Beruflich Dokumente

Kultur Dokumente

TBC - ARTCILE - Transfer Pricing

Hochgeladen von

Vandana JaiswalOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TBC - ARTCILE - Transfer Pricing

Hochgeladen von

Vandana JaiswalCopyright:

Verfügbare Formate

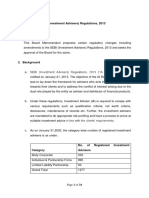

LAWS ON TRANSFER PRICING AND FINANCE BILL, 2009- - IMPORTANT CHANGES

By Timir Baran Chatterjee Sr. Executive Vice President(Corporate Affairs & Legal) and Company Secretary- DIC India Limited.

Concept Transfer Pricing (TP) relates to the pricing of international transactions (such as transfer of goods, services, intangibles and funds) that take place within associated enterprises ( which means related and group companies as defined in Section 92A of the Income Tax Act) in different tax jurisdictions. The TP transactions include export of goods and services to Associated enterprise or import of goods and services from Associated enterprise. Even a loan taken from foreign holding company or technical collaboration arrangement with the foreign parent company will come under the ambit of TP. However, TP regulation does not cover international transactions(e.g. imports, exports etc) with unrelated companies even if the transaction amounts to a very high value. Similarly TP regulation does not cover transactions with domestic companies even if the transactions are made with the related or group companies. It only covers international transactions with associated companies. Why TP Regulation is necessary To illustrate this, let us suppose a subsidiary company A resident in country India (which has a tax rate of, say, 34%) manufactures goods and transfers them to its parent company B in country Singapore (which has a tax rate of 20%) for trading. In order to increase the overall profits (net earnings after payment of tax) of the group company, the Company A (subsidiary) located in India may supply the goods at prices which are lower than the market price to its parent company B(holding ). These goods are sold ultimately in Singapore at market price. So, in effect, the subsidiary company A in country India will have lower profits and [therefore,] a lower tax incidence whereas the parent company B in country Singapore is affected in the opposite manner i.e. higher profits due to low costs, but lower taxes because of the tax rate - which illustrates the importance of TP from a taxation perspective. As a result Indian Tax Authority will get lower tax revenue in view of showing low profitability in India and overall net earnings (PAT) of the Group ( Indian Co + Singapore Co) will enhance .

We may also take the help of one more example by which a foreign MNC may even enhance its overall net earnings of the Group by way exporting profit to India ( normally such case is unheard of ) as under: Subsidiary company A sets up a manufacturing facility in India as a SEZ Unit. SEZ unit enjoys tax exemption for a specified period ( first five years 100%, next five years 50% and subsequent next five years 50% subject to certain compliances). Company A supplies goods to its various associated units (within the same group) located in USA, Europe, and other countries where the average tax rate say 30%. In order to increase the overall profits of the Group, the Company A located in India may supply goods to its associated companies located outside India at a price more than the market price. These goods are sold ultimately at the destination countries at Market Price. So in effect we will find that Indian Company s book (Company A) will show higher profit but it will have no effect towards payment of tax since it enjoys tax holiday. The group companies located outside India will show lower profit due to higher cost of imports and correspondingly it will pay lower tax. In effect the overall net earnings ( Indian Company +other group companies located outside India) of the Group will enhance substantially. To curb the revenue leakages as stated above, the Finance Act, 2001 introduced provisions regulating TP in the Income Tax Act, 1961 with effect from 1 April, 2001. The 2001 amendment, which defined associated enterprise and international transaction for the first time, has brought much needed clarity to the law. The concept of Arms Length Price (ALP) has also been introduced and according to section 92(1) of the Act, any income arising from an international transaction shall be computed having regard to the ALP Methods for calculating arms length price To counter TP manipulations, the Organization of Economic Cooperation & Development (OECD) introduced the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations in 1995. These guidelines are respected worldwide and the Indian TP regime is primarily based on them, though with a few customized features. Under the TP regime, the transfer price has to be determined on the basis of the arms length principle and the price so determined is the Arms Length Price (ALP). According to the arms length principle, there are two sets of method for arriving at the ALP: Transactional methods: These methods emphasize each transaction specifically rather than considering the overall profit figure of related entities to arrive at the ALP. These are: (a) Comparable Uncontrolled Prices method (CUP)

(b)Cost Plus Method (CPM) Resale Price Method (RPM). Non Transactional Methods: In non transactional methods, related parties income figures are considered and adjusted according to their share. These are: (a) Profit Split Method (PSM) (b) Transactional Net Margin Method (TNMM): Under the Indian TP regime, there is no hierarchy in terms of preferred methods of determining ALP. Indeed, as per section 92C (2) of the Income Tax 1961, the most appropriate method has to be applied for determining ALP in the manner prescribed under Rules 10 A to 10C notified vide S.O. 808 E dated 21.8.2001. Disputes in TP Assessment As deals get increasingly complicated, and given other regulatory considerations, determining of arms length price becomes a delicate exercise and transfer pricing reporting and compliance becomes difficult. Often there are no comparable uncontrolled transactions and prices applied by related parties are always subject to challenge. In the absence of relevant comparable datas and other details most of the MNCs use TNMM Method which are mostly disputed by the revenue. Transfer pricing has, therefore, increasingly become a cause of dispute for entities engaged in cross border trade with related parties. Transfer Pricing regulation and Finance Bill, 2009 Under Finance Bill, 2009 certain important amendments have been introduced in the transfer pricing provisions to ease the existing condition. The primary amendments are the introduction of the concept of Safe Harbour Rules and Alternate Dispute Resolution(ADR) mechanism. Introduction of safe harbour rules The Finance Bill 2009 introduced Safe Harbour rules by empowering Central Board of Direct Taxes, an apex tax administrative body (CBDT) to frame such rules. The concept of Safe Harbour suggests that the results declared by the taxpayers who fulfill the prescribed conditions are accepted without detailed scrutiny. In general, the theory of a TP safe harbour is that the burden imposed in applying Arms length principle can be relieved by providing the circumstances in which the taxpayers could follow a simple set of rules under which the Tax

Authority would automatically accept the pricing of the assessee. In effect, a safe harbour is a defined parameter. Internationally, safe harbours aim to reduce transfer pricing compliance requirements and provide certainty to taxpayers by reducing the challenges of reported prices. Safe harbours typically fall into two categories, one where certain types of transactions are exempt from transfer pricing compliance and the other, where industry-specific price ranges may be prescribed and compliance with such changes will deem a price to be at arms length price. With respect to first type-where exemptions are prescribed based on the threshold values of international transactions or entity size- these would prove useful to entities where the value of international transactions with associates enterprises are minimal or small entities. Examples of such transactions may be providing of ECB (External Commercial Borrowing) to the Indian subsidiary when such loans are provided by complying RBI guidelines or Issue of convertible Debentures to Holding Company when such conversion price is determined as per SEBI guidelines etc. In the second type of safe harbour, there will be industry-specific price range this will be coupled with easier reporting system. So long the industry maintains the above price range there would not be any further scrutiny or adjustment with regard to TP issues. However, CBDT is to come out with exact rules and modus operandi. Though the Safe Harbour provisions provide a degree of certainty to tax payers, particularly to non-residents investing in India, but the international community is divided on account of demerits associated with it viz., difficulty in quantification of safe harbour, exemption limit, acceptance of safe harbour rules by one jurisdiction in another jurisdiction which may give rise to double taxation, create tax planning opportunities, acceptance of safe harbour price range by the Customs authority for the purpose of import (from associated enterprise) valuation etc. Introduction of Alternative Disputes Resolution A new Section 144C has been inserted in the Income Tax Act providing the mechanism of ADR akin to the concept of Advance Pricing Mechanism. The law has been amended to provide for an alternate dispute resolution (ADR) mechanism for dealing with TP disputes for all categories of taxpayers, as well as disputes relating to taxation of foreign companies in general. Key features of the Rules are as under:

(a) A Dispute Resolution Panel (Panel) comprising of 3 Commissioners of Income Tax is proposed to be constituted by the CBDT. (b) The taxpayers who are subjected to TP adjustment and foreign companies are covered under the ADR mechanism. (c) The Tax Authority is required to forward a copy of the draft assessment order to the taxpayers if the former proposes a variation to the income or loss which is prejudicial to the taxpayers. (d) The taxpayers need to file their objections, if any, with the Panel and the Tax Authority, within 30 days of the receipt of the draft order. (e) The Panel would consider the facts and circumstances of the case and issue appropriate directions to the Tax Authority, within a maximum period of 9 months. The directions of the Panel are binding on the Tax Authority. (f)Orders passed by the Tax Authority, in accordance with the direction of the Panel, are directly appealable before the ITAT. It is expected that with the introduction of Safe Harbour Rules and ADR mechanism, the TP related disputes will be minimized in future to a considerable extent.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- JacoMUN Conference HandbookDokument14 SeitenJacoMUN Conference HandbookPromit BiswasNoch keine Bewertungen

- University of Cagayan Valley: Professional Conduct and Ethical StandardDokument3 SeitenUniversity of Cagayan Valley: Professional Conduct and Ethical StandardLeonie Anne TumaliuanNoch keine Bewertungen

- Contemporary Banking-A Micro Finance PerspectiveDokument4 SeitenContemporary Banking-A Micro Finance PerspectiveHardhik S ShethNoch keine Bewertungen

- Chapter 15 Self Study SolutionsDokument22 SeitenChapter 15 Self Study SolutionsTifani Titah100% (1)

- MasteringPhysics - CH 31-KirchhoffsDokument19 SeitenMasteringPhysics - CH 31-KirchhoffsBalanced100% (5)

- Evid DigestsDokument66 SeitenEvid DigestsDarlene ReyesNoch keine Bewertungen

- Sample Position PapaerDokument1 SeiteSample Position PapaeremmaldavisNoch keine Bewertungen

- Technical Data - LUPOLEN 5261 ZDokument3 SeitenTechnical Data - LUPOLEN 5261 ZCristhian Huanqui TapiaNoch keine Bewertungen

- SEBI Circular Compliance AuditDokument34 SeitenSEBI Circular Compliance AuditAnkit UjjwalNoch keine Bewertungen

- Mattermost Vs Slack TCODokument6 SeitenMattermost Vs Slack TCOdracknerNoch keine Bewertungen

- Slavery PamphletDokument41 SeitenSlavery PamphletCassianoPereiradeFariasNoch keine Bewertungen

- Covid Care FacilityDokument5 SeitenCovid Care FacilityNDTVNoch keine Bewertungen

- Client Manual Consumer Banking - CitibankDokument29 SeitenClient Manual Consumer Banking - CitibankNGUYEN HUU THUNoch keine Bewertungen

- Holtz DeclinationDokument1 SeiteHoltz DeclinationCeleste KatzNoch keine Bewertungen

- National Human Rights CommissionDokument15 SeitenNational Human Rights CommissionVDNoch keine Bewertungen

- Financial Statement AnalysisDokument4 SeitenFinancial Statement AnalysisAreti SatoglouNoch keine Bewertungen

- Quinto Vs ComelecDokument3 SeitenQuinto Vs ComelecEthan ZacharyNoch keine Bewertungen

- Number: CIPT Passing Score: 800 Time Limit: 120 Min File Version: 1Dokument30 SeitenNumber: CIPT Passing Score: 800 Time Limit: 120 Min File Version: 1Mohamed Fazila Abd RahmanNoch keine Bewertungen

- Hate Speech Social MediaDokument12 SeitenHate Speech Social MediaΑγγελικήΝιρούNoch keine Bewertungen

- Integration of IndiaMART V2.0Dokument3 SeitenIntegration of IndiaMART V2.0himanshuNoch keine Bewertungen

- TRU - Academic Schedule and Important Dates - 2023-2024Dokument1 SeiteTRU - Academic Schedule and Important Dates - 2023-2024Aravind KrishnaNoch keine Bewertungen

- 02 Intertrod Maritime Vs NLRCDokument3 Seiten02 Intertrod Maritime Vs NLRCDavid Antonio A. EscuetaNoch keine Bewertungen

- S1720, S2700, S5700, and S6720 V200R011C10 Configuration Guide - Interface ManagementDokument121 SeitenS1720, S2700, S5700, and S6720 V200R011C10 Configuration Guide - Interface ManagementkfNoch keine Bewertungen

- M. A. Political Science Semester System Course Scheme: 1 SEMESTER (Autumn) 4 CORE CoursesDokument73 SeitenM. A. Political Science Semester System Course Scheme: 1 SEMESTER (Autumn) 4 CORE Coursestarak madduNoch keine Bewertungen

- Review of A Prayer To Our FatherDokument7 SeitenReview of A Prayer To Our FatherJonathan W. LankfordNoch keine Bewertungen

- Life As A Model of ExcellenceDokument10 SeitenLife As A Model of ExcellencemaryamNoch keine Bewertungen

- Iso-Iec 19770-1Dokument2 SeitenIso-Iec 19770-1Ajai Srivastava50% (2)

- Filipinas Synthetic Fiber Corporation vs. CA, Cta, and CirDokument1 SeiteFilipinas Synthetic Fiber Corporation vs. CA, Cta, and CirmwaikeNoch keine Bewertungen

- Police Officer Cover Letter Minimalist - BlueDokument2 SeitenPolice Officer Cover Letter Minimalist - BlueRia Elrica DayagNoch keine Bewertungen

- PornographyDokument5 SeitenPornographySyed Ahtasham ul haqNoch keine Bewertungen