Beruflich Dokumente

Kultur Dokumente

Presented By:-B.Jayati Gupta Sameera Patnaik

Hochgeladen von

B Jayati GuptaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Presented By:-B.Jayati Gupta Sameera Patnaik

Hochgeladen von

B Jayati GuptaCopyright:

Verfügbare Formate

Presented By:B.

Jayati Gupta Sameera Patnaik

Private equity is the provision of equity capital

by financial investors over the medium or

long term to non-quoted companies with high

growth potential

Create

a business & develop your export performance

Improve

Recruit

Sell

highly qualified personnel

part or all of your company

Change

the size of your business and take

over one of your competitors

Launch

a new product your management capacity some of your assets

Improve

Liquidise

Private Private

equity v/s self financing

equity v/s debt

Private

equity v/s raising capital via stock

market flotation

INSTITUTIONAL INVESTORS

FUND OF FUNDS

PRIVATE INDIVIDUALS

CORPORATES

OTHERS

PRIVATE EQUITY INVESTMENT FUND

PORTFOLIO/INVESTEE CO.1 PORTFOLIO/INVESTEE CO.2 PORTFOLIO/INVESTEE CO.3

PE MANAGEMENT COMPANY

Independent Captive

Semi

- captive

Business

Plan

The executive summary Company History Management Team Products and Services Analysis of your market and your competitors Operational Management

Financial projections Capital requirement Exit possibilities

Selecting The

a private equity firm

negotiation process

Company valuation

Offer letter

Final negotiation

Signing

the agreement

Venture capital means funds made available

for startup firms and small businesses with exceptional growth potential. Venture capital is a subset of private equity All venture capital is private equity but all private equity is not a venture capital

Venture Capitalists generally: Finance new and rapidly growing companies Purchase equity securities Assist in the development of new products or services Add value to the company through active participation.

The SEBI has defined Venture Capital Fund in its

Regulation 1996 as a fund established in the

form of a company or trust which raises money through loans, donations, issue of securities or

units as the case may be and makes or proposes

to make investments in accordance with the regulations.

Injects Shares

long term equity finance both the risk and reward practical advice and assistance

Provides

Network

Venture

of contacts

capitalists are experienced in the

process of IPO

SEED MONEY

START UP

FIRST ROUND

FOURTH ROUND

THIRD ROUND

SECOND ROUND

Financial Stage

Period (Funds locked in years)

Risk Perception

Activity to be financed For supporting a concept or idea or R&D for product development Initializing operations or developing prototypes

Seed Money

7-10

Extreme

Start Up

5-9

Very High

First Stage

3-7

High

Start commercials production and marketing

Financial Stage

Period (Funds locked in years) 3-5

Risk Perception

Activity to be financed

Second Stage

Sufficiently high

Expand market and growing working capital need

Market expansion, acquisition & product development for profit making company Facilitating public issue

Third Stage

1-3

Medium

Fourth Stage

1-3

Low

Deal origination

Screening

Due diligence (Evaluation) Deal structuring Post investment activity Exit plan

The financing pattern of the deal is the most

important element. Following are the various methods of venture financing:

Equity

Conditional loan Income note Participating debentures Quasi equity

Initial public offer(IPOs)

Trade sale

Promoter buy back Acquisition by another company

Company %

types

Acquired

Size Structure Stage

Risk

& return

Das könnte Ihnen auch gefallen

- Venture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhallDokument24 SeitenVenture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhalltarunshridharNoch keine Bewertungen

- Venture Capital .Dokument20 SeitenVenture Capital .Chanakya BharadwajNoch keine Bewertungen

- F#4 Venture CapitalDokument6 SeitenF#4 Venture CapitalMahnoor AbidNoch keine Bewertungen

- FMS Venture CapitalDokument20 SeitenFMS Venture CapitalChanakya BharadwajNoch keine Bewertungen

- Venture CapitalDokument28 SeitenVenture CapitalAdii AdityaNoch keine Bewertungen

- VenturecapitalDokument37 SeitenVenturecapitalJulie ChristianNoch keine Bewertungen

- Presentation On: Venture CapitalDokument15 SeitenPresentation On: Venture Capitalvineeta4604Noch keine Bewertungen

- Venture Capital and Private Equity Investments: DR Saif SiddiquiDokument22 SeitenVenture Capital and Private Equity Investments: DR Saif SiddiquiRahul Kumar JhaNoch keine Bewertungen

- K.Sai Vinay Kumar M.Vamsee Krishna TrinathDokument8 SeitenK.Sai Vinay Kumar M.Vamsee Krishna Trinathvinayvin19Noch keine Bewertungen

- On Venture CapitalDokument20 SeitenOn Venture Capitalsouravcdx50% (2)

- Financial Sevice ProjectDokument7 SeitenFinancial Sevice ProjectAbdul AzeemNoch keine Bewertungen

- Venture Capital - FINDokument5 SeitenVenture Capital - FINclaudiaNoch keine Bewertungen

- This Is A Way To Raise Money To Start A Business and This Is Known As Venture CapitalDokument17 SeitenThis Is A Way To Raise Money To Start A Business and This Is Known As Venture CapitalJigar DhuvadNoch keine Bewertungen

- What Is Venture Capital?Dokument5 SeitenWhat Is Venture Capital?Symon StefenNoch keine Bewertungen

- How Venture Capital Firms WorkDokument8 SeitenHow Venture Capital Firms Worksanket sunthankarNoch keine Bewertungen

- Venture Capital FinalDokument18 SeitenVenture Capital Finalprgupta92Noch keine Bewertungen

- What Is Venture Capital?Dokument9 SeitenWhat Is Venture Capital?Stephane LabrosseNoch keine Bewertungen

- Venture CapitalDokument11 SeitenVenture CapitalRakesh SNoch keine Bewertungen

- Venture Capital Funding - FSDokument14 SeitenVenture Capital Funding - FSashaya_j_007Noch keine Bewertungen

- Venture CapitalDokument28 SeitenVenture CapitalSurbhi10Noch keine Bewertungen

- Doing Deals in PEDokument139 SeitenDoing Deals in PEHarjot SinghNoch keine Bewertungen

- Venture CapitalDokument6 SeitenVenture CapitalpriyankaNoch keine Bewertungen

- Lecture#29 2Dokument14 SeitenLecture#29 2Nasira IdreesNoch keine Bewertungen

- Lecture#29 2Dokument14 SeitenLecture#29 2Nasira IdreesNoch keine Bewertungen

- Venture CapitalDokument16 SeitenVenture CapitalmahinderNoch keine Bewertungen

- Venture Capital": Prepared byDokument13 SeitenVenture Capital": Prepared byRatnesh SinghNoch keine Bewertungen

- Venture CapitalDokument51 SeitenVenture Capitaljravish100% (6)

- Early Stage FundingDokument29 SeitenEarly Stage FundingHarsh AgarwalNoch keine Bewertungen

- VC Funding FinalDokument18 SeitenVC Funding FinalShipra SrivastavaNoch keine Bewertungen

- Venture Capital: Presented By: Prof.B.ManchandaDokument47 SeitenVenture Capital: Presented By: Prof.B.ManchandaAkshat AgarwalNoch keine Bewertungen

- Venture CapitalDokument47 SeitenVenture CapitalAkshat AgarwalNoch keine Bewertungen

- Capital Catalyst: The Essential Guide to Raising Funds for Your BusinessVon EverandCapital Catalyst: The Essential Guide to Raising Funds for Your BusinessNoch keine Bewertungen

- Venture CapitalDokument14 SeitenVenture CapitalMinaz VhoraNoch keine Bewertungen

- CH 10 Venture Capital Financing (M.Y.Khan)Dokument18 SeitenCH 10 Venture Capital Financing (M.Y.Khan)Gowtham Reloaded DNoch keine Bewertungen

- Venture Capital: Samyak Anand Mba B&F A50050220004Dokument16 SeitenVenture Capital: Samyak Anand Mba B&F A50050220004samyakNoch keine Bewertungen

- Venture Capital: MMS - FinanceDokument16 SeitenVenture Capital: MMS - FinanceRanjit SinghNoch keine Bewertungen

- 210402100010-Anushka Bhut-Introduction of Venture Capital Project ReportDokument9 Seiten210402100010-Anushka Bhut-Introduction of Venture Capital Project ReportAnushka BhutNoch keine Bewertungen

- Venture CapitalDokument45 SeitenVenture Capital1986anuNoch keine Bewertungen

- Venture CapitalDokument27 SeitenVenture CapitalVkiran GowdaNoch keine Bewertungen

- Venture CapitalDokument38 SeitenVenture CapitalPardeep PardeepNoch keine Bewertungen

- Venture CpitalDokument32 SeitenVenture CpitalshilpavivekNoch keine Bewertungen

- Priyanshu DecemberDokument2 SeitenPriyanshu DecemberYash PathakNoch keine Bewertungen

- Venture CapitalDokument12 SeitenVenture CapitalSamraizTejaniNoch keine Bewertungen

- Venture Capital and Entrepreneurial FinanceDokument15 SeitenVenture Capital and Entrepreneurial FinanceArun KumarNoch keine Bewertungen

- FINSIGHTDokument12 SeitenFINSIGHTGaurav AnandNoch keine Bewertungen

- Raghav DecemberDokument2 SeitenRaghav DecemberYash PathakNoch keine Bewertungen

- 46 46 What Is Venture CapitalDokument51 Seiten46 46 What Is Venture CapitalPavan KumarNoch keine Bewertungen

- Priyanshu DecemberDokument2 SeitenPriyanshu DecemberYash PathakNoch keine Bewertungen

- Unit 21 Private Equity and Venture CapitalDokument10 SeitenUnit 21 Private Equity and Venture CapitalHari RajNoch keine Bewertungen

- Institute of Management & Technology: Submitted ToDokument39 SeitenInstitute of Management & Technology: Submitted ToIsha VohraNoch keine Bewertungen

- Week 4 - Venture Capital - Investment ApproachDokument48 SeitenWeek 4 - Venture Capital - Investment ApproachHanna TauschkaNoch keine Bewertungen

- Phase 2Dokument10 SeitenPhase 2Akesh GuptaNoch keine Bewertungen

- About Venture Capital (VC)Dokument16 SeitenAbout Venture Capital (VC)Shalini JaiswalNoch keine Bewertungen

- Case 2Dokument19 SeitenCase 2sharnette.daley22Noch keine Bewertungen

- Venture Capital PresentationDokument20 SeitenVenture Capital PresentationAcousticParesh PatelNoch keine Bewertungen

- VC 131209235045 Phpapp02Dokument45 SeitenVC 131209235045 Phpapp02rachealllNoch keine Bewertungen

- Entrepreneurship Mba 802 Pp8 Financing The BusinessDokument25 SeitenEntrepreneurship Mba 802 Pp8 Financing The BusinessfrancisNoch keine Bewertungen

- Megha Minor Front Page SAIMDokument28 SeitenMegha Minor Front Page SAIMHarshvardhan SolankiNoch keine Bewertungen

- Ethical Valuation: Navigating the Future of Startup InvestmentsVon EverandEthical Valuation: Navigating the Future of Startup InvestmentsNoch keine Bewertungen

- EC Corporate Presentation-July 2010Dokument18 SeitenEC Corporate Presentation-July 2010Zeid MassadNoch keine Bewertungen

- Bomer and Maxim - 2018Dokument32 SeitenBomer and Maxim - 2018Hoai AnhNoch keine Bewertungen

- International RetailingDokument13 SeitenInternational RetailingAbhi SinghNoch keine Bewertungen

- Corparate FinanceDokument8 SeitenCorparate FinanceREDAPPLE MEDIANoch keine Bewertungen

- 4 International Strategic Management ADokument111 Seiten4 International Strategic Management AKiran RimalNoch keine Bewertungen

- Investors Email List SampleDokument6 SeitenInvestors Email List SampleAsheesh prajapatiNoch keine Bewertungen

- Innovation - Growth Engine For Nation - Nice Buzzword But Often MisunderstoodDokument642 SeitenInnovation - Growth Engine For Nation - Nice Buzzword But Often MisunderstoodRajiv DharaskarNoch keine Bewertungen

- UT Dallas Syllabus For Fin6315.0g1.10s Taught by Madison Pedigo (mfp013000)Dokument8 SeitenUT Dallas Syllabus For Fin6315.0g1.10s Taught by Madison Pedigo (mfp013000)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Towards A Healthy Ecology of Arts and CultureDokument13 SeitenTowards A Healthy Ecology of Arts and CultureMission Models MoneyNoch keine Bewertungen

- An Analysis of Investors Behaviour On Various Investment Avenues in IndiaDokument74 SeitenAn Analysis of Investors Behaviour On Various Investment Avenues in IndiaDivya ChawhanNoch keine Bewertungen

- Entrepreneurship Successfully Launching New Ventures 5th Edition Ebook PDFDokument62 SeitenEntrepreneurship Successfully Launching New Ventures 5th Edition Ebook PDFdouglas.smith397100% (38)

- Motilal Oswal - Priyadarshini-06036Dokument125 SeitenMotilal Oswal - Priyadarshini-06036Nipun Triwadi33% (3)

- HW Listening - StartupsDokument2 SeitenHW Listening - StartupsLuis Manuel JuárezNoch keine Bewertungen

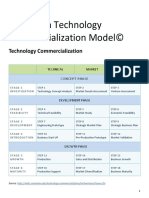

- Goldsmith Technology Commercialization Model©Dokument24 SeitenGoldsmith Technology Commercialization Model©FiqriNoch keine Bewertungen

- Investor-VC PitchDokument20 SeitenInvestor-VC Pitchsamir ChaudhariNoch keine Bewertungen

- Entrepreneurship and Innovation The Keys To Global Economic RecoveryDokument24 SeitenEntrepreneurship and Innovation The Keys To Global Economic RecoveryglamisNoch keine Bewertungen

- FIN 310 Fall 2020 SyllabusDokument4 SeitenFIN 310 Fall 2020 SyllabusShadow FightNoch keine Bewertungen

- 01 - The Nature and Importance of EntrepreneursDokument26 Seiten01 - The Nature and Importance of Entrepreneursphirlayayadil100% (1)

- EntrepreneurshipDokument21 SeitenEntrepreneurshipTalha AkramNoch keine Bewertungen

- MSC - TIP - AY2021 - English - TechnoprenurshipDokument8 SeitenMSC - TIP - AY2021 - English - TechnoprenurshipRADHIKANoch keine Bewertungen

- Case Study CrumplerDokument11 SeitenCase Study CrumplerAlexanderWebbNoch keine Bewertungen

- Enterprenurship Course Outline HECDokument4 SeitenEnterprenurship Course Outline HECKashif KhanNoch keine Bewertungen

- Dashdondov. A Study On Mongolia's National Innovation SystemDokument11 SeitenDashdondov. A Study On Mongolia's National Innovation SystemHanfie VandanuNoch keine Bewertungen

- VC Rejection RateDokument4 SeitenVC Rejection Ratemoonerman100Noch keine Bewertungen

- Chap 15 SolutionsDokument6 SeitenChap 15 SolutionsMiftahudin MiftahudinNoch keine Bewertungen

- Commercial Law by AryaDokument10 SeitenCommercial Law by AryaArya BhartiNoch keine Bewertungen

- Managing Director Private Equity in New York NY Resume Eliot PowellDokument2 SeitenManaging Director Private Equity in New York NY Resume Eliot PowellEliotPowellNoch keine Bewertungen

- Sample ChapterDokument33 SeitenSample ChapterYoga KalyanamNoch keine Bewertungen

- Best Business Plan For Iostream Hotel PDFDokument23 SeitenBest Business Plan For Iostream Hotel PDFbiniam85% (48)

- Module 1Dokument11 SeitenModule 1Rpatil AshwiniNoch keine Bewertungen