Beruflich Dokumente

Kultur Dokumente

Steps To Invest in Tax Deeds and Tax Lien Certificates

Hochgeladen von

ericsobe7Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Steps To Invest in Tax Deeds and Tax Lien Certificates

Hochgeladen von

ericsobe7Copyright:

Verfügbare Formate

Steps to Invest in Tax Deeds and Tax Lien Certificates

http://www.buyingtaxdeeds.com/Freqently_Asked_.php

Uncovering the Secrets of Tax Deeds & Tax Liens

#1 Internet Website for Accurate Tax Deed Info

Home Page

Tax Deed Sales

Tax deed sales are properties offered for sale to the highest bidder for delinquent taxes. An employee with the Clerk's Office conducts the sale or public auction in accordance with Florida Statutes. A list of upcoming tax deed sales is available in the Recording Department. We recommend that you refer to Florida Statute, Chapter 197 for a complete understanding of Tax Deeds.

Tax Sale Lists FYI Tax Deed Blog Finding Tax Deeds County Links Free Newsletter Freqently Asked Home Study Upcoming Sales Upcoming Events

Question

Answer

About Us Earn 18 Percent Related Links

What is a tax deed sale?

A tax deed sale is a public auction where property is sold to the highest bidder in order to recover delinquent property taxes.

Who conducts the tax deed sale?

A deputy clerk employed by the Clerk of the Circuit Court conducts the sale or public auction in accordance with Florida Statute 197.103

Where is the tax deed sale held?

Tax deed sales are held as advertised at the County Courthouse.

Are the tax deed sales advertised in a local newspaper?

Yes, the tax deed sales are advertised in one of the local newspapers which advertise public notices. The Clerk of Circuit Court is required by Florida Statute 197.402 to advertise each sale once a week for four consecutive weeks prior to the public auction.

How can I find out if there are any liens or encumbrances on a property coming up for tax deed sale?

An ownership and encumbrance report is provided in the file maintained on each property to be sold at a tax deed sale. The files are available for the public to review in the Recording Department of the Clerk of Circuit Court.

What liens or encumbrances survive against a property after it is sold at a tax deed sale?

Private Liens & Judgments do not survive the Tax Sale. Governmental liens & judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale. Governmental liens not satisfied in full survive the issuance of a tax deed. However certain State liens can be extinguished in a Tax Deed sale.

How long does the property owner have to "redeem" the property?

The property owner has up until the day of the sale to "redeem" the property, which is to pay to the Tax Collector all current and delinquent taxes and other costs associated with the tax deed sale. Payment must be made in full and payable to the County Tax Collector by cash or certified funds. The property owner may redeem the property up until the time the successful bidder renders payment and a tax deed is issued.

You may wish to research or seek legal advice on any property you are Does a tax deed sale provide a considering bidding for before the tax deed sale. Generally, when any marketable title? lands are sold for the nonpayment of taxes, the title may not be a marketable title. If you are the successful bidder, you may need to file a

1 of 3

1/17/2012 11:33 AM

Steps to Invest in Tax Deeds and Tax Lien Certificates

http://www.buyingtaxdeeds.com/Freqently_Asked_.php

Question

Answer quiet title suit to clear the title to the property. Quiet title suits are civil law suits and are not handled by the tax deed clerk. Information on this procedure and costs would be available from an attorney that handles these suits.

If I am the successful bidder at a tax deed sale, am I entitled to If a demand for possession is refused, the tax deed owner may apply to immediate possession of the the circuit court for a writ of assistance upon 5 days notice directed to the property after a tax deed has person refusing to deliver possession. If the person does not vacate the been issued to me? property the tax deed owner must file with the circuit court, if the filing is in order the court will direct the sheriff to put the tax deed owner in possession of the property.

According to Florida Statute 197.562, the grantee of any tax deed shall be entitled to the immediate possession of the lands described in the deed.

The opening bid of each property to be sold is determined by adding together the sum of all the outstanding tax certificates, delinquent taxes How can I obtain the opening paid, fees, costs of the sale and interest, all as specified in the Florida bid amount on a certain parcel? Statutes. The opening bid is usually determined approximately ten days to two weeks prior to the sale date. It is available in the file maintained in the recording department of the Clerk of Circuit Court.

If I am interested in bidding, do I need to "pre-register" or check You may need to "pre-register" or check in with the deputy clerk before the in with the deputy clerk sale. After the sale, if you are the successful bidder, you will receive conducting the sale before I can instructions from the deputy clerk. bid?

What action must I take if I am the successful bidder at the sale?

You may need to report to the Recording Department of the Clerk's office immediately after the sale to receive information from the deputy clerk. You will be given the total payment due, which includes the bid amount, recording fees and documentary stamps. You will be asked to provide to the deputy clerk the name(s) in which you wish the tax deed to be issued. Your total payment must be made within 24 hours from the date and time of the sale. Payment must be in the form of cash, cashier's check or money order payable to the Clerk of Circuit Court. Remember, the property owner can redeem the property at the Tax Collector up until the time the successful bidder makes full payment and a tax deed is issued. Once the deputy clerk issues the tax deed, the property cannot be redeemed. At the conclusion of the bidding, the high bidder is required by law to pay the Clerk $200.00 cash.

What if I am the successful bidder and fail to return with payment within 24 hours?

According to Florida Statutes 197.542(1), the Clerk may refuse to recognize the bid of any person who has previously bid and refused, for any reason, to honor such bid. In other words, you would not be allowed to bid at any future tax deed sales in this county. The property would be re-advertised and offered for sale again at a later date.

What if I need additional information regarding a tax deed sale?

The Property Appraiser's Office can provide you with information on any structural improvements on the property. Additional information is provided in the tax deed file which is located in the Recording department of the Clerk of Circuit Court. The laws governing tax deed sales can be found in Chapter 197 of the Florida Statutes. The rules of the Florida Department of Revenue regarding tax deed sales can be found in their administrative code beginning at 12D-13.060.

Where can I How do I find more From time to time, I do choose a select number of students who will get information regarding the sale of further training on how to buy Tax Deeds and make a Profit from Tax Deed "tax deed sales" and tax Sales. If you would like to learn about this program, please sign up for our

2 of 3

1/17/2012 11:33 AM

Steps to Invest in Tax Deeds and Tax Lien Certificates

http://www.buyingtaxdeeds.com/Freqently_Asked_.php

Question

Answer free Tax Deed Newsletter by emailing taxdeeds@ibuymorehomes.com

certificate sales?

[ Home Page | Tax Sale Lists FYI | Tax Deed Blog | Finding Tax Deeds | County Links | Free Newsletter | Freqently Asked | Home Study | Upcoming Sales | Upcoming Events | About Us | Earn 18 Percent | Related Links ]

3 of 3

1/17/2012 11:33 AM

Das könnte Ihnen auch gefallen

- Understanding Tax Lien and Tax Deed Investing No Fluff eBook: No FluffVon EverandUnderstanding Tax Lien and Tax Deed Investing No Fluff eBook: No FluffNoch keine Bewertungen

- The Wonderful World of Tax SalesDokument9 SeitenThe Wonderful World of Tax Saleslyocco1Noch keine Bewertungen

- Your Great Book Of Tax Liens And Deeds Investing - The Beginner's Real Estate Guide To Earning Sustainable Passive IncomeVon EverandYour Great Book Of Tax Liens And Deeds Investing - The Beginner's Real Estate Guide To Earning Sustainable Passive IncomeBewertung: 5 von 5 Sternen5/5 (1)

- FAQs On Florida Tax Deed SalesDokument9 SeitenFAQs On Florida Tax Deed SalesrafarecNoch keine Bewertungen

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesVon EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNoch keine Bewertungen

- Wholesaling Contract Sell Side CompletedDokument7 SeitenWholesaling Contract Sell Side CompletedIan Jakovan DunlapNoch keine Bewertungen

- Tax Liens: How To Generate Income From Property Tax Lien CertificatesVon EverandTax Liens: How To Generate Income From Property Tax Lien CertificatesNoch keine Bewertungen

- NVC Tax Lien Invest in ReportDokument8 SeitenNVC Tax Lien Invest in ReportJosh AlexanderNoch keine Bewertungen

- High Returns from Tax Lien CertificatesDokument167 SeitenHigh Returns from Tax Lien CertificatesThomas Wise100% (2)

- Make Money: Work at Home with a Tax Sale Overages BusinessVon EverandMake Money: Work at Home with a Tax Sale Overages BusinessBewertung: 5 von 5 Sternen5/5 (1)

- 50-State Tax Sale Cheat Sheet: Deedgrabber PresentsDokument67 Seiten50-State Tax Sale Cheat Sheet: Deedgrabber Presentschill main100% (2)

- Tax Lien and Tax Deed Investing: The Proven TechniqueVon EverandTax Lien and Tax Deed Investing: The Proven TechniqueNoch keine Bewertungen

- 10 Minute Tax Lien Investing SuccessDokument35 Seiten10 Minute Tax Lien Investing Successandrew_ikedaNoch keine Bewertungen

- The Ultimate Guide To Wholesaling Real Estate: How To Find, Sign And Close Your First 100 DealsVon EverandThe Ultimate Guide To Wholesaling Real Estate: How To Find, Sign And Close Your First 100 DealsNoch keine Bewertungen

- Florida County Held Tax Lien CertificatesDokument22 SeitenFlorida County Held Tax Lien Certificateslarry_greer5398Noch keine Bewertungen

- Make Money: Work at Home with a Tax Lien Certificates & Tax Deeds BusinessVon EverandMake Money: Work at Home with a Tax Lien Certificates & Tax Deeds BusinessNoch keine Bewertungen

- Beginners Guide To Liens DeedsDokument24 SeitenBeginners Guide To Liens Deedsvituco1230% (1)

- Understanding Tax Lien and Tax Deed Investing: No Fluff: Real Estate Knowledge Series, #2Von EverandUnderstanding Tax Lien and Tax Deed Investing: No Fluff: Real Estate Knowledge Series, #2Noch keine Bewertungen

- Avoid Big Mistakes When Starting Tax Lien InvestingDokument24 SeitenAvoid Big Mistakes When Starting Tax Lien InvestinghoxjoeNoch keine Bewertungen

- The Complete Guide to Investing in Real Estate Tax Liens & Deeds: How to Earn High Rates of Return - Safely REVISED 2ND EDITIONVon EverandThe Complete Guide to Investing in Real Estate Tax Liens & Deeds: How to Earn High Rates of Return - Safely REVISED 2ND EDITIONBewertung: 5 von 5 Sternen5/5 (3)

- StateGuide - Tax Liens PDFDokument69 SeitenStateGuide - Tax Liens PDFmpox100% (2)

- What's F.R.E.E? - the Real-Estate Wholesaling Blue-PrintVon EverandWhat's F.R.E.E? - the Real-Estate Wholesaling Blue-PrintBewertung: 5 von 5 Sternen5/5 (2)

- GoAhead BeADeedGrabberDokument88 SeitenGoAhead BeADeedGrabberhottadot730@gmail.com0% (1)

- ABCs 20online PDFDokument106 SeitenABCs 20online PDFJime Guevara100% (4)

- TaxSaleResearch OkDokument44 SeitenTaxSaleResearch OkMarlon Ferraro100% (1)

- Tax Lien Investor Secrets: A Revealing LookDokument56 SeitenTax Lien Investor Secrets: A Revealing LookWalter RodriguezNoch keine Bewertungen

- How to Build Wealth Through Apartment InvestingDokument137 SeitenHow to Build Wealth Through Apartment Investingdq70100% (3)

- The InsidersGuideDokument15 SeitenThe InsidersGuideAnonymous oziP2Jn100% (1)

- 0 Down Real Estate InvestingDokument410 Seiten0 Down Real Estate Investinghunavara88% (8)

- No Down No New LoanDokument162 SeitenNo Down No New LoanTerrance OatesNoch keine Bewertungen

- WholesalingDokument11 SeitenWholesalingmd. rabin shakNoch keine Bewertungen

- Seller Finance Real EstateDokument68 SeitenSeller Finance Real EstateChris Goff67% (3)

- 10 Steps To Wholesaleing 10 Houses A Month PDFDokument73 Seiten10 Steps To Wholesaleing 10 Houses A Month PDFquedyah100% (1)

- Get Your Deals Done Jump Start GuideDokument73 SeitenGet Your Deals Done Jump Start Guide88quiznos8867% (6)

- Foreclosure Home Buying Secrets-BookDokument102 SeitenForeclosure Home Buying Secrets-BookKevin GoodnightNoch keine Bewertungen

- Dave Lindahl's 27 No Money Down Real Estate StrategiesDokument11 SeitenDave Lindahl's 27 No Money Down Real Estate StrategiesBlvsrNoch keine Bewertungen

- How To WholesaleDokument41 SeitenHow To WholesaleG8azn100% (7)

- 21 Creative Financing Terms For Your Real Estate Investing ToolboxDokument3 Seiten21 Creative Financing Terms For Your Real Estate Investing ToolboxAdetokunbo Ademola100% (1)

- Secrets To Foreclosure Investing E-BookDokument93 SeitenSecrets To Foreclosure Investing E-BookCharles GalanNoch keine Bewertungen

- 27 Waysto Buy Real Estate With No Money DownDokument10 Seiten27 Waysto Buy Real Estate With No Money DownBlvsr100% (1)

- Virtual Wholesaling GuideDokument47 SeitenVirtual Wholesaling GuideLauren Elise100% (14)

- Agent Scripts To Find Cash Buyers 073120Dokument3 SeitenAgent Scripts To Find Cash Buyers 073120Azim Mohammed100% (1)

- Filthy Riches Manual 2016Dokument472 SeitenFilthy Riches Manual 2016LexMercatoriaNoch keine Bewertungen

- Creative Real Estate InvestingDokument6 SeitenCreative Real Estate InvestingAchille Piotti100% (2)

- Private Lending GuideDokument23 SeitenPrivate Lending GuideRobert Granham100% (5)

- Making Big Money PDFDokument289 SeitenMaking Big Money PDFgem2014100% (5)

- 7 STEPS No Money Down Real Estate Course 4639f8Dokument84 Seiten7 STEPS No Money Down Real Estate Course 4639f8KrishnaNoch keine Bewertungen

- TurnKey Investor's Subject-To Mortgage Documents Collection (Table of Contents, Intro)Dokument14 SeitenTurnKey Investor's Subject-To Mortgage Documents Collection (Table of Contents, Intro)Matthew S. Chan50% (2)

- Volume 1 Final PDFDokument218 SeitenVolume 1 Final PDFmikeNoch keine Bewertungen

- Strait Path EbookDokument233 SeitenStrait Path EbookRelebogile Tlhabirwa Kgoadi0% (1)

- E-book-The Tax Smart LandlordDokument136 SeitenE-book-The Tax Smart Landlordopenid_9qRPjRwMNoch keine Bewertungen

- Funding KitDokument91 SeitenFunding KitTiffany Hall100% (4)

- Clever Investor 37 Ways For Locating Attracting Motivated SellersDokument82 SeitenClever Investor 37 Ways For Locating Attracting Motivated SellersMiguel100% (2)

- 30 Days To Real Estate CashDokument160 Seiten30 Days To Real Estate Cashbillyd0189% (9)

- Seller Financing On Steroids - Dawn RickabaughDokument91 SeitenSeller Financing On Steroids - Dawn RickabaughHai Dinh100% (1)

- How to Turn a Troubled Apartment Building Into a Profitable Asset FastDokument22 SeitenHow to Turn a Troubled Apartment Building Into a Profitable Asset FastBlvsrNoch keine Bewertungen

- How To Get All The Money You Need To Buy PropertyDokument83 SeitenHow To Get All The Money You Need To Buy PropertyKora Sadler100% (1)

- How To Buy and Sell Apartment BuildingsDokument243 SeitenHow To Buy and Sell Apartment Buildingsmelon98melon100% (11)

- Account Statement From 1 Oct 2019 To 18 Oct 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument4 SeitenAccount Statement From 1 Oct 2019 To 18 Oct 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAjay NigamNoch keine Bewertungen

- Bank statement activity and dispute rights under $1Dokument3 SeitenBank statement activity and dispute rights under $1shani ChahalNoch keine Bewertungen

- Configure Down Payment Processing Using Document ConditionsDokument7 SeitenConfigure Down Payment Processing Using Document ConditionsJayakumarVasudevanNoch keine Bewertungen

- F 706Dokument31 SeitenF 706Bogdan PraščevićNoch keine Bewertungen

- Valet Parking Locations UAEDokument3 SeitenValet Parking Locations UAEvineet sharmaNoch keine Bewertungen

- BIR Form 1903Dokument2 SeitenBIR Form 1903rafael soriaoNoch keine Bewertungen

- Interpretation of Statute - ResearchDokument7 SeitenInterpretation of Statute - ResearchBlood MoneyNoch keine Bewertungen

- Property Tax PresentationDokument8 SeitenProperty Tax PresentationOloruntobaNoch keine Bewertungen

- Flowcharts in LtomDokument14 SeitenFlowcharts in LtomKristel Faye TandogNoch keine Bewertungen

- Bmtax CompilationDokument50 SeitenBmtax CompilationMarco Alexander O. AgtagNoch keine Bewertungen

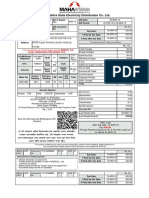

- Light Bill Sept 2019Dokument1 SeiteLight Bill Sept 2019Sanjyot KolekarNoch keine Bewertungen

- Bill details and charges for May 2018Dokument3 SeitenBill details and charges for May 2018Mah Jabeen0% (1)

- E Ticket PDFDokument2 SeitenE Ticket PDFnazar40% (5)

- Statement of HSBC Red Credit Card Account Red: Page 1 / 4Dokument4 SeitenStatement of HSBC Red Credit Card Account Red: Page 1 / 4Anson LchNoch keine Bewertungen

- ESTATE TAXATION KEY POINTSDokument4 SeitenESTATE TAXATION KEY POINTSChincel G. ANI50% (2)

- GST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateDokument17 SeitenGST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateshyamNoch keine Bewertungen

- N28 TU2 Yljhuo PV 7 GDokument15 SeitenN28 TU2 Yljhuo PV 7 GVishal BawaneNoch keine Bewertungen

- Challan of Cash Paid in To Challan NoDokument2 SeitenChallan of Cash Paid in To Challan NoWnc WestridgeNoch keine Bewertungen

- E BillDokument1 SeiteE BillManglesh SinghNoch keine Bewertungen

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Dokument38 SeitenCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNoch keine Bewertungen

- BOG Notice BG GOV SEC 2022 01 Notice On Use of Ghana Card For All Financial Transactions 1Dokument2 SeitenBOG Notice BG GOV SEC 2022 01 Notice On Use of Ghana Card For All Financial Transactions 1Sammy Ben HammondNoch keine Bewertungen

- Mitc For Amazon Pay Credit CardDokument7 SeitenMitc For Amazon Pay Credit CardBlain Santhosh FernandesNoch keine Bewertungen

- Kolom Jurnal KhususDokument6 SeitenKolom Jurnal KhususOkta VianiNoch keine Bewertungen

- Abdullin Modernpaymentssecurity Emvnfcetc 121127044827 Phpapp02Dokument100 SeitenAbdullin Modernpaymentssecurity Emvnfcetc 121127044827 Phpapp02Sratix100% (1)

- Example of Deferred Tax LiabilityDokument1 SeiteExample of Deferred Tax Liabilityarjun-chopra-4887Noch keine Bewertungen

- Forex Policy For Customer ContractsDokument16 SeitenForex Policy For Customer ContractsSaurav SinghNoch keine Bewertungen

- Business Taxation: History of Income Tax Law in PakistanDokument26 SeitenBusiness Taxation: History of Income Tax Law in PakistanMUHAMMAD UMARNoch keine Bewertungen

- GST in INDIA - Project Report GSTDokument39 SeitenGST in INDIA - Project Report GSTanubabar19903483% (95)

- Bakeri - GIFT CITY - CPDokument42 SeitenBakeri - GIFT CITY - CPnmmmNoch keine Bewertungen

- Banking Section OverviewDokument2 SeitenBanking Section Overviewarpitgupta100% (1)