Beruflich Dokumente

Kultur Dokumente

Accounting Grade 10 Lesson and Tasks

Hochgeladen von

nashi04Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Grade 10 Lesson and Tasks

Hochgeladen von

nashi04Copyright:

Verfügbare Formate

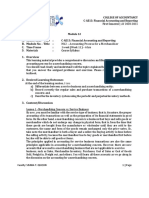

ACCOUNTING GRADE 10 Inventory Control System

Lesson: Notes, Tasks and solutions

Learning Outcome 3: Managing Resources 10.3.4 Discuss the perpetual inventory system and record transactions in the subsidiary journals and ledgers What is perpetual inventory system? Perpetual (continuous) inventory system is a method of finding the value of merchandise after each purchase or sale. It provides inventory and cost of goods sold data on a continuous, up-to-date basis. The cost of each item is recorded in the Trading Stock account when purchased. There is a continuous recording of trading stock movement, i.e. Trading stock accounts is updated after each purchase or sale. Records of the inventory quantities are kept and updates as they are bought and sold. It is possible to ascertain from the trading stock account, what the stock on hand should be. No detailed records of the actual stock on hand are maintained during the period. As merchandise is sold, its cost is transferred from trading stock account to the Cost of Goods Sold. The balance of the Trading stock account equals the cost of goods on hand. The balance of the Cost of Goods Sold account equals the cost of the merchandise sold to customers

Example 1: On May 1, 2006: Purchased 1,000 units of goods at R30 per unit. On May 6, 2006: Sold 200 units of goods at R50 per unit on credit. Record the transaction in the subsidiary journals and post to the ledger. Perpetual inventory system: 1/5/2006 Debit Credit Trading stock 30 000 Creditors Control 30 000 6/5/2006 Debtors Control Sales 6/5/2006 Debit 10 000 Credit 10 000 Credit 6 000

Debit Cost of goods sold 6 000 Trading Stock * Changes in trading stock account are recorded after each transaction.

POSTING TO THE LEDGER

Dr 1/5/06 Creditors control CJ Trading stock Account 30 000 6/5/06 Cost of goods sold GJ Cr 6 000

Dr 1/5/06 Dr 6/5/06

Creditors Control account 1/5/06 Trading stock Debtors Control Account 10 000

Cr GJ 30 000 Cr

Sales

GJ

Dr

Sales Account 6/5/06 Debtors Control

Cr GJ 10 000

Dr 1/5/06

Trading stock

GJ

Cost of Goods Sold Account 6 000

Cr

Advantages In perpetual cost of goods sold is determined in every sale This system provides useful information for management purposes. Records are kept of the quantity and, usually, the cost of individual items as they are bought or sold. Stock loss/gain is immediately noticed and not at the end of year when the physical count of the inventory is taken. Disadvantages

Is too demanding and the cost of using this system is high, but this disadvantage is gradually fading away because users get used to the system.

TASK 1.On June 5, 2006: Purchased 600 units of merchandise at R35 per unit. On June 16, 2006: sold 400 units of merchandise at R55 per unit on credit. Required: Use perpetual inventory system to record the above transaction in the subsidiary journal and post to the trading stock, sales, creditors and debtors ledger accounts.

SUMMARY: Entries in the general ledger when the perpetual system is used NO TRANSACTION PERPETUAL INVENTORY SYSTEM Debit Credit 1 Credit purchases of merchandise Trading stock Creditors control 2 Merchandise purchases by cheque Trading stock Credit Bank 3 Merchandise returned to suppliers /purchases returns Creditors Trading stock control 4 Carriage on purchases merchandise for credit/for Trading stock Bank/ creditors cash control 5 Merchandise withdrawn for personal use Drawings Trading stock 6 Credit sales of merchandise Debtors control Sales Cost of sales Trading stock 7 Merchandise returned by customers/sales returns Debtors Debtors control allowances 8 Trading stock Cost of sales COMPLETED THE TASK? SOLUTION

TASK: On June 5, 2006: Purchased 600 units of merchandise at R35 per unit. On June 16, 2006: Sold 400 units of merchandise at R55 per unit on credit. Perpetual inventory system: Debit

2

Credit

5/6/2006 16/6/200 6 16/6/2006

Trading stock Creditors Control Debtors Control Sales Cost of goods sold Trading Stock

21,000 Debit 22 000 Debit 14 000 21,000 Credit 22 000 Credit 14 000

POSTING TO THE LEDGER

Dr 5/6/06 Creditors control CJ Trading stock Account 21 000 16/6/06 Cost of goods sold GJ Cr 14 000

Dr

Creditors Control account 5/6/06 Trading stock

Cr 21 000

Dr 16/6/06 Dr

Sales

GJ

Debtors Control Account 22 000 Sales Account 16/6/06 Debtors Control

Cr

Cr DJ 22 000

Dr 16/6/0 6

Trading stock

GJ

Cost of Goods Sold Account 14 000

Cr

Das könnte Ihnen auch gefallen

- Visual Programming 1: - Exam Preparation: With MCQS, Pracs, Questions and SolutionsDokument27 SeitenVisual Programming 1: - Exam Preparation: With MCQS, Pracs, Questions and SolutionsChikoNoch keine Bewertungen

- Megan Goodale 2012 PDFDokument28 SeitenMegan Goodale 2012 PDFemilNoch keine Bewertungen

- CSE4DSS Lecture 1 Decision Support and Business IntelligenceDokument53 SeitenCSE4DSS Lecture 1 Decision Support and Business IntelligenceAbdulaziz AlaliNoch keine Bewertungen

- Validity of The Postrotary Nystagmus Test For Measuring Vestibular FunctionDokument8 SeitenValidity of The Postrotary Nystagmus Test For Measuring Vestibular FunctionTasneem BismillaNoch keine Bewertungen

- ACC 304 Week 2 Quiz 01 - Chapter 8Dokument6 SeitenACC 304 Week 2 Quiz 01 - Chapter 8LereeNoch keine Bewertungen

- Managing in Organisation Syllabus PDFDokument5 SeitenManaging in Organisation Syllabus PDFArafath CholasseryNoch keine Bewertungen

- Chapter 2Dokument37 SeitenChapter 2basitNoch keine Bewertungen

- INF1520 Assignment 2Dokument9 SeitenINF1520 Assignment 2ruvenNoch keine Bewertungen

- CS507 Mid Term Without RepeatedDokument22 SeitenCS507 Mid Term Without RepeatedvuqamarNoch keine Bewertungen

- Chapter - 1-Introduction To Accounting and BusinessDokument49 SeitenChapter - 1-Introduction To Accounting and BusinessAsaye TesfaNoch keine Bewertungen

- Data Resource ManagementDokument67 SeitenData Resource ManagementYasir HasnainNoch keine Bewertungen

- ACC 304 Week 3 Quiz 02 Chapter 09Dokument6 SeitenACC 304 Week 3 Quiz 02 Chapter 09LereeNoch keine Bewertungen

- Prelim ExaminationDokument4 SeitenPrelim ExaminationMyra Palangdan CalisenNoch keine Bewertungen

- International Marketing Chapter 1Dokument32 SeitenInternational Marketing Chapter 1Amir Ali100% (4)

- Question and Answer - 4Dokument31 SeitenQuestion and Answer - 4acc-expertNoch keine Bewertungen

- Binary To Decimal ConversionDokument32 SeitenBinary To Decimal ConversionpeachyskizNoch keine Bewertungen

- BITS211 Syllabus 2014Dokument11 SeitenBITS211 Syllabus 2014MichaelLouis35Noch keine Bewertungen

- Perpetual Inventory SystemDokument8 SeitenPerpetual Inventory SystemJancee kye BarcemoNoch keine Bewertungen

- Admas University Bishoftu Campus: Course Title - Maintain Inventory RecordsDokument6 SeitenAdmas University Bishoftu Campus: Course Title - Maintain Inventory RecordsTilahun GirmaNoch keine Bewertungen

- Admas University Bishoftu Campus: Course Title - Maintain Inventory RecordsDokument6 SeitenAdmas University Bishoftu Campus: Course Title - Maintain Inventory RecordsTilahun GirmaNoch keine Bewertungen

- Financial Accounting Mid Term ExamDokument4 SeitenFinancial Accounting Mid Term ExamMamoonah HassanNoch keine Bewertungen

- FINANCIAL ACCOUNTING 2020-2021 - MODULE 4 - RevisedDokument26 SeitenFINANCIAL ACCOUNTING 2020-2021 - MODULE 4 - RevisedAnn CalabdanNoch keine Bewertungen

- Merchandising Entity ModuleDokument38 SeitenMerchandising Entity ModuleMiru YuNoch keine Bewertungen

- Notes - Accounting Cycle of A Merchandising CompanyDokument10 SeitenNotes - Accounting Cycle of A Merchandising CompanyRoanne Mae Canedo-PelorianaNoch keine Bewertungen

- Bookkeeping To Trial Balance 6Dokument11 SeitenBookkeeping To Trial Balance 6elelwaniNoch keine Bewertungen

- ADokument57 SeitenAAliaJustineIlagan100% (1)

- Operating Cycle of A Merchandising BusinessDokument10 SeitenOperating Cycle of A Merchandising BusinessJanelle FortesNoch keine Bewertungen

- Merchandising Periodic SampleDokument14 SeitenMerchandising Periodic SampleYam Pinoy100% (2)

- Chapter 06 - Merchandising ActivitiesDokument117 SeitenChapter 06 - Merchandising Activitiesyujia ZhaiNoch keine Bewertungen

- Chapter 3 Handout 2013Dokument24 SeitenChapter 3 Handout 2013samita2721Noch keine Bewertungen

- Fundamentals of Accountancy, Business and Management 1: Module No. 3: Week 3: Second QuarterDokument6 SeitenFundamentals of Accountancy, Business and Management 1: Module No. 3: Week 3: Second QuarterCrestina Chu BagsitNoch keine Bewertungen

- A Presentation On: Accounting For Merchandising OperationDokument26 SeitenA Presentation On: Accounting For Merchandising OperationKayesCjNoch keine Bewertungen

- Chap 006Dokument114 SeitenChap 006N100% (1)

- Accounting For Merchandising OperationsDokument31 SeitenAccounting For Merchandising OperationsBülent Kılıç100% (1)

- Actbas 2 Downloaded Lecture NotesDokument72 SeitenActbas 2 Downloaded Lecture Notesdavesanity23100% (1)

- Fabm NATURE OF MERCHANDISING BUSINESSDokument1 SeiteFabm NATURE OF MERCHANDISING BUSINESSPhegiel Honculada MagamayNoch keine Bewertungen

- Periodic PerpetualDokument25 SeitenPeriodic PerpetualNunung Nurul100% (1)

- Principle of Accounting: BA. in International Business Foreign Trade UniversityDokument30 SeitenPrinciple of Accounting: BA. in International Business Foreign Trade UniversityAjinkya AdhikariNoch keine Bewertungen

- Describe Merchandising Operations and Inventory SystemsDokument4 SeitenDescribe Merchandising Operations and Inventory SystemsSadia RahmanNoch keine Bewertungen

- Far 6-12Dokument38 SeitenFar 6-12Lisel SalibioNoch keine Bewertungen

- AccountingDokument8 SeitenAccountingShafqat WassanNoch keine Bewertungen

- Chapter 06 - Merchandising ActivitiesDokument114 SeitenChapter 06 - Merchandising ActivitiesElio BazNoch keine Bewertungen

- Accounting For Merchandising BusinessDokument20 SeitenAccounting For Merchandising BusinessJen RossNoch keine Bewertungen

- Maintaining Inventory RecordsDokument28 SeitenMaintaining Inventory RecordsTesfu TesfuNoch keine Bewertungen

- Retail ManagementDokument34 SeitenRetail Managementjai bakliyaNoch keine Bewertungen

- Unit I Accounting For Merchandising Business1Dokument38 SeitenUnit I Accounting For Merchandising Business1Jeffrey JosephNoch keine Bewertungen

- Chapter 8Dokument11 SeitenChapter 8Paw VerdilloNoch keine Bewertungen

- FINACTDokument15 SeitenFINACTsheengaleria11Noch keine Bewertungen

- ACCT 1005 - Summary Notes 5 - Merchandising Businesses - 2015Dokument6 SeitenACCT 1005 - Summary Notes 5 - Merchandising Businesses - 2015Kenya LevyNoch keine Bewertungen

- Lesson 1 - Accounting Cycle of A Merchandising BusinessDokument27 SeitenLesson 1 - Accounting Cycle of A Merchandising Businessdenise andalocNoch keine Bewertungen

- FABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusDokument8 SeitenFABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusVenus Ariate100% (1)

- Fabm Module03 File01Dokument8 SeitenFabm Module03 File01PREFIX THAT IS LONG - Lester LoutteNoch keine Bewertungen

- Periodic and Perpetual Inventory SystemDokument19 SeitenPeriodic and Perpetual Inventory SystemMichelle RotairoNoch keine Bewertungen

- Ch3 Accounting For MerchandisingDokument29 SeitenCh3 Accounting For MerchandisingÌbsa IñdaleNoch keine Bewertungen

- Accounting For Merchandising OperationsDokument13 SeitenAccounting For Merchandising OperationsAB Cloyd100% (1)

- Accounting ReviewerDokument5 SeitenAccounting ReviewerMeynard BatasNoch keine Bewertungen

- Ch-5 - ACCOUNTING FOR MERCHANDISING OPERATIONSDokument51 SeitenCh-5 - ACCOUNTING FOR MERCHANDISING OPERATIONSMetoo ChyNoch keine Bewertungen

- Perpetual Vs Periodic Inventory SystemDokument9 SeitenPerpetual Vs Periodic Inventory SystemKhrystyna Kos100% (1)

- Review of The Accounting Cycle: Survival Notes - Actbas2 TERM 1 AY 2014-2015Dokument12 SeitenReview of The Accounting Cycle: Survival Notes - Actbas2 TERM 1 AY 2014-2015Gilbert TiongNoch keine Bewertungen

- Chapter 5. Accounting For Merchandising OperationsDokument5 SeitenChapter 5. Accounting For Merchandising OperationsÁlvaro Vacas González de EchávarriNoch keine Bewertungen

- Anand Classes Syb - Com Sem 3Dokument11 SeitenAnand Classes Syb - Com Sem 3Anandkumar Gupta0% (1)

- Creation Via SWIFT: User GuideDokument580 SeitenCreation Via SWIFT: User GuideVivian DivagaranNoch keine Bewertungen

- Accounting Concepts and ConventionsDokument7 SeitenAccounting Concepts and ConventionsPraveenKumarPraviNoch keine Bewertungen

- Chapter 5 - Bank Reconciliation StatementDokument23 SeitenChapter 5 - Bank Reconciliation StatementNchumthung JamiNoch keine Bewertungen

- Rules of Journalising: Personal Accounts Impersonal AcoountsDokument4 SeitenRules of Journalising: Personal Accounts Impersonal AcoountsRachit DixitNoch keine Bewertungen

- Exam Finals Manon-OgDokument14 SeitenExam Finals Manon-OgJM RoxasNoch keine Bewertungen

- Multiple Choice Problems 9Dokument15 SeitenMultiple Choice Problems 9Dieter LudwigNoch keine Bewertungen

- Welcome To The Trade Planning and Execution To Claim Settlement: EBS Business Process AdvisorDokument32 SeitenWelcome To The Trade Planning and Execution To Claim Settlement: EBS Business Process AdvisorSandeep KavuriNoch keine Bewertungen

- SPECIALIZED FABM2 Module 05 Week 05 - Statement of Changes in EquityDokument8 SeitenSPECIALIZED FABM2 Module 05 Week 05 - Statement of Changes in Equitylams.ronaldsunigaNoch keine Bewertungen

- BP080 Accounts Payables V1 0Dokument29 SeitenBP080 Accounts Payables V1 0Justice AttohNoch keine Bewertungen

- Introduction To Final AccountsDokument38 SeitenIntroduction To Final AccountsCA Deepak Ehn88% (8)

- December 2021 Diploma in Accountancy QaDokument216 SeitenDecember 2021 Diploma in Accountancy QaWalusungu A Lungu BandaNoch keine Bewertungen

- 6 Miscellaneous TransactionsDokument4 Seiten6 Miscellaneous TransactionsRichel ArmayanNoch keine Bewertungen

- Module 12 - Accounting Process For A Merchandising EntityDokument8 SeitenModule 12 - Accounting Process For A Merchandising EntityNina AlexineNoch keine Bewertungen

- Book of AccountsDokument22 SeitenBook of AccountsAngel PadillaNoch keine Bewertungen

- Working Capital ManagementDokument8 SeitenWorking Capital ManagementNickNoch keine Bewertungen

- Completing The Accounting CycleDokument52 SeitenCompleting The Accounting CycleHEM CHEA100% (2)

- Fabm1 q3 Mod7 Journalizing FinalDokument32 SeitenFabm1 q3 Mod7 Journalizing FinalAdonis Zoleta Aranillo88% (8)

- Abm 003 - ReviewerDokument12 SeitenAbm 003 - ReviewerMary Beth Dela CruzNoch keine Bewertungen

- BCAoct09 (52-69)Dokument117 SeitenBCAoct09 (52-69)errum_shraddhaNoch keine Bewertungen

- CHAPTER 2 - Nature and Formation of A PartnershipDokument6 SeitenCHAPTER 2 - Nature and Formation of A PartnershipRamm Raven CastilloNoch keine Bewertungen

- JPM Access Bai2 UserguideDokument41 SeitenJPM Access Bai2 UserguideSharad Akhouri100% (1)

- Cost 531 2021 AssignmentDokument10 SeitenCost 531 2021 AssignmentWaylee CheroNoch keine Bewertungen

- Essay English About General LedgerDokument2 SeitenEssay English About General LedgerDheaNoch keine Bewertungen

- SAP Table Relations: Christopher SolomonDokument29 SeitenSAP Table Relations: Christopher Solomonvips1981100% (1)

- Payments User Guide - English (2006)Dokument39 SeitenPayments User Guide - English (2006)Gláucia CarvalhoNoch keine Bewertungen

- Homework 2: Soal - 1Dokument3 SeitenHomework 2: Soal - 1Rahadian ToramNoch keine Bewertungen

- PreQB QuestionnaireDokument6 SeitenPreQB QuestionnaireLeenNoch keine Bewertungen

- Oracle Receivables Lockbox: Frequently Asked Questions (FAQ) (Doc ID 1075485.1)Dokument39 SeitenOracle Receivables Lockbox: Frequently Asked Questions (FAQ) (Doc ID 1075485.1)Chockalingam Sankaran100% (1)

- Debit Account Transactions Date Description Type Amount Available Anson BasackerDokument3 SeitenDebit Account Transactions Date Description Type Amount Available Anson BasackerClifton WilsonNoch keine Bewertungen