Beruflich Dokumente

Kultur Dokumente

The Dow, S&P 500 and NASDAQ Are Set To Challenge March Highs.

Hochgeladen von

ValuEngine.comOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Dow, S&P 500 and NASDAQ Are Set To Challenge March Highs.

Hochgeladen von

ValuEngine.comCopyright:

Verfügbare Formate

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com. ValuEngine is a fundamentally-based quant research firm in Newtown, PA.

ValuEngine covers over 7,000 stocks every day. A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks, and commentary can be found http://www.valuengine.com/nl/mainnl To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe? April 30, 2012 The Dow, S&P 500 and NASDAQ are set to Challenge March Highs. Markets in Review: Asian stocks were lower on Friday. The Nikkei 225 ended their session at 9,521 down 0.43% on

the day. The Hang Seng ended their session at 20,741 down 0.33% on the day. European exchanges closed higher. The FTSE 100 ended their session at 5,777 up 0.49% on the day. The DAX ended their session at 6,801 up 0.91% on the day. The CAC 40 ended their session at 3,266 up 1.14% on the day. The yield on the 10-Year US Treasury tested my semiannual pivot at 1.903. The Advanced reading of Real GDP for the first quarter of 2012 came in below expectations at just 2.2%. A drag was Business Investment which was down 2.1%, the first decline since Q4 2009. Gold traded as high as $1668.4 the Troy ounce still below the death cross defined by the 50-day simple moving average at $1679.3 being below the 200-day simple moving average at $1697.4. Crude oil rebounded to $105.00 per barrel to $105.00 staying below its 50day simple moving average at $105.12. The euro versus the dollar traded up to 1.3269 above its 50-day simple moving average at 1.3210. The Dow Industrial Average rallied to a high at 13,266.68 versus the March 16th high at 13,289.08. The S&P 500 traded as high as 1406.6 testing last weeks risky level with its March 27th high at 1419.15. The NASDAQs rallied to a high at 3076.44 versus the March 27th high at 3134.17.

Todays Four in Four Key Levels: 1. Yields The yield on the 10-Year US Treasury tested my semiannual pivot at 1.903. The 50-day / 200-day at 2.081 / 2.087 could confirm a Death Cross this week, which is a warning for higher yields ahead. This weeks value level is 2.186. 2. Commodities If gold stays above my semiannual pivots at $1635.8 and $1659.4 the Death Cross with the 50-day below the 200-day at $1679.3 and $1697.4 could be challenged, but lagging gold stocks should be considered a warning. Crude oil is trading around my semiannual pivot at $104.84 with the 50-day SMA at $105.12. 3. Currencies The euro versus the dollar remains above my semiannual value level at 1.2980 with my weekly pivot at 1.3180 and quarterly risky level at 1.3366. 4. Equities My overall neutral zone is between my annual pivot at 1363.2 on the S&P 500 and 836.15 on the Russell 2000. Quarterly value levels are 1337.7 SPX and 2911 NASDAQ with quarterly pivots at 12,794 Dow Industrials and 829.34 Russell 2000, and quarterly risky level at 5420 on Dow Transports. This weeks pivots / risky levels are 13,210 Dow Industrials, 1415.8 SPX, 3120 NASDAQ, 5336 Dow Transports, and 836.88 Russell 2000. My prediction remains that Dow Transports and Russell 2000 will continue to lag 2011 all time highs at 5627.85 set on July 7th and 868.57 set on May 2nd.

5. ValuEngine Valuations Stocks remains reasonably priced fundamentally with 57.4% of all stocks undervalued with six undervalued sectors and ten overvalued sectors. Aerospace is 10.1% UV, Computers & Technology 12.7% OV, Finance 11.6% OV, Medical 13.9% OV, and Retail-Wholesale 14.7% OV.

VE Morning Briefing If you want expanded analysis of the US Capital Markets go to this link and sign up: http://www.valuengine.com/nl/mainnl?nl=D

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Sbi AnalyticalDokument21 SeitenSbi AnalyticalGurjeevNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDokument6 SeitenAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNoch keine Bewertungen

- Working capital managementDokument9 SeitenWorking capital managementAbegail Ara Loren33% (3)

- Jean-Michel Basquiat Dark Milk - 031721Dokument7 SeitenJean-Michel Basquiat Dark Milk - 031721Robert Vale100% (1)

- Ffa Pilot PaperDokument21 SeitenFfa Pilot PaperSyeda Saba BatoolNoch keine Bewertungen

- SpyderDokument3 SeitenSpyderHello100% (1)

- O.M Scoott and Sons Case Study HarvardDokument6 SeitenO.M Scoott and Sons Case Study Harvardnicole rodríguezNoch keine Bewertungen

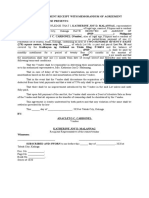

- Acknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Dokument1 SeiteAcknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Christina Pic-it BaguiwanNoch keine Bewertungen

- ValuEngine Weekly: Construction Stocks, JPMorgan Chase, Valuation Watch, and MoreDokument6 SeitenValuEngine Weekly: Construction Stocks, JPMorgan Chase, Valuation Watch, and MoreValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Finance Stocks, Horizon Pharma, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Finance Stocks, Horizon Pharma, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Tech Stocks, General Motors, and MoreDokument5 SeitenValuEngine Weekly: Tech Stocks, General Motors, and MoreValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Finance Stocks, Twitter, Valuation Watch, and MoreDokument5 SeitenValuEngine Weekly: Finance Stocks, Twitter, Valuation Watch, and MoreValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Basic Materials Stocks, Twitter, Market Valuations, Benzinga Show, and ValuEngine CapitalDokument11 SeitenValuEngine Weekly: Basic Materials Stocks, Twitter, Market Valuations, Benzinga Show, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Medical Stocks, Toyota Motor, Valuation Warning, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Medical Stocks, Toyota Motor, Valuation Warning, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalDokument6 SeitenValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Basic Materials Stocks, Raytheon, Valuation Watch, and MoreDokument6 SeitenValuEngine Weekly: Basic Materials Stocks, Raytheon, Valuation Watch, and MoreValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalDokument6 SeitenValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- December 2, 2016: Market OverviewDokument7 SeitenDecember 2, 2016: Market OverviewValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Industrial Products, Macy's, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Industrial Products, Macy's, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Oils/Energy Stocks, Deutsche Bank, Benzinga Pre-Market Prep, and ValuEngine CapitalDokument8 SeitenValuEngine Weekly: Oils/Energy Stocks, Deutsche Bank, Benzinga Pre-Market Prep, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Aerospace Stocks, JCPenney, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Aerospace Stocks, JCPenney, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Basic Materials Sector, General Electric, Valuation Study, and MoreDokument10 SeitenValuEngine Weekly: Basic Materials Sector, General Electric, Valuation Study, and MoreValuEngine.comNoch keine Bewertungen

- December 2, 2016: Market OverviewDokument7 SeitenDecember 2, 2016: Market OverviewValuEngine.comNoch keine Bewertungen

- December 2, 2016: Market OverviewDokument7 SeitenDecember 2, 2016: Market OverviewValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Construction Stocks, Mylan, Market Valuation Study, and ValuEngine CapitalDokument10 SeitenValuEngine Weekly: Construction Stocks, Mylan, Market Valuation Study, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- Ve Weekly NewsDokument7 SeitenVe Weekly NewsValuEngine.comNoch keine Bewertungen

- Ve Weekly NewsDokument8 SeitenVe Weekly NewsValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Consumer Staples Stocks, Cooper Standard, New Market Highs, and ValuEngine CapitalDokument8 SeitenValuEngine Weekly: Consumer Staples Stocks, Cooper Standard, New Market Highs, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Retail/Wholesale Stocks, Softbank, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Retail/Wholesale Stocks, Softbank, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Tech Stocks, Apple, and ValuEngine CapitalDokument8 SeitenValuEngine Weekly: Tech Stocks, Apple, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Basic Materials Stocks, UPS, ValuEngine View Results, and ValuEngine CapitalDokument8 SeitenValuEngine Weekly: Basic Materials Stocks, UPS, ValuEngine View Results, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Health Care Stocks, Tesla, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Health Care Stocks, Tesla, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Finance Stocks, FOX, Valuations, and ValuEngine CapitalDokument10 SeitenValuEngine Weekly: Finance Stocks, FOX, Valuations, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Construction Stocks, Hewlett Packard, and ValuEngine CapitalDokument7 SeitenValuEngine Weekly: Construction Stocks, Hewlett Packard, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Industrial Product Stocks, Apple, Valuations, and ValuEngine CapitalDokument11 SeitenValuEngine Weekly: Industrial Product Stocks, Apple, Valuations, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Transport Stocks, Boeing, Brexit, and ValuEngine CapitalDokument8 SeitenValuEngine Weekly: Transport Stocks, Boeing, Brexit, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- ValuEngine Weekly: Tech Stocks, Cigna, Chinese Reports, and ValuEngine CapitalDokument8 SeitenValuEngine Weekly: Tech Stocks, Cigna, Chinese Reports, and ValuEngine CapitalValuEngine.comNoch keine Bewertungen

- Impact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaDokument10 SeitenImpact of Liberalisation of The Insurance Sector On The Life Insurance Corporation of IndiaBrijbhushan ChavanNoch keine Bewertungen

- SACAP - PPE PBA Payment Certificate (March 2015)Dokument1 SeiteSACAP - PPE PBA Payment Certificate (March 2015)Ben MusimaneNoch keine Bewertungen

- Raghu Nayjas PDFDokument2 SeitenRaghu Nayjas PDFManish R ShankarNoch keine Bewertungen

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsDokument4 SeitenStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNoch keine Bewertungen

- CT1 2017Dokument1 SeiteCT1 2017Emai TetsNoch keine Bewertungen

- Fort Lauderdale Police and Fire Pension Board Investment Workshop 2009Dokument209 SeitenFort Lauderdale Police and Fire Pension Board Investment Workshop 2009Ken RudominerNoch keine Bewertungen

- Cenizabusinessplan 2Dokument68 SeitenCenizabusinessplan 2Dexterr DivinooNoch keine Bewertungen

- Finmar Outline: Chapter 1 - Intro To Financial MarketsDokument2 SeitenFinmar Outline: Chapter 1 - Intro To Financial MarketsJanice Ann MacalinaoNoch keine Bewertungen

- Analyze Financial Ratios of a CompanyDokument9 SeitenAnalyze Financial Ratios of a Companyshameeee67% (3)

- FMA-Quiz 3Dokument5 SeitenFMA-Quiz 3vishvajitjNoch keine Bewertungen

- FX Market ReflectionDokument1 SeiteFX Market ReflectionHella Mae RambunayNoch keine Bewertungen

- E-tax Acknowledgement for Form 26QB TDS SubmissionDokument1 SeiteE-tax Acknowledgement for Form 26QB TDS SubmissionVyapar NitiNoch keine Bewertungen

- Quotation for Safety ShoesDokument2 SeitenQuotation for Safety ShoesAlbert LioeNoch keine Bewertungen

- BS Delhi English 22-10-2022Dokument26 SeitenBS Delhi English 22-10-2022Relaxing MusicNoch keine Bewertungen

- Details of New Credit Ratings Assigned During Last Six Months 2011Dokument43 SeitenDetails of New Credit Ratings Assigned During Last Six Months 2011SK Business groupNoch keine Bewertungen

- Pper Walden PhiDokument3 SeitenPper Walden PhiCarlos JesenaNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountMohit SachdevNoch keine Bewertungen

- Acct Statement - XX9031 - 19032024Dokument9 SeitenAcct Statement - XX9031 - 19032024khadnan.1234Noch keine Bewertungen

- Applying International Accounting Standards Chapter 16 ConsolidationDokument6 SeitenApplying International Accounting Standards Chapter 16 ConsolidationIzzy BNoch keine Bewertungen

- Taxable Income and Tax Calculation for Starlight LimitedDokument8 SeitenTaxable Income and Tax Calculation for Starlight LimitedAlina ZubairNoch keine Bewertungen

- 1185 Chapter 6 Building Financial Functions Into ExcelDokument37 Seiten1185 Chapter 6 Building Financial Functions Into ExcelAndré BorgesNoch keine Bewertungen

- 794-10102017-Project Vijay-Vijaypath Role Manual PDFDokument53 Seiten794-10102017-Project Vijay-Vijaypath Role Manual PDFdhananjayNoch keine Bewertungen