the lender will give back the deposit receipt to and collect the cheque from the borrower. The interest rates are determined by liquidity in the inter bank market and financial system, the repo rate and reverse repo rate Participants in call money market currently include banks, Primary dealers development finance institutions select insurance companies and select mutual funds of these banks and PDs can operate both as borrowers and lenders in the market. Non-bank institutions, which have

MONEY MARKET & ITS INSTRUMENTS

been given specific permission to operate in call/notice money market, can however, operate as lenders only. Inter-bank borrowing is exempt from CRR. However, if the lender is not a bank, CRR applies.

TRADING PLATFORM

Deals are mostly concluded on NDS_Call.

For such deals the

procedure is simple and automatic. The deals concluded over phones must be reported on NDS but settlement is outside NDS, through RBIs high value clearing or RTGS. Deals should be reported within 15 minutes in NDS, irrespective of size of the deal 9or whether the counter party is a member of the NDS or not in case, there is repeated non reporting deals by an NDS member it will be considered whether non reported deals by that member should be treated as invalid with effect from a future date

TRADE ROUTING

The traders are routed directly between banks and counter party. Broker intermediary is not allowed

INTEREST CALCULATION

Interest is calculated on actual /365 basis. The interest payable is rounded off to the nearest rupee. Thus if Rs 10 Crores borrowed over

MONEY MARKET & ITS INSTRUMENTS

night at 8% p.a., interest is calculated as( 0.088x1/365 x 10 Crores)=Rs 21918( rounded to the nearest rupee)

NOTICE MONEY LENDING/ BORROWING

Notice money is borrowing or lending maturing in more than one day but less than 15 days. Both borrower and lender have the option to prepay/recall with 24 hours notice. The brrower/lender must convey his intention to repay/recall the amount borrowed/ lent with at least24 hours notice.

RBI LIMIT ON NOTICE MONEY LENDING/ BORROWING

ON A FORTNIGHTLY AVERAGE BASIS , Lending ( including call money) should not exceed 25% of their capital funds; however banks are allowed to lend a maximum of 50% of their capital funds on any day, during a fortnight On a fortnightly average basis, borrowing (including call money) should not exceed 100% of capital funds (i.e., sum of Tier 1 and Tier 2 of latest audited balance sheet. However banks are allowed to borrow a maximum of 125% of their capital funds on any day, during a fortnight.

TRANSACTION PROCESS AND RESTRICTIONS

The borrower of funds will collect the cheque and hand over the deposit receipt to the lender on the value date of the deal on a due date, the

MONEY MARKET & ITS INSTRUMENTS

lender will give back the deposit receipt to and collect the cheque from the borrower. The interest rates are determined by liquidity in the inter bank market and financial system, call money rate, the repo rate and reserve repo rate Participants in money market currently include banks primary dealers development finance institution, select insurance companies and select mutual funds. Of these, banks and PDs can operate both as borrowers in the market. Non bank institutions, which have been given specific permission to operate in call/notice money market, can however, operate as lenders only. Inter bank borrowing is exempt from CRR. However if the lender is not a bank CRR applies.

TRADING PLATFORM

Deals are mostly concluded NDS. However, the deals concluded on phone must be reported on NDS, through RBIs high value clearing or RTGS. Deals should be reported on NDS within 15 minutes on NDS, irrespective of the size of the deal or whether the counterparty is a member of the NDS or not. In case, there is repeated non reporting of

deals by an NDS member, it will be considered whether non reporting deals by that member should be treated as invalid with effect from a future date.

TRADE ROUTING

MONEY MARKET & ITS INSTRUMENTS

The trades are routed directly between bank and counterparty. Broker Intermediary is not allowed.

INTEREST CALCULATION

Interest is calculated on actual/365 basis. The interest payable is rounded off to the nearest rupee .Thus , if Rs. 10 Crores is borrowed for 5 days @ 8.00% p.a. interest is calculated as ( 0.08 x 5/365 x 10 Crores) = Rs 1,09,589.

TERM MONEY (STD )LENDING/BORROWING

PRODUCT DESCRIPTION

Term money also called Short term Deposit Placement in the Bank, is the borrowing or lending for maturities beyond 15 days without collateral. Bank is exempt from CRR for sub or one year borrowing if the borrowing is inter-bank but must provide for SLR. Normally the rate of interest on term money is fixed and interest payment is along with principal on maturity. However, there is no restriction in payment of coupon periodicity or the tenor. The interest rate can either be fixed or floating. The maximum term money placements between the banks in the past have been for a period as long as 5 years with half yearly coupon payments.

MONEY MARKET & ITS INSTRUMENTS

Premature cancellation after 14 days can be done by mutual agreed terms.

TRANSACTION PROCESS AND RESTRICTIONS

The borrower of funds will collect the payment either through RTGS or cheque and handover the deposit receipt to the lender on the value date of the deal. On the due date, the lender will give the deposit receipt to and collect the payment from the borrower. In case the maturity of term money falls on a holiday, the repayment will be made on the next working day. Additional interest will be paid for such period on the amount borrowed ( principal only) at the contracted rate. The interest rates depend on the T-bill and CP yields for the tenor. The interest rates should normally lie between the two but sometimes exceed later because of the liquid bank institutions which have been given specified requirements of specific banks or financial year ending pressures. Term money borrowing and lending could also be of the floating rate time in which the period of deposit is fixed but the rate of interest is reset every day. Interest may or may not be compounded daily. Participants in term money currently include banks primary dealers, development finance institutions, select insurance companies and select mutual funds. Of these, banks and PDs can operate both as

MONEY MARKET & ITS INSTRUMENTS

borrowers and lenders in the market. Non bank institutions which have been given specific permission to operate in call or notice money market can, however, operate in call/notice money market can, however, operate as lenders only. No loan or overdraft can be granted against term money. STD should not exceed limits, if any, or lending placed through placed through the investment policy of the bank.

TRADING PLATFORM

Deals are mostly concluded on phone. Concluded deals must be reported on NDS, through RBIs high value clearing or RTGS. Deals should be reported on NDS within 15 minutes on NDS, irrespective of the size of the deal or whether the counterparty is a member of the NDS or not. In case, there is repeated non reporting of deals by an NDS member, it will be considered whether non reported deals by that member should be treated as invalid with effect from a future date.

TRADE ROUTING

The trade is routed directly between bank and counterparty. Broker intermediary is not allowed.

INTEREST CALCULATION

Interest is to be calculated on actual/365 days basis and is to be rounded off to the nearest rupee. Periodicity for payment of interest can also be quarerly/halfyearly/ on redemption, as agreed to at the line of

MONEY MARKET & ITS INSTRUMENTS

the deal. Interest can be either fixed or floating and may or may not be compounded daily. For instance, a 90 day borrowing of Rs. 10 Crores @ 7.00% (fixed) per annum would cost Rs. (90/365 x 10 Crores) = Rs 17,26,027.

COLLATERALISED BORROWING & LENDING OBLIGATION

PRODUCT DESCRIPTION Collateralized borrowing and lending obligation (CBLO) is a secured form of borrowing and lending. The collateral is government of India securities and treasury bills with residual maturity over six months. Collateralized borrowing and lending obligation, a money market instrument as approved by RBI, is a product developed by CCIL for the benefit of the entities who have either been phased out from inter bank call money market or have been given restricted participation in terms of ceiling on call borrowing and lending transactions and who do not have access to the call money market. CBLO is a discounted instrument available in electronic book entry form for the maturity period ranging from one day to ninety days (can be made available up to one year as

MONEY MARKET & ITS INSTRUMENTS

per guidelines).In order to enable the market participants to borrow and lend funds, CCIL provides the dealing system through Indian financial network (INFINET), a closed user group to the members of the negotiated dealing system (NDS) who maintain current account with RBI.

CCIL membership of CBLO segment is exempted to banks, financial institutions, insurance companies, mutual funds, primary dealers, NBFCs non government provident funds, Corporates etc. The members are required to open constituent SGL (CSGL) account with CCIL for depositing securities which are offered as collateral/margin for borrowing and lending of funds. TRANSACTION PROCESS AND RESTRICTIONS Borrowing limit for the members is fixed everyday after marking to market and applying appropriate hair-cuts on the securities deposited in the CSGL account. The post hair- cut mark- to- market value after adjusting for the amounts already borrowed by the members is the borrowing limit, which, in effect, denotes the drawing power up to which the members can borrow funds. Members are required to deposit initial margin generally in the form of cash/government securities and initial margin is computed at the rate of 0.50% on the total amount borrowed /lent by the members.

MONEY MARKET & ITS INSTRUMENTS

For lending, deals are allowed only with approved counterparties. The borrowing/lending rates for CBLO are determined electronically using CCILs trading platform and depend on the demand and supply of funds. The normal market settles on T+0 or T+1 to specified timings. The normal market can be accessed for borrowing funds to the extent of their available borrowings limit, besides members can sell CBLOs held by them to meet their funds requirement instead of waiting till maturity. Members intended to sell CBLOs (borrow funds) place their offers directly on the market watch screen indicating the amount and rate for a specific CBLO. Likewise, members to buy CBLOs (lend funds) place their bids specifying the amount and rate for a particular CBLO. The matching of bids and offers takes place on Best yield- Time priority basis. There is also an auction market facility, through practically all trades is done in the normal market.

TRADING PLATFORM The trading platform is provided by CCIL TRADE ROUTING The trades are routed directly between bank and counterparty. Broker intermediary is not allowed. DAY COUNT CONVENTION

MONEY MARKET & ITS INSTRUMENTS

Discount is calculated on actual /365 basis. The interest payable is rounded off to the nearest rupee. Thus, if Rs 10 Crores is borrowed overnight @ 8.00 per annum. Discount is calculated as (0.08x1/365x 10 Corers) =Rs 21,918.

Certificate of deposit

Product Description Certificate of deposit (CD) is a negotiable money market instrument and issued in dematerialized form or as a usance promissory note, for funds deposited at a bank or other eligible financial institutes for a specified time period. Certificates of deposit (CDs) can be issued by (i) scheduled commercial banks excluding regional rural banks (RRBs) and local area banks(LABs) ; and (ii) select all India financial institutions that have been permitted by RBI to raise short term resources within the umbrella limit fixed by RBI. Banks have the freedom to issue the CDs depending on their requirements. Minimum amount of a CD should be Rs 1 lakh, i.e. the minimum deposit that could be accepted from a single subscriber should not be less than Rs 1 lakh and in the multiples of Rs 1 lakh thereafter. The maturity period of CDs issued by banks should not be less than 7 days and not more than 1 year. The FIs can issue CDs for a

MONEY MARKET & ITS INSTRUMENTS

period not less than 1 year and not exceeding 3 years from the date of issue. Banks / FIs cant grant loans against CDs. Furthermore, they cant buy back their own CDs before maturity.

Banks have to maintain the appropriate reserve requirements, i.e., cash reserve ratio (CRR) and statutory liquidity ratio (SLR) , on the issue price of the CDs. Discount Rate CDs may be issued at a discount on face value. Banks /FIs are also allowed to issue CDs on floating rate basis provided the methodology of compiling the floating rate is objective, transparent and market based. The issuing Bank / FI is free to determine the discount/ coupon rate. The interest rate on floating rate CDs would have to be reset periodically in accordance with a predetermined formula that indicates the spread over a transparent benchmark. Thus, CDs can be issued on discount value basis or coupon bearing basis. The parties to contract are free to determine the discount rate.

Discount is calculated on actual / 365 day basis.

MONEY MARKET & ITS INSTRUMENTS

The discount to be calculated on rear-ended basis. The price is to be calculated up to a maximum of four decimal places and rounded off to the 4th decimal place.

Scenario A:In case yield is given then: Price = 100 PP=== --------------------------------------------------------------------(1 + yield* No. of days to maturity) ------------------------------------------365*100 Scenario B: In case price is given then: Yield= (100- Price)* 365*100

(price *No. of days to maturity)

TRANSACTION PROCESS AND RESTRICTIONS Investing in Primary issues

MONEY MARKET & ITS INSTRUMENTS

The investor has to apply for investment in CD in CD application format. The back office is required to transfer funds to issuers account either through RTGS or RBI cheque. The investor bank advices issuer of its Depository Account details and the issuer send the CD to the Depository for custody in banks name. Issuer also provides CD Redemption Account details to the bank.

Investing Through Secondary Market Currently, Banks are authorized to invest in CDs only in demat form. The counter parties may decide upon the sequence of delivery of funds and securities at the time of concluding the deal in the secondary market. Buying In respect of investment through secondary market, the investor bank has to invest the CD through usual channels similar to other instruments such as debentures. The dealer has to prepare a deal slip giving details of issuer, face value, discounted price and maturity. The investor has to receive deal confirmation from the seller and also send his own deal confirmation to the seller. He also has to advise the seller the DP details. The seller must send delivery instruction to its DP for transfer of CD to custody of banks DP.

MONEY MARKET & ITS INSTRUMENTS

The investor has to issue the RTGS funds transfer instruction or cheque /pay order favoring the seller.

Selling

The transaction is done over normal dealing platforms. A Deal Slip giving details of issuer, face value, discounted price and maturity and Deal Confirmation is prepared and sent to buyer. Deal Confirmation should specifically state that there is no recourse to bank if issuer defaults on redemption. Simultaneously, the seller receives a Deal Confirmation from the buyer. The buyer transfers funds through RTGS to bank (or bank gets cheque /pay order). The buyer advises bank of its DP details and bank sends Delivery instruction to its DP for transfer to the Buyers DP.

Redemption of CDs in Banks Investment Portfolio

Bank asks DP to transfer its CD to the CD Redemption Account of the issuer. (This should be done at least 2 working days in advance). Copy of this instruction to Banks DP to be sent to issuer with details of center and account to which bank requires the redemption payment to be remitted. In case, the redemption date is a holiday, redemption is done the previous working day.

Derivative Usance Promissory Notes

Product Description

MONEY MARKET & ITS INSTRUMENTS

Derivative Usance Promissory Notes (DUPN) or Bills Rediscounting Scheme (BRD) are instruments accepted for payment by a bank on a specific maturity date. Underlying a bill is a transaction representing supply of goods drawn by the supplier on the buyer. The supplier discounts the bill with his bank, the discount representing the interest till maturity. BRD is the rediscounting of trade bills, which have already been purchased by/ discounted with the bank by the customers. The banks normally rediscount the bills that have already been discounted with them or raise usance promissory notes in convenient lots and maturities and rediscount them. The bill (or a portfolio of such bills) is converted into a promissory note (called Derivative Usance Promissory Note- DUPN) by the discounting bank. The minimum and maximum tenors are 15 and 90 days respectively. Discounted / rediscounted bills/ DUPNs are transferable by endorsement and delivery. In the process, they become marketable, liquid instruments. Market is OTC. Only the DUPNs move to the rediscounting banks. The underline bills remain in the custody of the (Primary) discounting bank. DAY COUNT CONVENTION AND DISCOUNT RATE The parties to contract are free to determine the discount rate. Discount is calculated on actual/365 day basis. The amount payable to the brrower is the principal amount less the discount/interest .While

MONEY MARKET & ITS INSTRUMENTS

discounting a bill /DUPNs the amount of discount is to be deducted at the time the bill/DUPN is issued .The discount is rounded of to the nearest rupee. On maturity the brrower would repay the principal amount.

EXAMPLE

Transaction Amount: RS 10,00, 00,000/-(Rupees ten crore) (principle amount) No. of days Rate of Discount Discount interest/discount : 45 days : 10.25 p.a. : Transaction Amount*No. of days*Rate of 365*100 i.e; 10,00,00,000*45 *10.25 365*100 i.e; Rs 9,87,36,301/Amount to be repaid on maturity: Rs 10, 00, 00,000

TRANSACTION PROCESS AND RESTRICTIONS The following types of bills can be accepted for rediscounting:

MONEY MARKET & ITS INSTRUMENTS

A bill drawn on and accepted by the purchasers bank and where the latter is not a licensed commercial bank, it should in addition bear the signature of a licensed bank. A bill drawn on the buyers bank jointly and accepted by them jointly. A bill drawn on and accepted by the buyer under an irrevocable letter of credit and certified by the buyers bank, which has opened the letter of credit. A bill drawn on and accepted by the buyer and endorsed by the seller in favour of his bank and bearing a legend signed by a licensed

scheduled bank who should be an endorser of the bill. The bill of exchange should be a genuine trade bill and should have arisen out of sale of goods. The bill should have a maturity period of not more than 90 days. The bill should contain a clause indicating the nature of the transaction out of which it has arisen. Bills arising out of sale of prohibited commodities notified by RBI are ineligible under this scheme. Accommodation bills are also ineligible. Services sector bills are not eligible for rediscounting.

Bank can be both buyer and seller (rediscounter) of these instruments. In either case it could be single bill or several bills or a portfolio of bills in the form of single usance promissory note. The RBI states that there should be a board-approved bill discounting policy in place. Bills

MONEY MARKET & ITS INSTRUMENTS

should represent genuine commercial and trade transactions of customers. Banks should not deal in without recourse bills.

TREASURY BILLS:

T-Bills are short term instruments issued by the RBI for Govt for financing the temporary funding requirements and are issued for maturities of 91 days, 182 days and 364 days. T-Bills have a face value of Rs 100 but have no coupon (no interest payment). T-Bills are instead issued at a discount to the face value (say @Rs 95) and redeemed at par (Rs 100). The difference of Rs 5(100-95) represents the return to the investor obtained at the end of the maturity period. T-bills are discount (zero coupon) debt instruments with a maximum maturity of 364 days. They must not be confused with ad hoc Treasury Bills, which were in the nature of overdrafts from the RBI to Government. The settlement of deals, reported on the NDS, is settled by CCIL. CCIL guarantees the settlement of the deals through novation. Issue Channels

MONEY MARKET & ITS INSTRUMENTS

There are two ways by which T-Bills can be purchased: Primary Issues: Through multiple price auctions. Bidders quote prices at discount to the face value (Rs 100). Multiple bids are allowed. As in the case of G-Secs, the RBI fixes a cutoff yield at and below which bids get full or partial allotment.

Secondary Market: In the secondary market, the trades are directly with counterparty or through broker intermediary. The market consists of banks, PDsentities which are obliged to bid in the primary auctions of the RBI and are paid a commission for their services-insurance companies and mutual funds. Types of Trade and trading Platforms: The types of trades are outright purchases/sales. The trading platforms for G-Sec are NDS-OM (Negotiated Dealing System-Order matching Segment) and OTC. In addition to NDS, GSecs can be traded on stock exchanges in dematerialized form. The trading platform in stock exchanges is automated and order driven. Trades will be settled similarly to equities through the concerned stock Exchanges clearing House. For this purpose: Day Count Convention is Actual /365

MONEY MARKET & ITS INSTRUMENTS

The market price quoted on yield to maturity basis. This can be converted to price. The price is to be calculated upto maximum of four decimal places and rounded off to the 4th decimal place Scenario A: In case yield is given then: Price= 100 ------------------------------------------------(1+yield*No of days to maturity) 365*100 Scenario B: In case price is given then Yield= (100-Price)*365*100 T-Bills are always valued at book value.

INTER-BANK PARTICIPATION CERTIFICATE(IBPS) PRODUCT DESCRIPTION As the name suggests, IBPCs are instruments which allow banks to acquire a share of another banks loan portfolio and enable banks with surplus funds to deploy them. The arrangement could be with or without risk-sharing .Not more than 40% of an advance can be earmarked for participations. In IBPCs of the risk sharing variety, the acquiring bank has no recourse to the IBPC issuing bank if the advance underlying the participations is in arrears or defaulters.

MONEY MARKET & ITS INSTRUMENTS

If it is without risk sharing, there is no credit risk exposure to the underlying advance but only to the IBPC-issuing bank. Thus, the bank can finance a portion of its loan portfolio by issuing IBPCs to other banks. It can also acquire IBPCs issued by other banks, representing a part of their loan portfolio. In the first case, the bank reduces the advances in its book while in the second it has an asset. Banks can issue IBPCs only against their standard assets. Also the loan agreement between the issuing bank and the borrower must explicitly provide for transfer of the borrowers liability to another bank. IBPCs are not transferable instruments.IBPCs are subject to the uniform code governing inter-bank participation. IBPC SCHEMES

RISK SHARING

Minimum maturity 91 days, maximum 180 days. Rate of interest is mutually negotiated between the issuer and buyer. Issuing bank should not finance more than 40% of an advance with IBPCs at the time of issue. In case the advance falls below IBPCs issued, the issuing bank must reduce participation to the extent necessary. In case the advance is crystallized, the IBPC-issuing bank must advise the participating banks of the fact. Recoveries from the brrower and his

MONEY MARKET & ITS INSTRUMENTS

assets will be shared proportionately among the issuing bank and the participating banks. The issuing bank is not subject to reserve requirements on these borrowings. CONDITIONS The issuing banks should make available all necessary information on the borrower to participating banks, including its appraisal, security details, sanction note to its board etc. All rights and powers of the participating banks will vest with the issuing bank. The issuing bank has discretion on expanding or waiving the conditions attached to the loan provided it does not dilute the obligations or the brrower and/or guarantor under the loan agreement. The issuer will fronted participants in all maters relating to administering the advance in terms of the loan agreements with the borrower .it will have full discretion to (or not to ) exercise its rights under the loan agreements. However, changes to the loan agreement which have the effect of varying a borrowers obligations require the consent of participants. The loan agreement must specifically provide for participations. NON-RISK-SHARING

MONEY MARKET & ITS INSTRUMENTS

Tenor not to exceed 90 days. The rate of interest is mutually negotiated between the issuer and

participating banks. COMMERCIAL PAPER

PRODUCT DESCRIPTION

Commercial Paper (CP) is an unsecured money market instrument issued in the form of a promissory note and is a discount (zero coupon) instrument CP can be issued for maturities between a minimum of 7 days and a maximum upto one year from the date of issue. The maturity date of the CP should not go beyond the date upto which the credit rating of the issuer is valid. With a minimum maturity of 7 days and maximum maturity of one year, it is issued by Corporates. CP can be acquired from the primary or secondary market. It is to be held and traded only in demat form as far as banks and institutional investors are concerned.

DISCOUNT RATE CPs may be issued at a discount on face value. The parties to contract are free to determine the discount rate. Discount is calculated on Actual/365 day basis.

MONEY MARKET & ITS INSTRUMENTS

Discount to be calculated on a rear ended basis. The price is to be calculated up to a maximum of four decimal places and rounded off to the 4th decimal place.

Scenario A: In case yield is given then: Price = 100 PP=== ------------------------------------------------------------(1 + yield* No. of days to maturity) ------------------------------------------365*100

Scenario B: In case price is given then: Yield= (100- Price)* 365*100

(price *No. of days to maturity)

TANSRACTION PROCESS AND RESTRICTIONS

Investing in primary issues

In a primary issue, the investing bank applies to the issuer along with payment in terms of the Letter of offer by CP Issuer. Yield offered in relation to credit rating and secondary market for similar issues should be checked. The investing bank advises issuer/IPA of its DP details and IPA issues CP to the DP for its custody on behalf of the investing bank .IPA issues a

MONEY MARKET & ITS INSTRUMENTS

Certificate to investing bank conforming compliance of issuer with the RBIs and other conditions for issue of CP and also gives rating and backstop (if any) particulars. Issuer swaps Deal Confirmation Note with the investing bank NDS has module to report CP issuance. All CP issues must be reported on the NDS in two days from completion of the issue, in addition to the existing RBI. Investing through secondary market Currently, banks are authorized to invest in CPs only in demat form .The counterparties may decide upon the sequence of delivery of funds and securities at time of concluding the deal in the secondary market.

Buying

In respect of investement through secondary market,the invester bank has to invest the CP through usual channels similar to other instruments such as CD. The dealer has to prepare a deal slip giving details of issuer, face value, discounted price and maturity. The investor has to receive deal confirmation from the seller and also send his own deal confirmation to the seller. He also has to advise the seller the DP details. The seller must send delivery instruction to its DP for transfer of CP to custody of banks DP.

MONEY MARKET & ITS INSTRUMENTS

The investor has to issue RTGS funds transfer instruction or cheque/pay-order favoring the seller.

Selling

The transaction is done over normal dealing platforms. A deal slip giving details of issuer, face value, discounted price and maturity and deal confirmation is prepared and sent to buyer. Deal confirmation should specifically state that there is no recourse to bank if issuer defaults on redemption. Simultaneously, the seller receives a deal confirmation from the buyer .The buyer transfers funds through RTGS to bank (or bank get cheque / pay order).The buyer advises bank of its DP details and bank sends delivery instruction to its DP for transfer to the buyers DP.

Redemption of CDs in banks investment portfolio

Investing bank asks its DP to transfer the CP to the CP redemption account of the IPA (details of which are available in the IPAs certificate).The transfer should be done by 3p.m.one working day before maturity so that the IPA can pay the investor on the maturity redemption is subject to the availability of sufficient funds of the issuer with IPA. In case the redemption date is holiday, redemption is done the previous working day.

MONEY MARKET & ITS INSTRUMENTS

Das könnte Ihnen auch gefallen

- Ishfaq Ahmad Dar1111Dokument54 SeitenIshfaq Ahmad Dar1111Ishfaq AhmadNoch keine Bewertungen

- JK Bank Summer Internship ReportDokument64 SeitenJK Bank Summer Internship ReportDevinder Choudhary71% (7)

- Summit BankDokument53 SeitenSummit BankJaved Iqbal50% (2)

- INDEX1Dokument64 SeitenINDEX1Rameez BhatNoch keine Bewertungen

- Summit Bank Final-1Dokument48 SeitenSummit Bank Final-1ABDUL BASIT100% (2)

- Summit Bank ReportDokument92 SeitenSummit Bank Reportamna1860% (2)

- Mehak Mahajan... Project Report On J & K Bank... Word 2007Dokument107 SeitenMehak Mahajan... Project Report On J & K Bank... Word 2007Mayank Mahajan0% (1)

- Introduction To The Report: 1.1 Back GroundDokument66 SeitenIntroduction To The Report: 1.1 Back GroundAtif Butt 1179-FMS/MS/S20Noch keine Bewertungen

- A Project Report On Financing SsiDokument70 SeitenA Project Report On Financing SsihirwanithakurNoch keine Bewertungen

- Internship Report On Askari Bank LimitedDokument146 SeitenInternship Report On Askari Bank LimitedSyed Ammar100% (2)

- Internship Report SilkbankDokument80 SeitenInternship Report SilkbankKomal Shujaat67% (6)

- Askari Bank Internship ReportDokument101 SeitenAskari Bank Internship ReportsolacuanNoch keine Bewertungen

- Microfinancial Analysis of J&K Grameen Bank2Dokument99 SeitenMicrofinancial Analysis of J&K Grameen Bank2Ayan NazirNoch keine Bewertungen

- Assessment of Working Capital HscprojectsDokument84 SeitenAssessment of Working Capital HscprojectsAkash MaheshwariNoch keine Bewertungen

- Assessment of Working CapitalDokument72 SeitenAssessment of Working Capitaladil sheikhNoch keine Bewertungen

- Project On: Submitted ToDokument72 SeitenProject On: Submitted ToMohmmad IqbalNoch keine Bewertungen

- Mba Marketing ProjectDokument67 SeitenMba Marketing ProjectMeer Tanveer100% (1)

- BLP - SME BankDokument15 SeitenBLP - SME BankSaadat KhanNoch keine Bewertungen

- Project of MCBDokument55 SeitenProject of MCBSana JavaidNoch keine Bewertungen

- AcknowledgementsDokument40 SeitenAcknowledgementsMuhammad SarwarNoch keine Bewertungen

- Complete ProjectDokument60 SeitenComplete ProjectSabahatRazaNoch keine Bewertungen

- Executive Summary: Credit SanctioningDokument18 SeitenExecutive Summary: Credit SanctioningMd. Tauhidur Rahman 07-18-45Noch keine Bewertungen

- Askari Bank Internship Report 2010Dokument77 SeitenAskari Bank Internship Report 2010Shafaq Khurram50% (2)

- Internship Report of Js Bank LTDDokument41 SeitenInternship Report of Js Bank LTDbbaahmad89100% (4)

- Internship Report On Meezan Bank CompleteDokument86 SeitenInternship Report On Meezan Bank CompleteArslan96% (27)

- Internship Report On MCB Bank LTDDokument66 SeitenInternship Report On MCB Bank LTDbbaahmad89Noch keine Bewertungen

- Internship Report On MCB Bank LimitedDokument40 SeitenInternship Report On MCB Bank Limitedbbaahmad89Noch keine Bewertungen

- Internship Report On Askari Bank Limited MBA Finance, Hazara University Mansehra, Internship Ship Final Report Part 2 Jahangir KhanDokument60 SeitenInternship Report On Askari Bank Limited MBA Finance, Hazara University Mansehra, Internship Ship Final Report Part 2 Jahangir KhanJahangir KhanNoch keine Bewertungen

- JK Bank ShriyaDokument69 SeitenJK Bank ShriyaRohit GanjooNoch keine Bewertungen

- Business OperationsDokument27 SeitenBusiness Operationsluckyhappy786Noch keine Bewertungen

- Asad CH 1 2Dokument12 SeitenAsad CH 1 2Abrar Alam ChowdhuryNoch keine Bewertungen

- Sme Financing of FSIBLDokument53 SeitenSme Financing of FSIBLKhan JewelNoch keine Bewertungen

- Training & DevelopmentDokument27 SeitenTraining & Developmentbushra saeedNoch keine Bewertungen

- Submitted For The Partial Fulfillment For The Award of Degree ofDokument62 SeitenSubmitted For The Partial Fulfillment For The Award of Degree ofsginni559150Noch keine Bewertungen

- Term Paper PBLMTB FIN 101Dokument29 SeitenTerm Paper PBLMTB FIN 101Onnesha Sadia HossainNoch keine Bewertungen

- Int RepDokument13 SeitenInt RepUman MushtaqNoch keine Bewertungen

- Mezaan Bank Internship UOGDokument47 SeitenMezaan Bank Internship UOGAhsanNoch keine Bewertungen

- MCBDokument84 SeitenMCBTari Baba100% (2)

- "Evaluating A Bank Performance and Finding Out The Opportunities and Threats: A StudyDokument25 Seiten"Evaluating A Bank Performance and Finding Out The Opportunities and Threats: A StudyMd.Imran HossainNoch keine Bewertungen

- Internship Report Askari BankDokument107 SeitenInternship Report Askari Bankafgan52Noch keine Bewertungen

- Chapter Seven FINALDokument19 SeitenChapter Seven FINALMd. Borhan UddinNoch keine Bewertungen

- Comparative Study of Financial Statement Reports of Canara Bank and Comparative BankDokument41 SeitenComparative Study of Financial Statement Reports of Canara Bank and Comparative Bankparamjeet kourNoch keine Bewertungen

- MCBDokument31 SeitenMCBkinza buttNoch keine Bewertungen

- The Effect of Financial Performance, External Factors, and Operational Ratio On Car Ratio of Sharia Commercial Banks in IndonesiaDokument8 SeitenThe Effect of Financial Performance, External Factors, and Operational Ratio On Car Ratio of Sharia Commercial Banks in Indonesiazhafirah nurhasanahNoch keine Bewertungen

- Internship Report On MCB Bank Ltd. (Specialization in Banking & Finance)Dokument95 SeitenInternship Report On MCB Bank Ltd. (Specialization in Banking & Finance)Khurram JavedNoch keine Bewertungen

- Bank Alfalah AssignmentDokument84 SeitenBank Alfalah AssignmentEhsan AsgharNoch keine Bewertungen

- Internship Report On SME Bank (11!08!2015)Dokument44 SeitenInternship Report On SME Bank (11!08!2015)Mohib AliNoch keine Bewertungen

- Working Capital of Borrower-Bank of BarodaDokument82 SeitenWorking Capital of Borrower-Bank of BarodaRaj KopadeNoch keine Bewertungen

- Executive Summary 1Dokument82 SeitenExecutive Summary 1madihaijazkhanNoch keine Bewertungen

- Comparison of Retail Loans of J&K Bank With Other Banks and Deposit SchemesDokument111 SeitenComparison of Retail Loans of J&K Bank With Other Banks and Deposit SchemesAnmol GuptaNoch keine Bewertungen

- ASK ReportDokument8 SeitenASK ReportashiqhussinNoch keine Bewertungen

- Internship ReportDokument40 SeitenInternship ReportAneeka ShahzadNoch keine Bewertungen

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Algerian Islamic Banks: The Role of Relationships Marketing Tactics and Customer LoyaltyVon EverandAlgerian Islamic Banks: The Role of Relationships Marketing Tactics and Customer LoyaltyNoch keine Bewertungen

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- Working Capital Management and FinanceVon EverandWorking Capital Management and FinanceBewertung: 3.5 von 5 Sternen3.5/5 (8)

- Mutual Funds in India: Structure, Performance and UndercurrentsVon EverandMutual Funds in India: Structure, Performance and UndercurrentsNoch keine Bewertungen

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksVon EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksBewertung: 5 von 5 Sternen5/5 (1)

- White Paper Disrupting DistributionDokument28 SeitenWhite Paper Disrupting DistributionGopi SundaresanNoch keine Bewertungen

- Marketing Strategies in PigagoDokument103 SeitenMarketing Strategies in PigagolalsinghNoch keine Bewertungen

- Amazon in India Research Report 1Dokument25 SeitenAmazon in India Research Report 1Thu NguyenNoch keine Bewertungen

- 1 - The Market and CompetitionDokument2 Seiten1 - The Market and Competitionsonic boomNoch keine Bewertungen

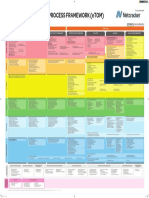

- Business Process Framework (Etom) : Frameworx Release 16.5Dokument1 SeiteBusiness Process Framework (Etom) : Frameworx Release 16.5mattiaNoch keine Bewertungen

- Netflix Vs Chorki - FinalDokument1 SeiteNetflix Vs Chorki - FinalRafid AhnafNoch keine Bewertungen

- QFD, Fmea, DfaDokument300 SeitenQFD, Fmea, DfaMohammad Shazil HassanNoch keine Bewertungen

- Order in The Matter of M/s Rich Infra Developers India LTDDokument17 SeitenOrder in The Matter of M/s Rich Infra Developers India LTDShyam SunderNoch keine Bewertungen

- PL 400Dokument105 SeitenPL 400Safan Momin50% (2)

- Noufal Varamangalath: Curriculum VitaeDokument4 SeitenNoufal Varamangalath: Curriculum VitaeNaufalNoch keine Bewertungen

- Salesmanship PowerpointDokument11 SeitenSalesmanship Powerpointdidato.junjun.rtc10Noch keine Bewertungen

- Unit 6 Internal Competences and Resources: StructureDokument30 SeitenUnit 6 Internal Competences and Resources: StructureRadhika KidambiNoch keine Bewertungen

- Summary BP - Assignment Semester 1Dokument9 SeitenSummary BP - Assignment Semester 1Ashvin GraceNoch keine Bewertungen

- Raute v. Veneer Technology, Inc., Dba VentekDokument7 SeitenRaute v. Veneer Technology, Inc., Dba VentekPriorSmartNoch keine Bewertungen

- Basiatu Bakery Business PlanDokument48 SeitenBasiatu Bakery Business PlanAlhaji Daramy100% (3)

- Understanding The Sales Process: Renuka TimilsenaDokument59 SeitenUnderstanding The Sales Process: Renuka TimilsenaSubashNoch keine Bewertungen

- Mithila Internship Report PDF Main Part PDFDokument53 SeitenMithila Internship Report PDF Main Part PDFMithila SultanaNoch keine Bewertungen

- Lic Dev Officer TrainingDokument36 SeitenLic Dev Officer TrainingPraveenNoch keine Bewertungen

- Entrepreneurship CHAPTER 10Dokument98 SeitenEntrepreneurship CHAPTER 10Erika Jane DeramasNoch keine Bewertungen

- Toyota Indus MotorsDokument25 SeitenToyota Indus MotorsMahnoorMohiuddinNoch keine Bewertungen

- CommodityTradingHubs. SingaporeDokument20 SeitenCommodityTradingHubs. SingaporeSaumya Raizada100% (1)

- Nestle Case 5 and 6Dokument1 SeiteNestle Case 5 and 6Fahim SheikhNoch keine Bewertungen

- Havmor Ice Creams Bba Mba Project ReportDokument98 SeitenHavmor Ice Creams Bba Mba Project ReportpRiNcE DuDhAtRa75% (20)

- Unit 1: Getting Started: Week 3: SAP S/4HANA Migration Cockpit - Direct Transfer ApproachDokument21 SeitenUnit 1: Getting Started: Week 3: SAP S/4HANA Migration Cockpit - Direct Transfer ApproachLuki1233332Noch keine Bewertungen

- The 10 Golden Rules of The Gold BusinessDokument3 SeitenThe 10 Golden Rules of The Gold BusinessAdolfo Vergara100% (2)

- GCMA BookDokument524 SeitenGCMA BookZiaul Huq100% (5)

- Nguyễn Huy Hoàng - 2112153062 - Bản thảo 2 BCGKDokument31 SeitenNguyễn Huy Hoàng - 2112153062 - Bản thảo 2 BCGKNguyễn Huy HoàngNoch keine Bewertungen

- Disrupt or Be Disrupted Report7 1 21 17 FINAL PDFDokument21 SeitenDisrupt or Be Disrupted Report7 1 21 17 FINAL PDFM.Tamam NafiriNoch keine Bewertungen

- Product ConceptDokument59 SeitenProduct ConceptAshish ShuklaNoch keine Bewertungen

- Tapping Into Global MarketDokument30 SeitenTapping Into Global MarketSadewa KuswandiNoch keine Bewertungen