Beruflich Dokumente

Kultur Dokumente

Hansson Report

Hochgeladen von

Fatima NazOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hansson Report

Hochgeladen von

Fatima NazCopyright:

Verfügbare Formate

Hansson Private Label, Inc: Evaluating an investment in expansion Submitted by : Fatima Naz Company Background: Hansson private limited

started in1992. Hansson purchased it at $42 million dollar. It was manufacturer of private label personal care product. It has considerable amount of 28% market share in its specific industry. The growth of HPL depends upon the growth of private label component within the industry. Private label with lower price and improving quality, offer an appealing alternative and substitute to more costly brand names. Hansson had expanded conservatively. Company had four plants all operating at more than 90 % of capacity. HPL manufacture personal care products like soap, shampoo, mouth wash, shaving cream etc. Financial performance HPLs historical financial performance has been steadily increasing for past five years. It has generated $681 million revenue in 2007. However due to high cost of goods sold company net income decreases this year. Companies total cash generated is in negative this is due to fact company had invested some of its cash into non-current assets as compare to previous years. Major Issues: One of the retail customer wanted to increase their share of private label manufacturing, due to this reason HPL have to invest 50$ million in order to accommodate their request, as most of the operating plant of HPL are already running at 90% of its capacity . However sooner or later HPL have to expand its business because companys future is in question by employees, they wanted to see change. Customer will only commit three year contracts, which is the main dilemma for Hansson, because at the end of contract fixed cost will increase if company unable to cater other retail customers. Need to determine return on investment to justify efforts and risk

May risk future opportunities of rapid growth and significant value creation by locking in strong relationship with huge powerful retailer Need to maintain debt at modest level to contain risk of financial distress in the event the company loses a big customer Analysis and Recommendation: The WACC provided by Dowling is based on historical data since Hansson has never taken an investment of such magnitude the historical data may not accurately project the future risk brought by the investment. The choice of appropriate discount rate depends upon amount of debt Hansson choses to take in addition to its internal cash to finance the project. Historical data that are available to Hansson are especially unsuitable to forecast, plus lack of experience greatly undermines Hansson management ability to forecast future cash flows and discount rate. In conclusion, this project is likely to provide large future pay out. The CEO needs to proceed with caution due to limitation on estimated sources and techniques.

Das könnte Ihnen auch gefallen

- PolarSports Solution PDFDokument8 SeitenPolarSports Solution PDFaotorres99Noch keine Bewertungen

- Hansson Private Label: Operating ResultsDokument28 SeitenHansson Private Label: Operating ResultsShubham SharmaNoch keine Bewertungen

- Case StudyDokument10 SeitenCase StudyEvelyn VillafrancaNoch keine Bewertungen

- The TOWS Matrix A Tool For Situational AnalysisDokument13 SeitenThe TOWS Matrix A Tool For Situational Analysisanon_174427911Noch keine Bewertungen

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDokument11 SeitenSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNoch keine Bewertungen

- LinearDokument6 SeitenLinearjackedup211Noch keine Bewertungen

- Hanson CaseDokument14 SeitenHanson CaseSanah Bijlani40% (5)

- Blaine Kitchenware Inc PDFDokument13 SeitenBlaine Kitchenware Inc PDFpatriciolivares3009Noch keine Bewertungen

- World Wide Paper CompanyDokument2 SeitenWorld Wide Paper CompanyAshwinKumarNoch keine Bewertungen

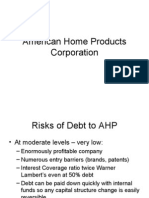

- American Home Products CorporationDokument7 SeitenAmerican Home Products Corporationpancaspe100% (2)

- Heinz Case SolutionDokument4 SeitenHeinz Case SolutionNischal Upreti0% (2)

- Panera BreadDokument23 SeitenPanera BreadtomNoch keine Bewertungen

- Equity - Valuation Introduction PDFDokument17 SeitenEquity - Valuation Introduction PDFhukaNoch keine Bewertungen

- Hansson Private Label - FinalDokument34 SeitenHansson Private Label - Finalincognito12312333% (3)

- Hansson PLDokument14 SeitenHansson PLdenden007Noch keine Bewertungen

- Hospital Supply Chain ManagementDokument39 SeitenHospital Supply Chain ManagementFatima Naz0% (1)

- Hansson Private Label FinalDokument13 SeitenHansson Private Label Finalrohan pankar67% (3)

- Case Hansson Private LabelDokument15 SeitenCase Hansson Private Labelpaul57% (7)

- Buckeye Bank CaseDokument7 SeitenBuckeye Bank CasePulkit Mathur0% (2)

- Butler Lumber CompanyDokument4 SeitenButler Lumber Companynickiminaj221421Noch keine Bewertungen

- 800 Power WordsDokument18 Seiten800 Power WordsSheryll ZamoraNoch keine Bewertungen

- Diageo RefenceDokument7 SeitenDiageo RefenceKenny HoNoch keine Bewertungen

- Hansson Private Label Case SolutionDokument3 SeitenHansson Private Label Case SolutionTracy PhanNoch keine Bewertungen

- DuPont QuestionsDokument1 SeiteDuPont QuestionssandykakaNoch keine Bewertungen

- Flash Memory IncDokument3 SeitenFlash Memory IncAhsan IqbalNoch keine Bewertungen

- Hansson Private LabelDokument4 SeitenHansson Private Labelsd717Noch keine Bewertungen

- American Home ProductsDokument6 SeitenAmerican Home Productsabhinav_capoor0% (1)

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Dokument30 SeitenTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaNoch keine Bewertungen

- Hansson PL CaseDokument11 SeitenHansson PL CaseJavierAdimir Huaman UscataNoch keine Bewertungen

- Investment Analysis Polar Sports ADokument9 SeitenInvestment Analysis Polar Sports AtalabreNoch keine Bewertungen

- SpyderDokument3 SeitenSpyderHello100% (1)

- Hannson Private Label VFDokument9 SeitenHannson Private Label VFAugusto Peña ChavezNoch keine Bewertungen

- Hansson Case AnalysisDokument6 SeitenHansson Case AnalysisKp Porter57% (7)

- Assignment 8 - W8 Hand in (Final Project)Dokument3 SeitenAssignment 8 - W8 Hand in (Final Project)Rodrigo Montechiari33% (6)

- Airthread Connections Case Work SheetDokument45 SeitenAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Welcome To Our PresentationDokument38 SeitenWelcome To Our PresentationTamanna ShaonNoch keine Bewertungen

- HPL CaseDokument2 SeitenHPL Caseprsnt100% (1)

- ACFINA2 Case Study HanssonDokument11 SeitenACFINA2 Case Study HanssonGemar Singian50% (2)

- HANSSON CASE Individual AssignmentDokument2 SeitenHANSSON CASE Individual AssignmentWawerudasNoch keine Bewertungen

- Harvard CaseDokument9 SeitenHarvard CaseGemar Singian0% (2)

- Donna Dubinsky CaseDokument9 SeitenDonna Dubinsky CaseFatima NazNoch keine Bewertungen

- Polar SportsDokument15 SeitenPolar SportsjordanstackNoch keine Bewertungen

- HBR Hannson Final Case AnalysisDokument5 SeitenHBR Hannson Final Case AnalysisTexasSWO75% (4)

- Hanson CaseDokument7 SeitenHanson CaseLe PhamNoch keine Bewertungen

- AMERICAN HOME PRODUCTS CORPORATION Group1.4Dokument11 SeitenAMERICAN HOME PRODUCTS CORPORATION Group1.4imawoodpusherNoch keine Bewertungen

- Polar SportsDokument7 SeitenPolar SportsShah HussainNoch keine Bewertungen

- Coursehero 40252829Dokument2 SeitenCoursehero 40252829Janice JingNoch keine Bewertungen

- Dynashears Inc CaseDokument4 SeitenDynashears Inc Casepratik_gaur1908Noch keine Bewertungen

- Case #7 Butler LumberDokument2 SeitenCase #7 Butler LumberBianca UcheNoch keine Bewertungen

- Sneaker Excel Sheet For Risk AnalysisDokument11 SeitenSneaker Excel Sheet For Risk AnalysisSuperGuyNoch keine Bewertungen

- Spyder Active SportsDokument12 SeitenSpyder Active SportsShubham SharmaNoch keine Bewertungen

- Hospital Corporation of AmericaDokument16 SeitenHospital Corporation of AmericaDhruv Kalia50% (2)

- What Can The Historical Income StatementsDokument3 SeitenWhat Can The Historical Income Statementsleo147258963100% (2)

- Blaine SolutionDokument4 SeitenBlaine Solutionchintan MehtaNoch keine Bewertungen

- Radent Case QuestionsDokument2 SeitenRadent Case QuestionsmahieNoch keine Bewertungen

- Case Analysis - Compania de Telefonos de ChileDokument4 SeitenCase Analysis - Compania de Telefonos de ChileSubrata BasakNoch keine Bewertungen

- Strategic ManagementDokument9 SeitenStrategic ManagementdiddiNoch keine Bewertungen

- FBE 529 Lecture 1 PDFDokument26 SeitenFBE 529 Lecture 1 PDFJIAYUN SHENNoch keine Bewertungen

- Nestle and Alcon - The Value of ADokument33 SeitenNestle and Alcon - The Value of Akjpcs120% (1)

- Hansson Private LabelDokument3 SeitenHansson Private LabelcesarNoch keine Bewertungen

- PESTEL Analysis of The Rise and Fall of BlackberryDokument4 SeitenPESTEL Analysis of The Rise and Fall of BlackberryVino DhanapalNoch keine Bewertungen

- Making Capital Structure Support StrategyDokument10 SeitenMaking Capital Structure Support StrategyAnggitNoch keine Bewertungen

- Accounts Project ReportDokument30 SeitenAccounts Project ReportkandysuchakNoch keine Bewertungen

- Case1 PWCDokument4 SeitenCase1 PWCryuryuryu2Noch keine Bewertungen

- 2012 Pioneer Bank Pre-Reading 1 - LOP v2 PDFDokument8 Seiten2012 Pioneer Bank Pre-Reading 1 - LOP v2 PDFjoe2605Noch keine Bewertungen

- Lady Gaga CaseDokument9 SeitenLady Gaga CaseFatima NazNoch keine Bewertungen

- Book ReviewDokument5 SeitenBook ReviewFatima NazNoch keine Bewertungen

- VLOOKUP Challenges: Challenge #1: What Is Amount Payable After Quantity Discount?Dokument6 SeitenVLOOKUP Challenges: Challenge #1: What Is Amount Payable After Quantity Discount?Saad UsmanNoch keine Bewertungen

- Sustainability 14 06644 v2Dokument17 SeitenSustainability 14 06644 v2Woeri AyuNoch keine Bewertungen

- Marketing Plan Presentation FINALDokument53 SeitenMarketing Plan Presentation FINALAmiel Carreon0% (1)

- Business Development Manager Job DutiesDokument6 SeitenBusiness Development Manager Job DutieszahidNoch keine Bewertungen

- MMPC 12 FinalDokument64 SeitenMMPC 12 FinalThe AristocratNoch keine Bewertungen

- DPB10013 - Microeconomics End of Chapter 2 (Clo2C) December 2020 Session Instruction: Answer All The Questions. Good LuckDokument2 SeitenDPB10013 - Microeconomics End of Chapter 2 (Clo2C) December 2020 Session Instruction: Answer All The Questions. Good LuckAmellia MaizanNoch keine Bewertungen

- RAY and SAYER. Culture and Economy After Cultural TurnDokument19 SeitenRAY and SAYER. Culture and Economy After Cultural TurnBruno Gontyjo Do CoutoNoch keine Bewertungen

- Chapter #1Dokument4 SeitenChapter #1Vivek KavtaNoch keine Bewertungen

- Innovation in Services: A Literature Review " ": Rabeh MorrarDokument9 SeitenInnovation in Services: A Literature Review " ": Rabeh Morrarayenarah lopezNoch keine Bewertungen

- Delivering Customer Value Individual Assignment: BM0009-3-2-DCVDokument14 SeitenDelivering Customer Value Individual Assignment: BM0009-3-2-DCVAseel AbubakrNoch keine Bewertungen

- The Dar Es Salaam Stock ExchangeDokument12 SeitenThe Dar Es Salaam Stock ExchangeMsuyaNoch keine Bewertungen

- Fin Mar Module 2 and Ass.Dokument28 SeitenFin Mar Module 2 and Ass.hellokittysaranghaeNoch keine Bewertungen

- The Harshad Mehta ScamDokument31 SeitenThe Harshad Mehta ScamShraddha SakharkarNoch keine Bewertungen

- Methodology SP Equity Indices Policies PracticesDokument65 SeitenMethodology SP Equity Indices Policies PracticesAndrew KimNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ajay Gupta0% (1)

- Bon Appetea Review On Related LiteratureDokument6 SeitenBon Appetea Review On Related LiteratureDessa VamentaNoch keine Bewertungen

- Money and Banking Cpa1Dokument19 SeitenMoney and Banking Cpa1kirwanicholasNoch keine Bewertungen

- Strategic Management in Action: 1. Using The Eight Conditions, Assess The Level of Current Rivalry in This Industry?Dokument2 SeitenStrategic Management in Action: 1. Using The Eight Conditions, Assess The Level of Current Rivalry in This Industry?ziiriinmohazNoch keine Bewertungen

- Running Head: Integrated Marketing Plan of Oyo Rooms 1Dokument14 SeitenRunning Head: Integrated Marketing Plan of Oyo Rooms 1Duong Trinh MinhNoch keine Bewertungen

- Lecture Slides ECON861 - Week 2Dokument78 SeitenLecture Slides ECON861 - Week 2taranpreetNoch keine Bewertungen

- 2022 Level I IFT Study PlannerDokument29 Seiten2022 Level I IFT Study PlannerBəhmən OrucovNoch keine Bewertungen

- Business Notes IB HLDokument28 SeitenBusiness Notes IB HLVicente DebhardNoch keine Bewertungen

- SAMPLE - Depreciation Problems AnswersDokument2 SeitenSAMPLE - Depreciation Problems AnswersSheinna Mae Von CalupigNoch keine Bewertungen

- 01 Cohen Ch01Dokument24 Seiten01 Cohen Ch01Sukayna AmeenNoch keine Bewertungen

- Entrepreneurship by Robert D Hisrich, Entrepreneurship by Robert D Hisrich, Michael P Peters, Dean A Shepherd Michael P Peters, Dean A ShepherdDokument40 SeitenEntrepreneurship by Robert D Hisrich, Entrepreneurship by Robert D Hisrich, Michael P Peters, Dean A Shepherd Michael P Peters, Dean A ShepherdSubheesh S Anand100% (1)

- Mankiw8eSM Macro Chap13 124 146Dokument23 SeitenMankiw8eSM Macro Chap13 124 146Erjon SkordhaNoch keine Bewertungen

- Capital Markets Research in Accounting: S.P. KothariDokument10 SeitenCapital Markets Research in Accounting: S.P. Kothariilham doankNoch keine Bewertungen