Beruflich Dokumente

Kultur Dokumente

CM Fimbres Fiscal Year 2013 Recommended Budget

Hochgeladen von

Richard G. FimbresOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CM Fimbres Fiscal Year 2013 Recommended Budget

Hochgeladen von

Richard G. FimbresCopyright:

Verfügbare Formate

Fiscal Year 2013 Recommended Budget Discussion: Council Member Fimbres Questions Dated 5/7/12 with Staff Responses

in Bold

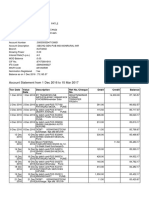

1. General Fund Restricted: Doesnt Mayor and Council have discretion over the General Fund portion of the budget and if so, how then can funds be restricted for specific programs? Mayor and Council have discretion over General Fund Unrestricted. Certain restrictions exist on General Fund Restricted expenditures due to state law (e.g. impound fees, special duty funds, forfeiture funds) and Mayor and Council direction (e.g., Southwest Gas franchise fees that are used to fund Transportation projects related to utility work). 2. Departments with a Projected Increase over their Requested Budgets: Can the following be explained in further detail? Requested Recommended Number of Employees (Change) City Attorney $8,512.650 $9,019,500 (-2) 97 City Court $9,839,770 $12,022,030 (0) 139 City Manager $7,412,400 $9,684,870 (2) 32* Environmental Services $46,922,160 $50,752,160 (0) 237** Finance $8,287,780**** $16,798,190 (4) 111*** Housing & Comm. Devel. $6,170,850**** $13,263,000 (-12.5)189.25 Information Technology $15,878,630**** $18,660,810 (1) 112.5 Transportation***** $960,980 $4,192,550 (-9.75)267 TCC****** $1,886,280 $2,340.580 (-3.5) 43.5 *Lists $2,272,470 in Grant Capacity. ** Lists $3,830,000 in Capital Improvement ***Lists 107 in Requested, but has 109 for FY 2012 and 111 for FY 2013 in Recommended. ****Has a quarterly projection only *****Unrestricted General Fund ******Adopted FY 2012 and Actual for Salaries differs $560,660 and the Requested and Recommended is for $2,340,580 and yet the number of employees is down by 3.5. The Recommended Budgets include all funds, including grants and capital projects. Line-item budgets reviewed by the City Manager (i.e. requests) did not include all funding sources or capital improvement projects. Personnel resource changes between fiscal years (i.e., both increases and decreases) are based on funding availability, dedication of resources to critical areas, and the managed attrition plans developed by the department heads in the fall of 2011. Increases in salary/benefit funding exist due to elimination of furloughs and pension and medical increases.

3. Fleet Services: The following question was posted by Councilmember Fimbres: Can the operating loss for Fleet Services be explained in more detail? The reply was the following: In Fiscal Year 2011, their revenues did not cover the depreciation expense. In previous fiscal years, the Fleet Services Fund collected specific revenues to fund vehicle replacement for its customer departments, except for Enterprise Funds. Those vehicles were assets entered into Fleet's asset account and subsequently depreciated annually. Revenue collections offset depreciation and enabled vehicle replacement. When the Citys vehicle replacement program was suspended in Fiscal Year 2008, Fleet Services was left with the depreciation with no method for offsetting the expense. That situation will continue until the City is once again able to establish a vehicle replacement program. 4. For Fiscal Year 2013, the anticipated interdepartmental charges of $25.8 million are projected to increase by $1.3 million from estimated Fiscal Year 2012 of $24.5 million primarily due to the anticipated increase to future fuel costs. Can it be explained since it has been stated that Fleet Services, on page C-31, lists a $2,500,000 surplus from FY 2012? C-31 shows "previous year surplus" of $2,400,000. This is a Fund Balance, balance sheet, item. To provide for a balanced FY 2013 budget, Fleet budgets customer charges equal to projected expenses. Fuel cost expenses are anticipated to increase for Fiscal Year 2013; therefore, we projected increased charges which will result in revenues to Fleet that will offset the actual fuel expenses. Actual charges to customers will equal actual expenses. The fund balance, which has accumulated over multiple fiscal years, is available for necessary capital purchases, such as new fuel system software. 5. Parks and Recreation: Explain in more detail the $2,387,150 listed for Grant Capacity in the Recommended Budget? Explain in more detail the $12,253,200 listed for Capital and the proposed increase of more than $2,100,000 in FY 2012? See page D-128 regarding grant capacity. Expenditure capacity has been set up that would potentially be funded by restricted revenues, civic contributions fund, and miscellaneous federal and non-federal grants. These funds would be used to leverage recreational opportunities and community support services. Grant funding is being explored and capacity is budgeted in the event it is received; however, please note actual funding received in FY 2012 is projected to be significantly lower than budgeted. 6. Parkwise: What is the $1,432,700 in debt service for, as listed in the requested budget? On D-79, explain the tripling of parking revenues from FY 2012 of $629,504 to projected $1,869,430 for FY 2013? The debt service is to make principal and interest payments on City garages: Pennington and Plaza Centro. See page C-16 for parking revenues which are projected to increase from an estimated $1,754,380 in Fiscal Year 2012 to $1,869,930 in Fiscal Year 2013.

Das könnte Ihnen auch gefallen

- Council Questions - Fiscal Year 2013 Budget Discussion March 2012Dokument6 SeitenCouncil Questions - Fiscal Year 2013 Budget Discussion March 2012Richard G. FimbresNoch keine Bewertungen

- FY 2011-2012 ADOPTED Budget 20110614Dokument829 SeitenFY 2011-2012 ADOPTED Budget 20110614City of GriffinNoch keine Bewertungen

- Kitsap Budget MemoDokument18 SeitenKitsap Budget MemopaulbalcerakNoch keine Bewertungen

- Subcommittees Chairs Report On Budget ExcerciseDokument21 SeitenSubcommittees Chairs Report On Budget ExcercisePhil AmmannNoch keine Bewertungen

- Acc423 in 2015 Better City Received 5000000 of BondDokument8 SeitenAcc423 in 2015 Better City Received 5000000 of BondDoreenNoch keine Bewertungen

- Mobile Mayor Sam Jones Proposed Budget For 2012Dokument25 SeitenMobile Mayor Sam Jones Proposed Budget For 2012jamieburch75Noch keine Bewertungen

- Projected Year-End Financial Results - Third QuarterDokument7 SeitenProjected Year-End Financial Results - Third QuarterpkGlobalNoch keine Bewertungen

- IBA Review of The Fiscal Year 2013 Proposed BudgetDokument30 SeitenIBA Review of The Fiscal Year 2013 Proposed Budgetapi-63385278Noch keine Bewertungen

- La Credit ReportDokument31 SeitenLa Credit ReportSouthern California Public RadioNoch keine Bewertungen

- New York State Dedicated Highway and Bridge Trust Fund CrossroadsDokument18 SeitenNew York State Dedicated Highway and Bridge Trust Fund CrossroadsNews10NBCNoch keine Bewertungen

- SD 21.reporttocitycouncilfy09Dokument63 SeitenSD 21.reporttocitycouncilfy09GGHMADNoch keine Bewertungen

- Council Questions - Fiscal Year 2013 Recommended Budget DiscussionDokument2 SeitenCouncil Questions - Fiscal Year 2013 Recommended Budget DiscussionRichard G. FimbresNoch keine Bewertungen

- Week 3 Answers To Questions Final DFTDokument10 SeitenWeek 3 Answers To Questions Final DFTGabriel Aaron Dionne0% (1)

- 2013 CB Sfaff OverviewDokument79 Seiten2013 CB Sfaff OverviewChris Capper LiebenthalNoch keine Bewertungen

- FY 2012-13 Adopted Budget SummaryDokument31 SeitenFY 2012-13 Adopted Budget SummaryBesir AsaniNoch keine Bewertungen

- Kitchener 2013 Budget Preview Nov 5 2012Dokument52 SeitenKitchener 2013 Budget Preview Nov 5 2012WR_RecordNoch keine Bewertungen

- West Hartford Proposed budget 2024-2025Dokument472 SeitenWest Hartford Proposed budget 2024-2025Helen BennettNoch keine Bewertungen

- Accounting for Business-Type ActivitiesDokument12 SeitenAccounting for Business-Type ActivitiesAnonymous mb9z2MPNoch keine Bewertungen

- Seattle Considers Expanding 'JumpStart' Tax On Big Businesses To Plug Budget DeficitDokument15 SeitenSeattle Considers Expanding 'JumpStart' Tax On Big Businesses To Plug Budget DeficitGeekWireNoch keine Bewertungen

- 2012 Budget BookDokument27 Seiten2012 Budget BookGerrie SchipskeNoch keine Bewertungen

- AG User Fees ReportDokument27 SeitenAG User Fees ReportBrian MacLeodNoch keine Bewertungen

- Attachment A - General Fund Budget Update Narrative and Schedule of Sources and UsesDokument11 SeitenAttachment A - General Fund Budget Update Narrative and Schedule of Sources and UsesReno Gazette JournalNoch keine Bewertungen

- Hyde and Analysis: Town Park Management'S DECEMBER 31.2006 Town) Town of For of Municipality Mid FireDokument10 SeitenHyde and Analysis: Town Park Management'S DECEMBER 31.2006 Town) Town of For of Municipality Mid Fireapi-107641637Noch keine Bewertungen

- FINAL BOCC Accomplishments 09 12 2012 - 201209121111531266Dokument4 SeitenFINAL BOCC Accomplishments 09 12 2012 - 201209121111531266Valerie DaleNoch keine Bewertungen

- 2013 State of The City ReportDokument6 Seiten2013 State of The City ReportScott FranzNoch keine Bewertungen

- Resident's Guide: Volume 1 FY2013Dokument15 SeitenResident's Guide: Volume 1 FY2013ChicagoistNoch keine Bewertungen

- Release 2011-07-27 2012 Budget and Capital ProgramDokument3 SeitenRelease 2011-07-27 2012 Budget and Capital ProgramElizabeth BenjaminNoch keine Bewertungen

- Brockton Schools AuditDokument4 SeitenBrockton Schools AuditBoston 25 DeskNoch keine Bewertungen

- 2014-2015 City of Sacramento Budget OverviewDokument34 Seiten2014-2015 City of Sacramento Budget OverviewCapital Public RadioNoch keine Bewertungen

- City MGM'T Memo On Restoring Certain Long Beach Fire Services (Nov. 5, 2013)Dokument5 SeitenCity MGM'T Memo On Restoring Certain Long Beach Fire Services (Nov. 5, 2013)Anonymous 3qqTNAAOQNoch keine Bewertungen

- Sioux City 2013 Operating BudgetDokument378 SeitenSioux City 2013 Operating BudgetSioux City JournalNoch keine Bewertungen

- Week 3 QuizDokument8 SeitenWeek 3 QuizPetraNoch keine Bewertungen

- Toronto Employment & Social Services Capital Budget Analyst Notes 2012 BudgetDokument22 SeitenToronto Employment & Social Services Capital Budget Analyst Notes 2012 BudgetarthurmathieuNoch keine Bewertungen

- Salem 2012-13 Budget Final in Depth Proposed 12-13Dokument14 SeitenSalem 2012-13 Budget Final in Depth Proposed 12-13Statesman JournalNoch keine Bewertungen

- Town of Galway: Financial OperationsDokument17 SeitenTown of Galway: Financial OperationsdayuskoNoch keine Bewertungen

- Coronado 2013-14 Budget in BriefDokument6 SeitenCoronado 2013-14 Budget in Briefapi-214709308Noch keine Bewertungen

- Cbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011Dokument20 SeitenCbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011jeanettecriscione762Noch keine Bewertungen

- Lakeport City Council - Final BudgetDokument119 SeitenLakeport City Council - Final BudgetLakeCoNewsNoch keine Bewertungen

- CDOT Monthly Cash Balance and Construction UpdatesDokument33 SeitenCDOT Monthly Cash Balance and Construction UpdatesAmir Mustakim Bin SuwandiNoch keine Bewertungen

- TRC News and Notes 2-16-12Dokument1 SeiteTRC News and Notes 2-16-12James Van BruggenNoch keine Bewertungen

- San Diego City Employees' Retirement System: Popular Annual Financial ReportDokument6 SeitenSan Diego City Employees' Retirement System: Popular Annual Financial Reportapi-201256435Noch keine Bewertungen

- Attachment 4163Dokument3 SeitenAttachment 4163Mark ReinhardtNoch keine Bewertungen

- Executive Summary - Correctional Officers Interest ArbitrationDokument11 SeitenExecutive Summary - Correctional Officers Interest ArbitrationsunnewsNoch keine Bewertungen

- Chapter 9 Governmental and Non-For-profit Accounting Test BankDokument16 SeitenChapter 9 Governmental and Non-For-profit Accounting Test BankAngelo Mendez100% (2)

- ACCT 567 Final ExamDokument12 SeitenACCT 567 Final ExamangleefanslerNoch keine Bewertungen

- Council Memo - 14.08.25 - CM Griggs' $3.84m Budget AmendmentDokument5 SeitenCouncil Memo - 14.08.25 - CM Griggs' $3.84m Budget AmendmentcityhallblogNoch keine Bewertungen

- 2012 Preliminary Budget & Levy PresentationDokument14 Seiten2012 Preliminary Budget & Levy PresentationCity of HopkinsNoch keine Bewertungen

- Fy12 TH FlierDokument1 SeiteFy12 TH FlierRichard G. FimbresNoch keine Bewertungen

- Government Budget and The EconomyDokument10 SeitenGovernment Budget and The EconomyFathimaNoch keine Bewertungen

- 19 0528 01000 FNDokument2 Seiten19 0528 01000 FNRob PortNoch keine Bewertungen

- Acct 260 Cafr 6-17Dokument4 SeitenAcct 260 Cafr 6-17StephanieNoch keine Bewertungen

- Key Action Points - Fund 9 - 1Dokument2 SeitenKey Action Points - Fund 9 - 1jimhtolbert434Noch keine Bewertungen

- Nashville Blue Ribbon Commission's Report On How Nashville Could Save $20M A YearDokument14 SeitenNashville Blue Ribbon Commission's Report On How Nashville Could Save $20M A YearUSA TODAY Network0% (1)

- Proposed Budget CutsDokument2 SeitenProposed Budget CutsIsaac GuerreroNoch keine Bewertungen

- MBND Overview and Valuation AnalysisDokument13 SeitenMBND Overview and Valuation Analysiscolinlee6cNoch keine Bewertungen

- 2018 July Financial Plan 2019 - 2022: Presentation To The BoardDokument15 Seiten2018 July Financial Plan 2019 - 2022: Presentation To The BoardSarath KumarNoch keine Bewertungen

- Test Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition GranofDokument17 SeitenTest Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition Granofhaeric0gas100% (20)

- 10232012-Department Head Responses To Budget Study Committee Report 10-19-12Dokument23 Seiten10232012-Department Head Responses To Budget Study Committee Report 10-19-12keithmontpvtNoch keine Bewertungen

- Montgomery TWP 2013 Budget PresentationDokument20 SeitenMontgomery TWP 2013 Budget Presentationsokil_danNoch keine Bewertungen

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Timeline USPS Consolidation - Tucson Postal Processing and Distribution Center Cherrybell Updated Nov 13 2020Dokument12 SeitenTimeline USPS Consolidation - Tucson Postal Processing and Distribution Center Cherrybell Updated Nov 13 2020Richard G. FimbresNoch keine Bewertungen

- Ward 5 August 2020 NewsletterDokument12 SeitenWard 5 August 2020 NewsletterRichard G. FimbresNoch keine Bewertungen

- City of Tucson Ward 5 Newsletter - March 2020Dokument10 SeitenCity of Tucson Ward 5 Newsletter - March 2020Richard G. FimbresNoch keine Bewertungen

- Tucson Councilmember Richard Fimbres' Ward 5 November 2019 NewsletterDokument12 SeitenTucson Councilmember Richard Fimbres' Ward 5 November 2019 NewsletterRichard G. FimbresNoch keine Bewertungen

- 2011 City of Tucson Primary and General Election ResultsDokument5 Seiten2011 City of Tucson Primary and General Election ResultsRichard G. FimbresNoch keine Bewertungen

- Ward 5 Councilmember Richard Fimbres - September 2019 NewsletterDokument10 SeitenWard 5 Councilmember Richard Fimbres - September 2019 NewsletterRichard G. FimbresNoch keine Bewertungen

- 2009 City of Tucson Primary and General Election ResultsDokument4 Seiten2009 City of Tucson Primary and General Election ResultsRichard G. FimbresNoch keine Bewertungen

- July 2020 NewsletterDokument8 SeitenJuly 2020 NewsletterRichard G. FimbresNoch keine Bewertungen

- Ward 5 June 2020 NewsletterDokument10 SeitenWard 5 June 2020 NewsletterRichard G. FimbresNoch keine Bewertungen

- 2007 City of Tucson Primary and General Election ResultsDokument2 Seiten2007 City of Tucson Primary and General Election ResultsRichard G. FimbresNoch keine Bewertungen

- City of Tucson Ward 5 Newsletter - December 2019Dokument10 SeitenCity of Tucson Ward 5 Newsletter - December 2019Richard G. FimbresNoch keine Bewertungen

- Ward 5 Councilmember Richard Fimbres Newsletter - February 2020Dokument10 SeitenWard 5 Councilmember Richard Fimbres Newsletter - February 2020Richard G. FimbresNoch keine Bewertungen

- Tucson Ward 5 Councilmember Richard Fimbres' Newsletter - August 2019Dokument10 SeitenTucson Ward 5 Councilmember Richard Fimbres' Newsletter - August 2019Richard G. FimbresNoch keine Bewertungen

- City of Tucson Ward 5 Newsletter - October 2019Dokument8 SeitenCity of Tucson Ward 5 Newsletter - October 2019Richard G. FimbresNoch keine Bewertungen

- WARD 5 MAY 2019 NewsletterDokument10 SeitenWARD 5 MAY 2019 NewsletterRichard G. FimbresNoch keine Bewertungen

- Ward 5 Councilmember Richard Fimbres Newsletter - June 2019Dokument8 SeitenWard 5 Councilmember Richard Fimbres Newsletter - June 2019Richard G. FimbresNoch keine Bewertungen

- Arizona State USBC Current Standings May 12Dokument22 SeitenArizona State USBC Current Standings May 12Richard G. FimbresNoch keine Bewertungen

- Ward 5 Newsletter - JULY 2019Dokument10 SeitenWard 5 Newsletter - JULY 2019Richard G. FimbresNoch keine Bewertungen

- Arizona State USBC Current Standings May 12Dokument22 SeitenArizona State USBC Current Standings May 12Richard G. FimbresNoch keine Bewertungen

- April 2019Dokument10 SeitenApril 2019Richard G. FimbresNoch keine Bewertungen

- Tucson Vice Mayor Richard Fimbres' Ward 5 Newsletter - December 2018Dokument18 SeitenTucson Vice Mayor Richard Fimbres' Ward 5 Newsletter - December 2018Richard G. FimbresNoch keine Bewertungen

- City of Tucson Ward 5 Newsletter: Richard Fimbres Vice Mayor Ward 5Dokument8 SeitenCity of Tucson Ward 5 Newsletter: Richard Fimbres Vice Mayor Ward 5Richard G. FimbresNoch keine Bewertungen

- Tucson Vice Mayor Richard Fimbres - Ward 5 Newsletter - October 2018Dokument10 SeitenTucson Vice Mayor Richard Fimbres - Ward 5 Newsletter - October 2018Richard G. FimbresNoch keine Bewertungen

- Vice Mayor Fimbres' Ward 5 Newsletter For February 2019Dokument10 SeitenVice Mayor Fimbres' Ward 5 Newsletter For February 2019Richard G. FimbresNoch keine Bewertungen

- Ward 5 Newsletter - November 2018Dokument12 SeitenWard 5 Newsletter - November 2018Richard G. FimbresNoch keine Bewertungen

- AugustDokument12 SeitenAugustRichard G. FimbresNoch keine Bewertungen

- City of Tucson Ward 5 Newsletter For January 2019Dokument12 SeitenCity of Tucson Ward 5 Newsletter For January 2019Richard G. FimbresNoch keine Bewertungen

- Tucson Vice Mayor Richard Fimbres - Ward 5 Newsletter - October 2018Dokument10 SeitenTucson Vice Mayor Richard Fimbres - Ward 5 Newsletter - October 2018Richard G. FimbresNoch keine Bewertungen

- Proposition 407 - Ward 5 Parks Project Proposals, Connectivity Project Proposals and Greenway Project ProposalsDokument44 SeitenProposition 407 - Ward 5 Parks Project Proposals, Connectivity Project Proposals and Greenway Project ProposalsRichard G. FimbresNoch keine Bewertungen

- Vice Mayor Richard Fimbres Ward 5 Newsletter - September 2018Dokument10 SeitenVice Mayor Richard Fimbres Ward 5 Newsletter - September 2018Richard G. FimbresNoch keine Bewertungen

- Ramos ReportDokument9 SeitenRamos ReportOnaysha YuNoch keine Bewertungen

- Infra Projects Total 148Dokument564 SeitenInfra Projects Total 148chintuuuNoch keine Bewertungen

- Introduction to Study of Textile OrganizationDokument48 SeitenIntroduction to Study of Textile OrganizationShyam C ANoch keine Bewertungen

- Account statement showing transactions from Dec 2016 to Feb 2017Dokument4 SeitenAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNoch keine Bewertungen

- Foreign Employment and Remittance in NepalDokument19 SeitenForeign Employment and Remittance in Nepalsecondarydomainak6Noch keine Bewertungen

- Capital Market InstrumentsDokument6 SeitenCapital Market Instrumentsgeet_rawat36Noch keine Bewertungen

- Stock Table WorksheetsDokument3 SeitenStock Table WorksheetsKaren MartinezNoch keine Bewertungen

- Supplier Selection: A Green Approach With Carbon Footprint MonitoringDokument8 SeitenSupplier Selection: A Green Approach With Carbon Footprint Monitoringamit_hoodaNoch keine Bewertungen

- SBI Statement 1.11 - 09.12Dokument2 SeitenSBI Statement 1.11 - 09.12Manju GNoch keine Bewertungen

- Urbanized - Gary HustwitDokument3 SeitenUrbanized - Gary HustwitJithin josNoch keine Bewertungen

- Regional Planning Techniques PDFDokument131 SeitenRegional Planning Techniques PDFRicha Sagarika0% (1)

- Nicl Exam GK Capsule: 25 March, 2015Dokument69 SeitenNicl Exam GK Capsule: 25 March, 2015Jatin YadavNoch keine Bewertungen

- 43-101 Bloom Lake Nov 08Dokument193 Seiten43-101 Bloom Lake Nov 08DougNoch keine Bewertungen

- Packaged Tea Leaves Market ShareDokument22 SeitenPackaged Tea Leaves Market ShareKadambariNoch keine Bewertungen

- KjujDokument17 SeitenKjujMohamed KamalNoch keine Bewertungen

- MBA IInd SEM POM Chapter 08 Capacity Planning and Facilities LocationDokument52 SeitenMBA IInd SEM POM Chapter 08 Capacity Planning and Facilities LocationPravie100% (2)

- Oxylane Supplier Information FormDokument4 SeitenOxylane Supplier Information Formkiss_naaNoch keine Bewertungen

- Smart Beta: A Follow-Up to Traditional Beta MeasuresDokument15 SeitenSmart Beta: A Follow-Up to Traditional Beta Measuresdrussell524Noch keine Bewertungen

- Individual Characteristics of The Successful AsnafDokument10 SeitenIndividual Characteristics of The Successful AsnafAna FienaNoch keine Bewertungen

- High Potential Near MissDokument12 SeitenHigh Potential Near Missja23gonzNoch keine Bewertungen

- Basel III: Bank Regulation and StandardsDokument13 SeitenBasel III: Bank Regulation and Standardskirtan patelNoch keine Bewertungen

- Ecotourism Visitor Management Framework AssessmentDokument15 SeitenEcotourism Visitor Management Framework AssessmentFranco JocsonNoch keine Bewertungen

- DonaldDokument26 SeitenDonaldAnonymous V2Tf1cNoch keine Bewertungen

- GEAR PPT Template OverviewDokument14 SeitenGEAR PPT Template OverviewAmor MansouriNoch keine Bewertungen

- Tourism 2020: Policies To Promote Competitive and Sustainable TourismDokument32 SeitenTourism 2020: Policies To Promote Competitive and Sustainable TourismHesham ANoch keine Bewertungen

- Liberal View of State: TH THDokument3 SeitenLiberal View of State: TH THAchanger AcherNoch keine Bewertungen

- Chapter 1Dokument16 SeitenChapter 1abhishek9763Noch keine Bewertungen

- 12-11-2022 To 18-11-2022Dokument74 Seiten12-11-2022 To 18-11-2022umerNoch keine Bewertungen

- Woodside in LibyaDokument5 SeitenWoodside in LibyaabhishekatupesNoch keine Bewertungen

- Zesco Solar Gyser ProjectDokument23 SeitenZesco Solar Gyser ProjectGulbanu KarimovaNoch keine Bewertungen