Beruflich Dokumente

Kultur Dokumente

Chapter13.Terminal Benefits

Hochgeladen von

Palagiri SrinivasOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter13.Terminal Benefits

Hochgeladen von

Palagiri SrinivasCopyright:

Verfügbare Formate

E2-E3/Finance

Rev. Date: 01-04-2011

E2-E3/FINANCE

CHAPTER-13 TERMINAL BENEFITS (PENSION, GRATUITY, LEAVE ENCASHMENT,GPF,EPF,DOT CELL) (Date of Creation: 01/04/2011)

BSNL, India

For Internal Circulation Only

E2-E3/Finance

Rev. Date: 01-04-2011

Terminal Benefits(Pension, Gratuity, Leave Encashment, GPF, EPF, DOT Cell)

Pension and Gratuity LEARNING GOALS

After reading this section, you will be conversant with Calculation of Pensionary Benefits viz (a) Pension (b) Gratuity (c) Family Pension (d) Commutation (e) Leave Encashment. Classes of Pension and its description. Processing of Pension papers.

Introduction DTO/DTS/DOT Employees as on 30-9-2000 & absorbed in BSNL are eligible for Pension/Family Pension & Gratuity as applicable to Central Government Servants. (Rule 37 A CCS Pension Rules, 1972 ) Pension is the series of periodic money payments to a person who retires from service on completion of the agreed span of service. The payment continues for the rest of natural life of the receipient and sometimes to a widow of the survivor. Principles Governing Pension There are certain underlying principles governing the grant of pension. An employee is not eligible for pension unless the qualifying service is paid for and rendered in a post under the Government and he is holder of a substantive appointment at the time of retirement. In the recent past provision was made for grant of pension to the employees who did not hold substantive appointment at the time of retirement, but had rendered not less than 10 years of service if they retire on superannuation or invalidation or rendered not less than 20 years and retire voluntarily. Future good conduct is implied condition for grant of pension and it continuance in future. Various rules relating to conditions, and regulation of amounts of pension etc., are contained in C.C.S (Pension) Rules 1972. In this handout the procedure for verification of services, processing the pension cases, issue of pension payment order etc., are described in the succeeding paras. Verification of Services The verification of services rendered by an employees is the first step of the settlement of a pension case. Verification cases received in DOT cell is of two types viz., BSNL, India For Internal Circulation Only 2

E2-E3/Finance

Rev. Date: 01-04-2011

i) Verification of qualifying service after completion of 25 years of service or 5 years before the date of retirement and ii) Verification of services while finalising the pension case. As a matter of fact the second category of case doe not come under verification cases, but final verification of qualifying service is also done while issuing the Enfacement Report and as such, they are entered(treated) as pension cases received for issue of Enfacement Report. Procedure for Verification A service statement along with the service book is received in pension section from the Head of the Office. The particulars of the case are entered in Register of Applications ( SY.133) for verification of services which is maintained to watch the proper disposal of the cases for verification of services. The serial number assigned in the register is noted on the statement to signify the entry in the register. The service statement is examined to see:1. that it is complete in all respects; 2. that the date of birth shown in it tallies with the service book; 3. that all periods of non-qualifying service agree with the entries in the service book and no spell is left out; 4. that necessary notes regarding verification of service exist in the Service Book; 5. that the periods of service not verified with reference to acquittance rolls have been verified in accordance with the provisions of Rule 58(iv) of C.C.S (Pension) Rules, 1972. 6. that necessary note exists in the Service Book under the signatures of the Circle Accountant or other competent authority for counting any military service which qualifies for Civil Pension; 7. in the case of foreign service the period should be verified from the particulars already recorded in a Service Book (Part- III) by the Chief Accounts Officer (TA). While checking if any discrepancies affecting the qualifying service are noticed, the case should be returned to the Head of the Office for reconciliation. If the discrepancies are such which do not affect the qualifying service, the same can be communicated to the Head of Office while returning the case after verification of the qualifying service. Issue of Verification Memo If the case is found fit for issue of a verification memo, it is prepared and signed by the Accounts Officer (DOT Cell). The Statement of services along with the service book should be returned to the Unit concerned. The disposal should be noted in the Register of Applications for verification of services. The maximum period allowed for disposal of verification statement is 15 days from the date of receipt of the case. Procedure followed in the Units Preparation of List of officials due to retire BSNL, India For Internal Circulation Only 3

E2-E3/Finance

Rev. Date: 01-04-2011

A list of officials (MSO(T)-26) who are due to retire within the next 24 to 30 months is prepared twice a year i.e., on 1st January and 1st July by the Head of Office. A copy of the list is supplied to the Accounts Officer(DOT Cell). Intimation to Directorate of Estates If the official is in occupation of Government accommodation, the Head of Office should write to the Directorate of Estates two years before the date of retirement for issue of No Demand Certificate in respect of the period preceding 8 months of retirement. Preparation of Pension Paper The work of preparing the pension papers of an official due to retire on superannuation is undertaken 2 years before the date of retirement. This work is completed in the following stages: a) Checking the Service Book & see whether certificates of verification are recorded., b) Verification of unverified portions with reference to pay rolls / acquittance rolls etc., and recording necessary certificates., c) Referring to the concerned office in respect of unverified portion relating to other offices., d) Obtaining the declaration from the official in respect of service which could not be verified with any source available with the office., e) Admitting the unverified portion for qualifying service on the basis of the written statement (declaration) submitted by the official., f) Taking all possible steps for making good any omissions/ imperfections/ deficiencies(in S.B) affecting qualifying service. g) Determining qualifying service omitting such portion the verification of which was found not possible. h) Calculation of average emoluments after verifying the correctness of emoluments for a period of 10 months preceding the date of retirement., i) Not later than ten months prior to the date of retirement of the Govt. Servant, the Head of Office shall furnish to the retiring Govt. Servant a certificate regarding the length of qualifying service proposed to be admitted for the purpose of pension and gratuity as also the emoluments proposed to be reckoned with for retirement gratuity and pension. In case the certified service and emoluments as indicated by the Head of Office are not acceptable to him, he shall furnish to the Head of Office the reasons for non acceptance, inter alia, supported by the relevant documents in support of his claim. j) Obtaining Form- 5 from the retiring official ( along with the documents to be attached to Form-5) 8 months before retirement. k) Completion of Part-I of Form-7 and l) Forwarding Pension Papers before 6 months.

BSNL, India

For Internal Circulation Only

E2-E3/Finance

Rev. Date: 01-04-2011

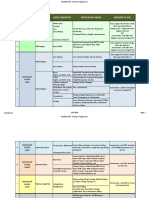

Procedure followed in DOT Cell Processing of Pension and Gratuity cases 1. Verification of service. 2. Reporting on applications for pension (including Family Pension, Gratuity, Commutation of pension) in the form of Enfacement Report. 3. Issuing Pension or Gratuity, or Family Pension Payment Orders. 4. Checking of pension and Gratuity payment vouchers (by territorial Circle Accountatns.) 5. Compilation of periodical returns etc. (a) The procedure regarding the first item (Verification of service) has been described already. Now the procedure for other items of work is described in the succeeding paras. (b) Reporting on applications for Pension: On receipt of the applications (Pension Papers) for pension and gratuity from the Head of Office the particulars are entered in the Register of Applications for Pension and Gratuity in Form No. SY. 134. The serial number assigned to each application in the register should be noted on the application to signify its entry in the Register. Each application should be scrutinized in respect of the following points. The following general checks are exercised in respect of the pension cases. Sl.No. 1 2 Item Forms used Name of official Points to be seen that it has been drawn up in proper forms. that uniformity of spelling in all accompanying documents was adopted.

Date of beginning of that it confirms with entry in service book and boy service service etc., are omitted as per rules. Date of ending of in the afternoon of the last day of the month in which the service in case of official attains the age of 60 years. superannuation An official, whose date of birth is 1st of a month, retires pension. on the afternoon of the last day of the preceding month on attaining the age of 60 years. Period of Military that it was treated as qualifying service for civil pension service under the provision of Rule 19 of CCS (Pension) Rules. Class of Pension that the class of pension admissible is properly specified.

BSNL, India

For Internal Circulation Only

E2-E3/Finance 7 Qualifying Service

Rev. Date: 01-04-2011 i) that the periods such asa) boy service b) suspension adjudged as penalty. c) EOL without MC where specific entries that it does not count for pension, d) Overstayal of leave and joining time and e) Interruption declared as non- qualifying service have not been counted. ii) that the period of training before appointment was taken into account. iii) that the service book contains the certificate of verification iv) that proper action was taken by the Head of Office completing omissions v) that the calculations in leave account are correct vi) that the entries of condonation of interruptions were properly made. vii) that the omissions, imperfections or deficiencies in Service Book which could not be completed were ignored. viii) that in the case of foreign service, contributions were recovered and entries to this effect were made. ix) Rounding Off of qualifying service: Rates of Pension/ gratuity have been prescribed with reference to the number of six-monthly periods of qualifying service. Under Rule 49(3) of CCS(Pension) Rules read with GID(2) thereunder, the period of three months and above will be reckoned as one completed half-year. This means that the fraction of a year consisting of Less than 3 months to be ignored 3 months and above .one completed but less than 9 six monthly or months. Half year period. 9months & above ........ Two completed six monthly or half year periods.

BSNL, India

For Internal Circulation Only

E2-E3/Finance Calculation of Average Emoluments Points to be seen:

Rev. Date: 01-04-2011

i) that periods of EOL, Dies-non, overstayal and suspension treated as nonqualifying service if any, falling within the period of 10 months were disregarded and equal period before 10 months was included. ii) that the month is reckoned as 30 days irrespective of actual number of days. iii) that the calculation of average emoluments is correct. iv) If the employee was on leave of any kind with leave salary, the emoluments admissible if he was on duty during that period will be taken as emoluments and not the leave salary actually drawn by him. Similarly, if he was under suspension and subsequently reinstated in service without forfeiture of service (i.e., if the period of suspension is allowed to count as qualifying service), the emoluments which he would have drawn but for suspension will be taken into account and not the proportionate pay allowed for the period of suspension. However any increase in pay which is not actually drawn shall not form part of his emmoulments.But annual increment falling due during the period of earned leave ( and not other kinds of leave) not exceeding 120 days (or during the first 120 days of earned leave) but not actually drawn will be taken into account as emoluments drawn. v) If the employee was on leave with leave salary after holding higher appointment in an officiating/ temporary capacity, the benefit of emoluments drawn in such higher post will be given (for the period of leave) only in cases where it is certified that he would have continued to officiate in the higher post but for leave. vi) The pay drawn by an employee while on foreign service will not be treated as emoluments but the pay which he would have drawn under Government but for foreign service will alone be taken as emoluments. vii) In the case of re-employed Civil/ Military pensioner who retains the pensionary benefit for his past service, the element of pension, if any, by which his pay in the re-employed post is reduced, will be taken into account as emoluments. Calculation of Pension, Gratuity, Family Pension, Commutation Value Points to be seen o That the calculations have been made correctly as per the CCS(Pension) Rules 1972. Submission of other documents Points to be seen: that the documents viz., a) 3 passport photographs (two in the case of unmarried) duly attested by the Head of the Office. BSNL, India For Internal Circulation Only 7

E2-E3/Finance b) c) d)

Rev. Date: 01-04-2011

2 slips of specimen signature duly attested by Gazetted Officer. 2 slips showing height & personal identification marks. Details of Family in Form-3 in case it was not submitted already.

Special Checks to be Exercised In addition to the general points detailed in the preceding paragraph, some special points requiring notice are stated below for each class of pension. Invalid Pension i) that the applicant is declared by the appropriate medical authority to be permanently incapacitated for further service in accordance with the instructions on the subject., ii) if, however, the medical certificate is submitted by the applicant while on leave, the service upto the date of termination of the leave is taken into account i.e., the retirement in such case does not take effect from the date of report of the medical authority., iii) that the amount of leave as debited against the leave account together with any period of duty beyond the date of the medical authoritys report should not exceed six months., iv) Invalid Pension should not be less than the normal Family Pension. However maximum commutation of Pension will be 40% of original Invalid Pension (before raising to that of Family Pension). Voluntary Retirement on Completion of 20 years of Qualifying Service (Rule 48A, CCS Pension Rules, 1972) i. The employee should give in writing to the appointing authority of his intension to retire at least three months before the intended date of retirement. The employee may, in writing, request for acceptance of notice of less than 3 months giving reasons therefor. This request may be considered by the appointing authority on merits on the condition that the employee shall not apply for commutation of his pension before the expiry of full notice period of 3 months. ii. Date of retirement will be a non-working day. Calculation of Pension and Gratuity PENSION: a) In the case of Govt. Servant retiring after completing qualifying service of not less than 33 years, the amount of pension will be 50% of the average emoluments subject to maximum of Rs.15000 per month (w.e.f 1.1.96) [Rs.22500 w.e.f. 1-4-2004 (CDA scale)] e.g. Pension = Average Emoluments. 2

BSNL, India

For Internal Circulation Only

E2-E3/Finance

Rev. Date: 01-04-2011

b) In the case of Govt. Servants retiring before completing the qualifying service of 33 years but after completing 10 years of qualifying service the amount of pension will be proportionate to the amount calculated under (a) above and subject to the minimum of Rs. 1275 per month (w.e.f. 1.1.96). [Rs.1913 w.e.f. 1-4-2004 (CDA scale)] e.g. Pension for 63 six monthly period = AE X 63 2 66 Average Emoluments= Total of last 10 months emoluments 10 Emoluments = Basic Pay, N.P.A., & Stagnation Inct. Emoluments for drawing in CDA scale w.e.f. 1-4-2004 = Basic Pay, NPA, & Stagnation Increment + Dearness Pay (50% of Basic Pay) In respect of civil and military pension, the floor ceiling of Rs.1275 taking the two pensions together will not apply and the individual pensions will be governed by respective pension rules. (Dept. Pen. P.W. No.38/38/02-P&PW(A) dt. 23-4-2003) W.E.F. 1-1-2006 Basic Pay in the revised pay structure means the pay drawn in the prescribed pay band plus the applicable grade pay but does not include any other type of pay like special pay, etc. (para 4.2 dt. 2-9-2008) ( the pay in the pay scale in the case of HAG + and above) The amount of pension shall be subject to minimum of Rs.3500 and maximum up to 50% of highest pay in the Government (The highest pay in the Govt. is Rs.90000 w.e.f. 1-1-2006) [para 5.5 dt. 2-9-2008] W.E.F. 2-9-2008 (applicable to Government servants retiring on or after 2-92008) Linkage of full pension with 33 years of qualifying service shall be dispensed with. Once a Government servant has rendered the minimum qualifying service of twenty years, pension shall be paid at 50% of the emolument or average emoluments received during the last 10 months, whichever is more beneficial to him (para 5.2 dt. 2-9-2008) In cases where Government servant becomes entitled to pension on completion of 10 years of qualifying service in accordance with Rule 49(2) of the CCS (Pension) rules, 1972, pension in those cases shall also be paid at 50% of the emoluments or average emoluments, whichever is more beneficial to the Government servant. (para 5.3 dt. 29-2008) It has now been decided that the provision for payment of pension at 50% of the emoluments (pay last drawn) or 50% of average emoluments received during the last 10 months, whichever is more beneficial to the retiring employee, shall be applicable to all Government servants retiring on or after 1-1-2006. [Dept. of Pension & PW no.38/37/08-P&PW(A) dt. 11-12-2008] It has now been decided that linkage of full pension with 33 years of qualifying service shall be dispensed with, with effect from 1-1-2006 instead of 2-9-2008. The BSNL, India For Internal Circulation Only 9

E2-E3/Finance

Rev. Date: 01-04-2011

revised provisions for calculation of pension in para 5.2 and 5.3 of the OM No.38/37/08-P&PW(A) dated 2-9-2008 shall come into force with effect from 1-12006 and shall be applicable to the Government servants retired/retiring after that date. Para 5.4 will further stand modified to that extent. Consequent upon the above revised provisions, in partial modification of para 7.1 of the OM No.38/37/01-P&PW(A) dated 2-9-08, the extant benefit of adding years of qualifying service for the purpose of computation of pension and gratuity shall stand withdrawn with effect from 1-1-2006. The overall calculation may take into account revised gratuity and revised pension/including arrears up to date of revision based on these instructions. However, no recoveries would be made in the cases already settled. [Dept. of Pension & PW no.38/37/08-P&PW(A) dt. 10-12-2009] c) The full pension in no case shall be less than 50% of the minimum of the revised scale of pay introduced with effect from 1st January, 1996 for the post last held by the employee at the time of his retirement. [From 1-4-2004, pension should be not less than 50% of the minimum of the CDA scale plus Dearness Pay of the post] However such pension will be suitably reduced pro rata, where the pensioner has less than maximum required service for full pension as per the rule (Rule 49 of CCS (Pension) Rules, 1972) applicable to the pensioner as on the date of his/her superannuation/ retirement and in no case it will be less than Rs. 1,275 p.m. [Rs.1913 w.e.f. 1-4-2004 (CDA scale)] W.E.F 1-1-2006 The full pension shall also not be lower than fifty percent of the sum of the minimum of the pay in the pay band and the grade pay (or 50% of the minimum of the scale in the case of HAG+ and above) For those who have retired between 1-1-2006 and 2-9-2008, the pension will be reduced pro-rata, where the pensioner had less than 33 years Q.S. (But, it should not be less than Rs.3500). In case the pension calculated in accordance with Rule 49 of CCS(Pension) Rules 1972, as applicable before 2-9-2008, is higher than the pension calculated in the manner indicated above, the same (higher pension) will be treated as Basic Pension. [Dept. P&PW OM NO.38/37/08-P&PW(A) pt.II dt. 3-10-2008] d) Government Servants retiring before completing qualifying service of 10 years are not eligible for pension. However they will be entitled for lumpsum payment termed as Service Gratuity calculated @ half emoluments for each completed 6 monthly period. Emoluments for Service Gratuity = Basic Pay, NPA, Stagnation Increment + DA [W.E.F. 1-1-2006 Pay drawn in the prescribed pay band plus the applicable grade pay (the pay in the pay scale in the case of HAG + and above) +DA on the date of retirement] (para 4.1 & 4.3 of OM dt. 2-9-2008)

BSNL, India

For Internal Circulation Only

10

E2-E3/Finance

Rev. Date: 01-04-2011

e) In the case of re-employment of a military pensioner in civil service, the pensionery benefits for second spell of service shall not be subject to any limitation as per provisions of Rule 18(3) of CCS Pension rules, 1972 W.E.F. 1-1-2006 The quantum of pension available to the old pensioners shall be increased as follows:Age of pensioner Additional quantum of pension From 80 years to less than 85 years 20% of basic pension From 85 years to less than 90 years 30% of basic pension From 90 years to less than 95 years 40% of basic pension From 95 years to less than 100 years 50% of basic pension 100 years or more 100% of basic pension The pension sanctioning authorities should ensure that the date of birth and the age of a pensioner is invariably indicated in the pension payment order to facilitate payment of additional pension by the Pension Disbursing authority as soon as it becomes due. (para 5.7 of OM dt. 2-9-2008) The additional quantum of pension, on attaining the age of 80 years and above, would be admissible from the 1st day of the month in which his date of birth falls. (Dept. of P&PW OM no.38/37/08-P&PW(A).pt.II dt.3-10-2008) GRATUITY. 1. Government Servants retiring after completing 5 years of qualifying service, Gratuity shall be calculated at the rate of 1/4th of emoluments for each completed six monthly period subject to a maximum of 16 times of emoluments or Rs. 3.5 lakhs whichever is less.(w.e.f. 1.1.1996) [Maximum Gratuity Rs.10 lakhs w.e.f. 1-1-2006] (para 6.1 dt. 2-9-2008) 2. Emoluments for this purpose shall be last pay drawn or Average Emoluments, whichever is higher plus DA on the date of retirement on Average Emoluments / Last Pay. 3. Last Pay / Average Emoluments = Basic Pay, NPA & Stagnation Increment. [W.E.F. 1-1-2006 Pay drawn in the prescribed pay band plus the applicable grade pay (the pay in the pay scale in the case of HAG + and above) +DA on the date of retirement] 4. A temporary G.S. who retires on superannuation or discharged from service or declared invalid for further service or absorbed in an autonomous body before completing ten years of continuous service shall be eligible to gratuity on the same scale and rates as are applicable to permanent civil G.S. under the provisions of CCS (Pension) Rules 1972.

BSNL, India

For Internal Circulation Only

11

E2-E3/Finance

Rev. Date: 01-04-2011

Clarification regarding payment of pensionary benefits to a retiree against whom personal court case (other than Department) is pending in the Competent court. The department of Pension & PW (vide their I.D.No.17729/03-P&PW(F) dated 10-32003) have advised that the term judicial proceedings mentioned in Rule 69 of CCS (Pension Rules )1972 is relating to judicial proceedings initiated against a Govt. Servant in his official capacity by the Government authorities. The judicial proceedings initiated against the Government servant by a private person/agency will not come the ambit of this rule. Hence there is no objection in releasing DCRG and final pension to those Govt. servants against whom judicial proceedings have been initiated by private parties. The Department of Legal affairs (vide their U.O. No.10412/03 dated 18-32003) have concurred in the above views of Department of Pension & PW. (DOT Lr.No.36-9/2002-Pen(T) dt. 24-3-2003) Retirement Benefits in respect of Government service to persons Dismissed/Removed after their Absorption in BSNL As per Sub-rule 24 of Rule 37-A of CCS (Pension) Rules, 1972, the absorbed employees of BSNL are entitled to retirement benefits for the service rendered under the Government even if they are dismissed/removed from the service after their absorption in BSNL for any misconduct during service in BSNL. The retirement benefits in such cases shall be admissible from the day following the date of dismissal/removal from BSNL (DOT No.318-12/2008-Pen(T) dt. 21-7-2009) Terminal/ Death Benefit to Temporary Employees. a) Terminal Benefits 1. Quasi- Permanent and temporary employees, who retire on superannuation or on being declared permanently incapacited for further Government service by the appropriate medical authority after having rendered temporary service of not less than 10 years, shall be eligible for grant of superannuation / invalid pension, retirement gratuity and family pension at the same scale as admissible to permanent employees under the C.C.S (Pension) Rules 1972. 2. Temporary and quasi-permanent employees who seek voluntary retirement after completion of 20 years of service shall continue to be eligible for retirement pension and other pensionary benefits like gratuity and family pension. 3. In case not covered by paragraphs 1 and 2 above the terminal benefits will continue to be admissible as at present under C.C.S (Temporary Service) Rules, 1965. b) Death Benefits: In the event of death in harness of temporary/ quasi permanent Government Servants, their families shall be eligible to family pension and death

BSNL, India

For Internal Circulation Only

12

E2-E3/Finance

Rev. Date: 01-04-2011

gratuity on the same scale as admissible to families of permanent Government Servant under the C.C.S(Pension) Rules, 1972. Commutation Pension A retired official is entitled to commute a fraction of his pension subject to a maximum of 40% of pension sanctioned.(w.e.f. 1.1.1996) a) The amount payable shall be calculated as shown below: Amount of Pension to be commuted x 12 x commutation factor. b) The commutation factor as per the commutation table on the basis of age of next birth day shall be taken into account. Commuted value of Pension is rounded off to the next higher rupee. The application for commutation of pension are of two categories. A brief description of each category is given below: Commutation Without Medical Examination a) A retiring official on superannuation pension can submit his application in Form 1-A for commutation of pension before the date of superannuation to the Head of Office. The application is forwarded to the Accounts Officer. After verification of the application, the Accounts Officer authorises the Head of Office to draw the amount of commuted value and disburse to the retiring official on or after the date following date of retirement. b) A retired official (as indicated in Rule 12 of( CCS Commutation of Pension) Rules 1981) can submit his application in Form-1 for commutation before the expiry of one year to the Head of office. The application is forwarded to the Accounts Officer. After verification of the application and receiving the PPO from the Post Office, the Accounts Officer will issue the authority for the payment of commuted value to the pension disbursing authority concerned and endorse a copy to the pensioner with instruction to collect the commuted value from the pension disbursing authority. A revised PPO for the reduced value of pension is issued. Commutation With Medical Examination All the retired officials listed in Rule 18 of CCS(Commutation of Pension) Rules 1981 will apply in form-2. Commuted Value of Pension will be authorised after medical examination and verification of the application etc. Cases where medical examination is necessary: 1) In Superannuation Pension & Retiring Pension, if the application for commutation is received after one year of date of retirement. 2) Invalid Pension. 3) Compulsory Retitrment Pension. A Government Servant or a pensioner against whom Departmental or judicial proceedings are pending is not eligible to commute a part of his pension till the finalization of the proceedings.

BSNL, India

For Internal Circulation Only

13

E2-E3/Finance

Rev. Date: 01-04-2011

Commutation is permissible on the provisional pension except in cases where the provisional pension is sanctioned due to pendency of Departmental or judicial proceedings. Reduction of Pension after commutation The reduction in the monthly pension as a result of commutation will take from i. If pension is drawn from the Pension Disbursing Officer, the date of receipt of the commutation amount by the pensioner or at the end of 3 months from the date of issue of authority for payment by the Accounts Officer, whichever is earlier. ii. If pension is drawn through Bank, the date of credit of the commutation amount to the applicants account. iii. If the application for commutation is submitted before superannuation, from the date following the date of retirement. However, if payment of commutation amount could not be effected due to administrative reasons within the first month after retirement , the difference of pension due for the period, i.e., from the day following the day of retirement and the day preceding the date of receipt of commutation amount is payable to the pensioner. iv. Nomination: Along with the application for commutation Nomination should be submitted in Form.5. In the event of the death of the pensioner before receipt of the commutation amount, the commutation amount will be paid to the nominee. In the absence of a valid nomination, the amount will be paid as in the case of Death Gratuity, failing which to the legal heirs. The part of the pension commuted will be restored after fifteen years from the date following the date of retirement, if the reduction in pension due to commutation is effected in the first month pension itself. Otherwise, it will be restored after fifteen years reckoned from the date of payment of the commutation amount. W.E.F 2-9-2008 The existing Table of commutation value for pension annexed to the CCS (Commutation of Pension) Rules, 1981 shall be substituted by a new table at Annex.I of this O.M. (para 9.2 dt. 2-9-2008) The revised table of commutation value for pension will be used for all commutations of pension which become absolute after the date of issue of this O.M. (2-9-2008) In the case of those pensioners, in whose case commutation of pension became absolute on or after 1-1-2006 but before the issue of this OM, the pre-revised table of commutation value for pension will be used for payment of commutation of pension based on pre-revised pay/pension. Such pensioners shall have an option to commute the amount of pension that has become additionally commutable on account of retrospective revision of pay/pension on implementation of the recommendations of the Sixth Central Pay commission. On exercising such an option by the pensioner, the revised Table of commutation value for pension will be used for the commutation of the additional amount of pension that has become commutable on account of retrospective revision of pay/pension. In all cases where the date of retirement/commutation of pension is on or after the date of issue of this OM, the BSNL, India For Internal Circulation Only 14

E2-E3/Finance

Rev. Date: 01-04-2011

revised table of commutation value for pension will be used for commutation of entire pension. (para 9.3 dt. 2-9-2008) S. No. Points raised Clarifications 1 What would be the age to be used for The age reckoned for calculation of commutation of additional commuted value of pension at the commutable pension and which time of original application for factor would be used for such commutation of pension will apply additional commuted value of for calculation of commutation value pension of additional commutable pension. However, as mentioned in the OM dated 2-9-2008, the commutation factor in the revised Table of commutation value for pension will be used for commutation of the additional amount of pension that has become commutable on account of retrospective revision of pay/pension 2. From which date the reduction in Reduction in pension on account of pension on account of additional additional commutation of pension commutation of pension will take will be in two stages as per the effect? provisions contained in Rule 6 of the CCS (Commutation of Pension) Rules, 1981. 3. What will be the date of restoration The commuted portion of pension of additional commutation of shall be restored after 15 years from pension? the respective dates of commutation as provided in Government of India decision no.1 under rule 10 of CCS (commutation of Pension) Rules, 1981. Necessary endorsement should be made in the PPO. [Dept. Pen &PW OM No.38/79/2008-P&PW(G) dt. 16-2-2009]

BSNL, India

For Internal Circulation Only

15

E2-E3/Finance ANNEXURE I

Rev. Date: 01-04-2011

COMMUTATION VALUE FOR A PENSION OF Re.1 PER ANNUM Age next birth day Commutation Age next value expressed birth day as number of years purchase Commutation value expressed as number of years purchase 9.075 9.059 9.040 9.019 8.996 8.971 8.943 8.913 8.881 8.846 8.808 8.768 8.724 8.678 8.627 8.572 8.512 8.446 8.371 8.287 8.194 Age next Commutation birth day value expressed as number of years purchase 62 8.093 63 7.982 64 7.862 65 7.731 66 7.591 67 7.431 68 7.262 69 7.083 70 6.897 71 6.703 72 6.502 73 6.296 74 6.085 75 5.872 76 5.657 77 5.443 78 5.229 79 5.018 80 4.812 81 4.611

20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40

9.188 9.187 9.186 9.185 9.184 9.183 9.182 9.180 9.178 9.176 9.173 9.169 9.164 9.159 9.152 9.145 9.136 9.126 9.116 9.103 9.090

41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61

BSNL, India

For Internal Circulation Only

16

E2-E3/Finance

Rev. Date: 01-04-2011

Sub:- Voluntary Retirement from BSNL Service The undersigned is directed to say that consequent upon insertion of sub-rule 37-A (11A) in Central Civil Services (Pension) rules, 1972 vide Central Civil Services (Pension) Amendment Rules, 2002 notified in the Gazette of India on 28-12-2002, a doubt arose as to whether Rule 48 and Rule 48-A of the same rules would continue to be applicable to the employees permenently absorbed in BSNL. It also required to be clarified as to whether the benefit of rule 48-B of CCS (Pension) Rules would be available to the govt. employees absorbed in BSNL covered under Rule 37-A(11A). Accordingly, all Telecom. Circle offices were advised to withhold further processing of voluntary retirement cases till further orders vide this office letter no.17-29/2004Pers.II dated 20-7-2004. After examining the matter in consultation with BSNL finance and Department of Telecom, it is hereby clarified that after notification of CCS(Pension) amendment rules, 2002, rule 48 and rule 48B of CCS (Pension) rules, 1972 are no more applicable to the Govt. employees absorbed in BSNL and consequently all voluntary reitrement requests of such employees are now covered under the provisions of sub-rule 37A(11A) of the same rules. As regards benefit of additional qualifying service as available under Rule 48-B of CCS(Pension) Rules, 1972, it is clarified that the same is not available to the employees retiring under sub-rule 37-A(11A) of CCS(Pension) Rules. Accordingly, Government employees absorbed in BSNL shall be required to submit their application/notice afresh under Rule 37A(11A) of the same rules for consideration and acceptance by the appointing authority. (BSNL HQ No.31-94/2004-Pen/BSNL dt. 8-10-2004) Family Pension Receipt of Pension Papers 1 On receipt of the intimation about the death of an employee while in service the Head of office will ascertain whether any Gratuity or family pension will be payable. 2 If the deceased employee is eligible for Death Gratuity, the Head of office shall address the concerned person to whom the amount is payable as per rules, in form-10 or form-11 as the case may be for making a claim in form-12. 3 If the family of the deceased employee is eligible for family pension, a claim in form-14 is obtained from the family by addressing (form-13) to make a claim. Where the family is residing in the place of duty of Head of office, the forms and documents, if possible, are obtained personally and for this purpose the services of Welfare Officer can be utilised. 4 If the deceased employee was an allottee of Government accomodation, Estates Officer should be addressed for issue of No Demand Certificate. Verification of Service The Service Book of the deceased employee is verified to see whether the certificates of verification are accepted as verified on the basis of the available entries in the BSNL, India For Internal Circulation Only 17

E2-E3/Finance

Rev. Date: 01-04-2011

service book. While accepting such periods, it should be ensured that the service was continuous and was not forfeited on account of dismissal/ removal or resignation from service or participation in strike. (a) For the purpose of determination of emoluments for family pension and Gratuity the verification of correctness of emoluments is confined for a maximum period of one year preceding the date of death of employee. Cases of incomplete service records a) Family Pension 1. If the deceased employee rendered more than one year but less than 7 years: The service and emoluments for the last one year of service is verified and the amount of family pension is determined. 2. If the service rendered is more than 7 years: The service for the last 7 years and emoluments for the service rendered in last one year should be verified and accepted and family pension is determined. 3. If the service rendered is more than 7 years and the service for the last 7 years is not capable of being verified and accepted, but the service for the last one year is capable of being verified and accepted : Pending verification of services for 7 years, family pension is calculated. The services for the last 7 years should be verified and accepted within the next two months and the amount of Family Pension at enhanced rate and the period for which it is payable should be determined. b) Death Gratuity 1) If the deceased employee rendered more than 5 years of service but less than 20 years of qualifying service and the spell of the last 5 years has been verified and accepted: The amount of gratuity will be equal to 12 times of emoluments. Where the verified and accepted service is less than 5 years of qualifying service the gratuity will be the amount as indicated in the table reproduced in Para No.9.1 2) If the deceased employee had rendered more than 24 years of service and entire service is not capable of being verified and accepted, but the service for the last 5 years has been verified and accepted, the gratuity equal to 12 times of the emoluments is allowed on provisional basis. Final amount of gratuity should be determined on the acceptance and verification of the entire service, to be done within a period of 6 months of the issue of the authority of provisional gratuity and the balance, if any, will be authorised to the beneficiaries. Admissibility: Family Pension is admissible on the death of a Government Servant while in service after having put in one years service, and also to those with less than one years service if proper medical fitness certificate for appointment has been submitted. It is also admissible in the case of death of a pensioner, receiving any pension or compassionate allowance. Definition of Family:- Family in relation to a Government Servant for the purpose of Family Pension means:-

BSNL, India

For Internal Circulation Only

18

E2-E3/Finance

Rev. Date: 01-04-2011

i) Wife or Husband (even in cases where the marriage took place after retirement), ii) A judicially separated wife/ husband if such separation was not granted on the ground of adultery and the surviving spouse was not held guilty of adultery; iii) Sons, unmarried daughters, Widowed and divorced daughters, legally adopted son/ unmarried daughter born/ adopted before or after retirement, who have not attained 25 years of age; iv) Posthumous child and v) Parents who were wholly dependent on the Government Servants when he/she was alive provided the deceased employee had not left behind a widow /widower, eligible son or daughter or a widowed/divorced daughter, who will have a prior claim to the family Pension in the order indicated. It has since been decided by the Government that the income criteria in respect of parents and widowed/divorced daughters will be that their earning is not more than Rs. 2,550/- per month. The parents will get family pension at 30% of basic pay of the deceased employee subject to a minimum of Rs. 1,275/- per month. They also will have to produce an annual certificate to the effect that their earning is not more than Rs.2,550 per month. Further, the family pension to the widowed/ divorced daughters will be admissible till they attain the age of 25 years or upto the date of her remarriage, whichever is earlier. It has also been decided by the Government on the basis of the recommendations of the Fifth Central Pay Commission and in partial modification of this Departments O.M No. 1(26)-P&PW/90-(E). dated 18.1.1993 that the Family Pension in respect of sons /daughters (including widowed/ divorced daughter) will be admissible subject to the condition that the payment should be discontinued/ not admissible when the eligible son/ daughter starts earning a sum of Rs. 2,550/- per month from employment in Government, the private sector, self employment, etc. It is further clarified that the family pension to the son/daughter will be admissible till he/ she attains 25 years of age or up to the date of his/ her marriage/ re-marriage whichever is earlier. There is however, no change in the provisions about admissibility of family pension in respect of sons/ daughters suffering from any disorder or disability of mind or who is physically crippled or disabled as mentioned in the O.M dated 18.1.1993. Admissibility of family pension to parents and widowed/ divorced daughter will be effective from 1.1.1998 subject to fulfilment of other usual conditions. The cases where family pension has already been granted to sons/ daughters after 1.1.1998 before issue/ implementation of this OM without imposition of earning condition need not be reopened. (G.I Dept. of Pen & Pen.Welfare O.M No. 45/51/97-P&PW(E) dtd. 5.3.98)

BSNL, India

For Internal Circulation Only

19

E2-E3/Finance

Rev. Date: 01-04-2011

Parents of Government servants who died prior to 1-1-98 will also be entitled to family pension, w.e.f. 1-1-98. The family pension wherever admissible to parents, the mother will receive first and after her death, the father will receive the family pension. Parents are eligible for family pension at the ordinary rate only i.e. 30% of the pay of the deceased employee. Payment of family pension is to be discontinued in the event of the eligible sons/daughters (including widowed/divorced daughters) getting married/remarried or on their earning a monthly income exceeding Rs.2550 or on attaining 25 years of age whichever is earlier. It has been decided that if the marriage of the disabled daughter is legally annulled, she would be eligible for family pension for life from the date her marriage stands annulled, subject to the following conditions:(i) Divorce is valid in law (ii) Divorced daughter comes back to her parental home. (iii) Disability is certified by an appropriate authority as required under the rules. (iv) The requirement regarding submission of the requisite certificates as laid down under rule 54(6) of the CCS (Pension) rules for becoming eligible to family pension for life shall continue to remain operative. Similarly, the widowed disabled daughter would also be eligible for family pension for life from the date of death of her husband, subject to fulfillment of above mentioned conditions, as applicable in her case. (Deptt. of Pension & P.W. No.45/51/97-P&PW(E) Vol.II dt. 25-7-2001) Payment of family pension is to be allowed to the judicially separated spouse of the deceased G.S. after his/her children cease to be eligibility for family pension till his/ her death or remarriage whichever is earlier. (Deptt. of Pension & P.W. No.1/6/98-P&PW(E) dt. 5-7-1999) Eligibility of divorced /widowed daughter for grant of Family Pension The undersigned is directed to say that as per Clauses (ii) and (iii) of sub-rule (6) of Rule 54 of the CCS (Pension) Rules, 1972 read with clause (b) of para 7.2 of this Departments O.M. No. 45/86/97-P& P W(A)-Part I, dated the 27th October, 1997, son/daughter including widowed/divorced daughter shall be eligible for grant of family pension till he/she attains the age of 25 years or up to the date of his/her marriage/remarriage, whichever is earlier (subject to income criterion to be notified separately). The income criterion has been laid down in this Departments O.M.No.45/51/97-P&PW(E), dated the 5th March, 1998 according to which, to be eligible for family pension, a son/ daughter (including widowed/divorced daughter) shall not have an income exceeding Rs.2550 per month from employment in Government, the private sector, self employment, etc. Further order were issued vide this Departments O.M. No.45/51/97-P&PW(E) (Vol.II), dated the 25th July 2001 regarding eligibility of disabled divorced/widowed daughter for family pension for life subject to conditions specified therein. BSNL, India For Internal Circulation Only 20

E2-E3/Finance

Rev. Date: 01-04-2011

2. Government has received representations for removing the condition of age limit in favour of divorced/widowed daughter so that they become eligible for family pension even after attaining the age limit of 25 years. The matter has been under consideration in this Department for some time. In consultation with the Ministry of Finance, Department of Expenditure and the Ministry of Lay and Justice, Department of Legal affairs etc., it has now been decided that there will be no age restriction in the case of the divorced/widowed daughter who shall be eligible for family pension even after their attaining 25 years of age subject to all other conditions prescribed in the case of son/daughter. Such daughter, including disabled divorced/widowed daughter shall, however, not be required to come back to her parental home as stipulated in para 2(ii) of this Departments O.M. dated the 25th July, 2001, which may be deemed to have been modified to that extent. (Dept. of Pen. & PW OM No.1/19/03-P & PW (E) dated 25-8-2004) Extension of scope of family pension to unmarried daughters of Central Government servants/pensioners The undersigned is directed to say that as per existing provisions under clauses (ii) and (iii) of sub-rule (6) of Rule 54 of the C.C.S. (pension) Rules, 1972, read with of para 7.2 (b) of this Departments O.M. No.45/86/97-P&PW(A)-Part I dated the 27th October 1997, son/daughter including widowed/divorced daughter is eligible for grant of family pension till he/she attains the age of 25 years or up to the date of his/her marriage/remarriage, whichever is earlier subject to income criterion laid sown in this Departments O.M.No.45/51/97-P&PW(E) dated the 5th March 1998 which stipulates that a son/daughter, including widowed/divorced daughter, shall not have an income exceeding Rs.2550/- per month from employment in Government, the private sector and self employment, etc., to be eligible for family pension. Orders were also issued vide this Departments O.M.No.45/51/97-P&PW (E) (Vol. II) dated 25th July 2001 regarding eligibility of disabled divorced/widowed daughter for family pension for life subject to conditions mentioned therein. Further, orders were issued for making the widowed/divorced daughter eligible for family pension vide this Departments O.M. of even number dated 25th August, 2004. 2. The staff side of National Council (JCM) had raised the issue of extension of scope of family pension to unmarried daughters of the government servants/Pensioners even after attaining the age of 25 years at par with the widowed/divorced daughters, which has been agreed to in principle. It has, accordingly, been decided that the unmarried daughters beyond 25 years of age shall also be eligible for family pension at par with the widowed/divorced daughters subject to other conditions being fulfilled. Grant of family pension to unmarried/widowed/divorced daughters shall be payable in order of their date of birth and younger of them will not be eligible for family pension unless the next above her has become ineligible for grant of family pension. It is further clarified that family BSNL, India For Internal Circulation Only 21

E2-E3/Finance

Rev. Date: 01-04-2011

pension to unmarried/widowed/divorced daughters above the age of 25 years shall be payable only after the other eligible children below the age of 25 years have ceased to be eligible to receive family pension and that there is no disabled child to receive the family pension. (Dept. of Pension & Pensioners welfare No.1/19/03-P&PW(E) dt. 6-9-2007) WE.F. 1-1-2006 For the purpose grant of Family Pension, the Family shall be categorized as under: Category-I (a) Widow or widower, up to the date of death or re-marriage, whichever is earlier; (b) Son / daughter (including widowed daughter), up to the date of his/her marriage/re-marriage or till the date he/she starts earning or till the age of 25 years, whichever is the earliest Category-II (c) (c) Unmarried/Widowed/Divorced daughter, not covered by Category I above, up to the date of marriage/re-marriage or till the date she starts earning or up to the date of death whichever is earliest (d) (d)Parents who were wholly dependent on the Government servant when he/she was alive provided the deceased employee had left behind neither a widow nor a child. Family pension to dependent parents, unmarried/divorced/widowed daughter will continue till the date of death. Family pension to Unmarried/widowed/divorced daughters in Category II and dependent parents shall be payable only after the other eligible family members in category I have ceased to be eligible to receive family pension and there is no disabled child to receive the family pension. Grant of family pension to children in respective categories shall be payable in order of their date of birth and younger of them will not be eligible for family pension unless the next above him/her has become ineligible for grant of family pension in that category. (para 8.4 of OM dt. 2-9-2008) The dependency criteria for the purpose of family pension shall be the minimum family pension along with dearness relief thereon (para 8.5 dt. 2-9-2008) The childless widow of a deceased Government employee shall continue to be paid family pension even after her remarriage subject to the condition that the family pension shall cease once her independent income from all other sources becomes equal to or higher than the minimum prescribed family pension in the Central Government. The family pensioner in such cases would be required to give a declaration regarding her income from other sources to the pension disbursing authority every six months. (para 8.6 dt. 2-9-2008) It has now been decided to include the dependent disabled siblings (i.e. brothers/sisters) of Government servants/pensioners in the definition of family for the purpose of eligibility for family pension. Such disabled siblings shall be eligible BSNL, India For Internal Circulation Only 22

E2-E3/Finance

Rev. Date: 01-04-2011

for family pension for life in the same manner and following the same disability criteria, as laid down in rule 54 of the CCS (Pension) rules, 1972 in the case of son/daughter of Government employees/Pensioners suffering from any disorder or disability of mind (including mentally retarded) or physically crippled or disabled, so as to render him/her unable to earn a living even after attaining the age of 25 years. [Dept. of Pen. & PW no.1/15/2008-P&PW(E) dt. 17-8-2009] RATES OF FAMILY PENSION. (W.E.F 1.1.96) Last Pay or Average Emoluments whichever is higher--- 30% Minimum-- Rs. 1,275/- [CDA scale w.e.f. 1-4-2004 =Rs.1913] Maximum Rs. 9,000/- [CDA scale w.e.f. 1-4-2004 =Rs.13500] Last Pay/ Average Emoluments = Basic Pay, NPA & Stagnation Increment [CDA Scale (1-4-2004) Basic Pay, NPA & Stagnation Increment + Dearness Pay (50% of Basic Pay)] [W.E.F. 1-1-2006 Pay drawn in the prescribed pay band plus the applicable grade pay ( the pay in the pay scale in the case of HAG + and above)] The family pension shall not be less than 30% of the minimum pay (not NPA) in the revised scale introduced w.e.f. 1-1-96 of the post last held by the pensioner/deceased Government servant. W.E.F. 1-1-2006 Minimum Rs.3500 Maximum Rs.27000 (30% of highest Pay Rs.90000) (para 8.1 of OM dt. 2-9-2008) ENHANCED RATES OF FAMILY PENSION i) A higher rate of family pension is payable for a period of 7 years from the date following the date of death or for a period up to the date on which the deceased Government Servant would have attained the age of 65 years (67 years in cases where government is to retire at the age of 60 years in pursuance of the notification No.GSR 248(E), DATED 13-5-1998 AND NOT WHERE Government servant has already retired at the age of 58 years or would have retired at the age of 58 years but for his premature demise) had he survived whichever is earlier, if the Government servant has rendered not less than 7 years of continuous service. ii) In the case of death while in service the family will be entitled for higher rate of family pension at the rate of 50 % of basic pay or twice the family pension whichever is less. iii) In the event of death of Government servant after retirement the family is entitled for higher rate of family pension at the rate of 50% of basic pay or twice the family pension or normal pension whichever is less. W.E.F. 1-1-2006 The enhanced family pension under Rule 54(3)(a)(i) shall be payable to the family of a Government servant who dies in service from the date of death of the Government

BSNL, India

For Internal Circulation Only

23

E2-E3/Finance

Rev. Date: 01-04-2011

servant for a period of ten years, without any upper age limit. (para 8.2 of OM dt. 2-92008) Whether the period of 10 years for Yes. The period of 10 years for payment payment of enhanced family pension of enhanced family pension will count would also apply in the case of a from the date of death of the Government Government servant who dies before 1-1- servant. These orders will, however, not 2006 and in respect of whom the family apply in a case where the period of seven was receiving enhanced family pension years for payment of enhanced family as on 1-1-2006. pension has already been completed as on 1-1-2006 and the family was in receipt of normal family pension on that date. (Dept. of P&PW OM no.38/37/08-P&PW(A).pt.II dt.3-10-2008) The quantum of family pension available to the old family pensioners shall be increased as follows:Age of family pensioner Additional quantum of family pension From 80 years to less than 85 years 20% of basic family pension From 85 years to less than 90 years 30% of basic family pension From 90 years to less than 95 years 40% of basic family pension From 95 years to less than 100 years 50% of basic family pension 100 years or more 100% of basic family pension The pension sanctioning authorities should ensure that the date of birth and the age of a family pensioner is invariably indicated in the Form 3 (regarding details of family) and the pension payment order to facilitate payment of additional family pension by the pension disbursing authority as soon as it becomes due. The amount additional family pension will be shown distinctly in the pension payment order (para 8.3 of OM dt. 2-9-2008) The additional quantum of family pension, on attaining the age of 80 years and above, would be admissible from the 1st day of the month in which his date of birth falls (Dept. of P&PW OM no.38/37/08-P&PW(A).pt.II dt.3-10-2008)

BSNL, India

For Internal Circulation Only

24

E2-E3/Finance

Rev. Date: 01-04-2011

DEATH GRATUITY In the event of death in harness, the Death Gratuity shall be admissible at the following rates:Emoluments = Average Emoluments / Last Pay whichever is higher Plus DA on the date of death. Average Emoluments/ Last Pay = Basic Pay, NPA & Stagnation Increment. Length of Service Rate of Gratuity Less than one year 2 times of emoluments. One year or more but less than 6 times of emoluments. 5 years. 5 years or more but less than 12 times of emoluments. 20 years. 20 years or more Half of emoluments for every completed six monthly period of qualifying service subject to a maximum of 33 times emoluments provided that the amount of Death Gratuity shall in no case, exceed 3.5 Lakh rupees w.e.f. 1.1.96. [Rs.10 Lakhs, w.e.f. 1-1-2006 (para 6.1 of OM dt. 2-908)] Definition of Family: For the purpose of payment of death gratuity, family in relation to a Government servant means: i) Wife or wives (including judicially separated), ii) Husband(including judicially separated), iii) Sons/stepsons/adopted sons, iv) Unmarried daughters/ stepdaughters/adopted daughters, v) Widowed daughters/ stepdaughters/ adopted daughters, vi) Father including adoptive father if personal law permits adoption; vii) Mother including adoptive mother if personal law permits adoption; viii) Brothers/ step brothers below 18 years of age; ix) Unmarried/ Widowed sisters including step-sisters; x) Married daughters; and xi) Children of pre-deceased son. (Rule 50(6)) Persons to whom gratuity is payable. i) Where a valid nomination exists:- If the nominee- family member or members are surviving and are eligible to receive the gratuity, payment will be made to all such nominees in the shares indicated in the nomination. Eligibility will have to be checked whether the nominees fulfill the conditions as on the date of death. For example, brother attaining the age of 18 years or sister getting married before death of the BSNL, India For Internal Circulation Only 25

E2-E3/Finance

Rev. Date: 01-04-2011

official becomes ineligible. If these events take place after the death of the official but before the payment is made, their eligibility will not be affected. If all the nominees are alive and are eligible, payment will be made as per the nomination without any difficulty. ii) Where a part of the nomination only is valid:- If only some members of the family become ineligible and the others nominated are eligible, the share/ shares of the ineligible members will be paid equally to the eligible nominees. iii) Where there is no valid nomination:- In cases where the entire nomination becomes invalid due to the nominee(s) as also the alternate nominee(s) either predeceasing the official or becoming ineligible or where no nomination was made, payment will be made as under: a) in equal shares to the surviving members of the family, viz., spouse, sons and daughters . b) if there are no surviving members as in (a) above, to other members of the family as in (v) to (xi) of Para 9.2 above. After obtaining the claim/ claims from the family, Form-18 is completed. It is sent to Accounts Officer with a covering letter in Form-19 alongwith the documents listed therein (from-19) within one month of the claim. The DOT Cell(CCA) will issue a sanction letter in favour of claimant or claimants indicating the amount of provisional family pension and 100% of gratuity. The amount recoverable from the gratuity is also indicated. After the issue of sanction letter, the provisional family pension and gratuity after deducting the dues are drawn & disbursed by the DOT Cell (CCA) to the claimant/claimants On receipt of the papers requisite checks are exercised and section I of Part-II of Form-18 is completed. The amount of balance of gratuity is determined after adjusting all dues. Then DOT Cell to draw & disburse the balance of gratuity to the claimant/ claimants. The fact of issue of pension payment order is reported to the Head of Office. When both husband and wife are Government servants On the death of both husband & wife, the children of the deceased couple will be granted two F.P. subject to the following limits: - (1-1-1996) 1. If both or one of the family pension is payable at the higher rate- Maximum Rs.15000 2. If both the F.Ps. are payable at the normal rate Rs.9000 (No.45/1/2001-P&PW(E) dt. 30-6-2005) Payment of benefits when an officials where-abouts not known. If an employee is missing and his whereabouts are not known, his family can be paid the retirement benefits. For this purpose, the family should have lodged a complaint

BSNL, India

For Internal Circulation Only

26

E2-E3/Finance

Rev. Date: 01-04-2011

with the Police Station concerned and obtained a report that the employee has not been traced after all efforts had been made. Benefits payable in the first instance.: Salary due, leave encashment due and the amount of GPF. After one year.: i) Death Gratuity limited to the amount of Retirement Gratuity; (ii) Family Pension from the date of FIR or expiry of leave whichever is later ; and (iii) Accumulations from the Savings Fund under Group Insurance Scheme. The nominees/ dependants should furnish an Indemnity Bond that all payments shall be adjusted against the payment due to the employee in case he/ she appears on the scene at a later date and makes a claim.

BSNL, India

For Internal Circulation Only

27

E2-E3/Finance

Rev. Date: 01-04-2011

After death is established or seven years.: i) Difference between death gratuity and retirement gratuity; ii) Insurance cover admissible under Group Insurance Scheme; iii) Deposit Linked Insurance Scheme(If conditions are satisfied.) The claimants should produce proper and indisputable proof of death or Decree of the Court that the employee concerned should be presumed to be dead as laid down in Section of 108 of the Indian Evidence Act. Subscriptions for one year and insurance premium alone for the next six years will be recovered with interest from the amounts payable on account of Savings Fund and Insurance Fund respectively under Group Insurance Scheme. If an employee dies while in service, his family will be eligible for immediate monetary relief of three months pay or Rs.8000, which ever is less in the form of advance(payable only to the person, in the same manner as payment of death gratuity), which is adjustable within 6 months from arrears of pay & allowances, leave salary, death gratuity, balance in GPF or any other payment due in respect of deceased official. Benefits from Welfare Fund Immediate financial assistance Rs.7000/- irrespective of the status of the employee to the family of BSNL i.e. whether he was a permanent or temporary official employees who die in Harness. or temporary status Mazdoor. The basic pay of the deceased employee should not be more than Rs.12750/-(CDA Pay-scale) on the date of his/her death. Financial assistance in cases of death occurred due to attack by robbers, terrorist, riots etc., (i) Death due to attack by robbers, terrorist, riots etc., while on duty Rs.10000/(ii) Death due to attack by robbers, terrorists riots etc., while not on duty Rs.5000/In case of Temporary Status Mazdoors and casual labourers also the above amount is to be paid to the bereaved families. The financial assistance indicated above will be in addition to the immediate relief of Rs.7000/- and lump sum compensation wherever applicable as provided under the companys orders. 5.Financial Assistance in case of death and Booking of expenditure thereof:- It has been decided that henceforth immediate financial assistance to the family of deceased employee be raised from Rs.7000/- to Rs.10000 and expenditure may continue to be met from the Welfare Fund. These orders shall be effective from the financial year 2006-07. (BSNL HQ No.12-1/2005-BSNL (Welfare) dt. 24-4-2006)] BSNL, India For Internal Circulation Only 28

E2-E3/Finance

Rev. Date: 01-04-2011

4. Financial assistance in case of death: It has been decided that the immediate financial assistance of Rs.15000 in case of death of employee be paid immediately to the family of deceased employee from the administrative fund, if the welfare fund is not available,. It can be recouped later from the Welfare fund [BSNL HQ No.12-1/2009-BSNL(WL) dt. 1-6-2009) Dearness relief to re-employed pensioners and employed family pensioners:(1) Dearness Relief at the rates applicable from time to time shall be admissible on Family Pension. (2) Re-employed pensioners (who held posts below Group A and those Exservicemen who held posts below the ranks of commissioned officers at the time of their retirement ) will be entitled to dearness relief on their pension. (3) Re-employed pensioners(who held Group-A post or posts of the ranks of commissioned officers at the time of their retirement ) will not be entitled to dearness relief on pension. POINTS OF DOUBT CLARIFICATION Who will make the payment of: In respect of item no.(i) to (iii) payments will i)DCRG be made by the DOT Cell for the employees ii)Commuted value of pension whether on deemed deputation or absorbed in iii)Provisional pension BSNL. iv)Leave encashment For item no.(iv) to (vi) payment will be made v)Accumulation in the CGEGIS80 & by the DOT Cell to employees who are on CGEIS77 deemed deputation but BSNL will make vi)GPF final payment on payments to the employees who are absorbed superanuation/retirement in BSNL. (DOT Lr.No.7-1/2000-TA-I/17 dt. 18/10/2000) Central Civil Services (Pension)Rules,1972 37A. Conditions for payment of pension on absorption consequent upon conversion of a Government Department into a Central Autonomous body or a Public sector Undertaking:(1) On conversion of a department of the Central Government into a public sector undertaking or an autonomous body, all government servants of that Department shall be transferred en-masse to that public sector undertaking or autonomous body, as the case may be, on terms of foreign service without any deputation allowance till such time as they get absorbed in the said undertaking or body, as the case may be, and such transferred government servants shall be absorbed in the public sector under taking or autonomous body, as the case may be, with effect from such date as may be notified by the government.

BSNL, India

For Internal Circulation Only

29

E2-E3/Finance

Rev. Date: 01-04-2011

(2) The central government shall allow the transferred government servants an option to revert back to the government or to seek permanent absorption in the public sector undertaking or autonomous body, as the case may be. (3) The option referred to in sub-rule(2) shall be exercised by every transferred government servant in such manner and within such period as may be specified by the government. (4) The permanent absorption of the government servants as employees of the public sector undertaking or a autonomous body shall take effect from the date on which their options are accepted by the government and on and from the date of such acceptance, such employees shall cease to be government servants and they shall be deemed to have retired from government service. (5) Upon absorption of government servants in the public sector undertaking or autonomous body, the posts which they were holding in the government before such absorption shall stand abolished. (6) The employees who opt to revert to government service shall be re-deployed through the surplus cell of the government. (7) The employees including quasi-permanent and temporary employees but excluding causal labourers, who opt for permanent absorption in the public sector undertaking or autonomous body, shall on and from the date of absorption, be governed by the rules and regulations or bye laws of the public sector undertaking or autonomous body, as the case may be. (8) A permanent government servant who has been absorbed as an employee of a public sector undertaking or autonomous body shall be eligible for pensionary benefits on the basis of combined service rendered by him in the government and in the public sector undertaking or autonomous body in accordance with the formula for calculation of pension/family pension under these rules as may be in force at the time of his retirement from the public sector undertaking or autonomous body, as the case may be. [ For at his option, to receive prorata retirement benefits for the service rendered under the Central Government in accordance with orders issued by the Central Government.(Dept. of P & P.W.No.4/66/2005-P&PW(D) dt. 14-10-2005)] EXPLANATION:- The amount of pension/family pension of the absorbed employee on superannuation from public undertaking/autonomous body shall be calculated in the same way as would be the case with a Central Government servant, retiring on superannuation, on the same day;

BSNL, India

For Internal Circulation Only

30

E2-E3/Finance

Rev. Date: 01-04-2011

(9) The pension of an employee under sub-rule(8) shall be calculated on the basis of his last ten months average pay. (10) In addition to pension or family pension, as the case may be, the employees shall also be eligible to dearness relief as per industrial dearness allowance pattern. (11) The benefits of pension and family pension shall be available to quasipermanent and temporary transferred government servants after they have been confirmed in the public sector undertaking or autonomous body. (11.A) A permanent Government servant absorbed in a public sector undertaking/autonomous body or a temporary/quasi permanent government servant who has been confirmed in the public sector undertaking/ autonomous body subsequent to his absorption therein, shall be eligible to seek voluntary retirement after completing 10 years of qualifying service with the government and autonomous body/public sector undertaking taken together, and he/she shall be eligible for pro-rata pensionary benefits on the basis of combined qualifying service (12) The Central government shall create a Pension fund in the form of a trust and the pensionary benefits of absorbed employees shall be paid out of such pension fund. (13) The Secretary of the administrative Ministry of the public sector undertaking or autonomous body shall be the chairperson of the Board of Trustees which shall include representatives of the Ministries of finance, Personnel, Public grievances and Pensions, Labour, concerned public sector undertaking or autonomous body and their employees and experts in the relevant field to be nominated by the central government. (14) The procedure and the manner in which pensionary benefits are to be sanctioned and disbursed from the pension fund shall be determined by the government on the recommendation of the Board of trustees. (15) The government shall discharge its pensionary liability by paying in lump sum as a one time payment to the Pension fund the pro rate pension or service gratuity and retirement gratuity for the service rendered till the date of absorption of the government servant in the public sector undertaking or autonomous body. (16) The manner of sharing the financial liability on account of payment of pensionary benefits by the public sector undertaking or autonomous body shall be determined by the government.

BSNL, India

For Internal Circulation Only

31

E2-E3/Finance

Rev. Date: 01-04-2011

(17) Lump sum amount of the pro rate pension shall be determined with reference to commutation Table laid down in central Civil services (commutation of Pension) rules,1981. (18) The public sector undertaking or autonomous body shall make pensionary contribution to the pension fund for the period of service to be rendered by the concerned employees under that undertaking or body at the rates as may be determined by the Board of trustees so that the pension fund shall be self-supporting. (19) If, for any financial or operational reason, the trust is unable to discharge its liabilities fully from the pension fund and the public sector undertaking or autonomous body is also not in apposition to meet the shortfall, the government shall be liable to meet such expenditure and such expenditure shall be debited to either the fund or to the public sector undertaking or autonomous body, as the case may be. (20) Payments of Pensionary benefits of the pensioners of a government Department on the date of conversion of it into a public sector undertaking or autonomous body shall continue to be the responsibility of the government and the mechanism for sharing its liabilities on this account shall be determined by the government. (21) Nothing contained in sub-rules(12) to (20) shall apply in the case of conversion of the Departments of Telecom services and Telecom Operations into Bharat sanchar Nigam Limited, in which case the pensionary benefits including family pension shall be paid by the government. (22) For the purposes of payment of pensionary benefits including family pension referred to in sub-rule(21), the government shall specify the arrangements and manner including the rate of pensionary contributions to be made by Bharat sanchar Nigam Limited to the government and the manner in which financial liabilities on this account shall be met. (23) The arrangements under sub-rule(22) shall be applicable to the existing pensioners and to the employees who are deemed to have retired from the government service for absorption in Bharat sanchar Nigam Limited and shall not apply to the employees directly recruited by the Bharat sanchar Nigam Limited for whom it shall devise its own pension scheme and make arrangements for funding and disbursing the pensionary benefits. (24) Upon conversion of a Government department into a public sector undertaking or autonomous body:(a) the balance of provident fund standing at the credit of the absorbed employees on the date of their absorption in the public under taking or autonomous body shall, with the consent of such undertaking or body, be transferred to the new Provident fund account of the employees in such undertaking or body, as the case may be; BSNL, India For Internal Circulation Only 32

E2-E3/Finance

Rev. Date: 01-04-2011

(b) earned leave and half pay leave at the credit of the employees on the date of absorption shall stand transferred to such undertaking or body, as the case may be; the dismissal or removal from service of the public sector undertaking or autonomous body of any employee after his absorption in such undertaking or body for any subsequent misconduct shall not amount to forfeiture of the retirement benefits for the service rendered under the government and in the event of his dismissal or removal or retrenchment the decisions of the undertaking or body shall be subject to confirmation by the Ministry administratively concerned with the undertaking or body. (25) In case the government disinvests its equity in any public sector undertaking or autonomous body to the extent of fifty-one percent or more, it shall specify adequate safeguards for protecting the interests of the absorbed employees of such public sector undertaking or autonomous body. (26) The safeguards specified under sub-rule(25) shall include option for voluntary retirement or continued service in the undertaking or body, as the case may be, or voluntary retirement benefits on terms applicable to government employees or employees of the public sector undertaking or autonomous body as per option of the employees, assured payment of earned pensionary benefits with relaxation in period of qualifying service, as may be decided by the government. [(Department of Pen. and PW) (The Gazette of India-Extraordinary) No.4/61/99-P&PW(D) dt. 30-9-2000 & No.4/61/99-P&PW(D) dt. 28-12-2002] S.O.1821(E). In exercise of the powers conferred by the proviso to article 309 and clause (5) of Article 148 of the constitution and after consultation with the Comptroller and Auditor General of India in relation to persons serving in the Indian Audit and Accounts Department and in supersession of the notification number S. O. 1487(E) dated 14th October, 2005 except things done or omitted to be done before such supersession, the President herby makes the following rules further to amend the Central Civil Services (Pension) Rules, 1972, namely:1. (1) These rules may be called the Central Civil Services (Pension) (Amendment) Rules, 2007. (2) They shall be deemed to have come into force from the 30th day of September, 2000 i.e. date from which provision of pro-rata pension was withdrawn. 2. In the Central Civil Services (Pension) Rules 1972, in rule 37A, for subrule(8), the following sub rule shall be substituted namely:A permanent Government servant who has been absorbed as an employee of a public sector undertaking or autonomous body shall be eligible for pensionary benefits on the basis of combined service rendered by him in the Government and in the public BSNL, India For Internal Circulation Only 33

E2-E3/Finance

Rev. Date: 01-04-2011