Beruflich Dokumente

Kultur Dokumente

Capital:: The Individual Subscribed Share Value and Liability of The Total Share Capital of A Company

Hochgeladen von

Anubhaw KumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital:: The Individual Subscribed Share Value and Liability of The Total Share Capital of A Company

Hochgeladen von

Anubhaw KumarCopyright:

Verfügbare Formate

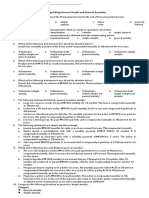

1.

capitals Capital: In simple words the term capital means the amount of money invested by the owner in the business to start a business. In case of Joint Stock Company the term share capital refers to the amount of money raised by the issue of shares. Kind of Capital: Authorized Capital: The authorized capital is also called nominal or registered. This is the maximum amount of capital which a company is authorized to issue. The amount of authorized capital is mentioned in the capital clause of memorandum of association along with Its division into shares of fixed amount. Issued Capital: Issued capital is that part of authorized capital which is offered to the public for subscription or for the sale of shares. For example, if the authorized capital of a company is 10 Million and the company issues shares valuing 7 million $ then the issued capital of the company is 7 million $. Subscribed capital

The individual subscribed share value and liability of the total share capital of a company. In detail:

Par value of that part of the authorized share capital which has been issued (sold) as shareswhether their purchasers (shareholders) have paid for them or not. A firm can, at any time, issue new shares up to the full amount of authorized share capital. Also called subscribed capital, issued share capital or subscribed share capital.

Un-issued Capital: The Portion of the authorized capital, which is not offered to the public for the sale of shares are known as un-issued capital. In the above example the un-issued capital of the company is 3 million $. Called-up Capital: The part of the subscribed capital, which in fact the company asks the shareholders to pay, is called the called up capital. Anonymous

2.

Working capital Talking about Circulating capital or working capital is the funds which are invested in current assets of a business. The current assets of a firm are cash on hand, demand deposits, readily marketable securities, inventories of goods and accounts receivable. Circulating capital is also sometimes called revolving capital because of the constant turnover of funds. The working capital is required for the purchase of raw material, salaries, wages, rent and other day to day expenditure. The circulating capital required by a firm depends upon a number of factors such as nature of business, rapidity of turn over period, length of period of manufactures, etc. in retailing services, for instance, the working capital can be rapidly recovered by the sale of goods. The requirements of working capital are, therefore, rather small in this business. A manufacturing concern, on the hand, has a slower turnover of circulating capital. Therefore, it needs larger amount of working capital to carry on business. In banking, the requirements of funds for working capital are very high. Short term financing is better suited to satisfy the circulating capital needs of a business, short term debt financing includes debts which have a maturity date of less than one year. It may here be noted that there is a minimum level of working capital current assets which is always needed by a firm during periods of an operating cycle. This can be called as permanent investment of the firm in current assets. The funds needed above this permanent level du8ringa year may be regarded at temporary needs. Anonymous

3.

Working capital There are two kinds of financial of capital requirements of a business. One of them is the capital which is required by a business to own durable assets such as building, land and machinery. This type of capital is called fixed capital or startup capital. The second capital is required for investment in short term assets such as purchase of raw material, payment of salaries, wages and rents. The capital is termed as current or working capital. Fixed capital as the name signifies is the fund which is used for meeting the permanent or long term needs of the business. Before a business is carried out the long term needs of a business are land, building, equipments and other sundry expenses. Circulating or working capital is the fund which is invested in current assets of a business. The current assets of a business are cash on hand, current deposits, readily marketable securities, inventories of goods and accounts receivable. Circulating capital is also sometimes called revolving capital because of the constant turnover of funds. The working capital is required for the purchase of raw material, salaries, wages and other day to day expenses. So this is also called operating capital or working capital for the business. Anonymous

4.

Working capital The assets invested

in

the

business

by

the

owner

are

termed

as

capital.

Registered capital:- the maximum amount which is registered with the registrar of the company. Issued capital:- the part /entire registered capital which is issued to the public. Paid up capital:- the capital which is paid by the public. called up capital:- the part of capital which is payable ( has not been paid) by the public.

NON FUND BASED LIMITS Deferred Payment Guarantees For acquisition of capital goods (Plant/Machinery including generators) and where there is provision for suppliers credit by the Manufacturer/Supplier.

Term Of Payment

In tune with credit extended by the manufacturer/supplier.

Security

1st Charge on fixed assets financed by us. Collateral Security and Personal/Third Party guarantee shall be insisted wherever required. Bank guarantees in lieu of Earnest Money Deposit, Security Deposit, Bid Bonds, Advance Payment, Performance, Retention Money etc., shall be issued depending on the nature of business, requirement, Margin, security, commission, period of guarantee shall be as per Bank's norms. Letters of Credit for purchase of raw materials/inputs and capital goods shall be opened as per the terms of supplier of such goods/services. Margin, security, commission shall be as per Bank's norms. Wherever necessary, Letters of Credit of Revolving type also shall be opened.

Bank Guarantee

Letters Of Credit DA/DP Terms

Deferred Payment Guarantees For acquisition of capital goods (Plant/Machinery including generators) and where there is provision for suppliers credit by the Manufacturer/Supplier. Term Of Payment In tune with credit extended by the manufacturer/supplier. Security 1st Charge on fixed assets financed by us. Collateral Security and Personal/Third Party guarantee shall be insisted wherever required. Bank Guarantee Bank guarantees in lieu of Earnest Money Deposit, Security Deposit, Bid Bonds, Advance Payment, Performance, Retention Money etc., shall be issued depending on the nature of business, requirement, Margin, security, commission, period of guarantee shall be as per Bank's norms. Letters Of Credit DA/DP Terms Letters of Credit for purchase of raw materials/inputs and capital goods shall be opened as per the terms of supplier of such goods/services. Margin, security, commission shall be as per Bank's norms. Wherever necessary, Letters of Credit of Revolving type also shall be opened.

5.

Pari passu charge Pari Passu is a term used in banking transactions which means that the charge to be created is in continuation of an earlier charge which might be held by the same institution or by an other institution. What is meant by Parri Passu Charge? Parri Passu is derived from Latin for 'with equal progress'. The phrase is used to indicate simultaneous and equal change or to describe similar ranking of securities or lenders; for example, when a new issue of shares is made, they could be said to rank pari passu, ie, equally with existing shares for the purposes of dividend payments. A common agreement between joint lenders is a pari passu clause under which, in the event of a shortfall, they agree to share equally whatever is available. The use of "Pari Passu" when creating a charge means that when company Y goes into dissolution, the assets over which the charge has been created will be distributed in proportion to the creditors' respective holdings. Therefore, if the Bank X has tendered a loan facility of 60 million PKR while another creditor, say Z, has tendered 40 million PKR, the recovery after selling assets of Company Y to which joint pari passu charge attached, shall be distributed in the ratio of 6:4 amongst X and Z. Where preferential rights attach to assets of the company, the preferential creditors rank higher in the distribution stakes i.e. they are paid in priority to other creditors of the company.

Read more: http://wiki.answers.com/Q/What_is_the_meaning_of_pari_passu_charge#ixzz1j7dHvtwo

6. Pari passu charge means when more than one creditor has a charge like mortgage on the same property though created at different times, if they agree among themselves, their charge/mortgage will rank equal in enforcement. For e.g. A Bank having a charge on 1.1.2007 and B Bank has a charge on the same property on 2/2/2008, normally A Bank has the priority. Only after satisfying the dues of A Bank, B bank can claim any surplus realised over and above the dues to A Bank. But if both the banks agree that their charges are pari passu , they can have the share of the proceeds of the sale of the property in enforcement of their mortgages equally i.e. pro rata to their advances or outstandings depending upon the wording of the document under which the pari passu charge has been agreed among them. Re counter guarantee means if A bank on behalf of its client B gives a guarantee to C, the bank will take a counter guarantee from B and any of his associates if stipulated a counter guarantee that in case C enforces the guarantee against A, B and his associates, if any, will make good the amount to A. Omnibus counter guarantee is taken where number of guarantees are issued up to a total limit, and the limit is maintained by issue of guarantees, one counter guarantee will be taken to cover all those guarantees which are issued within the total limit up to which the bank issues guarantees under the omnibus guarantee.

1. What is the difference between primary security and collateral security?

Primary security is the asset created out of the credit facility extended to the borrower and / or which are directly associated with the business / project of the borrower for which the credit facility has been extended. Collateral security is any other security offered for the said credit facility. For example, hypothecation of jewellery, mortgage of house, etc.

2. Under the Scheme, any third party guarantee obtained for the credit facilities will make them ineligible for guarantee cover. What is third party guarantee?

As per the extent guidelines no third party guarantee should be obtained if the account is to be covered under the Credit Guarantee Scheme. However, in case the constitution of the borrower is proprietary or partnership, the personal guarantee of proprietor/ partner is not treated as third party guarantee. Personal guarantee of directors, were borrower constitution is a company would be treated as third party guarantee.

Collateral The last decade has seen an enormous growth in the use of securities as collateral. Purchasing securities with borrowed money secured by other securities or cash itself is called "buying on margin". Where A is owed a debt or other obligation by B, A may require B to deliver property rights in securities to A, either at inception (transfer of title) or only in default (non-transfer-of-title institutional). For institutional loans property rights are not transferred but nevertheless enable A to satisfy its claims in the event that B fails to make good on its obligations to A or otherwise becomes insolvent. Collateral arrangements are divided into two broad categories, namely security interests and outright collateral transfers. Commonly, commercial banks, investment banks, government agencies and other institutional investors such as mutual funds are significant collateral takers as well as providers. In addition, private parties may utilize stocks or other securities as collateral for portfolio loans in securities lending scenarios. On the consumer level, loans against securities have grown into three distinct groups over the last decade: 1) Standard Institutional Loans, generally offering low loan-to-value with very strict call and coverage regimens, akin to standard margin loans; 2) Transfer-of-Title (ToT) Loans, typically provided by private parties where borrower ownership is completely extinguished save for the rights provided in the loan contract; and 3) Non-Transfer-of-Title Credit Line facilities where shares are not sold and they serve as assets in a standard lien-type line of cash credit. Of the three, transfer-of-title loans have fallen into the very high-risk category as the number of providers have dwindled as regulators have launched an industry-wide crackdown on transfer-of-title structures where the private lender may sell or sell short the securities to fund the loan. See sell short. Institutionally managed consumer securities-based loans, on the other hand, draw loan funds from the financial resources of the lending institution, not from the sale of the securities.

Das könnte Ihnen auch gefallen

- FM Chapter 2: Source of FinanceDokument11 SeitenFM Chapter 2: Source of FinancePillows GonzalesNoch keine Bewertungen

- Sources of Funds: Unit IiDokument36 SeitenSources of Funds: Unit IiFara HameedNoch keine Bewertungen

- Chapter 8Dokument54 SeitenChapter 8Bishounen 42Noch keine Bewertungen

- FM NotesDokument49 SeitenFM Notesanuj goelNoch keine Bewertungen

- Lesson - Sources of FundsDokument14 SeitenLesson - Sources of FundsJohn Paul GonzalesNoch keine Bewertungen

- Sources of Finance DefinitionDokument6 SeitenSources of Finance Definitionpallavi4846100% (1)

- Areas Covered in FPRDokument4 SeitenAreas Covered in FPRNikunj BhatnagarNoch keine Bewertungen

- Technopreneurship WK13Dokument96 SeitenTechnopreneurship WK13Juvill VillaroyaNoch keine Bewertungen

- Assets, Liabilities, and The Balance SheetDokument19 SeitenAssets, Liabilities, and The Balance Sheetdebojyoti100% (1)

- Project ManagementDokument6 SeitenProject ManagementEmuyeNoch keine Bewertungen

- Managing Financial Resources and Decisions of Finance Finance Essay (WEB)Dokument28 SeitenManaging Financial Resources and Decisions of Finance Finance Essay (WEB)johnNoch keine Bewertungen

- Basic Accounting Terminology: Tangible AssetsDokument4 SeitenBasic Accounting Terminology: Tangible Assetskavya guptaNoch keine Bewertungen

- Constructive NoticeDokument13 SeitenConstructive NoticeAbhishek SinghNoch keine Bewertungen

- Sources of Working CapitalDokument7 SeitenSources of Working CapitalSreelekshmi Kr100% (1)

- Term PaperDokument11 SeitenTerm PapermehrearNoch keine Bewertungen

- Acconting NotesDokument27 SeitenAcconting NotesparinkhonaNoch keine Bewertungen

- Lecture ABM2 II. The Statement of Financial PostionDokument9 SeitenLecture ABM2 II. The Statement of Financial PostionKing happy langNoch keine Bewertungen

- 'Common Stock': 'Capital Structure'Dokument3 Seiten'Common Stock': 'Capital Structure'kooltezNoch keine Bewertungen

- MSMEDokument3 SeitenMSMELrajNoch keine Bewertungen

- Acc Financial Statement Proj InfoDokument13 SeitenAcc Financial Statement Proj InfoSandhya ThaparNoch keine Bewertungen

- Iii. Statement of Financial PositionDokument9 SeitenIii. Statement of Financial PositionAnthon Karl AvenidoNoch keine Bewertungen

- Lecture Notes of Working Capital ManagementDokument9 SeitenLecture Notes of Working Capital Managementমোঃ আশিকুর রহমান শিবলু100% (1)

- Chapter 14 Revision Notes: Sources of Finance and The Cost of CapitalDokument7 SeitenChapter 14 Revision Notes: Sources of Finance and The Cost of CapitalRyan ParejaNoch keine Bewertungen

- NsimDokument200 SeitenNsimkimakar100% (1)

- Sources of Financing To Non-GovtDokument14 SeitenSources of Financing To Non-GovtCorolla SedanNoch keine Bewertungen

- M204-19 Vishakha KateDokument8 SeitenM204-19 Vishakha KatevishakhaNoch keine Bewertungen

- Module 3 NotesDokument14 SeitenModule 3 NotesRuth MuñozNoch keine Bewertungen

- Definition of Business FinanceDokument4 SeitenDefinition of Business FinanceClovisNoch keine Bewertungen

- Capital MarketDokument4 SeitenCapital MarketKimberly BastesNoch keine Bewertungen

- Typical Account Titles UsedDokument3 SeitenTypical Account Titles Usedwenna janeNoch keine Bewertungen

- Module 7Dokument3 SeitenModule 7Esier Davies Paul MalabadNoch keine Bewertungen

- Corporate FininanceDokument10 SeitenCorporate FininanceMohan KottuNoch keine Bewertungen

- IS Definitions v2Dokument13 SeitenIS Definitions v2Ajith VNoch keine Bewertungen

- Financing For Profit: Unit - FourDokument44 SeitenFinancing For Profit: Unit - FourSarahNoch keine Bewertungen

- A. Under Statement of Financial Position: Typical Account Titles UsedDokument6 SeitenA. Under Statement of Financial Position: Typical Account Titles UsedAshlyn MaeNoch keine Bewertungen

- Medium Term Finance (Loan) Is Usually Provided FromDokument19 SeitenMedium Term Finance (Loan) Is Usually Provided FromAntora HoqueNoch keine Bewertungen

- International Financial Reporting StandardsDokument23 SeitenInternational Financial Reporting StandardsAneela AamirNoch keine Bewertungen

- Module 8 Elect 2Dokument13 SeitenModule 8 Elect 2Franz Ervy MallariNoch keine Bewertungen

- Financial TermsDokument19 SeitenFinancial TermstayaisgreatNoch keine Bewertungen

- Kslu Unit 4 Q & A Company LawDokument33 SeitenKslu Unit 4 Q & A Company LawMG MaheshBabuNoch keine Bewertungen

- COMPANY SHARES CORPORATE CAPITAL PDFDokument30 SeitenCOMPANY SHARES CORPORATE CAPITAL PDFprashansha kumudNoch keine Bewertungen

- BantomtatDokument5 SeitenBantomtatmanhphatcube1704Noch keine Bewertungen

- Balance Sheet and Financial StatementDokument3 SeitenBalance Sheet and Financial StatementRochelle AntoinetteNoch keine Bewertungen

- Convertible Note (UPenn)Dokument14 SeitenConvertible Note (UPenn)Robert ScottNoch keine Bewertungen

- Basic Accounting TermsDokument8 SeitenBasic Accounting Termsjosephinemusopelo1Noch keine Bewertungen

- Engineering EconomicsDokument12 SeitenEngineering EconomicsAwais SiddiqueNoch keine Bewertungen

- Sources of Short Term and Long Term FinanceDokument6 SeitenSources of Short Term and Long Term FinanceSharath KannanNoch keine Bewertungen

- TechStars Bridge Term Sheet-2Dokument3 SeitenTechStars Bridge Term Sheet-2Josh WestermanNoch keine Bewertungen

- Financial Instruments - Session 2 Jan 7Dokument56 SeitenFinancial Instruments - Session 2 Jan 7Sagar 'Oman' TilakrajNoch keine Bewertungen

- Capital StructureDokument57 SeitenCapital StructureRao ShekherNoch keine Bewertungen

- Corporate Finance PPT 1Dokument58 SeitenCorporate Finance PPT 1Major SehrawatNoch keine Bewertungen

- Raising DebtDokument4 SeitenRaising DebtvaishnaviNoch keine Bewertungen

- Vce ST01 FMDokument4 SeitenVce ST01 FMSourabh ChiprikarNoch keine Bewertungen

- According To Time-PeriodDokument9 SeitenAccording To Time-PeriodMin JeeNoch keine Bewertungen

- Glossary of MDokument35 SeitenGlossary of MbboyvnNoch keine Bewertungen

- Personal Assets: AssetDokument6 SeitenPersonal Assets: AssetDipak NandeshwarNoch keine Bewertungen

- Chapter 6-Business Accounting and FinanceDokument5 SeitenChapter 6-Business Accounting and FinanceVinetha KarunanithiNoch keine Bewertungen

- The Concept of CollateralDokument3 SeitenThe Concept of CollateralElle BadussyNoch keine Bewertungen

- Guia Segundo ParcialDokument12 SeitenGuia Segundo ParcialBety MedinaNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingVon EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNoch keine Bewertungen

- 07 08 OSAP Eligibility and Need Assessment Manual1Dokument140 Seiten07 08 OSAP Eligibility and Need Assessment Manual1Bezimeni BezimenovicNoch keine Bewertungen

- Basic Accounting Concepts and PrinciplesDokument4 SeitenBasic Accounting Concepts and Principlesalmyr_rimando100% (1)

- Security Bank and Trust Company VDokument9 SeitenSecurity Bank and Trust Company VGladys CubiasNoch keine Bewertungen

- Interest Rate Markets - Siddhartha JhaDokument6 SeitenInterest Rate Markets - Siddhartha JhaNipun DuaNoch keine Bewertungen

- ZTBL ReportDokument76 SeitenZTBL Reportapi-224920675Noch keine Bewertungen

- IBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Dokument19 SeitenIBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Zehra RizviNoch keine Bewertungen

- Financial Literacy NotesDokument11 SeitenFinancial Literacy NotesMaimai Durano100% (1)

- Accounting Assignment 2Dokument4 SeitenAccounting Assignment 2Laddie LMNoch keine Bewertungen

- Azeze Mulugojam FINALDokument66 SeitenAzeze Mulugojam FINALSingitan YomiyuNoch keine Bewertungen

- A Case Study On Mega Merger of Sbi With Its Associate Banks and Bhartiya Mahila BankDokument34 SeitenA Case Study On Mega Merger of Sbi With Its Associate Banks and Bhartiya Mahila BankMihirParmarNoch keine Bewertungen

- Recto Law and Maceda LawDokument3 SeitenRecto Law and Maceda LawdhadhagladysNoch keine Bewertungen

- Annu Singh FinalDokument64 SeitenAnnu Singh Finalsauravv7100% (1)

- Growth GenerationDokument16 SeitenGrowth Generationcguerin100% (2)

- Temp For Credit Letter No 2 No ValidationDokument3 SeitenTemp For Credit Letter No 2 No Validationjrod37100% (3)

- GAP Analysis in BanksDokument15 SeitenGAP Analysis in BanksAdiluhung WisesoNoch keine Bewertungen

- Solution Manual For Financial Reporting and Analysis 7th Edition by RevsineDokument33 SeitenSolution Manual For Financial Reporting and Analysis 7th Edition by Revsinea619353646100% (1)

- 11 Sps Silos Vs PNBDokument7 Seiten11 Sps Silos Vs PNBNaomi InotNoch keine Bewertungen

- Fundamental of TallyDokument50 SeitenFundamental of TallyhimanshiNoch keine Bewertungen

- Nego CasesDokument91 SeitenNego CasesBruce WayneNoch keine Bewertungen

- Bir Form 1600Dokument44 SeitenBir Form 1600Jerel John CalanaoNoch keine Bewertungen

- Official Form 206sum: Summary of Assets and Liabilities For Non-IndividualsDokument1 SeiteOfficial Form 206sum: Summary of Assets and Liabilities For Non-IndividualsReading_EagleNoch keine Bewertungen

- Co Act On Loans Accepted & GivenDokument43 SeitenCo Act On Loans Accepted & GivendkdineshNoch keine Bewertungen

- Distinguishing Between Simple and General AnnuitiesDokument2 SeitenDistinguishing Between Simple and General AnnuitiesErnie Caracas Lahaylahay100% (1)

- Glossary of Terms - Indian Real EstateDokument9 SeitenGlossary of Terms - Indian Real EstatealistairdsaNoch keine Bewertungen

- Company Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDokument9 SeitenCompany Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNoch keine Bewertungen

- Keec 106Dokument17 SeitenKeec 106KarthikPrakashNoch keine Bewertungen

- 08 Sample PaperDokument38 Seiten08 Sample Papergaming loverNoch keine Bewertungen

- RDAG Doc 779 1.3.19 MUSA Request To CompelDokument6 SeitenRDAG Doc 779 1.3.19 MUSA Request To CompelKCBD DigitalNoch keine Bewertungen

- Direct Foreign Investment: Restrictions On ImportsDokument5 SeitenDirect Foreign Investment: Restrictions On ImportsVenus Gavino ManaoisNoch keine Bewertungen