Beruflich Dokumente

Kultur Dokumente

Ashok Leyland Result Updated

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ashok Leyland Result Updated

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

4QFY2012 Result Update | Automobile

May 15, 2012

Ashok Leyland

Performance Highlights

Y/E March (` cr) Net sales EBITDA EBITDA margin (%) Reported PAT

Source: Company, Angel Research

BUY

CMP Target Price

4QFY11 3,848 508 13.2 298 % chg (yoy) 12.0 (7.5) (230)bp (13.2) Angel est. 4,298 464 10.8 253 % diff 0.3 1.2 10bp 2.4

`26 `33

12 Months

4QFY12 4,311 470 10.9 259

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Automobile 6,878 0.7 33/20 807,083 1 16,328 4,943 ASOK.BO AL@IN

Ashok Leyland (AL) reported an in-line results for 4QFY2012 led by a strong volume growth of 20.2% yoy (53.7% qoq) aided by increasing contribution from the recently launched light commercial vehicle (LCV) Dost, ~14% of total volumes in 4QFY2012. Due to attractive valuations we maintain our Buy rating on the stock. In-line results for 4QFY2012: For 4QFY2012, AL reported an in-line revenue growth of 12% yoy (48.5% qoq) drive by a strong 20.2% yoy growth in volumes, which was partially offset by 6.8% yoy (3.4% qoq) decline in net average realization. While volume growth was supported by the incremental volumes from Dost; net average realization declined led by adverse product-mix (higher contribution from lower priced Dost) and higher level of discounts. EBIDTA margins came in at 10.9% (down 230bp yoy and up 366bp qoq) impacted on account of weaker product mix and high other expenditure. Other expenditure increased primarily on account of increase in advertising and brand building expenses (`6cr) and higher R&D spends (`10cr) during the quarter. Further, AL also incurred a MTM loss of `15cr on forex liabilities. As a result, operating profit declined by 7.5% yoy to `470cr. Net profit, however, declined by 13.2% yoy to `259cr led by higher interest (up 32% yoy on higher working capital requirements) and depreciation expense (up 24% yoy) . Outlook and valuation: At `26, AL is trading at attractive valuations of 8.8x its FY2014E earnings. We maintain our Buy rating on the stock with a target price of `33, valuing the stock at 11x its FY2014E earnings. Key financials

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 38.6 20.1 30.6 10.7

Abs. (%) Sensex Ashok Leyland

3m (11.6)

1yr

3yr 34.1

(10.3) (11.9)

4.4 135.4

FY2011 11,177 50.9 631 64.6 10.9 2.4 11.0 2.6 16.5 14.1 0.7 6.7

FY2012E 12,842 14.9 564 (10.6) 9.8 2.1 12.2 2.4 13.8 12.8 0.6 6.2

FY2013E 14,798 15.2 645 14.3 9.6 2.4 10.7 2.1 14.7 13.8 0.5 5.7

FY2014E 16,687 12.8 791 22.6 9.6 3.0 8.8 1.9 16.5 15.0 0.4 4.8

Yaresh Kothari

022-3935 7800 Ext: 6844 yareshb.kothari@angelbroking.com

Please refer to important disclosures at the end of this report

Ashok Leyland | 4QFY2012 Result Update

Exhibit 1: Quarterly performance

Y/E March (` cr) Net Sales Consumption of RM (% of Sales) Staff Costs (% of Sales) Purchase of traded goods (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM Interest Depreciation Other Income PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) (% of Sales) Provision for Taxation (% of PBT) Reported PAT PATM Equity capital (cr) EPS (`)

Source: Company, Angel Research

4QFY12 4,311 3,026 70.2 247 5.7 183 4.3 385 8.9 3,841 470 10.9 72 96 11 313 (2) 314 7.3 56 17.7 259 6.0 266 1.0

4QFY11 3,848 2,712 70.5 302 7.8 64 1.7 262 6.8 3,340 508 13.2 55 77 16 392 392 10.2 93 23.9 298 7.7 266 1.1

yoy chg (%) 12.0 11.6 (18.2) 184.7 47.1 15.0 (7.5) 32.0 23.8 (30.5) (20.1) (19.7) (40.4) (13.2)

3QFY12 2,903 1,992 68.6 272 9.4 156 5.4 272 9.4 2,693 210 7.2 60 87 9 72 0 72 2.5 5 7.0 67 2.3 266

qoq chg (%) 48.5 51.9 (9.4) 17.1 41.6 42.6 123.4 20.0 10.3 27.0 334.7 336.9 1,000.6 286.7

FY2012 12,842 8,954 69.7 1,020 7.9 507 4.0 1,104 8.6 11,586 1,256 9.8 255 353 40 688 (2) 690 5.4 124 18.0 566 4.4 266

FY2011 11,177 7,899 70.7 960 8.6 273 2.4 831 7.4 9,963 1,214 10.9 189 267 44 802 802 7.2 171 21.3 631 5.6 266 2.4

chg (%) 14.9 13.4 6.3 85.6 32.8 16.3 3.5 35.1 31.9 (9.2) (14.1) (13.9) (27.3) (10.3)

(13.2)

0.3

286.7

2.1

(10.3)

Exhibit 2: Volume performance

(units) MHCV passenger MHCV goods LCV (ex. Dost) Total volume (ex. Dost) Dost Total volume (incl. Dost) Exports (inc. above )

Source: Company, Angel Research

4QFY12 8,767 21,731 297 30,795 4,893 35,688 4,123

4QFY11 6,960 22,460 260 29,680 29,680 3,513

yoy chg (%) 26.0 (3.2) 14.2 3.8 20.2 17.4

3QFY12 qoq chg (%) 5,625 14,697 403 20,725 2,490 23,215 3,017 55.9 47.9 (26.3) 48.6 96.5 53.7 36.7

FY2012 25,845 67,408 1,172 94,425 7,383 101,808 12,909

FY2011 25,226 68,007 873 94,106 94,106 10,306

chg (%) 2.5 (0.9) 34.2 0.3 8.2 25.3

Net sales up 12% yoy on 20.2% yoy growth in volumes: AL reported an in-line 12% yoy (48.5% qoq) growth in net sales to `4,311cr, led by strong volume growth of 20.2% yoy (53.7% qoq). Volume performance was boosted by the recently launched LCV Dost, which accounted for ~14% of total sales during the quarter. While volumes in the MHCV goods segment declined by 3.2% yoy, MHCV passenger volumes jumped by 26% yoy. Net average realization, however, witnessed a decline of ~6.8% yoy (down 3.4% qoq), largely on account of higher contribution from the lower priced Dost vehicles and higher levels of discounts.

May 15, 2012

Ashok Leyland | 4QFY2012 Result Update

Exhibit 3: Volumes up 20.2% yoy aided by Dost sales

(units) 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 14.3 15.0 (9.9) 25.9 (3.9) 0.0 (50.0) 20.2 50.0 72.0 138.9 178.2 Total volumes yoy chg (%) (%) 200.0 150.0 100.0

Exhibit 4: Net average realization down 6.8% yoy

(`) 1,350,000 1,300,000 1,250,000 1,200,000 1,150,000 1,100,000 1,050,000 1,000,000 950,000 1.0 (7.5) 0.0 (6.8) 7.2 3.5 13.9 18.0 Net average realisation yoy chg (%) 18.7 (%) 25.0 20.0 15.0 10.0 5.0 0.0 (5.0) (10.0)

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Net sales up 12% yoy

(`cr) 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 157.3 141.3 Net sales yoy chg (%) (%) 180.0 160.0 140.0 120.0 72.0 30.9 6.3 14.0 30.4 12.0 100.0 80.0 60.0 40.0 20.0 0.0 22.5

Exhibit 6: Domestic market share trend

(%) 60.0 50.0 40.0 30.0 20.0 10.0 0.0

37.9 26.6 35.7 27.0 25.3 27.6 20.4 24.4 24.9 15.6 24.6 19.2 27.2 22.2 48.9 41.4 45.1 39.9 40.2 42.9 43.5

M&HCV passenger

M&HCV goods

Total M&HCV

4QFY12

21.0 25.5 17.8 22.3

23.7

21.1

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

Source: Company, Angel Research

Source: Company, SIAM, Angel Research

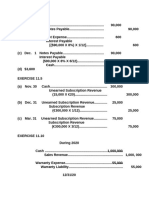

EBITDA margin recovers sequentially to 10.9%: For 4QFY2012, ALs EBITDA margin recovered 366bp sequentially to 10.9% primarily due to higher operating leverage. However, margins witnessed a 230bp of contraction on a yoy basis led by weaker product mix, higher discounts and higher other expenditure. Other expenditure jumped 47.1% yoy (41.6% qoq) on forex loss of `15cr, one time charge on marketing and brand building of `6cr, R&D expenditure of `16cr, and transportation cost of moving vehicles from Pantnagar to Southern India of `25cr. Higher other expenses was partially offset by lower staff cost (down 18.2% yoy and 9.4% qoq), primarily due to actuarial gains and lower bonus provision for FY2012 on account of lower profits. As a result, the companys operating profit declined 7.5% yoy (up 123.4% qoq on higher volumes and margin expansion) to `470cr.

May 15, 2012

4QFY12

Ashok Leyland | 4QFY2012 Result Update

Exhibit 7: EBITDA margin inches up to 10.9%

(%) 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 12.9 10.0 11.3 7.5 13.2 9.4 10.7 7.2 10.9 73.2 73.9 73.6 73.2 72.8 72.1 73.5 75.9 75.8 EBITDA margin Raw material cost/sales

Exhibit 8: Net profit down 13.2% yoy

(` cr) 350 300 250 200 150 100 50 0 1.9 5.2 3.5 2.3 7.6 6.2 5.0 Net profit 7.7 6.0 Net profit margin (%) 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

Source: Company, Angel Research

4QFY12

Source: Company, Angel Research

Net profit down 13.2% yoy: Net profit at `259cr (down 13.2% yoy) was in-line with our estimates benefitting from lower tax rate led by higher R&D spends. However increase in interest (up 32% yoy on higher working capital requirements) and depreciation expense (up 24% yoy) impacted the companys bottom-line performance. Sequentially, net profit increased 286.7% yoy led by sharp improvement in operating performance and high other income.

May 15, 2012

4QFY12

Ashok Leyland | 4QFY2012 Result Update

Investment arguments

Volume growth to benefit from easing of interest rates and recently launched Dost: MHCV demand has witnessed a slowdown in recent times due to high interest rates and slowdown in industrial activity; however, we believe MHCV demand is near its trough. With easing of interest rates we expect pick-up in industrial activity, leading to a rebound in MHCV sales. Further, recently introduced LCV - Dost (through JV with Nissan) have been received well by the markets and AL expects to ramp-up the production in FY2013E. As such we expect AL to register a strong ~20% volume CAGR over FY2012-14E. EBITDA margin pressures to persist due to change in product-mix: While the raw-material prices have stabilized and AL continues to benefit from the ramp-up in production at Pantnagar facility (profitability estimated to be ~25% higher due to cost savings of ~`35,000/vehicle); the product-mix is set to change due to increasing proportion of lower margin LCV Dost (contribution to total volumes to increase from ~7% in FY2012 to ~23% in FY2013E). AL has indicated that it earns marketing/distribution fees of `15,000-`18,000/vehicle on Dost sales and expects margins to be impacted by 50-100bp going ahead.

Outlook and valuation

At `26, AL is trading at attractive valuations of 8.8x its FY2014E earnings. We maintain our Buy rating on the stock with a target price of `33, valuing the stock at 11x its FY2014E earnings.

Exhibit 9: Key assumptions

(units) MHCV passenger MHCV goods LCV (ex. Dost) Dost Total volume (units) % yoy chg Domestic Exports

Source: Company, Angel Research

FY2009 19,981 33,071 1,379 54,431 (34.7) 47,619 6,812

FY2010 18,481 44,345 1,100 63,926 17.4 57,947 5,979

FY2011 25,226 68,007 873 94,106 47.2 83,800 10,306

FY2012 25,845 67,408 1,172 7,383 101,808 8.2 88,899 12,909

FY2013E 27,396 72,801 1,348 30,000 131,544 29.2 116,699 14,845

FY2014E 30,135 80,081 1,483 34,500 146,199 11.1 129,126 17,072

Exhibit 10: Angel vs. consensus

Angel estimates FY13E Net sales (` cr) EPS (`) 14,798 2.4 FY14E 16,687 3.0 Consensus FY13E 14,512 2.6 FY14E 16,363 3.2 Variation (%) FY13E 2.0 (8.1) FY14E 2.0 (6.5)

Source: Bloomberg, Angel Research

May 15, 2012

Ashok Leyland | 4QFY2012 Result Update

Exhibit 11: One-year forward P/E band

(`) 45 40 35 30 25 20 15 10 5 0 Share Price (`) 6x 9x 12x 15x

Exhibit 12: One-year forward P/E chart

(x) 35 30 25 20 15 10 5 One-yr forward P/E Five-yr average P/E

Dec-05

Apr-03

Jan-05

Jun-10

Feb-04

Nov-06

Oct-07

Sep-08

May-11

Apr-12

Jul-09

Feb-11

Aug-05

Mar-06

Aug-08

Sep-11 May-11 Oct-11

Jun-07

Jan-08

Apr-09

Jun-10

Oct-06

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 13: One-year forward EV/EBITDA band

(` cr) 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 EV (` cr) 2x 4x 6x 8x

Exhibit 14: One-year forward EV/EBITDA chart

(x) 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 One-yr forward EV/EBITDA Five-yr average EV/EBITDA

Jul-05

Jul-08

Jan-04

Jan-07

Apr-03

Apr-06

Apr-09

Jan-10

Jul-11

Oct-04

Oct-07

Oct-10

Apr-12

Jul-06

Jul-07

Nov-09

May-10

Dec-07

Dec-08

Jun-08

Jan-06

Aug-05

Jan-07

Jun-09

Nov-09

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 15: Automobile - Recommendation summary

Company Ashok Leyland Bajaj Auto Hero MotoCorp Maruti Suzuki M&M Tata Motors TVS Motor Reco. Buy Accumulate Buy Buy Buy Accumulate Buy CMP Tgt. price (`) (`) 26 1,609 1,893 1,215 657 290 35 33 1,811 2,280 1,510 802 328 55 Upside (%) 26.5 12.6 20.5 24.3 21.9 12.9 60.8 P/E (x) FY13E 10.7 14.4 13.5 14.0 14.7 7.5 6.9 FY14E 8.8 13.3 12.8 12.1 13.5 6.8 6.2 EV/EBITDA (x) FY13E 5.7 8.7 7.4 8.7 7.8 4.7 2.9 FY14E 4.8 7.5 5.8 6.9 6.7 4.1 2.5 RoE (%) FY13E 14.7 43.1 54.8 15.3 18.8 39.8 18.9 FY14E 16.5 37.1 43.3 15.4 18.1 33.9 18.2 FY11-14E EPS CAGR (%) 7.8 8.3 13.8 8.3 4.1 14.5 8.6

Source: Company, Angel Research

May 15, 2012

Nov-10

Apr-12

Apr-12

Ashok Leyland | 4QFY2012 Result Update

Profit & Loss Statement

Y/E March (` cr) Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation & Amortization EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of PBT) PBT (reported) % chg Extraordinary Expense/(Inc.) PBT (adjusted) Tax (% of PBT) PAT (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Adjusted EPS (`) % chg FY09 6,098 (23.1) 5,642 4,480 132 563 467 456 (43.5) 7.5 178 278 (56.0) 4.6 160 91 46.3 208 (67.3) 11 197 18 9.4 190 179 (60.3) 2.9 0.7 0.7 (60.3) FY10 7,407 21.5 6,648 5,212 135 667 634 760 66.6 10.3 204 555 100.1 7.5 102 91 18.1 545 161.3 40 505 121 24.0 424 384 114.6 5.2 1.6 1.4 114.6 FY11 11,177 50.9 9,963 8,173 168 960 663 1,214 59.8 10.9 267 946 70.4 8.5 189 44 5.5 802 47.2 802 171 21.3 631 631 64.6 5.6 2.4 2.4 64.6 FY12E 12,842 14.9 11,586 9,462 193 1,020 911 1,256 3.5 9.8 353 903 (4.5) 7.0 255 40 5.8 688 (14.1) (2) 690 124 18.0 566 564 (10.6) 4.4 2.1 2.1 (10.6) FY13E 14,798 15.2 13,377 10,906 222 1,184 1,065 1,421 13.1 9.6 381 1,040 15.1 7.0 290 46 5.8 797 15.7 797 151 19.0 645 645 14.3 4.4 2.4 2.4 14.3 FY14E 16,687 12.8 15,085 12,298 250 1,335 1,201 1,602 12.8 9.6 397 1,204 15.8 7.2 266 50 5.1 989 24.1 989 198 20.0 791 791 22.6 4.7 3.0 3.0 22.6

May 15, 2012

Ashok Leyland | 4QFY2012 Result Update

Balance Sheet

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves & Surplus Shareholders Funds Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 4,939 1,540 3,399 998 264 3,166 88 790 2,288 2,141 1,025 10 5,695 6,019 1,769 4,250 561 326 4,152 519 973 2,660 2,961 1,191 5 6,334 6,692 2,058 4,634 358 1,230 4,367 180 794 3,394 3,528 839 4 7,065 7,498 2,411 5,087 375 1,534 4,915 33 1,336 3,547 4,818 97 4 7,097 8,086 2,791 5,295 404 1,534 5,595 202 1,480 3,914 4,902 693 4 7,931 8,385 3,189 5,197 419 1,534 6,472 390 1,669 4,414 5,466 1,006 4 8,161 133 3,341 3,474 1,958 263 5,695 133 3,536 3,669 2,280 385 6,334 133 3,830 3,963 2,658 444 7,065 266 3,942 4,208 2,399 490 7,097 266 4,276 4,542 2,899 490 7,931 266 4,756 5,022 2,649 490 8,161 FY09 FY10 FY11 FY12E FY13E FY14E

May 15, 2012

Ashok Leyland | 4QFY2012 Result Update

Cash Flow Statement

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Others Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY09 197 178 (785) (7) (91) (18) (526) (2,466) 346 91 (2,028) 1,071 234 519 1,823 (731) 451 88 FY10 505 204 264 329 (91) (121) 1,090 (643) (63) 91 (614) 322 156 (523) (45) 430 88 519 FY11 802 267 13 (276) (44) (171) 591 (470) (904) 44 (1,329) 378 233 (213) 398 (340) 519 180 FY12E 688 353 648 (40) (124) 1,522 (823) (304) 40 (1,087) (260) 321 (580) (146) 180 33 FY13E 797 381 (428) (46) (151) 552 (618) 46 (572) 500 311 189 169 33 202 FY14E 989 397 (125) (50) (198) 1,013 (314) 50 (264) (250) 311 (561) 188 202 390

May 15, 2012

Ashok Leyland | 4QFY2012 Result Update

Key Ratios

Y/E March Valuation Ratio (x)

P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) Working capital cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Interest) 0.5 3.5 1.7 0.4 1.9 5.5 0.3 1.0 5.0 0.2 0.7 3.5 0.3 0.8 3.6 0.1 0.5 4.5 1.5 76 40 114 33 1.4 73 49 110 40 1.8 63 36 92 22 1.8 63 35 105 10 1.9 62 35 109 7 2.0 62 35 109 12 6.2 6.5 6.4 9.2 12.4 10.7 14.1 17.0 16.5 12.8 15.7 13.8 13.8 16.2 14.7 15.0 18.6 16.5 4.6 0.9 1.7 7.1 10.2 0.3 6.3 7.5 0.8 1.7 9.7 3.7 0.4 12.2 8.5 0.8 2.2 14.8 6.0 0.4 17.9 7.0 0.8 2.3 13.1 8.3 0.3 14.3 7.0 0.8 2.4 13.8 8.9 0.2 15.0 7.2 0.8 2.6 15.0 7.7 0.2 16.4 0.7 0.7 1.4 0.5 7.9 1.4 1.4 2.2 0.8 8.8 2.4 2.4 3.4 1.0 10.0 2.1 2.1 3.5 1.0 10.9 2.4 2.4 3.9 1.0 12.2 3.0 3.0 4.5 1.0 14.0 38.8 18.8 3.3 1.9 1.3 18.7 1.5 18.1 11.8 3.0 2.9 1.0 11.0 1.3 11.0 7.7 2.6 3.8 0.7 6.7 1.2 12.2 7.5 2.4 3.8 0.6 6.2 1.1 10.7 6.8 2.1 3.8 0.5 5.7 1.0 8.8 5.8 1.9 3.8 0.4 4.8 0.9 FY09 FY10 FY11 FY12E FY13E FY14E

May 15, 2012

10

Ashok Leyland | 4QFY2012 Result Update

Research Team Tel: 022 3935 7800 DISCLAIMER

E-mail: research@angelbroking.com

Website: www.angelbroking.com

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Ashok Leyland No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 15, 2012

11

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Inventory Valuation ProblemsDokument12 SeitenInventory Valuation Problemspranay raj rathoreNoch keine Bewertungen

- Tesda Perpetual and Periodic Inventory SystemsDokument6 SeitenTesda Perpetual and Periodic Inventory Systemsnelia d. onteNoch keine Bewertungen

- Muh - Syukur - A031191077 (Problem 6-18 Dan Problem 6-19) Akuntansi ManajemenDokument4 SeitenMuh - Syukur - A031191077 (Problem 6-18 Dan Problem 6-19) Akuntansi ManajemenRismayantiNoch keine Bewertungen

- Liabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasDokument158 SeitenLiabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasErika Mae LegaspiNoch keine Bewertungen

- Document 1517 6758Dokument52 SeitenDocument 1517 6758rubyhien46tasNoch keine Bewertungen

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADokument7 SeitenQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNoch keine Bewertungen

- (C) Substantive Procedures For Directors' BonusesDokument10 Seiten(C) Substantive Procedures For Directors' BonusesMD Sabuj SarkerNoch keine Bewertungen

- Fsa Solved ProblemsDokument27 SeitenFsa Solved ProblemsKumarVelivela100% (1)

- Midterm Exam Afar1Dokument13 SeitenMidterm Exam Afar1Rujean Salar AltejarNoch keine Bewertungen

- Literature Review On Financial Statements AnalysisDokument10 SeitenLiterature Review On Financial Statements AnalysisLaarnie PantinoNoch keine Bewertungen

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 3 PDF ScribdDokument41 SeitenInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 3 PDF Scribdlauryn.corbett387100% (39)

- Chapter 2 Q&P Answers SanchezDokument14 SeitenChapter 2 Q&P Answers SanchezRobert Jr.Noch keine Bewertungen

- Balaji TelefilmsDokument23 SeitenBalaji TelefilmsShraddha TiwariNoch keine Bewertungen

- Analisis Kredit (Likuiditas Dan Modal Kerja)Dokument42 SeitenAnalisis Kredit (Likuiditas Dan Modal Kerja)Frans Willdansya FitranyNoch keine Bewertungen

- Ias 1Dokument10 SeitenIas 1Pangem100% (1)

- BS4Dokument4 SeitenBS4Von Andrei MedinaNoch keine Bewertungen

- Afar Concepts 25Dokument2 SeitenAfar Concepts 25jajajaredredNoch keine Bewertungen

- Sales Less: Operating Expenses Opg Variable Expenses Opg Fixed Expenses Pbit Interest Fin Fixed Exp PBT TAX PAT EPSDokument102 SeitenSales Less: Operating Expenses Opg Variable Expenses Opg Fixed Expenses Pbit Interest Fin Fixed Exp PBT TAX PAT EPSAksh KhandelwalNoch keine Bewertungen

- Key Chapter 11Dokument3 SeitenKey Chapter 11JinAe NaNoch keine Bewertungen

- IA Activity 2 Chapter 4&5Dokument9 SeitenIA Activity 2 Chapter 4&5Sunghoon SsiNoch keine Bewertungen

- Problem 4.1 Britmart'S ReturnsDokument16 SeitenProblem 4.1 Britmart'S ReturnsPablo MelchorNoch keine Bewertungen

- Financial Ratio Analysis of United Commercial Bank and South-East Bank LimitedDokument27 SeitenFinancial Ratio Analysis of United Commercial Bank and South-East Bank LimitedJakaria Khan100% (5)

- Final Business Plan 2Dokument28 SeitenFinal Business Plan 2api-506056407Noch keine Bewertungen

- André Maggi Participacoes Sa AmaggiDokument88 SeitenAndré Maggi Participacoes Sa AmaggiJefferson AnacletoNoch keine Bewertungen

- Balance Sheet Definition Characteristics and Format - Business JargonsDokument4 SeitenBalance Sheet Definition Characteristics and Format - Business JargonsnarendraNoch keine Bewertungen

- Accounting 1Dokument5 SeitenAccounting 1afiatika ayyiNoch keine Bewertungen

- Cfas ReviewerDokument10 SeitenCfas ReviewershaylieeeNoch keine Bewertungen

- KasusDokument4 SeitenKasusTry DharsanaNoch keine Bewertungen

- Bram 2016Dokument270 SeitenBram 2016Frederick SimanjuntakNoch keine Bewertungen

- Balance Sheets: 1. What Information Goes On A Balance Sheet?Dokument4 SeitenBalance Sheets: 1. What Information Goes On A Balance Sheet?Yubely MahechaNoch keine Bewertungen