Beruflich Dokumente

Kultur Dokumente

Swabhiman Scheme.

Hochgeladen von

shiven_patiraOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Swabhiman Scheme.

Hochgeladen von

shiven_patiraCopyright:

Verfügbare Formate

Swabhiman scheme for 5 cr families soon: Pranab

Under the scheme subscribers would get Rs1,000 from the government each year for a subscription amount of Rs12,000 per year

New Delhi: The government on Tuesday said its financial inclusion programme Swabhiman, in which five crore households would be provided access to banking services in unbanked areas, will be rolled out soon. At Economic Editors Conference in New Delhi, finance minister Pranab Mukherjee said, Swabhiman a nationwide programme on financial inclusion, estimated to cover approximately five crore households, is now ready for roll out. He said the government has also launched Swavalamban, a pension scheme for workers in the unorganised sector, who do not have access to the social security net. Under the scheme subscribers would get Rs1,000 from the government each year for a subscription amount of Rs12,000 per year. The scheme will remain valid for this financial year and for the next three consecutive fiscals. Government has targeted ten lakh workers from un- organized sectors each during the initial four years of the implementation of Swavalamban Scheme totalling to 40 lakh subscribers by March 2014, Mukherjee added. NEFT facilitates one-to-one funds transfers between banks, irrespective of location Retail Provides six settlements at 9.00, 11.00, 13.00, 14.00, 15.00 and 17.00 hrs Covers 91 banks and 60,000 branches at over 4,500 centres Around 5 mn. transactions on monthly basis No amount limits Operates on a T+0 basis (for settlement) Customers can use funds on same day or next day Branches need to have a IFSC code for participation List of IFSC codes updated and placed on RBI website

Highly Secured smart card based access Implemented in India with effect from 26th March 2004 'Y' topology structure Membership to RTGS is open to all scheduled commercial and cooperative banks, primary dealers, clearing agencies and other institutions at the discretion of RBI. Transactions types permitted Member's own inter-institutional transactions Transactions on behalf of customers Financial market related transactions Multilateral net settlement obligations of cheque-based and other electronic

clearing. Branch coverage now nearly 60,000 RTGS timings extended

Monday Friday 9.00 to 16.30 hrs Customer 9.00 to 18.00 hrs Inter-bank

Saturday 9.00 to 12.30 hrs Customer Highest

9.00 to 14.30 hrs Inter-bank Settled 2.34 mn transactions in July 2009 for value Rs. 31.79 tn

ever volume SEBIs request to consider corporate bond settlement in RTGS on DVP-I basis has been acceded to

IFSC stands for Indian Financial System Code . The Payment System Applications such as Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT) and Centralised Funds Management System (CFMS) developed by the Reserve Bank of India use these codes. The code consists of 11 Characters : (e.g ICIC0000039)

First 4 characters represent the entity (ICIC0000039 ) Fifth position has been defaulted with a '0' (Zero) for future use (ICIC0000039) Last 6 character denotes the branch identity (ICIC0000039 )

IFSC is being identified by the RBI as the code to be used for various payment system projects within the country, and it would, in due course, cover all networked branches MICR is an acronym for Magnetic Ink Character Recognition. The MICR Code is a numeric code that uniquely identifies a bank-branch participating in the ECS Credit scheme. The MICR code consists of 9 digits : (e.g 411229003)

First 3 digits represent the city (411229003 ) Next 3 digits represent the bank (411229003 ) Last 3 digits represent the branch (411229003 )

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- DD / MC Dilna Form: Bank SealDokument1 SeiteDD / MC Dilna Form: Bank Sealwolf tanvirNoch keine Bewertungen

- PNG invoice summary for imported goodsDokument3 SeitenPNG invoice summary for imported goodsProcopio DoysabasNoch keine Bewertungen

- Australian Property Tax GuideDokument14 SeitenAustralian Property Tax GuideAllenRuan100% (2)

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDokument23 SeitenTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenNoch keine Bewertungen

- GST Tax Invoice Format For GoodsDokument2 SeitenGST Tax Invoice Format For GoodsZahir ComputersNoch keine Bewertungen

- Clover - PreApplication NEWDokument1 SeiteClover - PreApplication NEWgreat augustNoch keine Bewertungen

- HELB Enquiry Form 2020Dokument1 SeiteHELB Enquiry Form 2020Human ResourcesNoch keine Bewertungen

- DT Volume 2 Dec 21 CS Executive CA Saumil Manglani UpdatedDokument180 SeitenDT Volume 2 Dec 21 CS Executive CA Saumil Manglani UpdatedSouvik MukherjeeNoch keine Bewertungen

- FRM Epay Echallan PrintDokument1 SeiteFRM Epay Echallan PrintSanket PatelNoch keine Bewertungen

- Bank statement activity and dispute rights under $1Dokument3 SeitenBank statement activity and dispute rights under $1shani ChahalNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pramod JavaliNoch keine Bewertungen

- Pakistan Custom Department MCQs For Appraising - Valuation Officer in BoRDokument5 SeitenPakistan Custom Department MCQs For Appraising - Valuation Officer in BoRShoaib AhmedNoch keine Bewertungen

- Form No.12baDokument2 SeitenForm No.12baAmit BhatiNoch keine Bewertungen

- Omnibus Investments Code of 1987 (EO 226), As AmendedDokument17 SeitenOmnibus Investments Code of 1987 (EO 226), As AmendedFrancane Vince LibagoNoch keine Bewertungen

- RB Statement 2022 12 12 448307994Dokument15 SeitenRB Statement 2022 12 12 448307994akhbar akhbar0% (1)

- Check Stub Template-1-2Dokument118 SeitenCheck Stub Template-1-2Liza GeorgeNoch keine Bewertungen

- Mastering QuickBooks Payroll 2013Dokument105 SeitenMastering QuickBooks Payroll 2013Chanty Sridhar100% (2)

- PasarDokument9 SeitenPasarAnonymous VtsflLix1Noch keine Bewertungen

- February 11, 2020 March 1, 2020: Credit Card StatementDokument3 SeitenFebruary 11, 2020 March 1, 2020: Credit Card StatementSusant SahooNoch keine Bewertungen

- Presston Engineering Corporation: System Generated Payslip, No Seal and Signature RequiredDokument1 SeitePresston Engineering Corporation: System Generated Payslip, No Seal and Signature RequiredRohith GsNoch keine Bewertungen

- Ghanshyam 1813 PPT Public FinanceDokument64 SeitenGhanshyam 1813 PPT Public FinanceShivansh JhaNoch keine Bewertungen

- Dhaka Power Distribution Company Ltd. (DPDC) : Payment Short Ledger (Post-Paid)Dokument6 SeitenDhaka Power Distribution Company Ltd. (DPDC) : Payment Short Ledger (Post-Paid)sagor islamNoch keine Bewertungen

- Bank of Baroda Bank of Baroda Bank of Baroda: No.: 2086601 No.: 2086601 No.: 2086601Dokument1 SeiteBank of Baroda Bank of Baroda Bank of Baroda: No.: 2086601 No.: 2086601 No.: 2086601Såñdèëp KNoch keine Bewertungen

- Alternative Minimum TaxDokument2 SeitenAlternative Minimum TaxJeremy A. MillerNoch keine Bewertungen

- January 23-February 22, 2019-MGTDokument10 SeitenJanuary 23-February 22, 2019-MGTLaurel BarteNoch keine Bewertungen

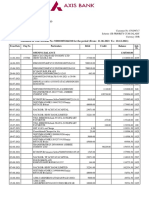

- Statement of Axis Account No:920010055264310 For The Period (From: 11-06-2021 To: 10-12-2021)Dokument4 SeitenStatement of Axis Account No:920010055264310 For The Period (From: 11-06-2021 To: 10-12-2021)Sanjay BaldwaNoch keine Bewertungen

- Sales Statement Month of 09 August, 2017: DomesticDokument74 SeitenSales Statement Month of 09 August, 2017: DomesticMarufan NessaNoch keine Bewertungen

- Account Statement: As of 21-09-2016 07:57:02 GMT +0200Dokument3 SeitenAccount Statement: As of 21-09-2016 07:57:02 GMT +0200Goretti JansenNoch keine Bewertungen

- Invoice 1796Dokument1 SeiteInvoice 1796Lucas CardosoNoch keine Bewertungen

- Payroll WTX Less Benefits Activity 4Dokument34 SeitenPayroll WTX Less Benefits Activity 4Ashley Jean CosmianoNoch keine Bewertungen