Beruflich Dokumente

Kultur Dokumente

Wilkerson Company 3

Hochgeladen von

Mohammad RakivOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Wilkerson Company 3

Hochgeladen von

Mohammad RakivCopyright:

Verfügbare Formate

Executive Summary Taking into account the difference among product and high proportion of overheads, Wilkerson should

abandon its existing cost system and move to activity-based costing. The profitability analysis indicates that the company earns healthy margins on pumps and valves. However, the margin of flow controllers at actual usage of capacity is negative. Wilkerson should consider action targeted at cost reduction (changes in flow controllers design or in their production and delivery process) or raising the price of flow controllers for customers. Since flow controllers are customized, the company can set different prices for different customers (groups of customers) based on the actual amount of resources spent (e.g. implement activity-based pricing). Problem Wilkerson has to estimate the profitability of its products in order to make long-term product mix decisions. These decisions should be based on estimation of product costs and might include decisions to continue / stop production of a particular product, pricing decisions, and decisions concerning product and process design, including customer relations. Information Information about direct labor and material costs as well as overhead costs is available. Overheads are recorded by five cost pools (machining, setup labor, receiving and production control, engineering, and packaging and shipment). We assume that the current month is typical in terms of (a) capacity utilization, and (b) cost of resources. Analysis Competitive situation The competitive situation varies for Wilkersons products. Pump and flow controllers are on the opposite sides of the spectrum. Pumps are commodity products, produced in high volumes for a market with severe price competition. Flow controllers, on the contrary, are customized products, sold in a less competitive market with inelastic demand at the current price range. The third..

Executive Summary Taking into account the difference among product and high proportion of overheads, Wilkersonshould abandon its existing cost system and move to activity-based costing. The profitability analysisindicates that the company earns healthy margins on pumps and valves. However, the margin of flow controllers at actual usage of capacity is negative. Wilkerson should consider action targeted atcost reduction (changes in flow controllers design or in their production and delivery process) orraising the price of flow controllers for customers. Since flow controllers are customized, thecompany can set different prices for different customers (groups of customers) based on the actualamount of resources spent (e.g. implement activity-based pricing).

Problem Wilkerson has to estimate the profitability of its products in order to make long-term product mixdecisions. These decisions should be based on estimation of product costs and might includedecisions to continue / stop production of a particular product, pricing decisions, and decisionsconcerning product and process design, including customer relations.

Information Information about direct labor and material costs as well as overhead costs is available. Overheadsare recorded by five cost pools (machining, setup labor, receiving and production control,engineering, and packaging and shipment). We assume that the current month is typical in terms of (a) capacity utilization, and (b) cost of resources.

Analysis Competitive situation The competitive situation varies for Wilkersons products. Pump and flow controllers are on theopposite sides of the spectrum. Pumps are commodity products, produced in high volumes for amarket with severe price competition. Flow controllers, on the contrary, are customized products,sold in a less...

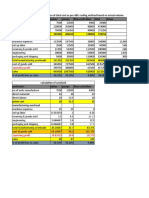

. Management Accounting Course Assessment In the Wilkerson Company case study of Harvard Business School, the main issue that the company is facing lower pre-tax operating margin (3%) comparing to historical pre-tax operating margin of 10%. Currently, the company uses simple Overhead Absorption Rate (OAR) in its accounting system. After OAR is obtained through dividing the total manufacturing overheads by the total activity level; it is then charged to different products' unit cost based on the respective direct labor hour spent. The OAR obtained in this case study is 300%. Referring to Exhibit 1, with the fact that flow

controllers have better selling price since this product line is protected from market competiveness, it appears to have the highest actual gross margin of 41.0%; followed by valves (34.9%) and pumps (19.5%). The OAR reflects the company's major product line - pumps, to hold direct responsibility on the overall poor income performance, mainly due to its continuous price reduction to compete against the market. Conversely comparing the operating statistics in March 2000, the flow controllers recorded the least units produced and yet required the highest production runs, shipments and engineering works. This product line also being charged at low manufacturing overheads comparing to pumps, by reason of its low direct labor cost. Exhibit 1 Considering another accounting system, Activity-Based Costing (ABC) identifies the company's activities level and allocate respective costs based on workload and expenditure; assigning indirect costs to the products' direct costs. Thus based on the company's study on Wilkerson's overheads, ABC would be fair as the selected accounting system to identify the products actual costs, where the manufacturing overheads and other expenses are charged based on the relevant activities level showed in Table 1. Referring to Exhibit 2, the ABC has indicated that valves (46.3%) have the highest actual gross margin, followed by pumps (33.1%) and flow controllers (-9.9%). In fact, it is found that the flow controllers are having negative gross margin due to the extensive workload required to produce and deliver the products. The results for both systems have turned out to be totally different, whereby the flow controllers' product line in underperforming and should be increased in selling price. As for valves and pumps, the ABC actually proves that valves have achieved, while pumps almost achieve the targeted 35% gross margin. Table 1 Exhibit 2 Recently, Wilkerson Company has raised the price for flow controllers for more than 10%, and it is found that the decision does not affect

Das könnte Ihnen auch gefallen

- Wilkerson Case SubmissionDokument5 SeitenWilkerson Case Submissiongangster91100% (2)

- Wilkerson Case Study Final1Dokument5 SeitenWilkerson Case Study Final1mayer_ofer95% (22)

- Wilkerson Case SolutionDokument4 SeitenWilkerson Case Solutionishan.gandhi1Noch keine Bewertungen

- Bridgeton Industries Case Study - Designing Cost SystemsDokument2 SeitenBridgeton Industries Case Study - Designing Cost Systemsdgrgich0% (3)

- Correlation Analysis Multiple Linear Regression With All 3 AnalystsDokument3 SeitenCorrelation Analysis Multiple Linear Regression With All 3 AnalystsEdward BerbariNoch keine Bewertungen

- Store24 A and B Questions - Fall - 2010Dokument2 SeitenStore24 A and B Questions - Fall - 2010Arun PrasadNoch keine Bewertungen

- Group 7B - Wilkerson Case SubmissionDokument5 SeitenGroup 7B - Wilkerson Case SubmissionHardik Sanghavi100% (1)

- Solution To WilkersonDokument5 SeitenSolution To WilkersonChinee Natividad100% (2)

- Wilkerson Company ABCDokument4 SeitenWilkerson Company ABCrajyalakshmiNoch keine Bewertungen

- BCHDokument3 SeitenBCHKhodyot Reang33% (3)

- Bridgeton WriteupDokument3 SeitenBridgeton Writeupzxcv3214100% (1)

- How Does Wilkerson's Existing Cost System Operate? Develop A Diagram To Show How Costs Flow From Factory Expense Accounts To ProductsDokument4 SeitenHow Does Wilkerson's Existing Cost System Operate? Develop A Diagram To Show How Costs Flow From Factory Expense Accounts To ProductsKunal DhageNoch keine Bewertungen

- Wilkerson CompanyDokument26 SeitenWilkerson CompanyChris Vincent50% (2)

- Anagene - Final Case AssignmentDokument19 SeitenAnagene - Final Case AssignmentSantiago Fernandez Moreno100% (1)

- Destin Brass Case AnalysisDokument1 SeiteDestin Brass Case Analysisfelipevwa100% (1)

- WilkDokument3 SeitenWilkMohammed Maaz GabburNoch keine Bewertungen

- Wilkerson Company Full ReportDokument9 SeitenWilkerson Company Full ReportFatihahZainalLim100% (1)

- Group 8Dokument20 SeitenGroup 8nirajNoch keine Bewertungen

- Vyaderm Caseanalysis PDFDokument6 SeitenVyaderm Caseanalysis PDFSahil Azher RashidNoch keine Bewertungen

- Case 2 Corporate FinanceDokument5 SeitenCase 2 Corporate FinancePaula GarciaNoch keine Bewertungen

- NLP 2019-20Dokument36 SeitenNLP 2019-20Akshay TyagiNoch keine Bewertungen

- Independent Review of SAPD's Special Victims UnitDokument26 SeitenIndependent Review of SAPD's Special Victims UnitDillon Collier100% (1)

- BSBHRM614 Appendices Templates V1.0Dokument24 SeitenBSBHRM614 Appendices Templates V1.0Fitri AnaNoch keine Bewertungen

- Case AnalysisDokument3 SeitenCase AnalysisBadri100% (2)

- Wilkerson Case Study FinalDokument5 SeitenWilkerson Case Study Finalmayer_oferNoch keine Bewertungen

- Wilkerson CompanyDokument4 SeitenWilkerson Companyabab1990Noch keine Bewertungen

- Management Accounting Wilkerson Company CasestudyDokument3 SeitenManagement Accounting Wilkerson Company CasestudysamacsterNoch keine Bewertungen

- Wilkerson Case Assignment Questions Part 1Dokument1 SeiteWilkerson Case Assignment Questions Part 1gangster91Noch keine Bewertungen

- Wilkerson Case Study Final1Dokument5 SeitenWilkerson Case Study Final1Swapan Kumar Saha100% (1)

- WilkersonDokument4 SeitenWilkersonmayurmachoNoch keine Bewertungen

- Wilkerson CompanyDokument2 SeitenWilkerson CompanyAnkit VermaNoch keine Bewertungen

- Case4 - Wilkerson CompanyDokument24 SeitenCase4 - Wilkerson CompanyCik Beb Gojes100% (1)

- Wilkerson CaseDokument4 SeitenWilkerson CaseChiara RibeiroNoch keine Bewertungen

- EX 1 - WilkersonDokument8 SeitenEX 1 - WilkersonDror PazNoch keine Bewertungen

- Wilkerson CaseDokument1 SeiteWilkerson CaseAna100% (1)

- Wilkerson - Case Study1 PDFDokument2 SeitenWilkerson - Case Study1 PDFPavanNoch keine Bewertungen

- International Accounting Group Assignment WilkersonDokument27 SeitenInternational Accounting Group Assignment WilkersonToshimichi ItoNoch keine Bewertungen

- Wilkerson CompanyDokument2 SeitenWilkerson Companydp14Noch keine Bewertungen

- Wilkerson ABC Costing Case StudyDokument8 SeitenWilkerson ABC Costing Case StudyParamjit Singh100% (4)

- Wilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverDokument2 SeitenWilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverLeonardoGomez100% (1)

- Wilkerson CompanyDokument9 SeitenWilkerson CompanyPrabhav GuptaNoch keine Bewertungen

- WilkersonDokument4 SeitenWilkersonVarun Gogia67% (3)

- CitibankDokument2 SeitenCitibankNiks Srivastava100% (1)

- Bridgeton CaseDokument8 SeitenBridgeton Casealiraza100% (2)

- Johnson Beverage Inc PresentationDokument20 SeitenJohnson Beverage Inc PresentationShouib MehreyarNoch keine Bewertungen

- A. Quantitative Factors: The Moulder Company Summary and Revised RecommendationDokument5 SeitenA. Quantitative Factors: The Moulder Company Summary and Revised RecommendationAaron SyNoch keine Bewertungen

- Section E - Group 1 - RegionFly CaseDokument6 SeitenSection E - Group 1 - RegionFly CaseAshish VijayaratnaNoch keine Bewertungen

- Wilkerson Company - Class PracticeDokument5 SeitenWilkerson Company - Class PracticeYAKSH DODIANoch keine Bewertungen

- Case Study WilkersonDokument2 SeitenCase Study WilkersonHIMANSHU AGRAWALNoch keine Bewertungen

- Aries Agro Limited Case StudyDokument10 SeitenAries Agro Limited Case StudySelwin DsouzaNoch keine Bewertungen

- Software Associates Case AnalysisDokument8 SeitenSoftware Associates Case AnalysisMuhammad AsifNoch keine Bewertungen

- Chemical Bank FinalDokument21 SeitenChemical Bank FinalMonisha SharmaNoch keine Bewertungen

- Caribbean Internet Café, CVP Analysis - Accurate EssaysDokument2 SeitenCaribbean Internet Café, CVP Analysis - Accurate EssaysVishali ChandrasekaranNoch keine Bewertungen

- Financial Management at Bajaj AutoDokument8 SeitenFinancial Management at Bajaj AutoNavin KumarNoch keine Bewertungen

- Sales Capacity Planning A Complete Guide - 2019 EditionVon EverandSales Capacity Planning A Complete Guide - 2019 EditionNoch keine Bewertungen

- CompanyDokument4 SeitenCompanyKomalVatsaNoch keine Bewertungen

- Abc Report ScriptDokument2 SeitenAbc Report ScriptKim DedicatoriaNoch keine Bewertungen

- Dwnload Full Managerial Accounting Creating Value in A Dynamic Business Environment 9th Edition Hilton Solutions Manual PDFDokument36 SeitenDwnload Full Managerial Accounting Creating Value in A Dynamic Business Environment 9th Edition Hilton Solutions Manual PDFjohncastroebx0100% (8)

- Chapter 3 SolutionDokument71 SeitenChapter 3 SolutionAatif KahloonNoch keine Bewertungen

- Wilkerson Solution On QuestionsDokument2 SeitenWilkerson Solution On QuestionsJihane DahanNoch keine Bewertungen

- Chap 005Dokument88 SeitenChap 005palak32100% (1)

- CH 5Dokument88 SeitenCH 5kenson100% (3)

- PMP Formulas 01234Dokument12 SeitenPMP Formulas 01234Waqas AhmedNoch keine Bewertungen

- US Staffing Website Content UpdatedDokument18 SeitenUS Staffing Website Content Updatedshilpa sunilNoch keine Bewertungen

- 5MIS - Business Applications-Part IDokument41 Seiten5MIS - Business Applications-Part IPravakar GhimireNoch keine Bewertungen

- Chapter 3Dokument27 SeitenChapter 3Roseanne YumangNoch keine Bewertungen

- Describe The Board Composition and Audit Reports Given in Each Individual ReportDokument2 SeitenDescribe The Board Composition and Audit Reports Given in Each Individual Reportmuhammad aalyanNoch keine Bewertungen

- Total Quality Management Short NoteDokument4 SeitenTotal Quality Management Short NoteHazim IzzatNoch keine Bewertungen

- 01 Handout 1Dokument3 Seiten01 Handout 1Aljean Kaye BalogoNoch keine Bewertungen

- 0414 - Performance Appraisal - Supervisory, ManagerialDokument6 Seiten0414 - Performance Appraisal - Supervisory, ManagerialMaria Monica TajonNoch keine Bewertungen

- Quality AwardsDokument22 SeitenQuality AwardsbhavinpvNoch keine Bewertungen

- Management Education, Issues, Challenges, OpportunitiesDokument27 SeitenManagement Education, Issues, Challenges, Opportunitieseveril fernandes100% (3)

- What Is A Technical Feasibility StudyDokument2 SeitenWhat Is A Technical Feasibility Studysapna_3Noch keine Bewertungen

- Kline 2017Dokument10 SeitenKline 2017OsamaIbrahimNoch keine Bewertungen

- Ch01 - Innovative Management For Turbulent TimesDokument24 SeitenCh01 - Innovative Management For Turbulent TimesRISRIS RISMAYANINoch keine Bewertungen

- The Art of Risk Management in InvestingDokument1 SeiteThe Art of Risk Management in InvestingfunukufuNoch keine Bewertungen

- Chapter 5Dokument31 SeitenChapter 5cherryyllNoch keine Bewertungen

- Bill of Material (BOM) ExcellenceDokument10 SeitenBill of Material (BOM) ExcellenceAjay DayalNoch keine Bewertungen

- How To Write A Test Plan PDFDokument4 SeitenHow To Write A Test Plan PDFNevets NonnacNoch keine Bewertungen

- Disaster Management LectureDokument59 SeitenDisaster Management LectureJulietRomeo100% (2)

- Task Performance in The Entrepreneurial MindDokument1 SeiteTask Performance in The Entrepreneurial MindBianca Nicole LiwanagNoch keine Bewertungen

- ACC223 Review Materials PDFDokument5 SeitenACC223 Review Materials PDFAra CatogNoch keine Bewertungen

- Bahasa Inggris XiiDokument10 SeitenBahasa Inggris XiiKasmadNoch keine Bewertungen

- Variable Costing: A Tool For ManagementDokument16 SeitenVariable Costing: A Tool For ManagementShehroze KayaniNoch keine Bewertungen

- Quality Assurance Quality PlanDokument24 SeitenQuality Assurance Quality Plan赵世伟Noch keine Bewertungen

- Catalog 2010-2011Dokument255 SeitenCatalog 2010-2011husna11Noch keine Bewertungen

- LEC 5 Standard Costing and Variance AnalysisDokument33 SeitenLEC 5 Standard Costing and Variance AnalysisKelvin CulajaráNoch keine Bewertungen

- Management As ProfessionDokument5 SeitenManagement As ProfessionJaspal AroraNoch keine Bewertungen

- Internship Letter of SAPDokument7 SeitenInternship Letter of SAPFurqanNoch keine Bewertungen

- Item A F 01 2017 Emm Annexure A Annual Report 2015 16Dokument471 SeitenItem A F 01 2017 Emm Annexure A Annual Report 2015 16Janice MkhizeNoch keine Bewertungen