Beruflich Dokumente

Kultur Dokumente

Import Export Contract Terms OnSales Contract

Hochgeladen von

alamcoalamcoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Import Export Contract Terms OnSales Contract

Hochgeladen von

alamcoalamcoCopyright:

Verfügbare Formate

Import Export Contract Terms on Sales Contract/Purchase Contract Import Export Contract Terms on Sales Contract/Purchase Contract A contract

is an agreement that creates an obligation that is a binding, legally enforceable agreement between two or more competent parties. A contract can be worked out either by the seller or the buyer, and it is called a sales contract or a purchase contract respectively. The formal contract consists of the following main terms: The name of commodity The quality of commodity The quantity of commodity The packing of commodity The price of commodity Payment Insurance Inspection Cargo claims Force majesties

Import Export Contract Terms on Price Methods FOB -Free on Board Free on Board means that the seller fulfills his obligation to deliver when the goods have passed over the ship's rail at the named port of shipment. The buyer has to bear all costs and risks of loss of or damage to the goods from that point. FOB terms require the seller to clear the goods for export. This term can only be used for sea or inland waterway transport. CFR or C&F - Cost and Freight Cost and Freight means that the seller must pay the cost and freight necessary to bring the goods to the named port of destination but the risk of loss or damage to the goods, as well as any additional costs due to events occurring after the time the goods have been delivered onboard the vessel, is transferred from the seller to the buyer when the goods pass the ship's rail in the port of shipment. The CFR term requires the seller to clear the goods for export. CIF - Cost, Insurance, and Freight CIF means that the seller has the same obligations as under CFR but with the addition that he has to procure marine insurance against the buyer's risk of loss of or damage to the goods during the carriage. The seller contracts for insurance and pays the insurance premium. DAF - Delivered at Frontier (...named place)DAF means that the seller fulfills his obligation to deliver when the goods have been made available, cleared for export, at the named point and place at the frontier, but before the customs border of the adjoining country. The term is primarily intended to be used when goods are to be carried by rail or road, but it may be used for any other mode of transport. Import Export Contract Terms on Payment Methods Irrevocable L/C(Letter of Credit) Irrevocable L/C is the one that cannot be withdrawn or amended by the opening bank without the agreement of the beneficiary. This kind of L/C is more secure and hence is most often used. It claims our attention that, according to Uniform Customs and Practice of Commercial Documentary Credits 500, if a L/C is not marked as being irrevocable or not, it should be taken as irrevocable. Remittance - Import Export Contract Terms Remittance is of three types: Mail Transfer (M/T), Telegraphic Transfer (T/T), and Demand Draft (D/D). By Mail Transfer, the buyer will hand over the payment of the goods to the remitting bank that will authorize its branch bank or correspondent bank in the country of the beneficiary by mail to make the payment to him. By Telegraphic Transfer, the buyer will hand over the payment of the goods to the remitting bank which will authorize its branch bank or correspondent bank in the country of the beneficiary by telegraphic means to make the payment to him. Mail transfer is less expensive, but it costs more time, while telegraphic transfer is more expensive but it is much sooner.

By Demand Draft, the buyer will come to the local bank to buy a banker's bill and then deliver it to the seller or beneficiary by mail. When the seller or beneficiary has received it, he will come to the bank designated by the banker's bill for cash. Apart from banker's bill, promissory notes or checks can also be used in this way. Documentary Collection - Import Export Contract Terms D/P at sight Under D/P at sight, the seller might either draw or not draw a draft on the buyer. He hand over the shipping documents together with (or without) the draft, and the shipping documents and the draft (or without draft) will be transferred to the collecting bank which will present them to the buyer and ask him to make the payment at sight. The buyer, upon sight, should then make the payment and get the shipping documents. When the collecting has thus finished the collection, it should immediately notify the remitting bank which will then make the payment to the seller. D/P at _ days after sight (date) The buyer shall duly accept the documentary draft drawn by the seller at _ days sight upon first presentation and make payment on its maturity. The shipping documents are to be delivered against payment only. Documents Against Acceptance (D/A) Under D/A, the buyer can get the shipping documents from the collecting bank after he has duly accepted the draft. This is only applicable to time draft. These will greatly convenience the buyer, but it means much more risk for the seller, for once he has delivered the shipping documents, he will have lost his title over the goods. D/A means more risks for the seller, for the buyer might refuse to pay after he has accepted the draft and taken the delivery of the goods. Certainly the seller might sue him, but as is often the case, the buyer claims bankruptcy and then the seller can do nothing to remedy the situation. Import Export Contract Terms on Documentation There are roughly five kinds of commonly used international trade documents are list here. They are categorized according to the document source. Government Control Documents Commercial (invoice) Documents Banking Documents Shipping Documents Insurance Documents

Export Documents Used For Government Control Export Documents - Government Control Documents International trade involves complex flows of goods and services between many countries. Therefore, a set of documents are used by countries to monitor and control these flows. These usually include: Import License and Foreign Exchange Authorization Many countries use import license and foreign exchange authorization system to restrict imports. Importers have to present pro-forma invoices to their licensing authorities or to their central banks, or sometimes to both to apply for the license. If the planned importation is legal and meets current requirements, the license will be issued. Therefore, exporters should not shipto importers who need licenses until the licenses are actually in hand. Export License - Export Documents At the present time, usually there are very few obstacles placed in the exporter's path by his own government. On the contrary, many governments are assisting and encouraging the export of goods and extension of overseas market. Nevertheless, there are some occasions when a particular restriction might be encountered due to the nature of the product, the market to which the goods are being exported or some other reasons. Certificate of Origin - Export Document A document that stating the country of origin of the goods being made. It is usually required by countries that do not use Customs Invoice or Consular Invoice to set the appropriate duties for the importers. It contains the nature, quantity, value of goods shipped and the place of manufacture. It enables the buyer not only to process the importation of the goods, but also permits preferential import duties where appropriate.

Das könnte Ihnen auch gefallen

- Software Product Development A Complete Guide - 2020 EditionVon EverandSoftware Product Development A Complete Guide - 2020 EditionNoch keine Bewertungen

- Import ProcedureDokument46 SeitenImport Procedureskedar89Noch keine Bewertungen

- Sale Contract ExampleDokument2 SeitenSale Contract ExampleLe AnNoch keine Bewertungen

- Employment AgreementDokument3 SeitenEmployment Agreementapi-224104463Noch keine Bewertungen

- Model Contract For International Distribution of Goods UNCTADDokument27 SeitenModel Contract For International Distribution of Goods UNCTADCarrilloyLawNoch keine Bewertungen

- Export Pricing Strategies Marginal Cost PricingDokument33 SeitenExport Pricing Strategies Marginal Cost PricingShamim Mahbub100% (1)

- Explicate The Cost and Risks To Buyer and Seller Involved Under Various Delivery Terms INCOTERMS in An International Trade TransactionDokument25 SeitenExplicate The Cost and Risks To Buyer and Seller Involved Under Various Delivery Terms INCOTERMS in An International Trade TransactionMegha MalhotraNoch keine Bewertungen

- Agreement For Export of Fresh FruitsDokument8 SeitenAgreement For Export of Fresh FruitsUmer FarooqNoch keine Bewertungen

- U GADJAH MADA Respondent IMLAM 2010Dokument36 SeitenU GADJAH MADA Respondent IMLAM 2010Ardianto Budi RahmawanNoch keine Bewertungen

- Venture Bonsai Deed of Adherence To A SHADokument1 SeiteVenture Bonsai Deed of Adherence To A SHAAntti HannulaNoch keine Bewertungen

- Oftware Evelopment Greement: Ompany OmpanyDokument7 SeitenOftware Evelopment Greement: Ompany OmpanygabrielaNoch keine Bewertungen

- Chile Import-Export Procedures: Section 11Dokument6 SeitenChile Import-Export Procedures: Section 11Fabián A. Barraza RochaNoch keine Bewertungen

- Import & Export ProcudureDokument4 SeitenImport & Export ProcudureArshad RashidNoch keine Bewertungen

- Export ProceduresDokument13 SeitenExport ProceduresghirenvNoch keine Bewertungen

- Visitors Non-Disclosure AgreementDokument6 SeitenVisitors Non-Disclosure AgreementRachelle Anne BillonesNoch keine Bewertungen

- LLP Agreement SpecimenDokument22 SeitenLLP Agreement SpecimenMahavir KapsheNoch keine Bewertungen

- Development and Publishing AgreementDokument9 SeitenDevelopment and Publishing AgreementRachelle Anne BillonesNoch keine Bewertungen

- Shipper'S Letter of Instruction: Fedex-Awb# Fedex-A/C#Dokument26 SeitenShipper'S Letter of Instruction: Fedex-Awb# Fedex-A/C#Aakash MehtaNoch keine Bewertungen

- Memorandum of Understanding For Auction ShowDokument2 SeitenMemorandum of Understanding For Auction ShowSatvikNoch keine Bewertungen

- Incoterms 2010 PresentationDokument42 SeitenIncoterms 2010 PresentationGilber Ticona MaqueraNoch keine Bewertungen

- Chinese English NNN AgreementsDokument6 SeitenChinese English NNN AgreementsYahya MuhammadNoch keine Bewertungen

- SPA Template 1Dokument9 SeitenSPA Template 1Ma. Angelica de GuzmanNoch keine Bewertungen

- DRAFT - Distributor Agreement For Male.Dokument5 SeitenDRAFT - Distributor Agreement For Male.Farrhath ThyibNoch keine Bewertungen

- Incoterms: Eneral NformationDokument4 SeitenIncoterms: Eneral NformationrooswahyoeNoch keine Bewertungen

- Seller DeclarationDokument3 SeitenSeller DeclarationAnonymous oQVQtYRQfNoch keine Bewertungen

- Covering Letter To Bank or Building SocietyDokument3 SeitenCovering Letter To Bank or Building SocietyNick SiddallNoch keine Bewertungen

- SAMPLE Master Distribution Agreement DRAFT 042213 (3) - 1Dokument17 SeitenSAMPLE Master Distribution Agreement DRAFT 042213 (3) - 1Syed Muhammad HassanNoch keine Bewertungen

- Export Import TradeDokument47 SeitenExport Import Tradekrissh_87Noch keine Bewertungen

- Agreement PDokument3 SeitenAgreement Pdoina slamaNoch keine Bewertungen

- 10C - Terms and Conditions of SaleDokument8 Seiten10C - Terms and Conditions of SaleQuynh VoNoch keine Bewertungen

- Model Broadcasting ContractDokument12 SeitenModel Broadcasting ContractRam IyerNoch keine Bewertungen

- Apple Contract - SummaryDokument4 SeitenApple Contract - SummaryCapital_and_MainNoch keine Bewertungen

- Switch BL FormatDokument1 SeiteSwitch BL FormatKolanji NathanNoch keine Bewertungen

- SDF Form & Annexure ADokument2 SeitenSDF Form & Annexure AAyushmani AhujaNoch keine Bewertungen

- Guide To Publishing ContractsDokument17 SeitenGuide To Publishing ContractsreadalotbutnowisdomyetNoch keine Bewertungen

- Asset Purchase Agreement by and Among Meredith Corporation, Gormally Broadcasting, LLC and Gormally Broadcasting Licenses, LLCDokument50 SeitenAsset Purchase Agreement by and Among Meredith Corporation, Gormally Broadcasting, LLC and Gormally Broadcasting Licenses, LLCmnwilliaNoch keine Bewertungen

- Export FinancingDokument27 SeitenExport FinancingPresha ShethNoch keine Bewertungen

- Agreement For DistributorDokument10 SeitenAgreement For Distributorvandana100% (1)

- Group 5: Arroyo, Aileen Jane Hernandez, Jaya Ley Tumambing, John DaveDokument59 SeitenGroup 5: Arroyo, Aileen Jane Hernandez, Jaya Ley Tumambing, John Daverl magsinoNoch keine Bewertungen

- Bull Machine Import Export Inc Sale ContractDokument3 SeitenBull Machine Import Export Inc Sale ContracttuhangNoch keine Bewertungen

- Pre Shipment FINANCEDokument4 SeitenPre Shipment FINANCEaniket7777Noch keine Bewertungen

- Rules of OriginDokument11 SeitenRules of Originalvindadacay100% (1)

- Non Exclusive Distribution AgreementDokument17 SeitenNon Exclusive Distribution AgreementDouglas SugimotoNoch keine Bewertungen

- Contract Sample 2Dokument4 SeitenContract Sample 2cefuneslpezNoch keine Bewertungen

- Certificate of OriginDokument1 SeiteCertificate of OriginPcelin OtrovNoch keine Bewertungen

- Sales Contract 1001051 Ks VFDokument2 SeitenSales Contract 1001051 Ks VFSơnTrịnhNoch keine Bewertungen

- S.K Vehicle Accessories: Subject: Quotation For Santro Car Head LightDokument4 SeitenS.K Vehicle Accessories: Subject: Quotation For Santro Car Head LightHema TiwariNoch keine Bewertungen

- Brokerage Agreement - 2 - 2Dokument3 SeitenBrokerage Agreement - 2 - 2Dobromira MihalevaNoch keine Bewertungen

- International Trade DocumentsDokument4 SeitenInternational Trade DocumentsNazmul H. Palash100% (1)

- KYC Form PDFDokument6 SeitenKYC Form PDFKarthik KichuNoch keine Bewertungen

- SREI Infrastructure Bond Application FormDokument8 SeitenSREI Infrastructure Bond Application FormPrajna CapitalNoch keine Bewertungen

- Agency AgreementDokument11 SeitenAgency AgreementRoy PersonalNoch keine Bewertungen

- Ib AgreementDokument17 SeitenIb AgreementYod SamecNoch keine Bewertungen

- Import Export ProcedureDokument13 SeitenImport Export ProcedureManinder SinghNoch keine Bewertungen

- Sales ContractDokument1 SeiteSales ContractkaracaoglunNoch keine Bewertungen

- (Your Company Name) (Your State or Jurisdiction)Dokument7 Seiten(Your Company Name) (Your State or Jurisdiction)Perimenopause Symptoms100% (1)

- Sub Agency AgreementDokument3 SeitenSub Agency AgreementDuong Truong0% (1)

- First Amended Complaint in Williams v. ScribdDokument35 SeitenFirst Amended Complaint in Williams v. ScribdBen SheffnerNoch keine Bewertungen

- Import Export Contract TermsDokument18 SeitenImport Export Contract TermsNyi Htut95% (19)

- Export Marketing: Prof. Zia-Ur-RehmanDokument11 SeitenExport Marketing: Prof. Zia-Ur-RehmanBader NoorNoch keine Bewertungen

- Wade Timmerson, Suzanne Caplan, - Building Big Profit in REDokument273 SeitenWade Timmerson, Suzanne Caplan, - Building Big Profit in REkafes51427Noch keine Bewertungen

- XXXXXXXXXXX8607 01 06 2021to23 09 2021Dokument12 SeitenXXXXXXXXXXX8607 01 06 2021to23 09 2021184H0 Yellu Anusha VCENoch keine Bewertungen

- Social Studies Sample Scope and Sequence Updated - Grade 6 PDFDokument287 SeitenSocial Studies Sample Scope and Sequence Updated - Grade 6 PDFJC Zapata67% (3)

- Select The Best AnswerDokument3 SeitenSelect The Best AnswercarlaNoch keine Bewertungen

- Pakistan Balance of PaymentsDokument94 SeitenPakistan Balance of PaymentsHamzaNoch keine Bewertungen

- Praveen Sagar Project ReportDokument12 SeitenPraveen Sagar Project Reportbhuvana uppalaNoch keine Bewertungen

- Forex Training Class Stage 2Dokument43 SeitenForex Training Class Stage 2Ibrahim AbdulateefNoch keine Bewertungen

- TFC Day 2 (Maret 2017) PDFDokument31 SeitenTFC Day 2 (Maret 2017) PDFacernam4849100% (1)

- Eppe3023 Tuto 8QDokument4 SeitenEppe3023 Tuto 8QMUHAMMAD AIMAN ZAKWAN BIN ROZANINoch keine Bewertungen

- The Time Value of MoneyDokument25 SeitenThe Time Value of Moneycheryl larasNoch keine Bewertungen

- Lesson Five HomeworkDokument3 SeitenLesson Five HomeworkLiam100% (1)

- Problem SolvingDokument7 SeitenProblem SolvingSantos, Kimberly R.Noch keine Bewertungen

- Si 2Dokument4 SeitenSi 2seraNoch keine Bewertungen

- Sales Attachment 2Dokument10 SeitenSales Attachment 2hamrawikebedeNoch keine Bewertungen

- Bill of Lading For Ocean Transport or Multimodal TransportDokument2 SeitenBill of Lading For Ocean Transport or Multimodal TransportLuis Felipe Laurada LiloyNoch keine Bewertungen

- Catfish Demand AnalysisDokument30 SeitenCatfish Demand AnalysisWolfie WufNoch keine Bewertungen

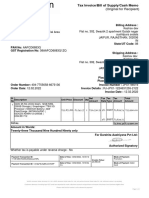

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)erjasdNoch keine Bewertungen

- Vikas Jain: Account Statement - Account StatementDokument16 SeitenVikas Jain: Account Statement - Account Statementvikas jainNoch keine Bewertungen

- Skin Care in China - Datagraphics: Country Report - Apr 2021Dokument4 SeitenSkin Care in China - Datagraphics: Country Report - Apr 2021Long Trần HoàngNoch keine Bewertungen

- Cambridge International AS & A Level: Economics 9708/22Dokument21 SeitenCambridge International AS & A Level: Economics 9708/22kitszimbabweNoch keine Bewertungen

- Power TradingDokument5 SeitenPower TradingCpgeorge JohnNoch keine Bewertungen

- BL Invoice 12 - 2020 Arabia SauditaDokument1 SeiteBL Invoice 12 - 2020 Arabia SauditaSegurança e Saúde PronaveNoch keine Bewertungen

- Import RegulationsDokument8 SeitenImport RegulationsAfaa NkamaNoch keine Bewertungen

- Week 6 Self AssessmentDokument13 SeitenWeek 6 Self AssessmentDaniel NikiemaNoch keine Bewertungen

- 5th Year DesertationDokument16 Seiten5th Year DesertationghNoch keine Bewertungen

- INTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample ProblemsDokument2 SeitenINTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample Problemsdimpy dNoch keine Bewertungen

- PDFFFFFDokument7 SeitenPDFFFFFkyla manaloNoch keine Bewertungen

- Fintech in Africa 1675424459Dokument207 SeitenFintech in Africa 1675424459Serge Kanga100% (1)

- StudentDokument21 SeitenStudentroger brownNoch keine Bewertungen

- (PAS 1 Par. 66) : Prepared By: Joseph R. Mendoza CPA, MBADokument3 Seiten(PAS 1 Par. 66) : Prepared By: Joseph R. Mendoza CPA, MBAJoshua LokinoNoch keine Bewertungen

- Profitable Photography in Digital Age: Strategies for SuccessVon EverandProfitable Photography in Digital Age: Strategies for SuccessNoch keine Bewertungen

- Learn the Essentials of Business Law in 15 DaysVon EverandLearn the Essentials of Business Law in 15 DaysBewertung: 4 von 5 Sternen4/5 (13)

- Contracts: The Essential Business Desk ReferenceVon EverandContracts: The Essential Business Desk ReferenceBewertung: 4 von 5 Sternen4/5 (15)

- The Certified Master Contract AdministratorVon EverandThe Certified Master Contract AdministratorBewertung: 5 von 5 Sternen5/5 (1)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseVon EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNoch keine Bewertungen

- How to Win Your Case In Traffic Court Without a LawyerVon EverandHow to Win Your Case In Traffic Court Without a LawyerBewertung: 4 von 5 Sternen4/5 (5)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetVon EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNoch keine Bewertungen

- Technical Theater for Nontechnical People: Second EditionVon EverandTechnical Theater for Nontechnical People: Second EditionNoch keine Bewertungen

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityVon EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNoch keine Bewertungen

- Crash Course Business Agreements and ContractsVon EverandCrash Course Business Agreements and ContractsBewertung: 3 von 5 Sternen3/5 (3)

- Law of Contract Made Simple for LaymenVon EverandLaw of Contract Made Simple for LaymenBewertung: 4.5 von 5 Sternen4.5/5 (9)

- Starting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingVon EverandStarting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingBewertung: 5 von 5 Sternen5/5 (1)

- How to Win Your Case in Small Claims Court Without a LawyerVon EverandHow to Win Your Case in Small Claims Court Without a LawyerBewertung: 5 von 5 Sternen5/5 (1)

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignVon EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Reality Television Contracts: How to Negotiate the Best DealVon EverandReality Television Contracts: How to Negotiate the Best DealNoch keine Bewertungen

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowVon EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowBewertung: 1 von 5 Sternen1/5 (1)