Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

Truth Press MediaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

Truth Press MediaCopyright:

Verfügbare Formate

http://www.hermes-press.com/index1.html http://www.hermes-press.com/WSupdate2.htm THE REGIONAL ECONOMIST | OCTOBER 2011 Is Shadow Banking Really Banking? By Bryan J.

Noeth and Rajdeep Sengupta The term "shadow banking" has been attributed to 2007 remarks by economist and m oney manager Paul McCulley to describe a large segment of financial intermediati on that is routed outside the balance sheets of regulated commercial banks and o ther depository institutions. Shadow banks are defined as financial intermediari es that conduct functions of banking "without access to central bank liquidity o r public sector credit guarantees." 1 As shown in Figure 1, the size of the shad ow banking sector was close to $20 trillion at its peak and shrank to about $15 trillion last year, making it at least as big as, if not bigger than, the tradit ional banking system.2 Given its size and role in the financial crisis, it would be useful to understand the mechanics of shadow banking. To do so, some basics of traditional banking need to be understood first. Figure 1 Shadow Bank vs. Traditional Bank Liabilities Click to enlarge SOURCE: Federal Reserve Board/Haver Analytics and calculations from Adrian, Ashc raft, Boesky and Pozsar. Simply put, banks are intermediaries that obtain funds from lenders in the form of deposits and provide funds to borrowers in the form of loans.3 The principal function of a bank is that of maturity transformationcoming from the fact that le nders prefer deposits to be of a shorter maturity than borrowers, who typically require loans for longer periods. It is important to point out that, because of sudden liquidity needs of individual agents or businesses, this function cannot be performed by individual agents or businesses alonetherein lies the rationale f or a bank. Banks are able to achieve this transformation by exploiting the fact that only a small fraction of depositors have liquidity needs at a given time. T herefore, the bank can store a small fraction of its deposits in the form of liq uid assets (readily convertible to cash) and lend out the rest in the form of te rm (illiquid) loans. This function is also known as qualitative asset transforma tion because, by changing the maturity of its assets, the bank also changes thei r liquidity.4 However, by performing this function, a bank is essentially rendered fragile. Th e fragility comes from the fact that even a healthy bank can be the victim of a bank run. If all depositors demand their deposits back, the bank would have to l iquidate all its assets (even those that are not liquid) to fulfill depositors' demands. Since almost no bank can liquidate all its assets within a short period without suffering a loss in value, a problem of illiquidity can essentially tur n into a problem of insolvency and the collapse of the bank. Accordingly, deposi tors are acting rationally when they withdraw their deposits even at the smalles t hint of bad news.5 More often than not, such bank runs are hardly limited to j ust one bank, precipitating what is called a banking panic. Given their inherent fragility, banks typically require credit enhancements in t he form of insurance of deposits or emergency access to funds from the central b ank.6 In most countries, public funds are the source of such provisions of emerg ency funding. Indeed, the financial history of the United States is replete with

stories about bank runs and bank failures prior to 1934. In that year, the Fede ral Deposit Insurance Corp. was created, ending runs on commercial banks in the U.S. However, the end of bank runs does not imply the end of bank failures. Indeed, t he inclusion of such credit-enhancement measures, especially those funded by thi rd parties, creates a significant moral hazard for banks.7 Banks investing in ri sky loans benefit from higher returns on the slim chance of success, whereas the taxpayer is left to bail out depositors in the likely event that the banks fail .8 Regulations seeking to prevent such moral hazard require banks to hold signif icantly higher capital for increased riskiness of loans (assets) on their balanc e sheetknown as a risk-weighted capital adequacy requirement. Banks view raising such capital as costly and often engage in practices that would help prevent the m from having to do so.9 One such practice is the creation of off-balance-sheet entities to host some of the banks' assets and, thereby, reduce their regulatory capital requirements. This practice is often viewed as one of the major reasons behind the creation and growth of shadow banking. Broadly speaking, credit intermediation through the shadow banking system is muc h like that through a traditional bankit fulfills the principal function of quali tative asset transformation. However, unlike traditional banking, which involves a simple process of deposit-taking and originating loans that are held to matur ity, shadow banking employs a much more complicated process to achieve maturity transformation. At the deposit end of the shadow banking system are wholesale in vestors (providers of funds) using the repo market and money market intermediari es such as money market mutual funds (MMMFs) to provide short-term loans that ar e essentially withdrawable on demand. At the loan origination end are finance co mpanies and even traditional banks that engage in the activity of originating lo ans, much like the traditional banking system. The shadow banking system intermediates between the ultimate consumer of funds ( borrower) and the wholesale investor of funds, whose liquidity needs may preclud e long-term investments. Shadow banking comprises a chain of intermediaries that are engaged in the transfer of funds channeled upstream in exchange for securit ies and loan documents that are moving downstream. Therefore, what was once acco mplished under a single roof in the traditional banking system is now done over a sequence of steps in the shadow banking system, each performed by specialized entities that are not vertically integrated. The Deposit End of the Shadow Banking System Most advanced economies have solved the problem of bank runs by the creation of deposit insurance. In 1980, deposit insurance in the U.S. was capped at $100,000 ; after the crisis, this limit was raised to $250,000. This meant that the deman d for safe, short-term investments from large, cash-rich financial and nonfinanc ial companies remained unfulfilled. The shadow banking system fulfilled this dem and in two waysboth of which made extensive use of widely available financial sec urities. The first of these arrangements uses repo, or repurchase, transactions, whereby firms with surplus cash buy securities for cash only and then resell them back a fter a short term. Effectively, this repo transaction is a short-term cash loan to the seller of the security, with the security acting as collateral on the loa n. Repo transactions can be open-ended and rolled over on a daily basis, making them analogous to deposits at a traditional bank that are withdrawable on demand . However, unlike demand deposits, which derive their safety from deposit insura nce, repo transactions derive their safety from the underlying security that is the collateral on the loan. In the event of default on the loan, the lender reta ins the right to sell the security in the open market and collect the proceeds. To enhance the safety of the transactions, repos are overcollateralizedthat is, t

he loan amount is typically less than the face value of the securities used as c ollateral. In this manner, overcollateralization imposes a "haircut" on the repo , a haircut that varies with the credit risk on the security put up for collater al. Naturally, haircuts on repo transactions using Treasury securities are lower than haircuts using comparable private-label securities. The second alternative for cash-rich investors is to purchase shares in money ma rket mutual funds. In MMMFs, investors pool funds to invest in high-quality shor t-term securities of the government and corporations. Notably, investments (shar es) in MMMFs are withdrawable on demand. The safety of investments in MMMFs comes from the fact that the securities they invest in are regulated to be of high quality and short maturity, such as Treasu ry bills and highest-grade commercial paper. While Treasury bills are regarded a s securities with no credit risk, commercial paper is backed by assets that poss ess some credit risk. To alleviate concerns for investors, Rule 2a-7 of the Secu rities and Exchange Commission's Investment Company Act of 1940 restricts the qu ality, maturity and diversity of investments by MMMFs. Cash-rich investors looking for safe investments that are withdrawable on demand can either purchase shares in MMMFs that are redeemable on demand or can purcha se securities under a repo agreement, whereby the seller promises to purchase th e securities back at a later date. The two avenues are somewhat different. Inves tments in MMMFs are in the form of a continuing contract with variable returns. On the other hand, a repo transaction is a one-time contract with fixed returns. The Loan Origination End of the Shadow Banking System This section refers to the processes by which the securities used in the deposit end of the system are created, either to be used as collateral in a repo transa ction or as investments for MMMFs. The processes described below are a simple pr ototype of numerous schematics involved in the creation of such securities. In p ractice, the chains used in warehousing, securitization and servicing can be sig nificantly more complicated than the illustrations given below. Financial intermediation has moved from an originate-to-hold model of traditiona l banking to an originate-to-distribute model of modern securitized banking. Eco nomist Gary Gorton argued in a book last year that deregulation and increased co mpetition in banking rendered the traditional model of banking unprofitable. In modern banking, origination of loans is done mostly with a view to convert the l oan into securitiesa practice called securitization, whereby the transaction, pro cessing and servicing fees are the intermediaries' principal source of revenue. Figure 2 The Creation of Securities from Loans Click to enlarge The diagram shows a simplified, five-step process for converting loan originatio ns into final securities. First, auto loans, student loans, mortgages and other loans are originated by regulated commercial banks and unregulated financial fir ms. Second, a warehouse bank (aggregator) buys loans from one or more originator s and pools the loans. Third, the pooled loans are sold to an administrator, usu ally a subsidiary of a large commercial or investment bank; the administrator cr eates a special purpose vehicle (SPV) to hold the loans; the SPV issues securiti es against loans held in its portfolio. Fourth, the securities created by the SP V are sold by an underwriter, typically an investment bank. Finally, the securit ies are bought by investors.

Figure 2 illustrates the process of converting loan originations into final secu rities. The starting point in this process is the origination of loans such as a uto loans, mortgages and student loans by regulated commercial banks and unregul ated finance companies. Under the traditional model of banking, this loan would reside on a bank's balance sheet, with the bank holding capital against the loan . Under the securitized model of banking, the bank arranges to sell the loan. The second step of the process involves warehousing the loan. This includes a wa rehouse bank that purchases loans from one or more originators to form a pool of such loans. The warehouse bank is also known as the aggregator, seller or spons or. In some cases, this entity can be the same as the originator. Typically, thi s financing occurs in the form of an extension of a line of credit from the ware house bank to the originator of the loan (a finance company or a small community bank) that closes on the loan with such funds. The loan documents are then sent downstream to the warehouse bank to serve as collateral for the line of credit. The third step in the process involves a sale of the pooled loans to an administ rator, typically a subsidiary of a large commercial or investment bank. The role of the administrator is to purchase the loans from the aggregator and create th e special purpose vehicle (SPV), which would finally hold the loans. Often, the administrator of the SPV receives a fee for services rendered. The SPV issues se curities against loans held on its portfolio. (See sidebar.) The fourth step involves the sale of the securities created by the SPV. Almost a lways, the securities are not sold directly by the administratorthe creator of th e trust. Typically, the administrator sells the certificates of the trust to the underwriter. The underwriter, which is generally an investment bank, purchases all such securities from the administrator with the responsibility of offering t hem up for sale to the ultimate investors. Notably, the underwriter can even ret ain some of these securities in its own portfolio. Retaining the riskiest securi ties is often viewed as a mechanism to signal the quality of those on sale. The fifth and final step of the process involves the purchase of securities by t he investor. The investor is then entitled to receive monthly payments of princi pal and interest on the securities from the SPV in their order of priority. The order of priority on the payment of principal and interest is determined by paym ent rights accorded to investors, depending on the class or tranche of security certificates purchased. The order of payment is determined in advance and stated on the indenture (legal document) that circumscribes the deal of securities gen erated in the process. At this stage, the ultimate investors of such securities can hold them on their balance sheet, sell them or even use them as collateral i n a repo arrangement. Is Shadow Banking Really Banking? The five steps above describe the simplest process of securitization by which se curities are created from originated loans. In some cases, segments of the proce ss are repeated to create more securities. Typically, the class of securities is sued depends on the maturity and type of underlying collateral (loans originated upstream). For example, mortgage-backed securities that are backed by residenti al or commercial mortgages typically have longer maturities than does asset-back ed commercial paper (ABCP) that is typically backed by loan receivables or credi t card receivables.10 MMMFs are among the principal investors in short-term ABCP. As mentioned above, MMMFs finance such investments with shares that can be redeemed on demand. On th e other hand, repo transactions employ securities of longer maturity as collater al for short-term borrowings of cash. In both cases, the liability formed is the oretically withdrawable on demand and of shorter maturity than the assets financ ed. In this way, the mechanics of the shadow banking system typically resemble t he functions of a commercial bank.

In the creation of securities, the cash proceeds from the sale of securities are passed upstream to all participating entitiesadministrator, aggregator and final ly to the originator of the loans. At each stage, therefore, each participating entity relies on the sale of the securities and loan documents for revenue. In a ddition, almost all of the participating entities require sources of short-term funding. This can arise for two reasons. First, as described earlier, the maturi ty on the securities can be of a shorter length than the maturity of the loans, requiring the entity to roll over the securities or use short-term funds to pay investors. Second, at each stage in the process of securitization, the need for short-term funding arises in the interval between the purchase of loans and thei r subsequent sale downstream. It has also been observed that all of the entities typically use a whole host of short-term instruments, like financial commercial paper, ABCP and repo transact ions, to fulfill their short-term funding requirements.11 To the extent that eac h entity uses short-term funding in the creation of assets (loans and securities ) of longer maturity, these entities perform the functions of a bank. In this se nse, individual entities of the credit intermediation process fulfill the functi ons of banking. Moreover, the process as a whole transforms longer-term loans with significant c redit risk (such as the origination of mortgages upstream) into instruments of s horter maturity and of considerably lower risk that are redeemable on demand (su ch as investment shares in MMMFs). In so doing, the credit intermediation proces s as a whole mimics the function of a bank. Shadow Banking and the Financial Crisis of 2007-2008 Given the discussion at the beginning of this essay, an obvious corollary that f ollows is the fragility of the shadow banking system. In traditional banking, th e fragility originates in a run by the bank's depositors. In securitized banking , the run comes from the deposit endthe providers of wholesale funding to the sha dow banks. The two markets in which such runs are most likely are the repo marke t and the commercial paper market. The evidence on runs in the markets for wholesale funding demonstrated the paral lel between traditional bank runs by depositors in the banking panics prior to 1 934 and the recent panic in credit markets that relied on wholesale funding. As wholesale funding dried up for troubled shadow banks, they were forced to sell o ff assets in order to meet liquidity demands of investors. Such a fire sale of a ssets lowered the prices of assets on similar collateral throughout the market, raising the cost of funding for healthy shadow banks precipitously. This trend was first pointed out for the repo market in a series of papers that are summarized in work by Gorton. In the interdealer repo market, a run occurred primarily through increased haircuts on the securities posted as collateral.12I n the case of some securities, especially those backed by troubled mortgage loan s, the haircuts were close to 100 percentimplying that these assets were no longe r eligible for repo transactions. An increase in the haircuts on the repo implie s an increased demand for collateral on the same loan or, conversely, a reductio n in the supply of funds for a given amount of collateral. Since the supply of c ollateral in the entire shadow banking system is fixed over the short run, this meant that there was a significant liquidity crunch (shortfall in the supply of funds) and a steep rise in the cost of funding through repo transactions. In the case of funding through MMMFs, the panic was witnessed in two major shock s to the commercial paper market in 2007-2008. The first shock came around JulyAugust 2007 with the collapse of certain financial entities that had invested he avily in subprime mortgages. This led investors to question the quality of even highly rated ABCP. As a result, the spread of ABCP over the federal funds rate i

ncreased from 10 basis points before the shock to 150 basis points in the days a fter the shock. The second and more severe shock occurred with the collapse of Lehman Brothers i n September 2008. This led to a direct default on commercial paper issued by Leh man Brothers, $785 million of which was held by the Reserve Primary Fundone of th e largest MMMFs, with more than $65 billion in assets. Needless to say, the news of exposure triggered a run on this fund and quickly spread to other MMMFs. To stem the run on MMMFs, the U.S. Treasury announced a temporary deposit insurance covering all money market instruments only three days after the collapse of Leh man. Conclusion The reader may question the rationale behind the development of the shadow banki ng system and all its components. While some analysts have asserted that the sha dow banking system is redundant and inefficient, it is not difficult to see the benefits of securitized banking. Securitization allows for risk diversification across borrowers, products and geographic location. In addition, it exploits ben efits of both scale and scope in segmenting the different activities of credit i ntermediation, thereby reducing costs. Moreover, by providing a variety of secur ities with varying risk and maturity, it provides financial institutions opportu nities to better manage their portfolios than would be possible under traditiona l banking. Finally, and contrary to popular belief, this form of banking increas es transparency and disclosure because banks now sell assets that would otherwis e be hosted on their opaque balance sheets. In summary, the shadow banking system can be viewed as a parallel systemone that is a complement to and not a substitute for traditional banking. The challenge g oing forward is to harness the benefits and mitigate the risks and redundancies of such a parallel banking system. The Special Purpose Vehicle Plays a Key Role in Shadow Banking The Special Purpose Vehicles (SPV) are typically organized as trusts to which th e seller/sponsor transfers the loan documents (receivables)sometimes on a rolling basis. The trust issues securities or trust certificates, which are then sold t o investors. Notably, SPVs are legal entities with no employees and no locations, merely crea ted by the administrator to hold the pool of loans and generate the securities. Technically, an SPV is bankruptcy-remote; this implies that if the administrator (creator of the SPV) were to enter a bankruptcy procedure, the administrator's creditors cannot seize the assets of the SPV. On the other hand, administrators will often provide an implicit guarantee beyond their contractual obligations to provide support to the SPV in the event of deterioration in asset performance.1 3 Figure 3 The Special Purpose Vehicle and Conduit

Click to enlarge The conduit for securitization is formed by the SPV and various third parties th at provide liquidity and credit enhancements to increase the marketability of th e security certificates sold to investors (Figure 3). In some cases, the maturit y of the certificates issued is shorter than the maturity on the originated loan s, requiring the conduit to roll over maturing securities to pay off investors.

Consequently, investors are exposed to roll-over risk and may require some form of liquidity provision as insurance against such risk. In addition, investors ca n require credit enhancement (against credit risk on loans that may default) in the form of a letter of credit from a bank or insurance company. The entities pr oviding the liquidity and credit enhancements, as well as administrative service s, are external to the SPV. It is possible that the administrator of the SPV is the same entity providing the liquidity and credit enhancements. Interestingly, the credit enhancements on the securities can also be internally generated. Two popular ways in which credit enhancement is achieved are overcoll ateralization and loan subordination (tranching). Overcollateralization is achie ved when either the SPV purchases loans at less than face value or issues certif icates whose total program size is less than that of the value of the loans purc hased or both. Tranching is the process by which payouts on the obligations are sliced, or tran ched, into classes, whereby the highest (senior-most) class of securities has se niority of claim over subordinated securities. Accordingly, the more senior-rate d tranches are less risky and generally have lower yields and higher bond credit ratings than the lower-rated tranches. An SPV may sell tranches of various clas ses linked by a waterfall structurea term referring to loans that are paid sequen tially from the most senior-rated tranches to most-subordinate tranches (Figure 4). It is important to note that the liquidity a nd credit enhancements on the s ecurities can be provided by one or all of the methods stated above. The sequence of payouts from the repayment on loans determines the rating and li quidity of each class of securities. The lowest tranche is known as the equity t ranche because it refers to the practice whereby the administrator or underwriter retains this tranche to mitigate problems of moral hazard and adverse selection . However, this norm has often been violated in practice.14 At the peak of the r ecent financial boom in the U.S., underwriters were able to sell equity tranches to investors with appetites for high risk. Figure 4 Tranching of Securities In a Waterfall Structure

Click to enlarge Write a Letter to the Editor | Read Letters to the Editor Endnotes See Adrian, Ashcraft, Boesky and Pozsar. [back to text] See Adrian, Ashcraft, Boesky and Pozsar. [back to text] Strictly speaking, this description fits commercial banks, which along with thri ft institutions (savings and loans and credit unions) make up the set of deposit ory institutions in the U.S. [back to text] In addition, credit intermediation involves "brokerage," whereby the bank also r educes pre- and post-contractual informational asymmetries between the borrower and the lender. Note that this brokerage function is not necessarily exclusive t o credit intermediation because many other intermediaries, such as used-car deal ers, perform a similar function. For more, see work by Greenbaum and Thakor. [ba ck to text] This key insight developed by Bryant and formalized in Diamond and Dybvig is arg uably the most celebrated work in banking theory. [back to text] See Diamond and Dybvig. [back to text]

See Wheelock and Wilson. [back to text] See Morrison and White. [back to text] See Admati, DeMarzo, Hellwig and Pfleiderer. [back to text] See Anderson and Gascon for details on MMMFs and ABCPs. [back to text] See Adrian, Ashcraft, Boesky and Pozsar. [back to text] The evidence is somewhat different for the tri-party repo market. See Copeland, Martin and Walker for details. [back to text] See Gorton and Souleles. [back to text] See Adrian, Ashcraft, Boesky and Pozsar. [back to text] References Admati, Anat R.; DeMarzo, Peter M.; Hellwig, Martin F.; and Pfleiderer, Paul. "F allacies, Irrelevant Facts, and Myths in the Discussion of Capital Regulation: W hy Bank Equity Is Not Expensive." Research Papers 2065, Stanford University Grad uate School of Business, 2010. Adrian, Tobias; Ashcraft, Adam; Boesky, Hayley; and Pozsar, Zoltan. "Shadow Bank ing." Staff Reports 458, Federal Reserve Bank of New York, July 2010. Anderson, Richard G.; and Gascon, Charles S. "The Commercial Paper Market, the F ed, and the 2007-2009 Financial Crisis." Federal Reserve Bank of St. Louis Revie w, Vol. 91, No. 6, November 2009, pp. 589-612. Bryant, John. "A Model of Reserves, Bank Runs, and Deposit Insurance." Journal o f Banking and Finance, Vol. 4, No. 4, 1980, pp. 335-44. Copeland, Adam; Martin, Antoine; and Walker, Michael. "The Tri-Party Repo Market before the 2010 Reforms." Staff Reports 477, Federal Reserve Bank of New York, November 2010. Diamond, Douglas W.; and Dybvig, Philip H. "Bank Runs, Deposit Insurance, and Li quidity." Journal of Political Economy, Vol. 91, No. 3, June 1983, pp. 401-19. Gorton, Gary B. Slapped by the Invisible Hand: The Panic of 2007. Oxford Univers ity Press, 2010. Gorton, Gary B.; and Souleles, Nicholas S. "Special Purpose Vehicles and Securit ization." in Carey, Mark; and Stulz, Ren M. eds., The Risks of Financial Institut ions. University of Chicago Press, 2007. Greenbaum, Stuart; and Thakor, Anjan V. Contemporary Financial Intermediation: S econd Edition. Elsevier, 2007. McCulley, Paul. "Teton Reflections." PIMCO Global Central Bank Focus, 2007. Morrison, Alan; and White, Lucy. "Crises and Capital Requirements in Banking." A merican Economic Review, Vol. 95, No. 5, December 2005, pp. 1548-72. Wheelock, David C.; and Wilson, Paul W. "Explaining Bank Failures: Deposit Insur ance, Regulation, and Efficiency." The Review of Economics and Statistics, Vol. 77, No. 4, November 1995, pp. 689-700. http://www.stlouisfed.org/publications/r e/articles/?id=2165 Notes: 1 I'm primarily using the term "transformation" instead of "revolution" to empha size that the social changes sought must be gained through peaceful, non-violent means. Where the word "revolution" is used, it connotes "peaceful revolution." 2 A counter-revolutionary is anyone who opposes or sabotages societal transforma tion or revolution, particularly those who act to stop change or act after a rev olution to try to overturn or reverse it. Counter-revolutionary: Tory, bitter-ender, diehard, hard hat, intransigent, obsc

urantist, reactionist, right-winger, rightist, royalist, standpatter, traditiona list, ultraconservative. The word "counterrevolutionary" originally referred to thinkers who opposed them selves to the 1789 French Revolution, such as Joseph de Maistre, Louis de Bonald , or, later, Charles Maurras, the founder of the Action franaise monarchist movem ent. Henceforth, it was used in France to qualify political movements that refus ed the legacy of the 1789 Revolution, which historian Ren Rmond referred to as lgit imistes. 3 Barry Grey, The revolutionary implications of the decline of American capitali sm, The Demonic Cabal's Economic War Against the World Author Barbaric Annihilation Worker Destitution Capitalist Genocide Replacing Capitalism Worker Survival Tone "Government is the only agency that can take a valuable commodity like paper, sl ap some ink on it, and make it totally worthless." Ludwig von Mises Modern American currency is an interesting example of how the demonic cabal has brainwashed common citizens to believe dangerous lies. Most Americans have no idea of how their currency is produced, if it has any intrinsic value, and ho w it is used by those in power to steal from the people. For example, when I ask ed college students this question I received very interesting answers: "Can United States currency be redeemed in gold only, or can it also be redeemed in silver?" 62% said that our currency is redeemable in both gold and silver. 35% said that is redeemable in neither gold nor silver. 19% said that it is redeemable only in gold. 8% admitted they didn't know. 0% said that it is redeemable in silver. (the answers were not mutually exclusive, thus the total percentage is more than 100%) Most Americans have been conditioned to believe unquestioningly in the infa llibility of the American monetary system and in the financial stability and int egrity of the American government. If we were awake to reality, we'd realize tha t we have our very survival staked on those beliefs. As defined in a background article, money is any object used in the exchang e of goods and services. However, we can distinguish between genuine money and m oney substitutes . Genuine money has several distinguishing characteristics: Real money is a durable, easily divisible commodity of a consistently high value

in its own right. Real money is a commodity which enjoys universal acceptance. This means its valu e is accepted by all people everywhere. Such a commodity has withstood the test of time as money; its value has been recognized over time in a number of countri es. To serve as real money, a commodity must be rare enough to be of great value yet available in adequate supply, or able to be produced in adequate amounts to ser ve as a medium of exchange or the basis of a medium of exchange. The only commodities which have consistently met these criteria in Western histo ry are gold and silver. A money substitute is anything that is circulated in place of money, such as pap er currency. A money substitute is illegitimate when it is merely the creation of a governme nt for the purposes of swindling the people: paper currency not backed by gold or silver digital notations within a computer system that have no necessary connection to money or money substitutes A money substitute is legitimate when it is: a note or receipt for real money--gold or silver or some commodity of equal valu e redeemable at any time in real money issued in reasonable proportion to the amount of real money in storage Modern Currency As a Ruler Hoax Until 1934, some of the currency of the United States was redeemable in gol d or silver. Note the $20 bill above indicated that the certificate was "payable to the bearer on demand" "IN GOLD COIN." Since the demonic cabal took over the American monetary system in 1913, wit h the creation of the "Federal" Reserve System, illegitimate money substitutes-called Federal Reserve Notes--have replaced genuine money and genuine money subs titutes. Note that the one dollar bill below does not include "payable to the be arer on demand." The Gold Reserve Act of 1934 abolished gold as domestic money and made it i llegal for American citizens to own gold. All gold and gold-backed currency was removed from circulation in the U.S. American gold-backed currency--that produce d before 1913--was still redeemable in gold or silver for foreign currency holde rs. However, in 1971, President Nixon in effect declared world bankruptcy; Ameri can currency was no longer redeemable for anyone. A booklet published by the Federal Reserve Bank of New York tells us: "Currency cannot be redeemed, or exchanged, for Treasury gold or any other asset used as backing. The question of just what assets 'back' Federal Reserve notes has little but bookkeeping significance." "It is well that the people of the nation do not understand our banking and mone tary system, for if they did, I believe there would be a revolution before tomor row morning." Henry Ford The Fed isn't shy about telling us about this money scam they're pulling on us. In a booklet entitled Modern Money Mechanics, the Federal Reserve Bank of C hicago says:

"In the United States neither paper currency nor deposits have value as commodit ies. Intrinsically, a dollar bill is just a piece of paper. Deposits are merely book entries. Coins do have some intrinsic value as metal, but generally far les s than their face amount." Why do Americans accept paper currency in place of real money--gold or silv er? Because the government forces them to. Federal Reserve currency has been des ignated "legal tender" by the government -- that is, it must be accepted. This i s what is meant by fiat money--currency or ledger entries that the government fo rces us to accept as money. In the fine print of a footnote in a bulletin of the Federal Reserve Bank o f St. Louis, we find this surprisingly candid explanation: "Modern monetary systems have a fiat base -- literally money by decree -- with d epository institutions, acting as fiduciaries, creating obligations against them selves with the fiat base acting in part as reserves. The decree appears on the currency notes: 'This note is legal tender for all debts, public and private.'" "The regional Federal Reserve banks are not government agencies. ...but are inde pendent, privately owned and locally controlled corporations." Lewis vs. United States, 680 F. 2d 1239 9th Circuit 1982 Wonder Why Dubya Increased the National Debt and Obama Raised the Debt Ceiling? Debt is the way the cabal, its corporate lackeys, and the Federal Reserve s teal from American taxpayers. It's a neat con game that almost all Americans are unaware of: The federal government prints a fancy piece of paper and calls it a bond or Tre asury note. Bonds or Treasury notes are merely promises to pay a specified sum a t a specified interest on a specified date. This is government debt, which will be paid for with taxpayer money. Unlike the Federal Reserve, which can create money out of thin air, tax revenues from working Americans come from their salaries which they earn through labor. The Fed then prints a Federal Reserve check and exchanges that with the governme nt in return for the bonds or notes that are left unsold from periodic governmen t sales. After this transaction, the government bonds and notes become "securiti es assets" for the Fed, which can be used to offset liabilities. Since it is required to have only 10% "reserve"--10% in some kind of reserve fun d to "back" its notes, then it can create 9 Fed notes for every dollar it has in "securities assets." These additional Fed notes can be loaned to other banks at interest. The government sends the Fed check to the Fed for deposit. Relative to that depo sit the government can now spend Fed notes (currency) for its expenses. Under th e Bush and Obama juntas, almost all of those Fed notes are paid out to the corpo rations that put them into power: the defense, pharmaceutical, and energy compan ies, among many others. What is actually happening is that huge amounts of currency created out of thin air (Fed notes without any backing whatsoever) now come into the American moneta ry system. This is inflation: increase in money substitutes. "The money power preys upon the nation in times of peace and conspires against i t in times of adversity. It is more despotic than monarchy, more insolent than a utocracy, more selfish than bureaucracy. I see in the near future a crisis appro aching that unnerves me and causes me to tremble for the safety of my country. C orporations have been enthroned, an era of corruption in high places will follow , and the money power of the country will endeavor to prolong its REIGN by worki ng upon the prejudices of the people until the wealth is aggregated in a few han

ds and the Republic is destroyed." President Abraham Lincoln after the National Banking Act of 1863 was passed Ever wonder why stamps have gone from 3 cents to 37 cents, why gasoline has gone from 20 cents to $3+ a gallon, etc. Has your salary gone up 100% in the la st twenty to thirty years? The demonic cabal puppets--American presidents and th eir cohorts--try to make you believe that inflation is something other than an i ncrease in the currency supply. It isn't. We can create a hypothetical society with a total currency supply of $10, w ith stamps costing 3 cents. If the total currency supply increases to $20 (100% increase) then there are now more Fed notes around to bid for that stamp and the price of the stamp goes up--possibly 100 percent. Only some sectors of the U.S. economy have experienced increases in prices. If you examine those that have, you'll see that they are all either state or fe deral governments or corporations which continually make huge donations to gover nment election campaigns. During this same time period, the after-expense income of the average worker has steadily and dramatically declined. The Banking Scam It's difficult for average Americans to understand what a hoax American ban king has become. Let's take a typical example, the purchase of a $100,000 home, with $30,000 paid for the cost of the land, architect's fee, sales commissions, building permits, etc., and $70,000 going for the cost of labor and building mat erials. The home buyer puts up $30,000 as a down payment and must then borrow $7 0,000. Let's say the loan is issued at 11% over a 30-year period; the amount of interest paid will be $167,806. That means the amount paid to the bank is about 2 1/2 times greater than p aid to those who provide all the labor and all the materials. Granted, this figu re represents the value of the amount borrowed over thirty years and might conce ivably be justified on the basis that a lender deserves to be compensated for su rrendering the use of his capital for 30 years. But that assumes the bank actually "surrendered" something real of value. It assumes that the bank had earned the money, saved it, and then loaned it for construction of someone's house. But the reality is that the bank did nothing to earn the money, had not saved it, and, in fact, simply created it out of thin a ir by putting numbers into a computer system. The Cabal's Weak Dollar Was Retaliation Against the Europeans The vindictive cabal has allowed the U.S. dollar to fall relative to Europe an currencies to attack their economies. This is how this exchange-rate ploy wor ks: To create a purely hypothetical situation, let's say that one U.S. dollar i s equivalent to two German marks. That means that a Mercedes SUV which sells for 100,000 DM (German marks) in Germ any will only cost $50,000. And it means that Americans are going to buy a lot o f Mercedes SUVs. However, if the American dollar drops in value so that it is worth only 1 G erman mark, then a Mercedes SUV which sells for 100,000 DM (German marks) in Germany will also cost $100,000. And it means that Americans are going to buy a lot few

er Mercedes cars and Europeans are going to be able to buy a lot more American g oods. So if you're a vindictive capitalist cabal, and you want to attack Europe's economy, then you allow the dollar to fall precipitately and Europe is suddenly selling a lot less Mercedes products and everything else to Americans and the r est of the world that deals in U.S. dollars. And you'll lie to the American peop le that this policy of letting the dollar slide against other currencies is in t he long-term interest of the American economy. The difficulty with this ploy is that the U.S. economy may go even further under than it is now--which will cause even more unemployment and less money for state and federal social support programs. Of course, the demonic cabal's puppe t presidents don't really care what happens to working people. And even if the e conomy goes into the toilet the wealthy have sufficient funds to weather the sto rm and when the crisis reaches its worst point, they'll be able to buy bankrupt businesses and real estate for pennies on the dollar. Meanwhile the cabal and its cronies ignore the warning signs of world depre ssion. The collapse of the world's 31st largest bank, the Osaka-based Resona Hol dings, became the subject of an emergency meeting of the Japanese cabinet and th e subsequent announcement of a $17 billion bailout operation by the Japanese gov ernment. America's Trade Deficit Shuffle America's current accounts deficit (which includes goods and services) will hit about $500 billion this year. Which means Americans will receive $500 billi on more in goods and services from other nations than we will provide to them. A ccording to Bridgewater Associates, foreigners currently hold 48% of the US Trea sury bond market. Foreigners also own 24% of our corporate bond market and 22% o f all US corporations. In total, foreigners hold $8 trillion of US financial ass ets. What this means is that Americans get goods, and foreigners get American dol lars, which, as we've seen, the Fed creates out of thin air and are not redeemab le in gold or silver. America's trade deficit means that foreigners are selling us more goods than they are buying from us; therefore, they have excess dollars, which are used to purchase Treasury bonds. By accepting and holding U.S. dollar s, foreign nations finance our trade deficit and the Bush and Obama administrati ons' wild deficit spending. Economists call this exporting inflation. The U.S. p rints ever more paper currency and foreigners end up paying higher prices. Economic analysts outside of America are fully aware of the cabal's economi c war against the other nations of the world. "America has launched its own weap on of mass destruction," said Nick Parsons, a currency strategist with Commerzba nk. "The US solution to deflation [lower prices] is to export it to the rest of the world." Europeans are clearly aware that one of the major reasons Bush created the Iraq war was to take Iraq oil interests off the Euro as the currency of exchange . Two other major reasons for Bush's fake war against Iraqi weapons of mass dest ruction was to reconfigure the entire Middle East and, whenever it becomes econo mically-politically expedient, to create a massive oil cartel with which to repl ace OPEC. The May 2003 terrorist strikes in Saudi Arabia raised speculation about po ssible CIA connection to the attack. Whoever carried out the attacks, and whoeve r was ultimately responsible for the operation, they give clear warning to the A rab world that regime change, cabal-style, may now be the inevitable future for them.

How We Can Defeat the Cabal Worldwide, people must realize that America is not the problem--the cabal a nd its puppets are! All of us need to distinguish clearly between the cabal and the American people. The struggle against the cabal must not degenerate into deb ilitating anti-American sentiments and activities. The American people do not de serve this power-mad band of thugs and they're not to blame for the havoc it's c ausing throughout the globe. Americans did not elect the cabal; it foisted itsel f on the American people by the criminal machinations of its illegal activities starting in the first decades of the twentieth century--and have continued in in creasing severity ever since. In the early part of 2003, European businesses began to boycott American go ods. This proved to be mostly a grand gesture, but it was in the right spirit. E uropeans, intelligent Americans, and others worldwide must begin standing up to the cabal, doing everything in our power to take power back from this insane gan g of outlaws, and making it clear to people everywhere just what an insane polic y the cabal's world imperialism really is. The worldwide anti-war protests were a harbinger of an effective reaction to the cabal's push toward a fascist dictat orship. A new strategy being seriously considered in the Muslim world is the re-ado ption of the gold dinar as the primary means of monetary exchange. Malaysia expe cts to use gold dinars to trade with other Islamic countries beginning in 2003. The gold dinar, which is 4.25 grams of 24-carat gold, would help Muslim nations fight the imperialistic onslaughts of Bush's misuse of the American dollar. The dinar is already being privately used in 22 countries and is minted in 4 nations . People in Europe, America, and other nations might also use the dinar and o ther gold coins as the foundation for a new, genuine gold-backed currency, retur ning to genuine money instead of fiat paper currency. The Islamic world has historically used a gold coin, so this would be a natu ral transition for them. Malaysian premier, Prime Minister Mahathir Mohamad, las t year proposed that the gold dinar could eliminate paper money and would obviat e arbitrary exchange rates and currency manipulation which was so rampant during the Asian financial crisis. "The risk of speculation," said Mohamad, "can be re duced to almost nothing. World trade can actually expand because the cost of bus iness will be much reduced as the need to hedge will practically disappear." People in America must be ready for the possibility that the cabal will rep roduce the history of 1930s Germany down to the hyper-inflationary crisis which brought financial ruin to hundreds of thousands of Germans and ushered in the de adly Nazi regime. The only safe course is to have one's own private supply of go ld coins--American Eagles--as a means of survival if the demonic cabal decides t o cause a complete collapse of the American economy. Our primary responsibility is to inform ourselves and to help others throug hout the world become fully informed as to what is really taking place--beyond t he delusions perpetrated by propaganda and disinformation and begin to create co operative commonwealth communities.

Updates:

8/1/2011: Banksters Attack American Sovereignty 1/21/2010: Haiti: a Crime of US Imperialism 10/8/03: Rove's Plan to Blame China for U.S. Manufacturing Job Loss 10/8/03: The End of American Economic Supremacy? 6/4/03: US-Europe tensions grow as Washington talks down the dollar 5/29/03: Currency upheaval could have major consequences 5/28/03: Bush Forces Tax Cut to Fool the Voters 5/27/03: Krugman: Anti-American Republicans Want a Fiscal Train Wreck So They Ca n Cut Basic Government Programs Republicans are creating fiscal conditions that make liberal programs unsustaina ble Militarism Supports Bush's Economic War Against the World

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Weiss Trustee HandbookDokument79 SeitenWeiss Trustee Handbook83jjmack96% (47)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Class Action Lawsuit Against Johnson & JohnsonDokument49 SeitenClass Action Lawsuit Against Johnson & JohnsonAnonymous GF8PPILW575% (4)

- Mandel 1965 Thesis On Jish Immign 1882-1914Dokument580 SeitenMandel 1965 Thesis On Jish Immign 1882-1914Gerald SackNoch keine Bewertungen

- State: Moorish Science Temple of America BookletDokument102 SeitenState: Moorish Science Temple of America BookletSheik Ron92% (36)

- State BookletDokument57 SeitenState BookletTruth Press Media100% (8)

- Securitization-101 Jean KeatingDokument23 SeitenSecuritization-101 Jean KeatingSue Rhoades100% (16)

- A Colonial History of Rowan County NorthDokument573 SeitenA Colonial History of Rowan County NorthTruth Press MediaNoch keine Bewertungen

- 34.list of Articles On Religious Topics PDFDokument6 Seiten34.list of Articles On Religious Topics PDFTruth Press MediaNoch keine Bewertungen

- Warren v. District of ColumbiaDokument1 SeiteWarren v. District of ColumbiaTruth Press MediaNoch keine Bewertungen

- Brian Schumaker Uscourts Ca11!11!13616 0Dokument15 SeitenBrian Schumaker Uscourts Ca11!11!13616 0Truth Press MediaNoch keine Bewertungen

- Van Guard CorpDokument17 SeitenVan Guard CorpTruth Press Media100% (1)

- 2 15-Cv-00212 - Doc 3 MS-MJD 2215 Michael Howard Reed 7 13 15Dokument2 Seiten2 15-Cv-00212 - Doc 3 MS-MJD 2215 Michael Howard Reed 7 13 15Truth Press MediaNoch keine Bewertungen

- Void Judgement Reed 95-Main 409-Cr-00076dlhDokument23 SeitenVoid Judgement Reed 95-Main 409-Cr-00076dlhTruth Press Media100% (1)

- Fiduciary Duty Howard Griswold 2 14 2015Dokument53 SeitenFiduciary Duty Howard Griswold 2 14 2015Truth Press Media100% (2)

- Howard Griswold March 31 2001Dokument12 SeitenHoward Griswold March 31 2001Truth Press MediaNoch keine Bewertungen

- Jesuit Extreme Oath of Induction Vertical FileDokument17 SeitenJesuit Extreme Oath of Induction Vertical FileTruth Press MediaNoch keine Bewertungen

- Exhibit G SecuritizationDokument54 SeitenExhibit G Securitizationzigzag7842611100% (1)

- 1850 Penal Code State of Georgia Gb0439Dokument259 Seiten1850 Penal Code State of Georgia Gb0439Truth Press MediaNoch keine Bewertungen

- United States Constitution - Circa 1787Dokument21 SeitenUnited States Constitution - Circa 1787Truth Press MediaNoch keine Bewertungen

- Greatest Story Never Told-UNTIL NOWDokument74 SeitenGreatest Story Never Told-UNTIL NOWtcyres100% (2)

- OurEnemyTheState byAlbertJKnockDokument101 SeitenOurEnemyTheState byAlbertJKnockTruth Press Media100% (1)

- Part IV Civil ProcedureDokument3 SeitenPart IV Civil Procedurexeileen08Noch keine Bewertungen

- Socialism and IslamDokument5 SeitenSocialism and IslamAbdul kalamNoch keine Bewertungen

- Newton 2nd and 3rd Laws Chapter 4-3Dokument20 SeitenNewton 2nd and 3rd Laws Chapter 4-3Jams FlorendoNoch keine Bewertungen

- PNR V BruntyDokument21 SeitenPNR V BruntyyousirneighmNoch keine Bewertungen

- Talend Data Quality DatasheetDokument2 SeitenTalend Data Quality DatasheetAswinJamesNoch keine Bewertungen

- Issues and Challenges Faced by Indian FederalismDokument7 SeitenIssues and Challenges Faced by Indian FederalismAnonymous JdfniItox3Noch keine Bewertungen

- Republic of The Philippines Province of Capiz Municipality of DumaraoDokument2 SeitenRepublic of The Philippines Province of Capiz Municipality of DumaraoCHEENY TAMAYO100% (1)

- 1788-10 Series 310 Negative Pressure Glove Box ManualDokument10 Seiten1788-10 Series 310 Negative Pressure Glove Box Manualzivkovic brankoNoch keine Bewertungen

- Necrowarcasters Cards PDFDokument157 SeitenNecrowarcasters Cards PDFFrancisco Dolhabaratz100% (2)

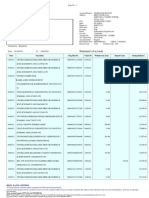

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument3 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirNoch keine Bewertungen

- Republic of The Philippines Province of Laguna Barangay - Office of The Barangay CaptainDokument3 SeitenRepublic of The Philippines Province of Laguna Barangay - Office of The Barangay CaptainNehru Valdenarro ValeraNoch keine Bewertungen

- Export-Import Documentation Aditya Kapoor PDFDokument8 SeitenExport-Import Documentation Aditya Kapoor PDFPradeepNoch keine Bewertungen

- Friday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleDokument11 SeitenFriday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleTom TuttleNoch keine Bewertungen

- Hearing Committee On Environment and Public Works United States SenateDokument336 SeitenHearing Committee On Environment and Public Works United States SenateScribd Government DocsNoch keine Bewertungen

- The UCC and The IRSDokument14 SeitenThe UCC and The IRSjsands51100% (2)

- of GoldDokument22 Seitenof GoldPooja Soni100% (5)

- Truth and Reconciliation Commission of Canada: PrinciplesDokument200 SeitenTruth and Reconciliation Commission of Canada: PrinciplesMaclean's Magazine100% (2)

- 03 Zoreta vs. SimplicianoDokument7 Seiten03 Zoreta vs. SimplicianoJed SulitNoch keine Bewertungen

- Avila V BarabatDokument2 SeitenAvila V BarabatRosana Villordon SoliteNoch keine Bewertungen

- 201908021564725703-Pension RulesDokument12 Seiten201908021564725703-Pension RulesanassaleemNoch keine Bewertungen

- GSTR1 Excel Workbook Template V1.7Dokument63 SeitenGSTR1 Excel Workbook Template V1.7Nagaraj SettyNoch keine Bewertungen

- In The Matter of The IBP 1973Dokument6 SeitenIn The Matter of The IBP 1973Nana SanNoch keine Bewertungen

- The Last Hacker: He Called Himself Dark Dante. His Compulsion Led Him To Secret Files And, Eventually, The Bar of JusticeDokument16 SeitenThe Last Hacker: He Called Himself Dark Dante. His Compulsion Led Him To Secret Files And, Eventually, The Bar of JusticeRomulo Rosario MarquezNoch keine Bewertungen

- Beebe ME Chain HoistDokument9 SeitenBeebe ME Chain HoistDan VekasiNoch keine Bewertungen

- MOTION FOR SUMMARY JUDGMENT (Telegram)Dokument59 SeitenMOTION FOR SUMMARY JUDGMENT (Telegram)ForkLogNoch keine Bewertungen

- Informal Market and Work Decent 212689Dokument507 SeitenInformal Market and Work Decent 212689Lenin Dos Santos PiresNoch keine Bewertungen

- The History of Oil Pipeline RegulationDokument20 SeitenThe History of Oil Pipeline Regulationsohail1985Noch keine Bewertungen

- SAN JUAN ES. Moncada North Plantilla 1Dokument1 SeiteSAN JUAN ES. Moncada North Plantilla 1Jasmine Faye Gamotea - CabayaNoch keine Bewertungen