Beruflich Dokumente

Kultur Dokumente

4 Q4 FY12 Exchange Format Consolidated

Hochgeladen von

Niket GandhiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4 Q4 FY12 Exchange Format Consolidated

Hochgeladen von

Niket GandhiCopyright:

Verfügbare Formate

MOTILAL OSWAL FINANCIAL SERVICES LTD Registered Office: Palm Spring Centre, Palm Court Complex, 2nd Floor,

Link Road, Malad (W), Mumbai - 400 064 Tel: +91-22-30801000, Fax: +91-22-28449044 Email:investors@motilaloswal.com CONSOLIDATED AUDITED FINANCIAL RESULTS FOR THE QUARTER & YEAR ENDED 31ST MARCH 2012 Quarter Ended 31.12.2011 (Rs in Lacs) Year Ended Y 31.03.2012 31.03.2011 3 1 . 44,367 1,765 46,132 11,386 1,297 19,547 32,230 13,903 421 14,324 360 13,964 1,299 15,263 4,844 10,419 (29) 10,390 1,451 112,642 58,092 915 59,007 13,724 1,313 23,402 38,439 20,568 1,068 21,636 566 21,070 21,070 7,120 13,950 (244) 13,706 1,444 104,507

Particulars 1. Income from Operations (a) Income from Operations (b) Other Operating Income Total Income 2. Expenditure a. Employees benefits expense b. Depreciation c. Other expenditure Total expenses 3. Profit from Operations before Other Income, Interest & Exceptional Items (1-2) 4. Other Income 5. Profit before Interest & Exceptional Items (3+4) 6. Finance Cost 7. Profit after Interest but before Exceptional Items (5-6) 8. Exceptional Items - (Expense)/Income 9. Profit / (Loss) from Ordinary Activities before tax (7-8) 10. Tax expense 11. Net Profit / (Loss) from Ordinary Activities after tax but before minority interests (9-10) 12. Share of minority interests in (profits)/ loss 13. Net Profit after tax and Minority Interests (1112) 14. Paid-up equity share capital (Face Value of Re. 1/- Per Share ) 15. Reserves excluding Revaluation Reserves 16. Earnings Per Share (EPS) (before Extraordinary items) ( od Rs. 1/- each) a) Basic EPS b) Diluted EPS 16. ii. Earnings Per Share (EPS) (after Extraordinary items) (of Rs. 1/- each) c) Basic EPS d) Diluted EPS PARTICULARS OF SHAREHOLDINGS 17. Public shareholding - Number of shares - Percentage of shareholding 18. Promoters and promoter group Shareholding a) Pledged/Encumbered - Number of shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the company) b) Non-encumbered - Number of shares - Percentage of shares (as a% of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the company) 19. INVESTORS COMPLAINTS Pending at the beginning of the quarter Received during the qyarter Disposed of during the quarter Remaining unresolved at the end of the quarter

31.03.2012

31.03.2011

12,399 482 12,881 3,168 483 5,626 9,277 3,604 (25) 3,579 143 3,436 3,436 1,255 2,181 (8) 2,173 1,451

10,573 318 10,891 2,672 269 4,349 7,290 3,601 236 3,837 58 3,779 3,779 1,165 2,614 (14) 2,600 1,451

12,525 (45) 12,480 2,951 325 5,297 8,573 3,907 122 4,029 91 3,938 3,938 1,485 2,453 (27) 2,426 1,444

1.50 1.50

1.80 1.80

1.68 1.68

7.17 7.17

9.52 9.52

1.50 1.50

1.80 1.80

1.68 1.68

7.17 7.17

9.52 9.52

43,282,882 29.82%

43,278,211 29.82%

44,531,979 30.84%

43,282,882 29.82%

44,531,979 30.84%

8,500,000 8.35% 5.86% 93,339,987 91.65% 64.32%

8,500,000 8.35% 5.86% 93,341,258 91.65% 64.32%

8,500,000 8.51% 5.89% 91,387,250 91.49% 63.32%

8,500,000 8.35% 5.86% 93,339,987 91.65% 64.32%

8,500,000 8.51% 5.89% 91,387,250 91.49% 63.28%

NIL 3 2 1

NIL 7 7 NIL

1 NIL 1 NIL

NIL 14 13 1

1 10 10 NIL

Notes 1 )The audited financial statements were reviewed by the Audit Committee and taken on record by the Board of Directors of the Company at its Meeting held on Wednesday, 25th April, 2012. There are no qualifications in the auditors report for these periods. The information presented above is extracted from the audited financial statements as stated 2) The Board of Directors recommended final dividend of Rs 0.50 per equity share of face value of Rs. 1 each. The payment is subject to the approval of the shareholders in the ensuing Annual General Meeting of the Company. 3) The consolidated results of the Company include the results of the subsidiaries Motilal Oswal Securities Limited (99.95%), Motilal Oswal Investment Advisors Private Limited (93.75%), Motilal Oswal Private Equity Advisors Private Limited (85%), Motilal Oswal Commodities Broker Private Limited (97.55%), Motilal Oswal Capital Markets Private Limited (99.95%), Motilal Oswal Wealth Management Private Limited (Formerly known as Antop Traders Private Limited) (99.95%), Motilal Oswal Insurance Brokers Private Limited (99%), Motilal Oswal Asset Management Company Limited (99.95%), Motilal Oswal Trustee Company Limited (99.95%), Motilal Oswal Securities International Private Limited (99.95%), Motilal Oswal Capital Markets (Singapore ) Pte Ltd (99.95%) & Motilal Oswal Capital Markets (Hong Kong ) Private Limited (99.95%). 4)During the quarter, the construction of the corporate headquarters Motilal Oswal Tower was completed and the company has Capitalized the Building and other costs thereof with effect from 1st March 2012 amounting to Rs. 26,908.07 Lacs. 5) Exceptional item for the year ended 31st March, 2012 consists of Profit on sale of Office Premises of Rs. 1299 Lacs. 6)The previous financial quarter / year figures have been regrouped/rearranged wherever necessary to make them comparable. 7)Standalone financial results are summarised below and also available on the Company's website: www.motilaloswal.com. Quarter Ended Particulars 31.03.2012 Gross Revenue Profit Before Tax Profit After Tax 2,513 2,085 1,875 31.12.2011 1,132 889 617 31.03.2011 1,023 812 527

Year Ended 31.03.2011 6,425 5,731 4,265

31.03.2012 8,195 6,622 5,630

Y e 3 1

9) CONSOLIDATED AUDITED SEGMENT RESULTS FOR THE QUARTER AND YEAR ENDED 31ST MARCH 2012 Particulars 31.03.2012 1. Segment Revenue (a) Equity Broking & Other related activities (b) Financing & Other activities (c) Investment Banking (d) Unallocated Total Less: Inter Segment Revenue Income From Operations, Other Operating income & Other Income 2. Segment Results Profit / (Loss) before tax and interest from Each segment (a) Equity Broking & Other related activities (b) Financing & Other activities (c) Investment Banking (d) Unallocated Total Less: Interest Profit/(Loss ) from Ordinary Activities before Tax Quarter Ended 31.12.2011 (Rs in Lacs) Year Ended Y 31.03.2012 31.03.2011 3 1 . 36,626 48,299 8,195 5,084 1,135 4,052 7,798 4,931 53,753 62,366 5,901 2,291 47,852 60,075

31.03.2011

9,991 2,513 401 2,047 14,952 2,096 12,856

8,203 1,132 160 2,498 11,993 866 11,127

9,781 1,023 537 1,764 13,105 503 12,602

2,852 723 (204) 333 3,704 267

2,596 889 (178) 575 3,882 103

2,613 812 258 352 4,035 97

11,408 3,157 (492) 1,726 15,799 537

14,955 4,314 1,832 520 21,621 551

3,436 3,779 3,938 15,262 21,070 3. Capital Employed (Segment assets Segment Liabilities) 54,926 44,994 (a) Equity Broking & Other related activities 51,842 54,956 51,842 57,313 56,811 (b) Financing & Other activities 54,149 57,313 54,149 354 584 (c) Investment Banking 1,050 595 1,050 1,500 12,204 (d) Unallocated (1,090) 1,674 (1,090) Total 114,093 114,593 105,951 114,537 105,951 Notes: 0 1. The above Segment information is presented on the basis of the unaudited consolidated financial statements. The company's operations predominantly relate to Equity broking and other related activities, financing and other activities, Investment banking, Private Equity, Asset Management & Commodities broking . In accordance with Accounting Standard -17 on segment reporting and Company (Accounting Standards) Rules,2006, the Company has Equity broking and other related activities, Financing and other activities & Investment banking as reportable segments. The balance is shown as unallocated items. 2.The previous financial quarter / year figures have been regrouped/rearranged wherever necessary to make them comparable. 10) STATEMENT OF ASSETS & LIABILITIES ( CONSOLIDATED ) (Rs in Lacs) As on Audited 31.03.2012 31.03.2011

Particulars A. EQUITY AND LIABILITIES 1. Shareholder's Fund a) Share Capital b) Reserves & Surplus Sub-total - Shareholders' funds 2. Minority Ineterest 3. Non-current liabilities a) Deferred tax liabilities (net) b) Long-term provisions Sub-total - Non-current liabilities 4. Current liabilities a) Trade payables b) Other current liabilities c) Short-term provisions Sub-total - Current liabilities TOTAL - EQUITY AND LIABILITIES B. ASSETS 1. Non-current assets a) Fixed assets b) Non-current investments c) Long-term loans and advances Sub-total - Non-current assets 2. Current assets a) Inventories b) Trade receivables c) Cash and cash equivalents d) Short-term loans and advances e) Other current assets Sub-total - Current assets TOTAL - ASSETS

1,451 112,642 114,093 444 467 633 1,099 27,164 8,281 3,407 38,851 154,488

1,444 104,507 105,951 518 15 393 408 29,096 8,510 6,530 44,136 151,012

34,451 9,415 3,162 47,028 15,739 24,781 27,105 39,372 462 107,460 154,488 0 0

28,923 5,884 2,770 37,577 18,750 27,383 27,720 39,171 411 113,435 151,012 0 On behalf of the Board of Directors Motilal Oswal Financial Services Limited

Motilal Oswal Chairman & Managing Director Mumbai, 25th April, 2012 investors@motilaloswal.com.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- 4Q Labor Case DigestsDokument53 Seiten4Q Labor Case DigestsKaren Pascal100% (2)

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating EmplDokument37 SeitenTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating Emplpolkadots939100% (1)

- UW Computational-Finance & Risk Management Brochure Final 080613Dokument2 SeitenUW Computational-Finance & Risk Management Brochure Final 080613Rajel MokNoch keine Bewertungen

- Zydus - Investor Presentation (Nov 10)Dokument22 SeitenZydus - Investor Presentation (Nov 10)Niket GandhiNoch keine Bewertungen

- Prestressing ProductsDokument40 SeitenPrestressing ProductsSakshi Sana100% (1)

- AKTA MERGER (FINAL) - MND 05 07 2020 FNLDokument19 SeitenAKTA MERGER (FINAL) - MND 05 07 2020 FNLNicoleNoch keine Bewertungen

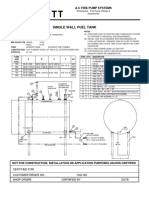

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDokument1 SeiteSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNoch keine Bewertungen

- About Golf EventsDokument15 SeitenAbout Golf EventsNiket GandhiNoch keine Bewertungen

- New Dimension Propelled: Hero Motocorp LTDDokument140 SeitenNew Dimension Propelled: Hero Motocorp LTDAkshay VetalNoch keine Bewertungen

- Secretary Bryson leads US business mission to India's $1 trillion infrastructure marketDokument11 SeitenSecretary Bryson leads US business mission to India's $1 trillion infrastructure marketNiket GandhiNoch keine Bewertungen

- Strategic Plan Mnre 2011 17Dokument85 SeitenStrategic Plan Mnre 2011 17Umasankar ChilumuriNoch keine Bewertungen

- Iip June 2010Dokument9 SeitenIip June 2010kdasNoch keine Bewertungen

- Rain Commodities Ltd-08Dokument96 SeitenRain Commodities Ltd-08Niket GandhiNoch keine Bewertungen

- Unleashing Potential of Renewable Energy in IndiaDokument57 SeitenUnleashing Potential of Renewable Energy in IndiaDwarak ValagamNoch keine Bewertungen

- Strategic Plan Mnre 2011 17Dokument85 SeitenStrategic Plan Mnre 2011 17Umasankar ChilumuriNoch keine Bewertungen

- Annual Return CIPLDokument8 SeitenAnnual Return CIPLNiket GandhiNoch keine Bewertungen

- KarnatakadraftDokument176 SeitenKarnatakadraftNiket GandhiNoch keine Bewertungen

- Gati LTD Detailed ReportDokument24 SeitenGati LTD Detailed ReportNiket GandhiNoch keine Bewertungen

- L-1 Linear Algebra Howard Anton Lectures Slides For StudentDokument19 SeitenL-1 Linear Algebra Howard Anton Lectures Slides For StudentHasnain AbbasiNoch keine Bewertungen

- 01 Automatic English To Braille TranslatorDokument8 Seiten01 Automatic English To Braille TranslatorShreejith NairNoch keine Bewertungen

- Unit 1 2marksDokument5 SeitenUnit 1 2marksLokesh SrmNoch keine Bewertungen

- Debentures Issued Are SecuritiesDokument8 SeitenDebentures Issued Are Securitiesarthimalla priyankaNoch keine Bewertungen

- Meanwhile Elsewhere - Lizzie Le Blond.1pdfDokument1 SeiteMeanwhile Elsewhere - Lizzie Le Blond.1pdftheyomangamingNoch keine Bewertungen

- Collaboration Live User Manual - 453562037721a - en - US PDFDokument32 SeitenCollaboration Live User Manual - 453562037721a - en - US PDFIvan CvasniucNoch keine Bewertungen

- Tech Letter-NFPA 54 To Include Bonding 8-08Dokument2 SeitenTech Letter-NFPA 54 To Include Bonding 8-08gl lugaNoch keine Bewertungen

- "60 Tips On Object Oriented Programming" BrochureDokument1 Seite"60 Tips On Object Oriented Programming" BrochuresgganeshNoch keine Bewertungen

- 1 Estafa - Arriola Vs PeopleDokument11 Seiten1 Estafa - Arriola Vs PeopleAtty Richard TenorioNoch keine Bewertungen

- Piping ForemanDokument3 SeitenPiping ForemanManoj MissileNoch keine Bewertungen

- GS Ep Cor 356Dokument7 SeitenGS Ep Cor 356SangaranNoch keine Bewertungen

- Ayushman BharatDokument20 SeitenAyushman BharatPRAGATI RAINoch keine Bewertungen

- ATOMIC GAMING Technical Tutorial 1 - Drawing Game Statistics From Diversity Multigame StatisticsDokument4 SeitenATOMIC GAMING Technical Tutorial 1 - Drawing Game Statistics From Diversity Multigame StatisticsmiltoncgNoch keine Bewertungen

- CASE DigeSTDokument2 SeitenCASE DigeSTZepht BadillaNoch keine Bewertungen

- Make a Battery Level Indicator using LM339 ICDokument13 SeitenMake a Battery Level Indicator using LM339 ICnelson100% (1)

- Assignment-2: MCA204 Financial Accounting and ManagementDokument6 SeitenAssignment-2: MCA204 Financial Accounting and ManagementrashNoch keine Bewertungen

- Comparing Time Series Models to Predict Future COVID-19 CasesDokument31 SeitenComparing Time Series Models to Predict Future COVID-19 CasesManoj KumarNoch keine Bewertungen

- Engine Controls (Powertrain Management) - ALLDATA RepairDokument4 SeitenEngine Controls (Powertrain Management) - ALLDATA Repairmemo velascoNoch keine Bewertungen

- Arizona Supreme CT Order Dismisses Special ActionDokument3 SeitenArizona Supreme CT Order Dismisses Special Actionpaul weichNoch keine Bewertungen

- Royal Enfield Market PositioningDokument7 SeitenRoyal Enfield Market PositioningApoorv Agrawal67% (3)

- Code Description DSMCDokument35 SeitenCode Description DSMCAnkit BansalNoch keine Bewertungen

- Usa Easa 145Dokument31 SeitenUsa Easa 145Surya VenkatNoch keine Bewertungen

- Difference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDokument2 SeitenDifference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDharma Teja TanetiNoch keine Bewertungen

- Gerhard Budin PublicationsDokument11 SeitenGerhard Budin Publicationshnbc010Noch keine Bewertungen