Beruflich Dokumente

Kultur Dokumente

Capital Structure Theories Explained

Hochgeladen von

shivavishnuOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Structure Theories Explained

Hochgeladen von

shivavishnuCopyright:

Verfügbare Formate

INTRODUCTION

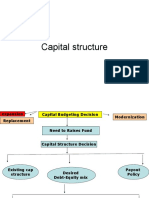

The optimum capital structure may be defined as that capital structure or combination of debt and equity that leads to the maximum value of the firm. Capital structure can affect the value of the company by affecting either its expected earnings or the cost of capital or both.

The first four sections of the chapter explain the major capital structure theories.

Net Income Approach Net Operating Income Approach Modigliani-Miller Approach Traditional Approach.

CAPITAL STRUCTURE THEROIES Assumptions

There are only two sources of funds used by a firm : perpetual riskless debt and ordinary shares. There are corporate taxes. This assumption is removed later. The dividend-payout ratio is 100%. That is, the total earnings are paid out as dividend to the shareholders and there are no retained earnings. The firms total assets are given and do not change. The investment decisions are, in other words, assumed to be constant. The firms total financing remains constant. The firm can change its degree of leverage (capital structure) either by selling shares and use by the proceeds to retire debentures or by raising more debt and reduce the equity capital. The operating profits (EBIT) are not expected to grow. All investors are assumed to have the same subjective probability distribution of the future expected EBIT for a given firm. The firms business risk is constant over time and is assumed to be independent of its capital structure and financial risk. Perpetual life of the firm.

NET INCOME APPROACH

The capital structure decision is relevant to the valuation of the firm. In other words, a change in the capital structure/financial leverage will lead to a corresponding change in the overall cost capital as well as the total value of the firm. If, therefore, the degree of financial leverage as measured by the ratio of debt to equity is increased, the weighted average cost of capital will decline, while of the firm as well as the market price of ordinary shares will increase. Conversely, a decrease in the leverage will cause an increase in the overall cost of capital and a decline both in the value of the firm as well as the market price of equity shares.

The Net Income approach to valuation is based on three assumptions.

There are no taxes. That the cost of debt is less than the equity capitalization rate or the cost of equity. That the use of debt does not change with the risk-perception of investors.

NET OPERATING INCOME (NOI) APPROACH

The net operating income (NOI) approach is diametrically opposite to the net income approach. The essence of this approach is that the leverage/capital structure decision of the firm is irrelevant. Any change the market price of shares, as the overall cost of capital is independent of the degree of leverage.

The NOI approach is based on the following propositions, Overall Cost of Capital/Capitalization Rate (Ko) is constant

The NOI approach to valuation argues that the overall capitalization rate of the firm remains constant for all degree of leverage. The value of the firm, given the level of EBIT, is determine V= EBIT Ko

Residual Value of Equity

The value of equity is a residual value which is determined by deducting the total value of debt (B) from the total value of the firm (V). Symbolically, Total market value of equity capital (S) = V B.

Changes in Cost of Equity Capital

The equity-capitalization rate/cost of equity capital (Ko) increase with the degree of leverage. The increase in the proportion of debt in the capital structure relatively to equity shares would lead to an increase in the financial risk to the ordinary shareholders. To compensate for the increased, the shareholders would expect a higher rate of return on their investments. The increase in the equity capitalization rate ( or the lowering of the price-earnings ratio, i.e. P/E ratio) would match the increase in the debt-equity ratio. The Ke would be

=Ko + (Ko Ki) B S

Cost of Debt

The cost of debt (Ki) has two parts: (a) explicit cost, represented by the rate of interest. Irrespective of the degree of leverage, the firm is assumed to be able to be borrow at a given rate of interest. This implies that the increasing proportion of debt in the financial structure does not affect the financial risk of the lenders and they do not penalise the frim by charging higher interest. (b) implicit or hidden cost.

Optimum Capital Structure

The total value of the firm is unaffected by its capital structure. No matter what the degree of leverage is, the total value of the firm will remain constant. The market price of shares will also not change with the change in the debt equity ratio. There is nothing such as an optimum capital structure. Any capital structure is optimum, according to the NOI Approach.

MODIGLIAN-MILLER (MM) APPROACH

The Modiglinian-Miller thesis relating to the relationship between the capital structure, cost of capital and valuation is askin to the net operating income (NOI) approach.

Das könnte Ihnen auch gefallen

- 13corporate Social Responsibility in International BusinessDokument23 Seiten13corporate Social Responsibility in International BusinessShruti SharmaNoch keine Bewertungen

- Capital StructureDokument41 SeitenCapital StructuremobinsaiNoch keine Bewertungen

- Chapter Four: Capital StructureDokument28 SeitenChapter Four: Capital StructureFantayNoch keine Bewertungen

- Leverage PPTDokument13 SeitenLeverage PPTamdNoch keine Bewertungen

- Relative Valuations FINALDokument44 SeitenRelative Valuations FINALChinmay ShirsatNoch keine Bewertungen

- Calculate Terminal Cash FlowDokument9 SeitenCalculate Terminal Cash FlowKazzandraEngallaPaduaNoch keine Bewertungen

- Capital Structure: Overview of The Financing DecisionDokument68 SeitenCapital Structure: Overview of The Financing DecisionHay JirenyaaNoch keine Bewertungen

- Fin33 3rdexamDokument3 SeitenFin33 3rdexamRonieOlarteNoch keine Bewertungen

- Major Research Project On "Impact of Availability Bias, Overconfidence Bias, Low Aversion Bias On Investment Decision Making"Dokument32 SeitenMajor Research Project On "Impact of Availability Bias, Overconfidence Bias, Low Aversion Bias On Investment Decision Making"shaurya bandil100% (2)

- Cost of CapitalDokument44 SeitenCost of CapitalSubia Hasan50% (4)

- 05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersDokument6 Seiten05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersMerr Fe PainaganNoch keine Bewertungen

- PICPA - Member in Good Standing 2022Dokument1 SeitePICPA - Member in Good Standing 2022Ricalyn E. SumpayNoch keine Bewertungen

- Chapter Five Inventory Management - Chapter 4Dokument10 SeitenChapter Five Inventory Management - Chapter 4eferemNoch keine Bewertungen

- Working Capital Management FinanceDokument16 SeitenWorking Capital Management FinanceHims75% (8)

- Basket Wonders Balance Sheet and Income Statement RatiosDokument32 SeitenBasket Wonders Balance Sheet and Income Statement RatiosOSAMA0% (1)

- Chapter 5 Statement of Changes in EquityDokument6 SeitenChapter 5 Statement of Changes in EquitylcNoch keine Bewertungen

- Cash Flow Statement Analysis Hul FinalDokument10 SeitenCash Flow Statement Analysis Hul FinalGursimran SinghNoch keine Bewertungen

- 05 Fixed Income SecuritiesDokument55 Seiten05 Fixed Income SecuritiessukeshNoch keine Bewertungen

- Cost of Capital PDFDokument34 SeitenCost of Capital PDFMathilda UllyNoch keine Bewertungen

- Chap 004Dokument30 SeitenChap 004Tariq Kanhar100% (1)

- An Evaluation of The Efficiency of Loan Collection Policies and Procedures Among Selected MultiDokument9 SeitenAn Evaluation of The Efficiency of Loan Collection Policies and Procedures Among Selected MultiMariz Lazalita RetolinNoch keine Bewertungen

- Chapter Three CVP AnalysisDokument65 SeitenChapter Three CVP AnalysisBettyNoch keine Bewertungen

- Income Taxation Exclusions and Gross IncomeDokument6 SeitenIncome Taxation Exclusions and Gross IncomeJane TuazonNoch keine Bewertungen

- Financial Planning and Forecasting Chapter SummaryDokument40 SeitenFinancial Planning and Forecasting Chapter SummaryannafuentesNoch keine Bewertungen

- Factors Affecting Cost of CapitalDokument40 SeitenFactors Affecting Cost of CapitalKartik AroraNoch keine Bewertungen

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Dokument22 SeitenDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNoch keine Bewertungen

- Cost of CapitalDokument53 SeitenCost of CapitalJaodat Mand KhanNoch keine Bewertungen

- Chapter 2 - The Business Plan Road Map To SuccessDokument52 SeitenChapter 2 - The Business Plan Road Map To SuccessFanie SaphiraNoch keine Bewertungen

- Valuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dokument47 SeitenValuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dufuxwerr WerrNoch keine Bewertungen

- H P I S T: IRE Urchase and Nstallment ALE RansactionsDokument46 SeitenH P I S T: IRE Urchase and Nstallment ALE RansactionsJayant MittalNoch keine Bewertungen

- Final Exam Taxation 101Dokument8 SeitenFinal Exam Taxation 101Live LoveNoch keine Bewertungen

- Module 3 - Capital BudgetingDokument1 SeiteModule 3 - Capital BudgetingPrincess Frean VillegasNoch keine Bewertungen

- The Cost of Capital: Multiple Choice QuestionsDokument26 SeitenThe Cost of Capital: Multiple Choice QuestionsRodNoch keine Bewertungen

- Banking CH 2 Central BankingDokument10 SeitenBanking CH 2 Central BankingAbiyNoch keine Bewertungen

- Module 2.1-Cost of CapitalDokument12 SeitenModule 2.1-Cost of CapitalBheemeswar ReddyNoch keine Bewertungen

- Chap 5Dokument52 SeitenChap 5jacks ocNoch keine Bewertungen

- Chapter 3 - Sources of FinancingDokument5 SeitenChapter 3 - Sources of FinancingSteffany RoqueNoch keine Bewertungen

- Seven Unidentified Philippine IndustriesDokument4 SeitenSeven Unidentified Philippine Industriessi_roselynNoch keine Bewertungen

- Receivable Management KanchanDokument12 SeitenReceivable Management KanchanSanchita NaikNoch keine Bewertungen

- Q: Compare The Following Goals and Explain Why Wealth Maximization Is Chosen by The Firms?Dokument1 SeiteQ: Compare The Following Goals and Explain Why Wealth Maximization Is Chosen by The Firms?Mahvesh ZahraNoch keine Bewertungen

- Chapter-17-LBO MergerDokument69 SeitenChapter-17-LBO MergerSami Jatt0% (1)

- C.A IPCC Ratio AnalysisDokument6 SeitenC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- CHAPTER 5 - Portfolio TheoryDokument58 SeitenCHAPTER 5 - Portfolio TheoryKabutu ChuungaNoch keine Bewertungen

- Financial Management: Week 10Dokument10 SeitenFinancial Management: Week 10sanjeev parajuliNoch keine Bewertungen

- 5.1 Receivable ManagementDokument18 Seiten5.1 Receivable ManagementJoshua Cabinas100% (1)

- Capital Budgeting MethodsDokument3 SeitenCapital Budgeting MethodsRobert RamirezNoch keine Bewertungen

- SRGGDokument31 SeitenSRGGPinky LongalongNoch keine Bewertungen

- 08 11 December 2018 Questions and AnswersDokument26 Seiten08 11 December 2018 Questions and AnswersMae TomeldenNoch keine Bewertungen

- Deductions From Gross IncomeDokument23 SeitenDeductions From Gross IncomeAidyl PerezNoch keine Bewertungen

- Capital Budgeting ProblemsDokument9 SeitenCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Cost of Capital: Concept, Components, Importance, Example, Formula and SignificanceDokument72 SeitenCost of Capital: Concept, Components, Importance, Example, Formula and SignificanceRamya GowdaNoch keine Bewertungen

- Direct TaxDokument39 SeitenDirect TaxPriyanka Vilas GawasNoch keine Bewertungen

- Corporate Financial Analysis with Microsoft ExcelVon EverandCorporate Financial Analysis with Microsoft ExcelBewertung: 5 von 5 Sternen5/5 (1)

- Net Operating Income ApproachDokument14 SeitenNet Operating Income ApproachRoopesh Kannur100% (1)

- Presentation 1 - Capital StructureDokument36 SeitenPresentation 1 - Capital StructureKomal KachoreNoch keine Bewertungen

- Numericals On Capital Structure Theories - KDokument12 SeitenNumericals On Capital Structure Theories - KnidhiNoch keine Bewertungen

- Capital Structure and LeverageDokument31 SeitenCapital Structure and Leveragealokshri25Noch keine Bewertungen

- FM Capital Structure TheoryDokument6 SeitenFM Capital Structure Theoryjabeenbegum916Noch keine Bewertungen

- Capital Structure DecisionDokument58 SeitenCapital Structure DecisionPinky AggarwalNoch keine Bewertungen

- Accounting-Formats For Cambridge IGCSEDokument11 SeitenAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (8)

- Assignment 3-IndividualDokument5 SeitenAssignment 3-IndividualAva MedNoch keine Bewertungen

- ACT Bill December 2019Dokument4 SeitenACT Bill December 2019kulaiNoch keine Bewertungen

- Deferred AnnuityDokument13 SeitenDeferred AnnuitySteven Baculanta100% (2)

- Chapter 22 FinalDokument15 SeitenChapter 22 FinalMichael HuNoch keine Bewertungen

- Credit Approval Process For Corporate CustomersDokument35 SeitenCredit Approval Process For Corporate CustomershummankhanNoch keine Bewertungen

- Warrants & ConvertiblesDokument12 SeitenWarrants & ConvertiblesKshitij SharmaNoch keine Bewertungen

- 9706 s12 QP 22Dokument16 Seiten9706 s12 QP 22Faisal RaoNoch keine Bewertungen

- FCFF Vs FCFE Reconciliation Template: Strictly ConfidentialDokument2 SeitenFCFF Vs FCFE Reconciliation Template: Strictly ConfidentialvishalNoch keine Bewertungen

- AFS - Financial ModelDokument6 SeitenAFS - Financial ModelSyed Mohtashim AliNoch keine Bewertungen

- BB Circuler 16 May 2019 Fepd 21eDokument5 SeitenBB Circuler 16 May 2019 Fepd 21eAdnan IslamNoch keine Bewertungen

- Debit Card RHBDokument2 SeitenDebit Card RHBTiong M Chiew100% (1)

- Annual Income Tax Return: Reset FormDokument4 SeitenAnnual Income Tax Return: Reset FormGil DelenaNoch keine Bewertungen

- In A NutshellDokument3 SeitenIn A NutshellJane TuazonNoch keine Bewertungen

- Frauds by DefaultDokument11 SeitenFrauds by Defaultsilvernitrate1953Noch keine Bewertungen

- Chapter 12 SolutionsDokument92 SeitenChapter 12 SolutionsCrystal Brown100% (1)

- Impact of Black-MoneyDokument26 SeitenImpact of Black-MoneyDevikaSharma100% (2)

- UNIT IV - The Accommodation Product Notes PDFDokument16 SeitenUNIT IV - The Accommodation Product Notes PDFKiran audinaNoch keine Bewertungen

- Clarkson Lumber Case Study - SolDokument5 SeitenClarkson Lumber Case Study - SolWaqar Azeem73% (11)

- Case Digest - FRIADokument13 SeitenCase Digest - FRIAAiko DalaganNoch keine Bewertungen

- Gallagher 5e.c4Dokument27 SeitenGallagher 5e.c4Stacy LanierNoch keine Bewertungen

- NegoDokument8 SeitenNegoJohn M. MoradaNoch keine Bewertungen

- Affidavit BIRDokument1 SeiteAffidavit BIREnp Gus AgostoNoch keine Bewertungen

- Shriram Life Insurance Company (Wiki)Dokument2 SeitenShriram Life Insurance Company (Wiki)KaranPatil50% (2)

- Language of businessDokument3 SeitenLanguage of businesslemerleNoch keine Bewertungen

- Harvard Case Study - Flash Inc - AllDokument40 SeitenHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Introduction To Compensation ManagementDokument15 SeitenIntroduction To Compensation Managementarpit verma0% (1)

- Payroll Project PDFDokument39 SeitenPayroll Project PDFUsmän Mïrżä100% (2)

- Technicalline 00147-171us Goingconcern 12january2017Dokument11 SeitenTechnicalline 00147-171us Goingconcern 12january2017SəbuhiƏbülhəsənliNoch keine Bewertungen

- EPF Act 1952 SummaryDokument14 SeitenEPF Act 1952 SummaryradhakrishnaNoch keine Bewertungen