Beruflich Dokumente

Kultur Dokumente

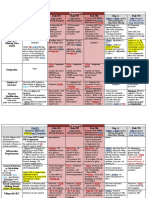

Secreg - Gun Jumping Exam Sheet

Hochgeladen von

Raj VashiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Secreg - Gun Jumping Exam Sheet

Hochgeladen von

Raj VashiCopyright:

Verfügbare Formate

1

PRE-FILING PERIOD

IN REGISTRATION?

SEC: I is in registration at least from the time an I reaches an

understanding w/ the B-D which is to act as managing UW [before]

the filing of a RS

can go in registration earlier if it starts active selling efforts for

offering before locating lead UW

WHAT IS AN OFFER?

2(a)(3) of S.A.: offer includes every offer and solicitation of an

offer to buy a security for value

Broad def necessary to control abuses and further goal to slow

selling process to give investors time to digest info

communications that condition the public mind or arouse

public interest in the particular securities may undermine

that goal [In the Matter of Carl M. Loeb, Rhoades]

Even if the info is news, can still be offer (frenzy)

S.A. Release No. 3844: conditioning the public mind includes: O

UW mailing bunch of brochures w/ positive info abt the Is industry

w/out mentioning either I or upcoming pub offering; O UW

sending press release containing reps, forecasts, & quotations which

cld not have been supported as reliable data (soft fwd-looking info)

fwd looking info difficult to verify; can mislead investors

S.A. Release No. 5180: SEC downplayed conflict faced by E.A.

reporting Is: Is can respond to legit inquiries but initiating

publicity while in registration is problematic

permissible: O ads, O periodic reports, O proxy statements,

and O answers to unsolicited inquiries

does not include soft fwd-looking info and opinions

concerning values

Above 3 outline key factors informing definition of offer:

O motivation of comm; O type of info, esp soft fwd-looking info; O

breadth and form of comm (i.e., written); O whether the UW is

mentioned by name (or other facts abt the offering

RULE 163A: 30-DAY COOL-OFF SAFE HARBOR

WHO: All Is (no UW or D)

FUNCTION: provides safe harbor from app of 5(c) for any comm

made by/on behalf of an I up to 30 days prior to filing RS

Doesnt bring comms covered by exemption w/in 12(a)(2)

CONDITIONS: O communication may not refer to the securities

offering [163A(a)]; O I must take reasonable steps to ensure that

further distribution or publication of the communication doesnt

occur during the 30 days immediately prior to the filing of the RS

[163A(a)]

RULE 163: WKSI SAFE HARBOR

WHO: WKSIs only (no UW or D)

FUNCTION: excludes written and oral communications from

definition of offer under 5(c),

BUT: written comms are deemed FWPs and prospectuses under

2(a)(1) relating to a pub offering R 10b-5 and 12(a)(2) private

antifraud liability still attach

CONDITIONS: O written comm must include a specific legend

[163(b)(1)]; O must file written comm w/ SEC promptly after the

filing of the RS [163(b)(2)]

RULE 135: NOTICE OF OFFERING

WHO: all Is, selling security holders (e.g., insiders), and those acting

on behalf of either

FUNCTION: excludes comms from def. of offer under 5(c), and

thus from the def. of a prospectus under 2(a)(10) 5(b)(1) no

longer prohibits the comm in the waiting/post-effective periods and

12(a)(2) antifraud liability doesnt apply

to publish a notice on the proposed pub. offg (exempts notice from

def of offer under 5)

CONDITIONS: O legend: reqs a mandatory indicating stmt offer

[135(a)(1)]; O limited notice content: (a) name of I, (b) title,

amount, and basic terms of the securities, (c) the amount of the

offering to be made by selling security holders (i.e., selling insiders),

and (d) a brief statement of the manner and purpose of the offering

permissible: name of UW [135(a)(2)]

RULE 169: NON-REPORTING ISSUER SAFE HARBOR

WHO: All Is (no UW or D)

FUNCTION: excludes communications from definition of offer

under 5(c), and thus from the definition of a prospectus under

2(a)(10) 5(b)(1) no longer prohibits the comm in the

waiting/post-effective periods and 12(a)(2) antifraud liability doesnt

apply

Takeaway: most non-EA reporting Is can continue the regular

release of factual business info only in the Pre-Filing, Waiting, and

Post-Effective periods.

CONDITIONS:

O only factual business info permitted [169(a)],

factual biz info includes [169(a)], where factual biz info

includes: C factual info about the I, its bus or fin developments,

or other aspects of its bus; and C ads of, or other info about, the

Is products or services [169(b)(1)]

O Doesnt permit disclosure of info about the public offering, nor

can such disclosure be a part of the offering activities [169(c)]

O Info must be regularly released or disseminated [169(a)], and

the I must have previously released or disseminated the same type of

info in the ordinary course of biz [169(d)(1)]

O The timing, manner, and form of the info must be consistent in

material respects w/ similar past releases [169(d)(2)]

O Employees of the I or the Is agents who have historically provided

such info must release or disseminate the info to persons other than

in their capacities as investors (i.e., as customers and suppliers)

[169(d)(3)]

RULE 168: REPORTING ISSUER SAFE HARBOR

WHO: EA reporting Is only (& those working on behalf); no UW or D

FUNCTION: excludes communications from definition of offer

under 5(c), and thus from the definition of a prospectus under

2(a)(10) 5(b)(1) no longer prohibits the communication in the

waiting/post-effective periods and 12(a)(2) antifraud liability doesnt

apply

Takeaway: most EA reporting Is can continue the regular release of

factual business info and fwd-looking info in the P-F, W, and P-

E pds

CONDITIONS:

O only factual bus or fwd-looking info are permitted [168(a)]

factual bus info includes [168(b)(1)]: C factual info abt the I, its

bus or financial developments, or other aspects of its bus; C ads

of, or other info abt, the Is products/services; C dividend

notice; and C anything in E.A. reporting filings

fwd-looking info includes [168(b)(2)]: C projections of the Is

revenues, income (loss), earnings (loss) per share, capital

expenditures, dividends, capital structure, or other fin items;

C statements about the I managements plans and objectives for

future ops, including plans or objectives relating to the

products/services of the I; C statements about the Is future

econ performance, including statements of the type

contemplated by the mgmts discussion & analysis of fin

condition & results of operation; and C assumptions

underlying or relating to any info described in above 3

O Doesnt permit disclosure of info about the pub offering, nor

can such disclosure be a part of the offering activities [168(c)]

O Info must be regularly released or disseminated [168(a)], and

the I must have previously released or disseminated the same type of

info in the ordinary course of biz [168(d)(1)]

O The timing, manner, and form of the info must be consistent in

material respects w/ similar past releases [168(d)(2)]

2

WAITING PERIOD

RULE 134: TOMBSTONE ADS /SOLICITATIONS OF INT.

WHO: all Is and UWs

FUNCTION: excludes communications (notices announcing

public offerings) from the definition of a prospectus under

2(a)(10) excludes communications from the prohibition of

5(b)(1)

also excludes communication from definition of a FWP under

Rule 405

Reg FD: Rule 100(b)(2)(iv)(E) of Reg FD exempts Rule 134

comms selective disclosure OK

CONDITIONS:

O the comm cant occur before filing RS w/ SEC

O exclusive list of permissible disclosure categories: legal

identity and biz location of I, title and price of the securities and

amt being offered, the general type of bus of the I, the intended

use of the proceeds, the type of UW-ing, the names of the UWs,

the schedule of the offering inclg description of marketing

events like road show, and the procedures the UWs will use to

conduct the offering;

O mandatory disclosure of specified legend and contact info

for those interested in obtaining a written 10 prospectus

[134(b)]

mandatory discl not reqd if [134(c)]:

O info contained in R134 notice is limited to only

contact info for those seeking to obtain a 10 prospectus

(and the web address for the prospectus), the type of

security, the price, and by whom orders will be

executed; or

O if the written comm is accompanied (hyperlink OK

[134(f)]) or preceded by a 10 prospectus);

O allows solicitation of offers to buy from investors [Rule

134(d)], but:

O there must be a specified legend (except for Ds being

solicited), and

O the solicitation must be preceded or accompanied by a

10 prospectus, including a price range if reqd by rule

(active hyperlink OK [134(f)]

RULE 430: PRELIMINARY PROSPECTUS

WHO: all Is and UWs

FUNCTION: can use preliminary prospectus prior to effective

date

Preliminary prospectus: must contain all the same info reqd by

a 10(a) final prospectus, but can omit price and price-related

(i.e., UW discount) info

Note: EA reporting Is may use a R431 summary prospectus

during the waiting period, but few do

RULE 405: FWP DEFINITION

R405 defines a FWP expansively to include written comms that

offer for sale a security subj to a RS, even if the comms dont

qualify as a 10 statutory prospectus

written comms: written, printed, broadcast, graphic comms

and indirect coms through media (i.e., interviews given by corp

officers)

RULE 164: FREE-WRITING PROSPECTUSES

WHO: I or OP, inclg UW or D, may use FWP after filing RS

FUNCTION: a FWP meeting the reqs of Rule 433 is treated as a

10(b) prospectus for purposes of 5(b)(1) [164(a)]

Note: FWPs falling under 433 both are prospectuses and are

specifically deemed to be public [433(a)] 12(a)(2)

antifraud liability applies

Curing: Rule 164 provides cure provisions for immaterial or

unintentional failures to meet: O the filing reqs of Rule 433

[164(b)]; O the legend req of Rule 433 [164(c)]; and O the

record retention req of Rule 433 [164(c)]

Must act in G.F. and w/ reas care and must cure mistake by

filing FWP as soon as practicable after discovering failure to

file

CONDITIONS:

O R433 applies only after filing RS containing a prospectus

meeting reqs of 10 [433(b)(1)]

if IPO I prospectus must contain price range for offering

[433(b)(2)]]

O Prospectus delivery requirements on certain Is [433(b)]

WKSIs and seasoned issuers that qualify for Form S-3

no delivery req

Non-reporting and unseasoned issuers: offering

participants transmitting a FWP must ensure that a 10

prospectus precedes or accompanies the communication

[433(b)(2)(i)]

Delivery req removed if a 10 prospectus has already

been provided, as long as no material difference from

current 10 prospectus [433(b)(2)(i)]

A 10(b) prelim prosp may be used to satisfy delivery

req only in waiting pd.; once 10(a) prosp becomes

available in post-effective pd., OPs must transmit the

10(a) final prospectus with or preceding the FWP to

meet req [433(b)(2)(i)]

Delivery of most recent 10 prosp through active

hyperlink OK [Note to 433(b)(2)]

O FWP information restrictions

Cant contain info that conflicts w/: O info in the RS; O

the 10 prospectus (or any prospectus supplement part of

the R.S.); or O any info in the Is periodic and current

reports filed w/ SEC under 13 or 15(d) of E.A [433(c)(1)]

Must include a specified legend and e-mail for use by those

interested in obtaining the statutory prospectus/base

prospectus and other docs filed by I w/ SEC (optionally: Is

web site or other site where docs can be found) [433(c)(2)]

O Filing req w/ SEC: FWP must be filed no later than the date of

first use [433(d)]

Issuers face most comprehensive filing req: must file all I

FWPs [433(d)(1)(i)(A)], which is defined to include those

FWPs prepared by or on behalf of the I or used or referred

to by an I: [433(h)]

Is must file any I info contained in FWP prepared by or

on behalf of any other OP (i.e., UW) [433(d)(1)(i)(B)]

UNLESS: info was previously filed w/ the SEC

[433(d)(4)]

BUT: info that the other OP generates based on the

I-supplied info is not included w/in the scope of I

info (i.e., UW projections based on financial #s

provided by I)

I must file a FWP containing a description of the final

terms of the Is securities in the offering

[433(d)(1)(i)(C)]

I has until 2 days of the later of the date such final

terms have been estd for all classes and the date of

first use to file [433(d)(5)]

Offering participants (other than I) must file their FWPs

w/ SEC, but only if distributed in a manner reasonably

designed to lead to its broad unrestricted dissemination

[433(d)(1)(ii)]

Exceptions: Is and other OPs dont need to file a new FWP

when it does not contain substantive changes from a

previously filed FWP [433(d)(3)]

Special filing rules for electronic road shows

Is transmitting pre-recorded versions of an electronic

roadshow (considered graphic comm) may qualify for

FWP treatment under 433 even if didnt file w/ SEC

BUT: non-reporting Is registering common

equity/convertible equity must file roadshows that

qualify as written comms w/ SEC unless the I makes

a bona fide version available w/out restriction

[433(d)(8)]

O Retention requirement: If an I or other OP doesnt file the

FWP w/ SEC, the I/OP must retain all non-filed FWPs for 3y

following the initial bona fide offering of the secs [433(g)]

RULE 433(F): SPECIAL REGIME FOR MEDIA FWPS

Media sources that publish or distribute a FWP w/ offering info

provided by the I or any person participating in the offering are

potentially exempt through R433(f) from the prospective

delivery req for unseasoned/non-reporting Is

If 433(f) is complied with the I or OP is deemed to stisfy the

filing [R433(d)] and legend [R433(c)(2)] requirements

Conditions on I or OP: O the media source cant be

compensated by the I or OP [433(f)(1)(i)] and O the I or OP

files w/ SEC the media comm w/ the R433(c)(2) legend w/in 4

bus days of becoming aware of the publication/dissemination of

the media comm or files all the materials provided to the media

including transcripts of interviews [R433(f)(2)(ii)]

Only applies if info is provided/authorized/appvd by an

I/OP for use by a media source

media source: in bus. of pubg, radio/TV bcasting, or

otherwise disseminating written comm

Excused from filing if the substance of the communication was

already filed w/ the SEC [R433(f)(2)(i)]

3

POST-EFFECTIVE PERIOD

GENERAL

5(b)(1): still blocks all prospectuses that dont satisfy 10

Rules 430A P, 431 Summary P, 433 FWP, 10(a) Final P all

satisfy

2(a)(10)(a) removes TFW from the def. of a prospectus in

the P-E pd. as long as preceded/accompanied by a 10(a)

final statutory prospectus

5(b)(2): prohibits the transmission of securities for sale unless

preceded or accompanied by a 10(a) prospectus

10(a) Final Prospectus only

TRADITIONAL FREE-WRITING

FUNCTION: potentially includes all written or broadcast

offering materials which would otherwise be a prospectus not

complying with 10(a)

2(a)(10)(a) removes TFW from def. of a prospectus in the P.E.

pd as long as preceded/accompanied by a 10(a) final

prospectus.

No legend, filing, or record retention reqs for TFW under

2(a)(10)

WKSIs and seasoned Is dont have a prospectus delivery req

for FWPs under 433(b)(1) so that might be more attractive

for them

PROSPECTUS DELIVERY REQUIREMENT

5(b)(2): reqs a 10(a) final prosp precede or accompany the

transmission of securities for sale through an instrument of

interstate commerce

BUT, 2(a)(10) defines a written confirmation of sales a s a

prospectus, but it is not a 10(a) or 10(b) prospectus

sending confirmation alone would violate 5(b)(1)

To get around this, Is use the TFW exemption from

prospectus status and precede or accompany the written

confirmation w/ a 10(a) final statutory prospectus

Brokers: Bs participating in an offering for non-reporting Is

must send a copy of the preliminary prospectus at least 48hrs

prior to sending the sales confirmation [Rule 15c2-8(b)]

ratl: final prospectus does little good to an investor w/ the

confirmation of the sale

Is and OPs can use R164, 433, or the 2(a)(10)(a) (TFW)

exemption to distrib. selling docs

RULE 430A PROSPECTUS

Allows Is to go effective w/ a RS that contains a form of

statutory prospectus that omits price info

Meets req for 10 for 5(b)(1), but cant be used as a 10(a)

final prospectus for other purposes

Can only be used for all-cash offerings

Also applies to RSs that are immediately eff. upon filing w/

SEC pursuant to R462(e) & (f) (shelf reg.)

Must eventually file price info w/ SEC

< 15 bus days after eff. date of RS, no post-effective am

nec; can file prospectus w/ price info under 424(b)(1)

Item 512(i): price info deemed part of RS as of original

effective date

> 15 bus days, info must be filed as post-effective am to RS

Item 512(i): each post-effective amend that contains a

form of prospectus deemed to be new RS relating to

offered securities

I has 2 bus days after earlier of: O the date of determination of

offering price, or O date it first used after effectiveness to file

10(a) containing info previously omitted pursuant to 430A

[424(b)(1)]

PROSPECTUS DELIVERY EXEMPTIONS

4(1): exempts any trans not involving an I, UW, or D

ordinary 2dary mkt trans executed w/ assistance of a B OK,

even though Bs are Ds.

4(3): exempts securities Ds from 5

4(3) not available for Ds who continue to act as UW for

a pub offering or who are selling part of an unsold allotment

of securities in a pub offering

Blackout Period: Ds are exempt as long as their trans dont

take place during a blackout period that extends for x days

from the eff. date or the first date on which the securities

were bona fide offered to the pub, whichever is later

Rule 174 defines blackout length based on type of I:

0d: I already a pub reporting co. [174(b)]

25d: Is securities will be listed on a registered natl

sec ex or included in certain electronic interdealer

quotation systems [174(d)]

40d: I doing seasd off & doesnt meet 174(b)/(d)

90d: I engaged in IPO & doesnt meet 174(b)/(d)

Within these time periods, Ds including those not

participating in the offering face a prospectus delivery

req

4(4): exempts Bs participating in an unsolicited Bs trans

from the prospectus deliver req

Helps Bs still working with IBs that are acting as UWs

ACCESS EQUALS DELIVERY

Rule 172: exempts written confirmations of sales from 5(b)(1)

[172(a)] and from 5(b)(2) [172(b)]

effectively eliminates prospectus delivery req for O

transmission of written sales confirmation and notices of

allocation of secs [172(a)]; and O securities for sale [172(b)]

Conditions:

O RS must be effective and not subject to any proceeding or

examination under 8(d)/(e) [172(c)(1)]

O None of the Is, UWs, or participating Ds may be subject

to a proceeding under 8A (which provides for SEC cease-

and-desist proceedings) [172(c)(2)]

O The I must file a 10(a) statutory prospectus w/ the SEC

or make a g.f. & reasonable effort to file w/in the time pd.

specified in Rule 424

If time period exceeded, I must file the prospectus as

soon as practicable [172(c)(3)]

Doesnt apply to for Ds in trans reqg delivery pursuant

to 4(3) [172(c)(4)]

presumably for Ds not acting as UWs in offering

Rule 173(a): during the prosp. delivery time pd. (as defined by

4(3) and R-174), the UWs and Ds selling in trans repg a sale by

the I or UW must incl a notice that sale is pursuant to a RS if a

statutory prosp. wld have been delivered but for R172

If no UW/D involved in trans, I must supply the notice [173(b)]

Failure to comply doesnt impair ability to rely on R172 access =

delivery [173(c)] & doesnt cause 12(a)(1) liab under 5 [But,

SEC enforcement action possible]

4

UPDATING IN POST-EFFECTIVE PERIOD

RS must be accurate only as of the effective date of the offering

Statutory prospectus must be accurate each time its delivered

Only when the I files the prospectus w/ the SEC (pursuant

to R-424(b)) is the info reincorporated into the RS

(resulting in a new effective date for the R.S.)

UPDATING THE STATUTORY PROSPECTUS

When must a statutory prospectus be updated?

O After 9 mo from the effective date of the R.S., the

statutory prospectus may not contain info more than 16 mo

old so far as such info is known to the user of such

prospectus or can be furnished by such user w/out

unreasonable effort or expense. [10(a)(3)]

duty implicated only if statutory prospectus sill in use

OThe prospectus must be accurate at all times since sales

occur during the prospectus delivery period

otherwise, exposed to 10b-5 or 12(a)(2) liability -> if

info changes materially, the I will at min. sticker the

corrected info onto the prospectus

A grossly misleading prospectus could (debated) violate delivery

req of 5, creating liab under 12(a)(1) [Manor Nurse]

Stickering: info added to prospectus w/out updating RS

UPDATING THE REGISTRATION STATEMENT

RS must be accurate as of its eff date b/c of 11 and 10b-5 liab

SEC may issue stop order under 8(d) if RS contains material

misrepresentations at time of eff date

2 major exceptions to gen rule tof no duty to update the RS

O Is using a Rule 415 shelf registration must include an

Item 512(a) undertaking pursuant to Reg S-K

see below for more info

O In certain circumstances, if I updates the prospectus, the

I also must also file that updated prospectus w/ SEC

Prospectus must be filed if has substantive change

from or addition to the info in previously filed

prospectuses [424(b)(3)]

substantive unclear, but > mere materiality

E.g., change in control/CEO, restatement of past

financials, events that wld req an 8-K

If non-subst, can sticker w/out new SEC filing

Huge consequences: info filed w/ SEC pursuant to

424(b) is deemed part of RS for 11 antifraud liability

ANALYSTS

Research reports: written comm that includes info,

opinions, or recs w/ respect to securities of an I or an analysis of

a security of an I [137(e), 138(d), 139(d)]

Dont forget: can try to fall under FWP!

FINRA quiet periods (see p. 438)

Rule 137: safe harbor for B-Ds not participating in the offering

Can take advantage of 4(3) exemption from 5 if: O the D

is not an UW; O the pub or distro of research didnt take

place during prospectus delivery req period defined in

4(3)/174; and O research report done in reg course of its

biz

Rule 138: provides limited safe harbor for E.A. reporting Is

only, exempting research reports of participating B-Ds from def

of offer for sale for purposes of 2(a)(10) and 5(c)

Can offer opinion on 1 group of conver/nonconvert even tho

I is offering to the other group

B-D must have previously pubd research on same type of

securities in regular course of biz [138(a)(3)]

Rule 139: directly protects B-D opinions from 5(b) and 5(c)

I-specific reports: only Is eligible for S-3 purusant to $75m

float or investment grade secs provisions are eligible

[139(a)(1)(i)]

must be part of reg course of its biz and not after lapse

Industry reports: all reporting Is eligible, but > research

limits: O report must incl similar info wrt a substantial #

of Is in the Is indus or sub-indus, or... a comprehensive list

of secs currently recd by the B or D [139(a)(2)(iii)];

O cant devote materially greater space or prominence to I

[139(a)(2)(iv)]; and O must pub reports in reg course of its

biz and at the time of pub incl similar info abt the I or its

secs in similar reports [139(a)(2)(v)]

ISSUERS

Form S-1: available to all Is; most comprehensive of the

disclosure docs and contains all 3 categories of disclosure

(trans-related info, co. info, exhibits and undertakings)

S-1 Is that are E.A. reporting Is and current in filings for

past 12 mo (among other reqs) may incorporate co-related

info by reference from previous SEC filings

Form S-3: available to domestic Is that have, among other

situations, been a reporting co. for 1 yr, are current in their SEC

filings, and have over $75m of voting and non-voting common

equity in hands of non-affiliates

$75m float req waived if selling <33% of its equity in

primary offering

cant apply this S-3 eligibility to other SEC rules/regs!

S-3 Is that meet above reqs can also incorporate subsequent

SEC filings after RS is declared effective

Non-Reporting Issuer: I that is not reqd to file reports

pursuant to 13 or 15(d) of the E.A. and is not filing such

reports voluntarily

Unseasoned Issuer: I that is red to file reports pursuant to 13

or 15(d) of the E.A., but it does not satisfy the reqs of Form S-

3 for a primary offering of its securities

Seasoned Issuer: I that is eligible to use Form S-3 to register

primary offerings of securities

primary offerings: securities to be sold by I or on its behalf,

on behalf of its sub, or on behalf of a person of which it is

the sub

WKSI: defined in Rule 405, principal reqs are:

eligible to register a primary offering of its secs on S-3

I, as of date w/in 60 days of the det date, has either:

min $700m common equity worldwide mkt value held

by non affiliates; or

issued $1b aggregate principal amnt of non-convertible

securities in registered offerings during the past 3 years

if eligible for S-3 b/c of $75m float, can also issue

common equity as a WKSI

Disqualified if: O not current in E.A. filings or late in in

preceding 12 mo.; O an ineligible I or asset-backed-I (in

past 3 years were blank check/shell co., issued a registered

penny stock, filed a BK petition, violated anti-fraud

provisions of fed securities laws; or O an investment co. or

biz devt co.

determination date: date the Is most recent shelf RS was

filed, or its most recent 10(a)(3) amendment to a shelf RS,

whichever is later

if no shelf RS, then date of filing of most recent annual report

on Form 10-K

5

SHELF REGISTRATION

6(a): a R.S. shall be deemed effective only as to the securities

specified therein as proposed to be offered

6(a) prohibits Is from registering securities not intended to

be offered immediately or in the near future, but precise

time limit on sale is not clear [Shawnee Chiles Syndicate]

2(a)(3): the issue or transfer of a right/privilege to convert

into another security shall not be deemed to be an offer or sale

of such other security; but once exercised, it shall be deemed a

sale of such other security

Under shelf registration, Is and other OPs can sell registered

securities for an extended period of time after the initial

effective date w/out running foul of the time limitation of 6(a)

Rule 415: offerings meeting reqs may be offered on a

continuous or delayed basis in the future. There are 5 basic reqs:

O Only certain types of offerings may qualify

Securities which are to be offered or sold solely by or on

behalf of a person(s) other than the R, a sub of the R or a

person of which the R is a sub [415(a)(1)(i)]

Securities which are to be issued upon conversion of other

outstanding securities [(415(a)(1)(iv)]

Securities the offering of which will be commenced

promptly, will be made on a continuous basis and may

continue for a period in excess of 30 days from the date of

initial effectiveness [415(a)(1)(ix)]

Securities registered (or qualified to be registered) on Form

S-3 which are to be offered and sold on an immediate,

continuous, or delayed basis by or on behalf of the R, a sub

of the R, or a person of which the R is a sub [415(a)(1)(x)]

O For non-S-3 Is:

2-year time limit for: (i) shelf reg offerings falling under

415(a)(1)(viii) (biz combos) and (ii) 415(a)(1)(ix)

(continuous offgs to be commenced promptly) [415(a)(2)]

Wiggle room: securities for such offerings must be

reasonably expected to be offered and sold w/in 2

years from the effective date of the RS

Excludes: secs sold by S-3 Is under 415(a)(1)(ix) or (x) &

offgs on behalf of persons other than the R (e.g., large

pre-existing SH of the R) or issued upon conversion

O Prospectus and R.S. updating requirements

The I must furnish the undertakings reqd by Item 512(a)

of Reg S-K for all shelf registration offering

Item 512(a)(1)(i): the I shall file any prospectus reqd

under 10(a)(3) as a post-effective amendment -> if an I

updates a prospectus used more than 9 mo after the

effective date of the R.S. w/ more current info under

10(a)(3), then Item 512(a) reqs the I to file the

prospectus as an amendment to the R.S.

Item 512(a)(1)(ii): reqs an I to reflect in the prospectus

any fundamental changes in the R.S. and file the new

prospectus w/ the fundamental changes as an

amendment to the R.S.

Item 512(a)(1)(iii): reqs that Is file a post-effective

amendment containing any material

Form S-3 Is are excused if info is contained in any

E.A. filing that is incorporated by reference in the

R.S. or the info is included in a filed prospectus

supplement under Rule 424(b)

Regardless of method used, I will still face 11

liability b/c any information included in a base

prospectus or in an E.A. periodic report

incorporated into a prospectus is included in the

R.S. [S.A. Release No. 8591]

O At the market equity offerings

Whether by or on behalf of I, I may only only make use of

415(a)(1)(x) to qualify for a shelf registration [415(a)(4)]

At the mkt equity offering: an offering of equity securities

into an existing trading mkt for outstanding shares of same

class at other than a fixed price [415(a)(4)]

O 3 year limit to shelf offerings [415(a)(5)]

Only if registered under: 415(a)(1)(vii), 415(a)(1)(ix) (if

registered on Form S-3), 415(a)(1)(x)

SEC eased burden of re-registering every 3 years

I must file a new RS for those offerings, but securities

registered under a prior shelf RS may continue to be

sold until the earlier of the effective date of the new RS

or 180 days after the 3rd anniversary of the initial

effective date of the prior RS. [415(a)(5)(ii)(A)

In the case of a continuous offering of securities, the I

may continue selling the securities until the effective

date of the new R.S. [415(a)(5)(ii)(B)]

Is may include in a new RS any unsold secs covered in

an earlier shelf RS falling under 415(a)(5) [415(a)(6)]

415(a)(6) also allows I to roll over previously paid

and unused filing fees w/ regard to the unsold

securities to offset filing fees for new RS

AUTOMATIC SHELF REGISTRATION

WKSIs can file an auto shelf registration for most types of

offerings filed on S-3 (dubbed universal shelf RS) [Rule 405]

An ASRS, as well as any post-effective amendment, is effective

upon filing w/ SEC, even w/out opp for SEC review [Rule 462]

WKSIs can register an unspecified amount of securities, only

indicating the name or class of the securities [430B(a)]

WKSIs using ASRS can also add addl classes of securities to

the offering w/out filing a new RS -- addl classes may be

added through a post-effective amendment [413(b)]

3 yr limit from initial eff. date for an ASRS [415(a)(5)]

Just needs to simply file a new RS that becomes effective

immediately under R 462(e)

THE BASE PROSPECTUS

In practice, Is will often file only a minimal base prospectus

w/ the initial RS in a shelf offering

Base prospectus omits info related to the pub offering price and

the UWs, among other info; the I will then include any omitted

info as part of a prospectus supplement

I must file such a prospectus supp w/ SEC no later than 2

biz day following the earlier of the date of determination of

the offering price or the date its first used after effectiveness

in connection w/ a pub offering or sales [424(b)(2)]

The prospectus filed under 424(b)(2) may disclose pub

offering price, description of securities, specific method

of distribution, or similar matters

Is have considerable latitude to omit info from the base

prospectus due 430B; the following info can be omitted:

Shelf-offerings pursuant to 415(a)(1)(vii) (mortgage-related

securities or 415(a)(1)(x) may omit information that is

unknown or not reasonably available to the I pursuant to

Rule 409 [430B(a)]

e.g., pub offering price and other price-related info, such

as UWing discount

Shelf-offerings under an ASRS and pursuant to 415(a)(1)

(but not 415(a)(1)(vii) or (viii)) may omit whether the

offering is a primary offering or an offering on behalf of

persons other than the I or a combination thereof, the plan

of distribution for the securities, a description of the

securities registered other than an identification of the

name or class of such securities, and the identification of

other Is. [430B(a)]

WKSI can omit info on plan of distribution and

whether offering is primary or secondary even if knows

info or info is reasonably available

Shelf offerings pursuant to 415(a)(1)(i) conducted by an

S-3 I may omit the info specified in 430B(a) as well as the

identities of selling security holders and amounts of

securities to be registered on their behalf.

Exclusion only applies for O an ASRS, or O situations

where (i) the initial offering trans of the securities . . .

the resale of which are being registered on behalf of

each of the selling security holders, was completed;

(ii) the securities . . . were issued and outstanding prior

tot he original date of filing the RS covering the resale of

the securities; (iii) the RS refers to any unnamed selling

security holders in a generic manner by identifying the

initial offering trans in which the securities were sold

Under 430B, a base prospectus omitting info pursuant to

the Rule wld meet reqs of 10 for purposes of 5(b)(1) of SA

Doesnt (just like 430A) allow omission of such info to

satisfy 10(a) for the purposes of 5(b)(2) or for the free

writing exception contained in 2(a)(10)(a)

How does the omitted info finally get into the prospectus?

430B gives 3 options: thru prospectus supp, E.A. report

(incorpd by reference), or a post-eff am [430B(d)]

Any added material is deemed part of the RS [Item 512(A)(5),

Rule 430B(e), (f)] -> creates a new eff date of the RS for 11

liability for I and UWs (Ds, Os, and experts have unchanged

effective date for their portions of the RS)

Das könnte Ihnen auch gefallen

- Sec Reg ChartDokument17 SeitenSec Reg ChartMelissa GoldbergNoch keine Bewertungen

- AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-PreviewDokument4 SeitenAWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Previewscottshear1Noch keine Bewertungen

- Securities Regulation OutlineDokument50 SeitenSecurities Regulation OutlineTruth Press Media100% (1)

- The Role of the Securities Act of 1933 and Key ConceptsDokument33 SeitenThe Role of the Securities Act of 1933 and Key ConceptsErin JacksonNoch keine Bewertungen

- Securities Regulation OutlineDokument55 SeitenSecurities Regulation OutlineJosh SawyerNoch keine Bewertungen

- Securities Regulation Outline: Definition of a SecurityDokument27 SeitenSecurities Regulation Outline: Definition of a SecurityWaseem Barazi100% (2)

- Securities Regulation HyposDokument46 SeitenSecurities Regulation HyposErin JacksonNoch keine Bewertungen

- SECURITIES REGULATION SUMMARYDokument14 SeitenSECURITIES REGULATION SUMMARYzklvkfdNoch keine Bewertungen

- SecReg Outline 1 - Stern DetailedDokument127 SeitenSecReg Outline 1 - Stern Detailedsachin_desai_9Noch keine Bewertungen

- Reach of Regulation: What Constitutes a "SecurityDokument33 SeitenReach of Regulation: What Constitutes a "SecurityErin Jackson100% (3)

- Attack Sec. RegDokument5 SeitenAttack Sec. RegTroyNoch keine Bewertungen

- Fed Securities Laws - Rule OutlineDokument30 SeitenFed Securities Laws - Rule OutlineVirginia Crowson100% (12)

- Sec Reg Attack 2021 - NEWDokument28 SeitenSec Reg Attack 2021 - NEWmattytangNoch keine Bewertungen

- Professional Responsibility OutlineDokument6 SeitenProfessional Responsibility OutlineTiffany Brooks100% (1)

- Securities Regulation Outline #1Dokument50 SeitenSecurities Regulation Outline #1tuyaNoch keine Bewertungen

- Limitations and Requirements of Copyright ProtectionDokument7 SeitenLimitations and Requirements of Copyright Protectionrquinner14Noch keine Bewertungen

- International Business Transactions (Myers Rome Program) - Full Discursive Outline and Pre-Written Exam Introduction ParagraphsDokument12 SeitenInternational Business Transactions (Myers Rome Program) - Full Discursive Outline and Pre-Written Exam Introduction ParagraphsNicole DrysdaleNoch keine Bewertungen

- Agency Relationships & LiabilityDokument75 SeitenAgency Relationships & LiabilityjryanandersonNoch keine Bewertungen

- Mini OutlineDokument10 SeitenMini OutlineadamNoch keine Bewertungen

- Professional Responsibilities LawyerDokument3 SeitenProfessional Responsibilities LawyerRooter CoxNoch keine Bewertungen

- Securities Regulation OutlineDokument67 SeitenSecurities Regulation OutlineSean Balkan100% (1)

- Checklist PRDokument8 SeitenChecklist PRDouglas GromackNoch keine Bewertungen

- Formation: SalesDokument44 SeitenFormation: SalesJun Ma100% (1)

- Buckham Securities OutlineDokument58 SeitenBuckham Securities OutlineJonDoeNoch keine Bewertungen

- FlowchartsDokument6 SeitenFlowchartsesanchezfloat100% (1)

- Patent Law Answer OutlineDokument30 SeitenPatent Law Answer OutlineGunby KgNoch keine Bewertungen

- Securities Regulation Outline SummaryDokument11 SeitenSecurities Regulation Outline SummaryGang GaoNoch keine Bewertungen

- IP OutlineDokument28 SeitenIP OutlineMichael LangerNoch keine Bewertungen

- Securities Regulations Law OutlineDokument32 SeitenSecurities Regulations Law Outlinetwbrown1220100% (1)

- M&A OutlineDokument27 SeitenM&A Outlinecflash94Noch keine Bewertungen

- Chart OutlineDokument29 SeitenChart OutlineKasem AhmedNoch keine Bewertungen

- Intro: Legal Knowledge Skill Thoroughness PreparationDokument2 SeitenIntro: Legal Knowledge Skill Thoroughness PreparationHaifaNoch keine Bewertungen

- Acing BA OutlineDokument64 SeitenAcing BA OutlineStephanie PayanoNoch keine Bewertungen

- Sec Reg 2016 OutlineDokument101 SeitenSec Reg 2016 OutlineRyan MaloleyNoch keine Bewertungen

- First Amendment 2011Dokument62 SeitenFirst Amendment 2011DavidFriedmanNoch keine Bewertungen

- SECURITIES REGULATION COURSE EXAMINES EXEMPTIONS AND REGISTRATIONDokument127 SeitenSECURITIES REGULATION COURSE EXAMINES EXEMPTIONS AND REGISTRATIONErin Jackson100% (1)

- Business Organizations - Agency and AuthorityDokument65 SeitenBusiness Organizations - Agency and AuthorityNas YasinNoch keine Bewertungen

- Business Organizations OutlineDokument71 SeitenBusiness Organizations Outlineesquire2014fl100% (3)

- Disclosure and Materiality Standards in Securities RegulationDokument22 SeitenDisclosure and Materiality Standards in Securities RegulationDaniel Novick100% (1)

- Corporations Outline Partnoy PalmiterDokument20 SeitenCorporations Outline Partnoy PalmiterMatt ToothacreNoch keine Bewertungen

- When Does the UCC Apply? – Key Factors and TestsDokument49 SeitenWhen Does the UCC Apply? – Key Factors and TestsLaura C100% (1)

- Antitrust Checklist 3Dokument6 SeitenAntitrust Checklist 3champion_egy325Noch keine Bewertungen

- 36.1 Basic Concepts: Chapter 36 - AntitrustDokument11 Seiten36.1 Basic Concepts: Chapter 36 - AntitrustpfreteNoch keine Bewertungen

- Evidence Outline - EldredDokument68 SeitenEvidence Outline - EldredJennifer Traveis100% (1)

- Contracts OutlineDokument48 SeitenContracts Outlinekino321100% (2)

- Sales OutlineDokument41 SeitenSales Outlineesquire1010100% (1)

- Amazing PR OutlineDokument27 SeitenAmazing PR OutlineMax Goldschmidt100% (4)

- Corporations OutlineDokument84 SeitenCorporations OutlinegsdqNoch keine Bewertungen

- Antitrust Exam ConsolidationDokument21 SeitenAntitrust Exam Consolidationmab2140Noch keine Bewertungen

- Federal Securities LawsDokument1 SeiteFederal Securities LawsJulie GonzalezNoch keine Bewertungen

- Federal Income Tax Outline 2021 AH FINALDokument71 SeitenFederal Income Tax Outline 2021 AH FINALAndrea Healy100% (1)

- Corporate Finance Outline, Spring 2013Dokument60 SeitenCorporate Finance Outline, Spring 2013Kasem Ahmed100% (1)

- Formation, acceptance, consideration in contract lawDokument19 SeitenFormation, acceptance, consideration in contract lawDavid Jules BakalNoch keine Bewertungen

- Attack OutlineDokument3 SeitenAttack OutlineSam Rodgers100% (2)

- Securities Law Outline Spring 2006Dokument124 SeitenSecurities Law Outline Spring 2006himanshuNoch keine Bewertungen

- Closely Held Business Org and Agency DutiesDokument85 SeitenClosely Held Business Org and Agency DutiesnabarrowNoch keine Bewertungen

- Community Property Final Outline - ADDokument62 SeitenCommunity Property Final Outline - ADAlexandra DelatorreNoch keine Bewertungen

- Antitrust I Outline: The Antitrust Laws Protect Competition, Not CompetitorsDokument18 SeitenAntitrust I Outline: The Antitrust Laws Protect Competition, Not Competitorscpulver7947100% (1)

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Von EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Noch keine Bewertungen

- Geberit Cunife BVDokument1 SeiteGeberit Cunife BVZipper NirvanaNoch keine Bewertungen

- Baotou Steel - ISO, CertificeDokument5 SeitenBaotou Steel - ISO, CertificeTuấn Phạm Anh100% (2)

- Ra 10021Dokument2 SeitenRa 10021nikkadavidNoch keine Bewertungen

- Reltio The Self Learning Enterprise 0228Dokument8 SeitenReltio The Self Learning Enterprise 0228Syed Mustaq AhamedNoch keine Bewertungen

- Application Form For Business Permit: AmendmentDokument2 SeitenApplication Form For Business Permit: AmendmentPatbing-sooNoch keine Bewertungen

- Legal Due Diligence: 1. Register of DeedsDokument3 SeitenLegal Due Diligence: 1. Register of DeedsJsimNoch keine Bewertungen

- Module 4 plans for road and water transportation of hazardous chemicalsDokument6 SeitenModule 4 plans for road and water transportation of hazardous chemicalsjishnusaji100% (1)

- Application Form For Outward Remittance From Nre AccountDokument1 SeiteApplication Form For Outward Remittance From Nre AccountArjun WadhawanNoch keine Bewertungen

- GAMA 2017 AnnualReport ForWeb Final PDFDokument60 SeitenGAMA 2017 AnnualReport ForWeb Final PDFYangNoch keine Bewertungen

- 50349Dokument2 Seiten50349Liviu BadeaNoch keine Bewertungen

- Regulations For The Procurement of Generation Capacity 2014Dokument19 SeitenRegulations For The Procurement of Generation Capacity 2014OgochukwuNoch keine Bewertungen

- Four Essential Elements of a ContractDokument4 SeitenFour Essential Elements of a ContractAnita Khan100% (1)

- The Karnataka Sakala Services Rules, 2012Dokument10 SeitenThe Karnataka Sakala Services Rules, 2012KASHINATH BAMANALLINoch keine Bewertungen

- C45 - Fiji Resolution - FINALDokument3 SeitenC45 - Fiji Resolution - FINALIntelligentsiya HqNoch keine Bewertungen

- Auditing Competence and AwarenessDokument8 SeitenAuditing Competence and AwarenessHani AhsaniahNoch keine Bewertungen

- Sample Housing Contract To SellDokument10 SeitenSample Housing Contract To SellGabriel LaoNoch keine Bewertungen

- Kimberly Clark Philippines V LorredoDokument2 SeitenKimberly Clark Philippines V LorredoKat RA100% (1)

- Asaphil Construction and Development Corporation V. Vicente Tuason, JRDokument34 SeitenAsaphil Construction and Development Corporation V. Vicente Tuason, JRBenjie PangosfianNoch keine Bewertungen

- IFRS As Global Standards Pocket Guide April 2015Dokument105 SeitenIFRS As Global Standards Pocket Guide April 2015Vitalie MihailovNoch keine Bewertungen

- EURORIDER CURSOR 10 EURO 4 TECHNICAL MANUALDokument166 SeitenEURORIDER CURSOR 10 EURO 4 TECHNICAL MANUALМихаил ШинкаренкоNoch keine Bewertungen

- Creation of the WRCDokument15 SeitenCreation of the WRCpaomillan0423Noch keine Bewertungen

- PHEONWJ-G-PRC-0007 Lifting Management SystemDokument23 SeitenPHEONWJ-G-PRC-0007 Lifting Management Systemdaffafi7882Noch keine Bewertungen

- Chapter III of Companies Act - Prospectus & Allotment of SecuritiesDokument11 SeitenChapter III of Companies Act - Prospectus & Allotment of SecuritiesJohn AllenNoch keine Bewertungen

- Harvard ModelDokument4 SeitenHarvard ModelAnonymous uxd1ydNoch keine Bewertungen

- Monzo Bank StatementDokument2 SeitenMonzo Bank StatementAlpamis100% (1)

- ECE 191 3rd QuizDokument7 SeitenECE 191 3rd QuizJay Amiel AjocNoch keine Bewertungen

- Auditing PSM SystemsDokument39 SeitenAuditing PSM SystemsPradeep Nair100% (1)

- DTI Region 02 - 5% Senior Citizens DiscountDokument7 SeitenDTI Region 02 - 5% Senior Citizens Discountferreous 3Noch keine Bewertungen

- Consumer RightsDokument13 SeitenConsumer RightsAadesh Abichandani0% (1)

- CASR Part 39-47 Safety RegulationsDokument26 SeitenCASR Part 39-47 Safety RegulationsAde YahyaNoch keine Bewertungen