Beruflich Dokumente

Kultur Dokumente

Steel Industry Update #273

Hochgeladen von

Michael LockerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Steel Industry Update #273

Hochgeladen von

Michael LockerCopyright:

Verfügbare Formate

Steel Industry Update/273

April 2012

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

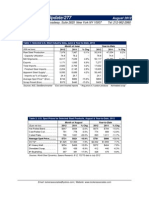

Table 1: Selected U.S. Steel Industry Data, February & Year-to-Date, 2012

Month of February

2012

2011

% Chg

8,316

7,374

12.8%

(000 net tons)

Raw Steel Production ...............

2012

16,811

Year-to-Date

2011

15,301

% Chg

9.9%

Capacity Utilization .................

80.7

75.4

--

79.1

74.2

--

Mill Shipments ..........................

8,407

6,967

20.7%

16,905

14,496

16.6%

Exports .....................................

1,211

951

27.3%

2,473

2,011

23.0%

Total Imports.............................

2,721

1,845

47.5%

5,536

3,962

39.7%

Finished Steel Imports ............

2,080

1,438

44.6%

4,284

3,138

36.5%

Apparent Steel Supply* .............

9,276

7,454

24.4%

18,716

15,624

19.8%

Imports as % of Supply*..........

22.4

19.3

--

22.9

20.1

--

Average Spot Price** ($/ton) ......

$833

$913

-8.8%

$835

$881

-5.3%

Scrap Price# ($/ton) ...................

$435

$432

0.7%

$451

$444

1.6%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 3 carbon products

#shredded scrap

Table 2: U.S. Spot Prices for Selected Steel Products, April & Year-to-Date, 2012

Hot Rolled Band....

Cold Rolled Coil........

Coiled Plate..................

Month of April

2012

2011

% Chg

688

879

-21.7%

792

960

-17.5%

936

1067

-12.3%

2012

711

810

937

Average Spot Price....

$805

$969

-16.9%

$819

$904

-9.4%

OCTG*

2,026

1,774

14.2%

2,028

1,758

15.4%

#1 Heavy Melt...

Shredded Scrap...

#1 Busheling.

390

430

441

400

442

471

-2.5%

-2.7%

-6.4%

400

443

469

406

443

447

-1.5%

0.0%

4.9%

($ per net ton)

Year-to-Date

2011

841

887

984

Sources: World Steel Dynamics, Spears Research, 3/12; *OCTG data is March, 2012

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

% Chg

-15.5%

-8.7%

-4.7%

Steel Industry Update/273

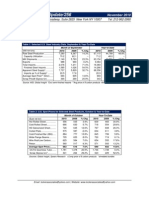

Table 3: World Crude Steel Production, March & Year-to-Date, 2012

Month of March

Year-to-Date

(000 metric tons)

2012

2011

%

Chg

2012

2011

Region

European Union.

15,661

16,300

-3.9%

43,874

45,672

Other Europe.

3,344

3,055

9.4%

9,606

8,840

% Chg

-3.9%

8.7%

C.I.S.

9,695

9,900

-2.1%

28,161

28,343

North America

10,584

10,258

3.2%

31,207

29,246

-0.6%

6.7%

South America...

4,242

4,223

0.4%

11,898

11,729

1.4%

Africa/Middle East.....

2,924

2,975

-1.7%

8,686

8,659

0.3%

Asia..

85,174

82,373

3.4%

241,746

238,199

1.5%

Oceania......

575

725

-20.7%

1,581

2,089

-24.3%

Total

132,198

129,809

1.8%

376,760

372,777

1.1%

China.......

Japan...

61,581

9,324

59,279

9,113

3.9%

2.3%

174,218

26,567

170,037

27,704

2.5%

-4.1%

United States..

7,764

7,368

5.4%

23,015

21,248

8.3%

Russia(e).

6,400

6,014

6.4%

18,355

17,494

4.9%

Country

India(e).

6,200

6,124

1.2%

18,000

18,003

0.0%

South Korea.......

6,019

5,834

3.2%

17,232

16,561

4.0%

Germany...

3,900

4,026

-3.1%

10,846

11,388

-4.8%

Turkey

3,128

2,733

14.5%

9,025

7,934

13.7%

Brazil...

3,105

3,038

2.2%

8,694

8,489

2.4%

Ukraine(e)...

2,700

3,154

-14.4%

8,082

8,795

-8.1%

All Others....

24,777

26,280

-5.7%

62,726

65,124

-3.7%

Source: World Steel Association, 4/12; e=estimate

Graph 1: World Crude Steel Production, March 2012

Source: World Steel Association, 4/12; in million metric tons

-2-

Steel Industry Update/273

Graph 2: World Steel Capacity Utilization, March, 2012

Source: World Steel Association, 4/12

Table 4: US Steel Exports by Country or Region, February & YTD, 2012

Country/Region

Canada

Mexico

EU

Other Asia

Brazil

Venezuela

Peru

Other W. Hemi

Africa

China

India

Colombia

Total World

Feb 12

639,598

351,783

42,307

25,437

21,719

20,427

17,566

17,097

13,127

8,813

7,964

6,447

1,211,177

Feb 11

534,150

232,578

40,292

18,199

5,626

2,522

1,947

13,569

15,143

13,863

9,861

6,703

951,284

% Chg

19.7%

51.3%

5.0%

39.8%

286.0%

710.0%

802.2%

26.0%

-13.3%

-36.4%

-19.2%

-3.8%

27.3%

YTD 12

1,302,152

718,102

81,827

51,224

34,313

29,394

19,155

44,273

22,986

18,069

14,883

20,995

2,473,290

YTD 11

1,100,918

456,193

82,507

43,502

24,904

9,179

24,876

28,198

24,999

36,777

21,133

10,826

2,010,648

% Chg

23.0%

57.4%

-0.8%

17.8%

37.8%

220.2%

-23.0%

57.0%

-8.1%

-50.9%

-29.6%

93.9%

23.0%

Source: AIIS, 4/15/12; in tons

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2012 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-3-

Steel Industry Update/273

Table 5: US Exports of Steel Mill Products, February, 2012

Product

Heavy structural

HD galvanized sheet/strip

Cut-to-length plate

Plate in coils

Cold-rolled sheet

Hot-rolled sheet

Blooms, billets and slabs

Oil country goods

Line pipe

Total

Feb 12

106,263

104,449

101,872

71,928

70,128

68,908

57,825

38,372

6,659

1,098,761

Jan 12

115,214

113,621

105,822

66,628

68,000

63,897

99,225

32,720

10,626

1,144,970

% Chg

-7.8%

-8.1%

-3.7%

8.0%

3.1%

7.9%

-41.7%

17.3%

-37.3%

-4.0%

Feb 11

71,069

85,715

95,212

52,876

41,819

41,269

33,389

25,289

8,185

862,991

Source: American Metal Market, 4/19/12; in tonnes; total includes more products than listed in this table

Table 6: US Slab Imports by District, February, 2012

Region

Mobile, AL

Columbia-Snake

Los Angeles

Philadelphia

Houston-Galveston

Buffalo

New Orleans

Detroit

Total

Feb 12

261,434

84,703

71,704

64,631

30,320

7,875

2,943

758

532,869

Jan 12

220,083

66,136

72,009

86,596

52,092

7,587

4,503

21,762

533,857

Feb 11

196,514

44,029

0

54,009

0

17,348

0

30,961

344,559

Source: American Metal Market, 4/20/12; in tonnes

Table 7: US Appliance Shipments by Product, 2010 & 2011

Product

Ranges/ovens

Washers

Dryers

Dishwashers

Refrigerators

Freezers

Total

2011

6,942

7,567

6,200

5,535

8,981

2,016

36,540

2010

7,239

8,005

6,551

5,710

9,369

1,958

38,183

% Chg

-4.1%

-5.5%

-6.6%

-3.1%

-4.1%

3.0%

-4.3%

Source: Metal Center News, March 2012; AHAM is the Association of Home

Appliance Manufacturers; in 000s units

-4-

% Chg

49.5%

21.9%

7.0%

36.0%

67.7%

67.0%

73.2%

51.7%

-18.6%

27.3%

Steel Industry Update/273

Table 8: Blast Furnace Production of Crude Steel, 2001-2010 (% of total crude steel production)

Region

Europe Union (15)

2001

58.9

2003

59.3

2005

59.3

2007

57.2

2008

56.5

2009

53.8

2010

56.3

European Union (27)

61.3

62.2

61.3

59.4

58.2

55.6

57.7

Other Europe

32.6

30.1

29.2

25.7

29.2

31.4

30.0

CIS

55.7

57.8

57.1

54.8

55.5

64.5

64.6

North America

50.9

47.4

44.0

41.3

41.8

37.2

39.3

United States

52.6

49.0

45.0

41.9

41.9

38.3

38.7

South America

65.7

65.5

62.8

61.6

63.0

61.3

64.4

Africa

48.5

45.2

41.6

36.5

35.6

33.5

33.3

Middle East

18.6

16.9

16.2

11.7

11.9

11.3

12.3

Asia

71.0

72.2

76.3

79.3

78.8

80.4

80.0

China

83.1

82.5

88.7

91.9

90.9

90.9

90.2

Oceania

81.2

81.3

80.7

80.0

79.8

80.9

82.1

World Total

62.2

63.0

65.4

66.9

67.1

70.2

69.8

Source: World Steel Association, 4/12

Table 9: Electric Furnace Production of Crude Steel, 2001-2010 (% of total crude steel production)

Region

Europe Union (15)

2001

41.1

2003

40.7

2005

40.7

2007

42.8

2008

43.5

2009

46.2

2010

43.7

European Union (27)

23.1

21.1

25.6

27.3

30.5

31.2

31.5

Other Europe

67.1

69.5

70.6

74.3

71.9

68.6

70.0

CIS

12.6

13.3

16.0

19.9

22.4

21.3

21.1

North America

49.1

52.6

56.0

58.6

58.2

62.8

60.7

United States

47.4

51.0

55.0

58.1

58.1

61.7

61.3

South America

33.1

33.2

35.9

37.2

36.1

37.4

34.5

Africa

51.5

54.8

58.3

63.4

64.4

66.5

66.6

Middle East

81.6

83.1

83.8

88.3

88.1

88.7

87.8

Asia

27.9

27.3

23.8

21.3

21.1

19.4

19.9

China

15.8

17.6

11.8

9.2

9.1

9.7

9.8

Oceania

18.8

18.7

19.2

20.0

20.2

19.1

17.9

World Total

33.5

33.5

31.9

31.0

30.8

28.5

29.0

Source: World Steel Association, 4/12

-5-

Steel Industry Update/273

Table 10: Top 20 North American Ferrous Scrap Processors, 2011

President or CEO

2011 Volume

(gross tons)

No of

Facilities

No of

Shredders

Deep-water

Port

New York, NY

Daniel Dienst

8.7 million

120*

N/A

Yes

OmniSource Corp

Fort Wayne, IN

Russell Rinn

5.9 million

70+

11

No

Schnitzer Steel Industries

Portland, OR

Tamara Lundgren

5.3 million

57

10

Yes

David J. Joseph Co

Cincinnati, OH

Keith Grass

5 million

69

17

Yes

Tube City IMS

Glassport, PA

Joseph Curtin

5 million

No

Commercial Metals Co

Irving, TX

Joseph Alvarado

3 million

42

No

Ferrous Processing Co

Detroit, MI

Howard Sherman

2.8 million

17

No

Alter Trading Corp

St. Louis, MO

Robert Goldstein

2.5 million

38

Yes

Triple M Metal, Inc

Bramton, ONT

Joe Caruso

2.5 million

15

No

GerdauAmeristeel

Whitby, ONT

Mark Mossey

2.1 mil (est)

20

N/A

American Iron & Metal

Montreal, QC

Herbert Black

1.8 million

40

N/A

PSC Metals, Inc

Mayfield, OH

Eddie Lehner

1.8 million

50

11

No

Azcon Corp

Chicago, IL

Ronnie Hirsh

1.7 million

Yes

European Metal Recycling

New York, NY

Colin Illes

1.6 mil (est)

80

Yes

AMG Resources Corp

Pittsburgh, PA

Allan Goldstein

1.5 mil (est)

N/A

Cohen Brothers, Inc

Middletown, OH

Kenneth Cohen

1.3 million

26

No

Miller Compressing Co

Milwaukee, WI

John Busby

1 mil +

N/A

Upstate Shredding

Owega, NY

Adam Weitsman

850,000

11

1**

No

Behr Iron & Metal Co

Rockford, IL

William Bremner

788,000 (est)

11

N/A

Liberty Iron & Metal

Phoenix, AZ

Marc Olgin

700,000 (est)

11

N/A

Company

Address

Sims Metal Management

Source: Recycling Today, March 2012; *includes SA Recycling; **second one under construction

Table 11: Evraz Steel Segment Sales & Shipments, 2011

Steel Sales

Construction products

Railway products

Flat-rolled

2011

$4,430

1,969

2010

$3,337

1,472

% Chg

32.8%

33.8%

2,763

2,007

37.7%

Tubular

1,322

1,309

1.0%

Semi-finished

2,235

2,340

-4.5%

Other steel products

Total

Steel Shipments

Construction products

Railway products

Flat-rolled

Tubular

Semi-finished

Other steel products

Total

592

411

44.0%

$14,717

$12,123

21.4%

5,515

2,098

5,090

1,913

8.3%

9.7%

2,872

2,573

11.6%

912

924

-1.3%

3,479

4,481

-22.4%

674

584

15.5%

15,550

15,565

-0.1%

Source: Steel Guru, 4/1/12; sales in USD million; shipments in 000 tonnes

-6-

Steel Industry Update/273

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

U.S. Scrap Prices

($ per ton)

500

1100

($ per ton)

#1 Busheling

Plate

1000

450

Shredded Scrap

900

400

CR Coil

800

#1 Heavy Melt

350

700

Rebar

HR Band

300

600

250

500

200

400

'07 '08 '09 '10 1q

2q

'07 '08 '09 '10 1q

2q

Locker Associates Steel Track: Performance

U.S. Raw Steel Production

10.0

(mil net tons)

9.0

2012

80%

7.0

70%

6.0

60%

5.0

50%

4.0

40%

2011

90%

8.0

3.0

U.S. Capacity Utilization

100%

2012

2011

30%

2012 8.5 8.3

2012 78% 81%

2011 7.9 7.4

2011 73% 75%

Steel Mill Products: US Imports, February & Year-to-Date, 2012

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border

Off Shore

Month of February

2012

2011

% Chg

470

398

18.1%

168

173

-2.9%

403

262

53.8%

382

258

48.1%

421

218

93.1%

843

458

84.1%

25

65

-61.5%

9

11

-18.2%

2,721

1,845

47.5%

2012

938

353

744

801

908

1,725

58

9

5,536

330

1,435

427

507

24

750

2,870

852

1,015

49

233

924

235

430

22

Source: AISI; *includes Russia

Update #273

-7-

41.6%

55.3%

81.7%

17.9%

9.1%

Year-to-Date

2011

% Chg

873

7.4%

524

-32.6%

460

61.7%

600

33.5%

297

205.7%

1,029

67.6%

150

-61.3%

27

-66.7%

3,962

39.7%

480

1,805

701

943

33

56.3%

59.0%

21.5%

7.6%

48.5%

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government

clients. By combining expert business and financial analysis with a sensitivity to labor issues,

the firm is uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel

Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Metallic Lathers and Reinforcing Ironworkers (2010-2011): strategic industry research and

ongoing advisement on major industry trends and companies to help enhance the competitive

position of the unionized NYC construction industry

Metallurgical Coal Producer (2011): prepared a detailed study on the major trends in the

world metallurgical coal market for a major metallurgical coal producer

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to raise

capital and promote a new hydrogen battery technology

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel

market before the Institute of Scrap Recycling Industries Commodities roundtable

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Technical AcronymsDokument451 SeitenTechnical AcronymsSudip SardarNoch keine Bewertungen

- Metaland CatalogueDokument95 SeitenMetaland CatalogueTimothy LovettNoch keine Bewertungen

- 2062Dokument17 Seiten2062hswed91100% (1)

- BS en 10067-1997Dokument12 SeitenBS en 10067-1997david13andreiNoch keine Bewertungen

- W3-311E Bar and Wire Rod Mills PDFDokument32 SeitenW3-311E Bar and Wire Rod Mills PDFMohammed IrfanNoch keine Bewertungen

- Steel Industry Update #282Dokument9 SeitenSteel Industry Update #282Michael LockerNoch keine Bewertungen

- Steel Industry Update 283Dokument9 SeitenSteel Industry Update 283Michael LockerNoch keine Bewertungen

- Steel Industry Update #281Dokument6 SeitenSteel Industry Update #281Michael LockerNoch keine Bewertungen

- CWA-CVC Investor Briefing Presentation 4-15-13Dokument20 SeitenCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNoch keine Bewertungen

- Steel Industry Update #279Dokument8 SeitenSteel Industry Update #279Michael LockerNoch keine Bewertungen

- Steel Industry Update #274Dokument8 SeitenSteel Industry Update #274Michael LockerNoch keine Bewertungen

- Steel Industry Update #277Dokument9 SeitenSteel Industry Update #277Michael LockerNoch keine Bewertungen

- Steel Industry Update #278Dokument9 SeitenSteel Industry Update #278Michael LockerNoch keine Bewertungen

- Steel Industry Update #272Dokument7 SeitenSteel Industry Update #272Michael LockerNoch keine Bewertungen

- Steel Industry Update #280Dokument10 SeitenSteel Industry Update #280Michael LockerNoch keine Bewertungen

- Steel Industry Update #275Dokument9 SeitenSteel Industry Update #275Michael LockerNoch keine Bewertungen

- Steel Industry Update #276Dokument7 SeitenSteel Industry Update #276Michael LockerNoch keine Bewertungen

- Steel Industry Update #271Dokument9 SeitenSteel Industry Update #271Michael LockerNoch keine Bewertungen

- Steel Industry Update #268Dokument13 SeitenSteel Industry Update #268Michael LockerNoch keine Bewertungen

- Steel Industry Update #269Dokument8 SeitenSteel Industry Update #269Michael LockerNoch keine Bewertungen

- Steel Industry Update #267Dokument9 SeitenSteel Industry Update #267Michael LockerNoch keine Bewertungen

- Steel Industry Update #259Dokument10 SeitenSteel Industry Update #259Michael LockerNoch keine Bewertungen

- Steel Industry Update #270Dokument9 SeitenSteel Industry Update #270Michael LockerNoch keine Bewertungen

- Locker RPA Transcript 6-9-11Dokument2 SeitenLocker RPA Transcript 6-9-11Michael LockerNoch keine Bewertungen

- Steel Industry Update #265Dokument7 SeitenSteel Industry Update #265Michael LockerNoch keine Bewertungen

- Steel Industry Update #266Dokument8 SeitenSteel Industry Update #266Michael LockerNoch keine Bewertungen

- Steel Industry Update #260Dokument6 SeitenSteel Industry Update #260Michael LockerNoch keine Bewertungen

- Steel Industry Update #258Dokument8 SeitenSteel Industry Update #258Michael LockerNoch keine Bewertungen

- Steel Industry Update #264Dokument10 SeitenSteel Industry Update #264Michael LockerNoch keine Bewertungen

- Steel Industry Update #263Dokument10 SeitenSteel Industry Update #263Michael LockerNoch keine Bewertungen

- Steel Industry Update #261Dokument8 SeitenSteel Industry Update #261Michael LockerNoch keine Bewertungen

- Steel Industry Update #262Dokument7 SeitenSteel Industry Update #262Michael LockerNoch keine Bewertungen

- Steel Industry Update #257Dokument8 SeitenSteel Industry Update #257Michael LockerNoch keine Bewertungen

- Steel Industry Update #256Dokument11 SeitenSteel Industry Update #256Michael LockerNoch keine Bewertungen

- Cold Rolled SteelDokument13 SeitenCold Rolled SteelRanjeet DongreNoch keine Bewertungen

- Unit Iii Bulk Processes Bulk DeformationDokument77 SeitenUnit Iii Bulk Processes Bulk DeformationAkash akNoch keine Bewertungen

- CRCA Technical Notes - 2018Dokument11 SeitenCRCA Technical Notes - 2018Sajib Chandra RoyNoch keine Bewertungen

- Bhilai Steel Plant 2.SbDokument15 SeitenBhilai Steel Plant 2.Sbkalyan1492Noch keine Bewertungen

- Onesteel Hot Rolled Products PDFDokument32 SeitenOnesteel Hot Rolled Products PDFdeeptiwagle5649Noch keine Bewertungen

- 277 - Galvanised Steel SheetsDokument10 Seiten277 - Galvanised Steel SheetsKaushik SenguptaNoch keine Bewertungen

- Appendix 1 Part 2 Magnetic Particle Inspection 5th Edition February 2016Dokument12 SeitenAppendix 1 Part 2 Magnetic Particle Inspection 5th Edition February 2016Alireza ZiaeddiniNoch keine Bewertungen

- Dillinger Dillimax Dillidur BrochureDokument12 SeitenDillinger Dillimax Dillidur BrochureVictorNoch keine Bewertungen

- Technical Supplement 14R Design and Use of Sheet Pile Walls in Stream Restoration and Stabilization ProjectsDokument36 SeitenTechnical Supplement 14R Design and Use of Sheet Pile Walls in Stream Restoration and Stabilization ProjectsThaung Myint OoNoch keine Bewertungen

- ImportedfromGoogleNotebook MaterialScienceDokument97 SeitenImportedfromGoogleNotebook MaterialScienceHarish PothepalliNoch keine Bewertungen

- HOT ROLLED OR DRAWN STEELS MATERIAL STANDARDDokument8 SeitenHOT ROLLED OR DRAWN STEELS MATERIAL STANDARDIBRNoch keine Bewertungen

- Vanderbijlpark Works PresentationDokument17 SeitenVanderbijlpark Works PresentationManoj SinghNoch keine Bewertungen

- Boe Linien en 090616onlinedoppelseite PDFDokument19 SeitenBoe Linien en 090616onlinedoppelseite PDFxavicojmNoch keine Bewertungen

- 4.0 Manufacturing Process Roll FormingDokument4 Seiten4.0 Manufacturing Process Roll FormingMuhd NadzriNoch keine Bewertungen

- Skin PassDokument14 SeitenSkin PassamanciotrajanoNoch keine Bewertungen

- 1852 - Rolling & Cutting Tolerances For Hot Rolled Steel ProductsDokument26 Seiten1852 - Rolling & Cutting Tolerances For Hot Rolled Steel ProductsKaushik SenguptaNoch keine Bewertungen

- B582-07 (Reapproved 2013)Dokument3 SeitenB582-07 (Reapproved 2013)Luis Jose DuranNoch keine Bewertungen

- Shearing and Slitting AHSS - ASKO HXT, 4-7-2017cDokument5 SeitenShearing and Slitting AHSS - ASKO HXT, 4-7-2017cBrian ShawNoch keine Bewertungen

- Precision Steel Product GuideDokument2 SeitenPrecision Steel Product GuideAnonymous iHJPiQI7Noch keine Bewertungen

- Iron Steel Sector Report 2018 PDFDokument42 SeitenIron Steel Sector Report 2018 PDFRam Deo AwasthiNoch keine Bewertungen

- Ejercicios de Teorias de FallaDokument5 SeitenEjercicios de Teorias de FallaLeonardo Fabio Gallego RamírezNoch keine Bewertungen

- Katalog 2011 enDokument278 SeitenKatalog 2011 ener_wenNoch keine Bewertungen

- Machine Design Problem New 28.07.09Dokument22 SeitenMachine Design Problem New 28.07.09muzahed100% (1)

- GATEMfg LatestDokument210 SeitenGATEMfg LatestniteshNoch keine Bewertungen

- Sheet Metal Rolling Using Two Roller Powered MachineDokument12 SeitenSheet Metal Rolling Using Two Roller Powered MachineRefly Excel MalinoNoch keine Bewertungen