Beruflich Dokumente

Kultur Dokumente

Lecture 7 - Making Capital Investment Decision (6 Pages Per Slide)

Hochgeladen von

Huy Nguyen VanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lecture 7 - Making Capital Investment Decision (6 Pages Per Slide)

Hochgeladen von

Huy Nguyen VanCopyright:

Verfügbare Formate

2

Outline

MAKING CAPITAL INVESTMENT DECISION

Incremental Cash Flows Pro Forma Financial Statements and Project

Cash flow vs. Accounting Income

Cash Flows

More about Project Cash Flow Alternative Definitions of Operating Cash Flow Some Special Cases of Discounted Cash Flow

Prepared by Hoang Thi Anh Ngoc

Analysis

Inflation

Cash Flow vs. Accounting Income

Using accounting income, rather than cash flow,

Cash Flow vs. Accounting Income

Cash Income Depreciation Accounting Income Year 1 Year 2 $1500 $ 500 - $1000 - $1000 + 500 - 500

500 500 + = $41.32 1.10 (1.10) 2 Apparent NPV =

could lead to erroneous decisions. Example A project costs $2,000 and is expected to last 2 years, producing cash income of $1,500 and $500 respectively. The cost of the project can be depreciated at $1,000 per year. Given a 10% required return, compare the NPV using cash flow to the NPV using accounting income.

Cash Flow vs. Accounting Income

Today Cash Income Project Cost Free Cash Flow - 2000 - 2000 Year 1 Year 2 $1500 $ 500 +1500 + 500

Relevant Cash Flows

The cash flows that should be included in a capital budgeting analysis are those that will only occur (or not occur) if the project is accepted These cash flows are called incremental cash flows The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows

Cash NPV =

500 - 2000 1500 + + = $223.14 1.10 (110) 2 (110) 3 . .

Asking the Right Question

You should always ask yourself Will this cash

Sunk costs costs that have accrued in the past Opportunity costs costs of lost options Side effects Positive side effects benefits to other projects Negative side effects costs to other projects Changes in net working capital Financing costs Taxes

Common Types of Cash Flows

flow occur ONLY if we accept the project?

If the answer is yes, it should be included in the

analysis because it is incremental

If the answer is no, it should not be included in the analysis because it will occur anyway If the answer is part of it, then we should include the part that occurs because of the project

Pro Forma Statements and Cash Flow

Capital budgeting relies heavily on pro forma

Pro Forma Income Statement

Sales (50,000 units at $4.00/unit) Variable Costs ($2.50/unit) Gross profit Fixed costs Depreciation ($90,000 / 3) EBIT Taxes (34%) Net Income $200,000 125,000 $ 75,000 12,000 30,000 $ 33,000 11,220 $ 21,780

accounting statements, particularly income statements

Computing cash flows refresher

Operating Cash Flow (OCF) = EBIT + depreciation taxes OCF = Net income + depreciation (when there is no

interest expense)

Cash Flow From Assets (CFFA) = OCF net capital spending (NCS) changes in NWC

Projected Capital Requirements

Year

Projected Total Cash Flows

Year 0 1 2 3 3

0 NWC NFA Total $110,000 90,000 $20,000 $20,000 60,000 $80,000

2 $20,000 30,000 $50,000

OCF $20,000 0 $20,000 Change in NWC NCS CFFA -$20,000 -$90,000 -$110,00

$51,780

$51,780

$51,780 20,000

$51,780

$51,780

$71,780 Should we accept or reject the project?

13

14

More on NWC

Why do we have to consider changes in NWC

Depreciation

Depreciation itself is a non-cash expense; consequently, it is only relevant because it affects taxes Depreciation tax shield = DT

Reduction in taxes attributable to depreciation D = depreciation expense T = marginal tax rate

separately?

GAAP requires that sales be recorded on the income

statement when made, not when cash is received

GAAP also requires that we record cost of goods sold when the corresponding sales are made, whether we have actually paid our suppliers yet Finally, we have to buy inventory to support sales,

although we havent collected cash yet

15

16

Computing Depreciation

Straight-line depreciation

D = (Initial cost salvage) / number of years Very few assets are depreciated straight-line for tax purposes

After-tax Salvage

If the salvage value is different from the book value of the

asset, then there is a tax effect

Book value = initial cost accumulated depreciation After-tax salvage = salvage T(salvage book value)

MACRS (Modified Accelerated Cost Recovery

System)

Allows higher tax deductions in early years and lower

deductions later

Need to know which asset class is appropriate for tax

purposes

Multiply percentage given in table by the initial cost Depreciate to zero Mid-year convention

10-16

17

18

Example: Depreciation and After-tax Salvage

You purchase equipment for $100,000, and it costs $10,000 to have it delivered and installed. Based on past information, you believe that you can sell the equipment for $17,000 when you are done with it in 6 years. The companys marginal tax rate is 40%. What is the depreciation expense each year and the aftertax salvage in year 6 for each of the following situations?

Example: Straight-line

Suppose the appropriate depreciation schedule is

straight-line

D = (110,000 17,000) / 6 = 15,500 every year for 6

years

BV in year 6 = 110,000 6(15,500) = 17,000 After-tax salvage = 17,000 - .4(17,000 17,000) =

17,000

Example: Three-year MACRS Example: Seven-Year MACRS

Year 1 2 .2449 .1749 .1249 .0893 .0892 .0892(110,000) = 9,812 .0893(110,000) = 9,823 .1249(110,000) = 13,739 .1749(110,000) = 19,239 .2449(110,000) = 26,939 .1429 .1429(110,000) = 15,719 MACRS Percent D

Year 1 2 3

4 5 6

MACRS percent .3333 .4445 .1481 .0741 .0741(110,000) = 8,151 .1481(110,000) = 16,291

After-tax salvage = 17,000 .4(17,000 0) = $10,200

3

D .3333(110,000) = 36,663 .4445(110,000) = 48,895

After-tax salvage = 17,000 .4(17,000 14,729) = 16,091.60

BV in year 6 = 110,000 36,663 48,895 16,291 8,151 = 0

BV in year 6 = 110,000 15,719 26,939 19,239 13,739 9,823 9,812 = 14,729

21

22

Example: Replacement Problem

Original Machine

Initial cost = 100,000 Annual depreciation = 9,000 Purchased 5 years ago Book Value = 55,000 Salvage today = 65,000 3-year MACRS depreciation Required return = 10% Tax rate = 40% Salvage in 5 years = 10,000 Cost savings = 50,000 per Salvage in 5 years = 0 5-year life Initial cost = 150,000

Replacement Problem

Remember that we are interested in incremental cash

New Machine

flows

If we buy the new machine, then we will sell the old

machine

What are the cash flow consequences of selling the old

year

machine today instead of in 5 years?

24

Replacement Problem Pro Forma Income Statements

Year Cost Savings Depr. New Old Increm. EBIT Taxes NI 5,403 3,602 9,005 40,995 57,675 (7,675) (3,070) (4,605) 9,000 9,000 49,995 66,675 22,215 9,000 13,215 36,785 14,714 22,071 11,115 9,000 2,115 47,885 19,154 28,731 0 9,000 (9,000) 59,000 23,600 35,400 50,000 50,000 50,000 1 2 3 4 50,000 5 50,000

Replacement Problem Incremental Net Capital Spending

Year 0

Cost of new machine = 150,000 (outflow) After-tax salvage on old machine = 65,000 - .4(65,000

55,000) = 61,000 (inflow)

Incremental net capital spending = 150,000 61,000 =

89,000 (outflow)

Year 5

After-tax salvage on old machine = 10,000 - .4(10,000 10,000) = 10,000 (outflow because we no longer receive this)

26

Replacement Problem Cash Flow From Assets

Year

Works only when there is no interest expense

Other Methods for Computing OCF

Bottom-Up Approach

OCF = NI + depreciation

0

46,398 53,070 35,286 30,846 26,400

OCF NCS

OCF = Sales Costs Taxes

-89,000 -10,000

Top-Down Approach

Dont subtract non-cash deductions

In NWC CFFA

OCF = (Sales Costs)(1 T) + Depreciation*T

-89,000 46,398 53,070 35,286 30,846 16,400

Tax Shield Approach

Should the company replace the equipment?

27

28

Example: Cost Cutting

Your company is considering a new computer system that will initially cost $1 million. It will save $300,000 per year in inventory and receivables management costs. The system is expected to last for five years and will be depreciated using 3-year MACRS. The system is expected to have a salvage value of $50,000 at the end of year 5. There is no impact on net working capital. The marginal tax rate is 40%. The required return is 8%.

Example: Setting the Bid Price

Consider the following information:

Army has requested bid for multiple use digitizing devices

(MUDDs)

Deliver 4 units each year for the next 3 years Labor and materials estimated to be $10,000 per unit Production space leased for $12,000 per year Requires $50,000 in fixed assets with expected salvage of

$10,000 at the end of the project (depreciate straight-line)

Require initial $10,000 increase in NWC Tax rate = 34% Required return = 15%

29

30

Example: Equivalent Annual Cost Analysis

Burnout Batteries

Initial Cost = $36 each 3-year life $100 per year to keep 5-year life $88 per year to keep

Inflation

INFLATION RULE

Be consistent in how you handle inflation!! Use nominal interest rates to discount nominal cash flows. Use real interest rates to discount real cash flows.

Long-lasting Batteries

Initial Cost = $60 each

charged

Expected salvage = $5 Straight-line depreciation

charged

Expected salvage = $5 Straight-line depreciation

You will get the same results, whether you use nominal or

real figures

The machine chosen will be replaced indefinitely and neither machine will have a differential impact on revenue. No change in NWC is required. The required return is 15%, and the tax rate is 34%.

31

32

Inflation

Example You own a lease that will cost you $8,000 next year, increasing at 3% a year (the forecasted inflation rate) for 3 additional years (4 years total). If discount rates are 10% what is the present value cost of the lease? Example - nominal figures

Inflation

Year Cash Flow 0 1 2 3 $29,072.98 8000x1.033 = 8,741.82 = 6,567.86 8000x1.03 = 8,240 8000x1.032 = 8,487.20

8240 1.10 8487.20 1.10 2 8741.82 1.103

PV @ 10% 8,000.00 = 7,490.91 = 7,014.22

8000

1 + real interest rate =

1+ nominal interest rate 1+inflation rate

33

34

Inflation

Example - real figures

Comprehensive Problem

PV@6.7961% 8,000

8,000 1.068 8,000 1.068 2

Year Cash Flow 0 8,000 1 2 3 8,000

8,000 = 6,567.86 1.0683 = $ 29,072.98

8,000 8,000

= 7,490.91 = 7,014.22

A $1,000,000 investment is depreciated using a sevenyear MACRS class life. It requires $150,000 in additional inventory and will increase accounts payable by $50,000. It will generate $400,000 in revenue and $150,000 in cash expenses annually, and the tax rate is 40%. What is the incremental cash flow in years 0, 1, 7, and 8?

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CP 343-1Dokument23 SeitenCP 343-1Yahya AdamNoch keine Bewertungen

- Chapter 10 AP GP PDFDokument3 SeitenChapter 10 AP GP PDFGeorge ChooNoch keine Bewertungen

- Chapter 16 - Energy Transfers: I) Answer The FollowingDokument3 SeitenChapter 16 - Energy Transfers: I) Answer The FollowingPauline Kezia P Gr 6 B1Noch keine Bewertungen

- Fraktur Dentoalevolar (Yayun)Dokument22 SeitenFraktur Dentoalevolar (Yayun)Gea RahmatNoch keine Bewertungen

- Front Wheel Steering System With Movable Hedlights Ijariie5360Dokument6 SeitenFront Wheel Steering System With Movable Hedlights Ijariie5360Ifra KhanNoch keine Bewertungen

- 47-Article Text-338-1-10-20220107Dokument8 Seiten47-Article Text-338-1-10-20220107Ime HartatiNoch keine Bewertungen

- Sto - Cristo Proper Integrated School 1 Grading Grade 9 Science Table of SpecializationDokument2 SeitenSto - Cristo Proper Integrated School 1 Grading Grade 9 Science Table of Specializationinah jessica valerianoNoch keine Bewertungen

- Rapid Prep Easy To Read HandoutDokument473 SeitenRapid Prep Easy To Read HandoutTina Moore93% (15)

- MS For Brick WorkDokument7 SeitenMS For Brick WorkSumit OmarNoch keine Bewertungen

- QP (2016) 2Dokument1 SeiteQP (2016) 2pedro carrapicoNoch keine Bewertungen

- Handout Tematik MukhidDokument72 SeitenHandout Tematik MukhidJaya ExpressNoch keine Bewertungen

- Tetracyclines: Dr. Md. Rageeb Md. Usman Associate Professor Department of PharmacognosyDokument21 SeitenTetracyclines: Dr. Md. Rageeb Md. Usman Associate Professor Department of PharmacognosyAnonymous TCbZigVqNoch keine Bewertungen

- A Compilation of Thread Size InformationDokument9 SeitenA Compilation of Thread Size Informationdim059100% (2)

- A6 2018 D Validation Qualification Appendix6 QAS16 673rev1 22022018Dokument12 SeitenA6 2018 D Validation Qualification Appendix6 QAS16 673rev1 22022018Oula HatahetNoch keine Bewertungen

- Current Relays Under Current CSG140Dokument2 SeitenCurrent Relays Under Current CSG140Abdul BasitNoch keine Bewertungen

- Library Dissertation in Community DentistryDokument9 SeitenLibrary Dissertation in Community DentistryPayForPaperCanada100% (1)

- Chap 2 Debussy - LifejacketsDokument7 SeitenChap 2 Debussy - LifejacketsMc LiviuNoch keine Bewertungen

- Discuss The Challenges For Firms To Operate in The Hard-Boiled Confectionery Market in India?Dokument4 SeitenDiscuss The Challenges For Firms To Operate in The Hard-Boiled Confectionery Market in India?harryNoch keine Bewertungen

- Math 202: Di Fferential Equations: Course DescriptionDokument2 SeitenMath 202: Di Fferential Equations: Course DescriptionNyannue FlomoNoch keine Bewertungen

- Acuity Assessment in Obstetrical TriageDokument9 SeitenAcuity Assessment in Obstetrical TriageFikriNoch keine Bewertungen

- Patent for Fired Heater with Radiant and Convection SectionsDokument11 SeitenPatent for Fired Heater with Radiant and Convection Sectionsxyz7890Noch keine Bewertungen

- 11 Baby Crochet Cocoon Patterns PDFDokument39 Seiten11 Baby Crochet Cocoon Patterns PDFIoanaNoch keine Bewertungen

- Plate-Load TestDokument20 SeitenPlate-Load TestSalman LakhoNoch keine Bewertungen

- Monster of The Week Tome of Mysteries PlaybooksDokument10 SeitenMonster of The Week Tome of Mysteries PlaybooksHyperLanceite XNoch keine Bewertungen

- SRS Design Guidelines PDFDokument46 SeitenSRS Design Guidelines PDFLia FernandaNoch keine Bewertungen

- Entrepreneurship Project On Jam, Jelly & PicklesDokument24 SeitenEntrepreneurship Project On Jam, Jelly & Picklesashish karshinkarNoch keine Bewertungen

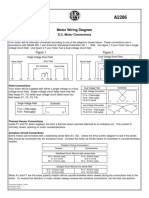

- Motor Wiring Diagram: D.C. Motor ConnectionsDokument1 SeiteMotor Wiring Diagram: D.C. Motor Connectionsczds6594Noch keine Bewertungen

- Retaining Wall-Masonry Design and Calculation SpreadsheetDokument6 SeitenRetaining Wall-Masonry Design and Calculation SpreadsheetfarrukhNoch keine Bewertungen

- Datasheet PDFDokument6 SeitenDatasheet PDFAhmed ElShoraNoch keine Bewertungen

- Are Hypomineralized Primary Molars and Canines Associated With Molar-Incisor HypomineralizationDokument5 SeitenAre Hypomineralized Primary Molars and Canines Associated With Molar-Incisor HypomineralizationDr Chevyndra100% (1)