Beruflich Dokumente

Kultur Dokumente

Capital Budgeting and Inflation

Hochgeladen von

Deepthi SiriOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Budgeting and Inflation

Hochgeladen von

Deepthi SiriCopyright:

Verfügbare Formate

American Finance Association

Inflation and Capital Budgeting Author(s): Charles R. Nelson Reviewed work(s): Source: The Journal of Finance, Vol. 31, No. 3 (Jun., 1976), pp. 923-931 Published by: Blackwell Publishing for the American Finance Association Stable URL: http://www.jstor.org/stable/2326436 . Accessed: 11/01/2012 02:44

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Blackwell Publishing and American Finance Association are collaborating with JSTOR to digitize, preserve and extend access to The Journal of Finance.

http://www.jstor.org

THE JOURNAL OF FINANCE

VOL. XXXI, NO. 3

JUNE 1976

INFLATION AND CAPITAL BUDGETING

CHARLES THE LITERATUREON

R.

NELSON*

capital budgeting has not generally reserved a specific role for the rate of price inflation in the analysis of capital investments. In the taxless world of most textbook discussions of the subject, inflation would presumably only augment both future cash flows and discount rates by comparable amounts, thus having no effect on present value calculations. Under the U.S. tax code, however, after-tax present values are not neutral with respect to different rates of inflation, because depreciation charges are based on historical costs. This complication may have been of little practical importance during much of the post-war period, but rates of inflation such as those experienced in recent years will generally be a material factor in present value calculations. In order to focus on the role of the tax effects of inflation in the capital budgeting decisions of the firm it is necessary to hold constant both real pretax cash flows associated with alternative investment projects (including capital costs) and real discount rates. The question of whether real pretax cash flows and real discount rates are in fact systematically related to the rate of inflation is esentially an empirical one and goes beyond the scope of the present paper. Some evidence to the contrary in the case of cash flows is given by Kessel and Alchain [5]. The hypothesis that real discount rates are unrelated to the rate of inflation, of course, goes back to Fisher [3, 4] and enjoys support from a large body of empirical literature.1 The analysis presented here does not distinguish between actual and expected future rates of inflation or cash flows. Whether the reader wishes to regard the discussion as an analysis under perfect certainty or prefers to interpret future magnitudes as certainty equivalents accompanied by appropriate discount rates is immaterial for present purposes. The paper is organized around five propositions dealing with the impact of inflation, ceteris paribus, on aspects of the capital budgeting decision relating to the optimal level of investment, the choice of technology, the ranking of competing projects, optimal durability, and replacement policy.

PROPOSITION A. The optimal level of capital investment will depend in general on the rate of inflation. The amount invested will typically be smaller the higher the rate of inflation.

Schoolof Business,Universityof of *AssociateProfessor BusinessEconomicsand Finance,Graduate Chicago. This paper was written during a visiting residence at the Graduate School of Business, to I Universityof Washington. would like to expressmy appreciation that institutionfor providingme to facilitiesduringmy visit.I would also like to expressmay appreciation LarrySchalland with research for Nancy Jacob for helpingto stimulatemy interestin this topic, althoughthey bear no responsibility The research the final product.I am also gratefulto DouglasVickers,the referee,for helpfulcomments. in was supported part by the National Science FoundationundergrantGS-34501. 1. See, for example,Yohe and Karnosky(6) and Fama (1).

923

924

The Journal of Finance

L.

1\

p=p2

FIGURE

This proposition is easily demonstrated with the simple example of an investment of I dollars producing a cash flow of X dollars one period later. The project would be fully depreciated in one period so the taxable profit would be X- I and the tax owed T(X - I) where T is the corporate tax rate. Let the real discount rate be r so that with no inflation the present value of the project is -I+ X- T(X-I) I+ r

If, however, the rate of inflation over the life of the project will be p, then the present value becomes PV(p) =-I+

I

))X lT((I +p)X-I) (

TI

(-T)X

(l + r)

(+ r)(l + p)

Inflation and Capital Budgeting The optimal level of investment will be given by the solution to

925

aPV(P)

aI

(1 - ) aX + _T_ ( + r) aI (1+r)(1 +p)

__

which will depend on p. Using the approximation (1 +p)- 1(I aPV(P) aI

(1 -iT) ax

T

___T

-p) we have

(1+r)

1+r

P1+r

so that the effect of a higher anticipated rate of inflation is a downward shift in the marginal present value schedule by amount pT/(1 + r). The situation is illustrated in Figure 1 for rates of inflation P1 and P2 with P2>P . It is clear that the optimal investmentI*(p) will be smaller the higher the anticipatedrate of inflation. The rate of inflation will influence the firm's choice of technologies of production throughits choice of a capital! labor ratio. Higher rates of inflation will typically be associated with lower capital! labor ratios. B. PROPOSITION We now consider how anticipated rates of inflation will affect the choice of an optimal combination of labor and capital inputs which in practice amounts to a choice among production technologies. The framework of Proposition A is extended to note that output X in constant dollars will be a function f( ) of I and labor input L. Discounted revenue for a competitive firm will be Revenue - (1 -T)Pf(I,L) (I1+ r) where P is the price of output assumed to vary according to the rate of general price inflation. Discounted costs can be written as

Cost= l+W( Cs-(l+r)

-

T) L + I

(Il+r)(I+p

W(- -T)

(I + r)(

+P)

I +r

(l +r)(l+p) (

where the wage rate W (paid at the end of the production period) is also assumed to vary with the rate of inflation. Now the "price" of labor is W(I - T)/(1 + r) per unit while the "price" of investment is {(I + r)(l+p) - T}/(I+ r)(l +p) per unit (dollar) which depends on p. It is clear that different p correspond to different factor price ratios and will in general lead to different choices of I and L. The situation is illustrated graphically in Figure 2. A typical isorevenue curve is indicated by R1 and does not depend on p. A typical cost schedule is represented by C(p1) which does depend on p. The decision problem can be thought of as one of maximizing revenue at each alternative level of cost and then finding the level of cost which maximizes the difference. If P2 is larger than pI then cost schedule C(p2)

926

The Journal of Finance

I4V

\c(p2)

FIGURE

would be relevant and isorevenue curve R2 would represent the highest attainable revenue. The shift in capital/labor ratio can be decomposed into that due to the change in the slope of C( ) (a "substitution" effect) and that due to a shift in the position of C ) (an "income" effect). In the "normal" case where the substitution effect dominates, higher levels of p will typically be associated with lower capital/labor ratios.

PROPOSITION C. The net present value ranking of mutually exclusive investment projects will depend in general on the rate of inflation.

When investment projects have lives greater than one period the impact of the rate of inflation on net present values will depend on how depreciation charges are distributed over the lives of alternative projects. The ranking of projects which produce different streams of depreciation charges against taxable income will therefore depend on the rate of inflation. To demonstrate that this is true in general we need to introduce notation as follows. Let X, represent net cash flow before taxes in constant dollars generated by the project in year t and let depreciation be calculated by the declining balance method at the rate of 8 for each tax year. Taxable profit in year t for a project costing I dollars in year zero would therefore be

?T

y0

8)

II _R\-

Inflation and Capital Budgeting

927

If the rate of inflation were zero the net present value of such a project would be

PV=

-I+

1=1

,T{

(1+ r)

,6l-)

where r denotes the constant real discount rate, and the life of the project is assumed to be infinite for algebraic simplicity. Now, if the general level of prices and costs rises at rate p, assumed to be constant, then current dollar cash flows become (1 +p)'X, and the net present value is

00

Xt

PV(p) =I+

(I1-T)

) + (

)1+)(-

using the formula for summing geometric series and the fact that the factors (1 +p)t cancel in the numerator and denominator of the second term. The third term is the contribution which depreciation charges make to net present value through tax savings and is easily seen to depend on the depreciation rate a and to be smaller the higher the rate of inflation p. To see how different rates of inflation would alter the ranking among alternative projects it is convenient and reasonably realistic to impose a simple pattern of decay on the cash flows generated by any given project. In particular the rate of flow is assumed to decay at rate X starting in period one so that the sequence of cash flows is (1 - X)X, (1 - X)2X,.... When this is the case, PV(p) simplifies to a function of p and X given by PV(p,X)=-I+ (1-T)(1-X)X r+X TSI + (1r)(1Ip-(-#)

where again the third term is the contribution which tax savings from depreciation make to net present value. To illustrate how rankings among projects will depend on p consider hypothetical projects I and II where the tax rate T =.5, the real interest rate r is .05, and where

XI=

.10

I=

.10

(first year cash flow)

(1 - XI)XI= 90 I=300 while

XII =.5

(1 -X,,)X,,

165 (first year cash flow)

I= 150

928

The Journal of Finance

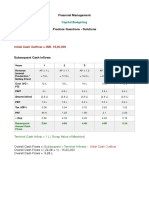

Project I requires a larger initial outlay than II and generates a smaller initial cash flow, but does so with a slower rate of decay. While X and a need not have been exactly identical, it is not unrealistic to assume that a project with the characteristics of I would be depreciated at a lower rate than II. Table 1 compares net present values for these two projects over a range of rates of inflation.

TABLE 1

NET PRESENT VALUES OF HYPOTHETICAL PROJECTS

Rate of Inflation .00 .10 .15 .20 .50 1.00

Project I 100.00 58.82 48.78 41.67 22.22 12.50

Project II 68.18 57.25 53.00 49.34 34.88 23.44

The reader will note that Project I has a higher present value than Project II at low rates of inflation, but that the ordering is reversed at rates of inflation above 10% (1 1.1 to be exact). The variation across rates of inflation is entirely due to variation in the capitalized value of future tax savings from depreciation charges. These savings are realized more slowly under Project I and therefore their present value is eroded more severely by higher rates of inflation. D. Net present value rankings of mutually exclusive projects which PROPOSITION differ with respect to durabilitywill depend on the rate of inflation. Typically, rankings will change in favor of projects with lower durability at higher rates of inflation. Investment projects which generate a declining stream of cash flows will generally be replaced after some interval depending on the specific pattern of cash flows, replacement cost, scrap value, and so forth. Projects which produce more rapidly declining cash flows, in other words are less durable, will typically be replaced more often. Where durability and therefore replacement interval differs among competing alternative projects, the rate of inflation will be an important determinant of net present value rankings. Higher rates of inflation will typically alter rankings in favor of less durable projects, because their depreciation cost will be restated in terms of current dollars at more frequent intervals. To focus on the role of durability in the choice among projects and abstract from replacement policy for a given project (considered explicitly under Proposition E) consider the following example. The problem is to choose one of two different

Inflation and Capital Budgeting

929

types of electric generating plants producing a specified power output. Project a is a thermonuclear reactor which is subject to almost no physical deterioration. Once built, it produces the specified power output in perpetuity, but is depreciated for tax purposes at rate 8. Project /3 on the other hand generates electric power using the residual heat from an underground nuclear blast. The heat generated is sufficient for only one year at which time a new blast is required. The cost of each new blast is written off in one year. The net present value of Project a will be

PVa=

-,a+

-r

(1+.r)(1 +p)

(1

8)

The net present value of Project /3 on the other hand is given by

00

(l+

)' +p)t (T)X t=i

(I +P) 'X- T {(l +P)tx - (I +p)'(1 +

T___

lip

t=O (1+ r)t(

r)t(1+p)t

+r I+ r

(I3

+r(1 +1)I

is the outlay in constant dollars where X is the same for both projects and required to produce a new nuclear blast each year. The first term of both present value expressions is the present value of all future investment outlays (which in the case of Project /3necessarily involves the real discount rate), the second term is the present value of future cash flows, and the third term is the present value of future tax savings from depreciation charges. The third terms differ in algebraic form because the cost of replacing Project a is restated each year in current dollars. It is clear from comparison at the third terms of the two present value expressions that the ranking of the two projects will depend on the rate of inflation. Suppose for purposes of illustration that

Ia= 1,500

1I=100

8 =.10

X=200 then the net present values corresponding to various rates of inflation are given in Table 2. At low rates of inflation Project a is preferred. However, successively higher rates of inflation decrease the tax savings occurring under a more rapidly than those under /3until the balance shifts in favor of /3at p equal to 7.14. Very high rates of inflation ultimately reduce the tax savings from both projects to the point where their present values are dominated by the first two terms in each expression. Because in this illustration the sum of the first two terms is $500 for a but (-$100) for /3, the balance finally shifts back in favor of a at rates of inflation above 33.3.

930

The Journal of Finance

TABLE 2

NET PRESENTVALUESOF HYPOTHETICAL PROJECTS WITH REPLACEMENT

Rate of Inflation .00 .05 .10 .20 .30 .50 1.00

Project a 1,000.00 870.37 794.12 708.33 661.29 611.11 562.50

Project f3 900.00 852.38 809.09 733.33 669.23 566.67 400.00

PROPOSITION E. Replacementpolicy will depend in general on the rate of inflation. The higher the rate of inflation the more likely will replacementbe deferred to a future period.

In many real situations the lifetime of a project is not prescribed by technology as in the case of the hypothetical projects discussed under Proposition D, but rather is a variable under the control of the firm. The optimal lifetime will depend on the structure of costs as the installation ages, scrap value, and details of the tax code under which the firm operates. The possible combinations of these factors are far too varied to permit a comprehensive treatment, but the basic role of inflation in replacement policy can be outlined as follows. A firm can continue to operate its present installation for another year or replace it with a new installation.2 New and old installations generate the same gross revenues, but the old installation becomes more costly to operate as it ages. The after-tax cost of operating the old installation for another year is C in constant dollars, while the present value of future after tax costs for a new installation less tax savings from future depreciation charges is PVC(p), a function of the rate of inflation as we have seen before. We assume in the calculation of PVC(p) that the installation will be replaced at appropriate intervals. Replacement is called for this year as opposed to next if (l+p)c + (1 +'r)(1 +p) or C > rPVC(p)

2. See Fama and Miller (2), pp. 130-134 for a lucid discussion of the replacement problem.

(1+p)PVC(p) (1 +r)(1 +p)

>PVC(p)

Inflation and Capital Budgeting

931

where C is assumed to be paid at the end of the current period. Since the component of PVC(p) which is a function of the rate of inflation is just the portion due to future tax savings from depreciation, and the present value of these savings varies inversely with the rate of inflation, then PVC(p), which is net cost, varies directly with the rate of inflation. Thus, some installations which would be replaced at a given point in time, for a given rate of inflaion, would not be replaced if the rate of inflation were higher. Of course, the calculated value of PVC depends on what is assumed about future replacement policies, but higher inflation rates will work against current replacementin any case. CONCLUDING REMARKS While a general discussion of the role of inflation on capital budgeting can only draw on illustrative examples, it seems apparent that at current rates of inflation the related tax effects must be an important factor in many present value comparisons arising in practice. Further, unless relative factor costs, prices, and discount rates have changed in very particular ways, it seems very probable that the ceteris paribus effects discussed in this paper are indicative of actual distortions which have been occurring as a result of inflation. One of the strongest arguments for "indexing" of accounting costs would be the elimination of such distortions.

REFERENCES 1. E. F. Fama."ShortTermInterestRates as Predictors Inflation." of Mimeo, Universityof Chicago, 1974(forthcoming American Economic Review). in 2. and M. H. Miller. The Theory of Finance. New York: Holt, Rinehart,and Winston, 1972. 3. I. Fisher.Appreciationand Interest. New York: The MacmillanCo., 1896. . The Theory of Interest. New York: The Macmillan 4. Co., 1930. 5. R. A. Kesseland A. A. Alchian."TheMeaningand Validityof the InflationInducedLag of Wages BehindPrices." American Economic Review (March,1960),45-66. 6. W. P. Yohe and D. S. Karnosky."InterestRates and Price Level Charges, 1952-1969." Federal Reserve Bank of St. Louis Review (December,1969),18-38.

Das könnte Ihnen auch gefallen

- Sample Contract of Land SellingDokument4 SeitenSample Contract of Land SellingLyn EscanoNoch keine Bewertungen

- Brand Image ToyotaDokument76 SeitenBrand Image ToyotaNishant Salunkhe100% (1)

- A Smorgasbord of Topics in Macroeconomic TheoryDokument10 SeitenA Smorgasbord of Topics in Macroeconomic Theoryniloyniloyniloy8587Noch keine Bewertungen

- Optimal Dividend Policy and Capital Structure in A Multi-Period DCF FrameworkDokument28 SeitenOptimal Dividend Policy and Capital Structure in A Multi-Period DCF FrameworkDevikaNoch keine Bewertungen

- Oxford University PressDokument5 SeitenOxford University PressAshwinikumar KulkarniNoch keine Bewertungen

- Neoclassical Growth Theory P 2Dokument8 SeitenNeoclassical Growth Theory P 2Matthew Marcus FongNoch keine Bewertungen

- The Impact of Inflation On Capital Budgeting and Working CapitalDokument9 SeitenThe Impact of Inflation On Capital Budgeting and Working CapitalNaga SreenivasNoch keine Bewertungen

- Finance Public in Models of Economic GrowthDokument39 SeitenFinance Public in Models of Economic GrowthLamine keitaNoch keine Bewertungen

- Investment TheoryDokument7 SeitenInvestment TheoryJoshua KirbyNoch keine Bewertungen

- Scarth - Savings PolicyDokument6 SeitenScarth - Savings PolicyAndrea AbeysekeraNoch keine Bewertungen

- Chapter 2 Macro SolutionDokument14 SeitenChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Kirill IlinskiDokument19 SeitenKirill IlinskiLeyti DiengNoch keine Bewertungen

- IGNOU MEC-002 Free Solved Assignment 2012Dokument8 SeitenIGNOU MEC-002 Free Solved Assignment 2012manish.cdmaNoch keine Bewertungen

- (A) Harod-Domar Growth Model: GDP (G) DependsDokument93 Seiten(A) Harod-Domar Growth Model: GDP (G) DependsAddisuNoch keine Bewertungen

- Seigniorage and The Welfare Cost of Inflation in Colombia: Martha LópezDokument16 SeitenSeigniorage and The Welfare Cost of Inflation in Colombia: Martha LópezNurita HtgNoch keine Bewertungen

- Chapter No.40Dokument6 SeitenChapter No.40Kamal SinghNoch keine Bewertungen

- Neoclassical Growth ModelDokument21 SeitenNeoclassical Growth ModelPrashantKNoch keine Bewertungen

- Capital Theory and Investment Behavior : Dale W. JorgensonDokument13 SeitenCapital Theory and Investment Behavior : Dale W. JorgensonstevenjstNoch keine Bewertungen

- No 59 PDFDokument29 SeitenNo 59 PDFeeeeeeeeNoch keine Bewertungen

- DCF Analysis and Excel FunctionsDokument10 SeitenDCF Analysis and Excel FunctionsJimmy JoyNoch keine Bewertungen

- Thomacos SeminarDokument30 SeitenThomacos SeminarLuiz VelosoNoch keine Bewertungen

- Effects of Inflation and Capital BudgetingDokument2 SeitenEffects of Inflation and Capital BudgetingKathlaine Mae ObaNoch keine Bewertungen

- Summary Ch.7 Economic GrowthDokument4 SeitenSummary Ch.7 Economic GrowthExza XNoch keine Bewertungen

- Thirlwall's Law and The Long-Term Equilibrium Growth Rate: An Application For Brazil (1951-2006)Dokument28 SeitenThirlwall's Law and The Long-Term Equilibrium Growth Rate: An Application For Brazil (1951-2006)Michael SommerNoch keine Bewertungen

- IGNOU MEC-002 Free Solved Assignment 2012Dokument8 SeitenIGNOU MEC-002 Free Solved Assignment 2012manuraj4Noch keine Bewertungen

- Capacity Utilization Measures - Berndt & MorrisonDokument6 SeitenCapacity Utilization Measures - Berndt & MorrisonMartín AlbertoNoch keine Bewertungen

- Mankiw7e CH14Dokument34 SeitenMankiw7e CH14Pablo PerezNoch keine Bewertungen

- Chapter 8Dokument7 SeitenChapter 8Andi AmirudinNoch keine Bewertungen

- SSRN Id3854965Dokument30 SeitenSSRN Id3854965pkennedyNoch keine Bewertungen

- BashirDokument6 SeitenBashirArsal GujjarNoch keine Bewertungen

- Dividend Policy TheoryDokument14 SeitenDividend Policy Theorydennise16Noch keine Bewertungen

- Slide 5Dokument38 SeitenSlide 5Shruti PaulNoch keine Bewertungen

- Economics 448: September 13, 2012Dokument18 SeitenEconomics 448: September 13, 2012ykaya11Noch keine Bewertungen

- The AK Model of New Growth Theory Is The Harrod - Domar Growth EquationDokument10 SeitenThe AK Model of New Growth Theory Is The Harrod - Domar Growth EquationAmaru Fernandez OlmedoNoch keine Bewertungen

- Dissertation UmdDokument7 SeitenDissertation UmdPayForAPaperKansasCity100% (1)

- Engeco Chap 04 - The Time Value of MoneyDokument27 SeitenEngeco Chap 04 - The Time Value of Moneyjivie300998Noch keine Bewertungen

- Assignment On Solow Growth ModelDokument12 SeitenAssignment On Solow Growth Modelmaha 709Noch keine Bewertungen

- Corporate FinanceDokument96 SeitenCorporate FinanceRohit Kumar80% (5)

- QTMDokument8 SeitenQTMKhalid AzizNoch keine Bewertungen

- Macroeconomic Impact of A Tariff Reduction: A Three-Gap Analysis With Model SimulationsDokument25 SeitenMacroeconomic Impact of A Tariff Reduction: A Three-Gap Analysis With Model SimulationsyaredNoch keine Bewertungen

- External Debt Challenges and Nigerian EconomyDokument14 SeitenExternal Debt Challenges and Nigerian EconomyBello AdoNoch keine Bewertungen

- EOQ and In#ation Uncertainty: Ira HorowitzDokument8 SeitenEOQ and In#ation Uncertainty: Ira HorowitzLivia MarsaNoch keine Bewertungen

- Asset Prices and Interest Rates: Notes To The InstructorDokument26 SeitenAsset Prices and Interest Rates: Notes To The InstructorRahul ChaturvediNoch keine Bewertungen

- Macroeconomics 2 Practice QandADokument10 SeitenMacroeconomics 2 Practice QandALaura Kwon100% (1)

- Arithmetic of Expenses by SharpeDokument8 SeitenArithmetic of Expenses by SharpeasgfNoch keine Bewertungen

- Macro Aliftia YasinDokument9 SeitenMacro Aliftia YasinAfny HnpiNoch keine Bewertungen

- C Effects QF Pernianent and Temporary Tax Policies: A Q Model of InvestmentDokument21 SeitenC Effects QF Pernianent and Temporary Tax Policies: A Q Model of Investmentbiblioteca economicaNoch keine Bewertungen

- Macro NotesDokument23 SeitenMacro NotesRiain McDonaldNoch keine Bewertungen

- A Dynamic Model of AggregateDokument27 SeitenA Dynamic Model of AggregateKristo SiagianNoch keine Bewertungen

- Marginal Efficiency of CapitalDokument9 SeitenMarginal Efficiency of CapitalAppan Kandala VasudevacharyNoch keine Bewertungen

- P T D Δ M P G X D T is real tax revenue, M is money supply, X is transfers. From this structureDokument7 SeitenP T D Δ M P G X D T is real tax revenue, M is money supply, X is transfers. From this structureGökhan DüzüNoch keine Bewertungen

- Spending (Or Aggregate Expenditure, or "Aggregate Demand") Curve Is Drawn As A Rising Line SinceDokument6 SeitenSpending (Or Aggregate Expenditure, or "Aggregate Demand") Curve Is Drawn As A Rising Line Sincealined2003Noch keine Bewertungen

- Linear GrowthDokument14 SeitenLinear GrowthPhilNoch keine Bewertungen

- Comparing Behavioural and Rational Expectations For The US Post-War EconomyDokument19 SeitenComparing Behavioural and Rational Expectations For The US Post-War Economymirando93Noch keine Bewertungen

- Vamvoukas 1997Dokument11 SeitenVamvoukas 1997wa.hamza88Noch keine Bewertungen

- Jtham@fetp - VNN.VN: Contact InformationDokument25 SeitenJtham@fetp - VNN.VN: Contact InformationPaulo CapriglioneNoch keine Bewertungen

- Barro, Sala I Martin - 1992Dokument47 SeitenBarro, Sala I Martin - 1992L Laura Bernal HernándezNoch keine Bewertungen

- High-Q Financial Basics. Skills & Knowlwdge for Today's manVon EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNoch keine Bewertungen

- Quantum Strategy II: Winning Strategies of Professional InvestmentVon EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNoch keine Bewertungen

- Capital Budgeting - SolutionDokument5 SeitenCapital Budgeting - SolutionAnchit JassalNoch keine Bewertungen

- Bài Tập Và Đáp Án Chương 1Dokument9 SeitenBài Tập Và Đáp Án Chương 1nguyenductaiNoch keine Bewertungen

- CNG SMDokument10 SeitenCNG SMSovan MangarajNoch keine Bewertungen

- Lecture06-07 Binomial Handout UpdateDokument25 SeitenLecture06-07 Binomial Handout Updatee.mahler1997Noch keine Bewertungen

- Case Analysis HP Compaq MergerDokument12 SeitenCase Analysis HP Compaq MergerSheetanshu Agarwal MBA 2016-18Noch keine Bewertungen

- (Chapter 9) : Water: A Confluence On Replenishable But Depletable ResourcesDokument17 Seiten(Chapter 9) : Water: A Confluence On Replenishable But Depletable Resourcesii muNoch keine Bewertungen

- Global Promotion StrategiesDokument4 SeitenGlobal Promotion StrategiesPatricia MumbiNoch keine Bewertungen

- Cost Accounting and Control, Budget and Budgetary Control.Dokument45 SeitenCost Accounting and Control, Budget and Budgetary Control.Bala MechNoch keine Bewertungen

- Itc WaccDokument185 SeitenItc WaccvATSALANoch keine Bewertungen

- Corona: A Situation Analysis by Matt D. NommensenDokument13 SeitenCorona: A Situation Analysis by Matt D. Nommensenapi-317836693Noch keine Bewertungen

- Full Text 01Dokument63 SeitenFull Text 01zerihunkNoch keine Bewertungen

- Statman - Behaviorial Finance Past Battles and Future EngagementsDokument11 SeitenStatman - Behaviorial Finance Past Battles and Future EngagementsFelipe Alejandro Torres CastroNoch keine Bewertungen

- Fundamental AnalysisDokument23 SeitenFundamental AnalysisAdarsh JainNoch keine Bewertungen

- Chapter 16 Homework ProblemsDokument5 SeitenChapter 16 Homework ProblemsHasanAminNoch keine Bewertungen

- BMA 12e SM CH 16 FinalDokument15 SeitenBMA 12e SM CH 16 Finalmandy YiuNoch keine Bewertungen

- BLOCK 2 Unit II Equity ValuationDokument18 SeitenBLOCK 2 Unit II Equity ValuationASHWININoch keine Bewertungen

- Statement of AccountDokument3 SeitenStatement of AccountdhruvidNoch keine Bewertungen

- Complete Notes Principles of ManagementDokument45 SeitenComplete Notes Principles of ManagementamitNoch keine Bewertungen

- Touchpoints in CRM of LICDokument7 SeitenTouchpoints in CRM of LICShahnwaz AlamNoch keine Bewertungen

- Cost Accounting Method of Costing PDFDokument2 SeitenCost Accounting Method of Costing PDFvikas sainiNoch keine Bewertungen

- CAF 3 Activity Based Costing by Sir Saud Tariq ST AcademyDokument21 SeitenCAF 3 Activity Based Costing by Sir Saud Tariq ST Academyrana hassan aliNoch keine Bewertungen

- 01 Revision Salary IncomeDokument24 Seiten01 Revision Salary IncomeUmer ArabiNoch keine Bewertungen

- CHAPTER 8 - Noncurrent Asset Held For SaleDokument19 SeitenCHAPTER 8 - Noncurrent Asset Held For SaleChristian GatchalianNoch keine Bewertungen

- L2 - ABFA1163 FA II (Student)Dokument4 SeitenL2 - ABFA1163 FA II (Student)Xue YikNoch keine Bewertungen

- Bombay Textile Mill Strike PDFDokument10 SeitenBombay Textile Mill Strike PDFPrasad BorkarNoch keine Bewertungen

- Chapter 6 Practice QuestionsDokument9 SeitenChapter 6 Practice QuestionsAbdul Wajid Nazeer CheemaNoch keine Bewertungen

- Property, Plant and Equipment: Recognition of PPEDokument6 SeitenProperty, Plant and Equipment: Recognition of PPEbigbaekNoch keine Bewertungen

- 10-1 Discussion - Reflection 7Dokument1 Seite10-1 Discussion - Reflection 7HikNoch keine Bewertungen