Beruflich Dokumente

Kultur Dokumente

Company Report of Infosys - Q3FY12 Result Update

Hochgeladen von

Mansukh Investment & Trading SolutionsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Company Report of Infosys - Q3FY12 Result Update

Hochgeladen von

Mansukh Investment & Trading SolutionsCopyright:

Verfügbare Formate

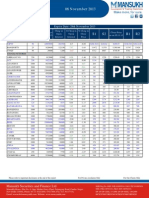

Results Tracker

Saturday, 21 Apr 2012

make more, for sure.

Q4FY12

Results to be Declared on Monday, 23rd April 2012

COMPANIES NAME

Alstom Projects

BOC India

Coromandel Intl

Geometric

GS Auto

Himgiri Foods

Noida Toll

Premier Syn

Rallis India

Relic Tech

Rose Merc

State Bank Mysre

Tata Sponge

TCS

Ultratech Cem

Gee El Woollens

Mahindra & Mah Fin

Ram Informatics

Supreme Petro

White Lion

Results Announced on 20th April 2012 (Rs Million)

Reliance Industries

Quarter ended

201203

201103

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

851820

22950

88580

7680

80900

26590

54310

11950

0

42360

726740

9170

107600

6960

100640

33870

66770

13010

0

53760

Equity

PBIDTM(%)

32710

10.4

32730

14.81

Year to Date

201203

201103

150.27

-17.68

10.34

-19.61

-21.49

-18.66

-8.15

0

-21.21

3299040

61920

398110

26670

371440

113940

257500

57100

0

200400

2481700

30520

411780

23280

388500

136080

252420

49560

0

202860

-0.06

-29.76

32710

12.07

32730

16.59

% Var

17.21

Year ended

201203

201103

102.88

-3.32

14.56

-4.39

-16.27

2.01

15.21

0

-1.21

3299040

61920

398110

26670

371440

113940

257500

57100

0

200400

2481700

30520

411780

23280

388500

136080

252420

49560

0

202860

-0.06

-27.27

32710

12.07

32730

16.59

% Var

32.93

% Var

32.93

102.88

-3.32

14.56

-4.39

-16.27

2.01

15.21

0

-1.21

-0.06

-27.27

The revenue for the March 2012 quarter is pegged at Rs. 851820.00 millions, about 17.21% up against Rs. 726740.00 millions recorded

during the year-ago period.The Company's Net profit for the March 2012 quarter have declined marginally to Rs. 42360.00 millions as

against Rs. 53760.00 millions reported during the corresponding quarter ended.Operating Profit reported a sharp decline to 88580.00

millions from 107600.00 millions in the corresponding previous quarter.

Cairn India

Quarter ended

Year to Date

Year ended

201203

14.4

201103

1.9

% Var

657.89

201203

88

201103

23.9

% Var

268.2

201203

88

201103

23.9

% Var

268.2

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

499.4

198.8

266

-67.2

0

-67.2

-32

0

-35.2

272.9

-86.2

182.8

-269

0.2

-269.2

0

0

-269.2

83

-330.63

45.51

-75.02

0

-75.04

0

0

86.92

2401.4

1589.5

1114.5

475

0

475

35.4

0

439.6

927.1

-259.5

1866.9

-2126.4

0.3

-2126.7

0

0

-2126.7

159.02

-712.52

-40.3

-122.34

0

-122.34

0

0

120.67

2401.4

1589.5

1114.5

475

0

475

35.4

0

439.6

927.1

-259.5

1866.9

-2126.4

0.3

-2126.7

0

0

-2126.7

159.02

-712.52

-40.3

-122.34

0

-122.34

0

0

120.67

Equity

PBIDTM(%)

19074

1380.56

19019.2

-4536.84

0.29

130.43

19074

1806.25

19019.2

-1085.77

0.29

266.36

19074

1806.25

19019.2

-1085.77

0.29

266.36

Sales

The total revenue stands at Rs. 14.40 millions for the March 2012 quarter. The mentioned figure indicates an increase of about 657.89% as

against Rs. 1.90 millions during the year-ago period.The Net Loss for the quarter ended March 2012 is Rs. -35.20 millions as compared to

Net Loss of Rs. -269.20 millions of corresponding quarter ended March 2011 Operating profit Margin for the quarter ended March 2012

improved to 198.80% as compared to -86.20% of corresponding quarter ended March 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

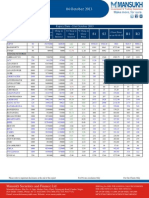

Results Tracker

Q4FY12

make more, for sure.

Honeywell Automation

Quarter ended

201203

201103

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

4131.5

19.6

267.4

0.6

266.8

34.3

232.5

66.9

0

165.6

3529.5

26.5

437.4

0

437.4

34.6

402.8

84.7

0

318.1

Equity

PBIDTM(%)

88.4

6.47

88.4

12.39

Year to Date

201203

201103

-26.04

-38.87

0

-39

-0.87

-42.28

-21.02

0

-47.94

4131.5

19.6

267.4

0.6

266.8

34.3

232.5

66.9

0

165.6

3529.5

26.5

437.4

0

437.4

34.6

402.8

84.7

0

318.1

0

-47.77

88.4

6.47

88.4

12.39

% Var

17.06

Year ended

201112

201012

-26.04

-38.87

0

-39

-0.87

-42.28

-21.02

0

-47.94

16190.6

103

1613.6

8.5

1605.1

148.1

1457

385.6

0

1071.4

13557.9

79.7

1518.8

0.8

1518

129

1389

338.5

0

1050.5

0

-47.77

88.4

9.97

88.4

11.2

% Var

17.06

% Var

19.42

29.23

6.24

962.5

5.74

14.81

4.9

13.91

0

1.99

0

-11.03

The revenue for the March 2012 quarter is pegged at Rs. 4131.50 millions, about 17.06% up against Rs. 3529.50 millions recorded during

the year-ago period.Profit after Tax for the quarter ended March 2012 saw a decline of -47.94% from Rs. 318.10 millions to Rs. 165.60

millions.A decline of 267.40 millions was observed in the OP in the quarter ended March 2012 from 437.40 millions on QoQ basis.

FAG Bearings India

Quarter ended

Year to Date

201203

201103

Sales

3633

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

Equity

PBIDTM(%)

Year ended

201203

201103

3089

% Var

17.61

201112

201012

3089

% Var

17.61

3633

13123.4

10485.9

% Var

25.15

112.7

749.2

3.6

745.6

62.8

682.8

219.7

0

463.1

71.1

696.7

2.8

693.9

53.2

640.7

211.9

0

428.8

58.51

7.54

28.57

7.45

18.05

6.57

3.68

0

8

112.7

749.2

3.6

745.6

62.8

682.8

219.7

0

463.1

71.1

696.7

2.8

693.9

53.2

640.7

211.9

0

428.8

58.51

7.54

28.57

7.45

18.05

6.57

3.68

0

8

270.6

2848.1

12.6

2835.5

225.9

2609.6

849.9

0

1759.7

167.6

2054.4

8.9

2019.9

201.1

1818.8

603.8

0

1215

61.46

38.63

41.57

40.38

12.33

43.48

40.76

0

44.83

166.2

20.62

166.2

22.55

0

-8.57

166.2

20.62

166.2

22.55

0

-8.57

166.2

21.7

166.2

19.59

0

10.77

The revenue zoomed 17.61% to Rs. 3633.00 millions for the quarter ended March 2012 as compared to Rs. 3089.00 millions during the

corresponding quarter last year.The Company has registered profit of Rs. 463.10 millions for the quarter ended March 2012, a growth of

8.00% over Rs. 428.80 millions millions achieved in the corresponding quarter of last year.Operating profit surged to 749.20 millions from

the corresponding previous quarter of 696.70 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q4FY12

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Das könnte Ihnen auch gefallen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Results Tracker: Thursday, 19 July 2012Dokument4 SeitenResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 14 July 2012Dokument4 SeitenResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Q2FY12 Results Tracker 13.10.11Dokument2 SeitenQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Q2FY12 Results Tracker 14.10.11Dokument3 SeitenQ2FY12 Results Tracker 14.10.11Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 18 August 2011Dokument3 SeitenResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Friday, 03 Aug 2012Dokument4 SeitenResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 11.07.2012Dokument2 SeitenResults Tracker 11.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Tuesday, 18 Oct 2011Dokument4 SeitenResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 18.07.2012Dokument2 SeitenResults Tracker 18.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 02 Aug 2012Dokument7 SeitenResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 04 Aug 2012Dokument7 SeitenResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Tuesday, 24 July 2012Dokument7 SeitenResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 17.07.2012Dokument2 SeitenResults Tracker 17.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 21 July 2012Dokument10 SeitenResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Wednesday, 08 Aug 2012Dokument4 SeitenResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Financial Reporting and Analysis ProjectDokument15 SeitenFinancial Reporting and Analysis Projectsonar_neel100% (1)

- Cebbco Spa 030412Dokument3 SeitenCebbco Spa 030412RavenrageNoch keine Bewertungen

- Results Tracker: Tuesday, 07 Aug 2012Dokument7 SeitenResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 28 July 2012Dokument13 SeitenResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 10.07.2012Dokument2 SeitenResults Tracker 10.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 07.11.2013Dokument3 SeitenResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Wednesday, 19 Oct 2011Dokument6 SeitenResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 26 July 2012Dokument7 SeitenResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 22.10.11Dokument14 SeitenResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Friday, 03 Feb 2012Dokument7 SeitenResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 12.01.12Dokument2 SeitenResults Tracker 12.01.12Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Ratios Analysis: Lahore Leads UniversityDokument24 SeitenRatios Analysis: Lahore Leads UniversityZee ShanNoch keine Bewertungen

- InfosysDokument9 SeitenInfosysvibhach1Noch keine Bewertungen

- Q2FY12 - Results Tracker 28.10.11Dokument7 SeitenQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Friday, 20 July 2012Dokument7 SeitenResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- GmmpfaudlerDokument16 SeitenGmmpfaudlerJay PatelNoch keine Bewertungen

- Results Tracker 12.07.2012Dokument2 SeitenResults Tracker 12.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDokument5 SeitenQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Tuesday, 25 Oct 2011Dokument5 SeitenResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Wednesday, 02 Nov 2011Dokument8 SeitenResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 16 Aug 2012Dokument8 SeitenResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 03 Nov 2011Dokument6 SeitenResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- BIMBSec - TM 1QFY12 Results Review - 20120531Dokument3 SeitenBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecNoch keine Bewertungen

- Annual Report 2010 11Dokument80 SeitenAnnual Report 2010 11infhraNoch keine Bewertungen

- Financial Analysis K-ElectricDokument7 SeitenFinancial Analysis K-ElectricFightclub ErNoch keine Bewertungen

- Kingsbury AR - 2012 PDFDokument52 SeitenKingsbury AR - 2012 PDFSanath FernandoNoch keine Bewertungen

- Results Tracker 10.01.13Dokument2 SeitenResults Tracker 10.01.13Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- SR DM 05Dokument42 SeitenSR DM 05Sumit SumanNoch keine Bewertungen

- Financial Modeling of TCS LockDokument62 SeitenFinancial Modeling of TCS LocksharadkulloliNoch keine Bewertungen

- Fin Analysis - Tvs Motor CompanyDokument16 SeitenFin Analysis - Tvs Motor Companygarconfrancais06Noch keine Bewertungen

- Six Years Financial SummaryDokument133 SeitenSix Years Financial Summarywaqas_haider_1Noch keine Bewertungen

- Broadening Connectivity, Widening Horizons.: Annual Report 2011 Pakistan Telecommunication Company LimitedDokument38 SeitenBroadening Connectivity, Widening Horizons.: Annual Report 2011 Pakistan Telecommunication Company LimitedFazal SajidNoch keine Bewertungen

- Results Tracker: Friday, 21 Oct 2011Dokument8 SeitenResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- New Listing For PublicationDokument2 SeitenNew Listing For PublicationAathira VenadNoch keine Bewertungen

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Dokument9 SeitenMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNoch keine Bewertungen

- Income Statement: Altus Honda Cars Pakistan LimitedDokument23 SeitenIncome Statement: Altus Honda Cars Pakistan LimitedTahir HussainNoch keine Bewertungen

- Sbi Annual Report 2012 13Dokument190 SeitenSbi Annual Report 2012 13udit_mca_blyNoch keine Bewertungen

- PTCLDokument169 SeitenPTCLSumaiya Muzaffar100% (1)

- Analysis of Sumsung Annual ReportDokument11 SeitenAnalysis of Sumsung Annual ReportEr YogendraNoch keine Bewertungen

- HDFC Bank AnnualReport 2012 13Dokument180 SeitenHDFC Bank AnnualReport 2012 13Rohan BahriNoch keine Bewertungen

- Results Tracker: Tuesday, 01 Nov 2011Dokument13 SeitenResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Accounts AssignmentDokument15 SeitenAccounts AssignmentGagandeep SinghNoch keine Bewertungen

- Ings BHD RR 3Q FY2012Dokument6 SeitenIngs BHD RR 3Q FY2012Lionel TanNoch keine Bewertungen

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Dokument11 SeitenProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNoch keine Bewertungen

- Results Tracker 09.11.2013Dokument3 SeitenResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 08.11.2013Dokument3 SeitenResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 07.11.2013Dokument3 SeitenResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen