Beruflich Dokumente

Kultur Dokumente

Derivatives Report 19th April 2012

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Derivatives Report 19th April 2012

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Derivative Report

India Research

April 19, 2012 Comments

The Nifty futures open interest increased by 4.12% while

Nifty Vs OI

Minifty futures open interest is decreased by 1.63% as market closed at 5300.00 levels.

The Nifty April future closed at a premium of 29.90 point

against a premium of 22.70 points. The May series closed at a premium of 56.85 points.

The Implied Volatility of at the money options is

decreased from 18.91% to 17.85%

The PCR-OI has being increased from 1.10 to 1.12

points.

The total OI of the market is `1,22,174/-cr. and the

stock futures OI are `29,693/-cr.

Few of the liquid counters where we have seen high cost-

of-carry are TTML, GVKPIL, SKUMARSYNF and GODREJIND.

CHAMBALFERT,

View OI Gainers

SCRIP BEL EXIDEIND IGL HCLTECH IDEA OI 87000 1584000 2461000 2290000 14088000 OI CHANGE (%) 70.59 42.19 34.15 27.08 25.25 PRICE 1521.80 132.05 239.85 494.30 89.95 PRICE CHANGE (%) 1.42 -5.20 4.37 2.80 -3.80 FIIs were net buyers in cash market segment; they

were net buyers worth of `222/- cr. On derivatives front they were net buyers in index futures with decent buildup in open interest, while in index options also they were net buyers and the quantum of buying was quite significant however the buildup in open interest was just 2% indicating most of the buying done to cover their shorts.

On options front not much of buildup was visible in

OI Losers

SCRIP CESC COLPAL HINDOILEXP MAX DABUR OI 597000 84500 3510000 586000 1898000 OI CHANGE (%) -14.10 -11.29 -10.05 -9.85 -8.04 PRICE 270.45 1134.20 129.85 199.15 111.15 PRICE CHANGE (%) 2.74 0.35 -2.04 -0.18 0.36

call option except 5600 strike price and some unwinding was observed in 5200 call option, while in put option 4900 strike price have seen significant amount of unwinding and 5200-5400 put option have seen some buildup in yesterdays trading session.

The counter of JPASSO has seen trading in the range

of `76-88 in recent few trading sessions and also the counter has seen good amount of short buildup at higher level. In last 2-3 trading session the stock has seen some long buildup followed by some long unwinding around its resistance level. We anticipate a mix of long unwinding and shorts could buildup in the counter which could take the stock to around `75. Hence go short at around `82-84 with the stop loss of `87.

Put-Call Ratio

SCRIP NIFTY INFY SBIN BANKNIFTY RELIANCE PCR-OI 1.12 0.29 0.93 0.83 0.61 PCR-VOL 1.01 0.29 0.79 0.91 0.61

Historical Volatility

SCRIP

BHUSANSTL SUNTV IDEA EXIDEIND GVKPIL

HV

48.77 48.00 33.86 43.06 71.87 For Private Circulation Only 1

SEBI Registration No: INB 010996539

Derivative Report | India Research

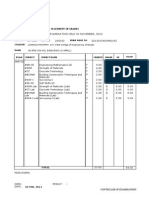

FII Statistics for 18-April-2012

Open Interest Detail Buy Sell Net Contracts INDEX FUTURES INDEX OPTIONS STOCK FUTURES STOCK OPTIONS TOTAL Value (Rs. in cr.) 10896.83 38697.26 23776.76 1387.93 74758.79 Change (%) 5.32 2.43 0.30 6.82 2.26

Turnover on 18-April-2012

No. of Contracts Turnover (Rs. in cr.) Change (%)

Instrument

1668.91

1079.45

589.47 1,405.34 (297.00) (77.66) 1,620.15

413041 1460313 834330 48804 2756488

INDEX FUTURES INDEX OPTIONS STOCK FUTURES STOCK OPTIONS TOTAL

349414 2863032 461038 188247 3861731

8769.72 76499.41 13888.22 5713.76 104871.12

-53.41 -37.09 -24.94 -31.36 -37.30

12489.39 11084.04 1315.60 639.00 1612.60 716.66

16112.90 14492.75

Nifty Spot =5300.00

Lot Size = 50

Bull-Call Spreads

Action Buy Sell Buy Sell Buy Sell Strike 5300 5400 5300 5500 5400 5500 Price 69.20 25.65 69.20 6.20 25.65 6.20 19.45 80.55 5419.45 63.00 137.00 5363.00 Risk 43.55 Reward 56.45 BEP 5343.55

Bear-Put Spreads

Action Buy Sell Buy Sell Buy Sell Strike 5300 5200 5300 5100 5200 5100 Price 47.15 19.65 47.15 8.50 19.65 8.50 11.15 88.85 5188.85 38.65 161.35 5261.35 Risk 27.50 Reward 72.50 BEP 5272.50

Note: Above mentioned Bullish or Bearish Spreads in Nifty (April. Series) are given as information and not as a recommendation.

Nifty Put-Call Analysis

For Private Circulation Only

SEBI Registration No: INB 010996539

Derivative Report | India Research

Strategy Date 02-04-2012 09-04-2012 16-04-2012

Scrip NIFTY TATAMOTORS HDFC

Strategy Ratio Put Spread Ratio Put Spread Call Hedge

Status Open Open Open

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section).

Derivative Research Team

Email Id : - derivatives.desk@angelbroking.com

For Private Circulation Only

SEBI Registration No: INB 010996539

Das könnte Ihnen auch gefallen

- Derivatives Report 12th April 2012Dokument3 SeitenDerivatives Report 12th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 22 February 2013Dokument3 SeitenDerivatives Report, 22 February 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 2nd March 2012Dokument3 SeitenDerivatives Report 2nd March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 1st March 2012Dokument3 SeitenDerivatives Report 1st March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 31st DecDokument3 SeitenDerivatives Report 31st DecAngel BrokingNoch keine Bewertungen

- Derivatives Report 20th Dec 2012Dokument3 SeitenDerivatives Report 20th Dec 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 15th JanDokument3 SeitenDerivatives Report 15th JanAngel BrokingNoch keine Bewertungen

- Derivatives Report 11th April 2012Dokument3 SeitenDerivatives Report 11th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 04 Apr 2013Dokument3 SeitenDerivatives Report, 04 Apr 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 27th April 2012Dokument3 SeitenDerivatives Report 27th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 2nd April 2012Dokument3 SeitenDerivatives Report 2nd April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 25th April 2012Dokument3 SeitenDerivatives Report 25th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 14th February 2012Dokument3 SeitenDerivatives Report 14th February 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 14 March 2013Dokument3 SeitenDerivatives Report, 14 March 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report, 22 April 2013Dokument3 SeitenDerivatives Report, 22 April 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report, 21 March 2013Dokument3 SeitenDerivatives Report, 21 March 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 13 APR 2012Dokument3 SeitenDerivatives Report 13 APR 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 12 Dec 2011Dokument3 SeitenDerivatives Report 12 Dec 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 23rd February 2012Dokument3 SeitenDerivatives Report 23rd February 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 24th February 2012Dokument3 SeitenDerivatives Report 24th February 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 12th March 2012Dokument3 SeitenDerivatives Report 12th March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 24th January 2012Dokument3 SeitenDerivatives Report 24th January 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 23 March 2012Dokument3 SeitenDerivatives Report 23 March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 07 Feb 2013Dokument3 SeitenDerivatives Report 07 Feb 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 26th April 2012Dokument3 SeitenDerivatives Report 26th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 16th December 2011Dokument3 SeitenDerivatives Report 16th December 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report, 13 March 2013Dokument3 SeitenDerivatives Report, 13 March 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 20th April 2012Dokument3 SeitenDerivatives Report 20th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 23 Aug 2012Dokument3 SeitenDerivatives Report 23 Aug 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 11 June 2013Dokument3 SeitenDerivatives Report, 11 June 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 22nd December 2011Dokument3 SeitenDerivatives Report 22nd December 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 25 Jun 2012Dokument3 SeitenDerivatives Report 25 Jun 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 9th February 2012Dokument3 SeitenDerivatives Report 9th February 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 20 February 2013Dokument3 SeitenDerivatives Report, 20 February 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 28 Aug 2012Dokument3 SeitenDerivatives Report 28 Aug 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 31 Aug 2012Dokument3 SeitenDerivatives Report 31 Aug 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 23 April 2013Dokument3 SeitenDerivatives Report, 23 April 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 27th February 2012Dokument3 SeitenDerivatives Report 27th February 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 14th November 2011Dokument3 SeitenDerivatives Report 14th November 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 10 Jul 2012Dokument3 SeitenDerivatives Report 10 Jul 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 24th October 2011Dokument3 SeitenDerivatives Report 24th October 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 18 Oct 2012Dokument3 SeitenDerivatives Report 18 Oct 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 13th March 2012Dokument3 SeitenDerivatives Report 13th March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 29th March 2012Dokument3 SeitenDerivatives Report 29th March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 23 Nov 2012Dokument3 SeitenDerivatives Report 23 Nov 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 31 Oct 2012Dokument3 SeitenDerivatives Report 31 Oct 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 23rd April 2012Dokument3 SeitenDerivatives Report 23rd April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 12 Dec 2012Dokument3 SeitenDerivatives Report 12 Dec 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 02 April 2013Dokument3 SeitenDerivatives Report, 02 April 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Aug 2012Dokument3 SeitenDerivatives Report 16 Aug 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 10th April 2012Dokument3 SeitenDerivatives Report 10th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 23rd September 2011Dokument3 SeitenDerivatives Report 23rd September 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 26 Oct 2012Dokument3 SeitenDerivatives Report 26 Oct 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 14 Dec 2012Dokument3 SeitenDerivatives Report 14 Dec 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 23 Oct 2012Dokument3 SeitenDerivatives Report 23 Oct 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 22nd March 2012Dokument3 SeitenDerivatives Report 22nd March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report, 25 February 2013Dokument3 SeitenDerivatives Report, 25 February 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 11 Oct 2012Dokument3 SeitenDerivatives Report 11 Oct 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 5 JUNE 2012Dokument3 SeitenDerivatives Report 5 JUNE 2012Angel BrokingNoch keine Bewertungen

- Trade Like Chuck: How to Create lncome in ANY MARKET!Von EverandTrade Like Chuck: How to Create lncome in ANY MARKET!Bewertung: 3 von 5 Sternen3/5 (1)

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Proposed) Declaration of Factual Innocence Under Penal Code Section 851.8 and OrderDokument4 SeitenProposed) Declaration of Factual Innocence Under Penal Code Section 851.8 and OrderBobby Dearfield100% (1)

- Imogen Powerpoint DesignDokument29 SeitenImogen Powerpoint DesignArthur100% (1)

- 1 Introduction To PPSTDokument52 Seiten1 Introduction To PPSTpanabo central elem sch.Noch keine Bewertungen

- Q3 Grade 8 Week 4Dokument15 SeitenQ3 Grade 8 Week 4aniejeonNoch keine Bewertungen

- HTTP Parameter PollutionDokument45 SeitenHTTP Parameter PollutionSpyDr ByTeNoch keine Bewertungen

- My Parenting DnaDokument4 SeitenMy Parenting Dnaapi-468161460Noch keine Bewertungen

- Performance MeasurementDokument13 SeitenPerformance MeasurementAmara PrabasariNoch keine Bewertungen

- Introduction To Control SystemDokument9 SeitenIntroduction To Control SystemAbdulhakam Abubakar YusufNoch keine Bewertungen

- Syllabus Biomekanika Kerja 2012 1Dokument2 SeitenSyllabus Biomekanika Kerja 2012 1Lukman HakimNoch keine Bewertungen

- DMemo For Project RBBDokument28 SeitenDMemo For Project RBBRiza Guste50% (8)

- Entrepreneurial Skills and Intention of Grade 12 Senior High School Students in Public Schools in Candelaria Quezon A Comprehensive Guide in Entrepreneurial ReadinessDokument140 SeitenEntrepreneurial Skills and Intention of Grade 12 Senior High School Students in Public Schools in Candelaria Quezon A Comprehensive Guide in Entrepreneurial ReadinessAngelica Plata100% (1)

- People Vs Felipe Santiago - FCDokument2 SeitenPeople Vs Felipe Santiago - FCBryle DrioNoch keine Bewertungen

- Deseret First Credit Union Statement.Dokument6 SeitenDeseret First Credit Union Statement.cathy clarkNoch keine Bewertungen

- Meike SchalkDokument212 SeitenMeike SchalkPetra BoulescuNoch keine Bewertungen

- Water and Wastewater For Fruit JuiceDokument18 SeitenWater and Wastewater For Fruit JuiceJoyce Marian BelonguelNoch keine Bewertungen

- 9francisco Gutierrez Et Al. v. Juan CarpioDokument4 Seiten9francisco Gutierrez Et Al. v. Juan Carpiosensya na pogi langNoch keine Bewertungen

- SANDHU - AUTOMOBILES - PRIVATE - LIMITED - 2019-20 - Financial StatementDokument108 SeitenSANDHU - AUTOMOBILES - PRIVATE - LIMITED - 2019-20 - Financial StatementHarsimranSinghNoch keine Bewertungen

- Jurnal UlkusDokument6 SeitenJurnal UlkusIndri AnggraeniNoch keine Bewertungen

- SET UP Computer ServerDokument3 SeitenSET UP Computer ServerRicHArdNoch keine Bewertungen

- Deadlands - Dime Novel 02 - Independence Day PDFDokument35 SeitenDeadlands - Dime Novel 02 - Independence Day PDFDavid CastelliNoch keine Bewertungen

- Crystek Technology Co.,LtdDokument35 SeitenCrystek Technology Co.,LtdCésar MarinNoch keine Bewertungen

- Medicidefamilie 2011Dokument6 SeitenMedicidefamilie 2011Mesaros AlexandruNoch keine Bewertungen

- Pediatric ECG Survival Guide - 2nd - May 2019Dokument27 SeitenPediatric ECG Survival Guide - 2nd - May 2019Marcos Chusin MontesdeocaNoch keine Bewertungen

- Abramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFDokument424 SeitenAbramson, Glenda (Ed.) - Oxford Book of Hebrew Short Stories (Oxford, 1996) PDFptalus100% (2)

- Project Report On ICICI BankDokument106 SeitenProject Report On ICICI BankRohan MishraNoch keine Bewertungen

- Different Types of Classrooms in An Architecture FacultyDokument21 SeitenDifferent Types of Classrooms in An Architecture FacultyLisseth GrandaNoch keine Bewertungen

- First Aid General PathologyDokument8 SeitenFirst Aid General PathologyHamza AshrafNoch keine Bewertungen

- CA-2 AasthaDokument4 SeitenCA-2 AasthaJaswant SinghNoch keine Bewertungen

- Grave MattersDokument19 SeitenGrave MattersKeith Armstrong100% (2)

- Nandurbar District S.E. (CGPA) Nov 2013Dokument336 SeitenNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaNoch keine Bewertungen